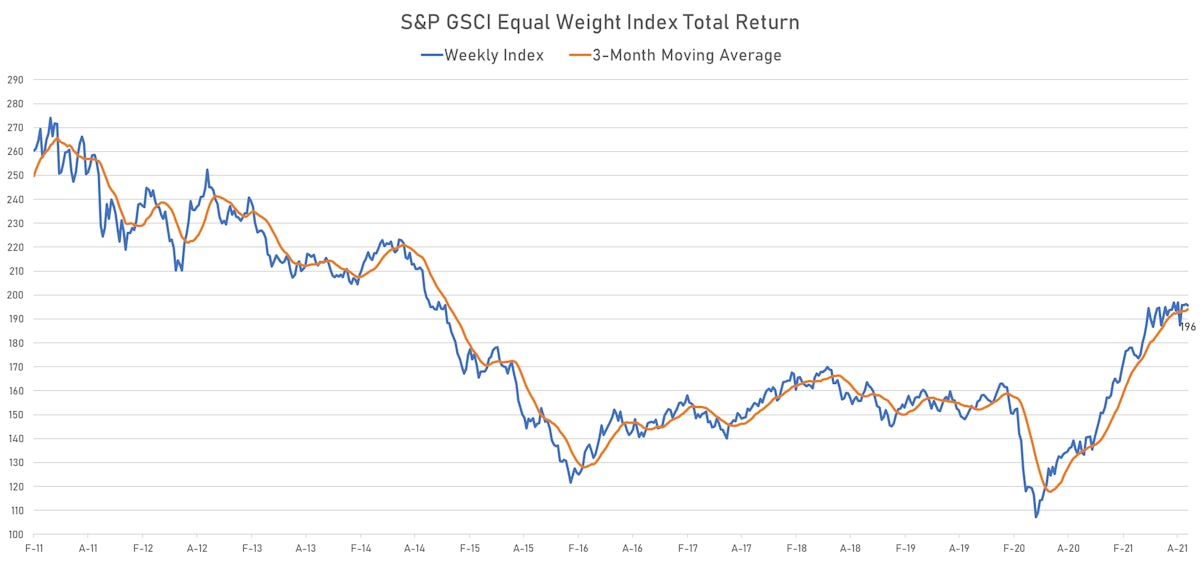

Commodities

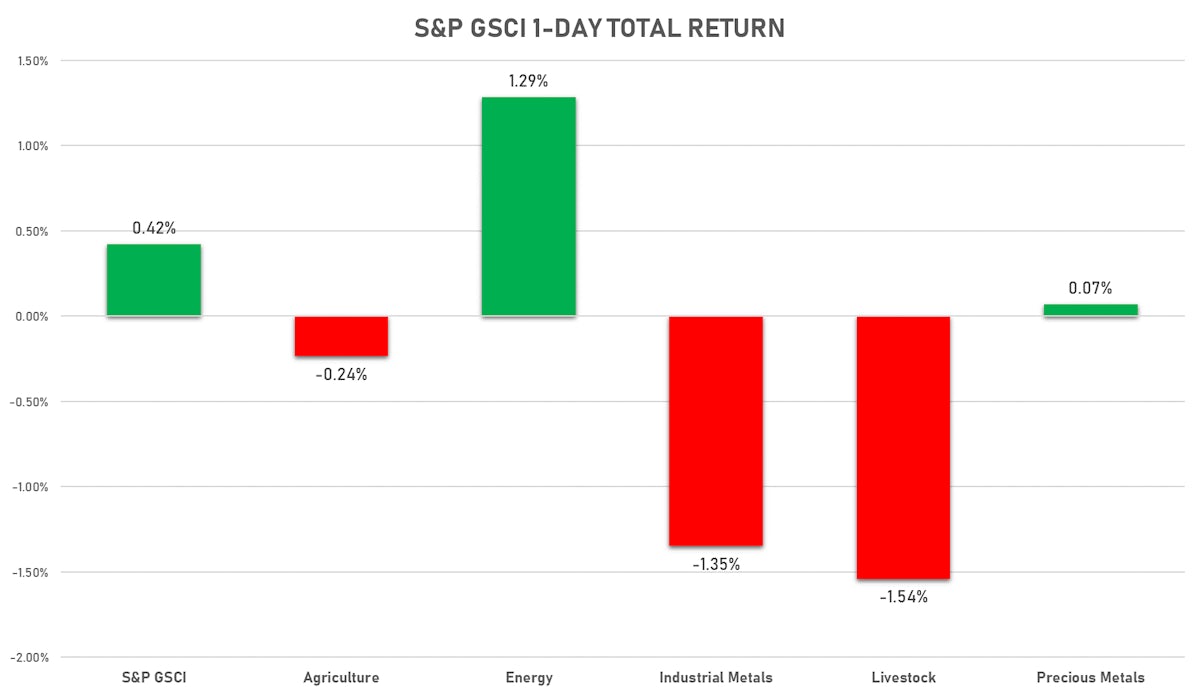

Energy Commodities Rise, Nat Gas At Highest Since 2014; Other Commodity Groups Fall

Thermal goal and natural gas have been rising in tandem: the US Energy Information Administration forecasts that high natural gas prices will push coal's share of power generation up from 20% in 2020 to 24% in 2021

Published ET

Thermal Coal vs. Natural Gas Front-Month Futures Prices | Source: Refinitiv

NOTABLE GAINERS TODAY

- Zhengzhou Exchange Thermal Coal up 6.5% (YTD: 45.5%)

- NYMEX Henry Hub Natural Gas up 5.9% (YTD: 106.0%)

- SHFE Aluminum up 3.6% (YTD: 49.9%)

- SMM Lithium Metal Spot Price Daily up 2.6% (YTD: 59.8%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily up 2.5% (YTD: 35.8%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 2.5% (YTD: 13.8%)

- DCE Iron Ore Continuation Month 1 up 2.3% (YTD: -21.1%)

- SHFE Copper up 2.2% (YTD: 23.6%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily up 2.2% (YTD: 35.9%)

- ICE Europe Low Sulphur Gasoil up 1.6% (YTD: 46.2%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily up 1.5% (YTD: 37.2%)

- SMM Rare Earth Terbium Metal Spot Price Daily up 1.5% (YTD: 13.4%)

- ICE-US Cocoa up 1.3% (YTD: 2.8%)

- NYMEX Light Sweet Crude Oil (WTI) up 1.0% (YTD: 45.2%)

- Crude Oil WTI Cushing US FOB up 1.0% (YTD: 45.9%)

NOTABLE LOSERS TODAY

- DCE Coking Coal Continuation Month 1 down -7.7% (YTD: 97.0%)

- Johnson Matthey Rhodium New York 0930 down -7.6% (YTD: -15.0%)

- SGX Iron Ore 62% China CFR Swap Monthly down -3.2% (YTD: -18.1%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -2.6% (YTD: -16.8%)

- Palladium spot down -2.3% (YTD: -14.7%)

- CME Lean Hogs down -2.0% (YTD: 14.9%)

- COMEX Copper down -1.9% (YTD: 24.2%)

- WUXI Metal Cobalt Bi-Monthly down -1.8% (YTD: 34.0%)

- CME Cattle(Feeder) down -1.3% (YTD: 9.5%)

- CBoT Corn down -1.2% (YTD: 2.6%)

- CME Live Cattle down -0.9% (YTD: 8.3%)

- DCE Coke down -0.9% (YTD: 51.3%)

- ICE-US Cotton No. 2 down -0.9% (YTD: 20.9%)

- ICE-US Coffee C down -0.7% (YTD: 43.7%)

- SHFE Nickel down -0.6% (YTD: 23.6%)

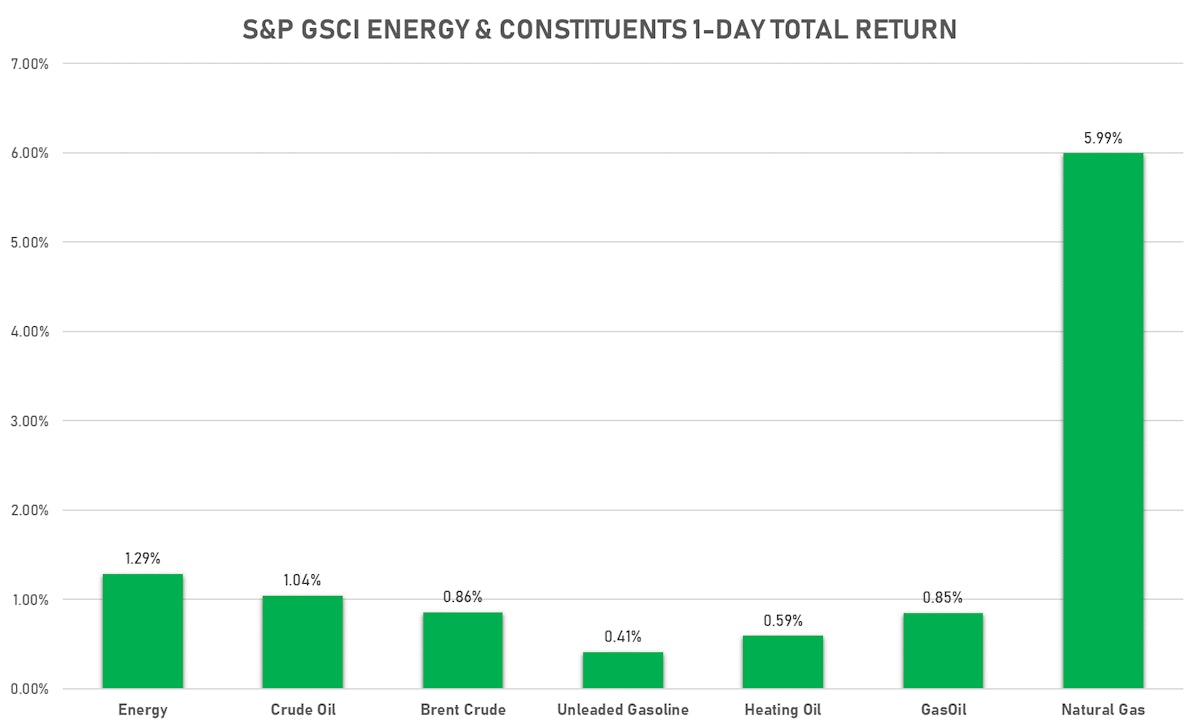

ENERGY UP TODAY

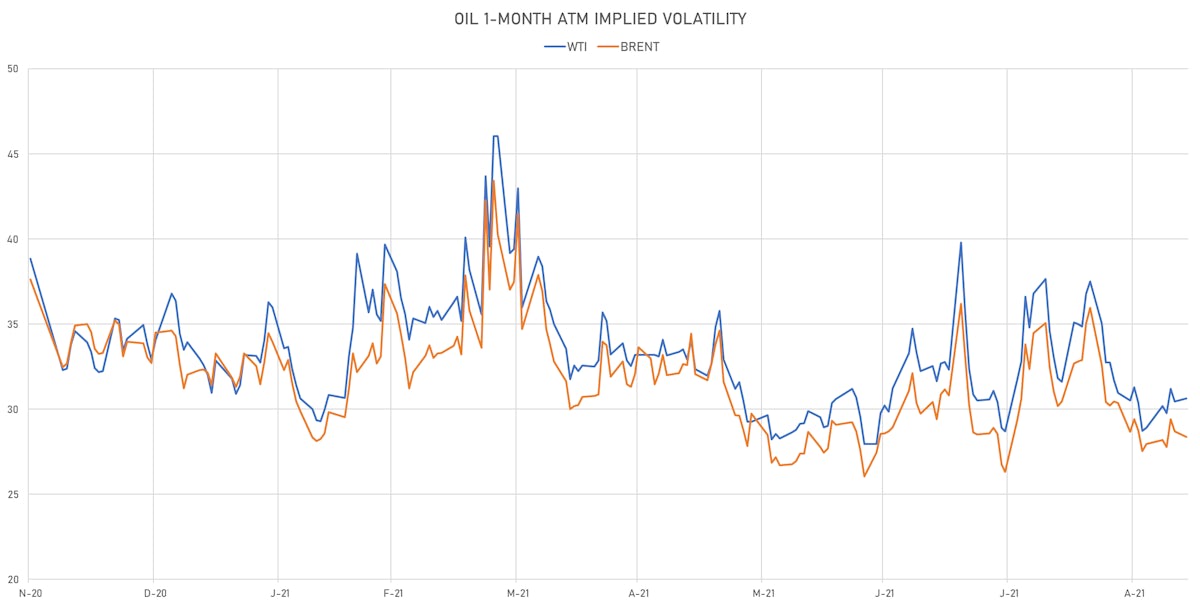

- WTI crude front month currently at US$ 70.70 per barrel, up 1.0% (YTD: +45.2%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 73.69 per barrel, up 0.8% (YTD: +41.9%); 6-month term structure in tightening backwardation

- Brent volatility at 28.4, down -1.1% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 177.50 per tonne, down -0.1% (YTD: +120.5%)

- Natural Gas (Henry Hub) currently at US$ 5.21 per MMBtu, up 5.9% (YTD: +106.0%)

- Gasoline (NYMEX) currently at US$ 2.17 per gallon, up 0.3% (YTD: +53.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 616.75 per tonne, up 1.6% (YTD: +46.2%)

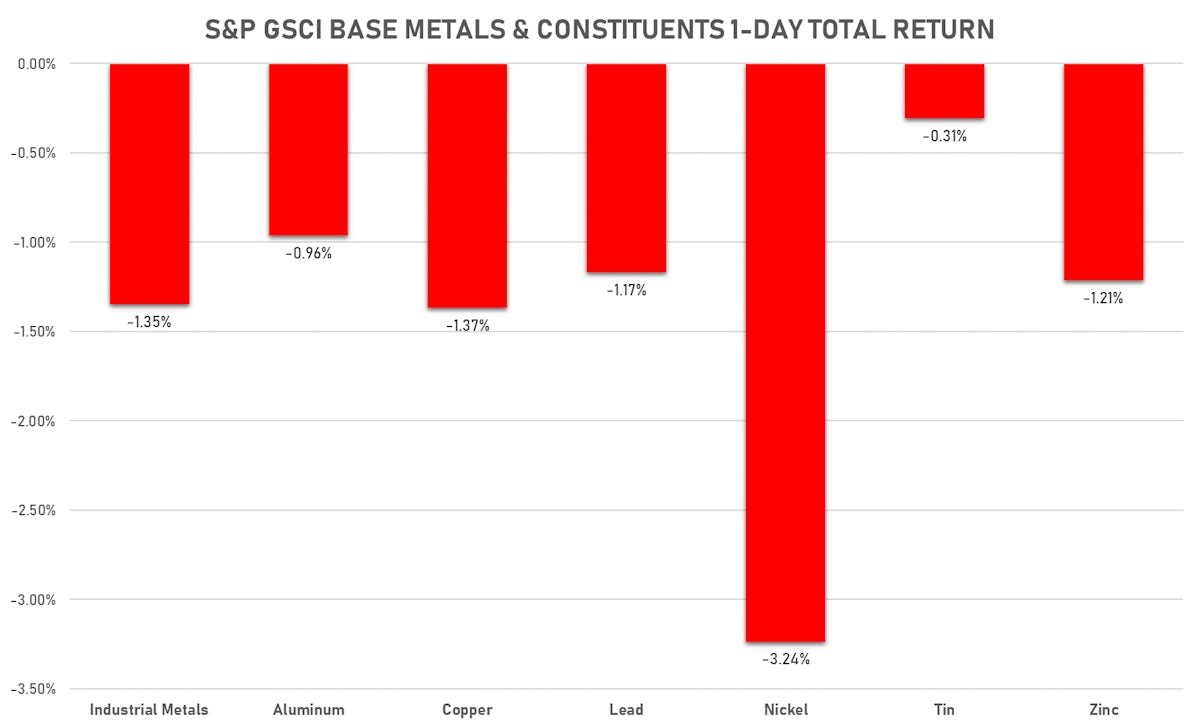

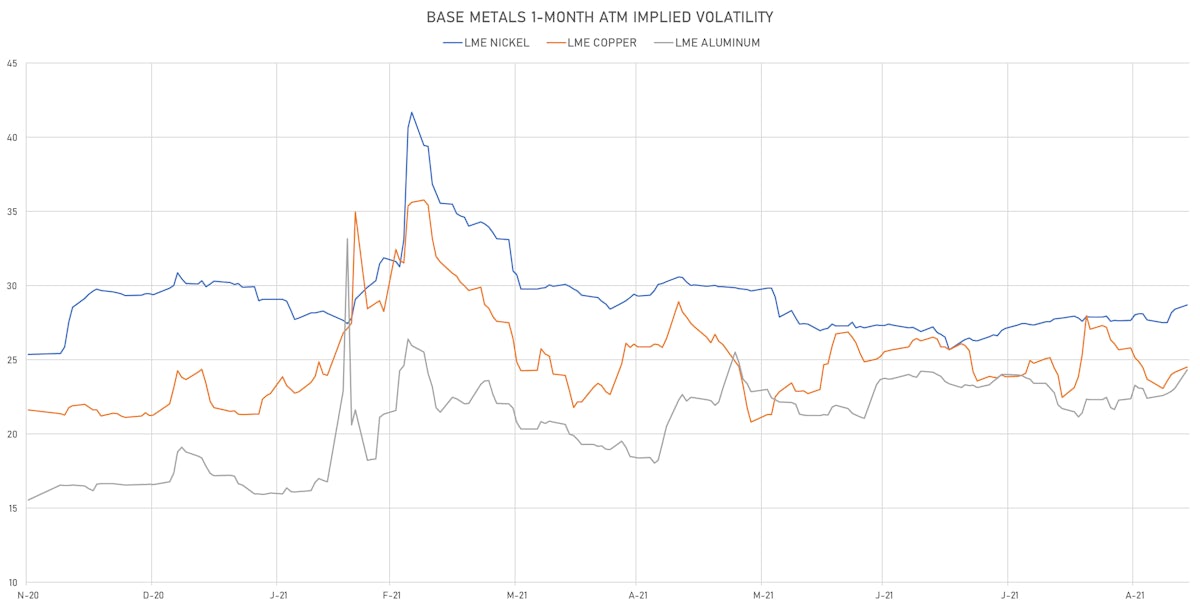

BASE METALS DOWN TODAY

- Copper (COMEX) currently at US$ 4.36 per pound, down -1.9% (YTD: +24.2%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 851.50 per tonne, up 2.3% (YTD: -21.1%)

- Aluminum (Shanghai) currently at CNY 22,780 per tonne, up 3.6% (YTD: +49.9%)

- Nickel (Shanghai) currently at CNY 148,400 per tonne, down -0.6% (YTD: +23.6%)

- Lead (Shanghai) currently at CNY 14,890 per tonne, up 0.3% (YTD: +2.5%)

- Rebar (Shanghai) currently at CNY 5,600 per tonne, down -0.1% (YTD: +32.7%)

- Tin (Shanghai) currently at CNY 257,390 per tonne, up 0.5% (YTD: +72.7%)

- Zinc (Shanghai) currently at CNY 22,640 per tonne, up 0.4% (YTD: +9.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 372,500 per tonne, unchanged (YTD: +35.9%)

- Lithium (Shanghai) spot price currently at CNY 775,000 per tonne, up 2.6% (YTD: +59.8%)

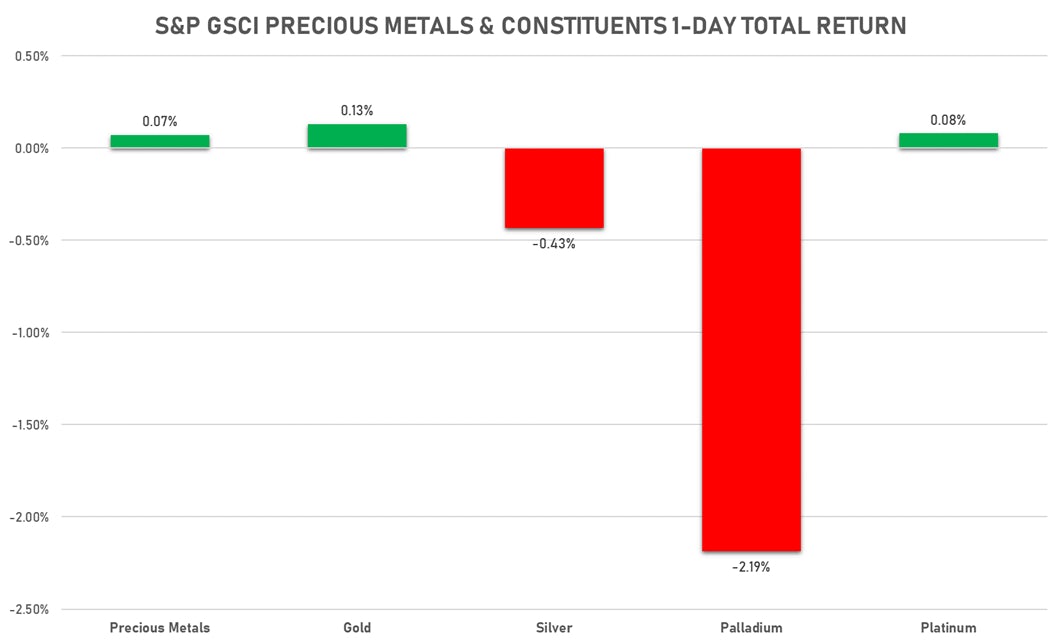

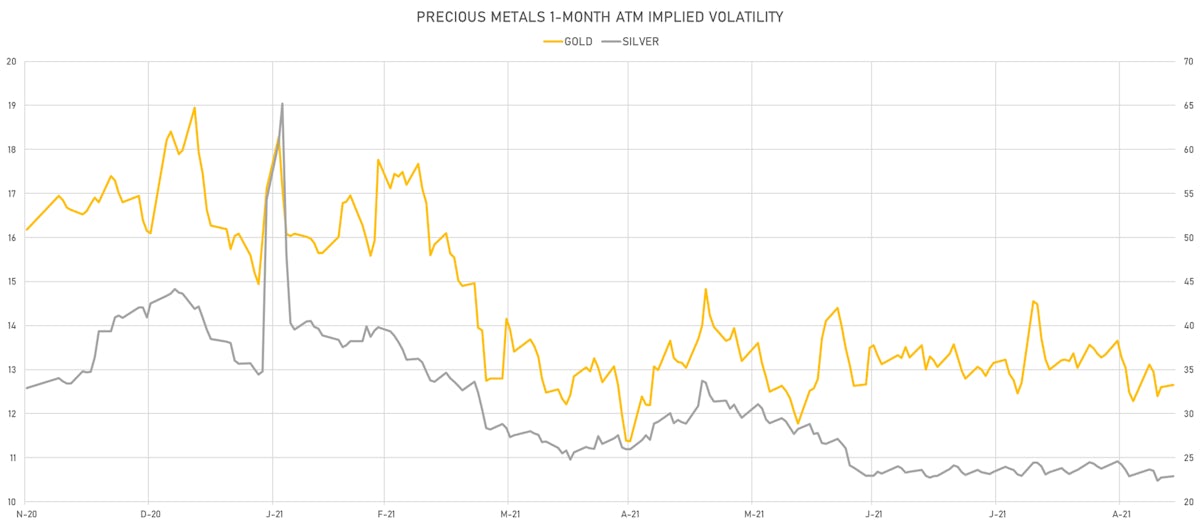

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,790.70 per troy ounce, up 0.3% (YTD: -5.5%)

- Gold 1-Month ATM implied volatility currently at 12.40, up 0.4% (YTD: -21.4%)

- Silver spot unchanged at US$ 23.69 per troy ounce (YTD: -10.0%)

- Silver 1-Month ATM implied volatility currently at 22.05, up 0.6% (YTD: -46.2%)

- Palladium spot currently at US$ 2,092.84 per troy ounce, down -2.3% (YTD: -14.7%)

- Platinum spot currently at US$ 960.37 per troy ounce, up 0.8% (YTD: -10.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,500 per troy ounce, down -7.6% (YTD: -15.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

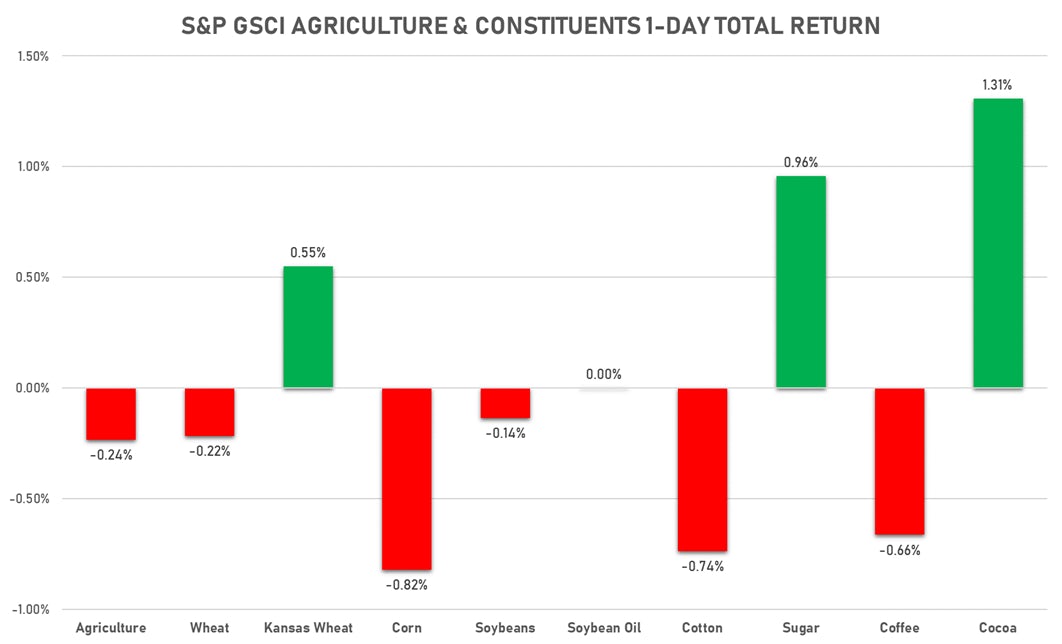

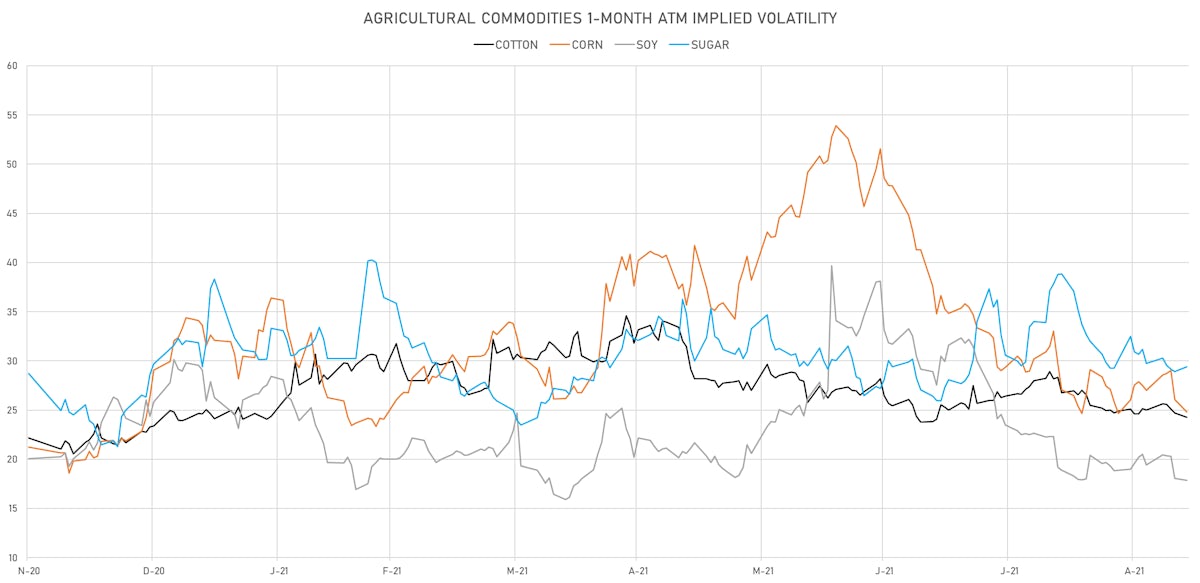

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 122.28 cents per pound, down 0.9% (YTD: +8.3%)

- Lean Hogs (CME) currently at US$ 80.78 cents per pound, down -2.0% (YTD: +14.9%)

- Rough Rice (CBOT) currently at US$ 13.33 cents per hundredweight, up 0.5% (YTD: +7.5%)

- Soybeans Composite (CBOT) currently at US$ 1,272.50 cents per bushel, down -0.2% (YTD: -3.3%)

- Corn (CBOT) currently at US$ 497.00 cents per bushel, down -1.2% (YTD: +2.6%)

- Wheat Composite (CBOT) currently at US$ 677.25 cents per bushel, down -0.1% (YTD: +5.3%)

- Sugar No.11 (ICE US) currently at US$ 18.98 cents per pound, up 1.0% (YTD: +22.5%)

- Cotton No.2 (ICE US) currently at US$ 94.41 cents per pound, down -0.9% (YTD: +20.9%)

- Cocoa (ICE US) currently at US$ 2,677 per tonne, up 1.3% (YTD: +2.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,435 per tonne, up 0.3% (YTD: +40.1%)

- Random Length Lumber (CME) currently at US$ 505.60 per 1,000 board feet, down -0.5% (YTD: -42.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,045 per tonne, up 0.6% (YTD: +7.7%)

- Soybean Oil Composite (CBOT) currently at US$ 55.80 cents per pound, up 0.1% (YTD: +28.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,617 per tonne, up 0.9% (YTD: +18.7%)

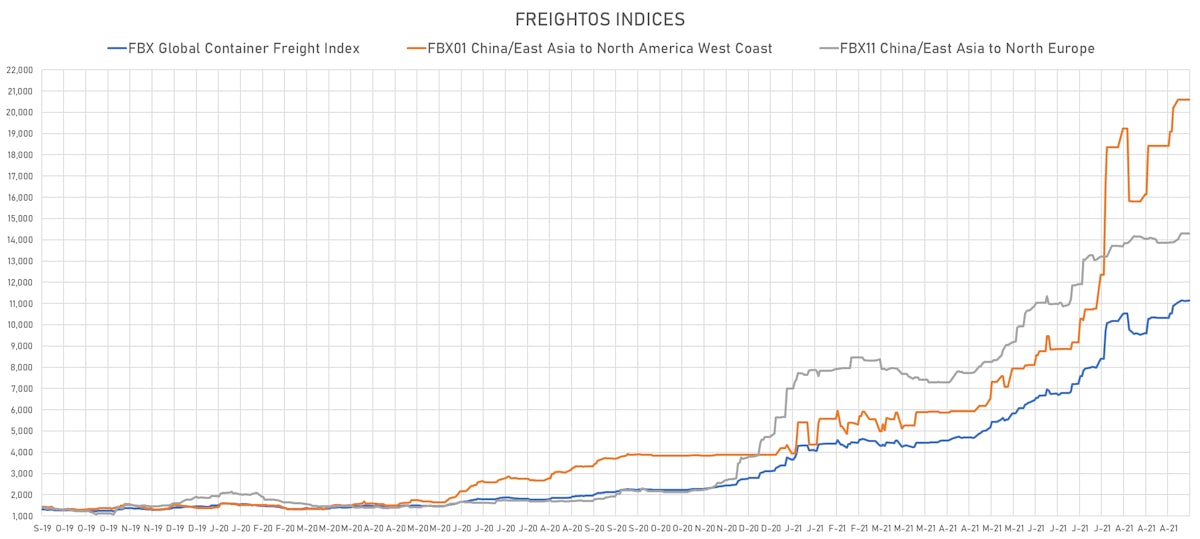

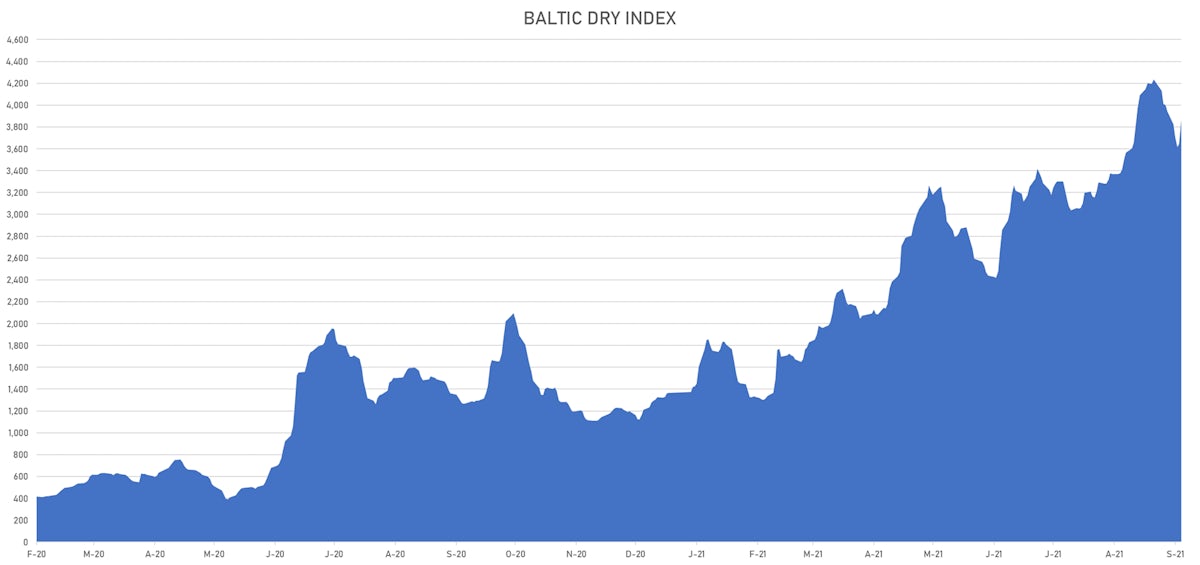

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,864, up 6.1% (YTD: +182.9%)

- Freightos China To North America West Coast Container Index currently at 20,586, unchanged (YTD: +390.2%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 495, up 35.2% (YTD: +36.4%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,299, up 0.0% (YTD: +152.5%)

- Freightos North Europe To China Container Index currently at 1,501, down -0.7% (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

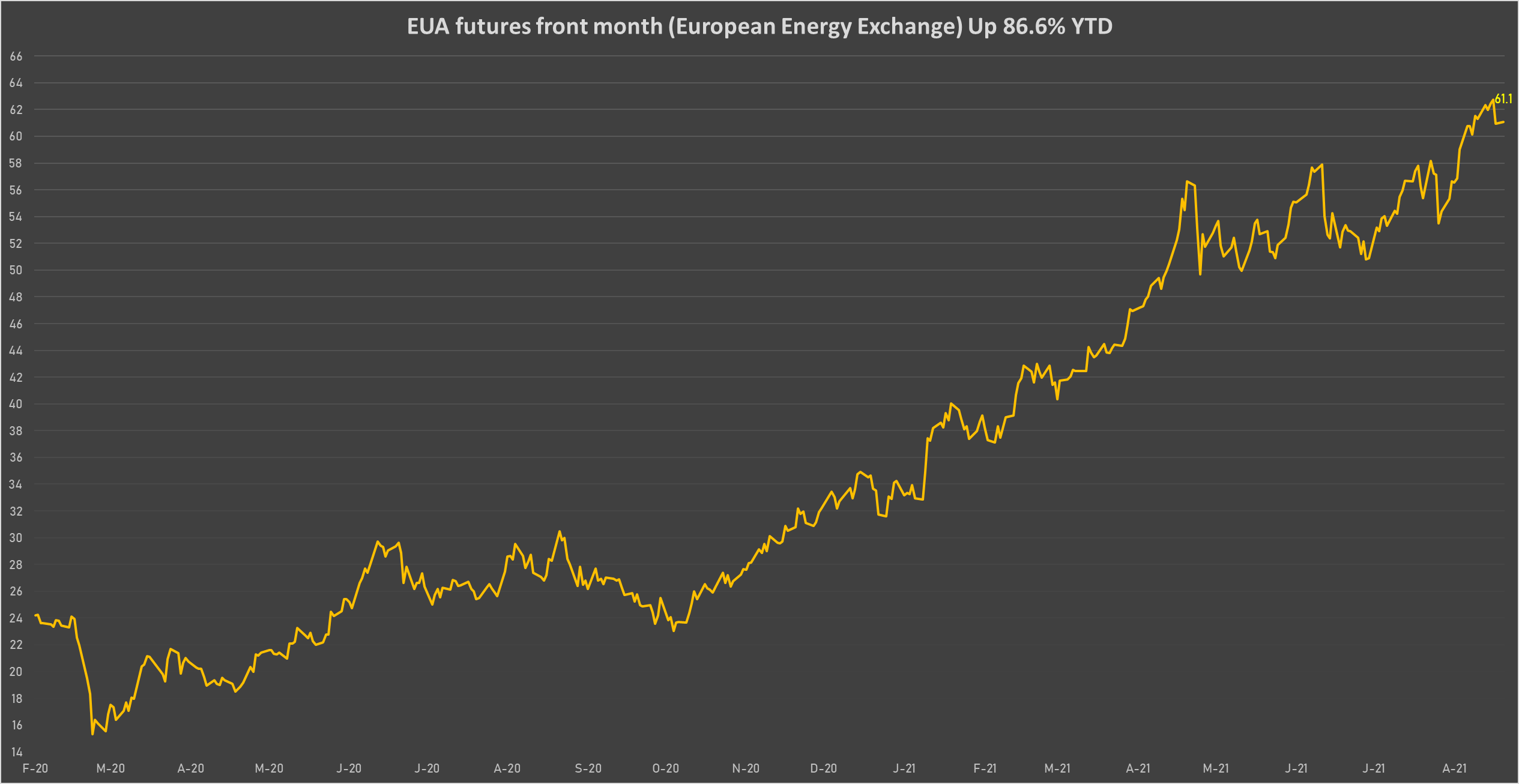

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 61.07 per tonne, up 0.2% (YTD: +86.6%)