Commodities

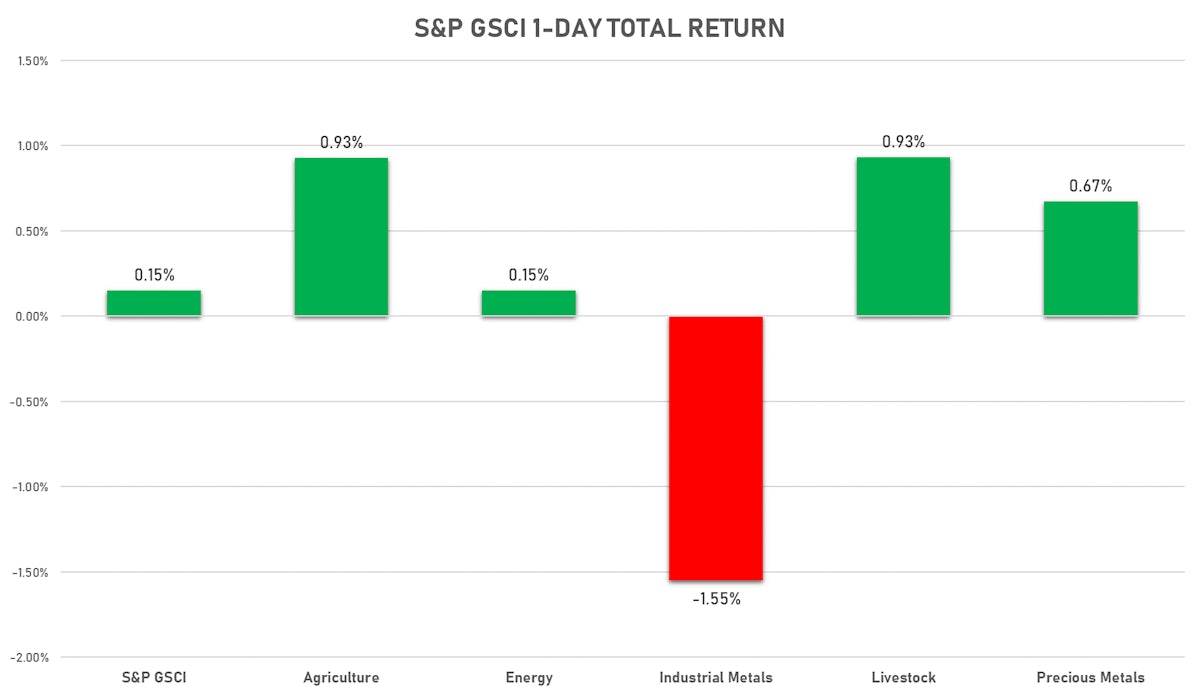

Industrial Metals Fall While Other Commodity Groups Rise

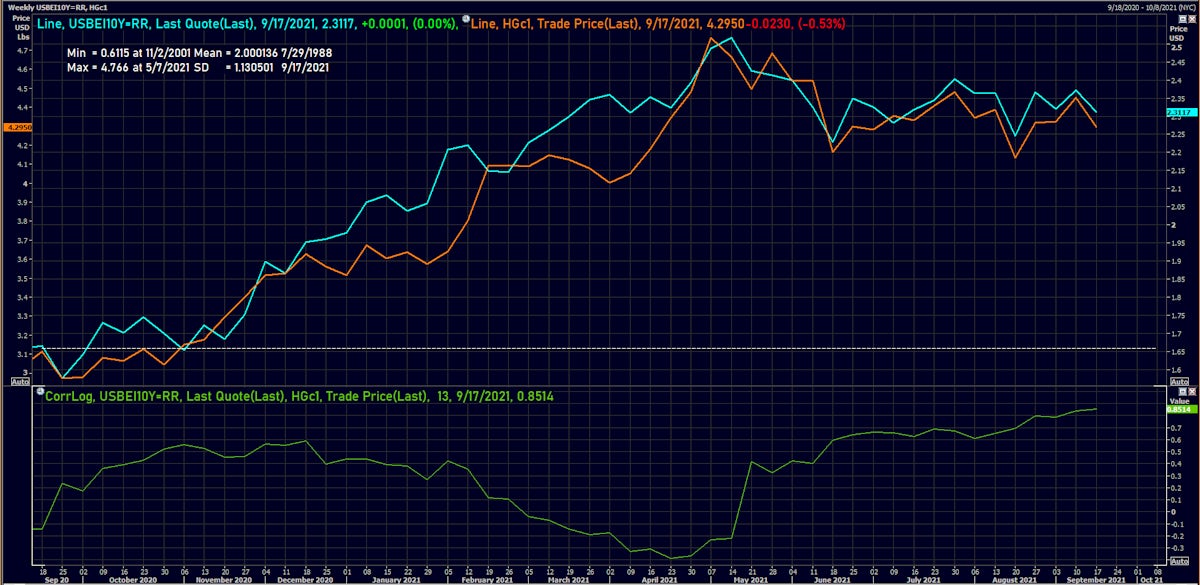

Copper followed the 10-year TIPS breakeven inflation down today, with the 3-month correlation of their weekly returns staying above 80%

Published ET

Copper Front-Month Futures Prices vs 10Y TIPS Breakeven Inflation | Source: Refinitiv

HEADLINES & MACRO

- API weekly inventories report: crude oil draw of 5.44M barrels, gasoline draw of 2.76M barrels, distillate draw of 2.89M barrels, Cushing draw of 1.35M barrels

- Consensus estimate for tomorrow's EIA report: Crude draw of 3.54M barrels, gasoline draw of 1.96M barrels, distillate draw of 1.61M barrels, with refinery capacity utilization expected to rise 1.7%

- As thermal and coking coals keep risking, GS wakes up and almost doubles its price forecast for front-month Newcastle coal to US$ 190 per ton in 4Q21 (7% above the current market price of $177.45): "A strong recovery in global power demand, gas prices, and steel production, combined with supply side issues in Australia, South Africa, China and Mongolia due to infrastructure and Covid-related challenges has tightened both markets significantly"

NOTABLE GAINERS TODAY

- Zhengzhou Exchange Thermal Coal up 4.6% (YTD: 52.2%)

- DCE Coking Coal Continuation Month 1 up 4.0% (YTD: 104.9%)

- DCE Iron Ore Continuation Month 1 up 3.9% (YTD: -18.0%)

- SMM Lithium Metal Spot Price Daily up 2.6% (YTD: 63.9%)

- Shanghai International Exchange TSR 20 up 2.2% (YTD: 10.1%)

- CME Cattle(Feeder) up 2.0% (YTD: 11.7%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 1.8% (YTD: 15.9%)

- CBoT Soybean Oil up 1.6% (YTD: 30.8%)

- CBoT Wheat up 1.6% (YTD: 6.9%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily up 1.5% (YTD: 38.0%)

- CME Live Cattle up 1.5% (YTD: 9.9%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily up 1.5% (YTD: 39.2%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily up 1.3% (YTD: 37.6%)

- SHFE Bitumen Continuation Month 1 up 1.3% (YTD: 25.5%)

- CBoT Corn up 1.3% (YTD: 3.9%)

NOTABLE LOSERS TODAY

- Johnson Matthey Rhodium New York 0930 down -15.5% (YTD: -28.2%)

- DCE Coke down -14.1% (YTD: 29.9%)

- CME Random Length Lumber down -6.8% (YTD: -46.1%)

- Palladium spot down -5.3% (YTD: -19.2%)

- DCE RBD Palm Oil down -3.9% (YTD: 22.3%)

- SHFE Nickel down -3.2% (YTD: 19.6%)

- SHFE Aluminum down -2.8% (YTD: 45.6%)

- Platinum spot down -2.1% (YTD: -12.0%)

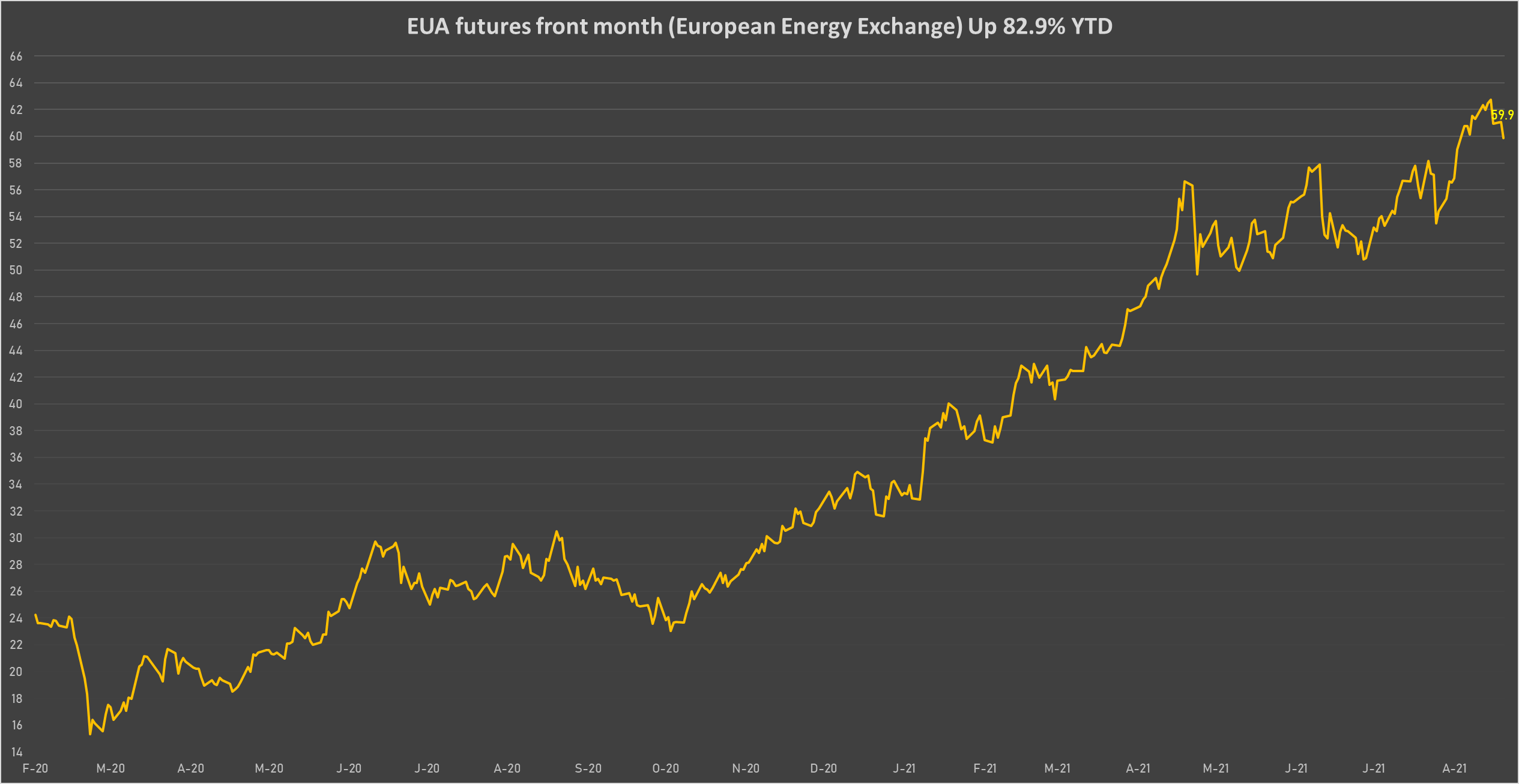

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -2.0% (YTD: 82.9%)

- EEX European-Carbon- Secondary Trading down -2.0% (YTD: 86.6%)

- SHFE Lead Continuation Month 1 down -1.6% (YTD: 0.9%)

- SHFE Copper down -1.5% (YTD: 21.7%)

- SHFE Stannum down -1.4% (YTD: 70.2%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -1.2% (YTD: -17.8%)

- SHFE Zinc down -1.1% (YTD: 8.7%)

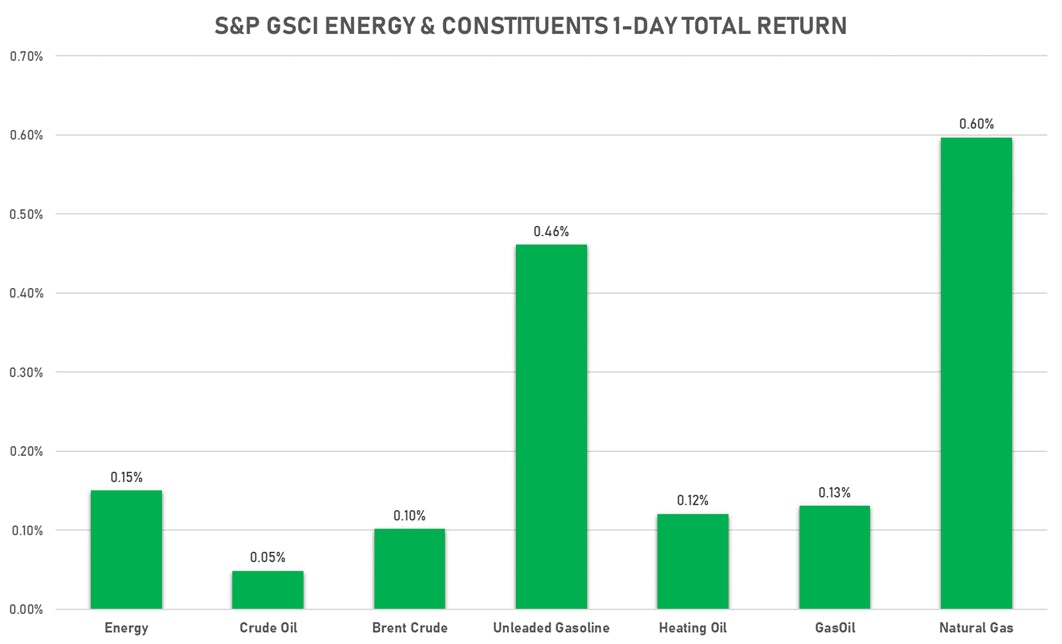

ENERGY UP TODAY

- WTI crude front month unchanged at US$ 70.89 per barrel (YTD: +45.2%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 74.03 per barrel, up 0.1% (YTD: +42.1%); 6-month term structure in widening backwardation

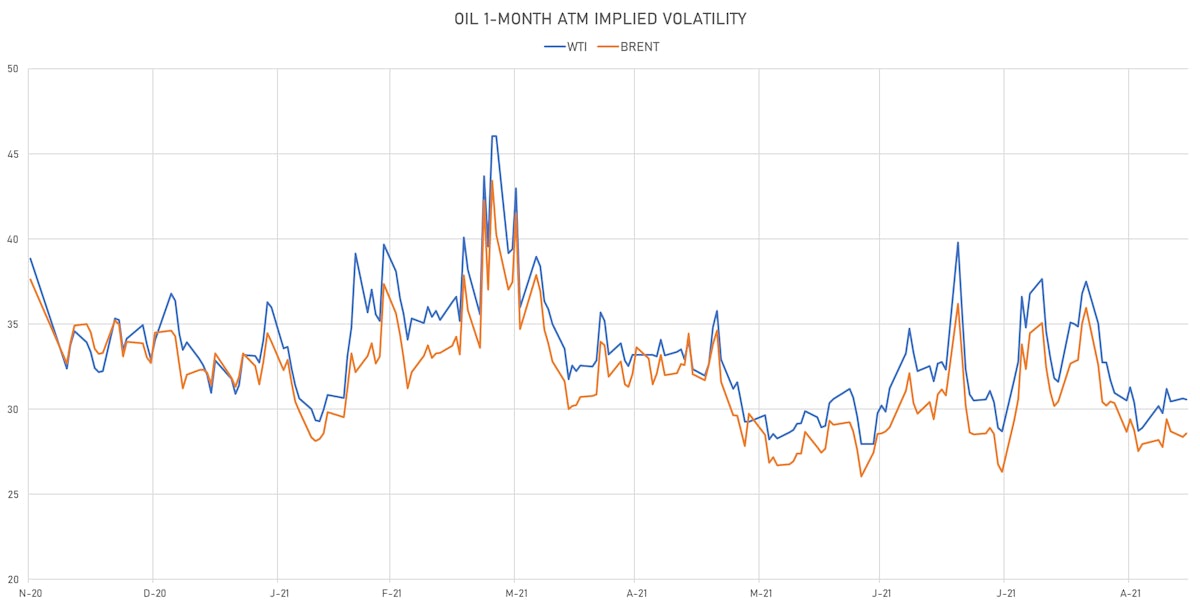

- Brent volatility at 28.6, up 0.7% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) unchanged at US$ 177.45 per tonne (YTD: +120.4%)

- Natural Gas (Henry Hub) currently at US$ 5.28 per MMBtu, up 0.6% (YTD: +107.2%)

- Gasoline (NYMEX) currently at US$ 2.18 per gallon, up 0.5% (YTD: +54.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) unchanged at US$ 617.75 per tonne(YTD: +46.2%)

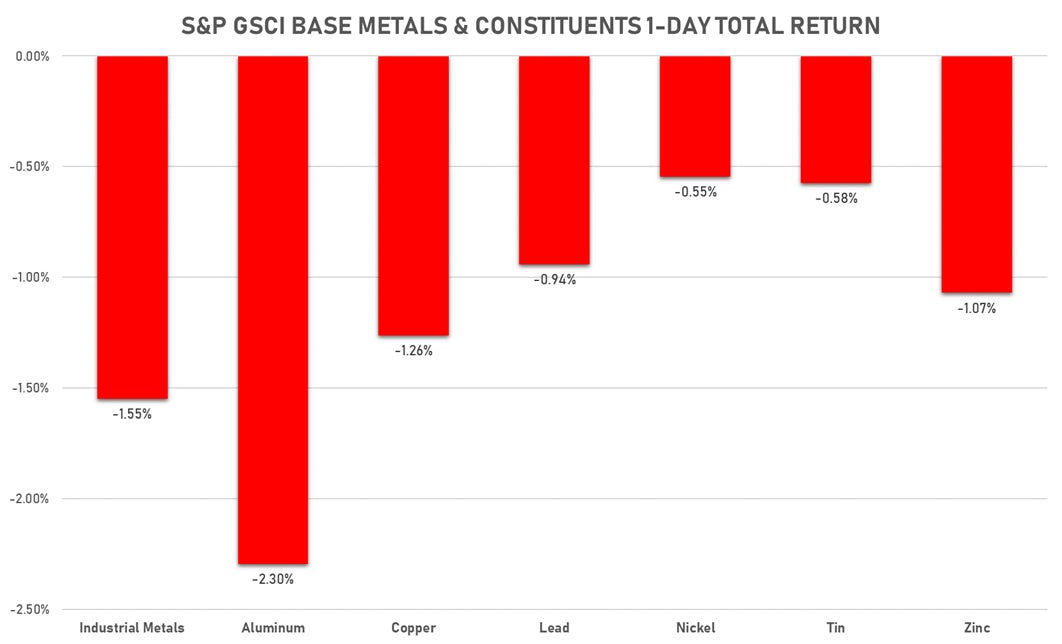

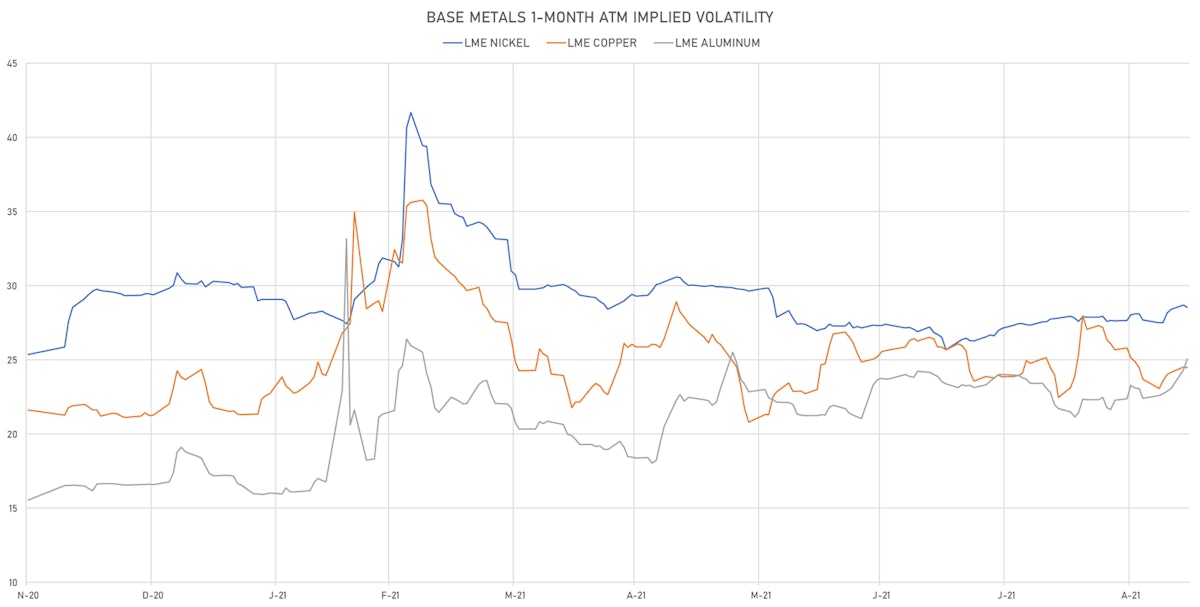

BASE METALS DOWN TODAY

- Copper (COMEX) currently at US$ 4.30 per pound, down -1.0% (YTD: +22.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 805.00 per tonne, up 3.9% (YTD: -18.0%)

- Aluminum (Shanghai) currently at CNY 22,260 per tonne, down -2.8% (YTD: +45.6%)

- Nickel (Shanghai) currently at CNY 148,000 per tonne, down -3.2% (YTD: +19.6%)

- Lead (Shanghai) currently at CNY 14,630 per tonne, down -1.6% (YTD: +0.9%)

- Rebar (Shanghai) currently at CNY 5,400 per tonne, down -0.5% (YTD: +32.0%)

- Tin (Shanghai) currently at CNY 256,500 per tonne, down -1.4% (YTD: +70.2%)

- Zinc (Shanghai) currently at CNY 22,510 per tonne, down -1.1% (YTD: +8.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,000 per tonne, up 0.7% (YTD: +36.9%)

- Lithium (Shanghai) spot price currently at CNY 795,000 per tonne, up 2.6% (YTD: +63.9%)

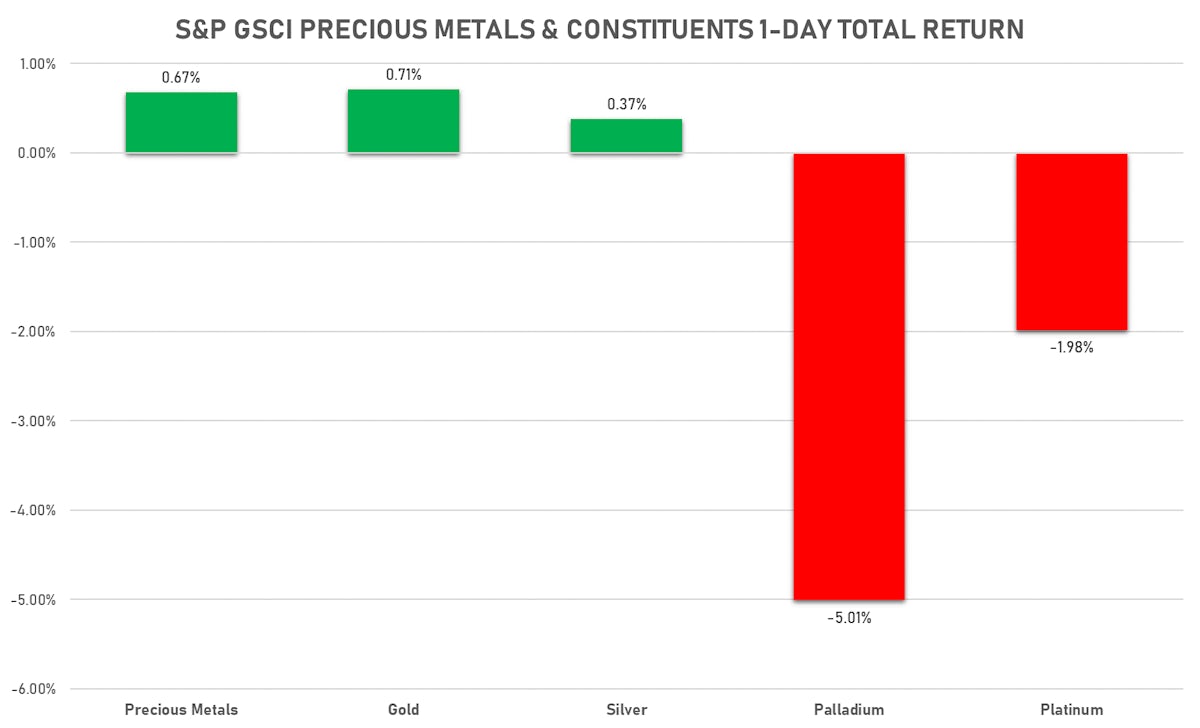

PRECIOUS METALS MIXED TODAY

- Gold spot currently at US$ 1,802.91 per troy ounce, up 0.6% (YTD: -4.9%)

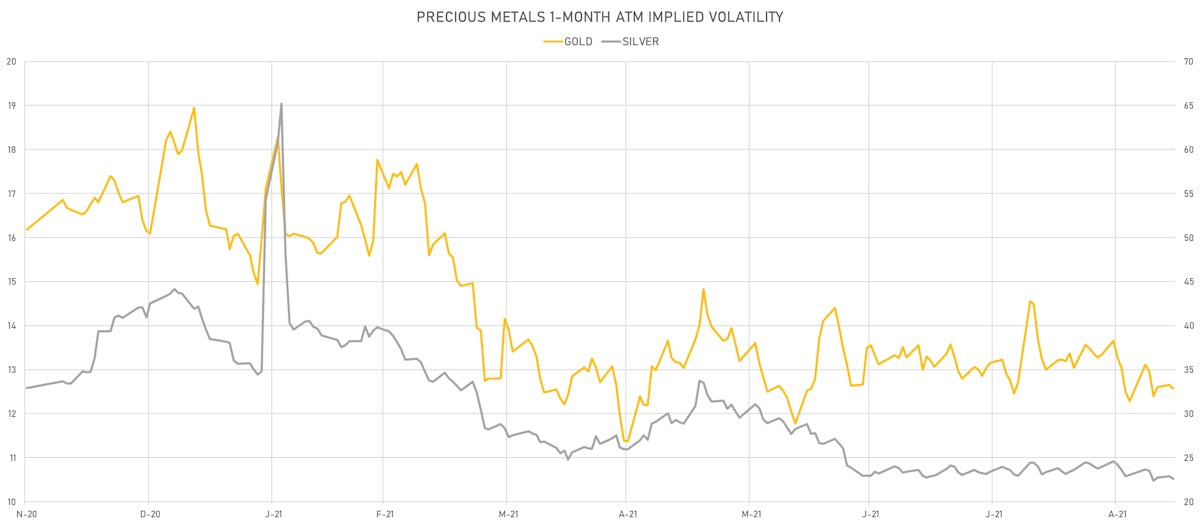

- Gold 1-Month ATM implied volatility currently at 12.15, down -0.3% (YTD: -21.7%)

- Silver spot currently at US$ 23.80 per troy ounce, up 0.5% (YTD: -9.6%)

- Silver 1-Month ATM implied volatility currently at 21.76, down -1.2% (YTD: -46.9%)

- Palladium spot currently at US$ 1,975.08 per troy ounce, down -5.3% (YTD: -19.2%)

- Platinum spot currently at US$ 932.58 per troy ounce, down -2.1% (YTD: -12.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 12,250 per troy ounce, down -15.5% (YTD: -28.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

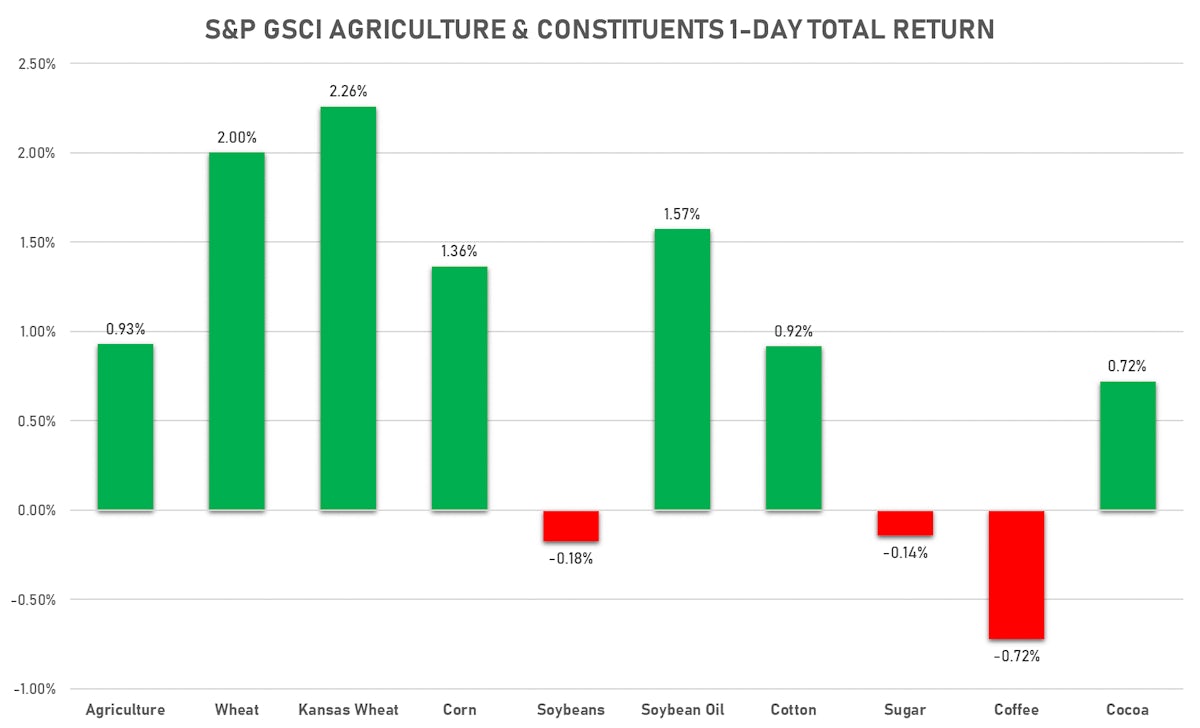

AGS TODAY

- Live Cattle (CME) currently at US$ 124.13 cents per pound, up 1.5% (YTD: +9.9%)

- Lean Hogs (CME) currently at US$ 80.38 cents per pound, down -0.5% (YTD: +14.4%)

- Rough Rice (CBOT) currently at US$ 13.56 cents per hundredweight, up 0.8% (YTD: +8.3%)

- Soybeans Composite (CBOT) currently at US$ 1,286.25 cents per bushel, up 0.3% (YTD: -2.9%)

- Corn (CBOT) currently at US$ 523.25 cents per bushel, up 1.3% (YTD: +3.9%)

- Wheat Composite (CBOT) currently at US$ 698.75 cents per bushel, up 1.6% (YTD: +6.9%)

- Sugar No.11 (ICE US) currently at US$ 18.96 cents per pound, down -0.1% (YTD: +22.4%)

- Cotton No.2 (ICE US) currently at US$ 94.96 cents per pound, up 0.6% (YTD: +21.6%)

- Cocoa (ICE US) currently at US$ 2,696 per tonne, up 0.7% (YTD: +3.6%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,405 per tonne, down -0.7% (YTD: +39.2%)

- Random Length Lumber (CME) currently at US$ 471.00 per 1,000 board feet, down -6.8% (YTD: -46.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,005 per tonne, up 2.2% (YTD: +10.1%)

- Soybean Oil Composite (CBOT) currently at US$ 56.89 cents per pound, up 1.6% (YTD: +30.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,631 per tonne, up 0.3% (YTD: +19.0%)

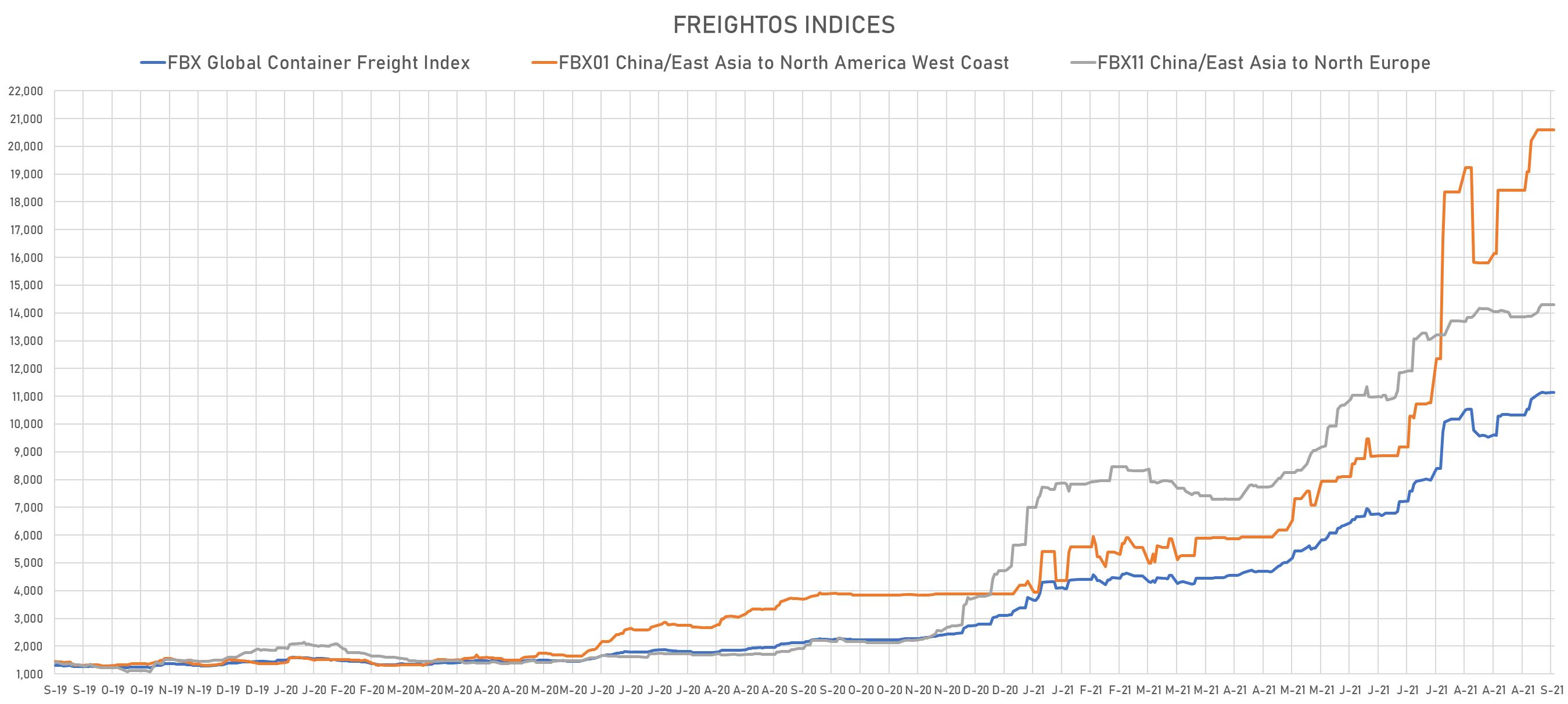

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,163, up 7.7% (YTD: +204.8%)

- Freightos China To North America West Coast Container Index currently at 20,586, unchanged (YTD: +390.2%)

- Freightos North America West Coast To China Container Index currently at 927, up 2.2% (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 554, up 11.9% (YTD: +52.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,860, down -0.1% (YTD: +267.0%)

- Freightos China To North Europe Container Index currently at 14,299, unchanged (YTD: +152.5%)

- Freightos North Europe To China Container Index currently at 1,501, unchanged (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 59.85 per tonne, down -2.0% (YTD: +82.9%)