Commodities

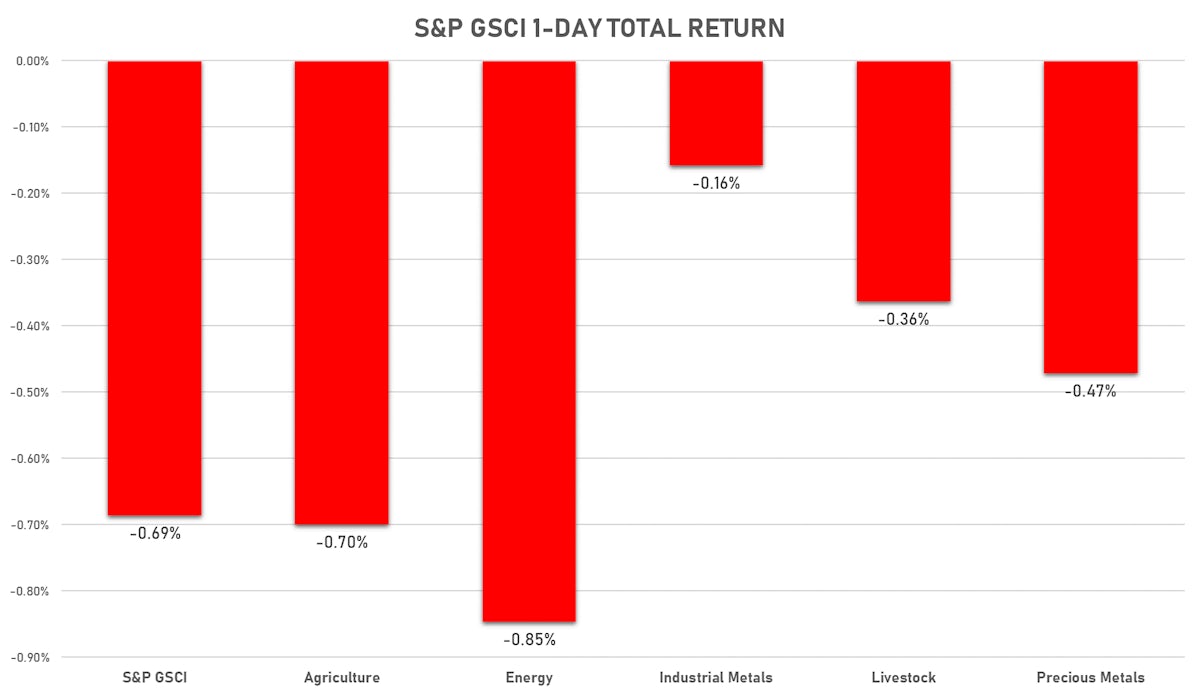

Losses Across All S&P GSCI Sub Indices On Friday, Stronger Dollar Weighs

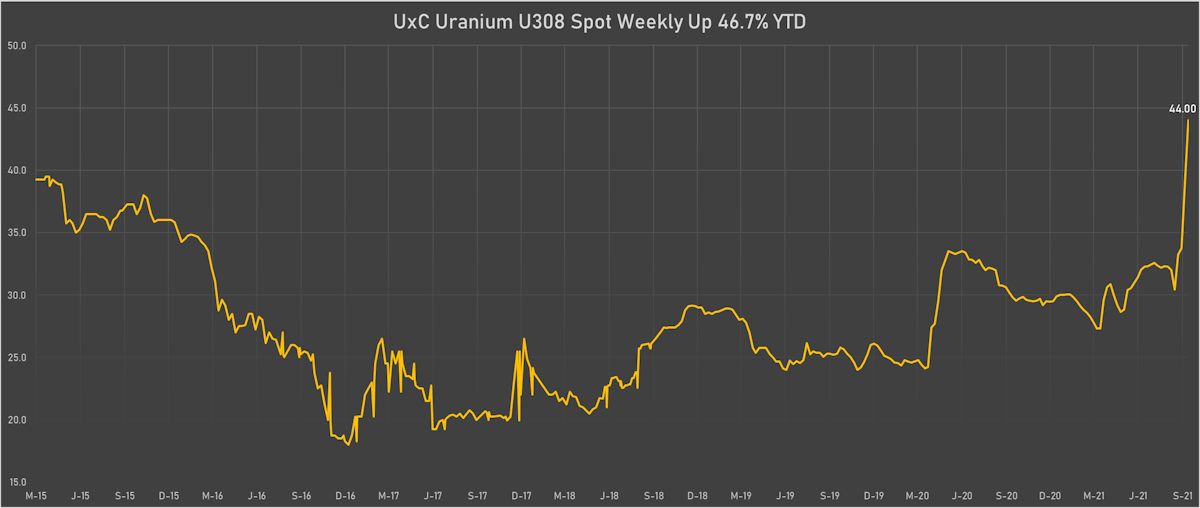

The best performers in the commodities complex this week were uranium, lumber and oats

Published ET

Uranium Prices Have Jumped This Month | Sources: ϕpost, Refinitiv data

BAKER HUGHES WEEKLY RIG COUNT

- North America: +20 this week at 666 (vs 646 prior)

- US: +9 this week at 512 (vs 503 prior)

- Oil: +10 this week at 411 (vs 401 prior)

- Nat Gas: -1 this week at 100 (vs 101 prior)

NOTABLE GAINERS TODAY

- Johnson Matthey Rhodium New York 0930 up 7.2% (YTD: -26.1%)

- CME Random Length Lumber up 6.8% (YTD: -27.4%)

- SMM Rare Earth Praseodymium Metal Spot Price Daily up 5.1% (YTD: 56.2%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 2.5% (YTD: -21.1%)

- SMM Rare Earth Neodymium Metal Spot Price Daily up 2.3% (YTD: 25.7%)

- SHFE Rebar up 1.8% (YTD: 35.3%)

- SMM Lithium Metal Spot Price Daily up 1.2% (YTD: 70.1%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 1.0% (YTD: 30.9%)

- ICE Europe Newcastle Coal Monthly up 0.9% (YTD: 120.5%)

- WUXI Metal Cobalt Bi-Monthly up 0.8% (YTD: 31.4%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily up 0.8% (YTD: 22.5%)

- SMM Rare Earth Praseodymium Oxide Spot Price Daily up 0.8% (YTD: 82.8%)

- Platinum spot up 0.7% (YTD: -12.1%)

- CBoT Rough Rice up 0.7% (YTD: 11.1%)

- SHFE Zinc up 0.7% (YTD: 9.1%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -7.4% (YTD: -35.2%)

- NYMEX Henry Hub Natural Gas down -4.3% (YTD: 101.1%)

- Bursa Malaysia Crude Palm Oil down -3.9% (YTD: 16.1%)

- SGX Iron Ore 62% China CFR Swap Monthly down -3.4% (YTD: -26.5%)

- DCE Coke down -2.3% (YTD: 34.7%)

- Silver spot down -2.2% (YTD: -15.1%)

- SHFE Nickel down -1.8% (YTD: 16.9%)

- ICE-US Sugar No. 11 down -1.6% (YTD: 23.8%)

- Shanghai International Exchange Bonded Copper down -1.6% (YTD: 19.0%)

- SHFE Bitumen Continuation Month 1 down -1.3% (YTD: 26.1%)

- SHFE Copper down -1.2% (YTD: 19.9%)

- DCE Coking Coal Continuation Month 1 down -1.1% (YTD: 133.0%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily down -1.1% (YTD: 37.5%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily down -1.1% (YTD: 37.1%)

- CBoT Soybean Oil down -1.0% (YTD: 29.9%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent increased net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice increased net long position

METALS

- Gold increased net long position

- Silver reduced net long position

- Platinum increased net short position

- Palladium turned to net short

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat turned to net short

- Corn reduced net long position

- Rough Rice reduced net short position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal increased net short position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

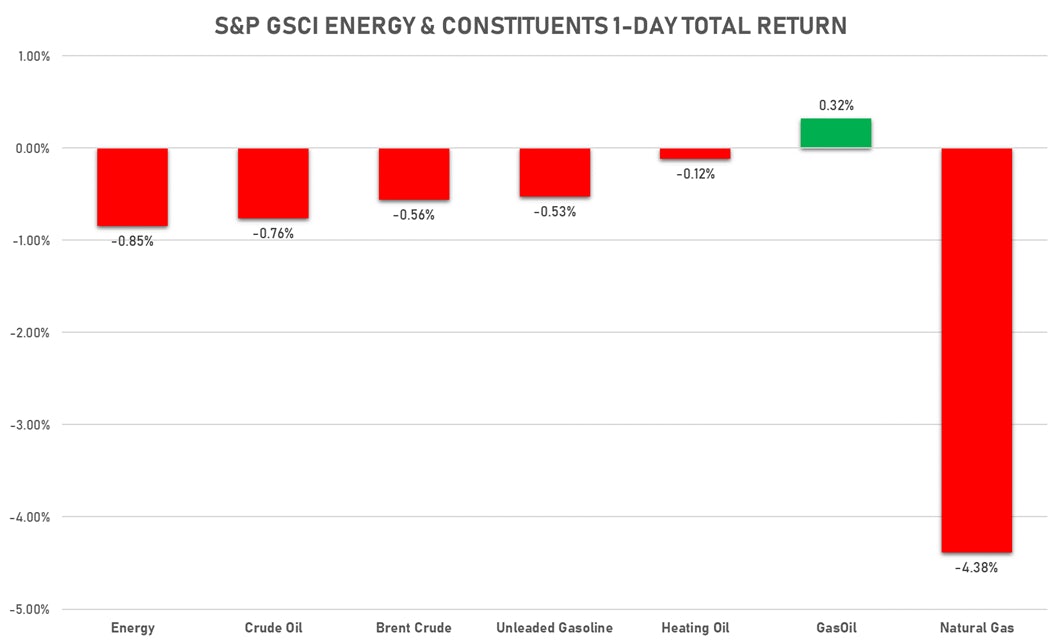

ENERGY FALLS TODAY

- WTI crude front month currently at US$ 71.97 per barrel, down -0.9% (YTD: +48.3%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 75.34 per barrel, down -0.4% (YTD: +45.4%); 6-month term structure in widening backwardation

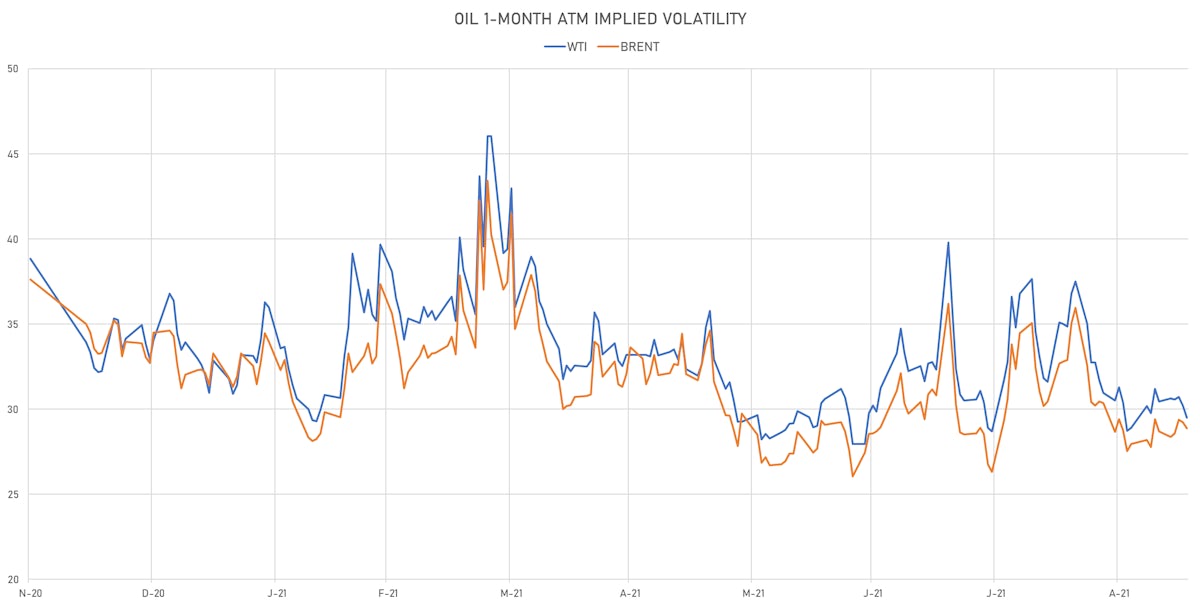

- Brent volatility at 28.9, down -1.2% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 177.50 per tonne, up 0.9% (YTD: +120.5%)

- Natural Gas (Henry Hub) currently at US$ 5.11 per MMBtu, down -4.3% (YTD: +101.1%)

- Gasoline (NYMEX) currently at US$ 2.17 per gallon, down -0.5% (YTD: +54.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 631.50 per tonne, up 0.4% (YTD: +50.1%)

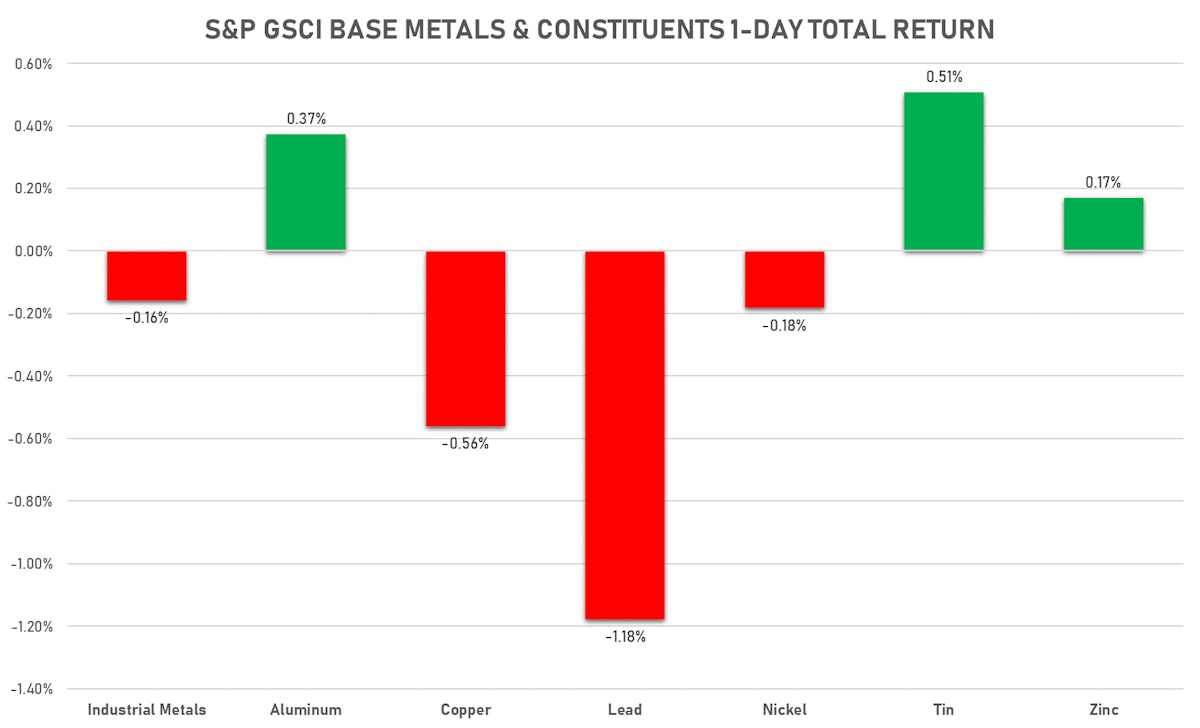

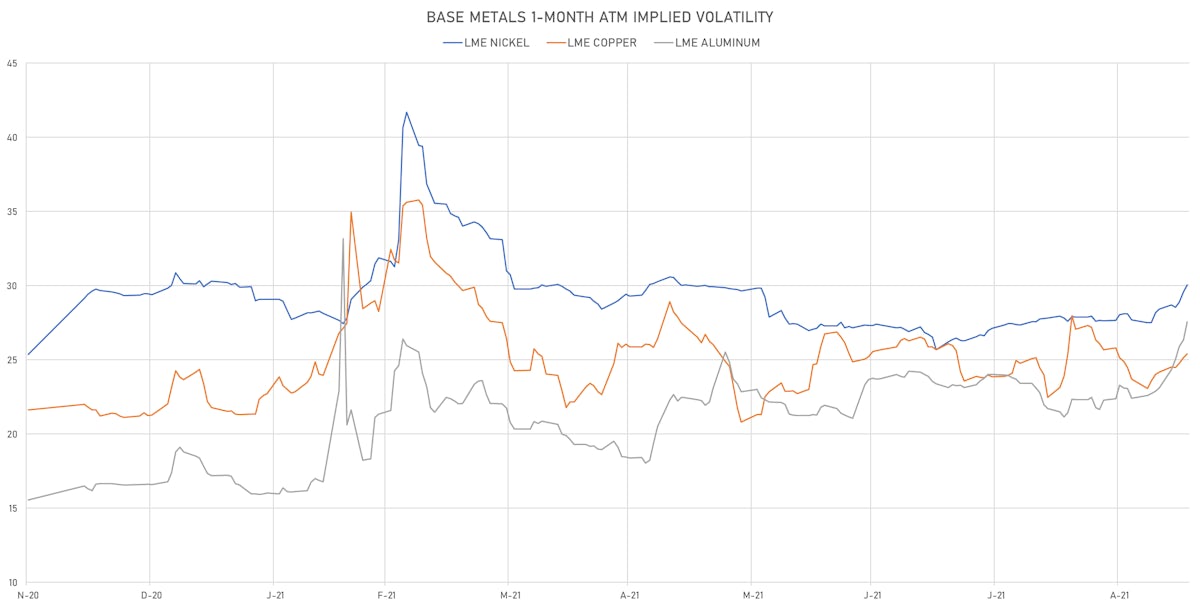

BASE METALS MIXED TODAY

- Copper (COMEX) currently at US$ 4.24 per pound, down -0.8% (YTD: +20.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 699.00 per tonne, down -7.4% (YTD: -35.2%)

- Aluminum (Shanghai) currently at CNY 22,620 per tonne, down -0.2% (YTD: +44.2%)

- Nickel (Shanghai) currently at CNY 144,690 per tonne, down -1.8% (YTD: +16.9%)

- Lead (Shanghai) unchanged at CNY 14,660 per tonne (YTD: -0.3%)

- Rebar (Shanghai) currently at CNY 5,709 per tonne, up 1.8% (YTD: +35.3%)

- Tin (Shanghai) currently at CNY 259,840 per tonne, up 0.4% (YTD: +72.7%)

- Zinc (Shanghai) currently at CNY 22,760 per tonne, up 0.7% (YTD: +9.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,000 per tonne, unchanged (YTD: +36.9%)

- Lithium (Shanghai) spot price currently at CNY 825,000 per tonne, up 1.2% (YTD: +70.1%)

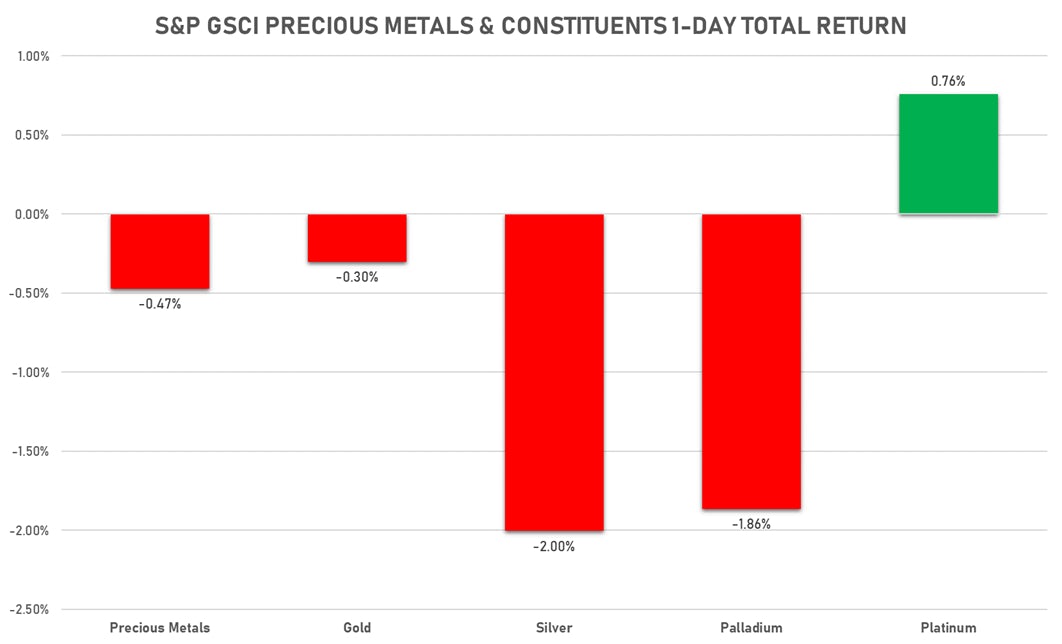

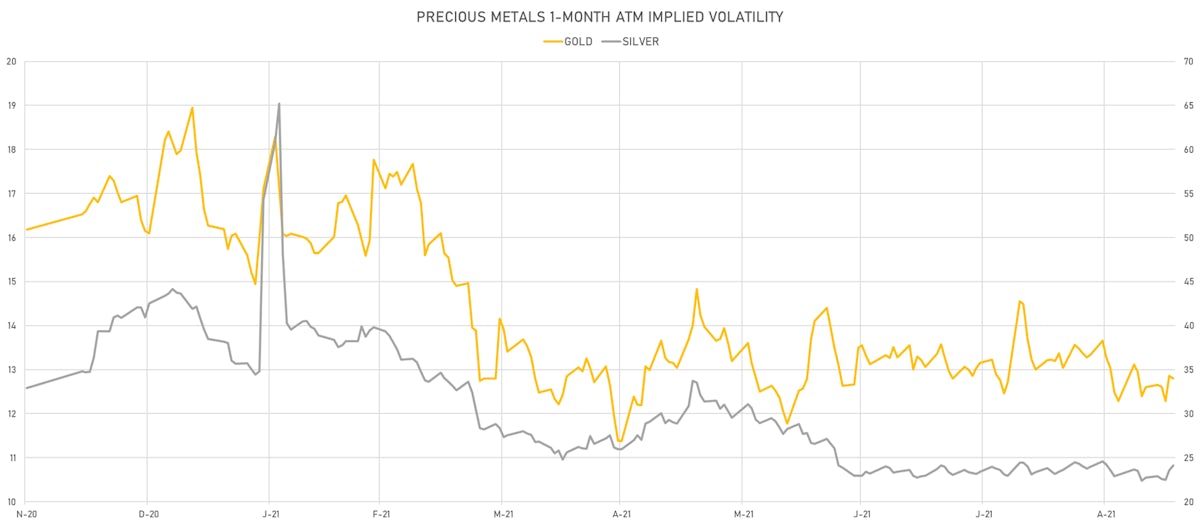

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot currently at US$ 1,754.16 per troy ounce, up 0.1% (YTD: -7.5%)

- Gold 1-Month ATM implied volatility currently at 12.30, down -0.4% (YTD: -20.5%)

- Silver spot currently at US$ 22.39 per troy ounce, down -2.2% (YTD: -15.1%)

- Silver 1-Month ATM implied volatility currently at 23.12, up 2.5% (YTD: -43.3%)

- Palladium spot currently at US$ 2,016.27 per troy ounce, down -0.7% (YTD: -17.5%)

- Platinum spot currently at US$ 939.28 per troy ounce, up 0.7% (YTD: -12.1%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 12,600 per troy ounce, up 7.2% (YTD: -26.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

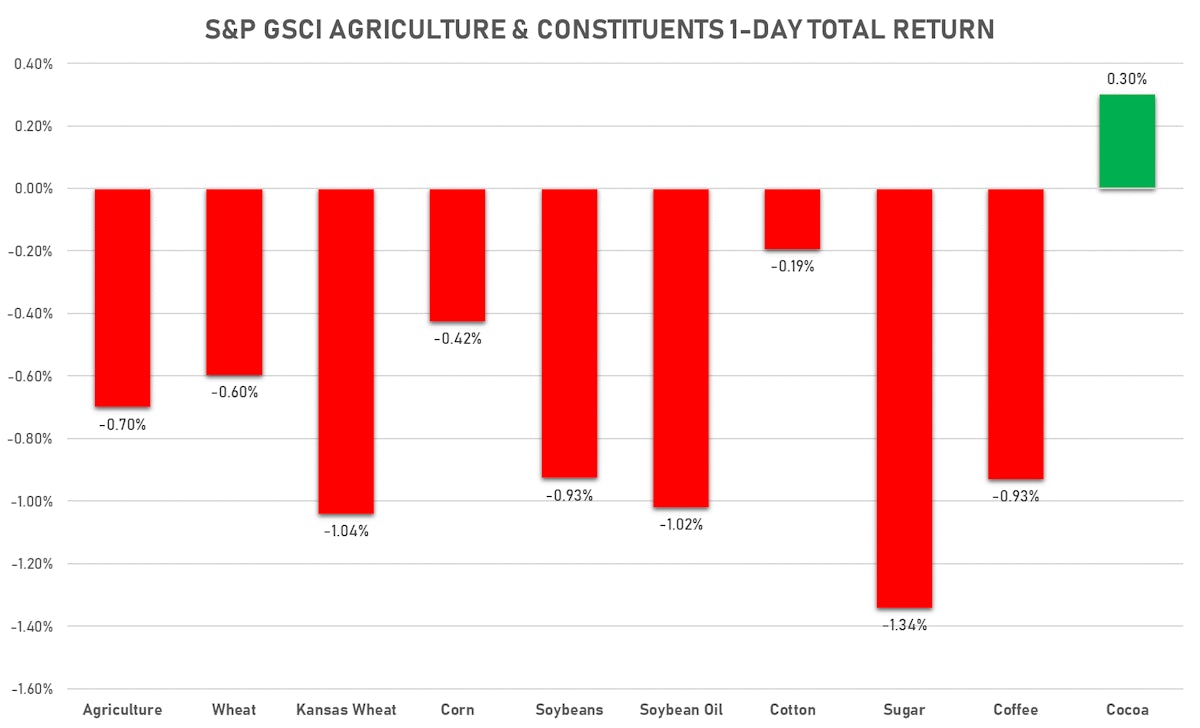

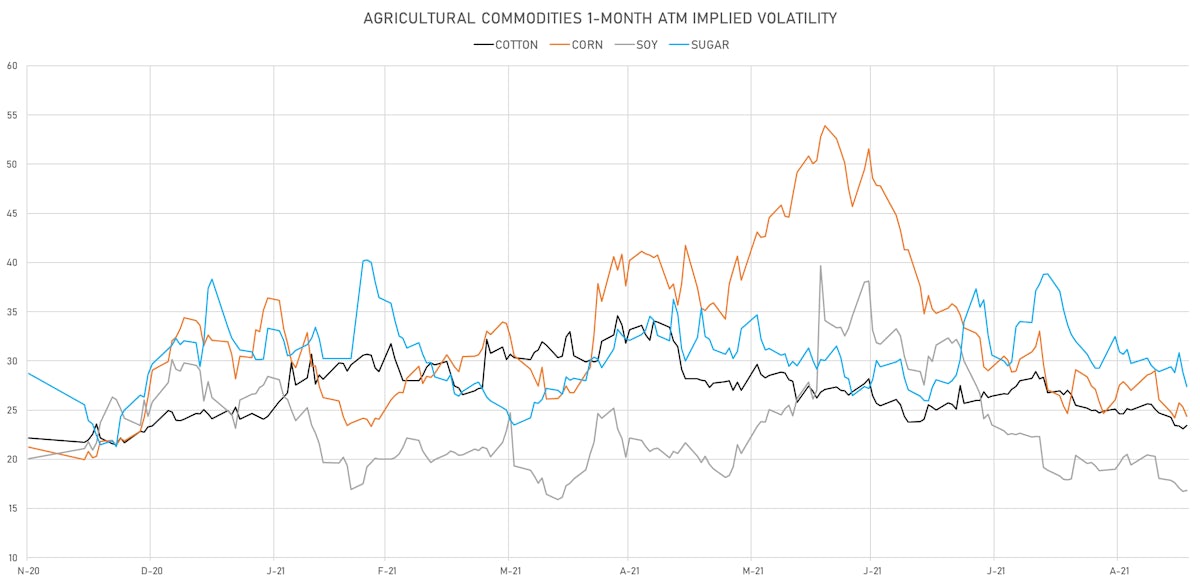

AGS FALL TODAY

- Live Cattle (CME) currently at US$ 122.80 cents per pound, down 0.6% (YTD: +8.7%)

- Lean Hogs (CME) currently at US$ 85.73 cents per pound, up 0.3% (YTD: +22.0%)

- Rough Rice (CBOT) currently at US$ 13.78 cents per hundredweight, up 0.7% (YTD: +11.1%)

- Soybeans Composite (CBOT) currently at US$ 1,284.00 cents per bushel, down -0.9% (YTD: -2.4%)

- Corn (CBOT) currently at US$ 527.25 cents per bushel, down -0.4% (YTD: +8.9%)

- Wheat Composite (CBOT) currently at US$ 708.75 cents per bushel, down -0.6% (YTD: +10.7%)

- Sugar No.11 (ICE US) currently at US$ 19.14 cents per pound, down -1.6% (YTD: +23.8%)

- Cotton No.2 (ICE US) currently at US$ 93.26 cents per pound, down -0.1% (YTD: +19.5%)

- Cocoa (ICE US) currently at US$ 2,660 per tonne, up 0.3% (YTD: +2.4%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,507 per tonne, up 0.6% (YTD: +42.4%)

- Random Length Lumber (CME) currently at US$ 634.00 per 1,000 board feet, up 6.8% (YTD: -27.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,325 per tonne, up 0.1% (YTD: +13.3%)

- Soybean Oil Composite (CBOT) currently at US$ 56.29 cents per pound, down -1.0% (YTD: +29.9%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,518 per tonne, down -3.9% (YTD: +16.1%)

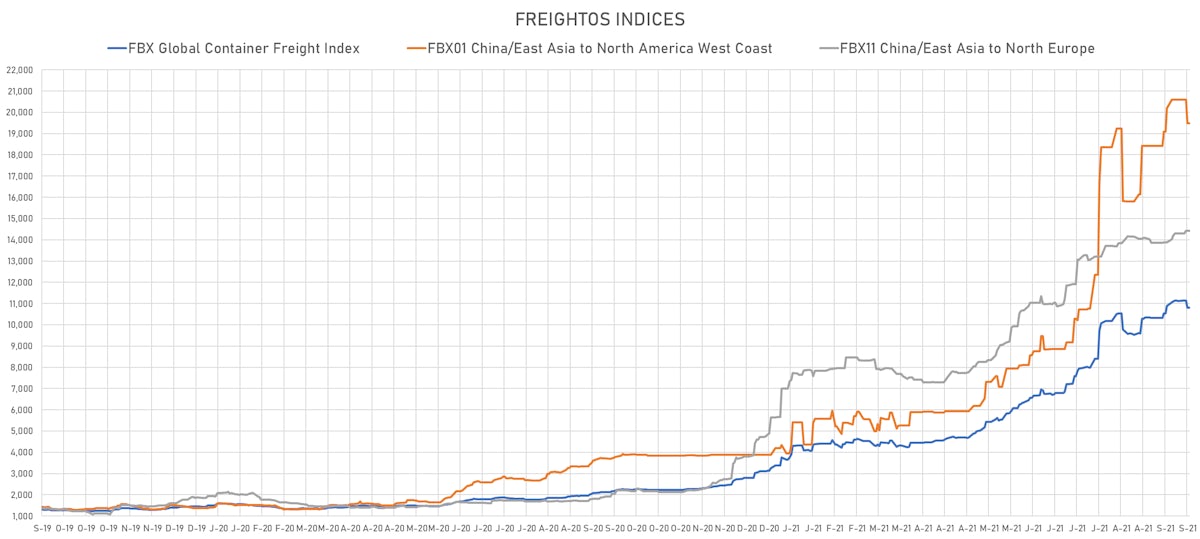

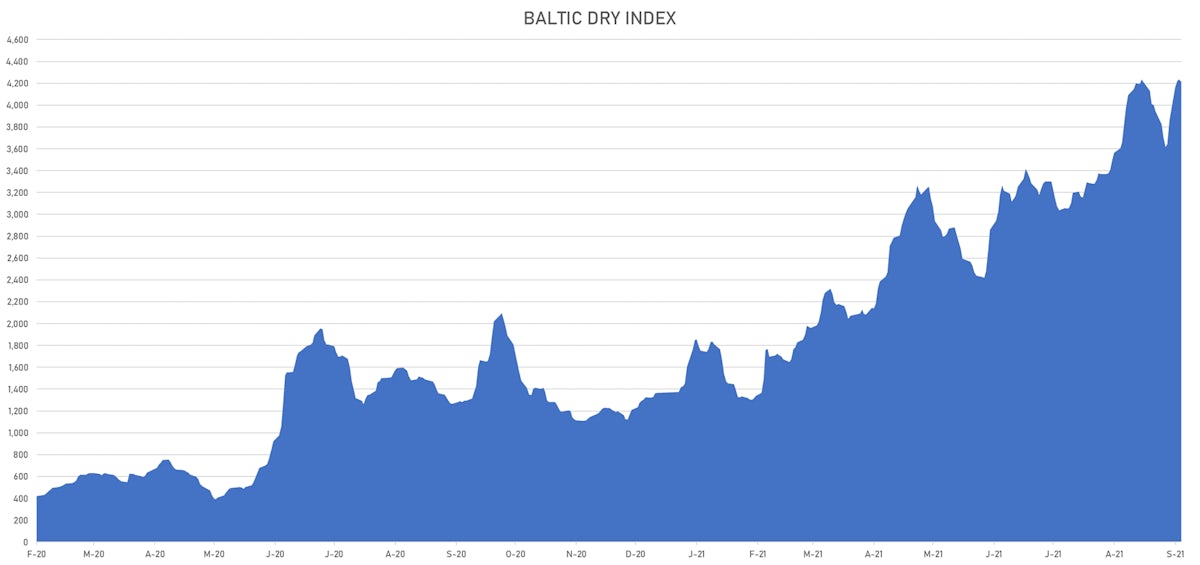

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,215, down -0.4% (YTD: +208.6%)

- Freightos China To North America West Coast Container Index currently at 19,478, unchanged (YTD: +363.8%)

- Freightos North America West Coast To China Container Index currently at 927, unchanged (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 554, unchanged (YTD: +52.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,431, unchanged (YTD: +154.9%)

- Freightos North Europe To China Container Index currently at 1,501, unchanged (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

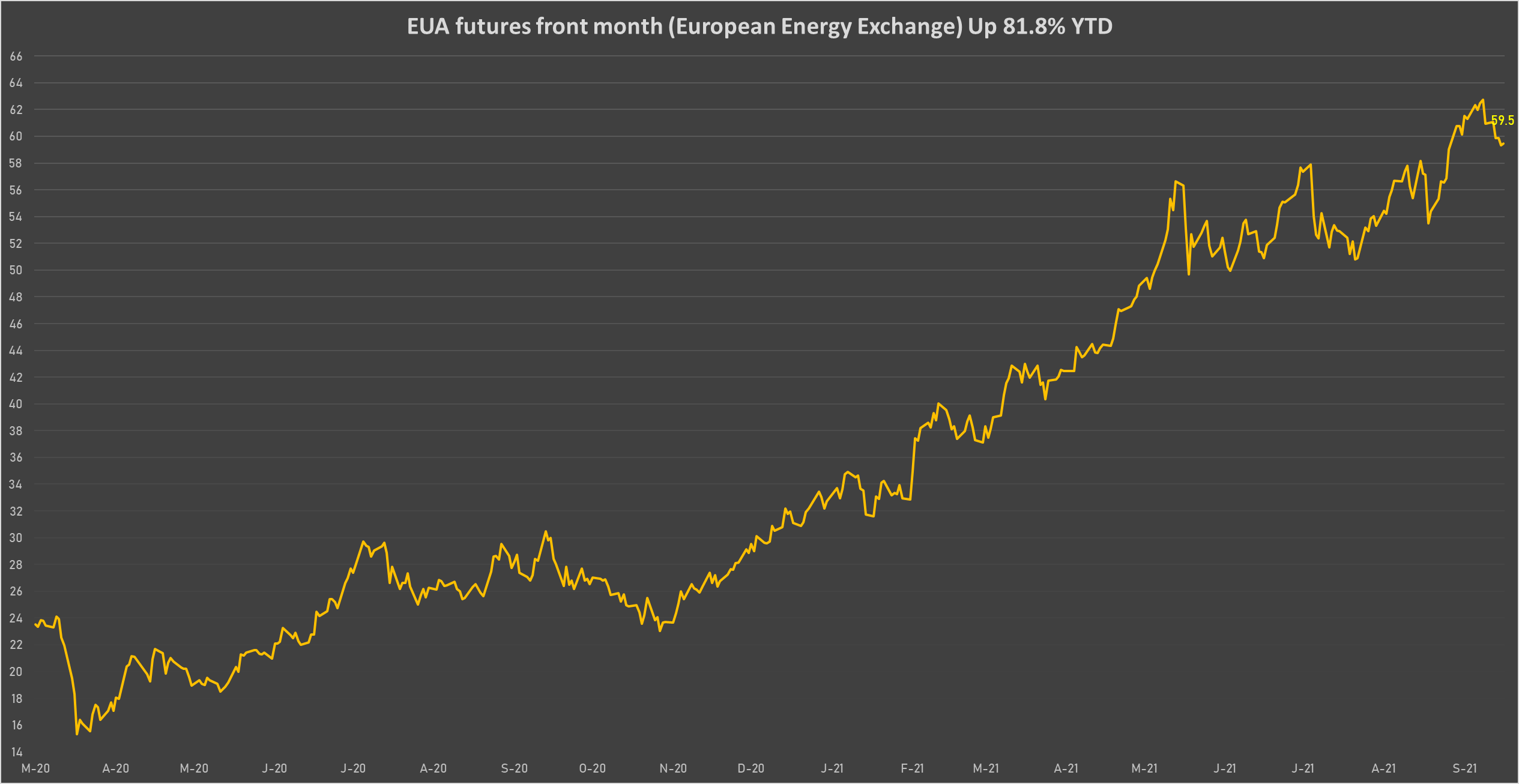

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 59.48 per tonne, up 0.3% (YTD: +81.8%)