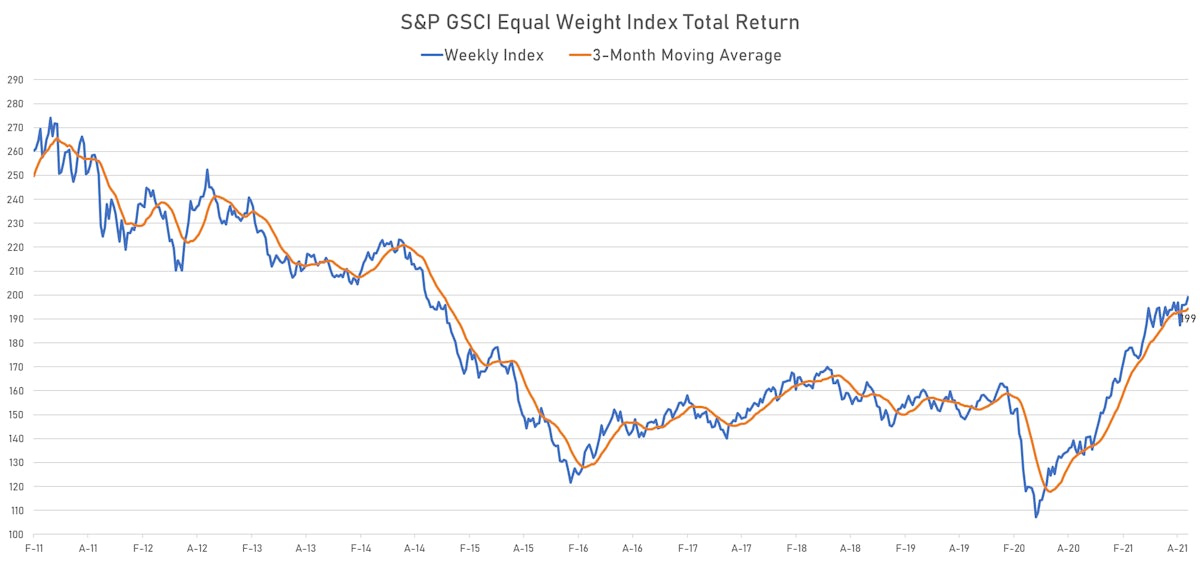

Commodities

Big Day For Energy As Crude Oil And Natural Gas Make Further Gains

We've been talking about those a lot lately, but the rise in their prices has gone exponential, with a temporary peak likely in sight for thermal coal, coking coal and natural gas

Published ET

Natural Gas, Thermal Coal, Coking Coal Front-Month Futures Prices | Source: Refinitiv

WEEKLY EIA DATA SHOWS LARGER THAN EXPECTED DRAW IN OIL INVENTORIES

- Total Crude Oil excluding SPR, Absolute change, Volume for W 10 Sep (EIA, United States) at -6.42 Mln, below consensus estimate of -3.54 Mln

- Total Distillate, Absolute change, Volume for W 10 Sep (EIA, United States) at -1.69 Mln, below consensus estimate of -1.61 Mln

- Gasoline, Absolute change, Volume for W 10 Sep (EIA, United States) at -1.86 Mln, above consensus estimate of -1.96 Mln

- Refinery Capacity Utilization, Absolute change, Volume for W 10 Sep (EIA, United States) at 0.20 %, below consensus estimate of 1.70 %

NOTABLE GAINERS TODAY

- DCE Coking Coal Continuation Month 1 up 11.9% (YTD: 129.3%)

- CBoT Corn up 6.1% (YTD: 10.2%)

- Zhengzhou Exchange Thermal Coal up 6.0% (YTD: 61.3%)

- DCE Coke up 4.1% (YTD: 35.2%)

- CBoT Wheat up 4.0% (YTD: 11.2%)

- NYMEX Henry Hub Natural Gas up 3.8% (YTD: 115.0%)

- NYMEX Light Sweet Crude Oil (WTI) up 3.1% (YTD: 49.6%)

- ICE Europe Low Sulphur Gasoil up 3.0% (YTD: 50.5%)

- ICE-US Sugar No. 11 up 3.0% (YTD: 26.0%)

- Crude Oil WTI Cushing US FOB up 2.9% (YTD: 50.1%)

- CBoT Soybean Oil up 2.9% (YTD: 34.6%)

- CBoT Rough Rice up 2.6% (YTD: 11.2%)

- ICE Europe Brent Crude up 2.5% (YTD: 45.7%)

- SMM Lithium Metal Spot Price Daily up 2.5% (YTD: 68.0%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 2.5% (YTD: 47.1%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -9.3% (YTD: -25.6%)

- Johnson Matthey Rhodium New York 0930 down -8.2% (YTD: -34.0%)

- CME Random Length Lumber down -3.5% (YTD: -48.0%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -3.1% (YTD: -20.3%)

- WUXI Metal Cobalt Bi-Monthly down -2.6% (YTD: 30.7%)

- SGX Iron Ore 62% China CFR Swap Monthly down -2.6% (YTD: -20.8%)

- SHFE Aluminum down -2.4% (YTD: 42.2%)

- SHFE Rebar down -1.9% (YTD: 29.5%)

- Shanghai International Exchange Bonded Copper down -1.8% (YTD: 18.0%)

- CBoT Soybean Meal down -1.6% (YTD: -22.7%)

- SHFE Lead Continuation Month 1 down -1.2% (YTD: -0.3%)

- SHFE Copper down -1.0% (YTD: 20.5%)

- SHFE Zinc down -0.9% (YTD: 7.6%)

- Gold spot down -0.6% (YTD: -5.5%)

- Coffee Arabica Colombia Excelso EP Spot down -0.4% (YTD: 38.6%)

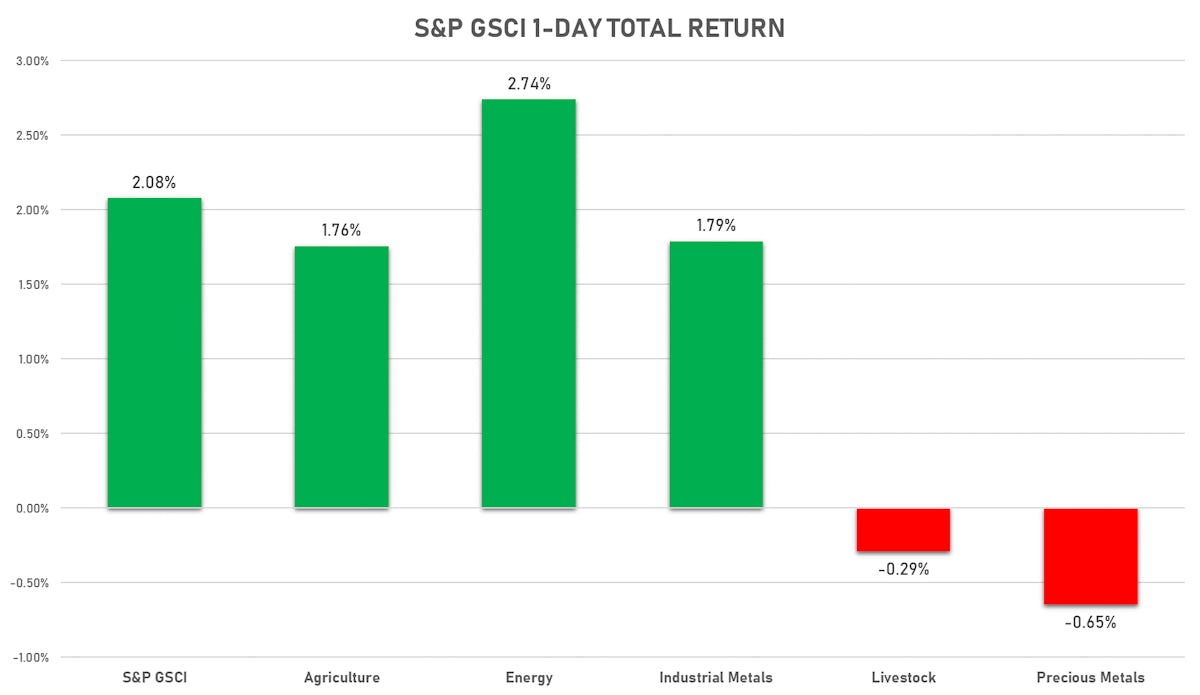

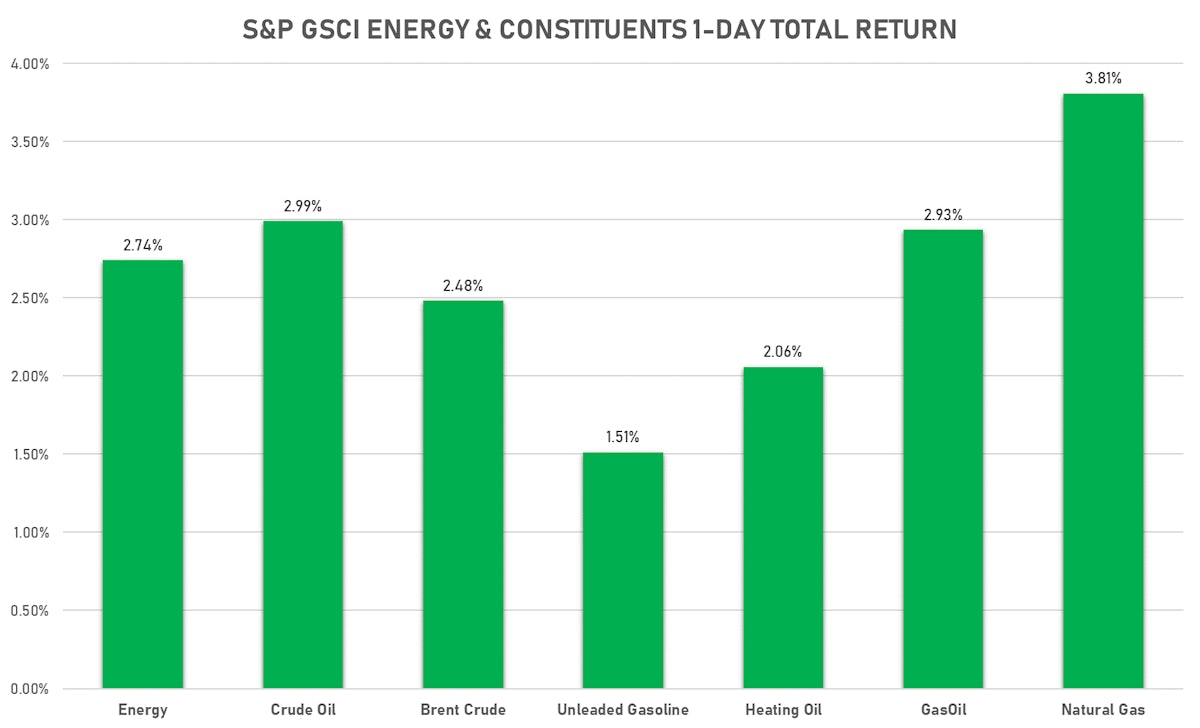

ENERGY UP BROADLY TODAY

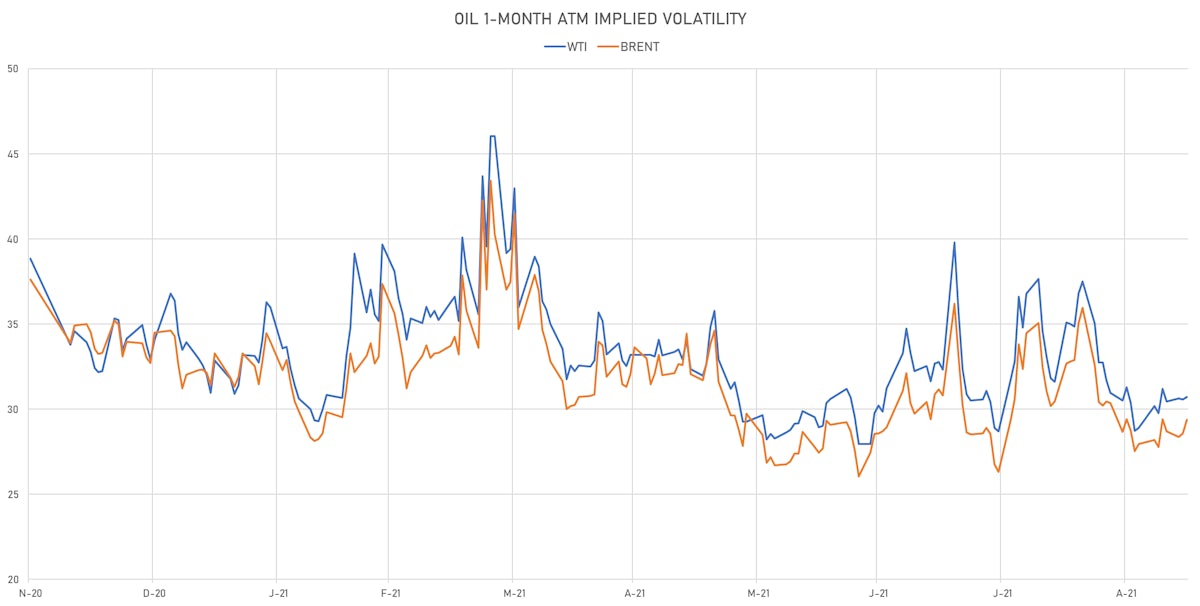

- WTI crude front month currently at US$ 72.47 per barrel, up 3.1% (YTD: +49.6%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.31 per barrel, up 2.5% (YTD: +45.7%); 6-month term structure in widening backwardation

- Brent volatility at 29.4, up 2.8% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) unchanged at US$ 177.50 per tonne (YTD: +120.5%)

- Natural Gas (Henry Hub) currently at US$ 5.41 per MMBtu, up 3.8% (YTD: +115.0%)

- Gasoline (NYMEX) currently at US$ 2.20 per gallon, up 1.6% (YTD: +56.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 629.00 per tonne, up 3.0% (YTD: +50.5%)

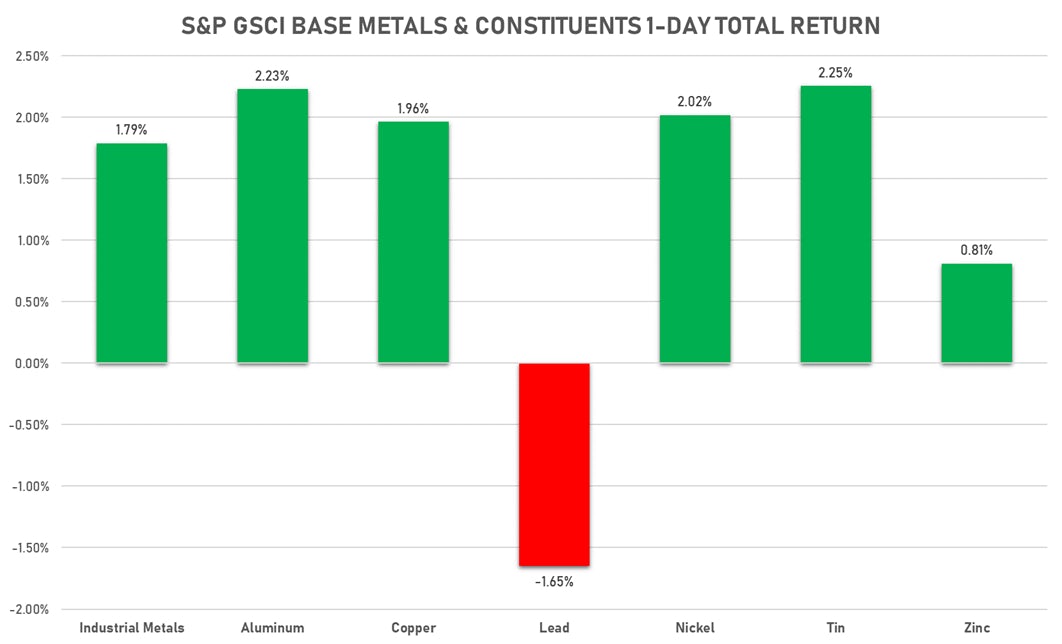

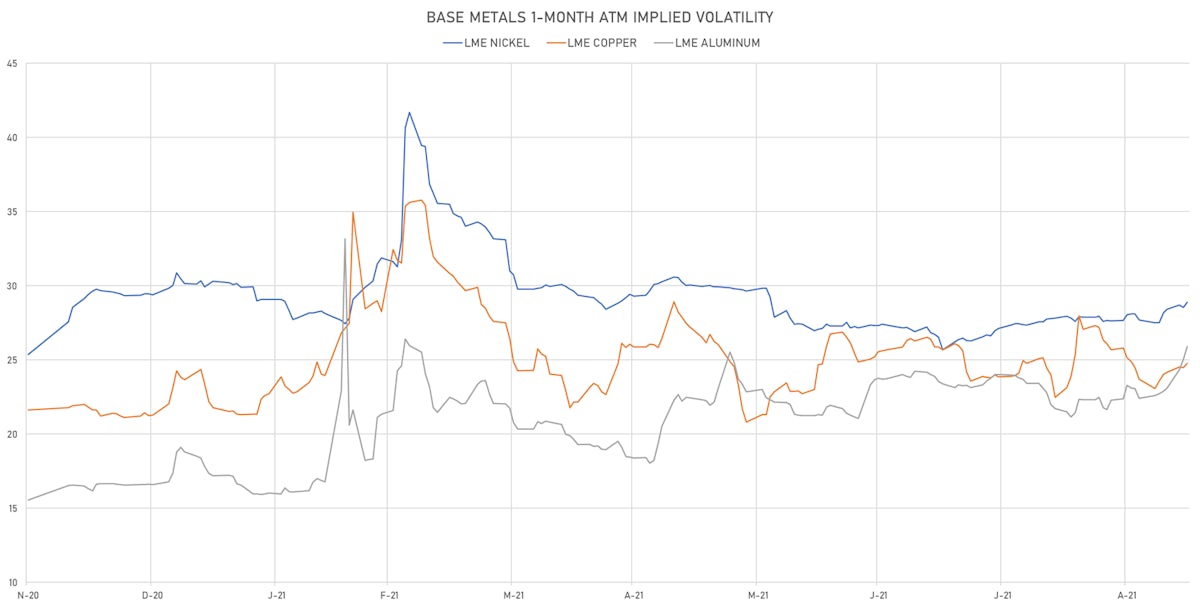

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) currently at US$ 4.40 per pound, up 2.0% (YTD: +25.3%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 766.50 per tonne, down -9.3% (YTD: -25.6%)

- Aluminum (Shanghai) currently at CNY 22,750 per tonne, down -2.4% (YTD: +42.2%)

- Nickel (Shanghai) unchanged at CNY 148,930 per tonne (YTD: +19.5%)

- Lead (Shanghai) currently at CNY 14,645 per tonne, down -1.2% (YTD: -0.3%)

- Rebar (Shanghai) currently at CNY 5,592 per tonne, down -1.9% (YTD: +29.5%)

- Tin (Shanghai) currently at CNY 259,980 per tonne, up 1.0% (YTD: +71.9%)

- Zinc (Shanghai) currently at CNY 22,675 per tonne, down -0.9% (YTD: +7.6%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,000 per tonne, unchanged (YTD: +36.9%)

- Lithium (Shanghai) spot price currently at CNY 815,000 per tonne, up 2.5% (YTD: +68.0%)

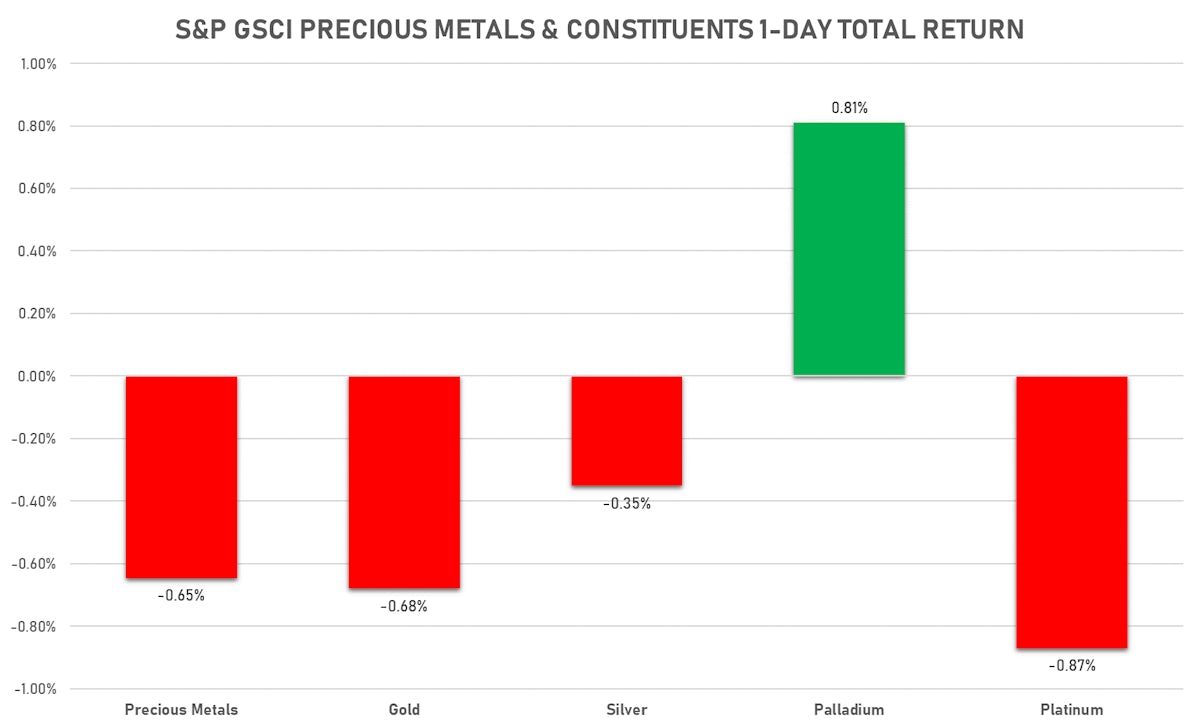

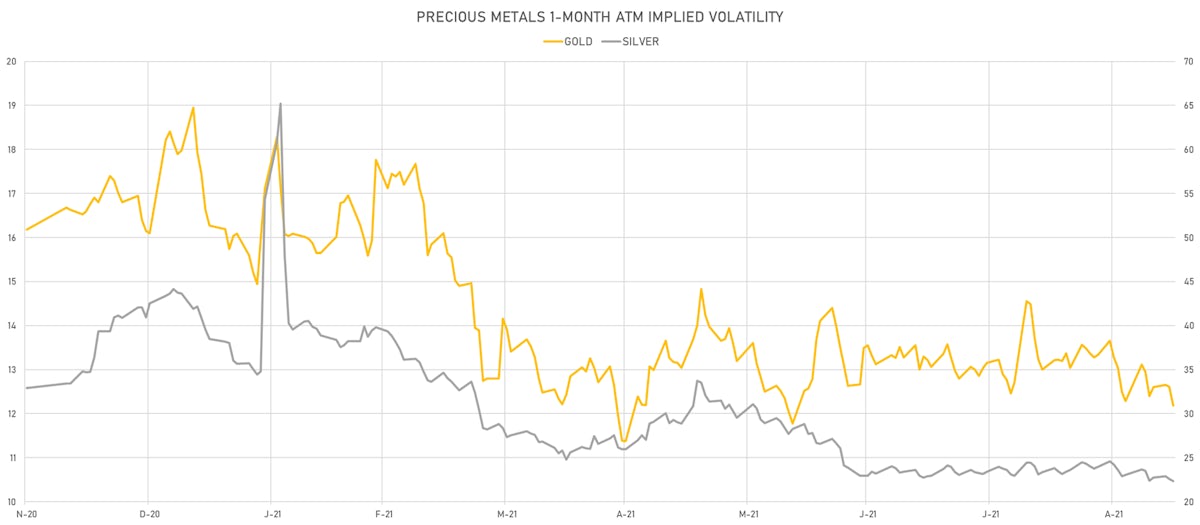

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot currently at US$ 1,792.88 per troy ounce, down -0.6% (YTD: -5.5%)

- Gold 1-Month ATM implied volatility currently at 11.76, down -2.6% (YTD: -23.7%)

- Silver spot currently at US$ 23.83 per troy ounce, down -0.1% (YTD: -9.7%)

- Silver 1-Month ATM implied volatility currently at 21.35, down -0.4% (YTD: -47.1%)

- Palladium spot currently at US$ 2,025.45 per troy ounce, up 1.6% (YTD: -17.9%)

- Platinum spot currently at US$ 952.10 per troy ounce, up 0.3% (YTD: -11.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 11,250 per troy ounce, down -8.2% (YTD: -34.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

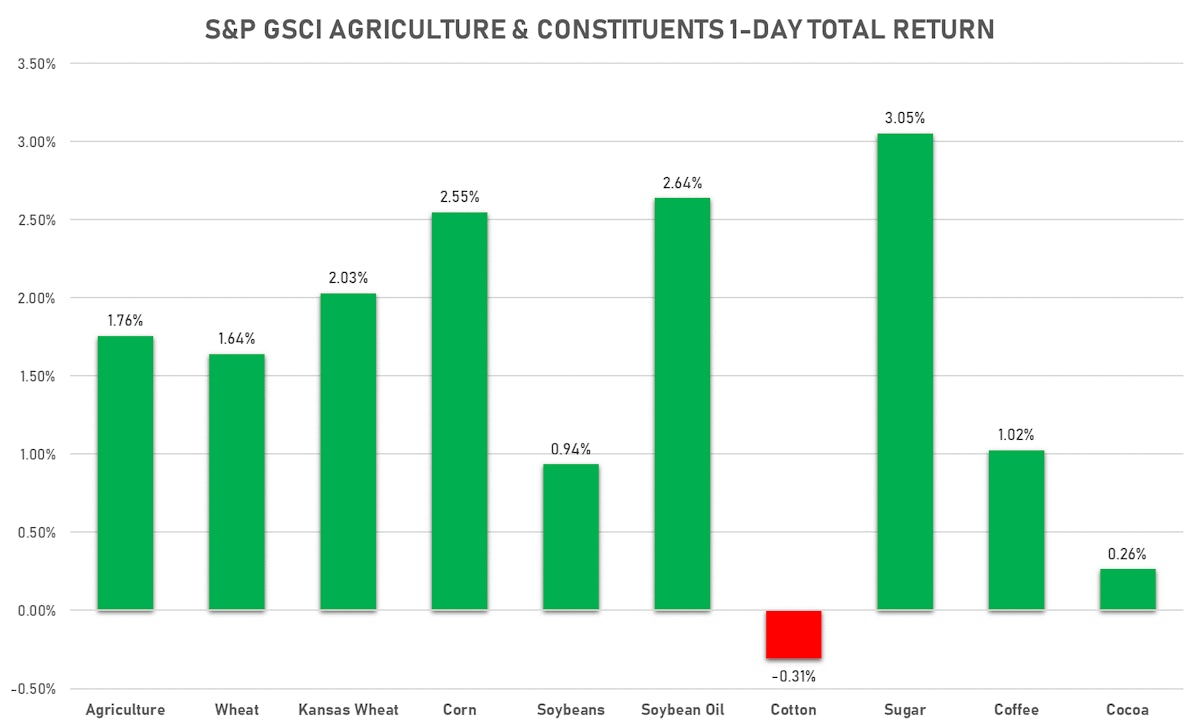

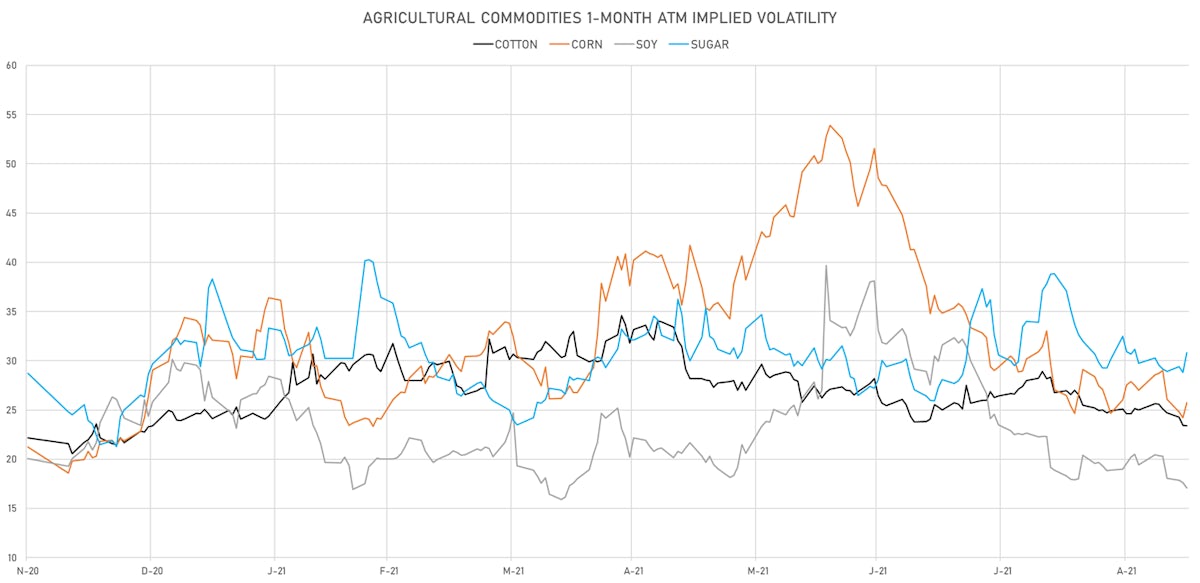

AGS UP BROADLY TODAY

- Live Cattle (CME) unchanged at US$ 124.18 cents per pound (YTD: +9.9%)

- Lean Hogs (CME) currently at US$ 82.28 cents per pound, up 2.4% (YTD: +17.1%)

- Rough Rice (CBOT) currently at US$ 13.78 cents per hundredweight, up 2.6% (YTD: +11.2%)

- Soybeans Composite (CBOT) currently at US$ 1,295.50 cents per bushel, up 1.4% (YTD: -1.6%)

- Corn (CBOT) currently at US$ 535.50 cents per bushel, up 6.1% (YTD: +10.2%)

- Wheat Composite (CBOT) currently at US$ 714.00 cents per bushel, up 4.0% (YTD: +11.2%)

- Sugar No.11 (ICE US) currently at US$ 19.52 cents per pound, up 3.0% (YTD: +26.0%)

- Cotton No.2 (ICE US) currently at US$ 94.67 cents per pound, down -0.3% (YTD: +21.2%)

- Cocoa (ICE US) currently at US$ 2,663 per tonne, up 0.3% (YTD: +3.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,386 per tonne, down -0.4% (YTD: +38.6%)

- Random Length Lumber (CME) currently at US$ 595.90 per 1,000 board feet, down -3.5% (YTD: -48.0%)

- TSR 20 Rubber (Shanghai) unchanged at CNY 11,350 per tonne (YTD: +10.1%)

- Soybean Oil Composite (CBOT) currently at US$ 58.11 cents per pound, up 2.9% (YTD: +34.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,700 per tonne, up 1.5% (YTD: +20.8%)

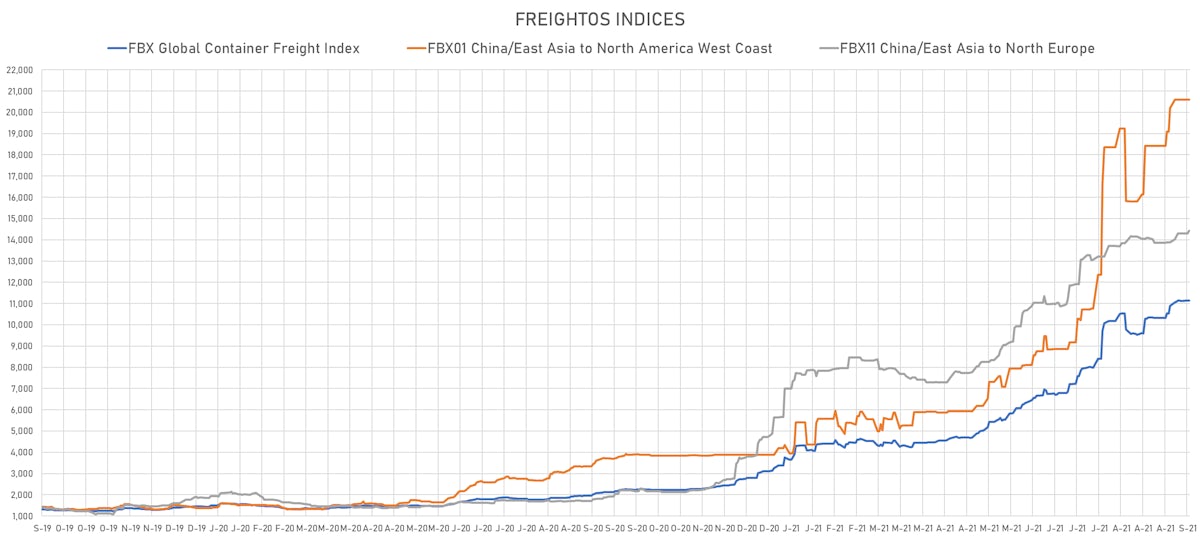

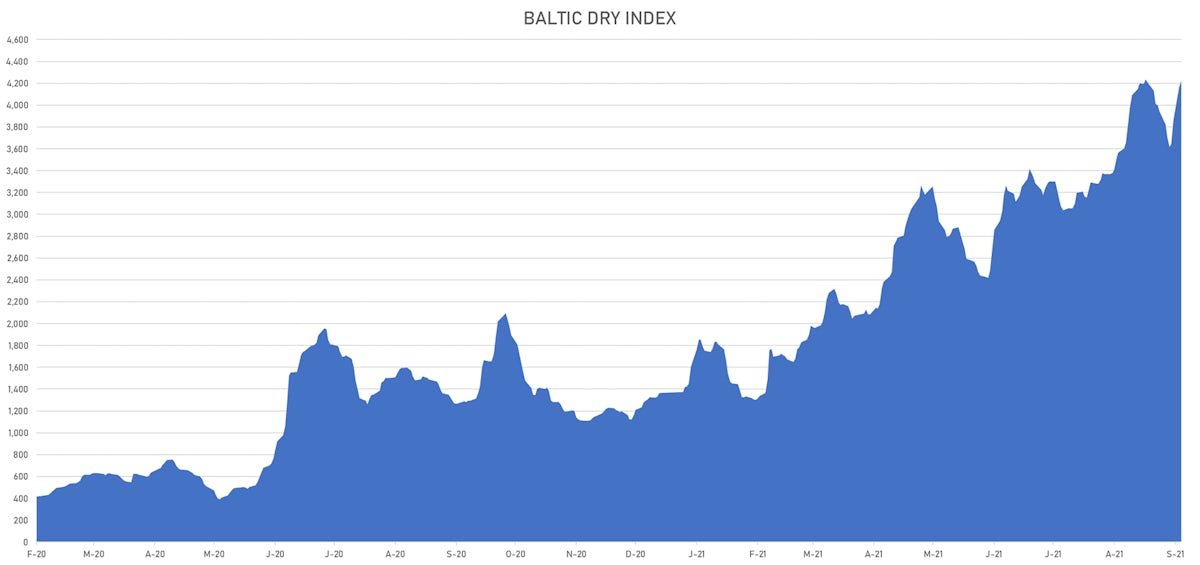

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,221, up 1.4% (YTD: +209.0%)

- Freightos China To North America West Coast Container Index currently at 20,586, unchanged (YTD: +390.2%)

- Freightos North America West Coast To China Container Index currently at 927, unchanged (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 554, unchanged (YTD: +52.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,860, unchanged (YTD: +267.0%)

- Freightos China To North Europe Container Index currently at 14,431, up 0.9% (YTD: +154.9%)

- Freightos North Europe To China Container Index currently at 1,501, unchanged (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

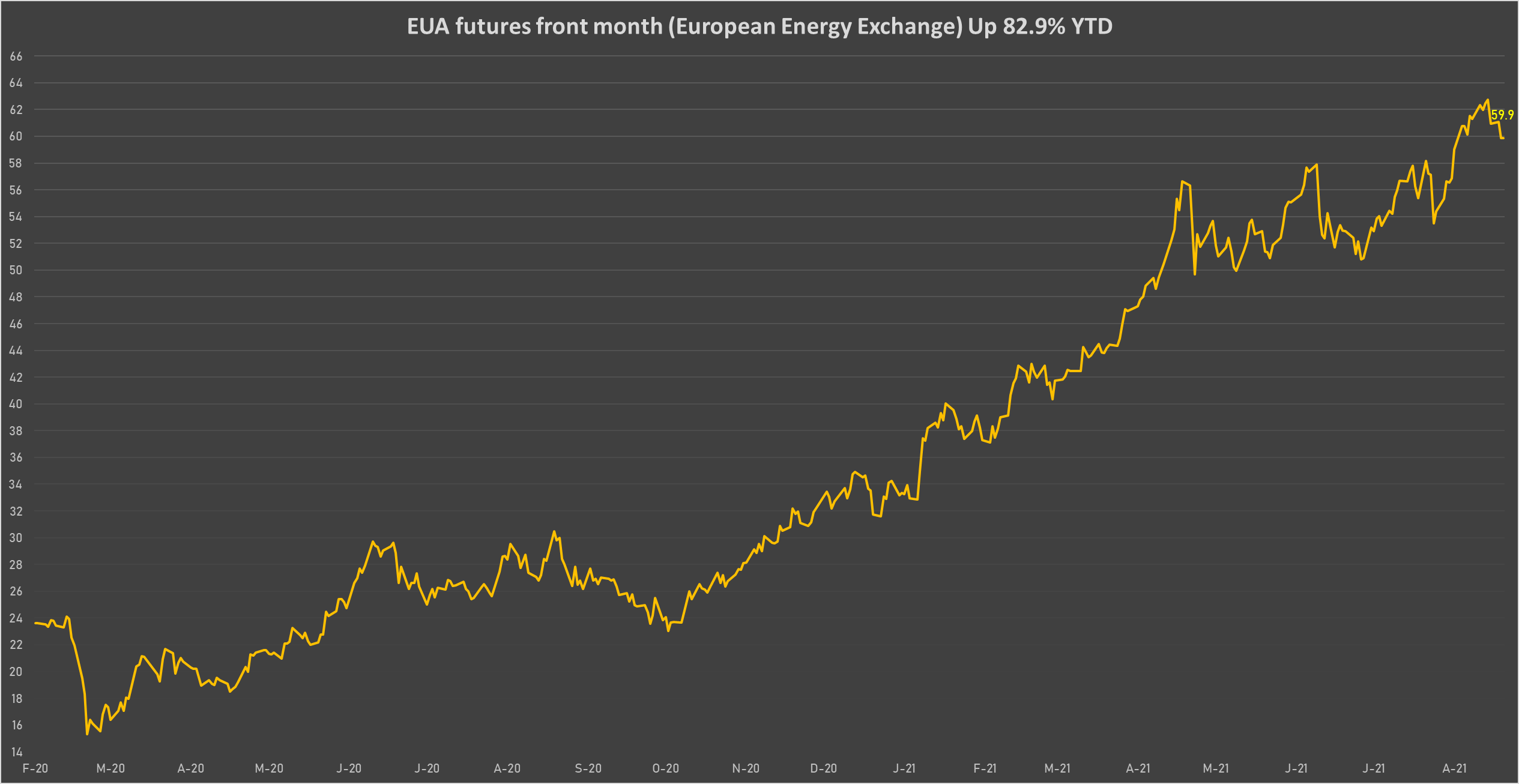

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) unchanged at EUR 59.86 per tonne (YTD: +82.9%)