Commodities

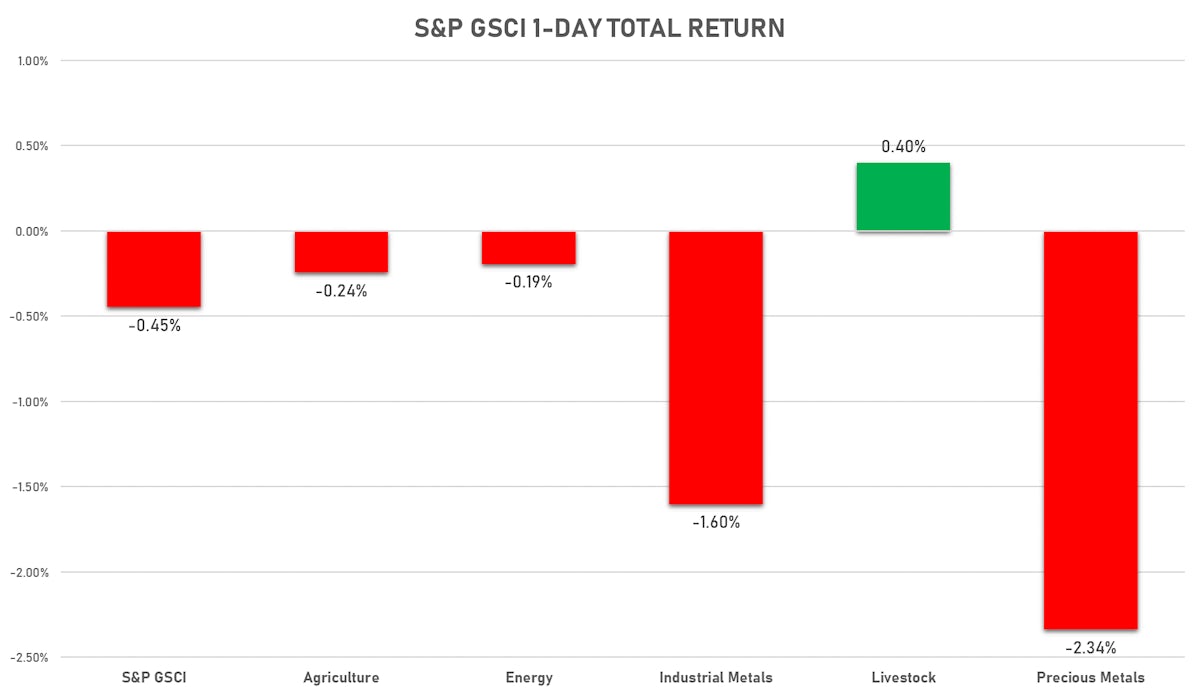

S&P GSCI Down Today, With Industrial Metals And Precious Metals The Biggest Losers

Natural gas took a breather today after huge gains and a larger-than-expected weekly injection, while copper is down this week in line with the 10Y TIPS breakeven inflation

Published ET

Huge Bounce In Lumber Futures Prices, Up 30% Today | Source: Refinitiv

EIA NATURAL GAS WEEKLY INJECTION

- United States, Stock Levels, EIA, Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 10 Sep (EIA, United States) at 83.00 bcf, above consensus estimate of 76.00 bcf

- CS analysts point out that with "7 weeks remaining in the annual refill season, storage is now on pace to enter winter about 280 Bcf (~7%) below the five-year average"

NOTABLE GAINERS TODAY

- CME Random Length Lumber up 30.7% (YTD: -32.0%)

- Johnson Matthey Rhodium New York 0930 up 4.4% (YTD: -31.1%)

- CME Lean Hogs up 3.9% (YTD: 21.6%)

- Shanghai International Exchange TSR 20 up 2.8% (YTD: 13.2%)

- DCE Coking Coal Continuation Month 1 up 2.8% (YTD: 135.7%)

- SHFE Rebar up 2.6% (YTD: 32.9%)

- Shanghai International Exchange Bonded Copper up 2.5% (YTD: 20.9%)

- Coffee Arabica Colombia Excelso EP Spot up 2.1% (YTD: 41.5%)

- DCE Coke up 2.0% (YTD: 37.9%)

- SHFE Bitumen Continuation Month 1 up 1.7% (YTD: 27.8%)

- SHFE Aluminum up 1.7% (YTD: 44.5%)

- DCE RBD Palm Oil up 1.5% (YTD: 25.9%)

- CBoT Soybean Meal up 1.3% (YTD: -21.7%)

- Palladium spot up 1.2% (YTD: -16.9%)

- CME Cattle(Feeder) up 0.7% (YTD: 12.2%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -5.9% (YTD: -30.0%)

- SGX Iron Ore 62% China CFR Swap Monthly down -4.0% (YTD: -23.9%)

- Silver spot down -3.9% (YTD: -13.2%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -3.4% (YTD: -23.0%)

- COMEX Copper down -2.8% (YTD: 21.8%)

- CBoT Soybean Oil down -2.5% (YTD: 31.2%)

- NYMEX Henry Hub Natural Gas down -2.3% (YTD: 110.1%)

- Gold spot down -2.2% (YTD: -7.6%)

- ICE-US Cocoa down -1.7% (YTD: 2.1%)

- ICE-US Cotton No. 2 down -1.3% (YTD: 19.6%)

- Platinum spot down -1.2% (YTD: -12.8%)

- NYMEX RBOB Gasoline down -1.2% (YTD: 54.9%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -1.1% (YTD: 45.5%)

- EEX European-Carbon- Secondary Trading down -0.9% (YTD: 84.9%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -0.9% (YTD: 81.3%)

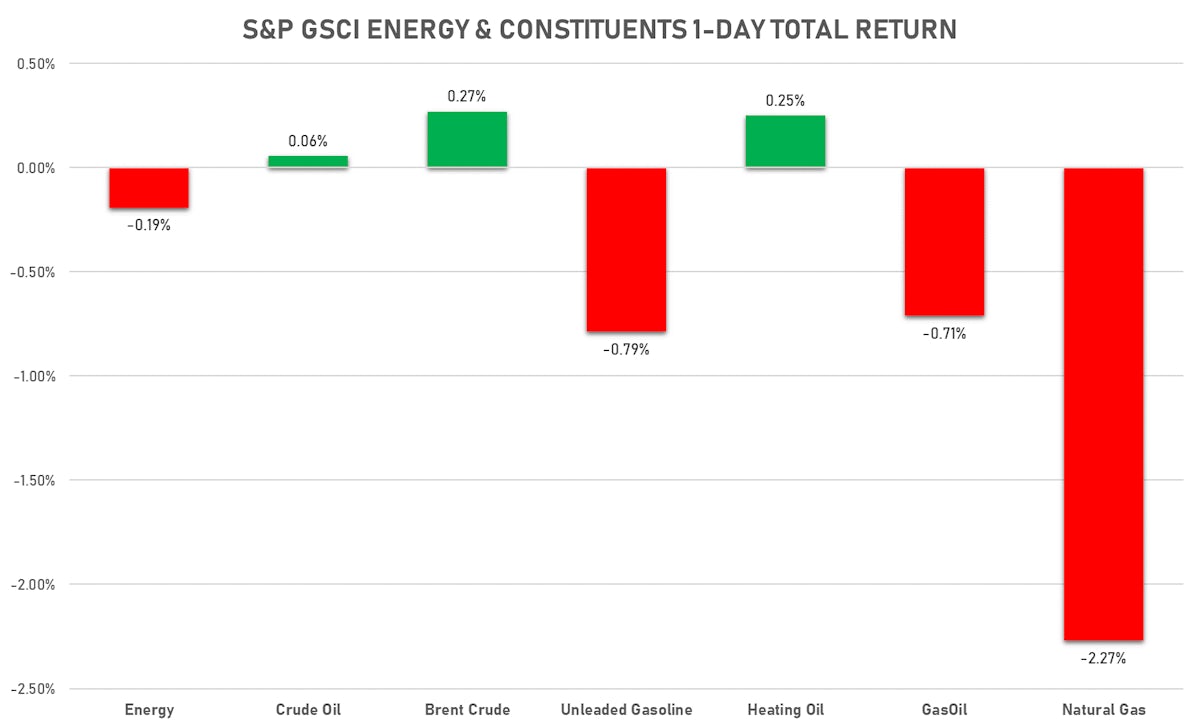

ENERGY LEANING DOWN TODAY

- WTI crude front month currently at US$ 72.45 per barrel (YTD: +49.6%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 75.50 per barrel, up 0.3% (YTD: +46.1%); 6-month term structure in widening backwardation

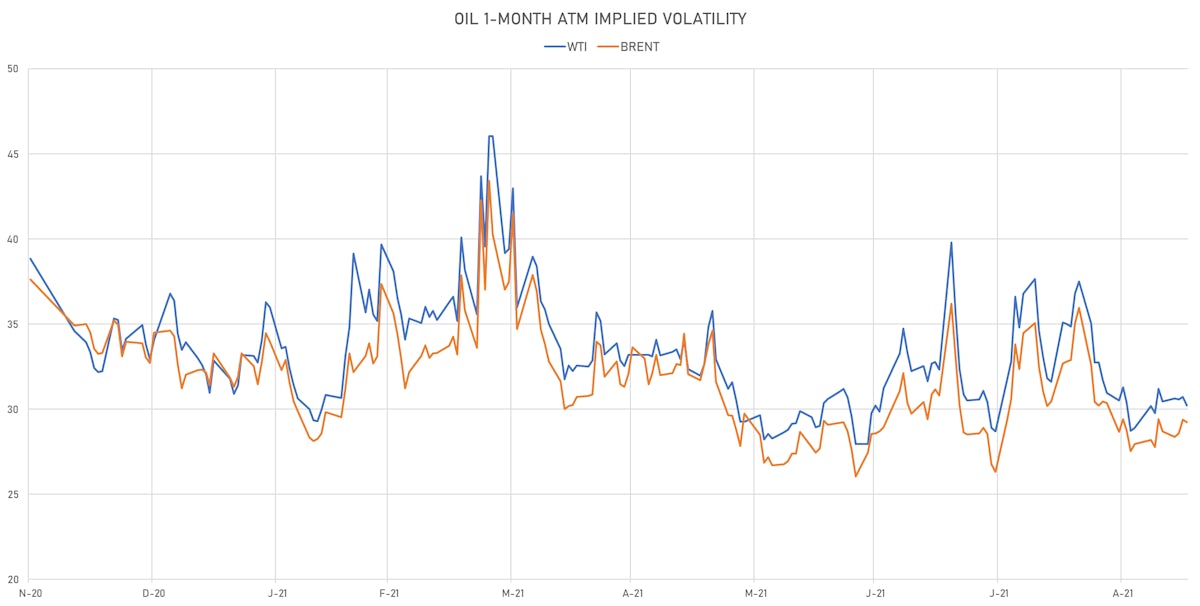

- Brent volatility at 29.2, down -0.5% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 176.00 per tonne, down -0.8% (YTD: +118.6%)

- Natural Gas (Henry Hub) currently at US$ 5.31 per MMBtu, down -2.3% (YTD: +110.1%)

- Gasoline (NYMEX) currently at US$ 2.18 per gallon, down -1.2% (YTD: +54.9%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 633.75 per tonne, down -0.7% (YTD: +49.4%)

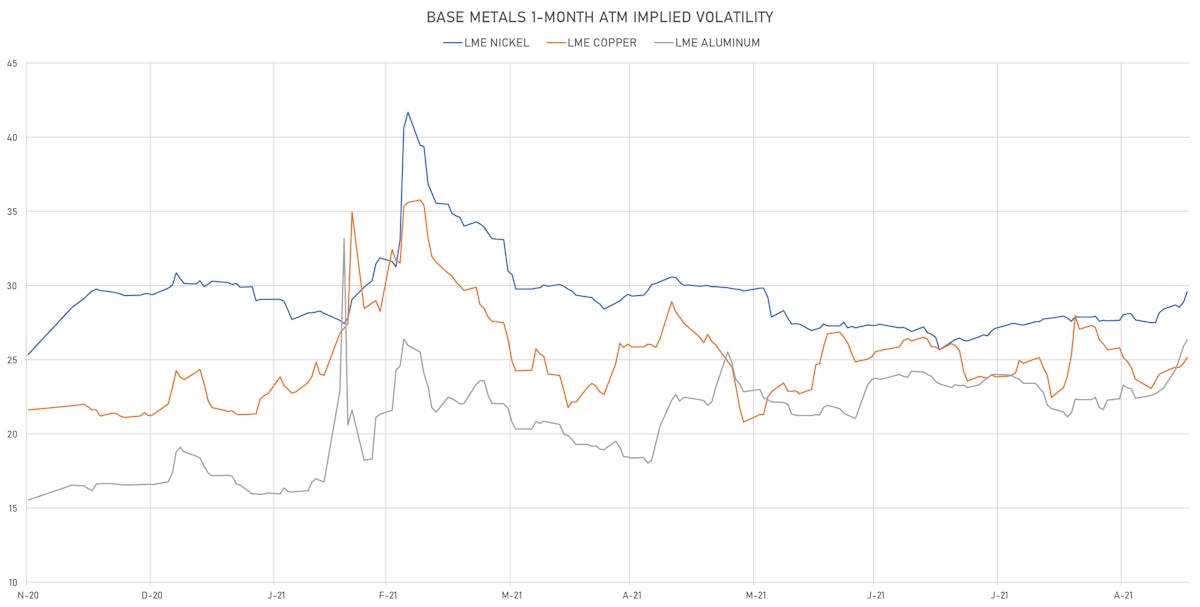

BASE METALS MOSTLY DOWN TODAY

- Copper (COMEX) currently at US$ 4.28 per pound, down -2.8% (YTD: +21.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 696.00 per tonne, down -5.9% (YTD: -30.0%)

- Aluminum (Shanghai) currently at CNY 22,715 per tonne, up 1.7% (YTD: +44.5%)

- Nickel (Shanghai) currently at CNY 145,320 per tonne, down -0.5% (YTD: +19.0%)

- Lead (Shanghai) unchanged at CNY 14,720 per tonne(YTD: -0.3%)

- Rebar (Shanghai) currently at CNY 5,716 per tonne, up 2.6% (YTD: +32.9%)

- Tin (Shanghai) currently at CNY 261,450 per tonne, up 0.1% (YTD: +72.0%)

- Zinc (Shanghai) currently at CNY 22,815 per tonne, up 0.7% (YTD: +8.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,000 per tonne, unchanged (YTD: +36.9%)

- Lithium (Shanghai) spot price currently at CNY 815,000 per tonne, unchanged (YTD: +68.0%)

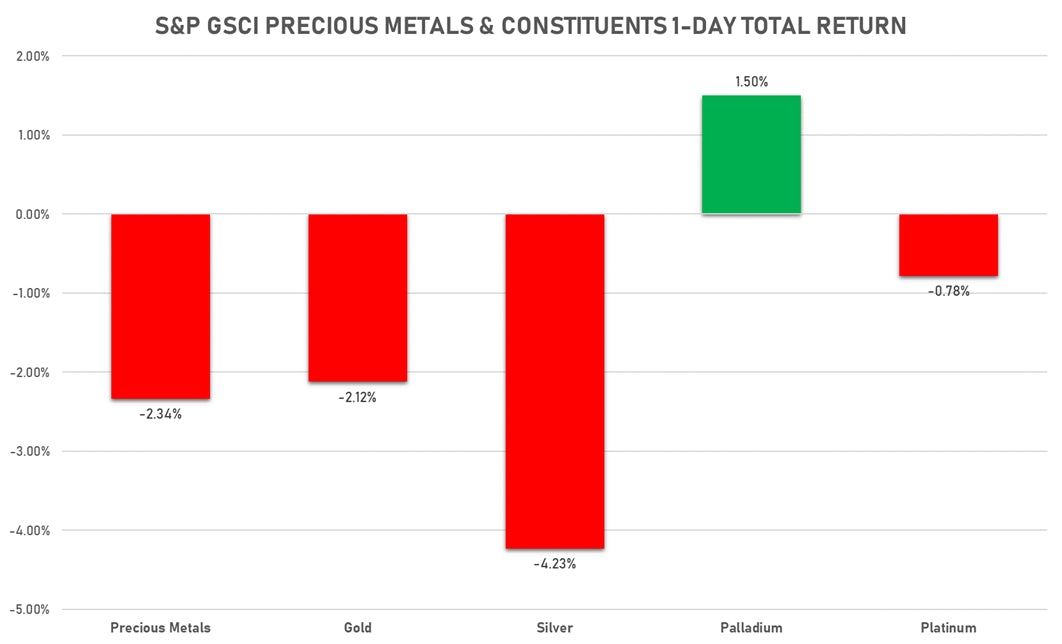

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot currently at US$ 1,757.70 per troy ounce, down -2.2% (YTD: -7.6%)

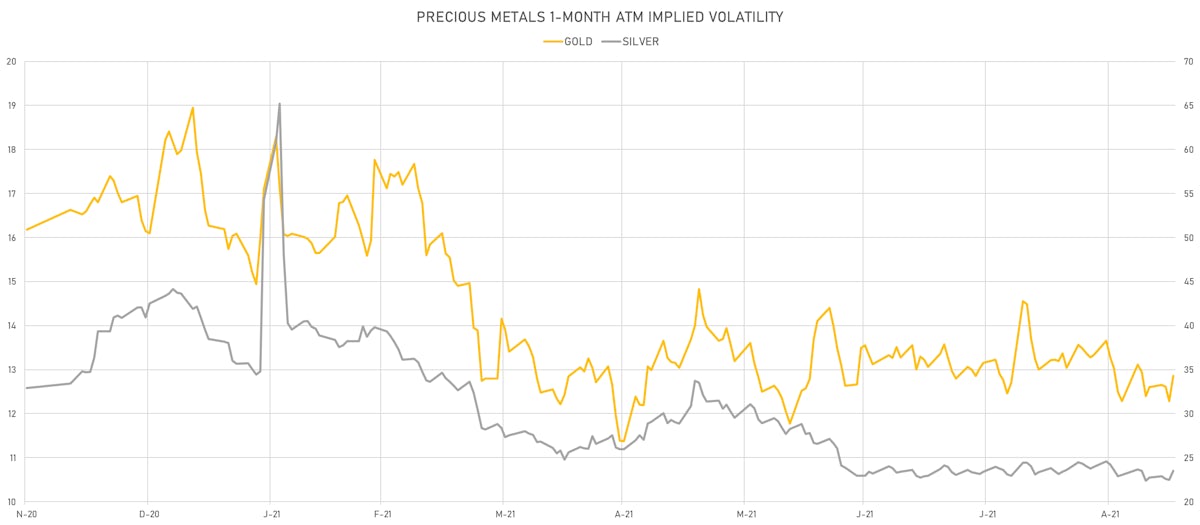

- Gold 1-Month ATM implied volatility currently at 12.36, up 4.6% (YTD: -20.2%)

- Silver spot currently at US$ 22.87 per troy ounce, down -3.9% (YTD: -13.2%)

- Silver 1-Month ATM implied volatility currently at 22.68, up 4.6% (YTD: -44.6%)

- Palladium spot currently at US$ 1,989.63 per troy ounce, up 1.2% (YTD: -16.9%)

- Platinum spot currently at US$ 942.25 per troy ounce, down -1.2% (YTD: -12.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 11,750 per troy ounce, up 4.4% (YTD: -31.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

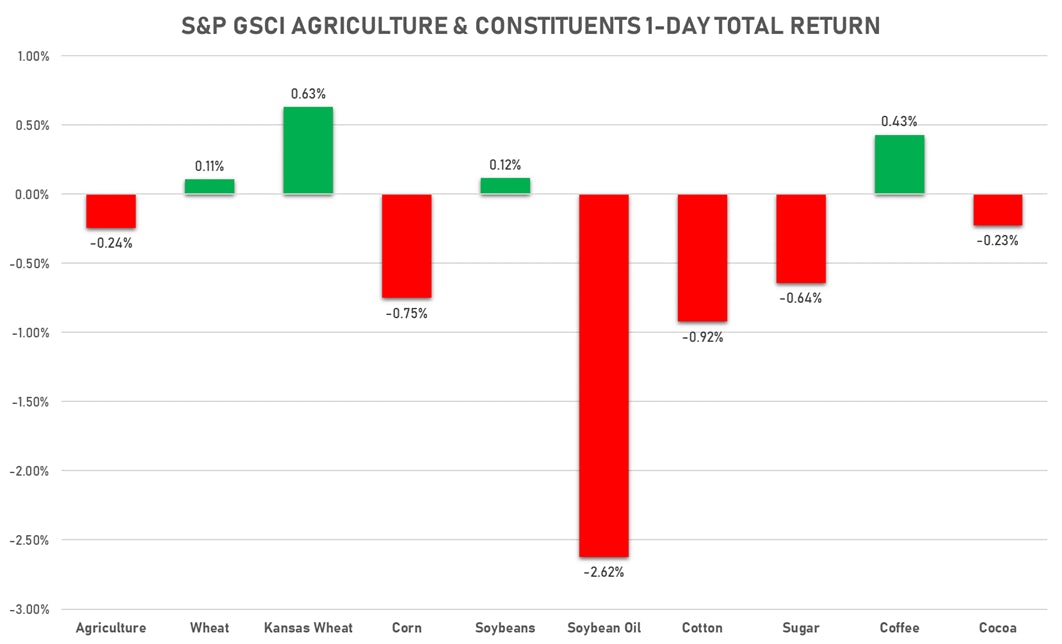

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 123.60 cents per pound, down 0.5% (YTD: +9.4%)

- Lean Hogs (CME) currently at US$ 85.48 cents per pound, up 3.9% (YTD: +21.6%)

- Rough Rice (CBOT) currently at US$ 13.69 cents per hundredweight, down -0.8% (YTD: +10.4%)

- Soybeans Composite (CBOT) currently at US$ 1,287.00 cents per bushel, up 0.1% (YTD: -1.5%)

- Corn (CBOT) currently at US$ 527.75 cents per bushel, down -0.7% (YTD: +9.4%)

- Wheat Composite (CBOT) currently at US$ 712.75 cents per bushel, up 0.1% (YTD: +11.3%)

- Sugar No.11 (ICE US) currently at US$ 19.49 cents per pound, down -0.2% (YTD: +25.8%)

- Cotton No.2 (ICE US) currently at US$ 93.41 cents per pound, down -1.3% (YTD: +19.6%)

- Cocoa (ICE US) currently at US$ 2,657 per tonne, down -1.7% (YTD: +2.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,480 per tonne, up 2.1% (YTD: +41.5%)

- Random Length Lumber (CME) currently at US$ 593.90 per 1,000 board feet, up 30.7% (YTD: -32.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,440 per tonne, up 2.8% (YTD: +13.2%)

- Soybean Oil Composite (CBOT) currently at US$ 56.36 cents per pound, down -2.5% (YTD: +31.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,496 per tonne, up 1.5% (YTD: +20.8%)

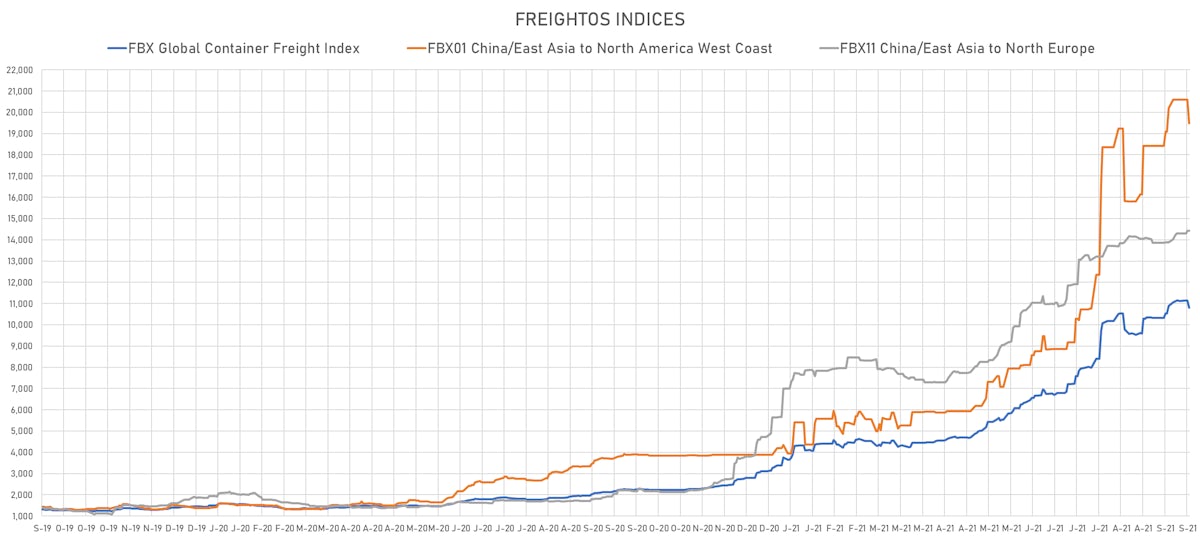

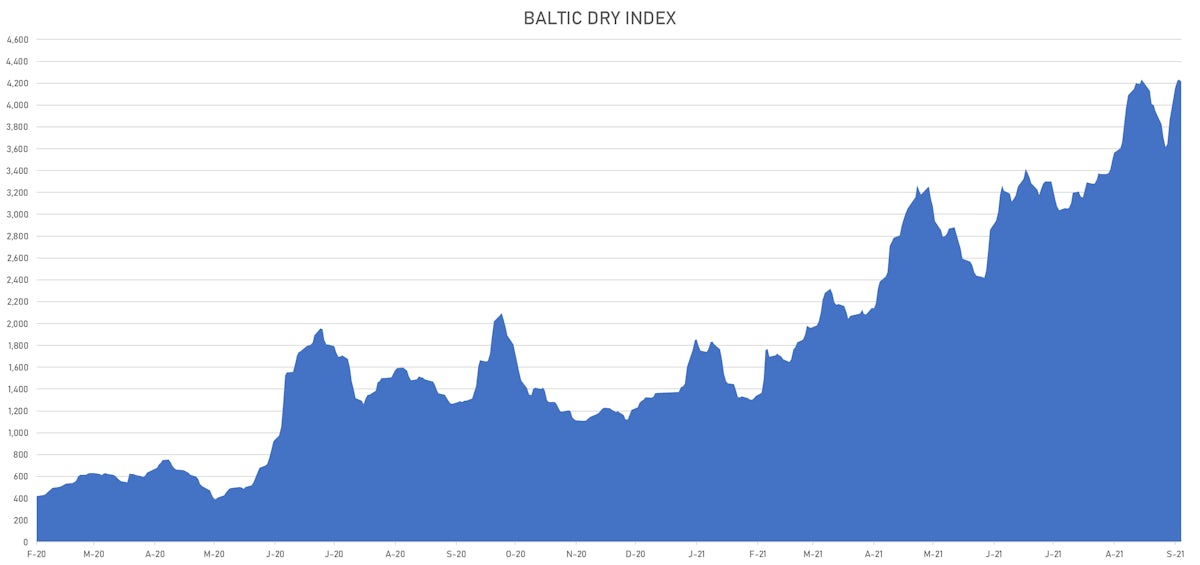

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,215, down -0.4% (YTD: +208.6%)

- Freightos China To North America West Coast Container Index currently at 19,478, down -5.4% (YTD: +363.8%)

- Freightos North America West Coast To China Container Index currently at 927, unchanged (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 554, unchanged (YTD: +52.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, up 0.1% (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,431, unchanged (YTD: +154.9%)

- Freightos North Europe To China Container Index currently at 1,501, unchanged (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

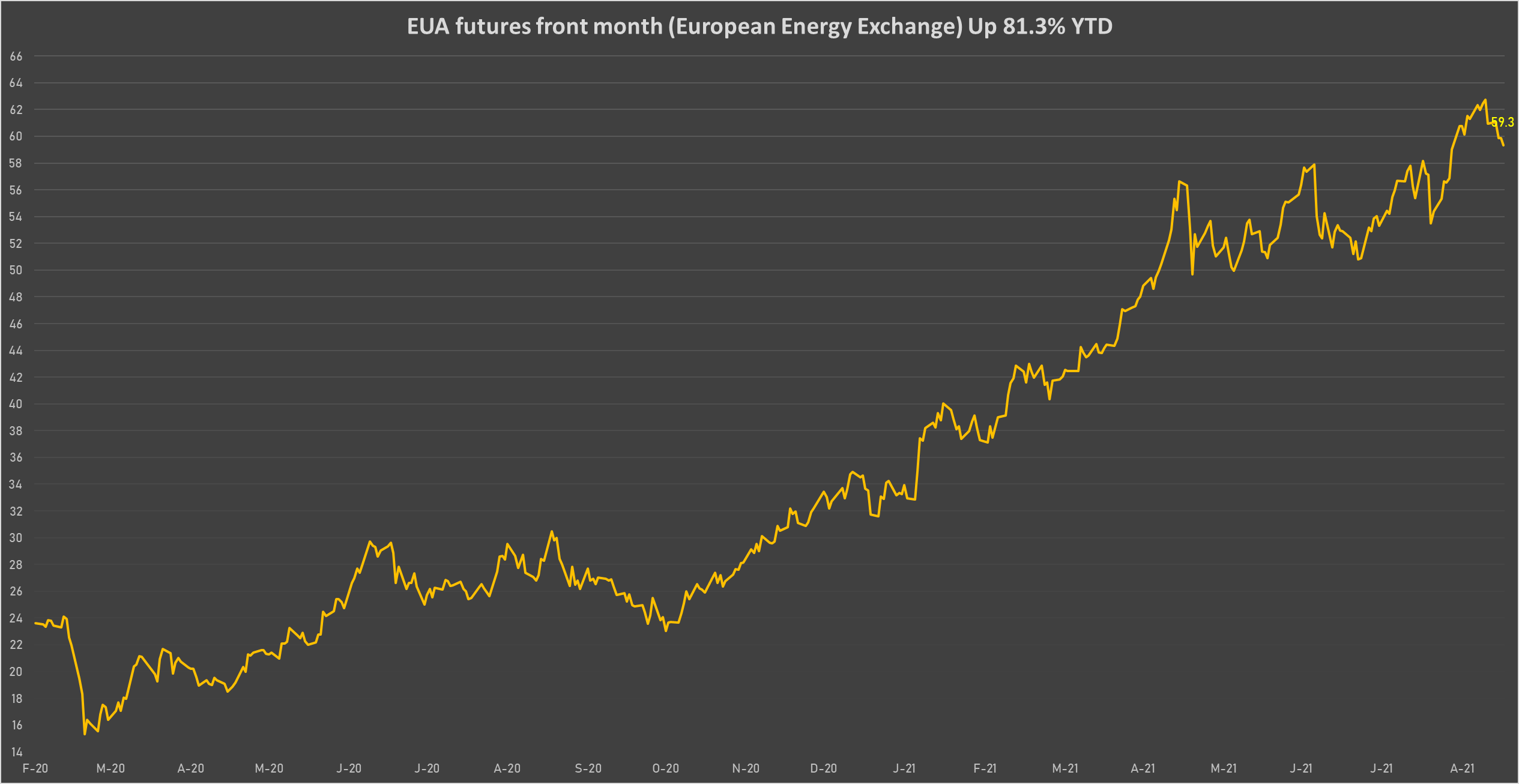

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 59.31 per tonne, down -0.9% (YTD: +81.3%)