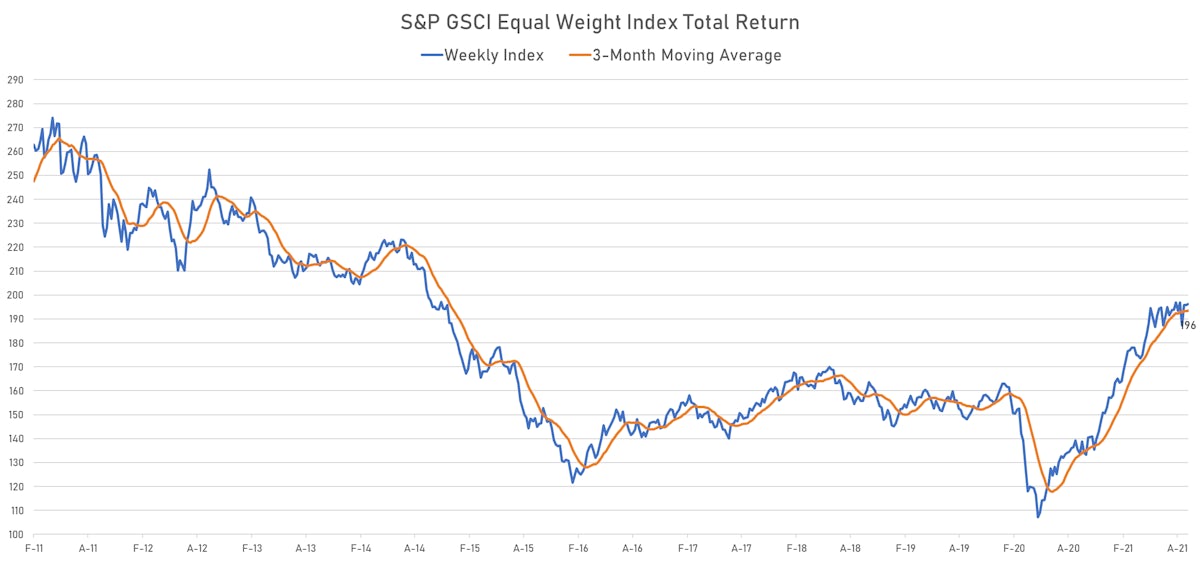

Commodities

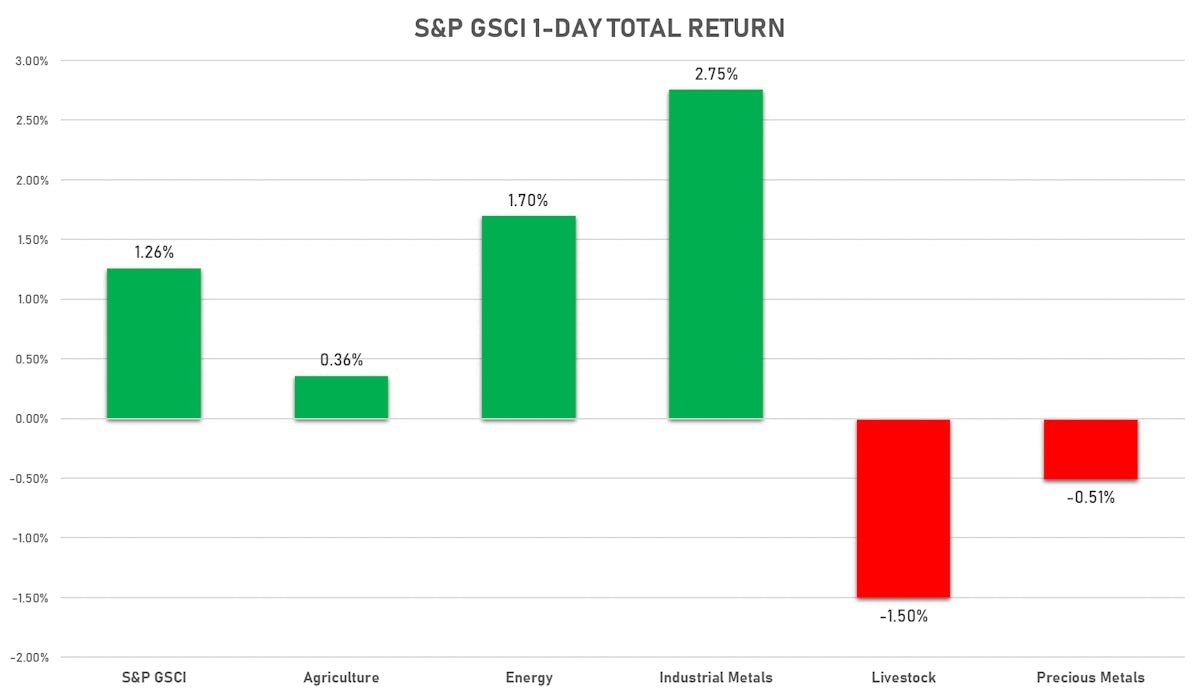

Positive Performance In Most Commodities Groups Today, Except For Precious Metals

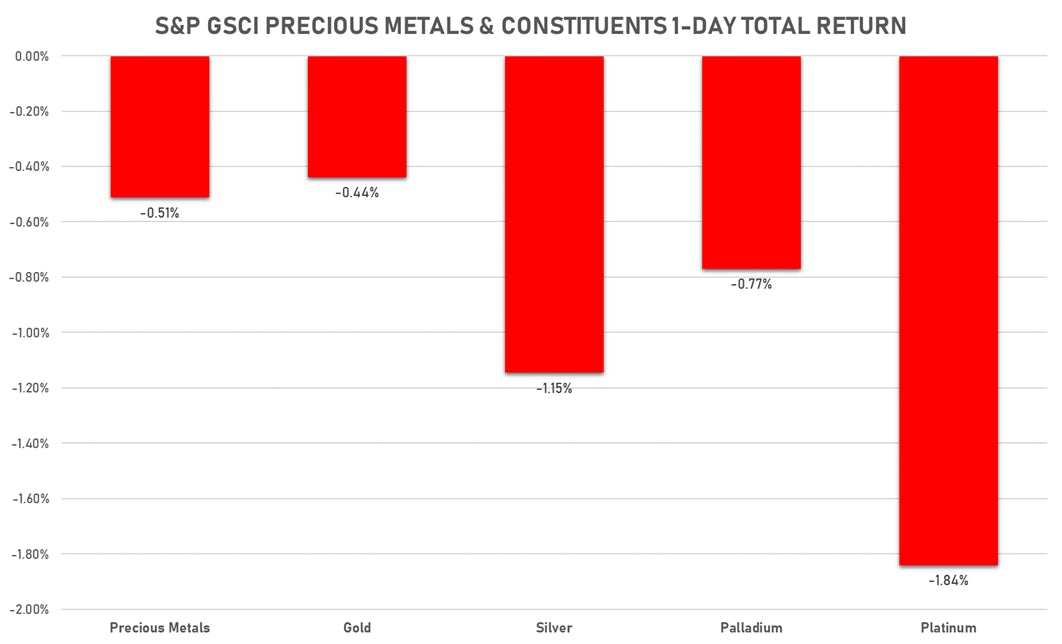

Palladium prices have fallen 12% over the past week, as production issues in the auto sector are weighing heavily on demand

Published ET

Palladium Spot Prices Intraday | Source: Refinitiv data

WEEKLY BAKER HUGHES RIG COUNT

- North American rig count down 3 to 646 this week (up 340 y/y)

- US rig count +6 to 503 this week: oil +7 to 401 and gas down 1 to 101

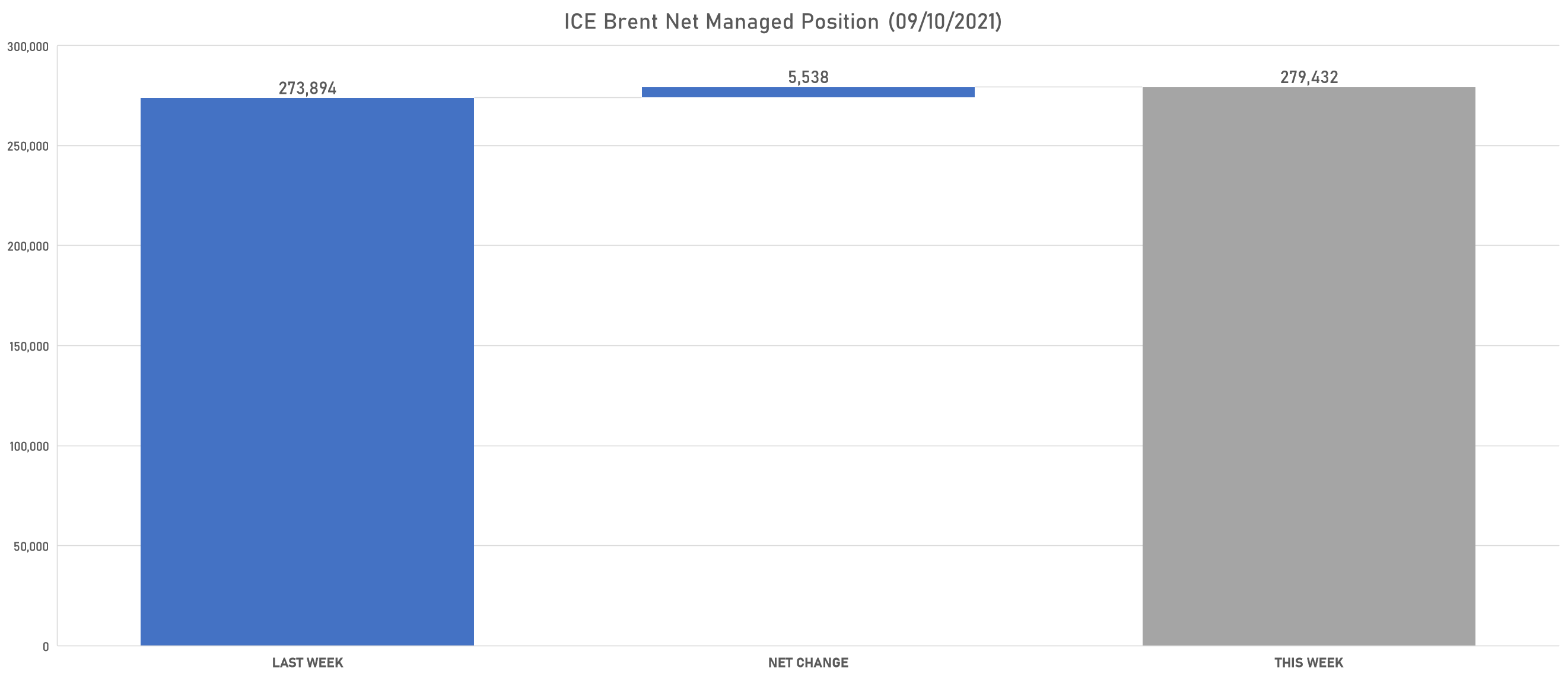

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent increased net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil increased net long position

- Henry Hub Ice increased net long position

METALS

- Gold reduced net long position

- Silver increased net long position

- Platinum increased net short position

- Palladium reduced net long position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net long position

- Corn reduced net long position

- Rough Rice increased net short position

- Oats increased net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal turned to net short

- Lean Hogs increased net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa increased net long position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice reduced net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

NOTABLE GAINERS TODAY

- DCE Coking Coal Continuation Month 1 up 6.4% (YTD: 113.5%)

- DCE Coke up 5.2% (YTD: 52.6%)

- COMEX Copper up 3.8% (YTD: 26.6%)

- DCE Iron Ore Continuation Month 1 up 3.3% (YTD: -22.9%)

- SHFE Nickel up 2.9% (YTD: 24.3%)

- SHFE Stannum up 2.8% (YTD: 71.8%)

- SMM Lithium Metal Spot Price Daily up 2.7% (YTD: 55.7%)

- NYMEX RBOB Gasoline up 2.6% (YTD: 52.9%)

- SMM Rare Earth Terbium Metal Spot Price Daily up 2.5% (YTD: 11.8%)

- NYMEX Light Sweet Crude Oil (WTI) up 2.3% (YTD: 43.7%)

- Crude Oil WTI Cushing US FOB up 2.3% (YTD: 44.4%)

- ICE Europe Brent Crude up 2.1% (YTD: 40.8%)

- SHFE Aluminum up 1.9% (YTD: 44.6%)

- Brent Forties and Oseberg Dated FOB North Sea Crude up 1.8% (YTD: 41.7%)

- WUXI Metal Cobalt Bi-Monthly up 1.8% (YTD: 36.4%)

NOTABLE LOSERS TODAY

- CME Lean Hogs down -3.5% (YTD: 17.3%)

- EEX European-Carbon- Secondary Trading down -2.9% (YTD: 89.9%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -2.9% (YTD: 86.2%)

- ICE-US Cocoa down -2.6% (YTD: 1.5%)

- ICE-US Sugar No. 11 down -2.3% (YTD: 21.3%)

- Platinum spot down -2.3% (YTD: -10.7%)

- Palladium spot down -1.9% (YTD: -12.6%)

- Johnson Matthey Rhodium New York 0930 down -1.9% (YTD: -7.9%)

- NYMEX Henry Hub Natural Gas down -1.8% (YTD: 94.5%)

- Bursa Malaysia Crude Palm Oil down -1.6% (YTD: 17.6%)

- Coffee Robusta Vietnam Grade 1 Wet Pol QSpot down -1.5% (YTD: 28.9%)

- SHFE Bitumen Continuation Month 1 down -1.3% (YTD: 23.3%)

- Silver spot down -1.3% (YTD: -10.1%)

- SGX Iron Ore 62% China CFR Swap Monthly down -1.0% (YTD: -15.5%)

- CME Cattle(Feeder) down -1.0% (YTD: 11.0%)

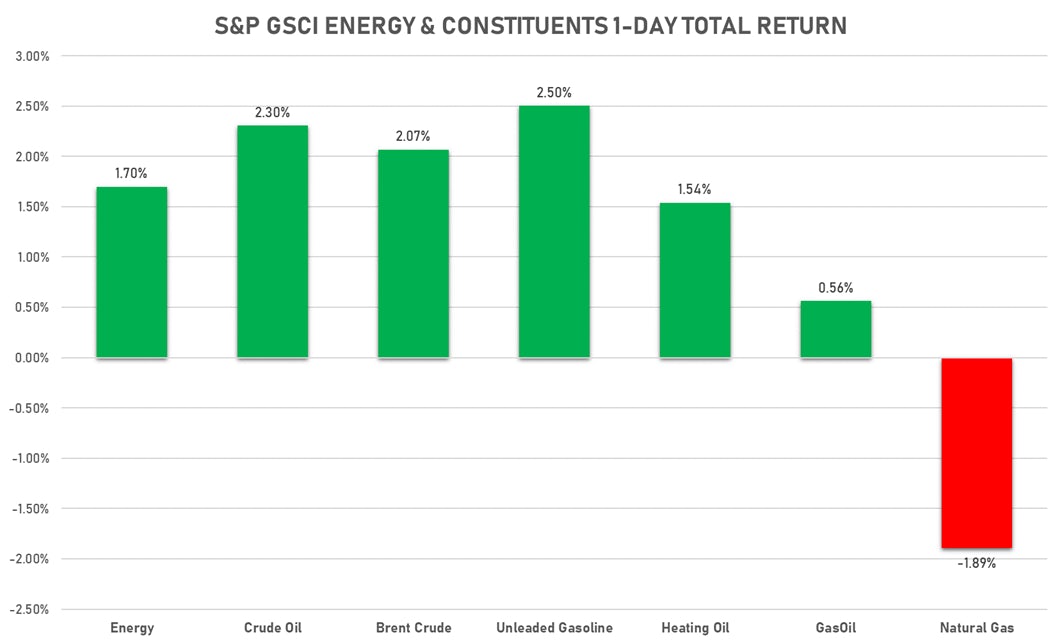

OIL & GASOLINE UP TODAY, NAT GAS DOWN

- WTI crude front month currently at US$ 69.72 per barrel, up 2.3% (YTD: +43.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 72.92 per barrel, up 2.1% (YTD: +40.8%); 6-month term structure in widening backwardation

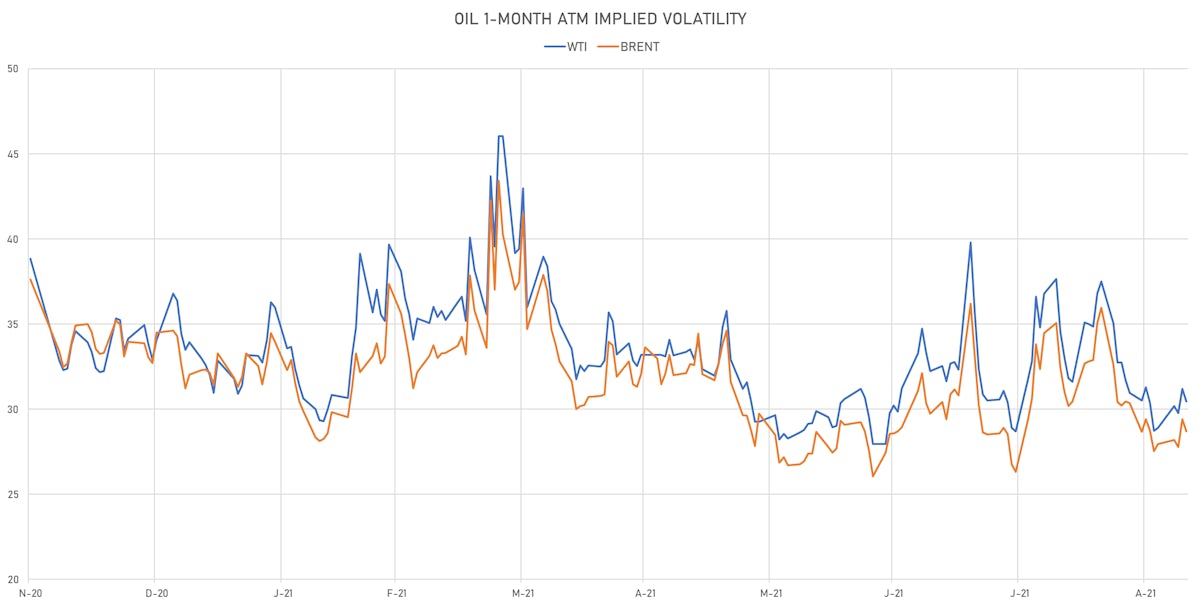

- Brent volatility at 28.7, down -2.4% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 177.60 per tonne, up 0.1% (YTD: +120.6%)

- Natural Gas (Henry Hub) currently at US$ 4.94 per MMBtu, down -1.8% (YTD: +94.5%)

- Gasoline (NYMEX) currently at US$ 2.15 per gallon, up 2.6% (YTD: +52.9%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) unchanged at US$ 610.00 per tonne (YTD: +43.9%)

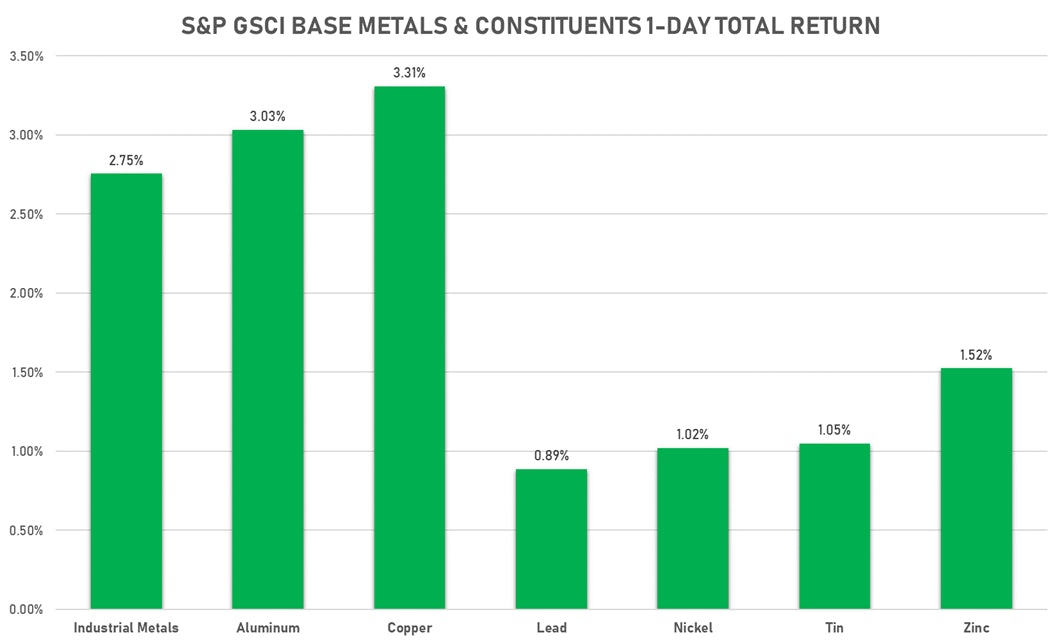

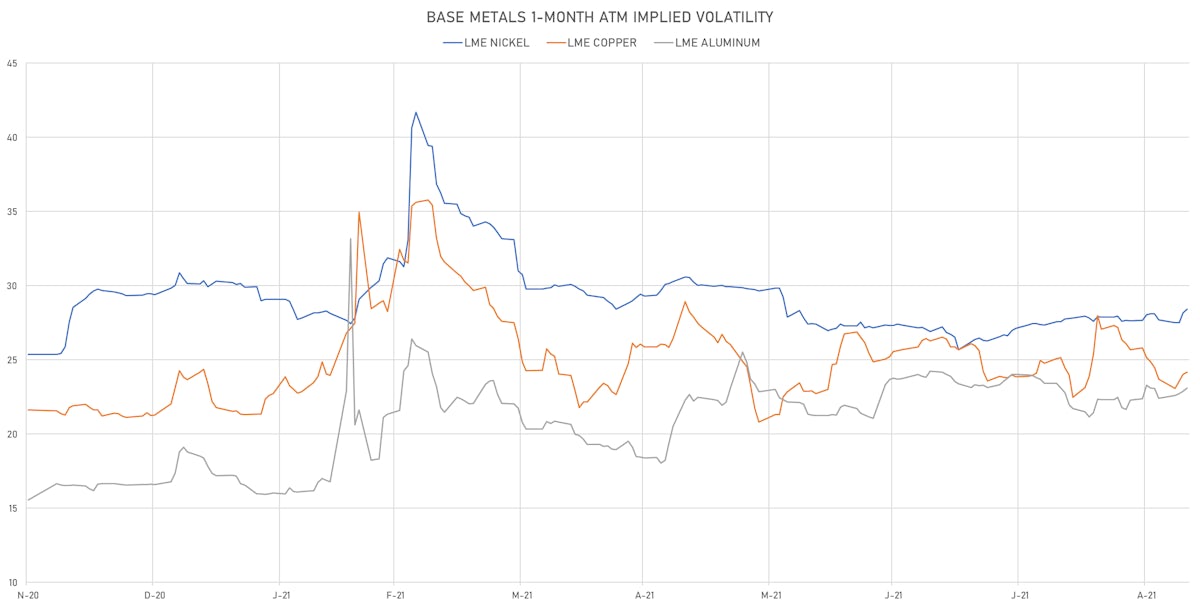

BASE METALS UP TODAY

- Copper (COMEX) currently at US$ 4.42 per pound, up 3.8% (YTD: +26.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 909.00 per tonne, up 3.3% (YTD: -22.9%)

- Aluminum (Shanghai) currently at CNY 23,300 per tonne, up 1.9% (YTD: +44.6%)

- Nickel (Shanghai) currently at CNY 154,300 per tonne, up 2.9% (YTD: +24.3%)

- Lead (Shanghai) currently at CNY 15,135 per tonne, up 0.6% (YTD: +2.2%)

- Rebar (Shanghai) currently at CNY 5,604 per tonne, up 0.5% (YTD: +32.8%)

- Tin (Shanghai) currently at CNY 262,200 per tonne, up 2.8% (YTD: +71.8%)

- Zinc (Shanghai) currently at CNY 23,065 per tonne, up 0.1% (YTD: +9.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 372,500 per tonne, up 1.1% (YTD: +35.9%)

- Lithium (Shanghai) spot price currently at CNY 755,000 per tonne, up 2.7% (YTD: +55.7%)

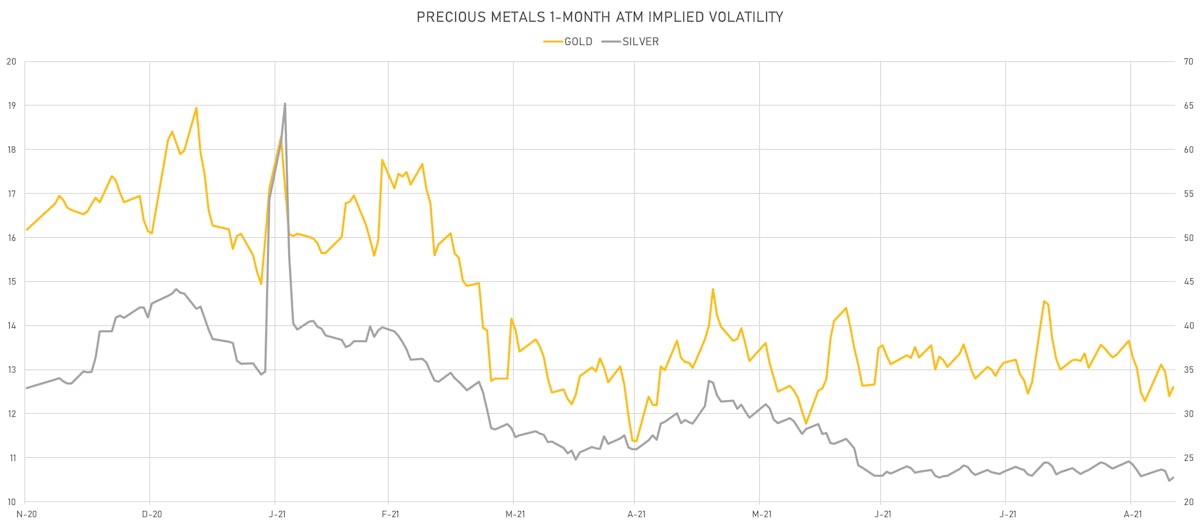

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,787.34 per troy ounce, down -0.4% (YTD: -5.8%)

- Gold 1-Month ATM implied volatility currently at 12.28, up 1.6% (YTD: -21.7%)

- Silver spot currently at US$ 23.72 per troy ounce, down -1.3% (YTD: -10.1%)

- Silver 1-Month ATM implied volatility currently at 21.73, up 1.4% (YTD: -46.5%)

- Palladium spot currently at US$ 2,136.50 per troy ounce, down -1.9% (YTD: -12.6%)

- Platinum spot currently at US$ 954.35 per troy ounce, down -2.3% (YTD: -10.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 15,700 per troy ounce, down -1.9% (YTD: -7.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

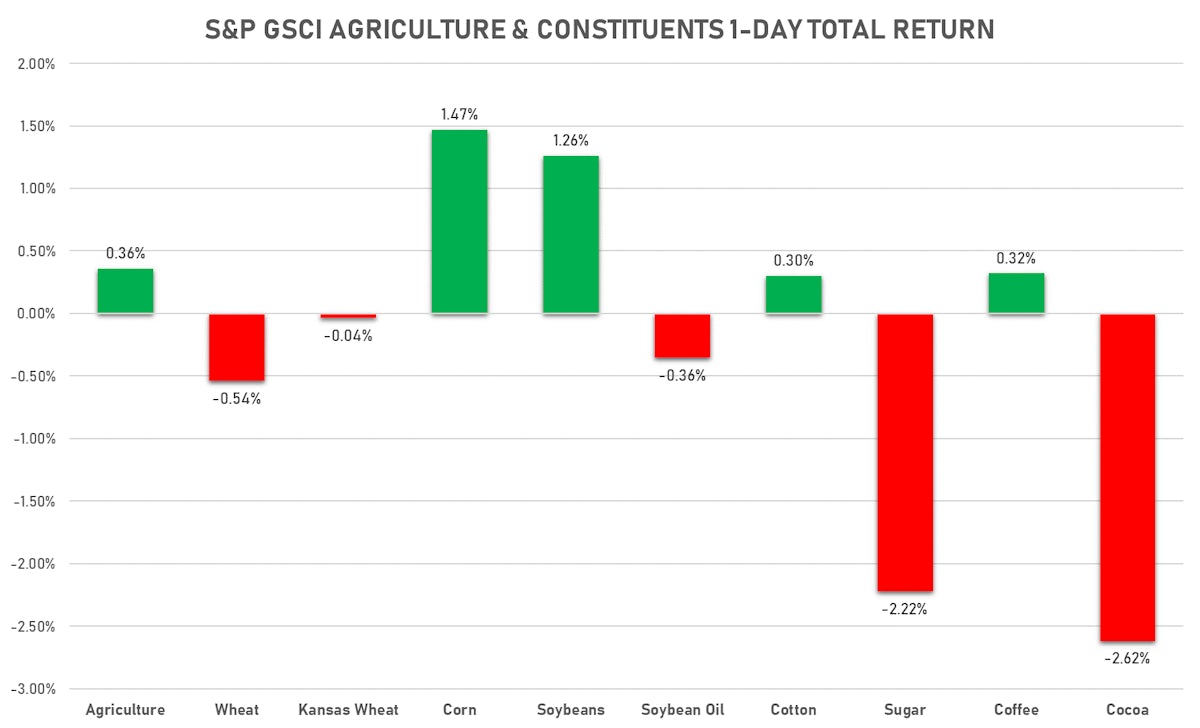

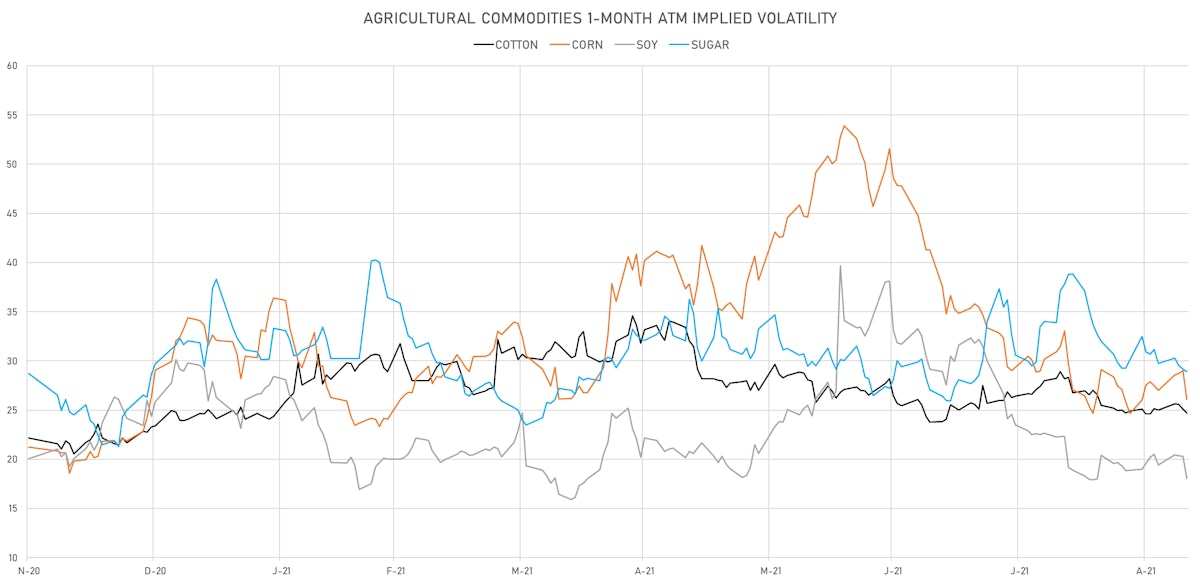

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 123.43 cents per pound, down 0.3% (YTD: +9.3%)

- Lean Hogs (CME) currently at US$ 82.45 cents per pound, down -3.5% (YTD: +17.3%)

- Rough Rice (CBOT) currently at US$ 13.26 cents per hundredweight, up 1.3% (YTD: +6.9%)

- Soybeans Composite (CBOT) currently at US$ 1,275.25 cents per bushel, up 1.3% (YTD: -3.0%)

- Corn (CBOT) currently at US$ 502.75 cents per bushel, up 1.4% (YTD: +3.9%)

- Wheat Composite (CBOT) currently at US$ 675.00 cents per bushel, down -1.0% (YTD: +5.4%)

- Sugar No.11 (ICE US) currently at US$ 18.84 cents per pound, down -2.3% (YTD: +21.3%)

- Cotton No.2 (ICE US) currently at US$ 95.11 cents per pound, up 0.7% (YTD: +21.9%)

- Cocoa (ICE US) currently at US$ 2,713 per tonne, down -2.6% (YTD: +1.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,422 per tonne, down -0.9% (YTD: +39.7%)

- Random Length Lumber (CME) currently at US$ 508.20 per 1,000 board feet, up 1.5% (YTD: -41.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,750 per tonne, down -0.4% (YTD: +7.1%)

- Soybean Oil Composite (CBOT) currently at US$ 55.74 cents per pound, down -0.5% (YTD: +28.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,625 per tonne, down -1.6% (YTD: +17.6%)

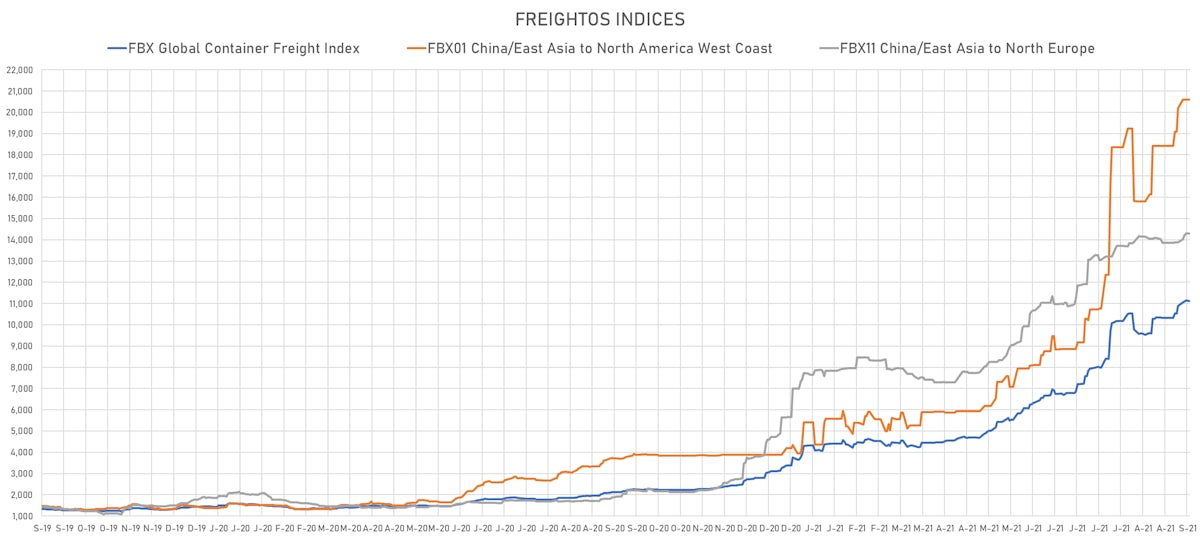

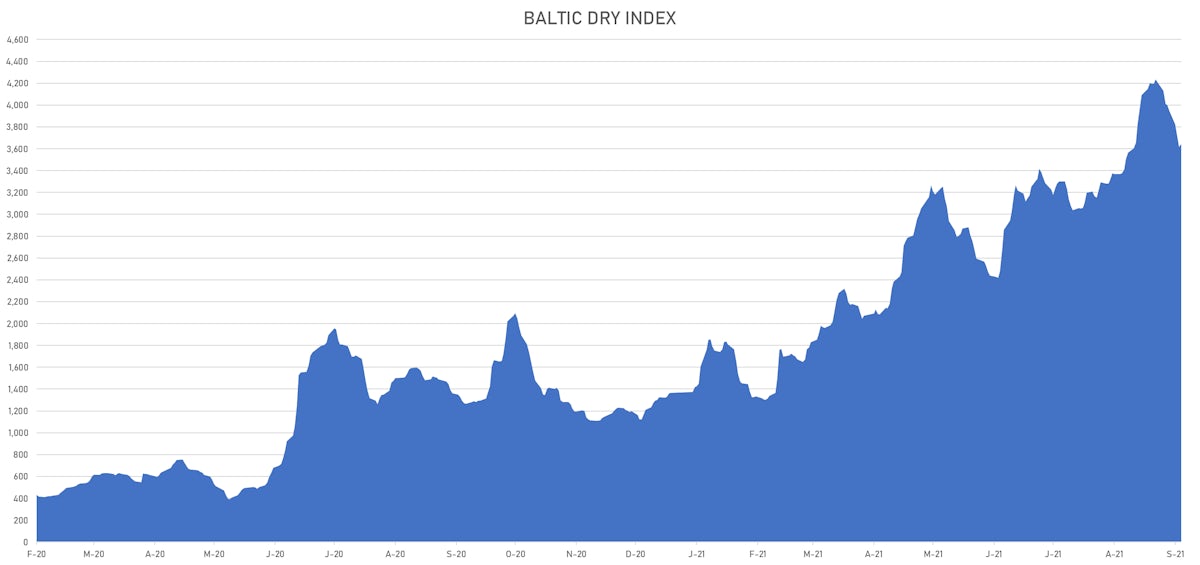

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,643, up 0.7% (YTD: +166.7%)

- Freightos China To North America West Coast Container Index currently at 20,586, unchanged (YTD: +390.2%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 366, unchanged (YTD: +0.8%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, down -1.6% (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,292, unchanged (YTD: +152.4%)

- Freightos North Europe To China Container Index currently at 1,512, up 0.6% (YTD: +9.9%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

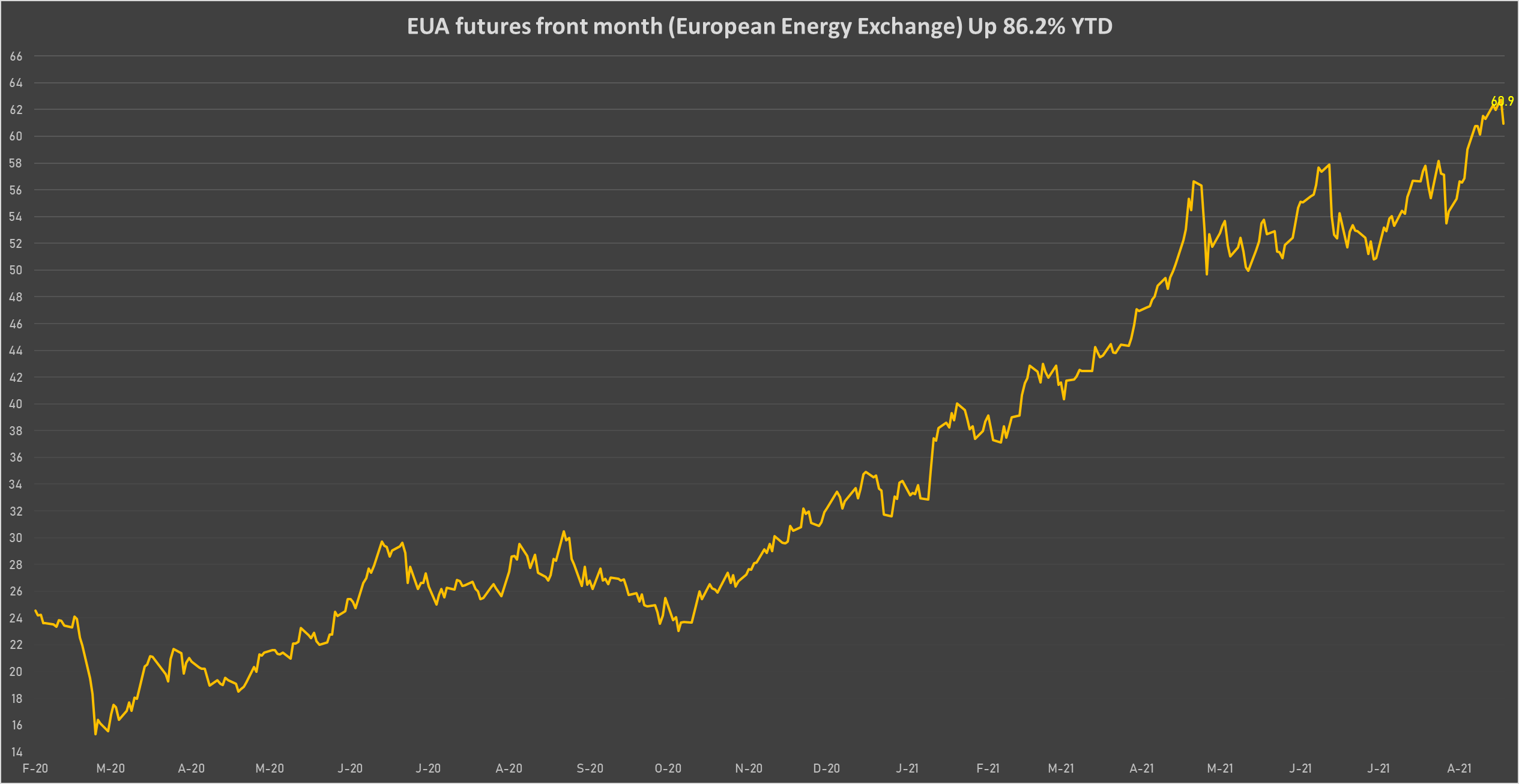

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 60.92 per tonne, down -2.9% (YTD: +86.2%)