Commodities

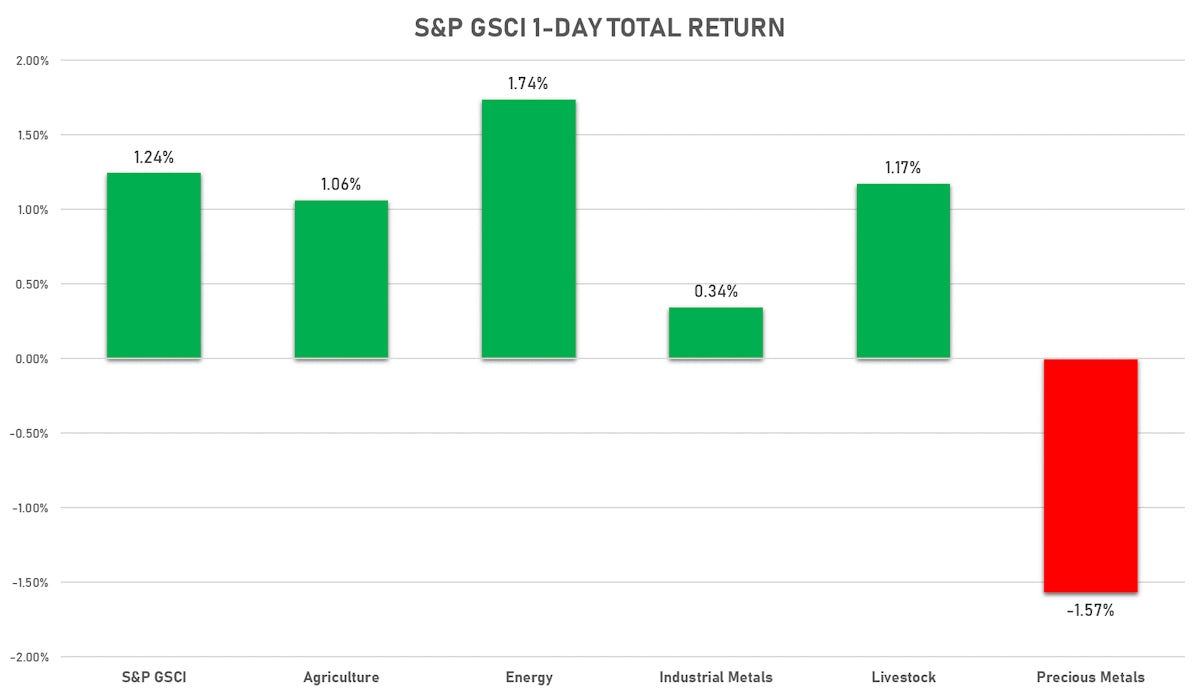

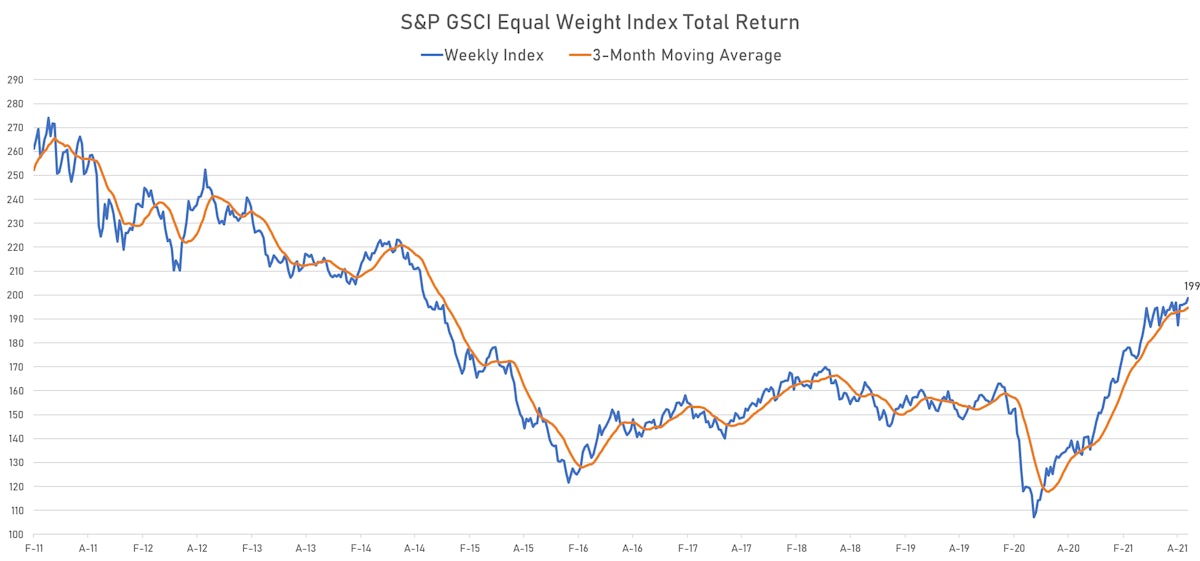

Risk-On Sentiment Positive For Energy, Base Metals But Rise In Real Rates Negative For Precious Metals

Though the move is less extreme than in Europe, US Nat Gas futures prices are still rising ahead of winter and moving in sync with coal futures (main substitute for power production)

Published ET

Henry Hub Natural Gas, Thermal Coal and Coking Coal All Up Together Ahead Of Winter | Source: Refinitiv

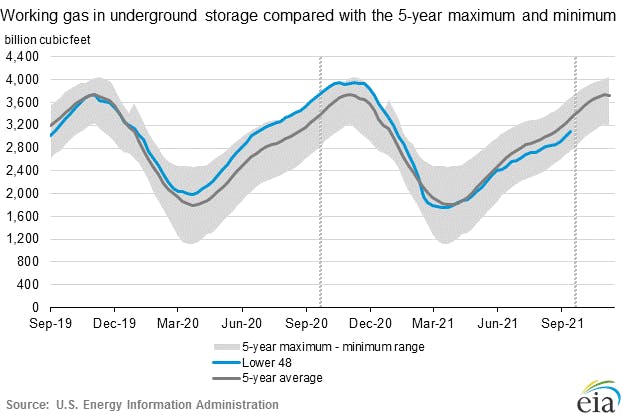

WEEKLY EIA NATURAL GAS STORAGE

- Injection in Underground Storage, Lower 48 States, Volume for W 17 Sep (EIA, United States) at 76.00 bcf, above consensus estimate of 75.00 bcf

- The injection only slightly tightens the deficit vs 5yr average to 229 Bcf

NOTABLE GAINERS TODAY

- Zhengzhou Exchange Thermal Coal up 4.4% (YTD: 70.9%)

- DCE Iron Ore Continuation Month 1 up 3.9% (YTD: -37.0%)

- NYMEX Henry Hub Natural Gas up 3.6% (YTD: 96.0%)

- DCE Coking Coal Continuation Month 1 up 3.3% (YTD: 142.8%)

- ICE-US Coffee C up 3.1% (YTD: 48.6%)

- ICE Europe Newcastle Coal Monthly up 3.0% (YTD: 130.9%)

- SHFE Tin up 2.4% (YTD: 82.7%)

- NYMEX RBOB Gasoline up 2.2% (YTD: 54.2%)

- Johnson Matthey Rhodium New York 0930 up 2.2% (YTD: -19.1%)

- SHFE Aluminum up 2.0% (YTD: 48.9%)

- Brent Forties and Oseberg Dated FOB North sea Crude up 1.9% (YTD: 49.7%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 1.9% (YTD: 49.2%)

- CME Random Length Lumber up 1.9% (YTD: -26.8%)

- ICE Europe Low Sulphur Gasoil up 1.8% (YTD: 54.0%)

- Bursa Malaysia Crude Palm Oil up 1.7% (YTD: 19.7%)

NOTABLE LOSERS TODAY

- Palladium spot down -2.2% (YTD: -19.0%)

- ICE-US Cocoa down -1.5% (YTD: 0.3%)

- Gold spot down -1.5% (YTD: -8.2%)

- Platinum spot down -1.0% (YTD: -7.5%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -0.9% (YTD: 32.9%)

- Silver spot down -0.8% (YTD: -14.7%)

- COMEX Copper down -0.5% (YTD: 20.4%)

- CBoT Rough Rice down -0.4% (YTD: 11.5%)

- CBoT Soybean Meal down -0.4% (YTD: -22.5%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily down -0.4% (YTD: 37.0%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily down -0.4% (YTD: 36.6%)

- CME Cash Settled Cheese down -0.4% (YTD: 0.0%)

- CME Class III Milk down -0.4% (YTD: 4.7%)

- SHFE Lead Continuation Month 1 down -0.4% (YTD: -3.3%)

- SHFE Rebar down -0.3% (YTD: 38.8%)

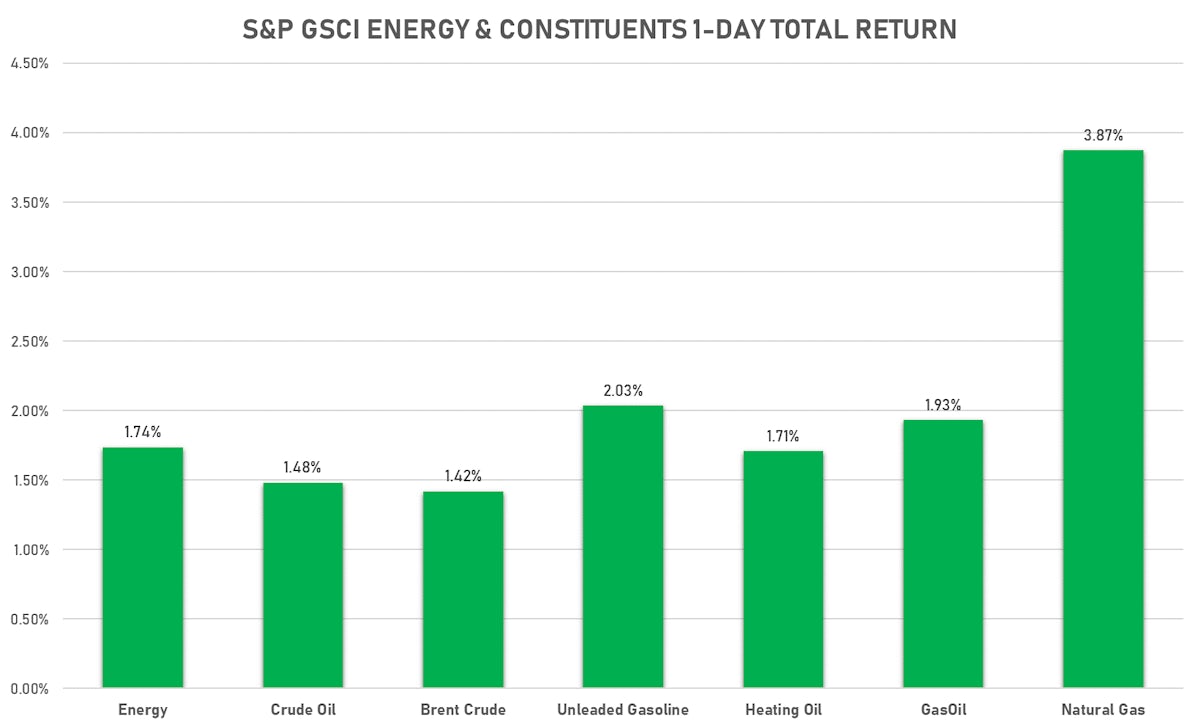

ENERGY RISES TODAY

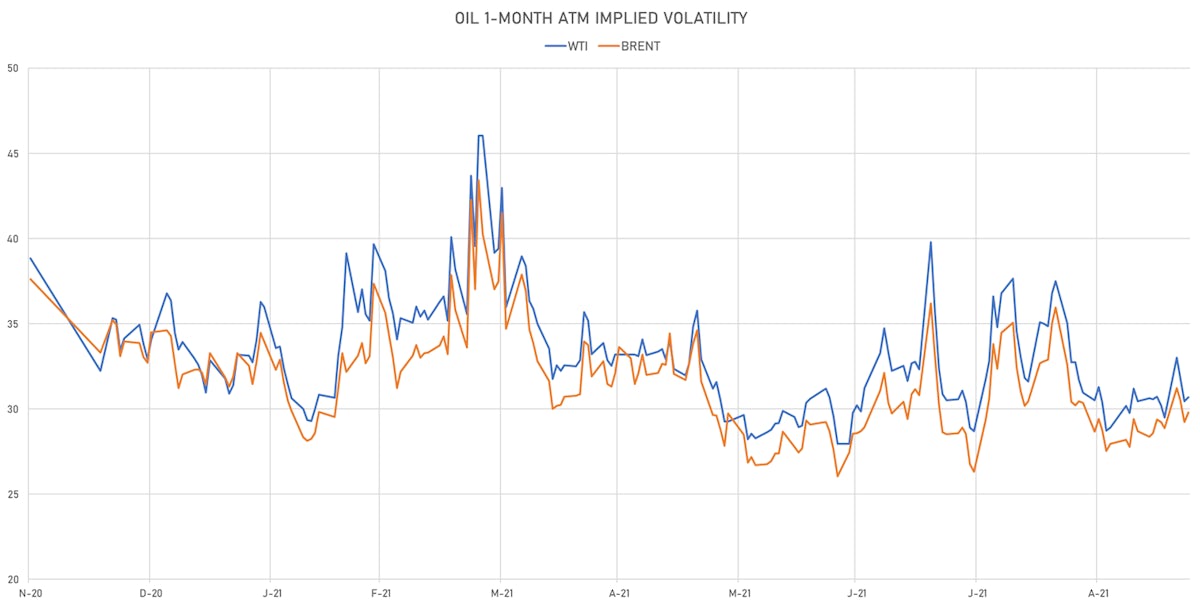

- WTI crude front month currently at US$ 73.18 per barrel, up 1.5% (YTD: +51.1%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 77.16 per barrel, up 1.4% (YTD: +49.1%); 6-month term structure in tightening backwardation

- Brent volatility at 29.8, up 2.0% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 185.90 per tonne, up 3.0% (YTD: +130.9%)

- Natural Gas (Henry Hub) currently at US$ 5.05 per MMBtu, up 3.6% (YTD: +96.0%)

- Gasoline (NYMEX) currently at US$ 2.17 per gallon, up 2.2% (YTD: +54.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 650.50 per tonne, up 1.8% (YTD: +54.0%)

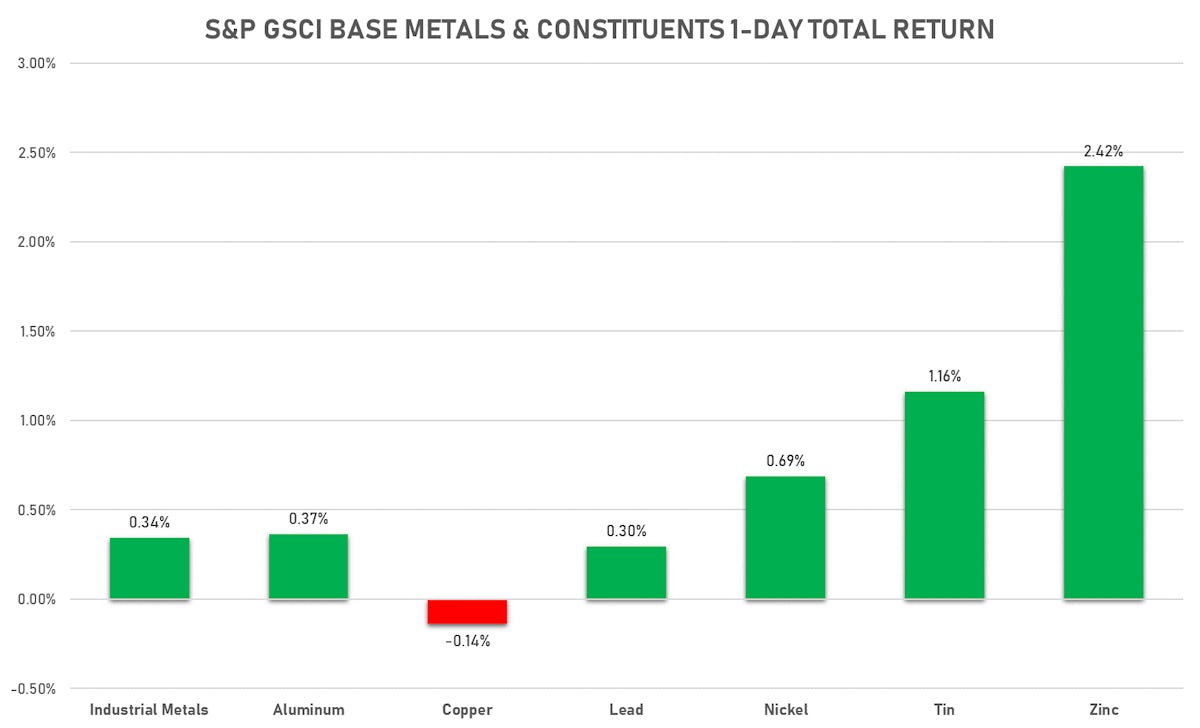

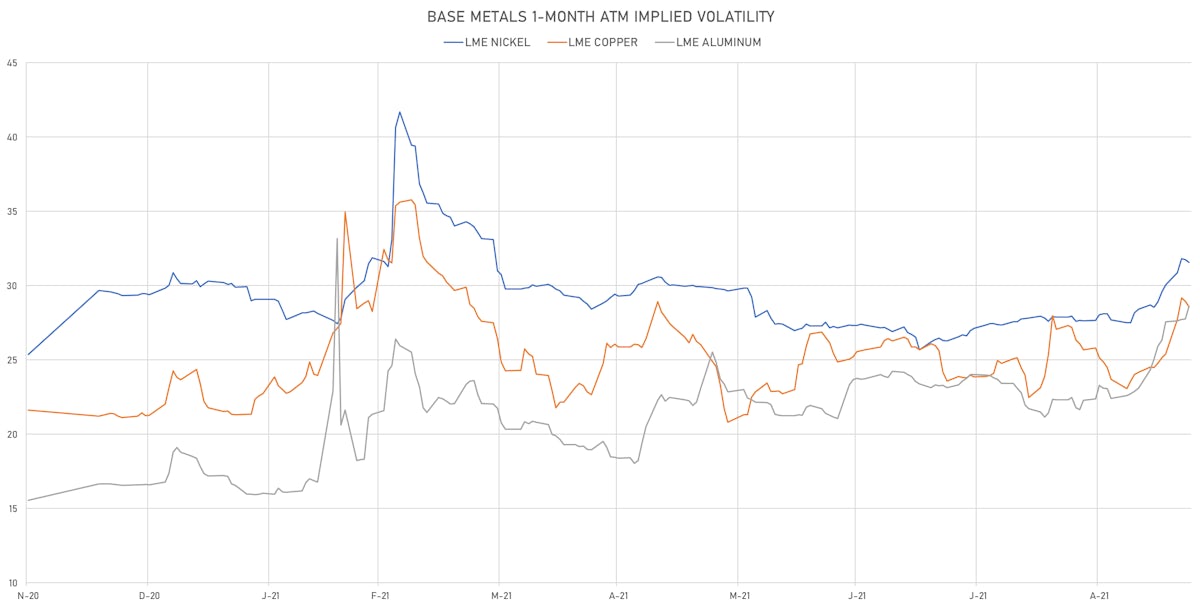

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) currently at US$ 4.23 per pound, down -0.5% (YTD: +20.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 678.00 per tonne, up 3.9% (YTD: -37.0%)

- Aluminum (Shanghai) currently at CNY 23,430 per tonne, up 2.0% (YTD: +48.9%)

- Nickel (Shanghai) currently at CNY 147,320 per tonne, up 0.3% (YTD: +16.9%)

- Lead (Shanghai) currently at CNY 14,290 per tonne, down -0.4% (YTD: -3.3%)

- Rebar (Shanghai) currently at CNY 5,812 per tonne, down -0.3% (YTD: +38.8%)

- Tin (Shanghai) currently at CNY 282,190 per tonne, up 2.4% (YTD: +82.7%)

- Zinc (Shanghai) currently at CNY 22,955 per tonne, down -0.1% (YTD: +8.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 380,000 per tonne, up 0.5% (YTD: +38.7%)

- Lithium (Shanghai) spot price currently at CNY 825,000 per tonne, unchanged (YTD: +70.1%)

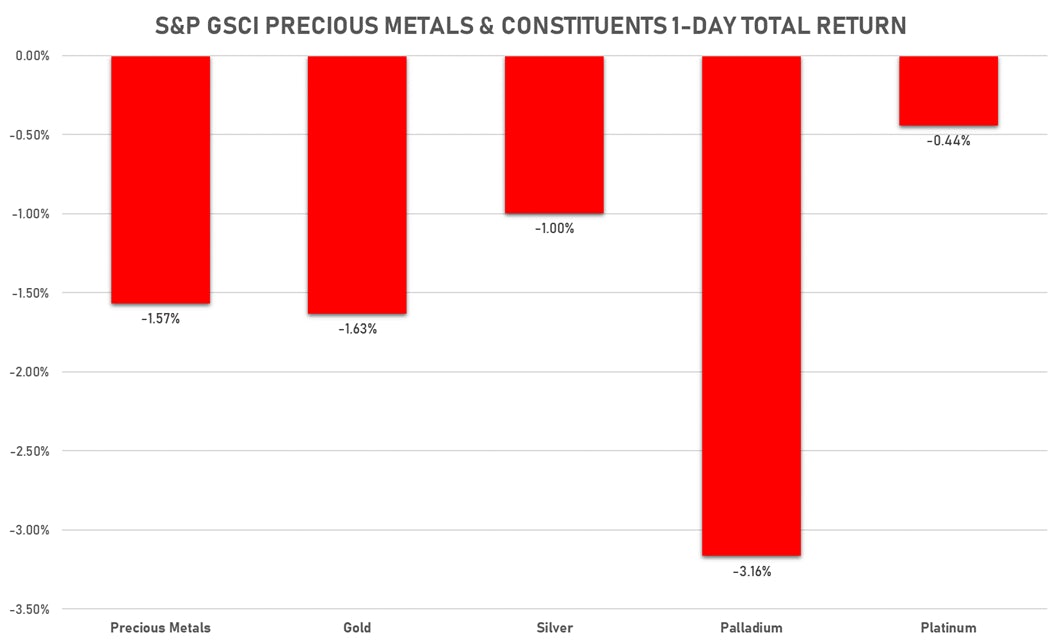

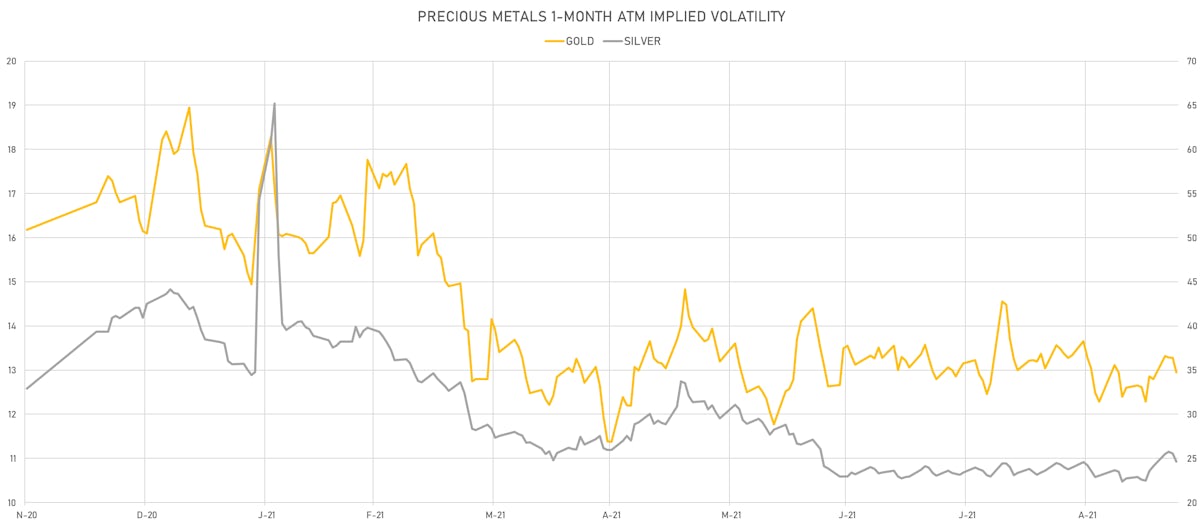

PRECIOUS METALS FALL TODAY

- Gold spot currently at US$ 1,747.51 per troy ounce, down -1.5% (YTD: -8.2%)

- Gold 1-Month ATM implied volatility currently at 12.48, down -2.8% (YTD: -19.9%)

- Silver spot currently at US$ 22.62 per troy ounce, down -0.8% (YTD: -14.7%)

- Silver 1-Month ATM implied volatility currently at 23.70, down -4.1% (YTD: -42.4%)

- Palladium spot currently at US$ 1,991.66 per troy ounce, down -2.2% (YTD: -19.0%)

- Platinum spot currently at US$ 981.09 per troy ounce, down -1.0% (YTD: -7.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 13,800 per troy ounce, up 2.2% (YTD: -19.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

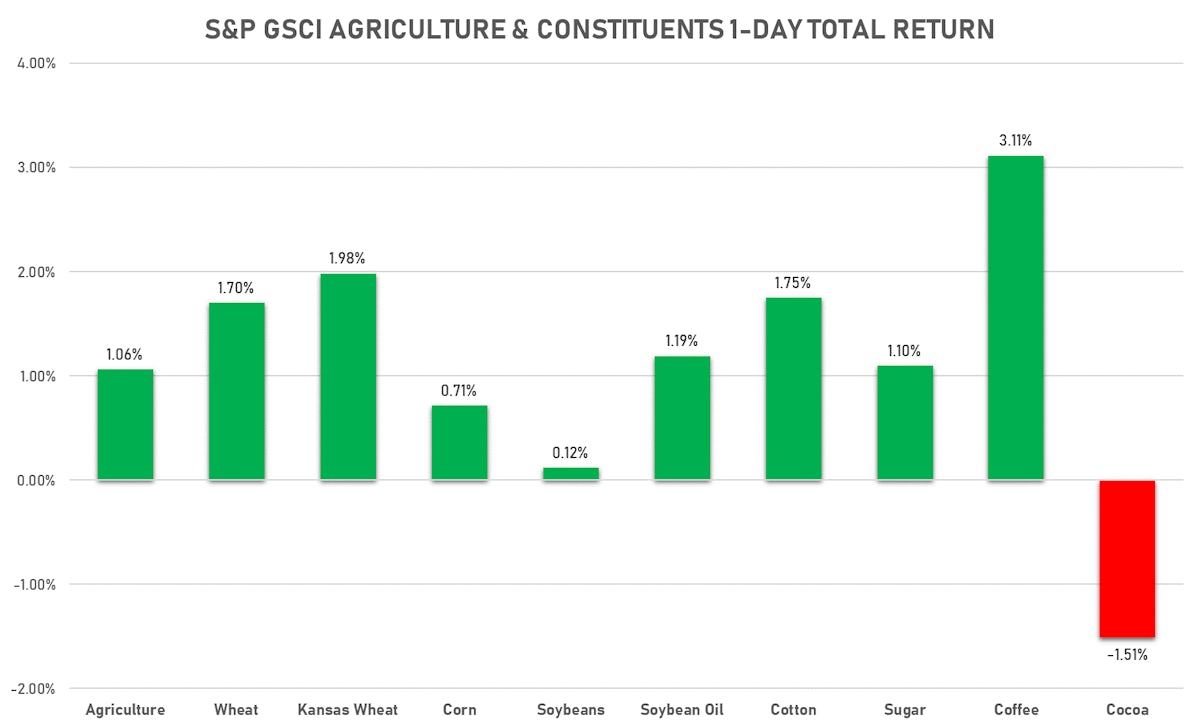

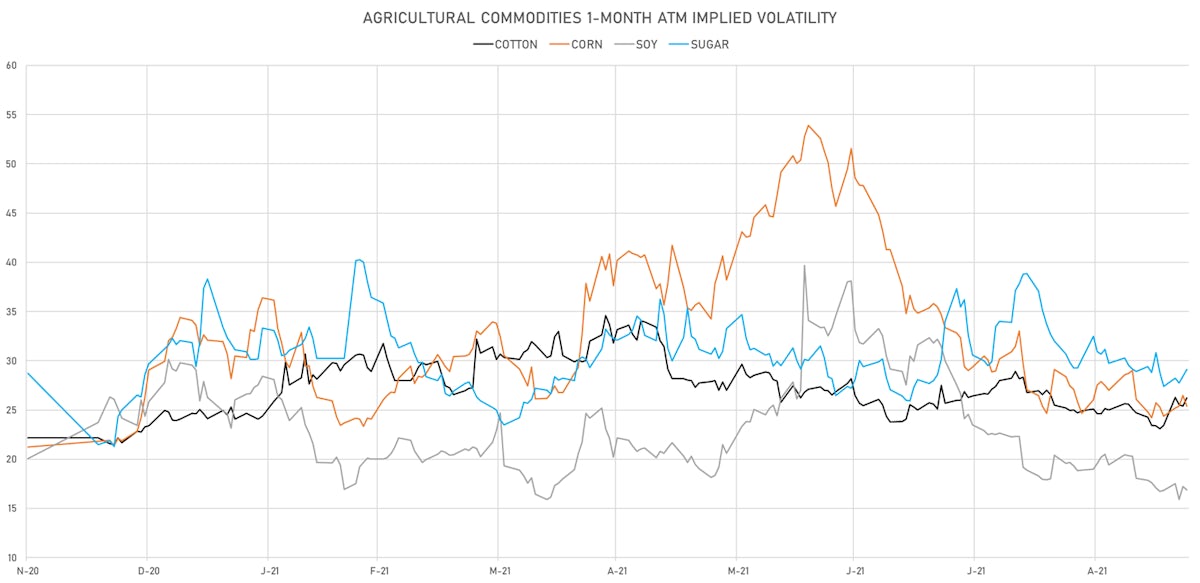

AGS MOSTLY UP TODAY

- Live Cattle (CME) unchanged at US$ 123.23 cents per pound (YTD: +9.1%)

- Lean Hogs (CME) currently at US$ 84.75 cents per pound, up 1.1% (YTD: +20.6%)

- Rough Rice (CBOT) currently at US$ 13.72 cents per hundredweight, down -0.4% (YTD: +11.5%)

- Soybeans Composite (CBOT) currently at US$ 1,283.00 cents per bushel, up 0.1% (YTD: -2.4%)

- Corn (CBOT) currently at US$ 528.50 cents per bushel, up 0.7% (YTD: +9.3%)

- Wheat Composite (CBOT) currently at US$ 719.25 cents per bushel, up 1.7% (YTD: +12.1%)

- Sugar No.11 (ICE US) currently at US$ 19.49 cents per pound, up 0.8% (YTD: +25.8%)

- Cotton No.2 (ICE US) currently at US$ 93.31 cents per pound, up 1.6% (YTD: +19.4%)

- Cocoa (ICE US) currently at US$ 2,612 per tonne, down -1.5% (YTD: +0.3%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,444 per tonne, up 0.5% (YTD: +40.4%)

- Random Length Lumber (CME) currently at US$ 638.80 per 1,000 board feet, up 1.9% (YTD: -26.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,855 per tonne, up 0.1% (YTD: +9.1%)

- Soybean Oil Composite (CBOT) currently at US$ 57.19 cents per pound, up 1.3% (YTD: +31.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,658 per tonne, up 1.7% (YTD: +19.7%)

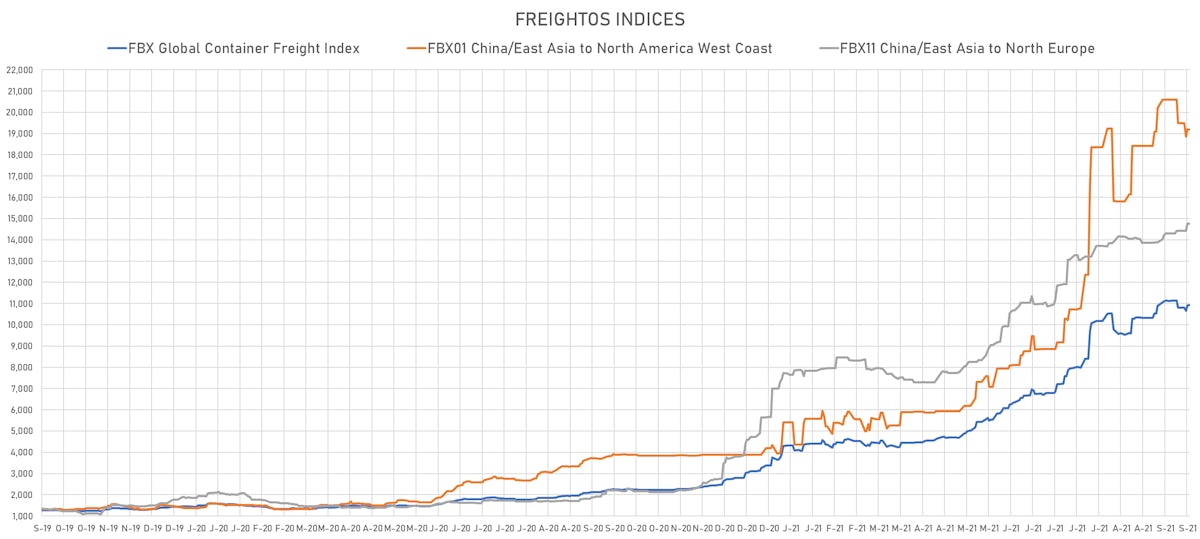

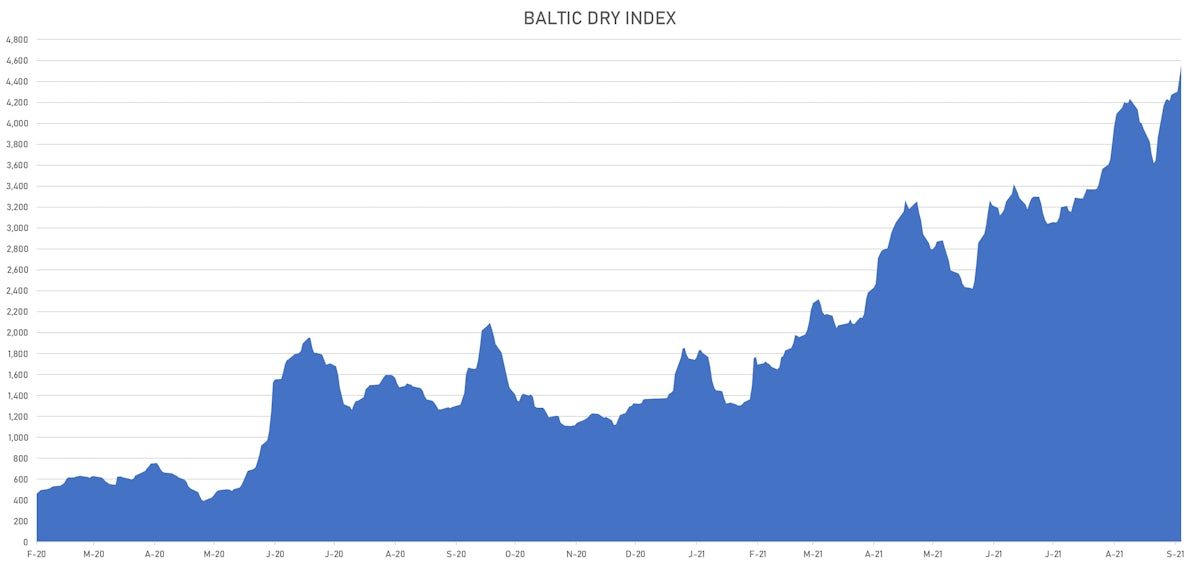

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,560, up 3.4% (YTD: +233.8%)

- Freightos China To North America West Coast Container Index currently at 19,182, unchanged (YTD: +356.8%)

- Freightos North America West Coast To China Container Index currently at 907, up 1.2% (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 533, unchanged (YTD: +46.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,756, unchanged (YTD: +160.6%)

- Freightos North Europe To China Container Index currently at 1,486, up 1.9% (YTD: +8.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

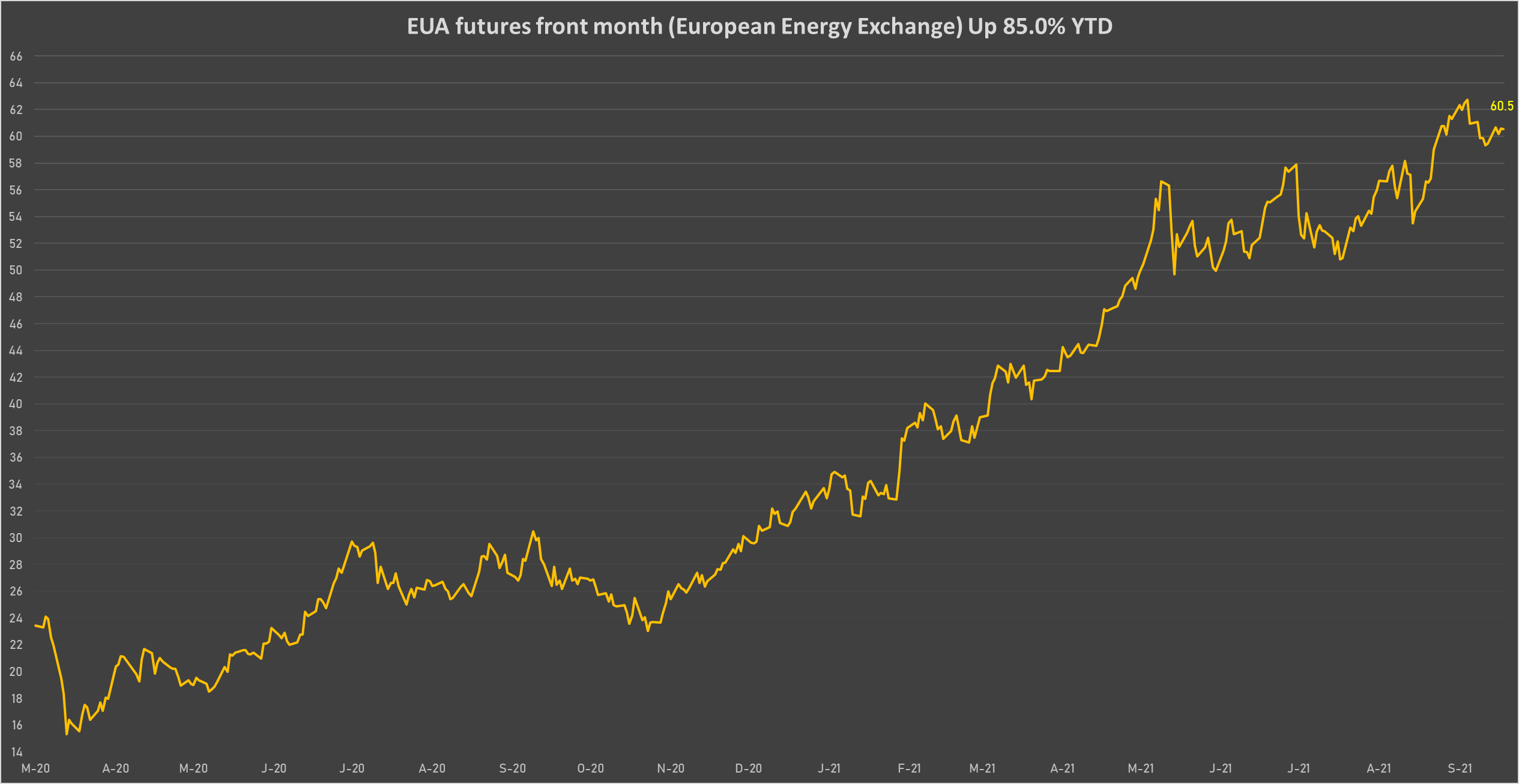

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 60.54 per tonne, down -0.1% (YTD: +85.0%)