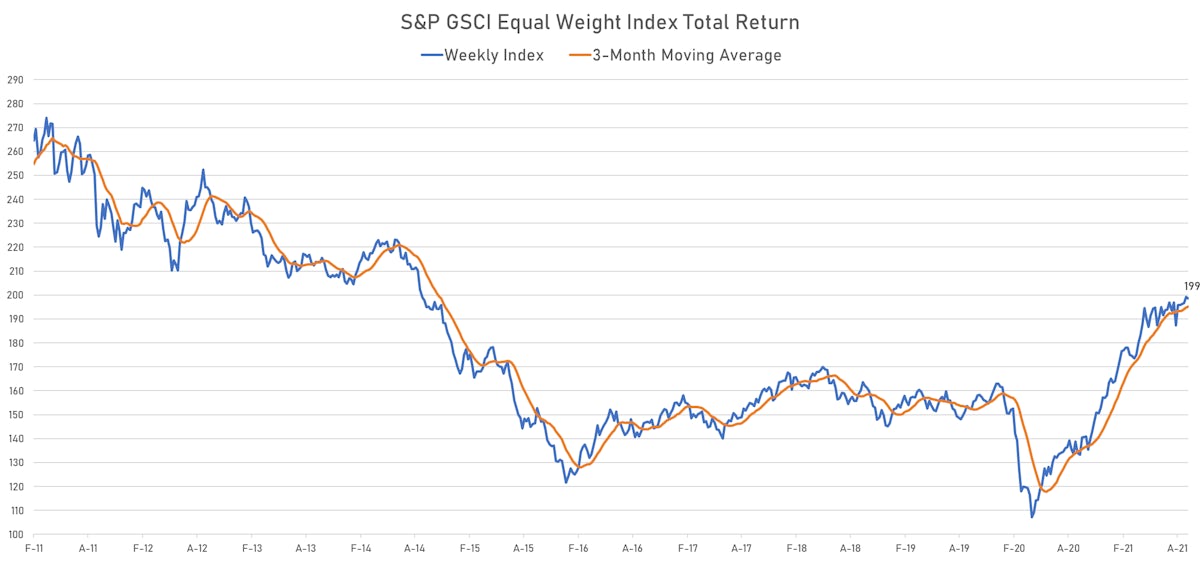

Commodities

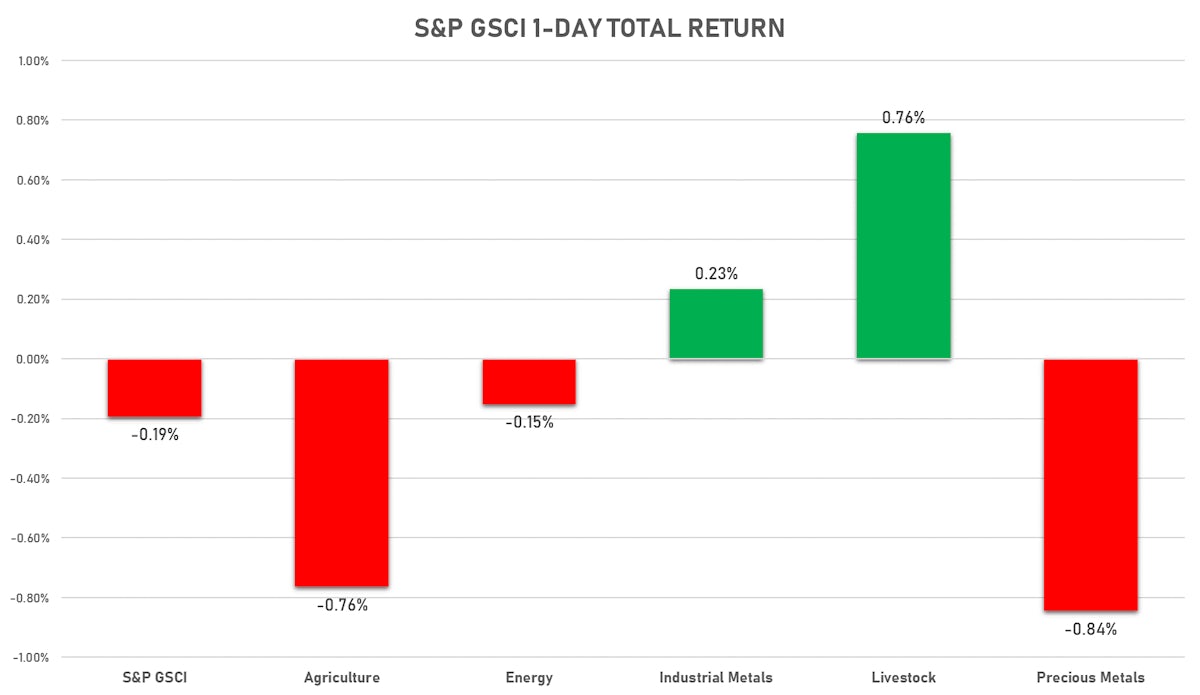

Precious Metals Fall On Higher US Real Rates, Other Commodity Groups Mixed

Coal shortages in China are pushing prices ever higher, a particularly serious issue ahead of winter in a country where about 60% of power generation is based on thermal coal

Published ET

Natural Gas & Thermal Coal Front Month Futures Prices | Source: Refinitiv

HEADLINES

- Natural gas up again to new multi-year high

- OPEC's latest World Oil Outlook shows little change in demand this year and doesn't expect post-pandemic demand to run into supply constraints

- API weekly report shows inventories build: crude +4.127M barrels, gasoline +3.555M, distillates +2.483M, Cushing +0.359M

NOTABLE GAINERS TODAY

- Zhengzhou Exchange Thermal Coal up 4.4% (YTD: 86.6%)

- ICE-US Coffee C up 2.6% (YTD: 54.9%)

- Shanghai International Exchange TSR 20 rubber up 2.5% (YTD: 12.2%)

- NYMEX Henry Hub Natural Gas up 2.4% (YTD: 130.1%)

- SHFE Rubber up 2.2% (YTD: -5.4%)

- ICE-US Cotton No. 2 up 2.0% (YTD: 29.2%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 2.0% (YTD: 46.6%)

- CME Lean Hogs up 1.6% (YTD: 30.5%)

- ICE Europe Newcastle Coal Monthly up 1.4% (YTD: 158.0%)

- DCE Coke up 1.4% (YTD: 35.1%)

- ICE-US Sugar No. 11 up 1.3% (YTD: 22.5%)

- Bursa Malaysia Crude Palm Oil up 1.3% (YTD: 20.5%)

- SHFE Bitumen Continuation Month 1 up 1.3% (YTD: 27.4%)

- SHFE Hot Rolled Coil up 0.9% (YTD: 26.5%)

- DCE Coking Coal Continuation Month 1 up 0.8% (YTD: 146.7%)

NOTABLE LOSERS TODAY

- SHFE Stannum down -4.8% (YTD: 79.9%)

- Palladium spot down -4.5% (YTD: -23.2%)

- CME Random Length Lumber down -4.1% (YTD: -29.5%)

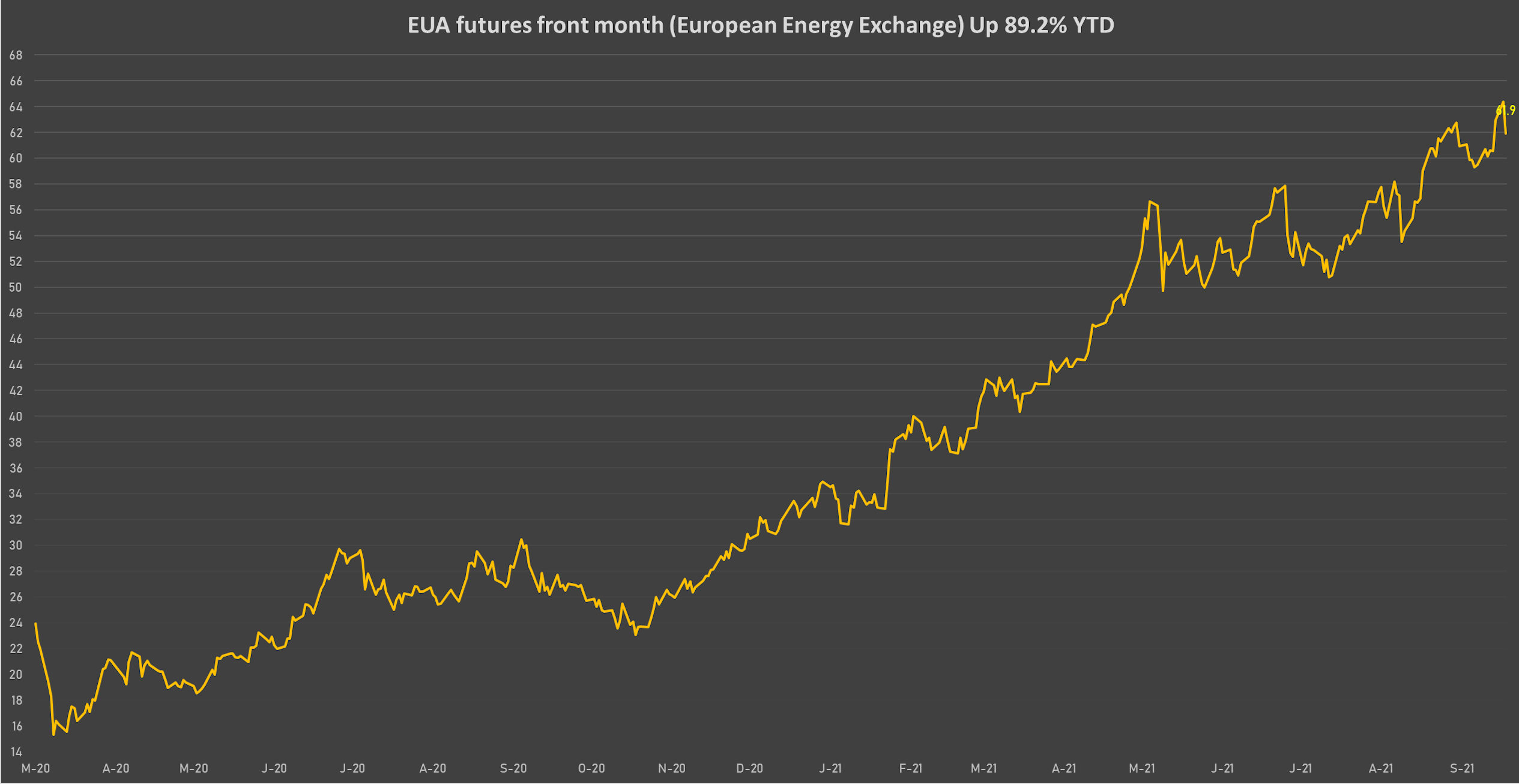

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -3.8% (YTD: 89.2%)

- EEX European-Carbon- Secondary Trading down -3.8% (YTD: 93.1%)

- SHFE Nickel down -2.3% (YTD: 14.9%)

- CBoT Wheat down -2.2% (YTD: 10.3%)

- Platinum spot down -1.7% (YTD: -9.9%)

- SHFE Aluminum down -1.5% (YTD: 44.3%)

- DCE Iron Ore Continuation Month 1 down -1.4% (YTD: -35.9%)

- CBoT Corn down -1.3% (YTD: 10.0%)

- Brent Forties and Oseberg Dated FOB North sea Crude down -1.2% (YTD: 52.2%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily down -1.2% (YTD: 21.1%)

- SHFE Zinc down -1.2% (YTD: 8.9%)

- COMEX Copper down -1.1% (YTD: 20.8%)

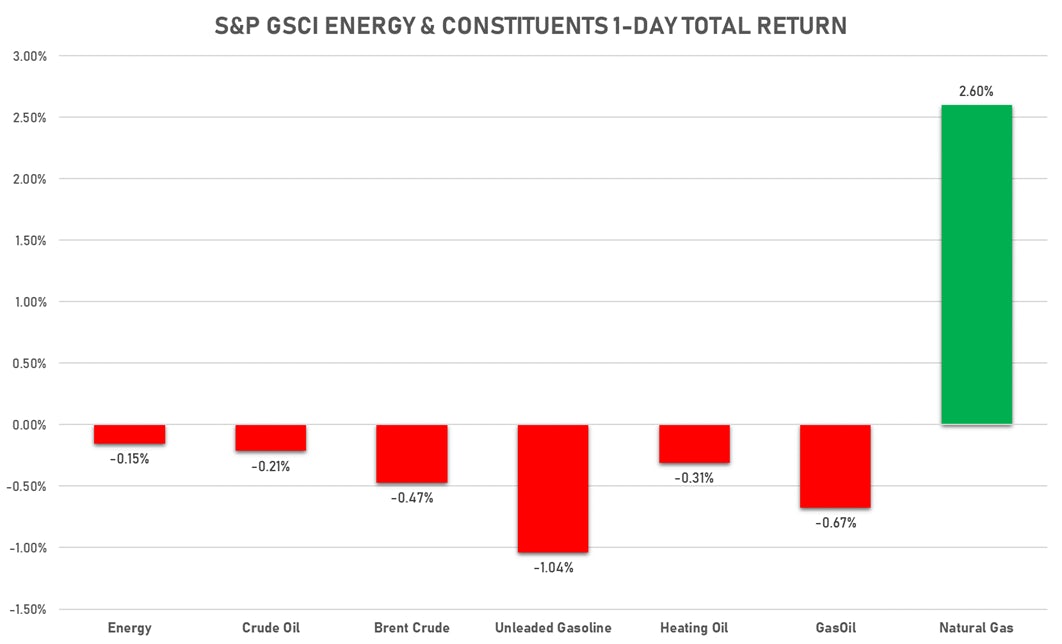

ENERGY MOSTLY DOWN TODAY

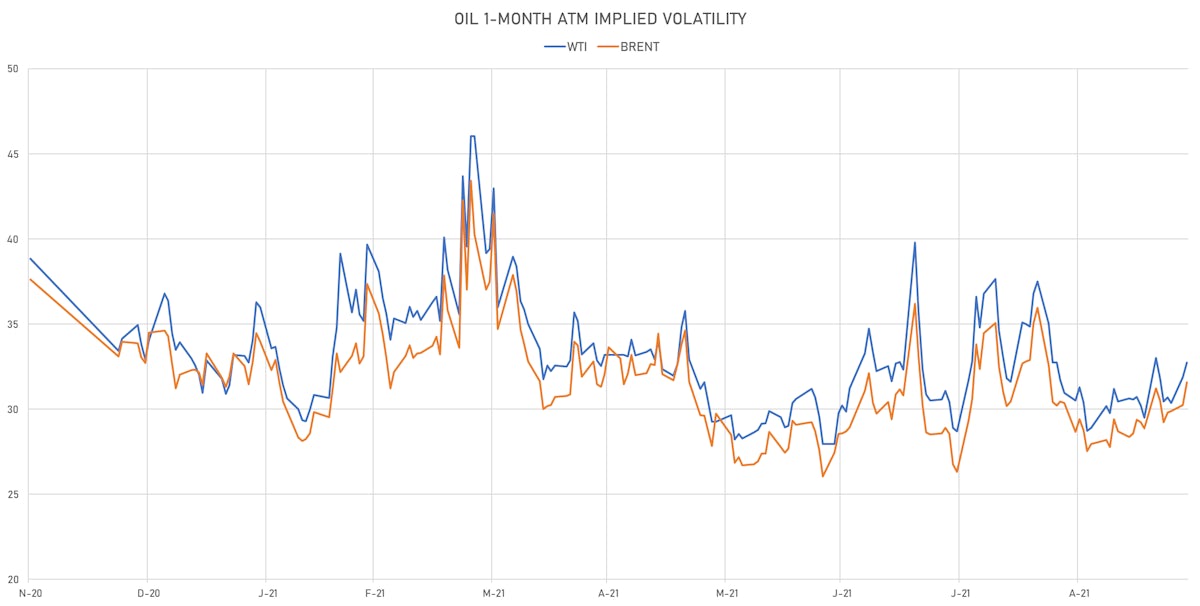

- WTI crude front month currently at US$ 74.52 per barrel, down -0.2% (YTD: +55.2%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 78.38 per barrel, down -0.6% (YTD: +52.7%); 6-month term structure in tightening backwardation

- Brent volatility at 31.6, up 4.4% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 207.70 per tonne, up 1.4% (YTD: +158.0%)

- Natural Gas (Henry Hub) currently at US$ 5.84 per MMBtu, up 2.4% (YTD: +130.1%)

- Gasoline (NYMEX) currently at US$ 2.17 per gallon, down -1.0% (YTD: +56.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 659.50 per tonne, down -0.7% (YTD: +57.9%)

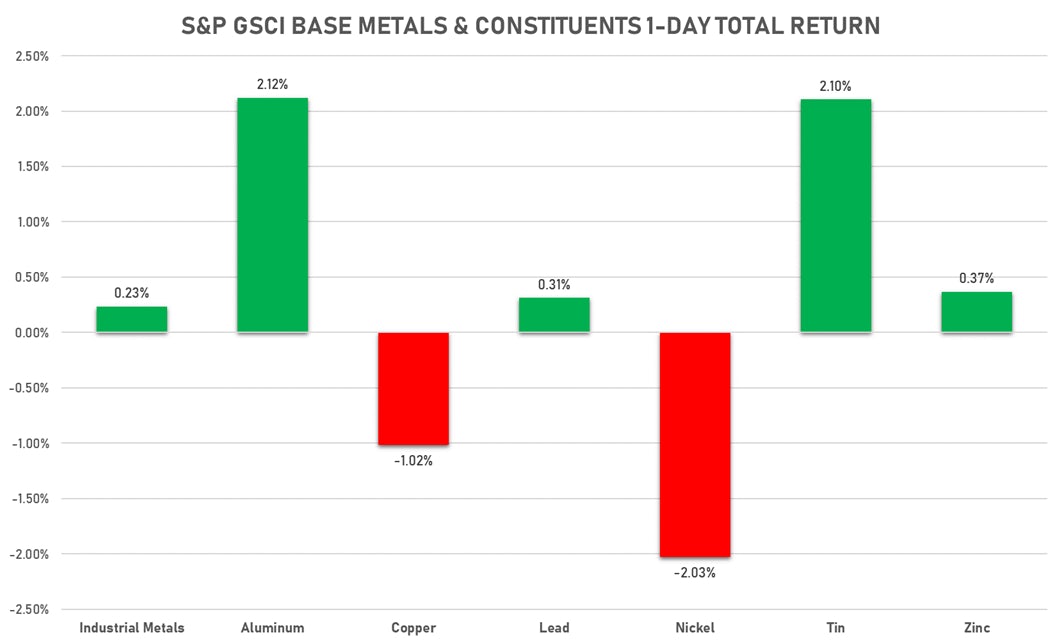

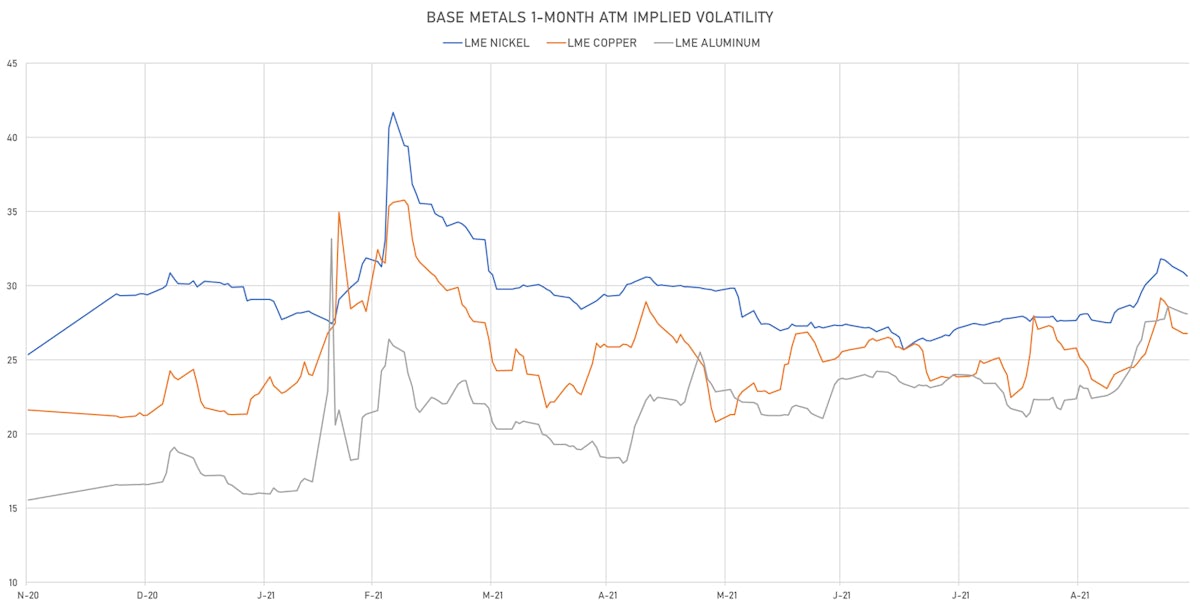

BASE METALS MIXED TODAY

- Copper (COMEX) currently at US$ 4.25 per pound, down -1.1% (YTD: +20.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 675.00 per tonne, down -1.4% (YTD: -35.9%)

- Aluminum (Shanghai) currently at CNY 22,950 per tonne, down -1.5% (YTD: +44.3%)

- Nickel (Shanghai) currently at CNY 141,100 per tonne, down -2.3% (YTD: +14.9%)

- Lead (Shanghai) currently at CNY 14,490 per tonne, up 0.1% (YTD: -1.4%)

- Rebar (Shanghai) currently at CNY 5,775 per tonne, up 0.7% (YTD: +38.0%)

- Tin (Shanghai) currently at CNY 275,810 per tonne, down -4.8% (YTD: +79.9%)

- Zinc (Shanghai) currently at CNY 22,645 per tonne, down -1.2% (YTD: +8.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 381,000 per tonne, unchanged (YTD: +39.1%)

- Lithium (Shanghai) spot price currently at CNY 835,000 per tonne, unchanged (YTD: +72.2%)

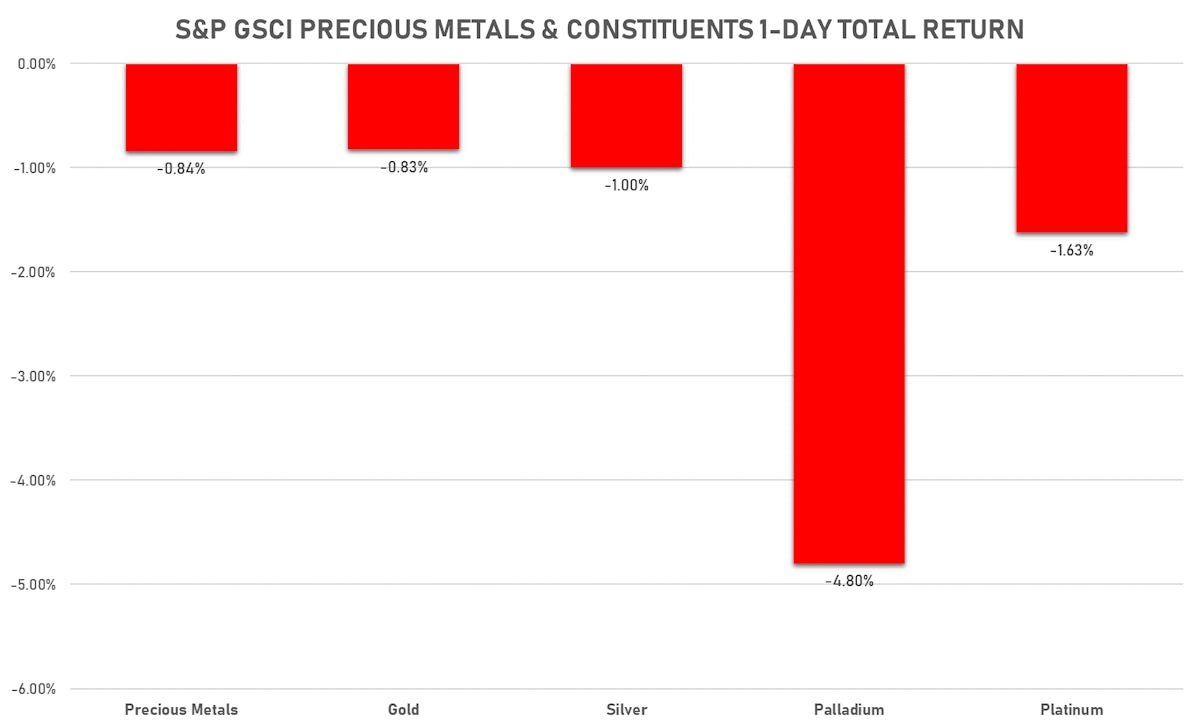

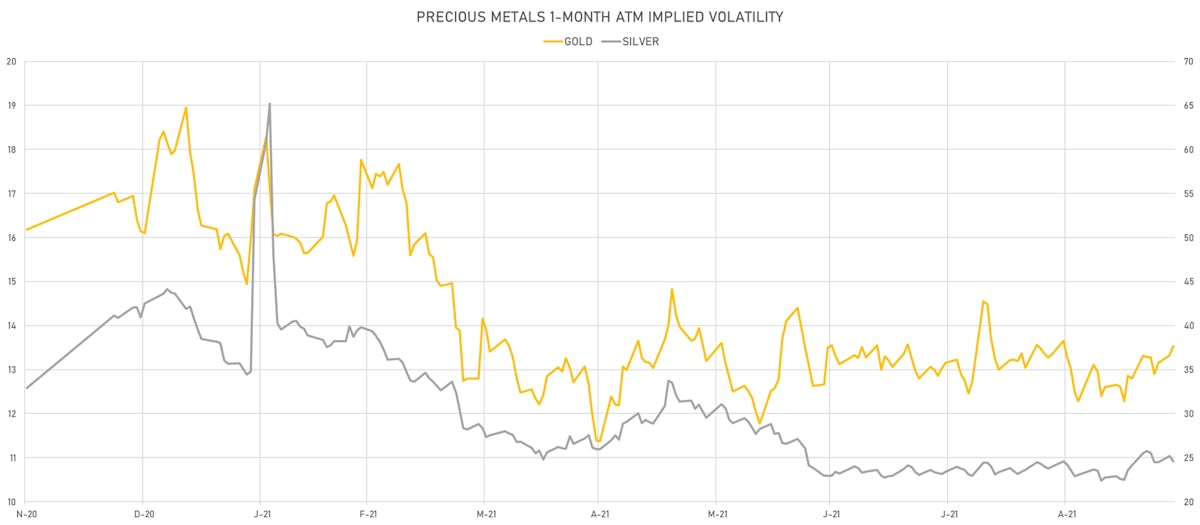

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,735.40 per troy ounce, down -0.9% (YTD: -8.6%)

- Gold 1-Month ATM implied volatility currently at 13.16, up 1.6% (YTD: -15.9%)

- Silver spot currently at US$ 22.46 per troy ounce, down -0.7% (YTD: -14.9%)

- Silver 1-Month ATM implied volatility currently at 23.57, down -2.6% (YTD: -42.2%)

- Palladium spot currently at US$ 1,889.91 per troy ounce, down -4.5% (YTD: -23.2%)

- Platinum spot currently at US$ 967.44 per troy ounce, down -1.7% (YTD: -9.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,500 per troy ounce, unchanged (YTD: -15.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

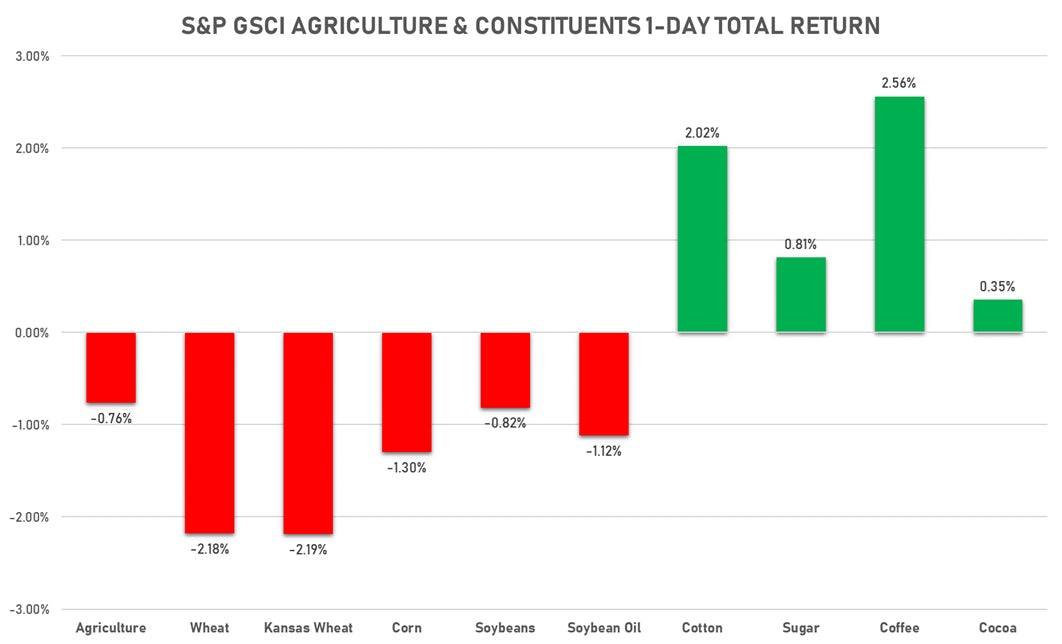

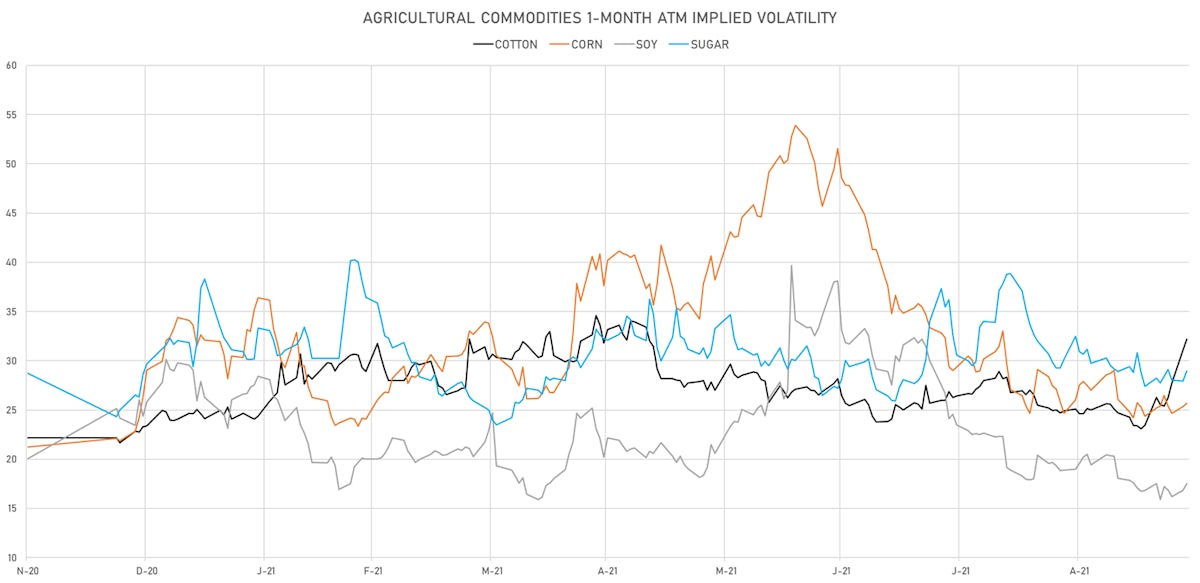

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 122.00 cents per pound, down 0.3% (YTD: +8.0%)

- Lean Hogs (CME) currently at US$ 91.68 cents per pound, up 1.6% (YTD: +30.5%)

- Rough Rice (CBOT) currently at US$ 13.89 cents per hundredweight, down -0.5% (YTD: +12.3%)

- Soybeans Composite (CBOT) currently at US$ 1,274.25 cents per bushel, down -0.8% (YTD: -2.9%)

- Corn (CBOT) currently at US$ 534.75 cents per bushel, down -1.3% (YTD: +10.0%)

- Wheat Composite (CBOT) currently at US$ 709.75 cents per bushel, down -2.2% (YTD: +10.3%)

- Sugar No.11 (ICE US) currently at US$ 18.98 cents per pound, up 1.3% (YTD: +22.5%)

- Cotton No.2 (ICE US) currently at US$ 100.91 cents per pound, up 2.0% (YTD: +29.2%)

- Cocoa (ICE US) currently at US$ 2,555 per tonne, up 0.4% (YTD: -1.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,632 per tonne, down -0.1% (YTD: +46.4%)

- Random Length Lumber (CME) currently at US$ 615.70 per 1,000 board feet, down -4.1% (YTD: -29.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,185 per tonne, up 2.5% (YTD: +12.2%)

- Soybean Oil Composite (CBOT) currently at US$ 57.56 cents per pound, down -0.9% (YTD: +33.3%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,688 per tonne, up 1.3% (YTD: +20.5%)

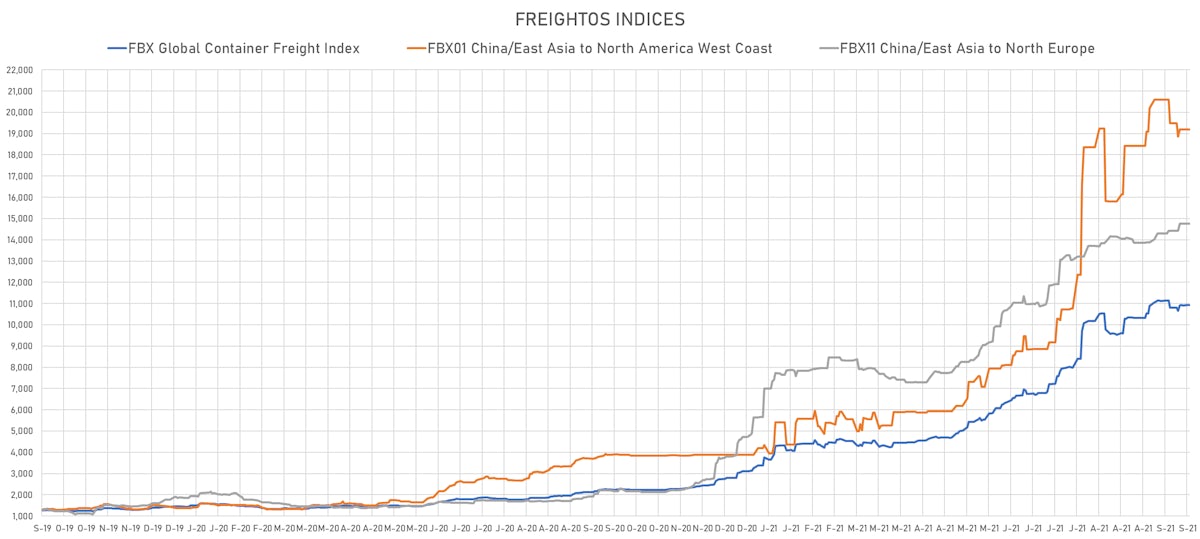

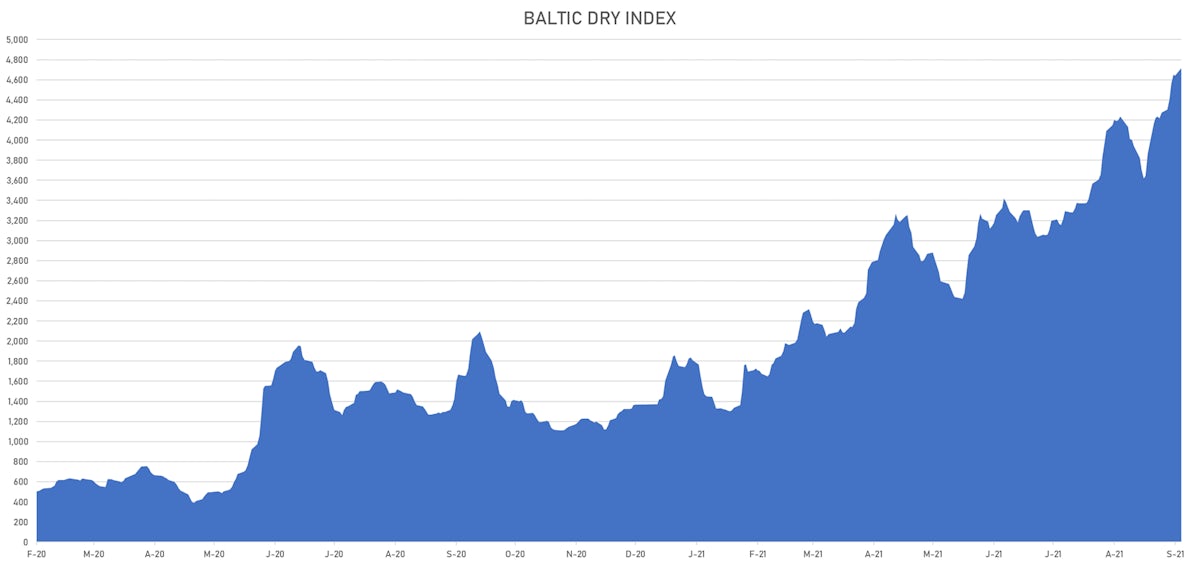

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,717, up 1.6% (YTD: +245.3%)

- Freightos China To North America West Coast Container Index currently at 19,182, unchanged (YTD: +356.8%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 462, unchanged (YTD: +27.3%)

- Freightos Europe To North America East Coast Container Index currently at 6,986, unchanged (YTD: +273.8%)

- Freightos China To North Europe Container Index currently at 14,756, unchanged (YTD: +160.6%)

- Freightos North Europe To China Container Index currently at 1,486, unchanged (YTD: +8.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 61.92 per tonne, down -3.8% (YTD: +89.2%)