Commodities

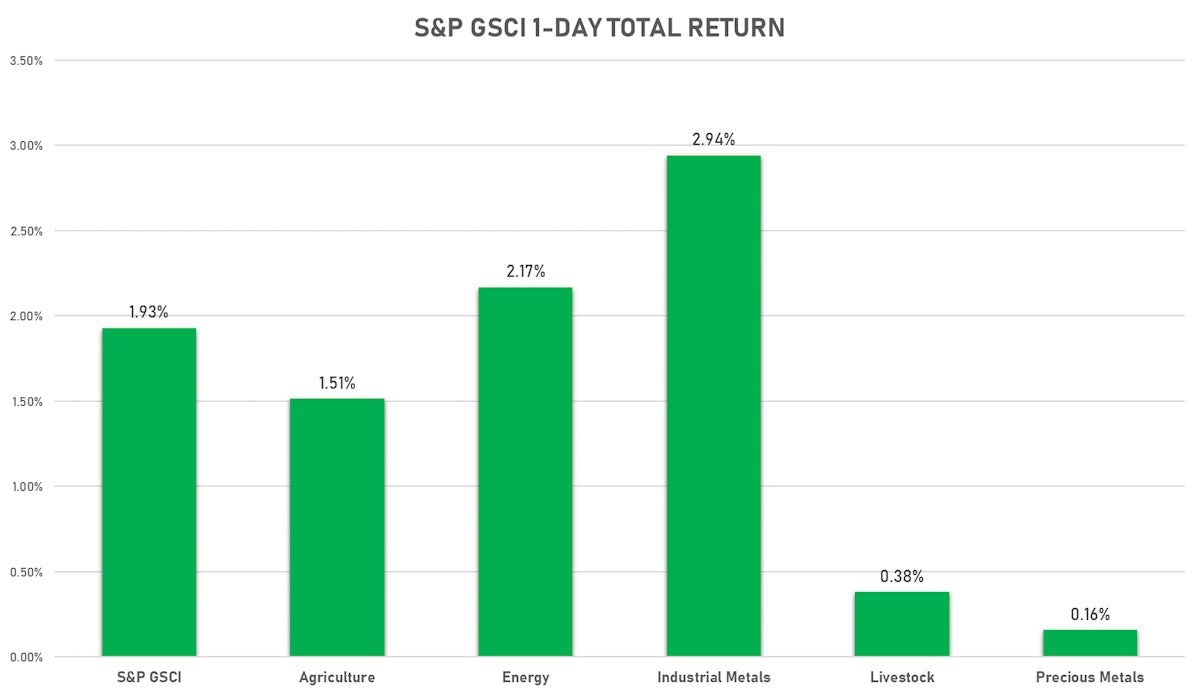

Broad Rise Across The Commodities Complex, Led By Energy And Industrial Metals

Crude oil rose sharply after the weekly EIA report showed a stronger than expected inventories draw, while a sharp increase in refinery capacity utilization led to an unexpected gasoline build

Published ET

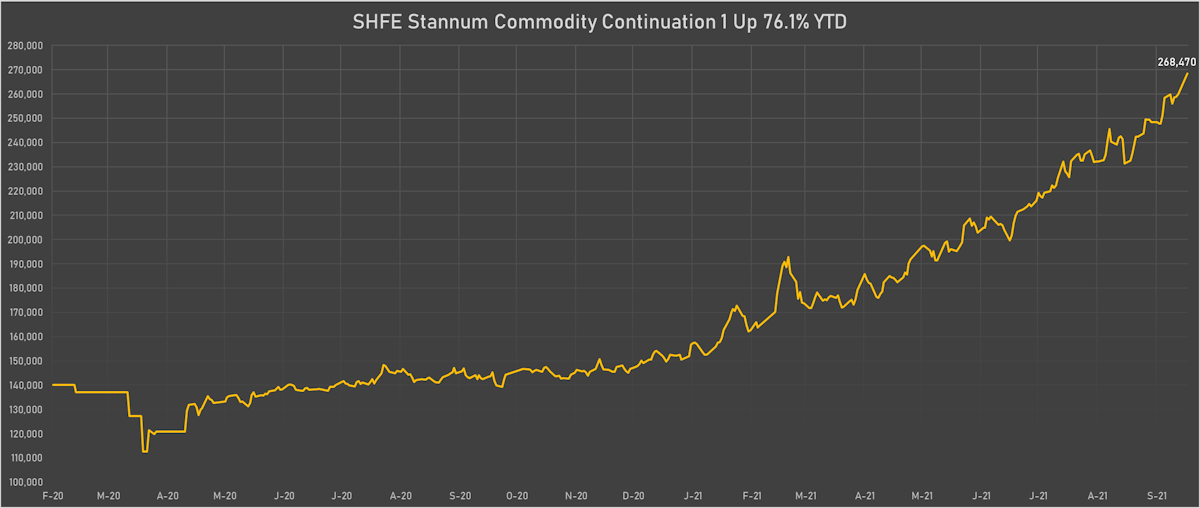

Shanghai Tin Front Month Futures | Sources: ϕpost, Refinitiv data

WEEKLY EIA REPORT

- Stock Levels, Total Crude Oil excluding SPR, Absolute change, Volume for W 17 Sep (EIA, United States) at -3.48 Mln, below consensus estimate of -2.44 Mln

- Stock Levels, Total Distillate, Absolute change, Volume for W 17 Sep (EIA, United States) at -2.56 Mln, below consensus estimate of -1.19 Mln

- Stock Levels, Gasoline, Absolute change, Volume for W 17 Sep (EIA, United States) at 3.48 Mln, above consensus estimate of -1.07 Mln

- Refinery Capacity Utilization, Absolute change, Volume for W 17 Sep (EIA, United States) at 5.40 %, above consensus estimate of 2.40 %

NOTABLE GAINERS TODAY

- Palladium spot up 6.4% (YTD: -17.1%)

- Platinum spot up 4.7% (YTD: -6.6%)

- CME Random Length Lumber up 4.2% (YTD: -28.2%)

- SHFE Stannum (Tin) up 3.3% (YTD: 78.5%)

- ICE Europe Brent Crude up 3.1% (YTD: 47.1%)

- COMEX Copper up 3.0% (YTD: 21.0%)

- SHFE Rebar up 2.9% (YTD: 39.2%)

- Crude Oil WTI Cushing US FOB up 2.6% (YTD: 49.7%)

- SGX Iron Ore 62% China CFR Swap Monthly up 2.6% (YTD: -24.6%)

- Bursa Malaysia Crude Palm Oil up 2.4% (YTD: 17.7%)

- NYMEX Light Sweet Crude Oil (WTI) up 2.4% (YTD: 48.9%)

- Zhengzhou Exchange Thermal Coal up 2.4% (YTD: 63.7%)

- CBoT Wheat up 2.2% (YTD: 10.2%)

- WUXI Metal Cobalt Bi-Monthly up 2.2% (YTD: 34.4%)

- Brent Forties and Oseberg Dated FOB North sea Crude up 2.0% (YTD: 46.8%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -6.4% (YTD: -39.3%)

- Shanghai International Exchange TSR 20 down -3.8% (YTD: 9.0%)

- SHFE Bitumen Continuation Month 1 down -3.0% (YTD: 22.3%)

- SHFE Rubber down -3.0% (YTD: -8.5%)

- SHFE Lead Continuation Month 1 down -2.7% (YTD: -3.0%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -1.8% (YTD: -22.5%)

- SHFE Copper down -1.1% (YTD: 18.6%)

- Shanghai International Exchange Bonded Copper down -1.1% (YTD: 17.7%)

- DCE RBD Palm Oil down -0.8% (YTD: 25.2%)

- CME Lean Hogs down -0.6% (YTD: 19.3%)

- SHFE Hot Rolled Coil down -0.4% (YTD: 27.1%)

- SHFE Zinc down -0.4% (YTD: 8.7%)

- SHFE Nickel down -0.4% (YTD: 16.5%)

- DCE Coke down -0.4% (YTD: 34.3%)

- Gold spot down -0.4% (YTD: -6.8%)

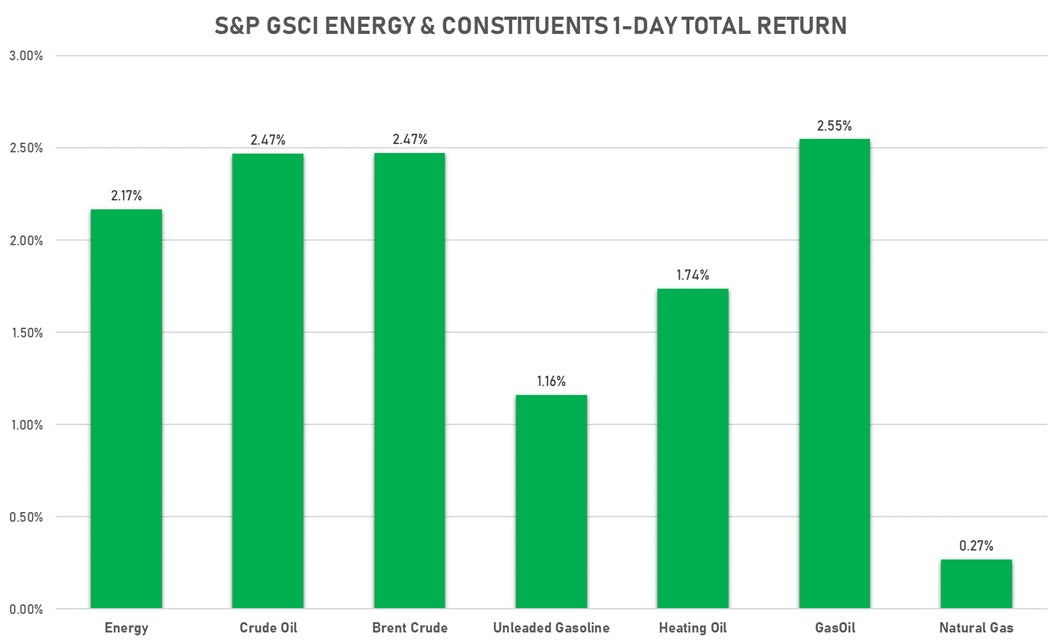

ENERGY UP TODAY

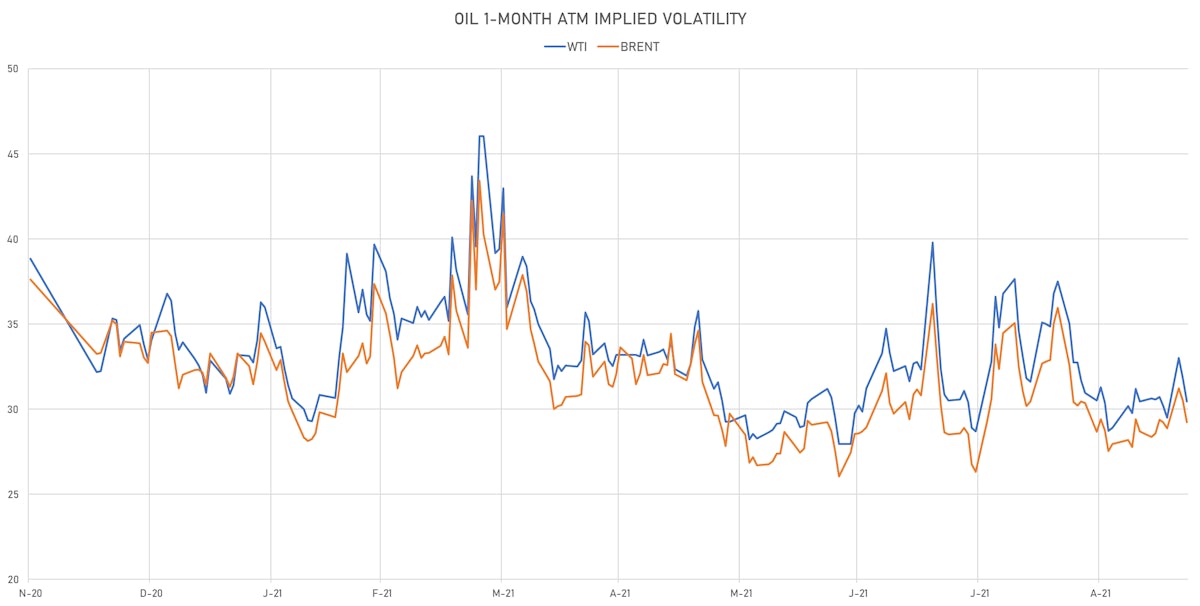

- WTI crude front month currently at US$ 72.01 per barrel, up 2.4% (YTD: +48.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.96 per barrel, up 3.1% (YTD: +47.1%); 6-month term structure in widening backwardation

- Brent volatility at 29.2, down -4.3% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 180.50 per tonne, up 1.7% (YTD: +124.2%)

- Natural Gas (Henry Hub) currently at US$ 4.78 per MMBtu, down -0.4% (YTD: +89.2%)

- Gasoline (NYMEX) currently at US$ 2.12 per gallon, up 0.9% (YTD: +50.8%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 640.00 per tonne, up 1.4% (YTD: +51.2%)

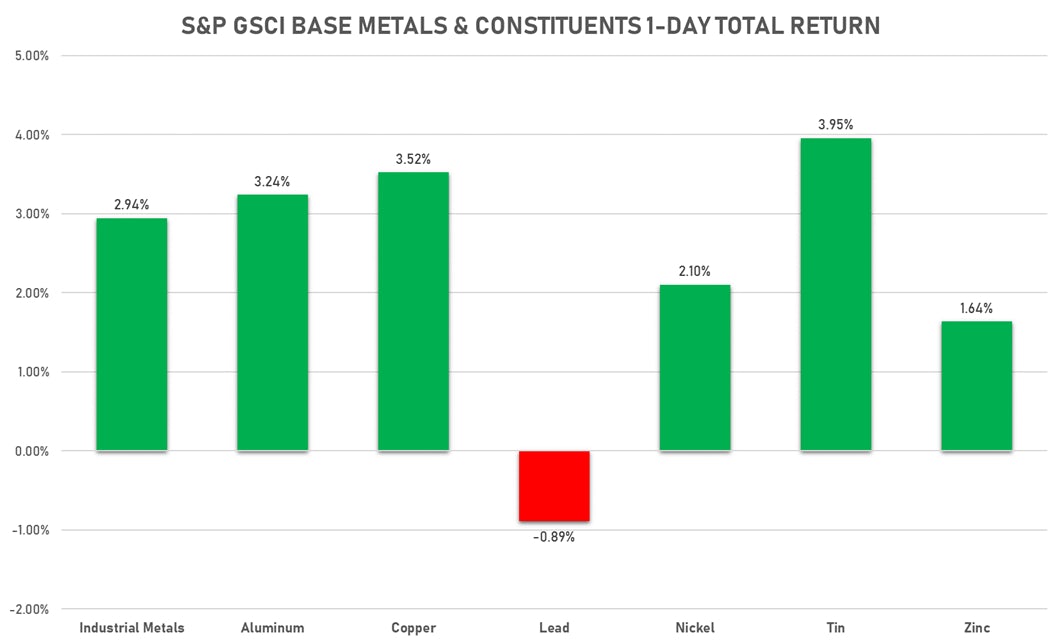

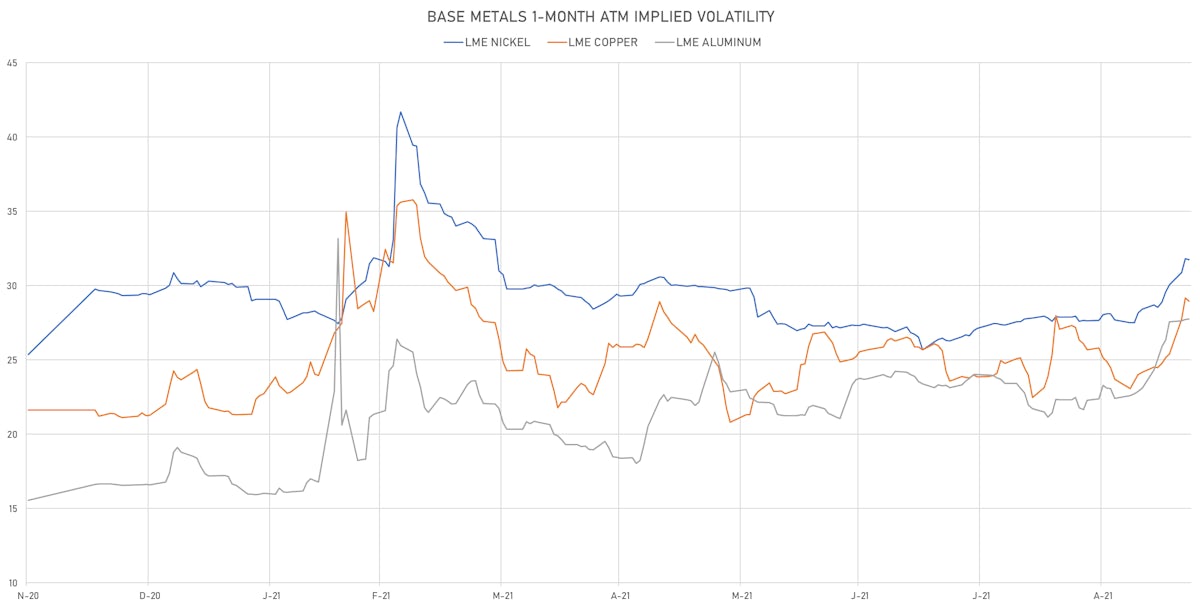

BASE METALS UP TODAY

- Copper (COMEX) currently at US$ 4.25 per pound, up 3.0% (YTD: +21.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 693.00 per tonne, down -6.4% (YTD: -39.3%)

- Aluminum (Shanghai) currently at CNY 23,295 per tonne, up 1.3% (YTD: +46.0%)

- Nickel (Shanghai) currently at CNY 144,300 per tonne, down -0.4% (YTD: +16.5%)

- Lead (Shanghai) currently at CNY 14,065 per tonne, down -2.7% (YTD: -3.0%)

- Rebar (Shanghai) currently at CNY 5,868 per tonne, up 2.9% (YTD: +39.2%)

- Tin (Shanghai) currently at CNY 274,240 per tonne, up 3.3% (YTD: +78.5%)

- Zinc (Shanghai) currently at CNY 22,555 per tonne, down -0.4% (YTD: +8.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 378,000 per tonne, up 0.8% (YTD: +38.0%)

- Lithium (Shanghai) spot price currently at CNY 825,000 per tonne, unchanged (YTD: +70.1%)

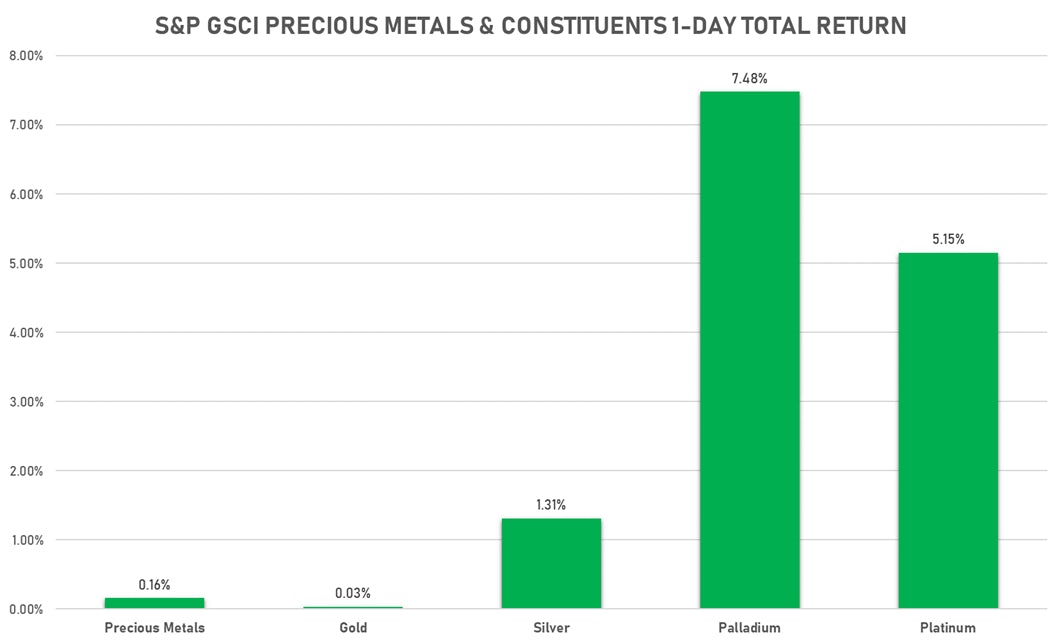

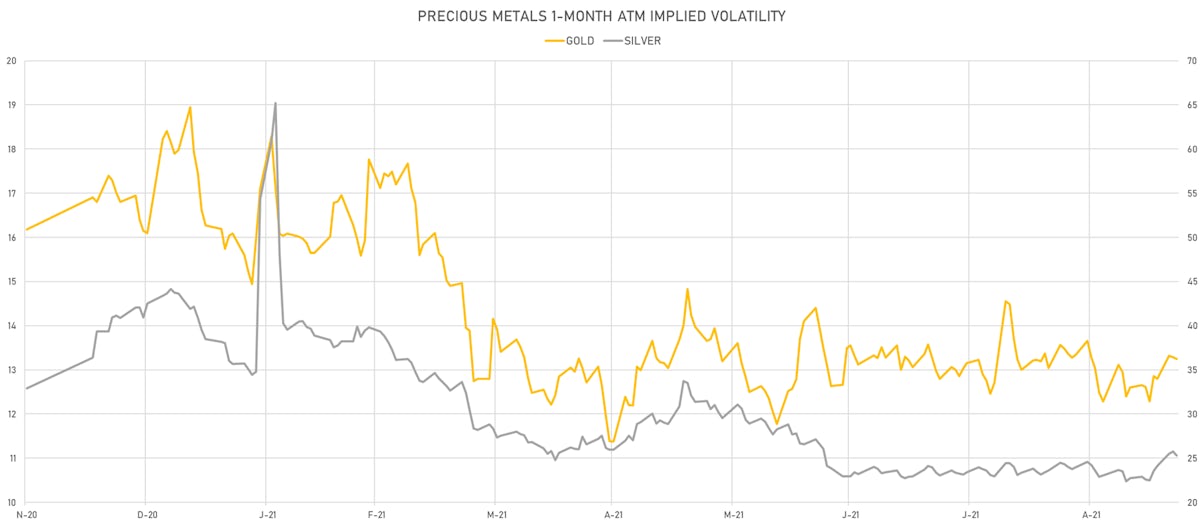

PRECIOUS METALS MOSTLY RISE TODAY

- Gold spot currently at US$ 1,764.87 per troy ounce, down -0.4% (YTD: -6.8%)

- Gold 1-Month ATM implied volatility currently at 13.03, down -0.1% (YTD: -17.5%)

- Silver spot currently at US$ 22.63 per troy ounce, up 0.8% (YTD: -14.0%)

- Silver 1-Month ATM implied volatility currently at 24.48, down -0.9% (YTD: -39.9%)

- Palladium spot currently at US$ 2,023.12 per troy ounce, up 6.4% (YTD: -17.1%)

- Platinum spot currently at US$ 996.90 per troy ounce, up 4.7% (YTD: -6.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 13,500 per troy ounce, up 1.5% (YTD: -20.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

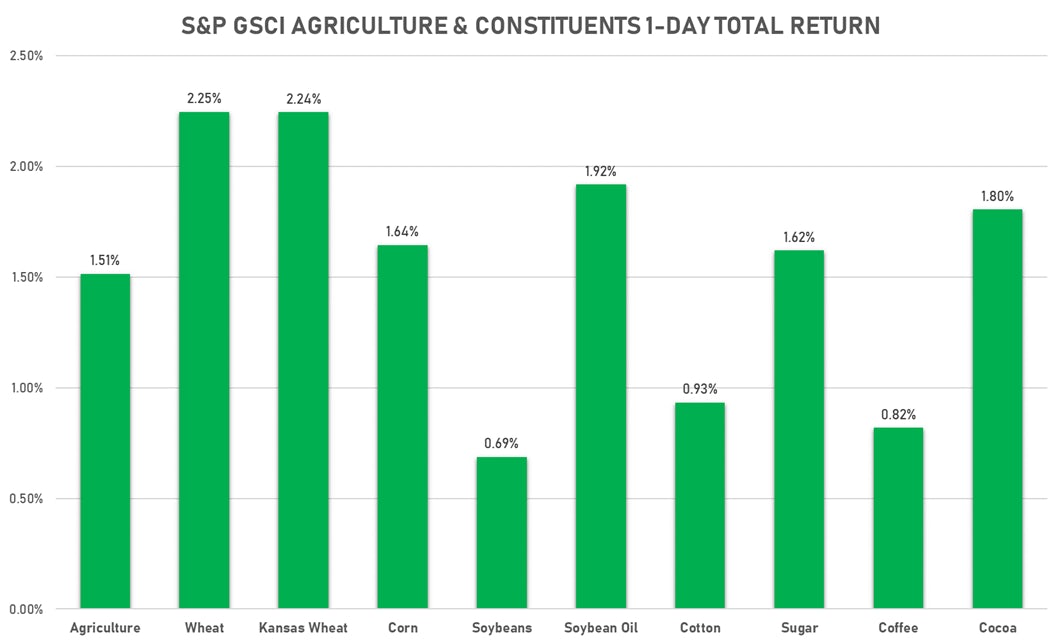

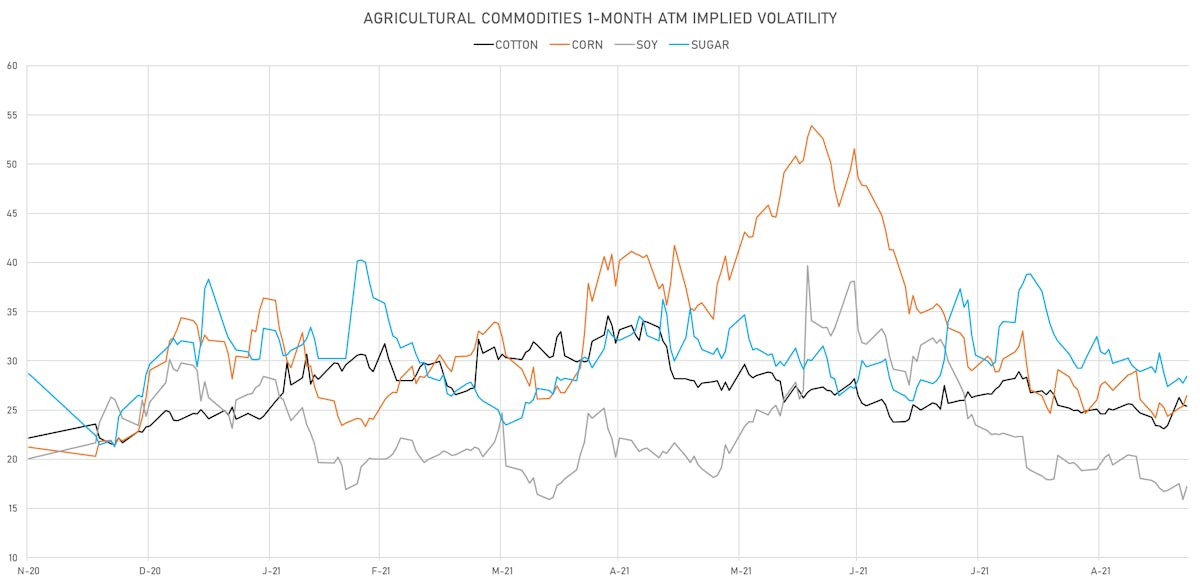

AGS RISE TODAY

- Live Cattle (CME) currently at US$ 123.28 cents per pound, up 0.7% (YTD: +9.1%)

- Lean Hogs (CME) currently at US$ 83.85 cents per pound, down -0.6% (YTD: +19.3%)

- Rough Rice (CBOT) currently at US$ 13.87 cents per hundredweight, up 0.3% (YTD: +12.0%)

- Soybeans Composite (CBOT) currently at US$ 1,281.50 cents per bushel, up 0.7% (YTD: -2.5%)

- Corn (CBOT) currently at US$ 523.25 cents per bushel, up 1.6% (YTD: +8.6%)

- Wheat Composite (CBOT) currently at US$ 705.50 cents per bushel, up 2.2% (YTD: +10.2%)

- Sugar No.11 (ICE US) currently at US$ 19.33 cents per pound, up 1.9% (YTD: +24.8%)

- Cotton No.2 (ICE US) currently at US$ 91.83 cents per pound, up 0.7% (YTD: +17.5%)

- Cocoa (ICE US) currently at US$ 2,652 per tonne, up 1.8% (YTD: +1.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,421 per tonne, up 0.2% (YTD: +39.7%)

- Random Length Lumber (CME) currently at US$ 627.00 per 1,000 board feet, up 4.2% (YTD: -28.2%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,955 per tonne, down -3.8% (YTD: +9.0%)

- Soybean Oil Composite (CBOT) currently at US$ 56.35 cents per pound, up 1.9% (YTD: +30.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,579 per tonne, up 2.4% (YTD: +17.7%)

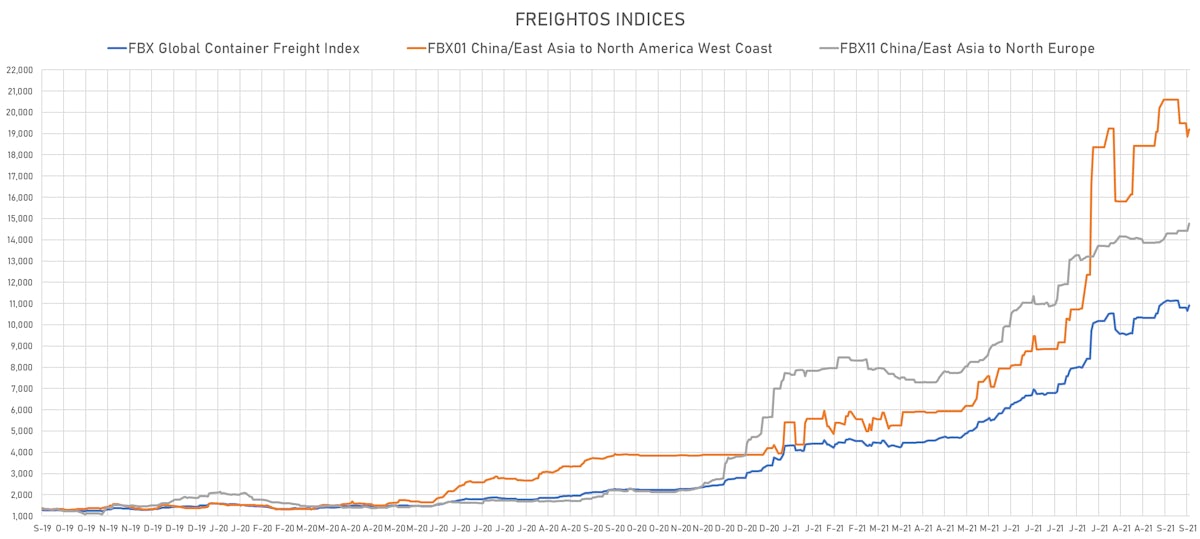

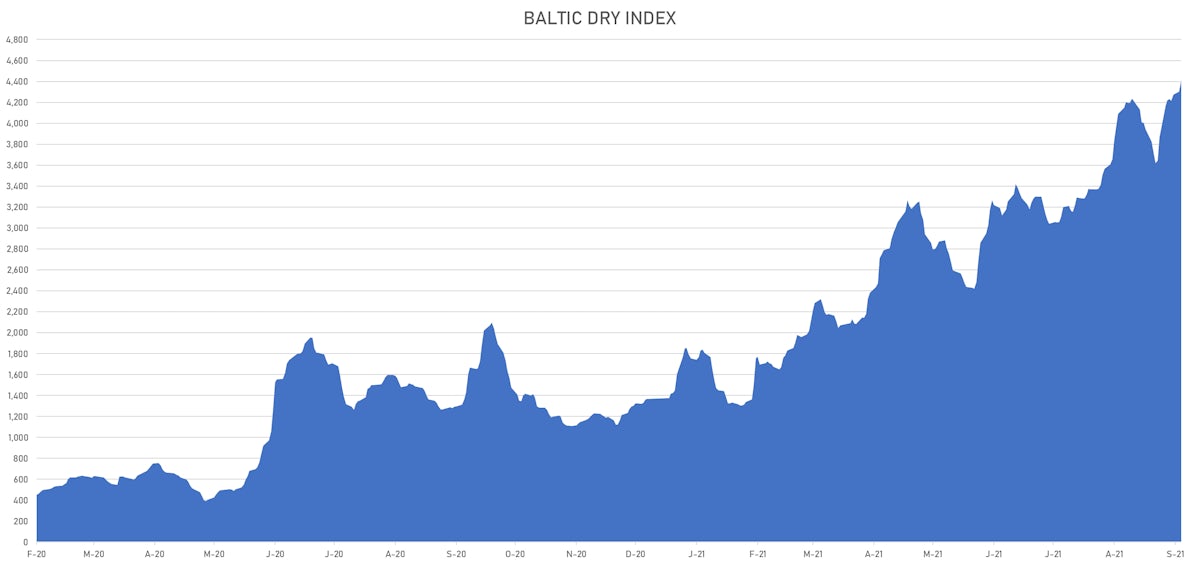

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,410, up 2.5% (YTD: +222.8%)

- Freightos China To North America West Coast Container Index currently at 19,182, up 1.8% (YTD: +356.8%)

- Freightos North America West Coast To China Container Index currently at 896, unchanged (YTD: +73.1%)

- Freightos North America East Coast To Europe Container Index currently at 533, unchanged (YTD: +46.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,756, up 2.3% (YTD: +160.6%)

- Freightos North Europe To China Container Index currently at 1,459, unchanged (YTD: +6.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

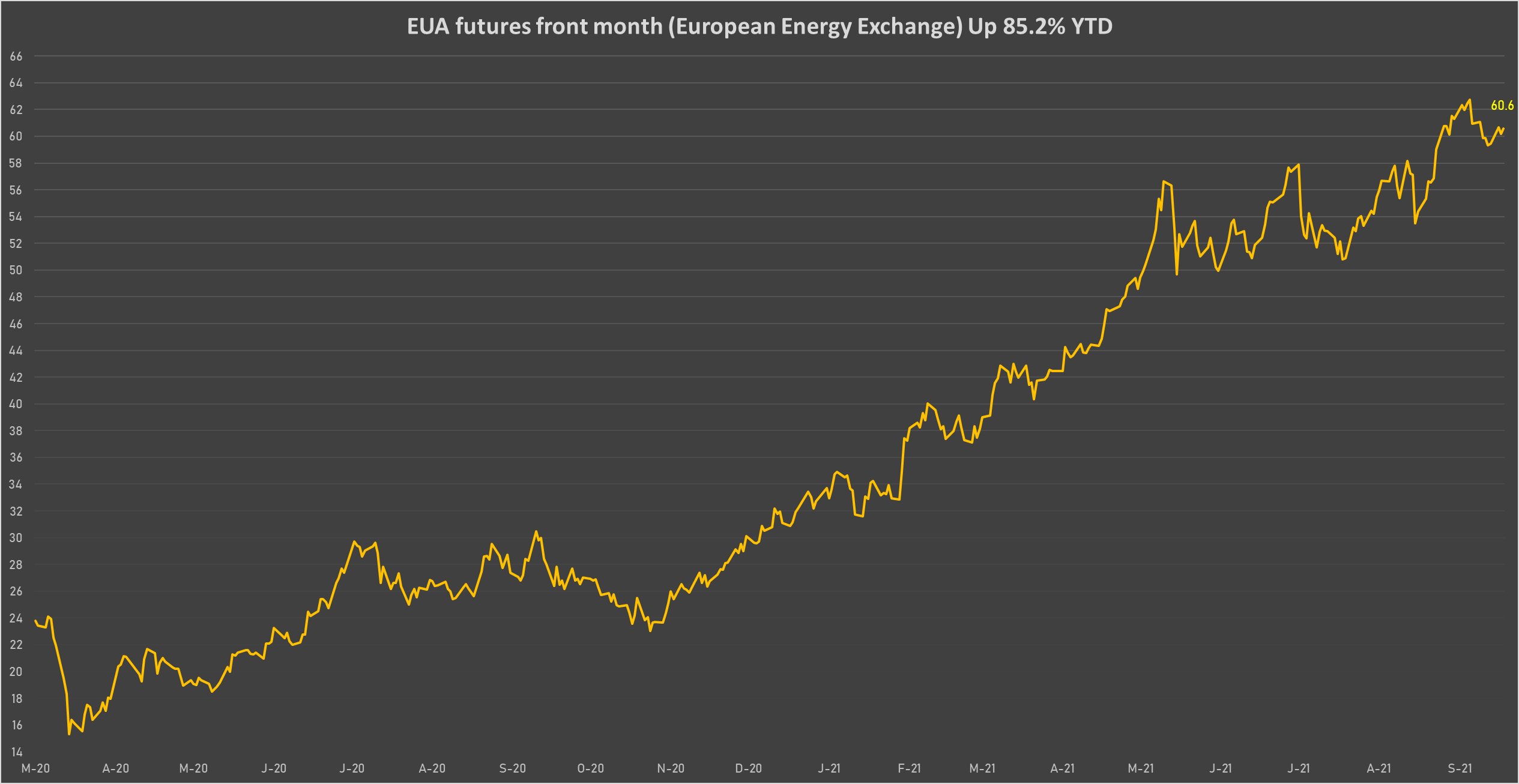

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 60.60 per tonne, up 0.7% (YTD: +85.2%)