Commodities

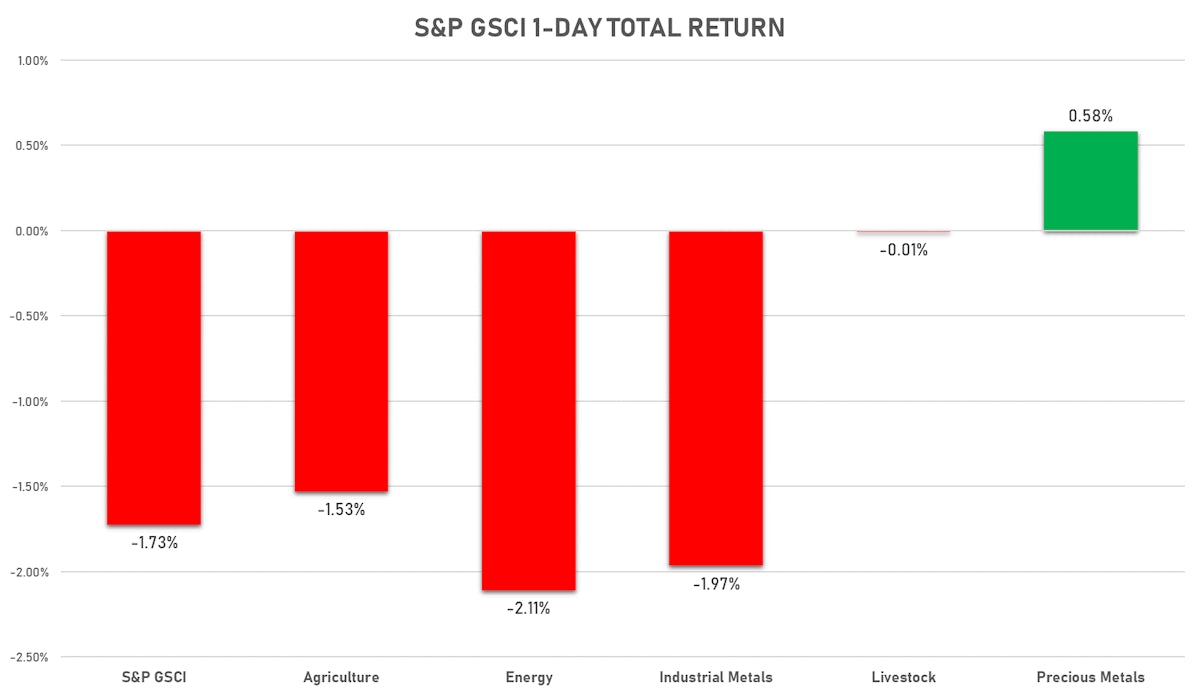

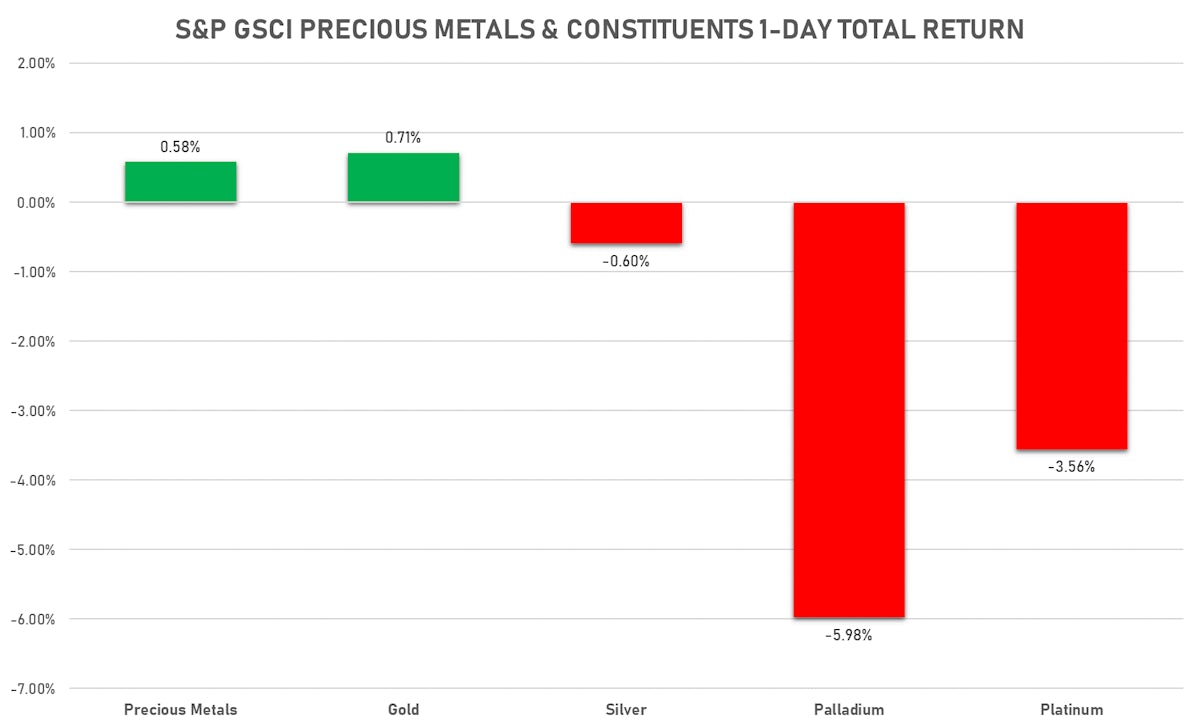

Gold Rises On Risk Aversion, Other Commodity Groups Fall

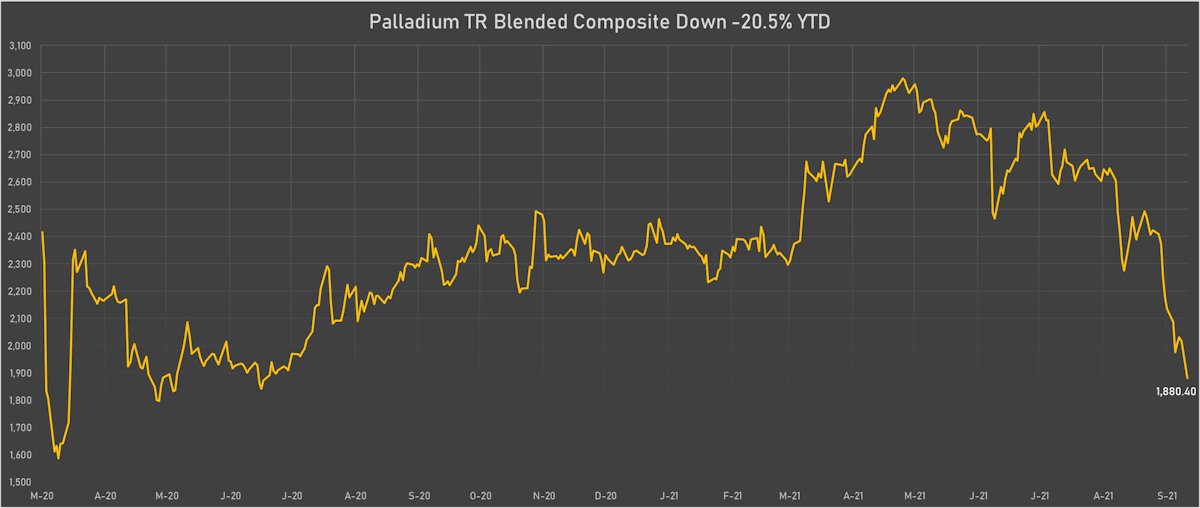

Palladium and platinum trade more like industrial metals and were down big today (-7% and -3% respectively)

Published ET

Palladium Has Struggled Recently With The Drop In Industrial Metals | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 2.1% (YTD: 33.7%)

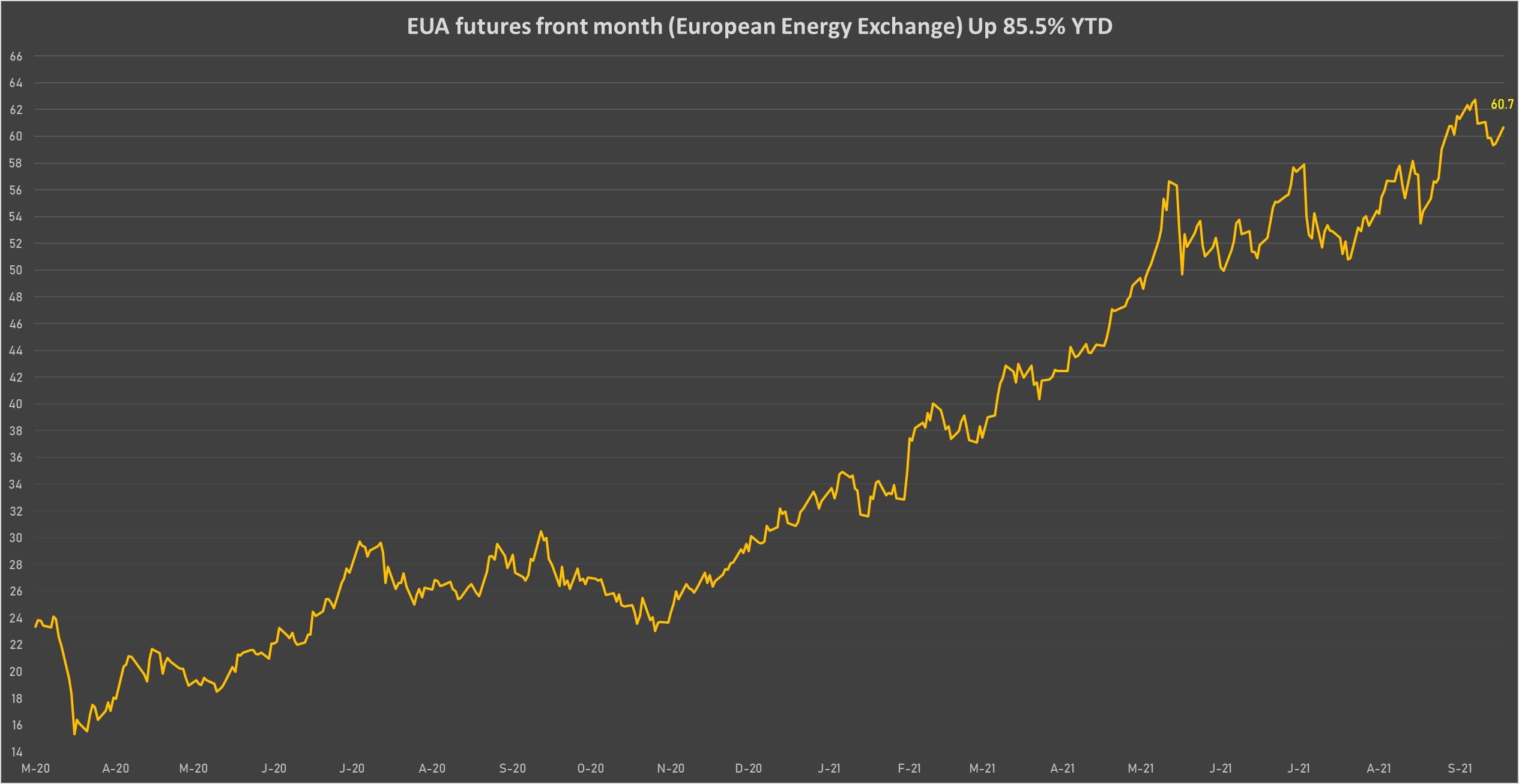

- Intercontinental Exchange European Union Allowance (EUA) Yearly up 2.0% (YTD: 85.5%)

- EEX European-Carbon- Secondary Trading up 2.0% (YTD: 89.1%)

- Gold spot up 0.6% (YTD: -7.0%)

- Johnson Matthey Rhodium New York 0930 up 0.4% (YTD: -25.8%)

- CME Cash Settled Cheese up 0.1% (YTD: 0.3%)

- CME Cattle(Feeder) up 0.1% (YTD: 11.6%)

NOTABLE LOSERS TODAY

- Palladium spot down -6.7% (YTD: -23.1%)

- CME Random Length Lumber down -6.4% (YTD: -32.0%)

- ICE-US Cotton No. 2 down -3.7% (YTD: 15.1%)

- COMEX Copper down -3.0% (YTD: 17.2%)

- Platinum spot down -2.9% (YTD: -14.7%)

- ICE-US Cocoa down -2.7% (YTD: -0.4%)

- NYMEX RBOB Gasoline down -2.6% (YTD: 50.2%)

- CBoT Soybean Oil down -2.5% (YTD: 26.7%)

- NYMEX Henry Hub Natural Gas down -2.4% (YTD: 96.3%)

- NYMEX Light Sweet Crude Oil (WTI) down -2.3% (YTD: 44.9%)

- Crude Oil WTI Cushing US FOB down -2.3% (YTD: 45.6%)

- NYMEX NY Harbor ULSD down -2.3% (YTD: 46.2%)

- ICE-US Coffee C down -2.0% (YTD: 43.1%)

- ICE Europe Brent Crude down -1.9% (YTD: 42.7%)

- CBoT Soybeans down -1.7% (YTD: -4.0%)

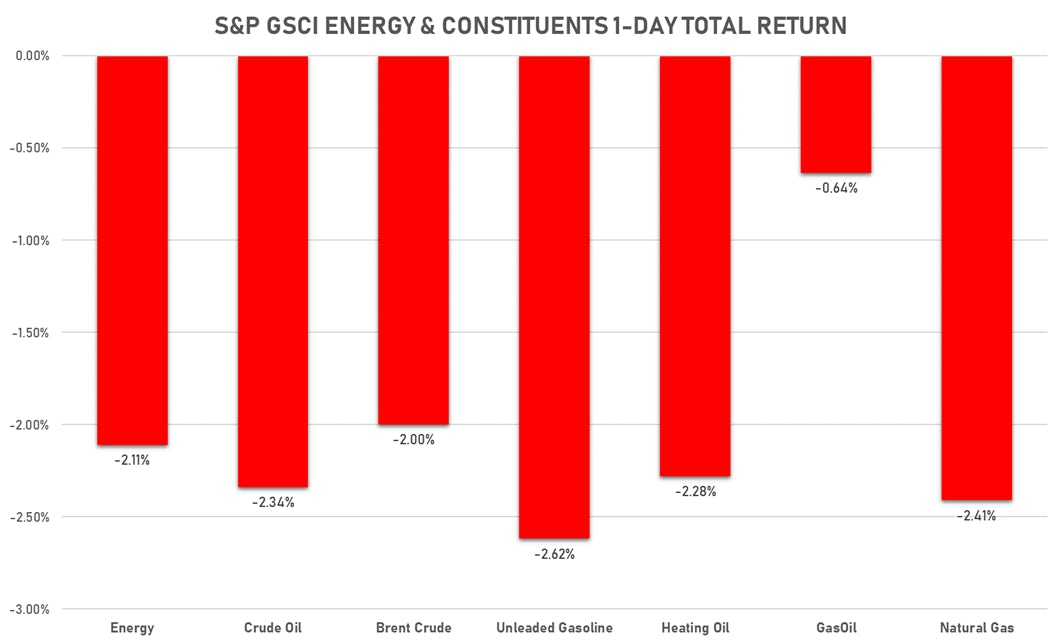

ENERGY DOWN TODAY

- WTI crude front month currently at US$ 70.74 per barrel, down -2.3% (YTD: +44.9%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 74.35 per barrel, down -1.9% (YTD: +42.7%); 6-month term structure in widening backwardation

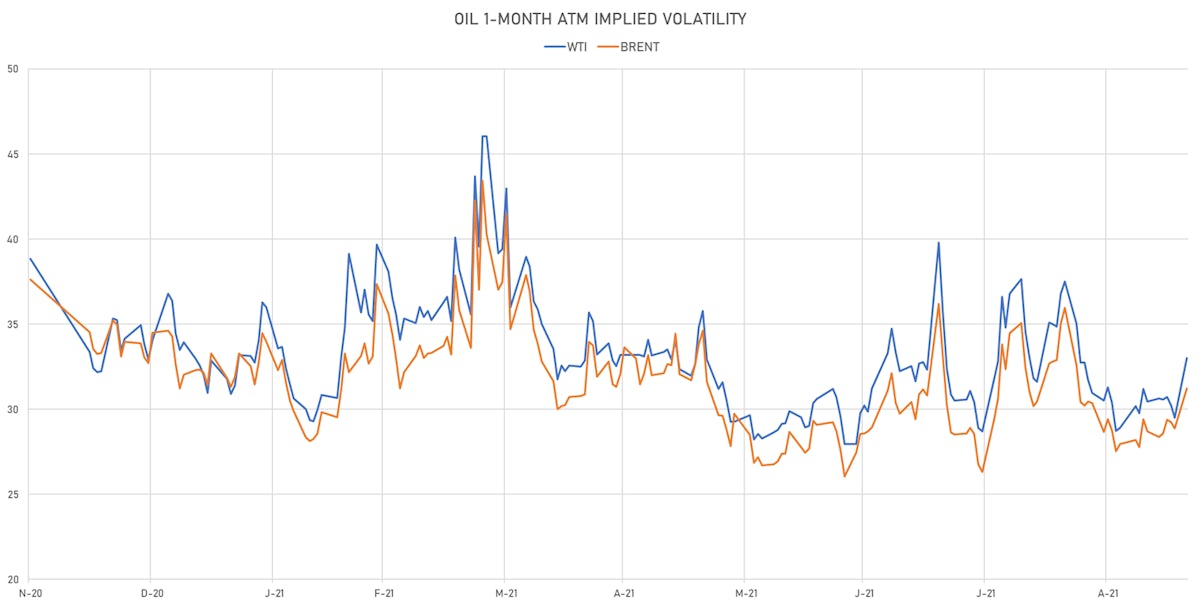

- Brent volatility at 31.2, up 8.2% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) unchanged at US$ 177.50 per tonne (YTD: +120.5%)

- Natural Gas (Henry Hub) currently at US$ 4.97 per MMBtu, down -2.4% (YTD: +96.3%)

- Gasoline (NYMEX) currently at US$ 2.12 per gallon, down -2.6% (YTD: +50.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 624.75 per tonne, down -0.6% (YTD: +49.1%)

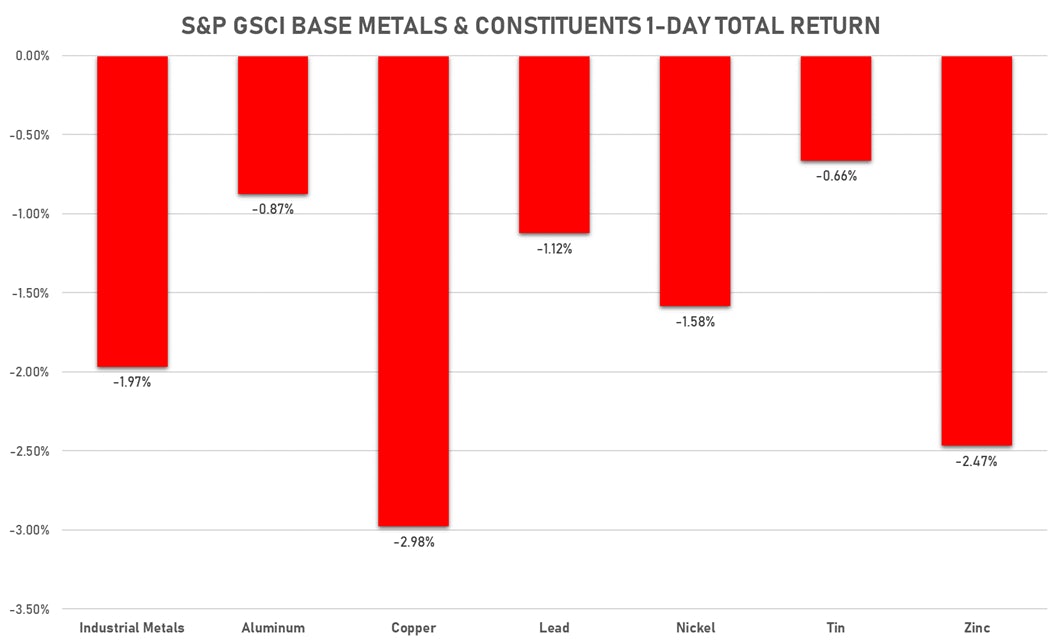

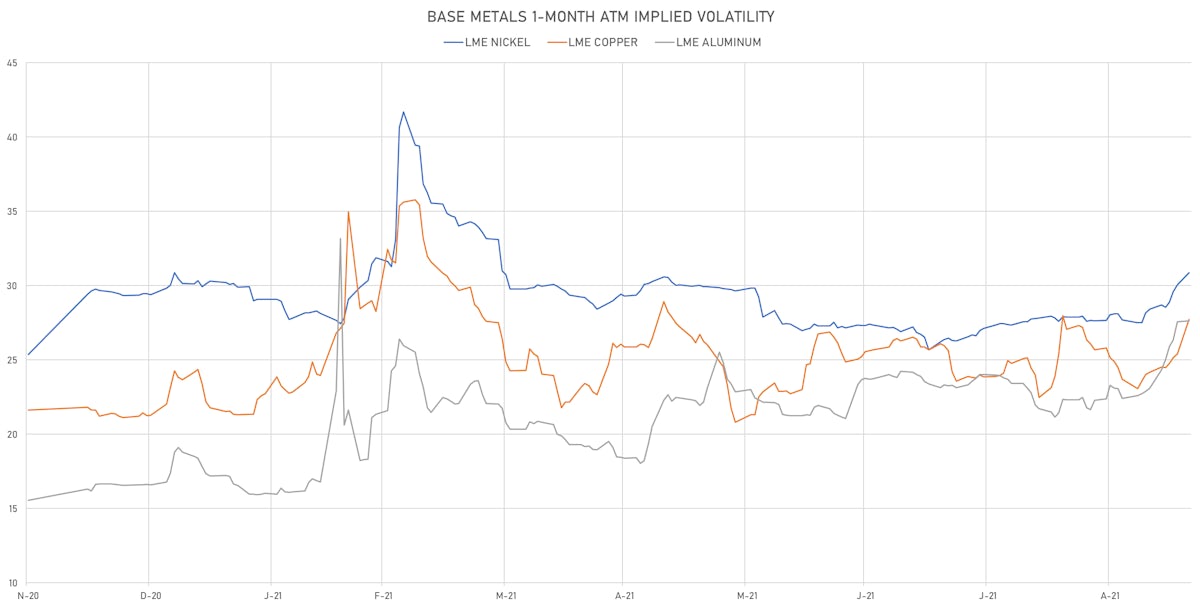

BASE METALS FALL TODAY

- Copper (COMEX) currently at US$ 4.14 per pound, down -3.0% (YTD: +17.2%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 699.00 per tonne (YTD: -35.2%)

- Aluminum (Shanghai) currently at CNY 22,620 per tonne (YTD: +44.2%)

- Nickel (Shanghai) currently at CNY 144,690 per tonne (YTD: +16.9%)

- Lead (Shanghai) currently at CNY 14,660 per tonne (YTD: -0.3%)

- Rebar (Shanghai) currently at CNY 5,709 per tonne (YTD: +35.3%)

- Tin (Shanghai) currently at CNY 259,840 per tonne (YTD: +72.7%)

- Zinc (Shanghai) currently at CNY 22,760 per tonne (YTD: +9.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,000 per tonne (YTD: +36.9%)

- Lithium (Shanghai) spot price currently at CNY 825,000 per tonne (YTD: +70.1%)

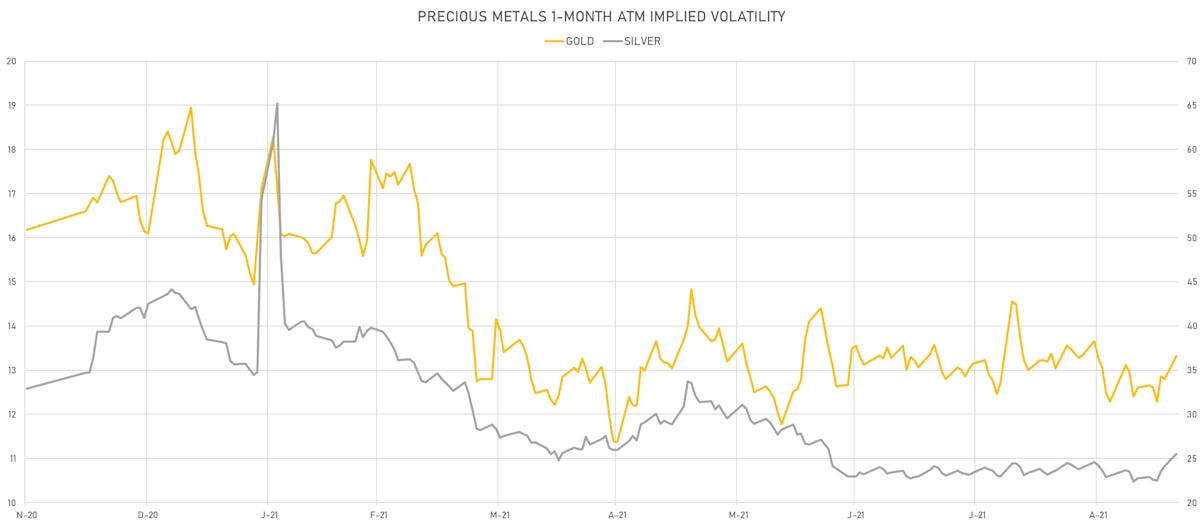

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot currently at US$ 1,763.54 per troy ounce, up 0.6% (YTD: -7.0%)

- Gold 1-Month ATM implied volatility currently at 13.07, up 4.0% (YTD: -17.3%)

- Silver spot currently at US$ 22.28 per troy ounce, down -0.7% (YTD: -15.7%)

- Silver 1-Month ATM implied volatility currently at 24.59, up 5.8% (YTD: -40.0%)

- Palladium spot currently at US$ 1,897.72 per troy ounce, down -6.7% (YTD: -23.1%)

- Platinum spot currently at US$ 915.90 per troy ounce, down -2.9% (YTD: -14.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 12,650 per troy ounce, up 0.4% (YTD: -25.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

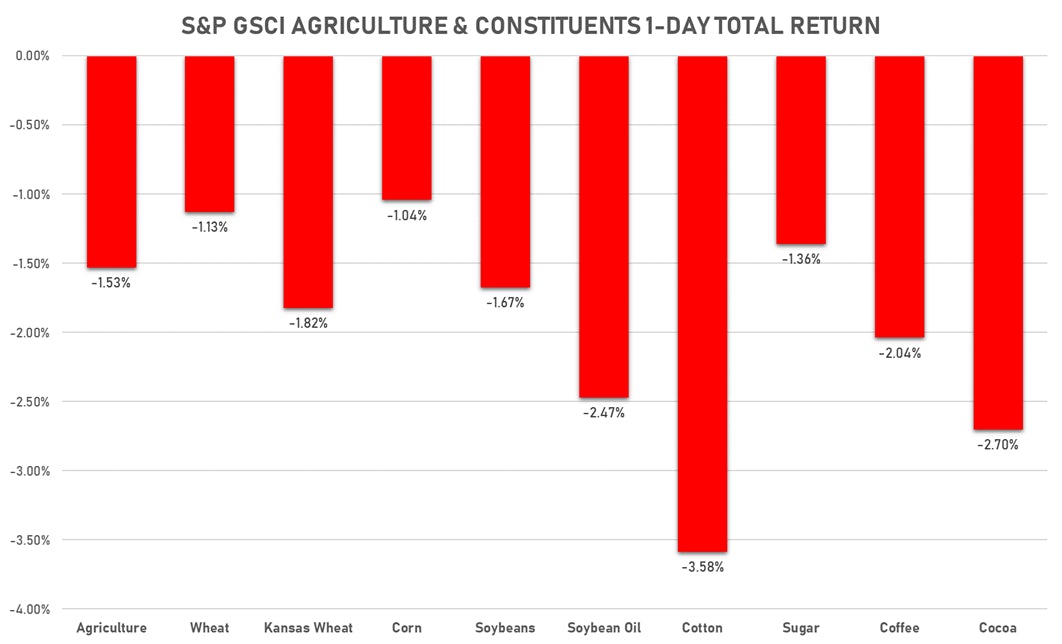

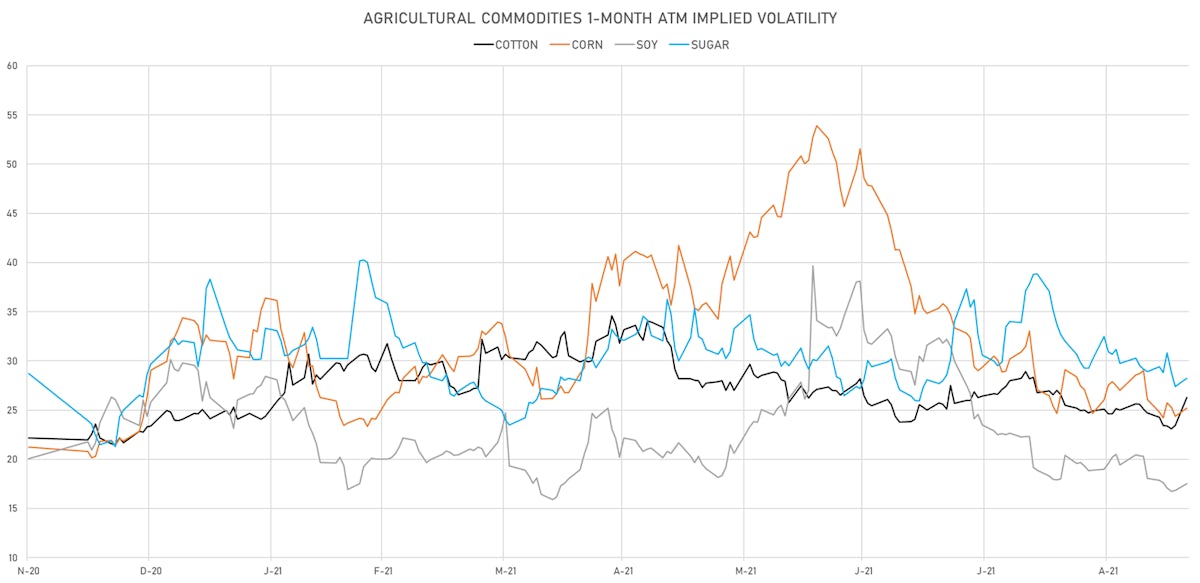

AGS FALL TODAY

- Live Cattle (CME) unchanged at US$ 122.78 cents per pound (YTD: +8.7%)

- Lean Hogs (CME) currently at US$ 84.98 cents per pound, down -0.9% (YTD: +20.9%)

- Rough Rice (CBOT) currently at US$ 13.69 cents per hundredweight, down -0.4% (YTD: +10.7%)

- Soybeans Composite (CBOT) currently at US$ 1,263.75 cents per bushel, down -1.7% (YTD: -4.0%)

- Corn (CBOT) currently at US$ 520.50 cents per bushel, down -1.0% (YTD: +7.8%)

- Wheat Composite (CBOT) currently at US$ 697.25 cents per bushel, down -1.1% (YTD: +9.4%)

- Sugar No.11 (ICE US) currently at US$ 18.86 cents per pound, down -1.7% (YTD: +21.8%)

- Cotton No.2 (ICE US) currently at US$ 89.79 cents per pound, down -3.7% (YTD: +15.1%)

- Cocoa (ICE US) currently at US$ 2,593 per tonne, down -2.7% (YTD: -0.4%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,496 per tonne, down -0.2% (YTD: +42.1%)

- Random Length Lumber (CME) currently at US$ 593.50 per 1,000 board feet, down -6.4% (YTD: -32.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,325 per tonne (YTD: +13.3%)

- Soybean Oil Composite (CBOT) currently at US$ 55.14 cents per pound, down -2.5% (YTD: +26.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,443 per tonne, down -1.7% (YTD: +14.2%)

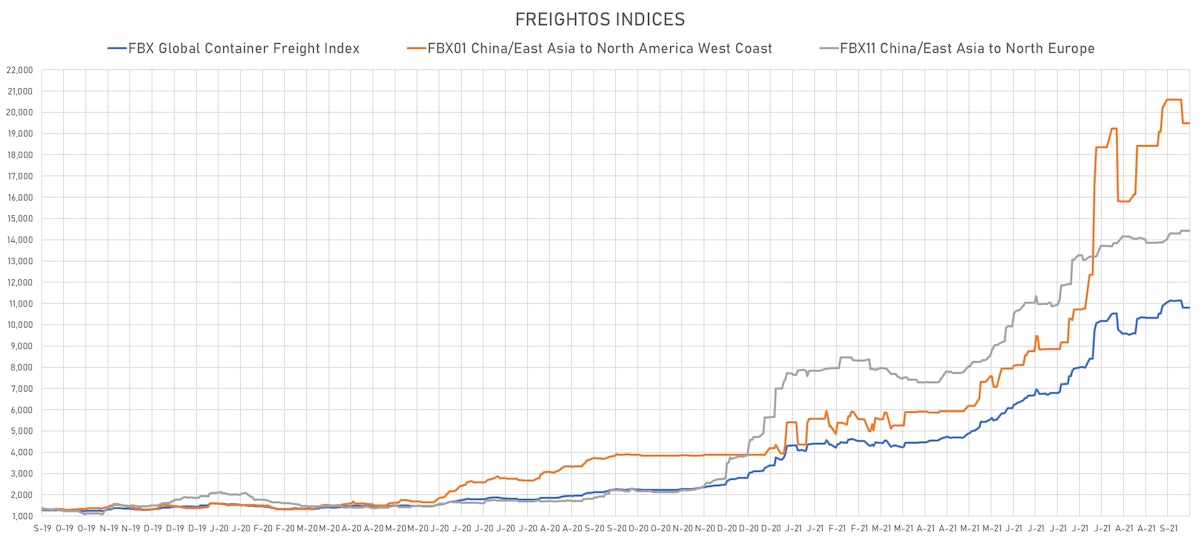

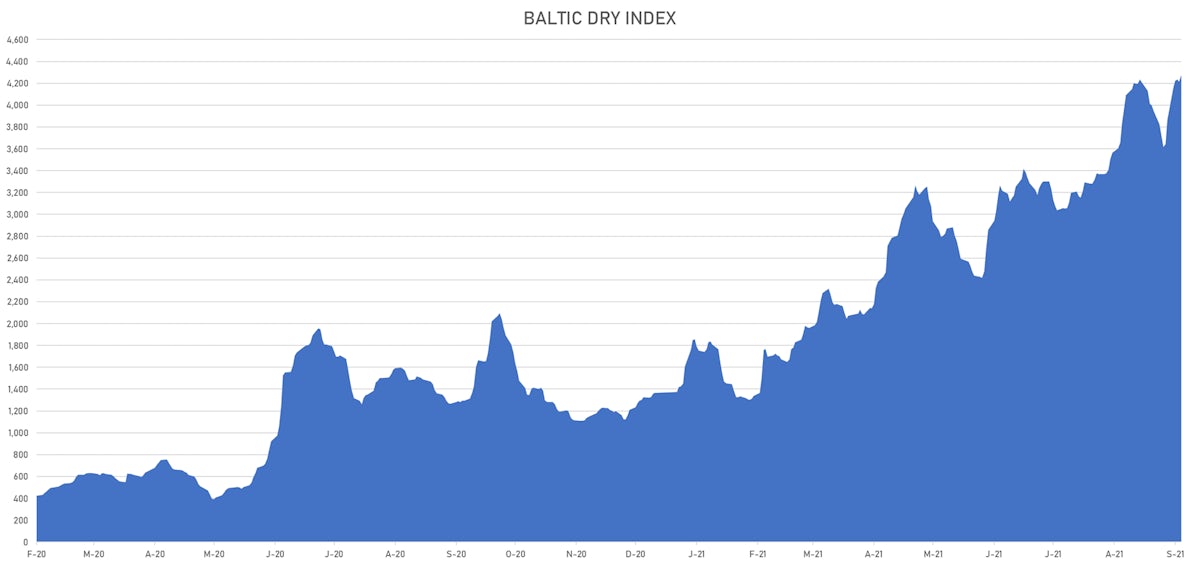

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,275, up 1.4% (YTD: +213.0%)

- Freightos China To North America West Coast Container Index currently at 19,478, unchanged (YTD: +363.8%)

- Freightos North America West Coast To China Container Index currently at 896, down -3.3% (YTD: +73.1%)

- Freightos North America East Coast To Europe Container Index currently at 554, unchanged (YTD: +52.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,431, unchanged (YTD: +154.9%)

- Freightos North Europe To China Container Index currently at 1,501, unchanged (YTD: +9.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 60.68 per tonne, up 2.0% (YTD: +85.5%)