Commodities

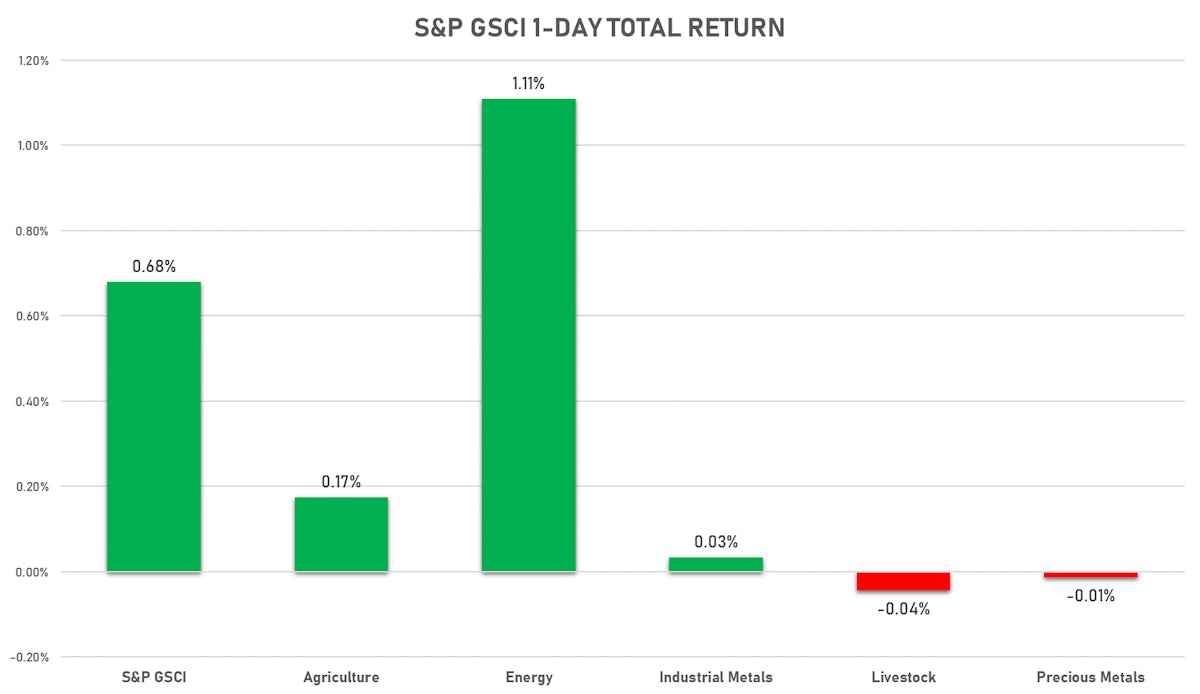

Energy Group Rises Further On Otherwise Quiet Day For Commodities

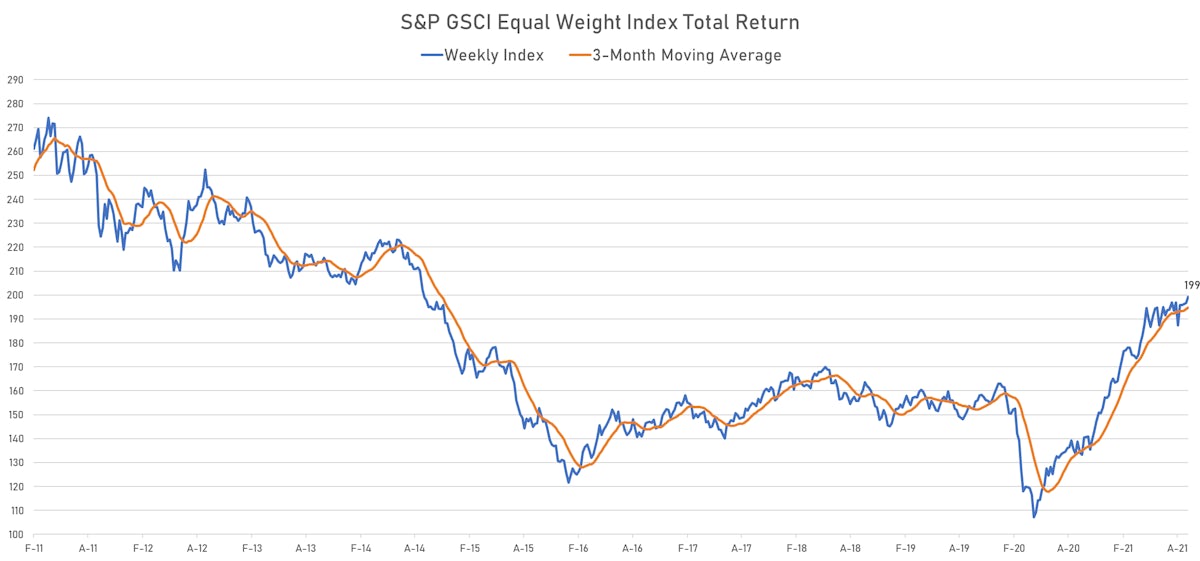

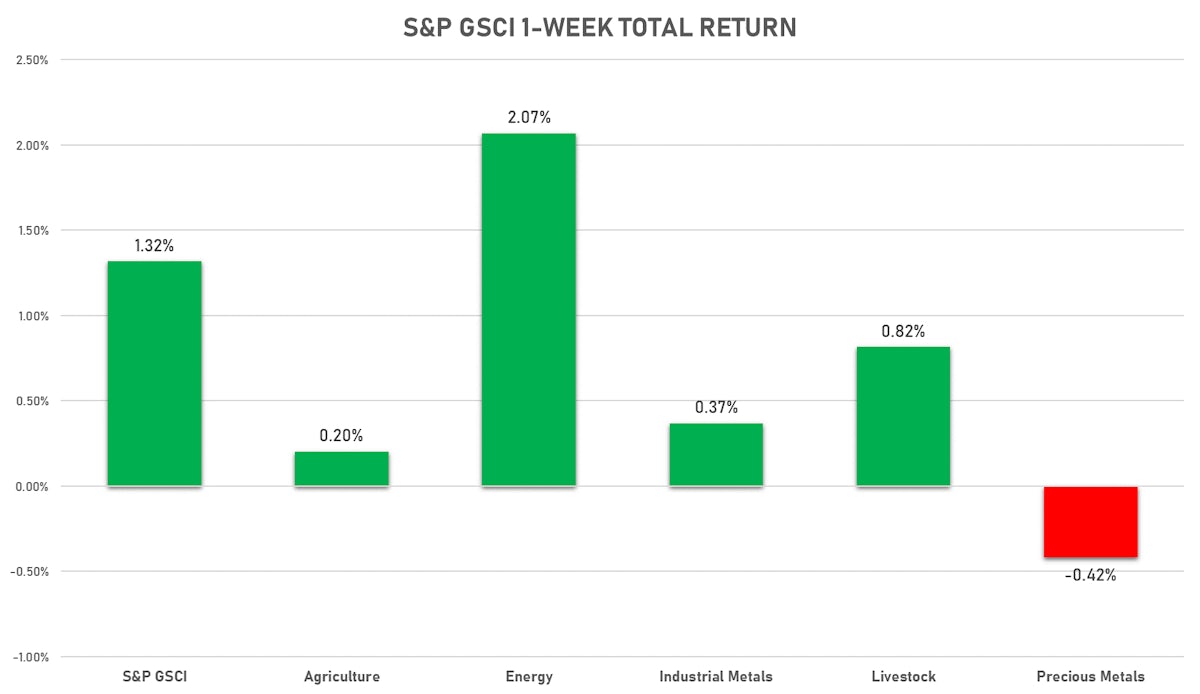

Good week across the complex: all groups made gains except precious metals, which were slightly hampered by the rise in real US rates

Published ET

S&P GSCI Sub Indices Total Returns For The Week | Sources: ϕpost, FactSet data

BAKER HUGHES WEEKLY RIG COUNT

- North American rig count +17 to 683 in latest week and +351 y/y

- US rig count +9 to 521 in latest week and +260 y/y

- Oil +10 to 421 in latest week and +238 y/y

- Gas -1 to 99 in latest week and +24 y/y

NOTABLE GAINERS TODAY

- Johnson Matthey Rhodium New York 0930 up 5.1% (YTD: -15.0%)

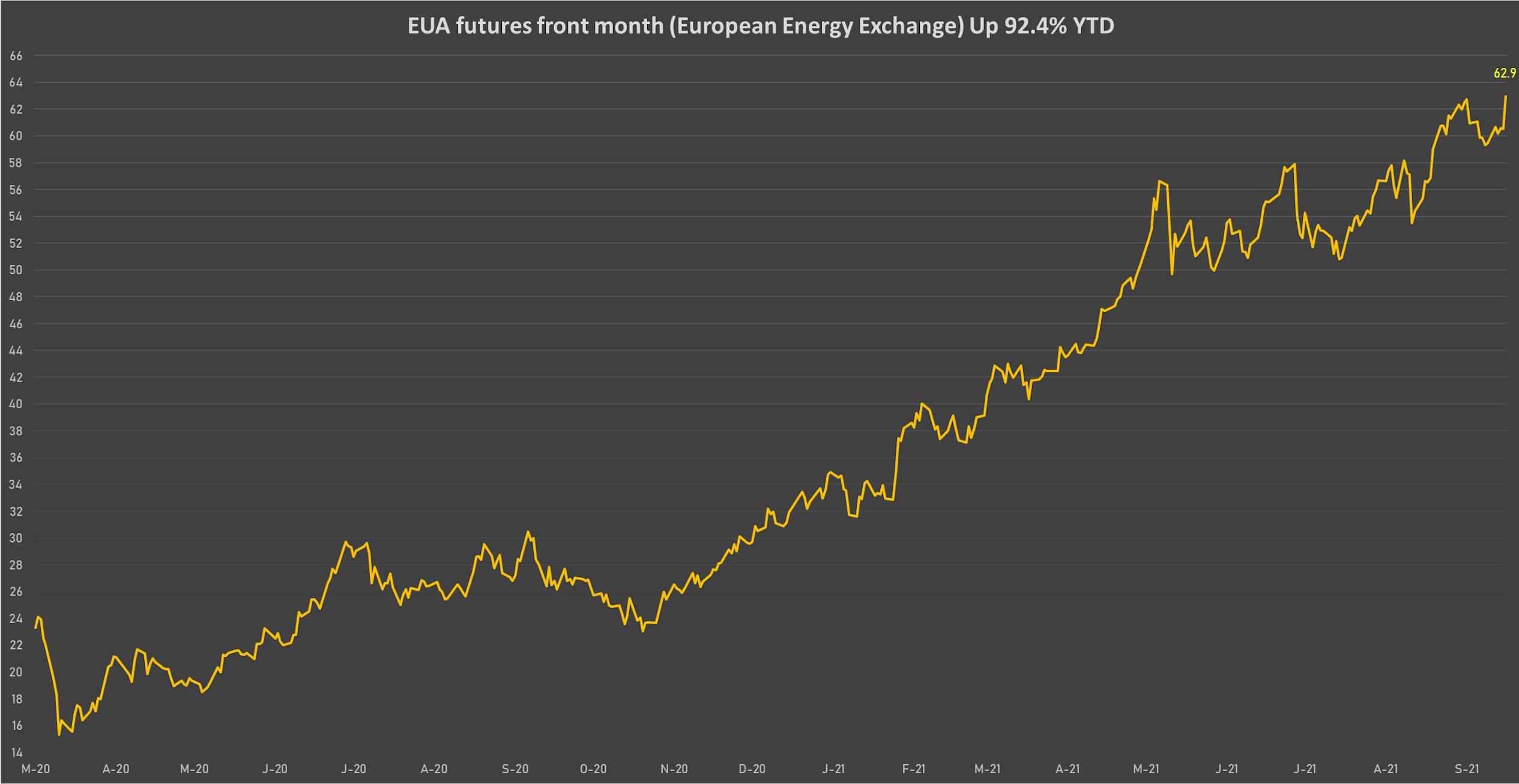

- Intercontinental Exchange European Union Allowance (EUA) Yearly up 4.0% (YTD: 92.4%)

- EEX European-Carbon- Secondary Trading up 4.0% (YTD: 96.2%)

- ICE-US Cotton No. 2 up 3.8% (YTD: 24.0%)

- NYMEX Henry Hub Natural Gas up 3.3% (YTD: 102.4%)

- Brent Forties and Oseberg Dated FOB North sea Crude up 3.1% (YTD: 51.4%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 3.1% (YTD: 50.9%)

- DCE RBD Palm Oil up 3.0% (YTD: 29.9%)

- ICE Europe Low Sulphur Gasoil up 3.0% (YTD: 55.7%)

- CME Lean Hogs up 3.0% (YTD: 24.2%)

- Zhengzhou Exchange Thermal Coal up 2.8% (YTD: 75.7%)

- Coffee Arabica Colombia Excelso EP Spot up 2.7% (YTD: 44.1%)

- ICE Europe Brent Crude up 2.5% (YTD: 50.8%)

- SHFE Stannum up 2.1% (YTD: 86.5%)

- ICE-US Coffee C up 2.0% (YTD: 51.5%)

NOTABLE LOSERS TODAY

- ICE-US Sugar No. 11 down -2.0% (YTD: 23.3%)

- DCE Coke down -1.7% (YTD: 33.9%)

- SHFE Hot Rolled Coil down -1.5% (YTD: 25.4%)

- Shanghai International Exchange TSR 20 down -1.1% (YTD: 8.0%)

- ICE-US Cocoa down -0.8% (YTD: -0.5%)

- SHFE Rebar down -0.8% (YTD: 37.7%)

- SHFE Aluminum down -0.7% (YTD: 47.9%)

- Platinum spot down -0.6% (YTD: -8.0%)

- CBoT Corn down -0.5% (YTD: 8.8%)

- Palladium spot down -0.5% (YTD: -19.4%)

- WUXI Metal Cobalt Bi-Monthly down -0.4% (YTD: 34.7%)

- Silver spot down -0.3% (YTD: -15.0%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -0.3% (YTD: -22.9%)

- CME Live Cattle down -0.2% (YTD: 8.8%)

- CME Cattle(Feeder) down -0.2% (YTD: 11.3%)

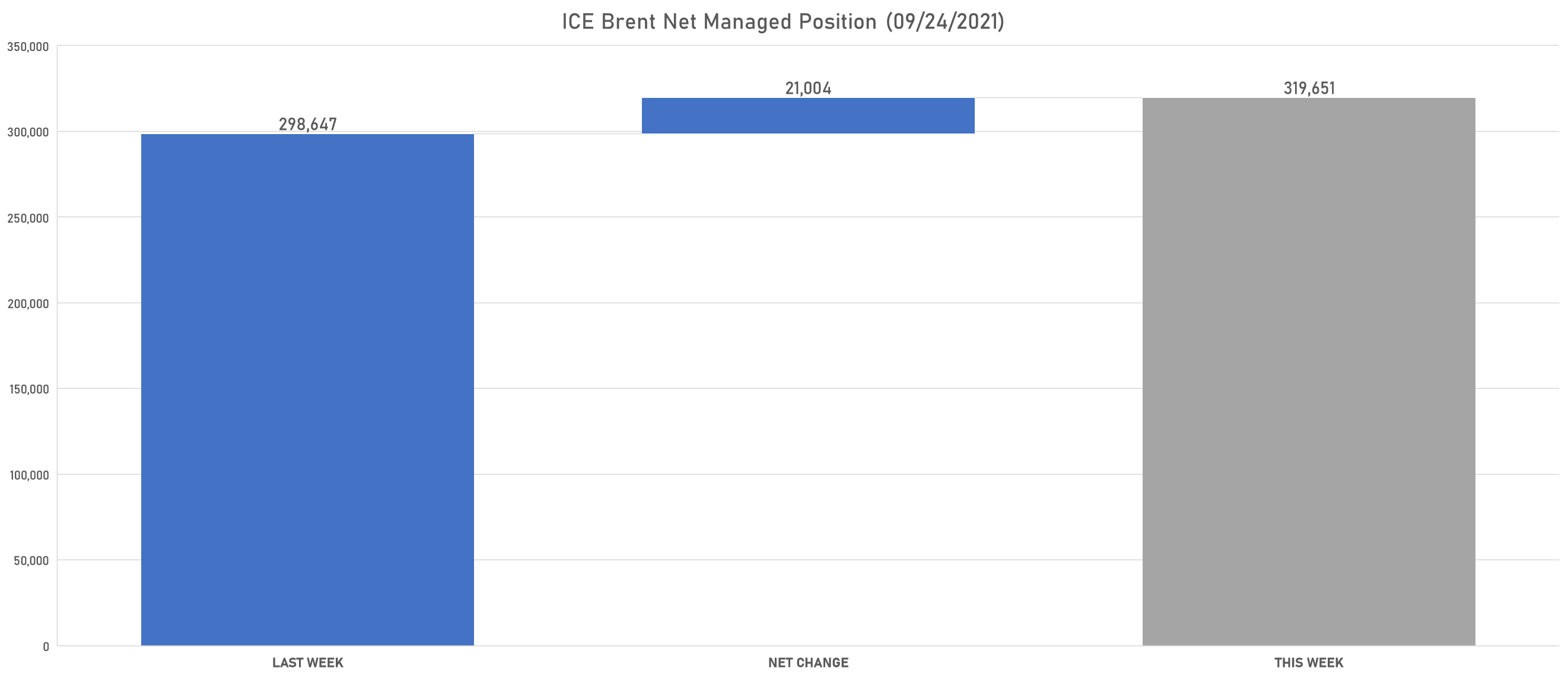

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent increased net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum reduced net short position

- Palladium increased net short position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net short position

- Corn increased net long position

- Rough Rice turned to net long

- Oats increased net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal increased net short position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle turned to net short

- Cocoa reduced net long position

- Coffee C increased net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice reduced net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

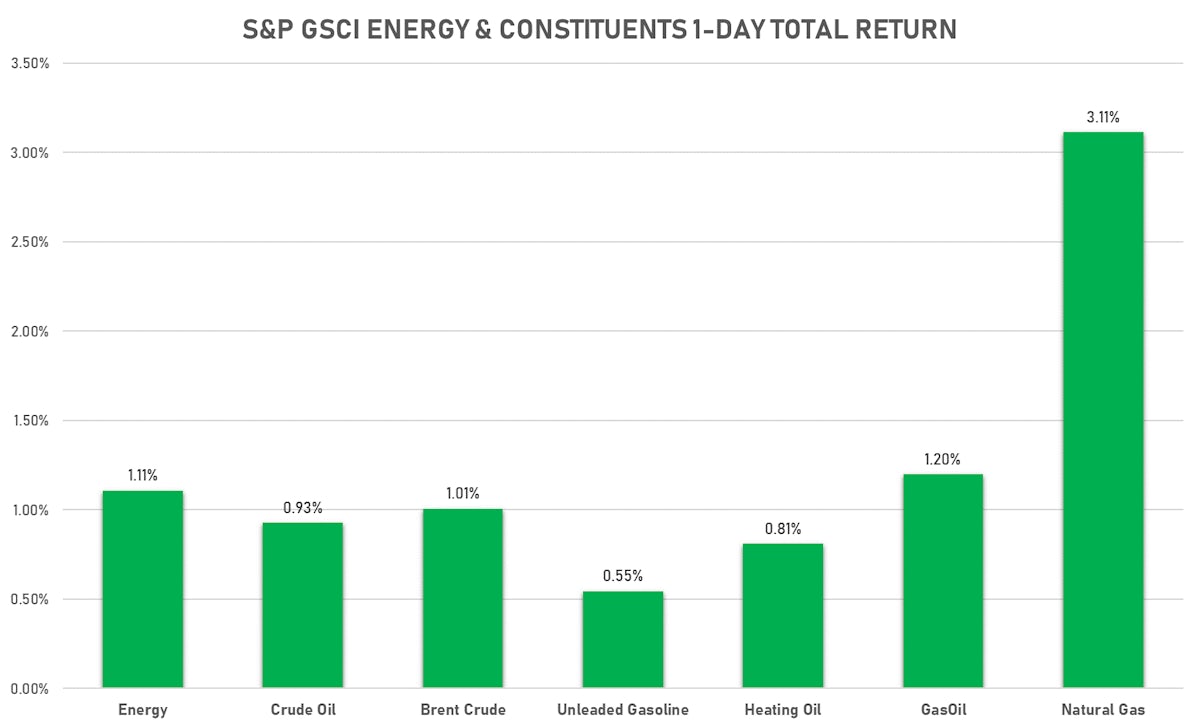

ENERGY UP TODAY

- WTI crude front month currently at US$ 73.98 per barrel, up 0.9% (YTD: +52.5%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 78.04 per barrel, up 2.5% (YTD: +50.8%); 6-month term structure in widening backwardation

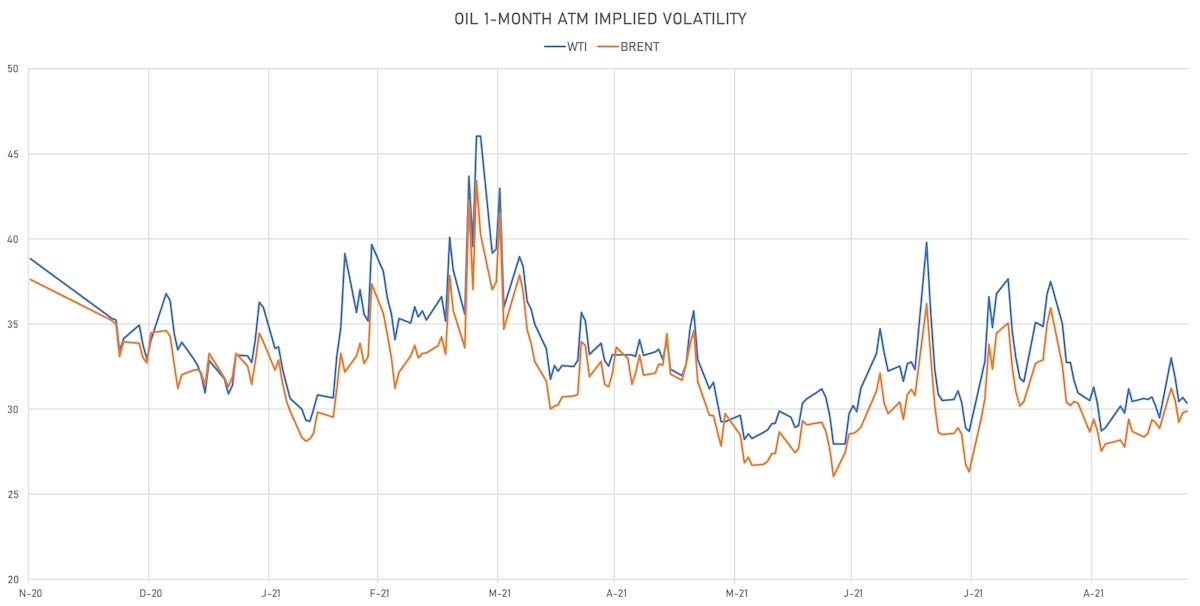

- Brent volatility at 29.9, up 0.2% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 181.00 per tonne, up 0.6% (YTD: +125.5%)

- Natural Gas (Henry Hub) currently at US$ 5.14 per MMBtu, up 3.3% (YTD: +102.4%)

- Gasoline (NYMEX) currently at US$ 2.19 per gallon, up 0.7% (YTD: +55.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 658.50 per tonne, up 3.0% (YTD: +55.7%)

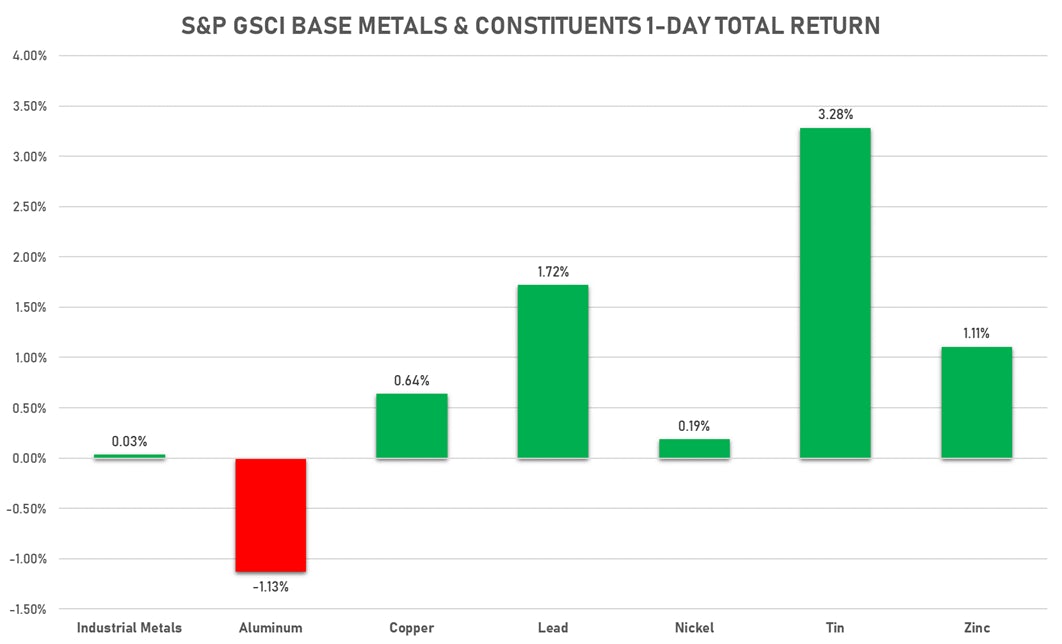

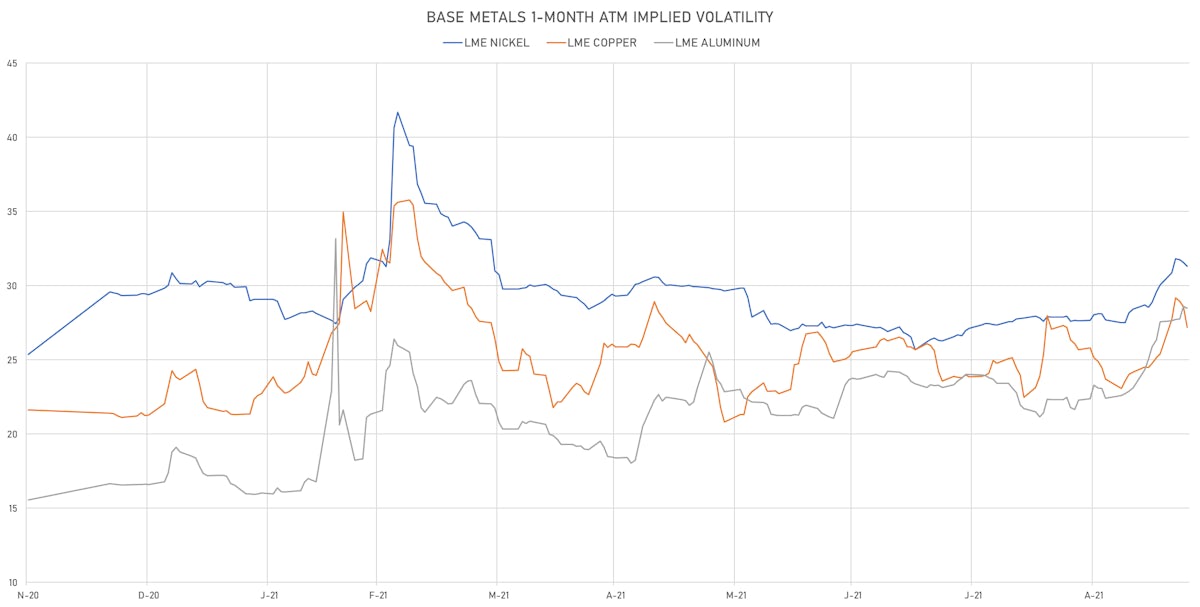

BASE METALS ROSE TODAY

- Copper (COMEX) currently at US$ 4.29 per pound, up 1.3% (YTD: +22.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 703.50 per tonne, up 1.3% (YTD: -36.2%)

- Aluminum (Shanghai) currently at CNY 22,960 per tonne, down -0.7% (YTD: +47.9%)

- Nickel (Shanghai) currently at CNY 145,550 per tonne, up 0.6% (YTD: +17.5%)

- Lead (Shanghai) currently at CNY 14,550 per tonne, up 0.6% (YTD: -2.7%)

- Rebar (Shanghai) currently at CNY 5,754 per tonne, down -0.8% (YTD: +37.7%)

- Tin (Shanghai) currently at CNY 289,000 per tonne, up 2.1% (YTD: +86.5%)

- Zinc (Shanghai) currently at CNY 23,065 per tonne, up 1.1% (YTD: +9.8%)

- Refined Cobalt (Shanghai) spot price currently at CNY 381,000 per tonne, up 0.3% (YTD: +39.1%)

- Lithium (Shanghai) spot price currently at CNY 835,000 per tonne, up 1.2% (YTD: +72.2%)

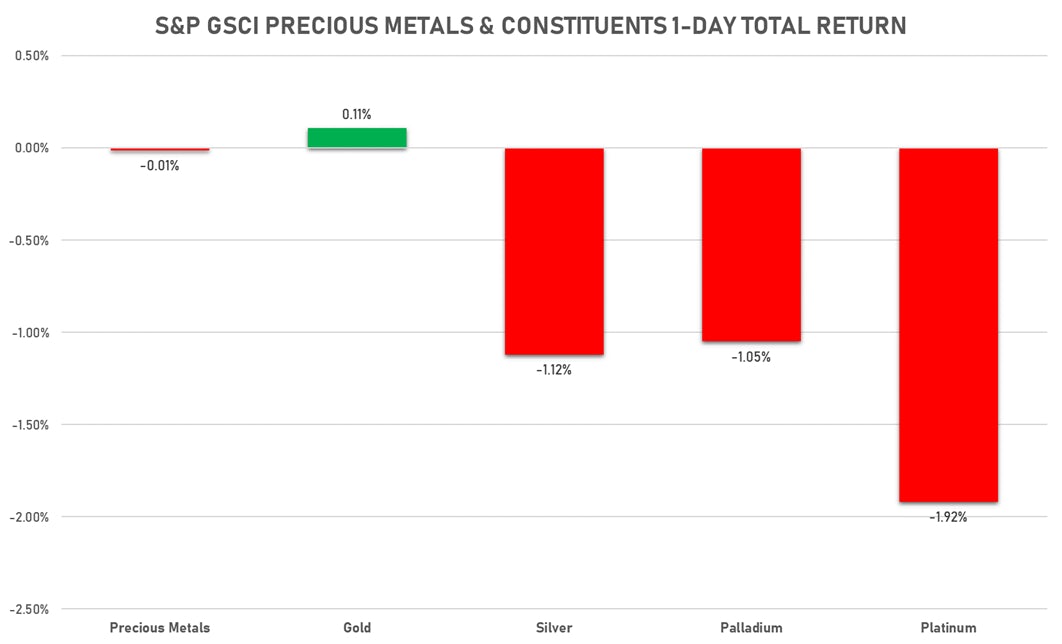

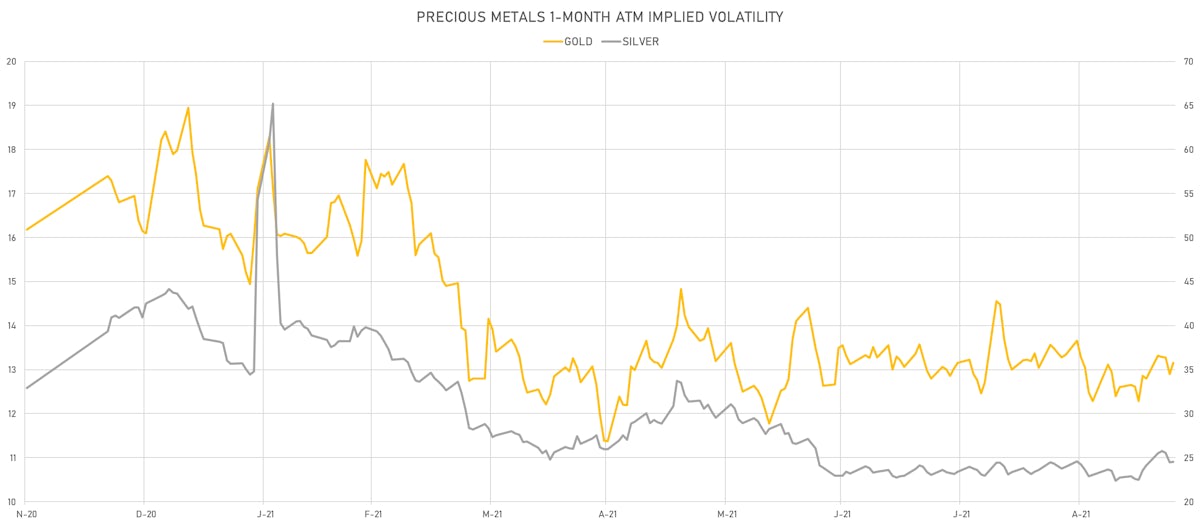

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,749.86 per troy ounce, up 0.5% (YTD: -7.8%)

- Gold 1-Month ATM implied volatility currently at 12.70, up 1.9% (YTD: -18.3%)

- Silver spot currently at US$ 22.42 per troy ounce, down -0.3% (YTD: -15.0%)

- Silver 1-Month ATM implied volatility unchanged at 23.51 (YTD: -42.4%)

- Palladium spot currently at US$ 1,971.57 per troy ounce, down -0.5% (YTD: -19.4%)

- Platinum spot currently at US$ 983.29 per troy ounce, down -0.6% (YTD: -8.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,500 per troy ounce, up 5.1% (YTD: -15.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

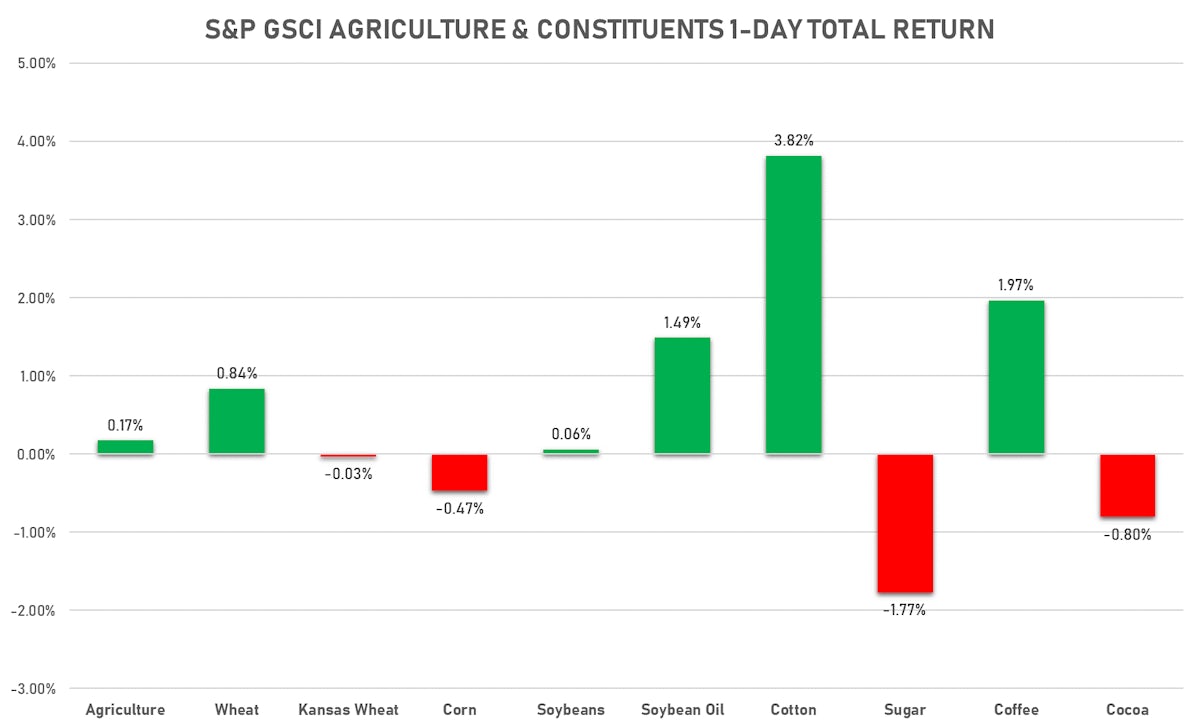

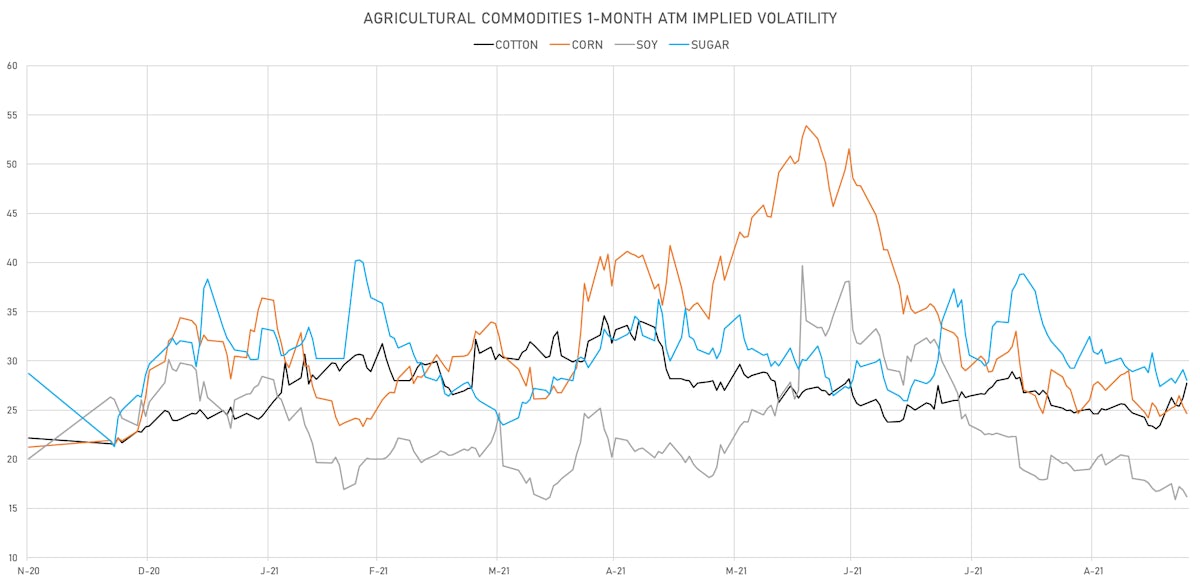

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 122.93 cents per pound, down 0.2% (YTD: +8.8%)

- Lean Hogs (CME) currently at US$ 87.28 cents per pound, up 3.0% (YTD: +24.2%)

- Rough Rice (CBOT) currently at US$ 13.90 cents per hundredweight, up 0.5% (YTD: +12.1%)

- Soybeans Composite (CBOT) currently at US$ 1,285.00 cents per bushel, up 0.1% (YTD: -2.3%)

- Corn (CBOT) currently at US$ 526.75 cents per bushel, down -0.5% (YTD: +8.8%)

- Wheat Composite (CBOT) currently at US$ 723.75 cents per bushel, up 0.8% (YTD: +13.0%)

- Sugar No.11 (ICE US) currently at US$ 19.16 cents per pound, down -2.0% (YTD: +23.3%)

- Cotton No.2 (ICE US) currently at US$ 93.31 cents per pound, up 3.8% (YTD: +24.0%)

- Cocoa (ICE US) currently at US$ 2,584 per tonne, down -0.8% (YTD: -0.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,562 per tonne, up 2.7% (YTD: +44.1%)

- Random Length Lumber (CME) currently at US$ 643.00 per 1,000 board feet, up 0.7% (YTD: -26.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,890 per tonne, down -1.1% (YTD: +8.0%)

- Soybean Oil Composite (CBOT) currently at US$ 57.97 cents per pound, up 1.5% (YTD: +33.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,665 per tonne, up 0.2% (YTD: +19.9%)

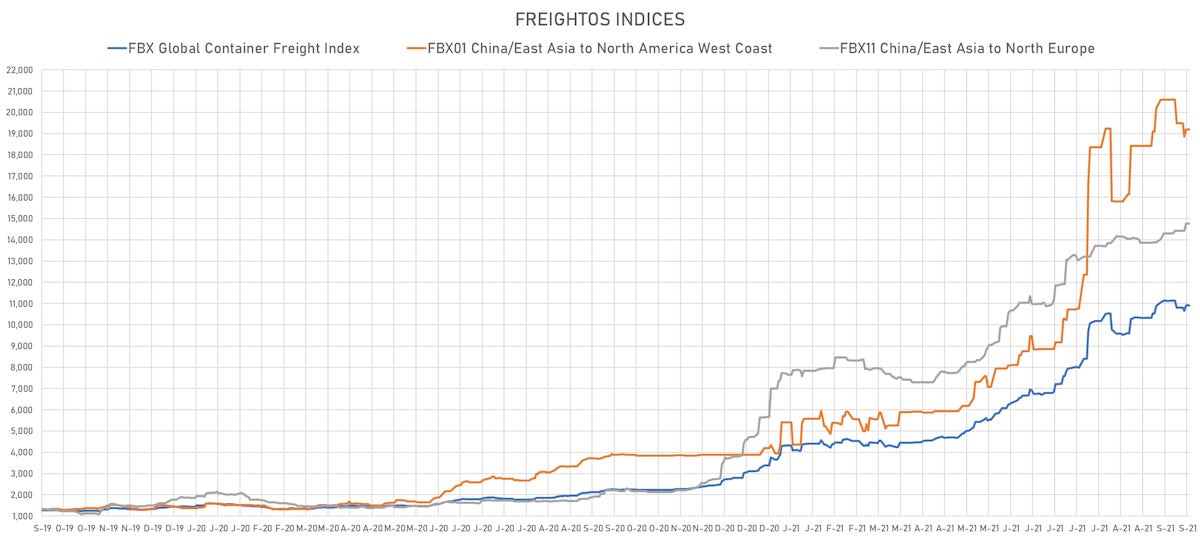

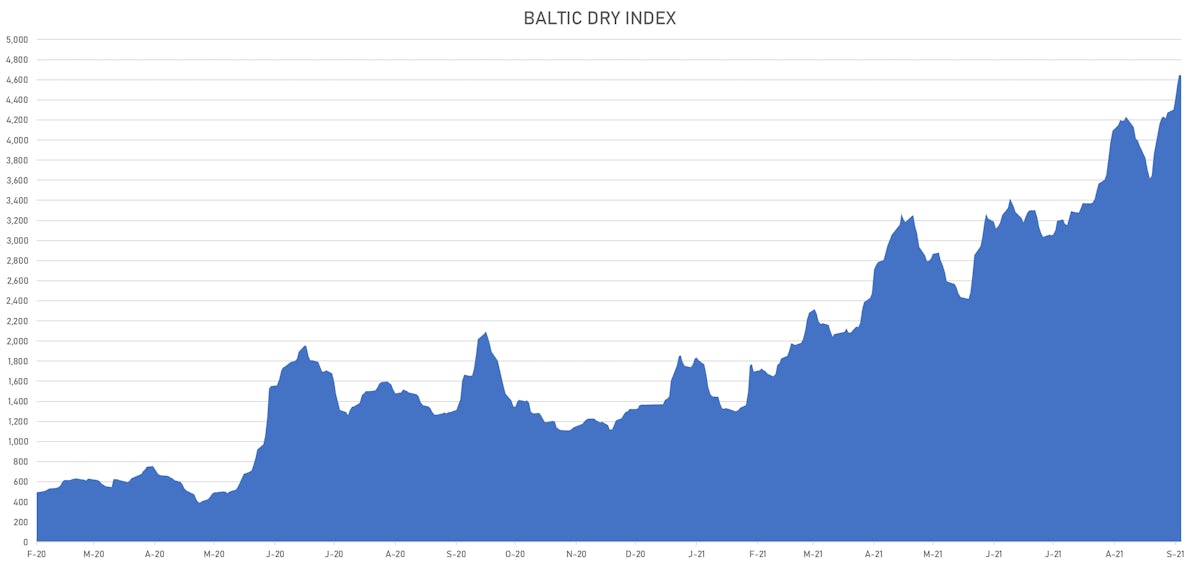

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,651, down -0.2% (YTD: +240.0%)

- Freightos China To North America West Coast Container Index currently at 19,182, unchanged (YTD: +356.8%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 462, down -13.3% (YTD: +27.3%)

- Freightos Europe To North America East Coast Container Index currently at 6,869, unchanged (YTD: +267.5%)

- Freightos China To North Europe Container Index currently at 14,756, unchanged (YTD: +160.6%)

- Freightos North Europe To China Container Index currently at 1,486, unchanged (YTD: +8.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 63.75 per tonne, up 4.0% (YTD: +92.4%)