Commodities

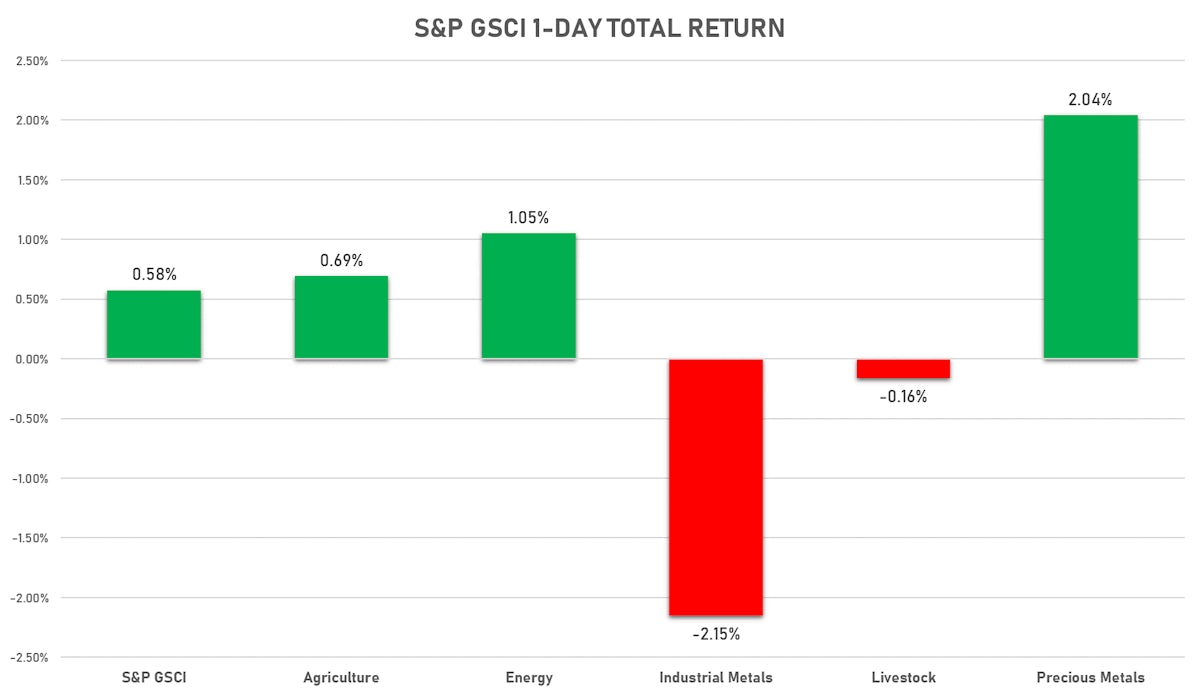

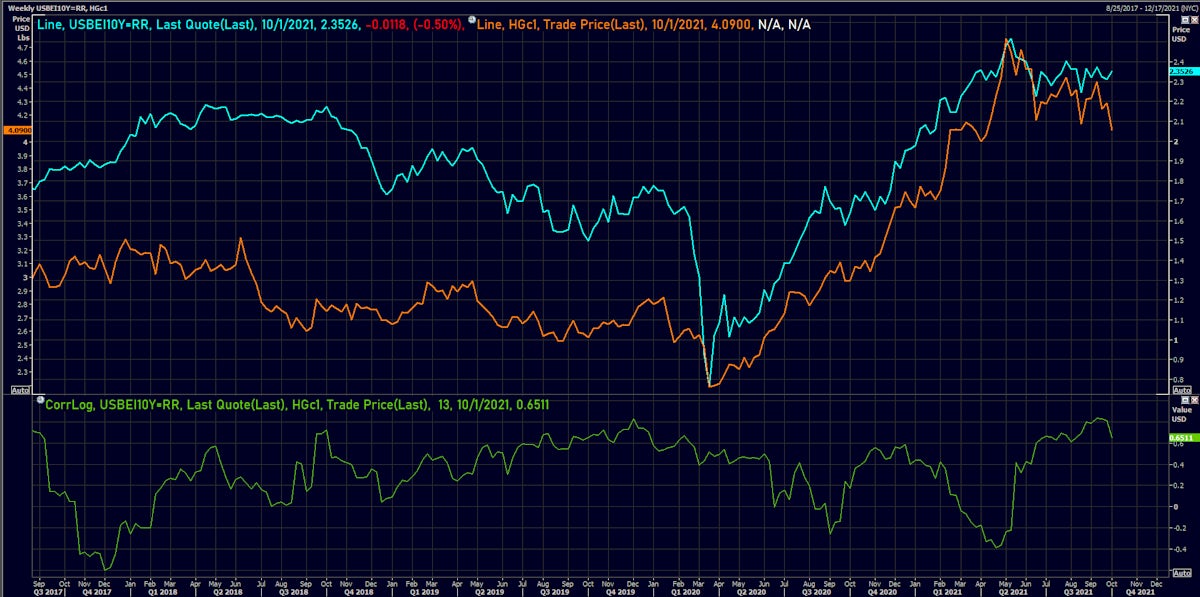

Base Metals Slide, While Precious Metals Rise On A Weaker Dollar

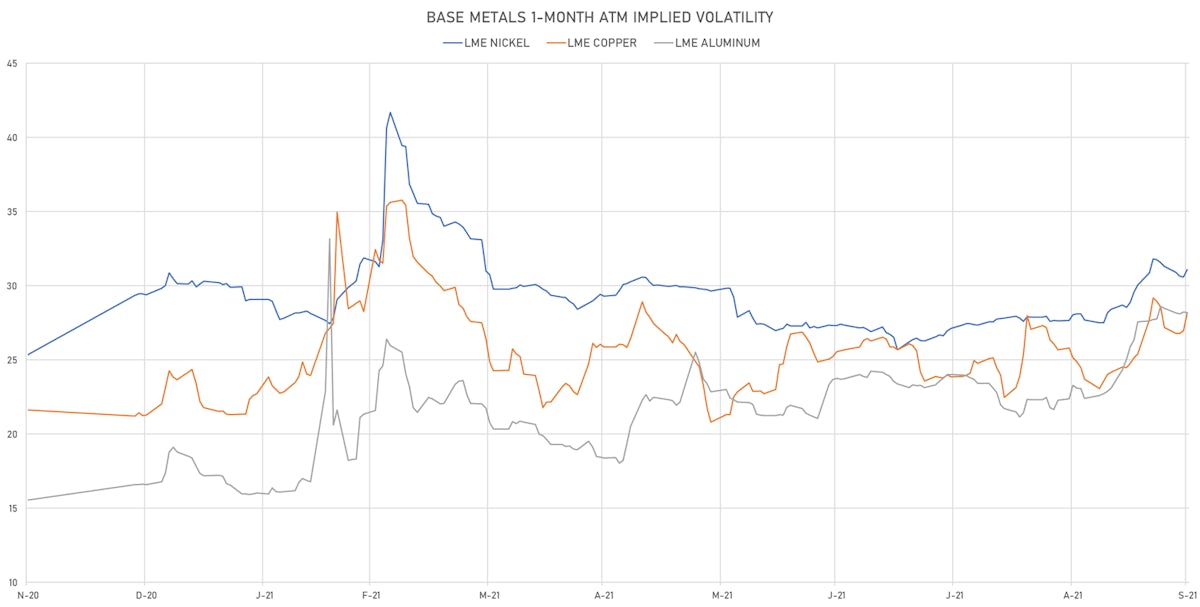

The correlation between copper prices and inflation expectations has weakened recently, as the base metal is more impacted by the weakening economic growth than a renewed "reflation trade"

Published ET

Log correlation between copper prices and 10Y TIPS breakeven inflation | Source: Refinitiv

HEADLINES & MACRO

- EIA weekly report shows injection pretty much in line with expectation (88.00 bcf vs 87.00 bcf Refinitiv consensus), with inventories now on pace to enter winter season at about 3.5 Tcf (6% below 5-yr average)

- ICE Newcastle Coal front month and Henry Hub Natural Gas front month futures are up (respectively) 21% and 18% in the past week, probably not a sustainable trajectory in the long run, but could rise further in the short term as winter weather is just around the corner

- OPEC is likely to increase supply further at its meeting next week, with global pressure intensifying since Brent hit $80 / barrel a couple of days ago

NOTABLE GAINERS TODAY

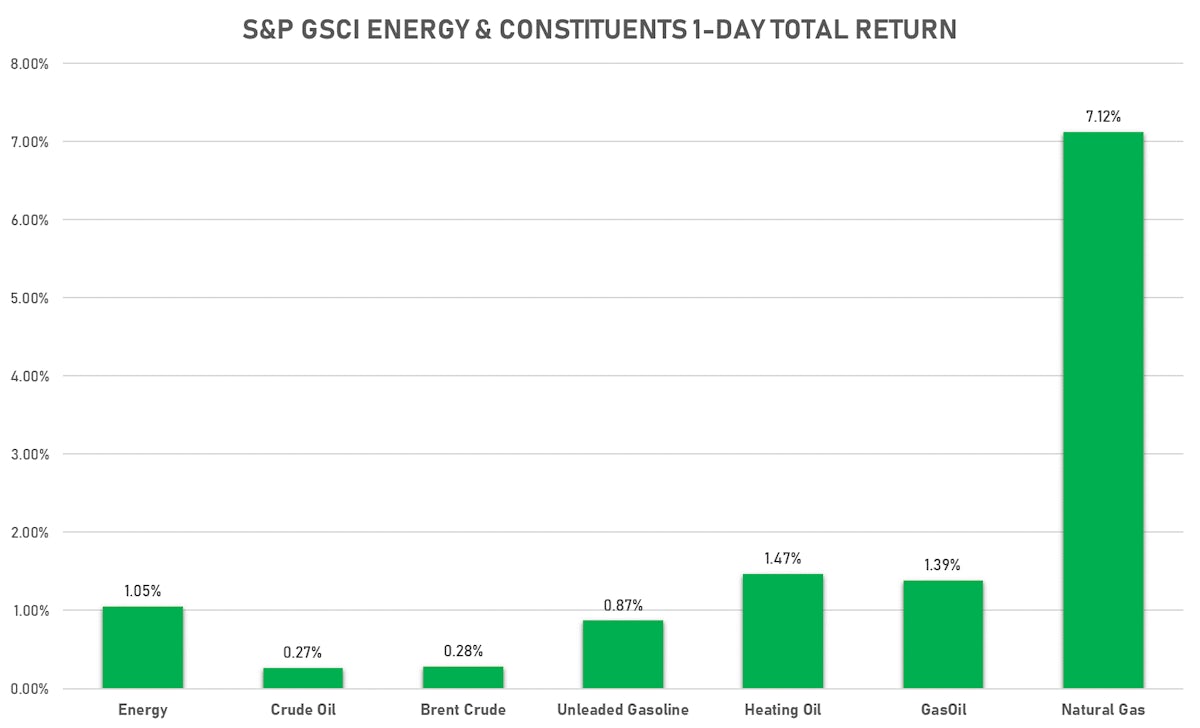

- NYMEX Henry Hub Natural Gas up 7.1% (YTD: 131.1%)

- DCE Iron Ore Continuation Month 1 up 6.4% (YTD: -33.7%)

- ICE-US Sugar No. 11 up 4.7% (YTD: 28.0%)

- ICE-US Cotton No. 2 up 3.7% (YTD: 38.0%)

- ICE Europe Newcastle Coal Monthly up 3.6% (YTD: 170.8%)

- CME Random Length Lumber up 3.5% (YTD: -28.1%)

- Silver spot up 3.0% (YTD: -16.0%)

- Palladium spot up 2.7% (YTD: -21.9%)

- Bursa Malaysia Crude Palm Oil up 2.6% (YTD: 24.2%)

- CME Dry Whey up 2.6% (YTD: 23.9%)

- ICE-US Cocoa up 2.4% (YTD: 1.9%)

- CBoT Wheat up 2.1% (YTD: 13.3%)

- Gold spot up 1.8% (YTD: -7.4%)

- CBoT Soybean Oil up 1.7% (YTD: 35.7%)

- DCE RBD Palm Oil up 1.5% (YTD: 32.4%)

NOTABLE LOSERS TODAY

- SHFE Bitumen Continuation Month 1 down -5.1% (YTD: 20.6%)

- Johnson Matthey Rhodium New York 0930 down -4.9% (YTD: -20.8%)

- Zhengzhou Exchange Thermal Coal down -3.6% (YTD: 80.9%)

- CBoT Soybean Meal down -3.5% (YTD: -24.9%)

- COMEX Copper down -2.6% (YTD: 16.4%)

- CBoT Soybeans down -2.2% (YTD: -4.5%)

- DCE Coke down -2.0% (YTD: 32.8%)

- EEX European-Carbon- Secondary Trading down -1.8% (YTD: 92.5%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -1.8% (YTD: 88.7%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -1.7% (YTD: 33.3%)

- Coffee Arabica Colombia Excelso EP Spot down -1.5% (YTD: 48.2%)

- Shanghai International Exchange Bonded Copper down -1.2% (YTD: 16.2%)

- SHFE Stannum down -1.2% (YTD: 81.0%)

- SHFE Lead Continuation Month 1 down -1.0% (YTD: -2.9%)

- CME Live Cattle down -1.0% (YTD: 6.8%)

ENERGY UP TODAY

- WTI crude front month currently at US$ 75.39 per barrel, up 0.3% (YTD: +54.6%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 78.69 per barrel, down -0.2% (YTD: +51.6%); 6-month term structure in tightening backwardation

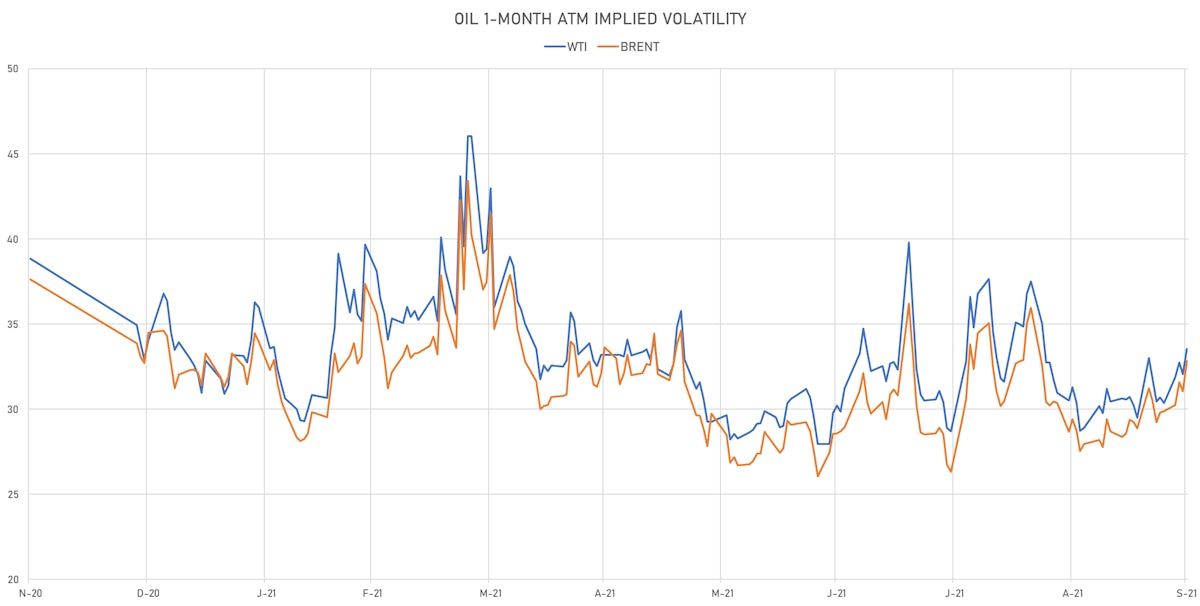

- Brent volatility at 32.8, up 5.8% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 218.00 per tonne, up 3.6% (YTD: +170.8%)

- Natural Gas (Henry Hub) currently at US$ 5.96 per MMBtu, up 7.1% (YTD: +131.1%)

- Gasoline (NYMEX) currently at US$ 2.20 per gallon, up 1.1% (YTD: +60.0%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 676.00 per tonne, up 1.4% (YTD: +60.7%)

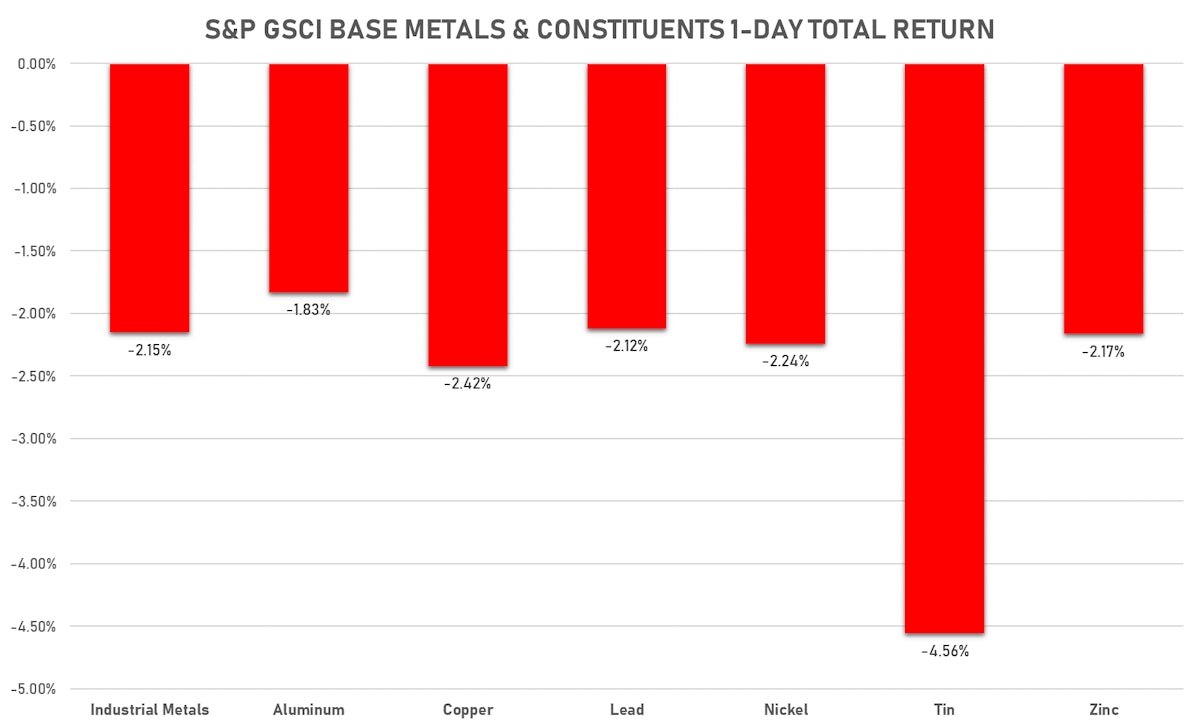

BASE METALS DOWN TODAY

- Copper (COMEX) currently at US$ 4.09 per pound, down -2.6% (YTD: +16.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 715.00 per tonne, up 6.4% (YTD: -33.7%)

- Aluminum (Shanghai) currently at CNY 22,725 per tonne, down -0.7% (YTD: +44.9%)

- Nickel (Shanghai) currently at CNY 140,400 per tonne, down -0.9% (YTD: +13.4%)

- Lead (Shanghai) currently at CNY 14,275 per tonne, down -1.0% (YTD: -2.9%)

- Rebar (Shanghai) currently at CNY 5,835 per tonne, up 0.6% (YTD: +38.3%)

- Tin (Shanghai) currently at CNY 272,270 per tonne, down -1.2% (YTD: +81.0%)

- Zinc (Shanghai) currently at CNY 22,540 per tonne, down -0.6% (YTD: +8.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 381,000 per tonne, unchanged (YTD: +39.1%)

- Lithium (Shanghai) spot price currently at CNY 855,000 per tonne, unchanged (YTD: +72.2%)

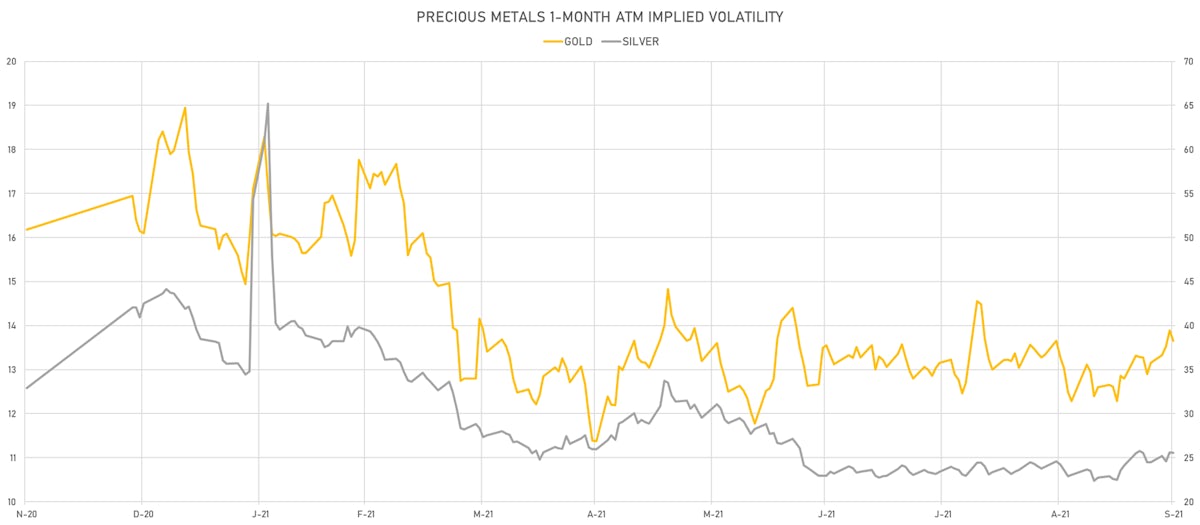

PRECIOUS METALS RISE TODAY

- Gold spot currently at US$ 1,752.82 per troy ounce, up 1.8% (YTD: -7.4%)

- Gold 1-Month ATM implied volatility currently at 13.28, down -1.7% (YTD: -15.2%)

- Silver spot currently at US$ 22.07 per troy ounce, up 3.0% (YTD: -16.0%)

- Silver 1-Month ATM implied volatility currently at 25.13, up 2.1% (YTD: -38.5%)

- Palladium spot currently at US$ 1,915.66 per troy ounce, up 2.7% (YTD: -21.9%)

- Platinum spot currently at US$ 962.59 per troy ounce, up 1.4% (YTD: -9.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 13,500 per troy ounce, down -4.9% (YTD: -20.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

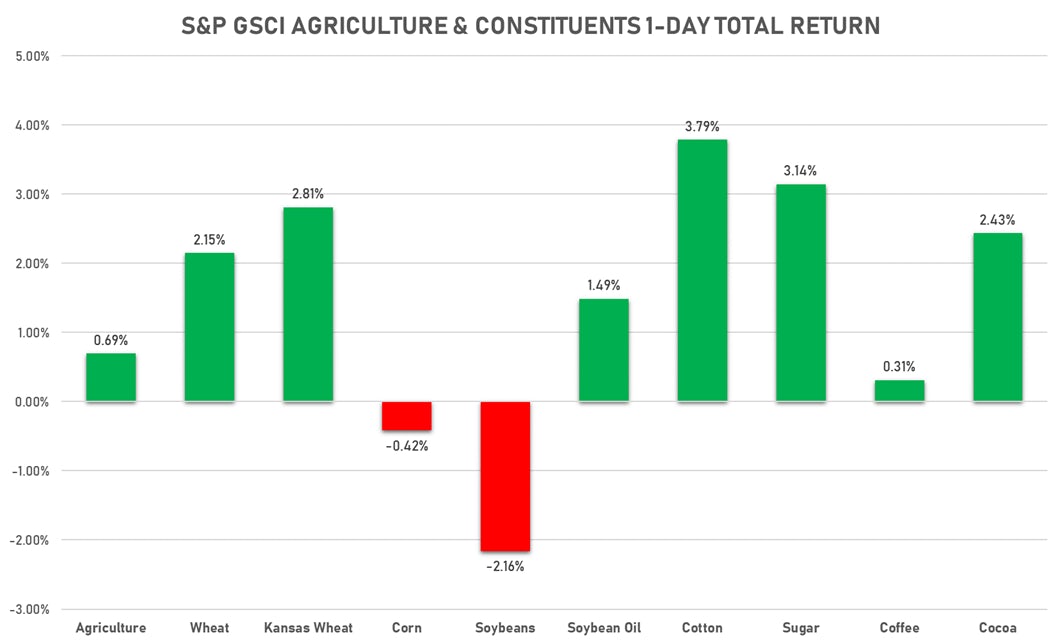

AGS MOSTLY UP TODAY

- Live Cattle (CME) currently at US$ 120.58 cents per pound, down 1.0% (YTD: +6.8%)

- Lean Hogs (CME) currently at US$ 91.60 cents per pound, up 0.9% (YTD: +30.3%)

- Rough Rice (CBOT) currently at US$ 13.67 cents per hundredweight, down -0.7% (YTD: +10.6%)

- Soybeans Composite (CBOT) currently at US$ 1,256.00 cents per bushel, down -2.2% (YTD: -4.5%)

- Corn (CBOT) currently at US$ 536.00 cents per bushel, down -0.4% (YTD: +10.9%)

- Wheat Composite (CBOT) currently at US$ 727.50 cents per bushel, up 2.1% (YTD: +13.3%)

- Sugar No.11 (ICE US) currently at US$ 20.34 cents per pound, up 4.7% (YTD: +28.0%)

- Cotton No.2 (ICE US) currently at US$ 107.80 cents per pound, up 3.7% (YTD: +38.0%)

- Cocoa (ICE US) currently at US$ 2,652 per tonne, up 2.4% (YTD: +1.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,689 per tonne, down -1.5% (YTD: +48.2%)

- Random Length Lumber (CME) currently at US$ 627.50 per 1,000 board feet, up 3.5% (YTD: -28.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,345 per tonne, up 1.1% (YTD: +13.5%)

- Soybean Oil Composite (CBOT) currently at US$ 58.54 cents per pound, up 1.7% (YTD: +35.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,833 per tonne, up 2.6% (YTD: +24.2%)

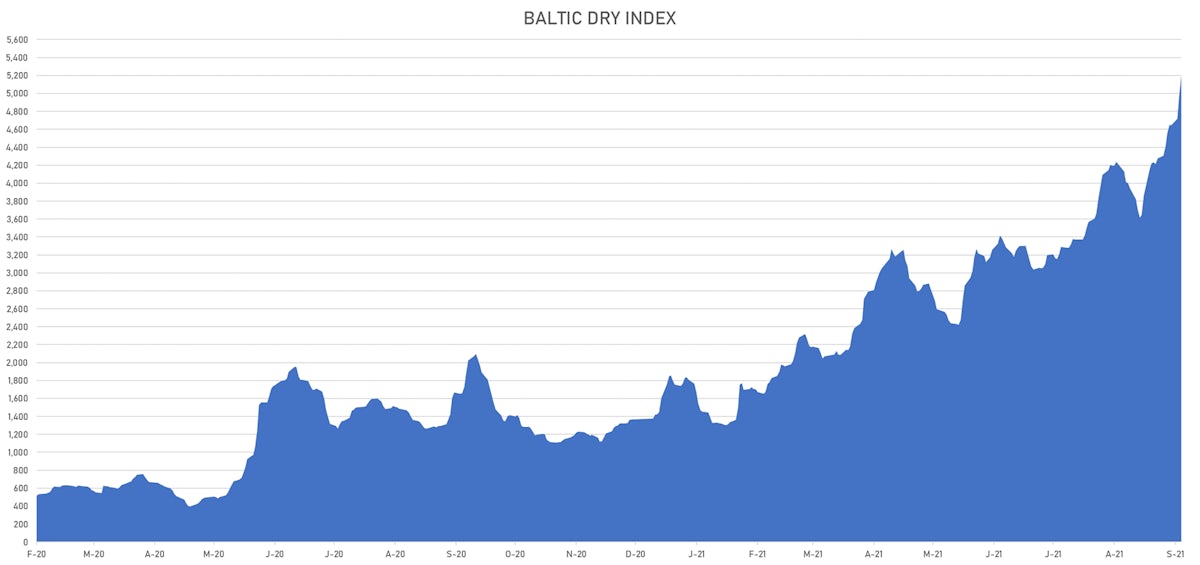

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 5,197, up 4.7% (YTD: +280.5%)

- Freightos China To North America West Coast Container Index currently at 16,153, down -15.8% (YTD: +284.6%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 492, up 6.5% (YTD: +35.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,986, unchanged (YTD: +273.8%)

- Freightos China To North Europe Container Index currently at 14,756, unchanged (YTD: +160.6%)

- Freightos North Europe To China Container Index currently at 1,482, down -0.3% (YTD: +7.8%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

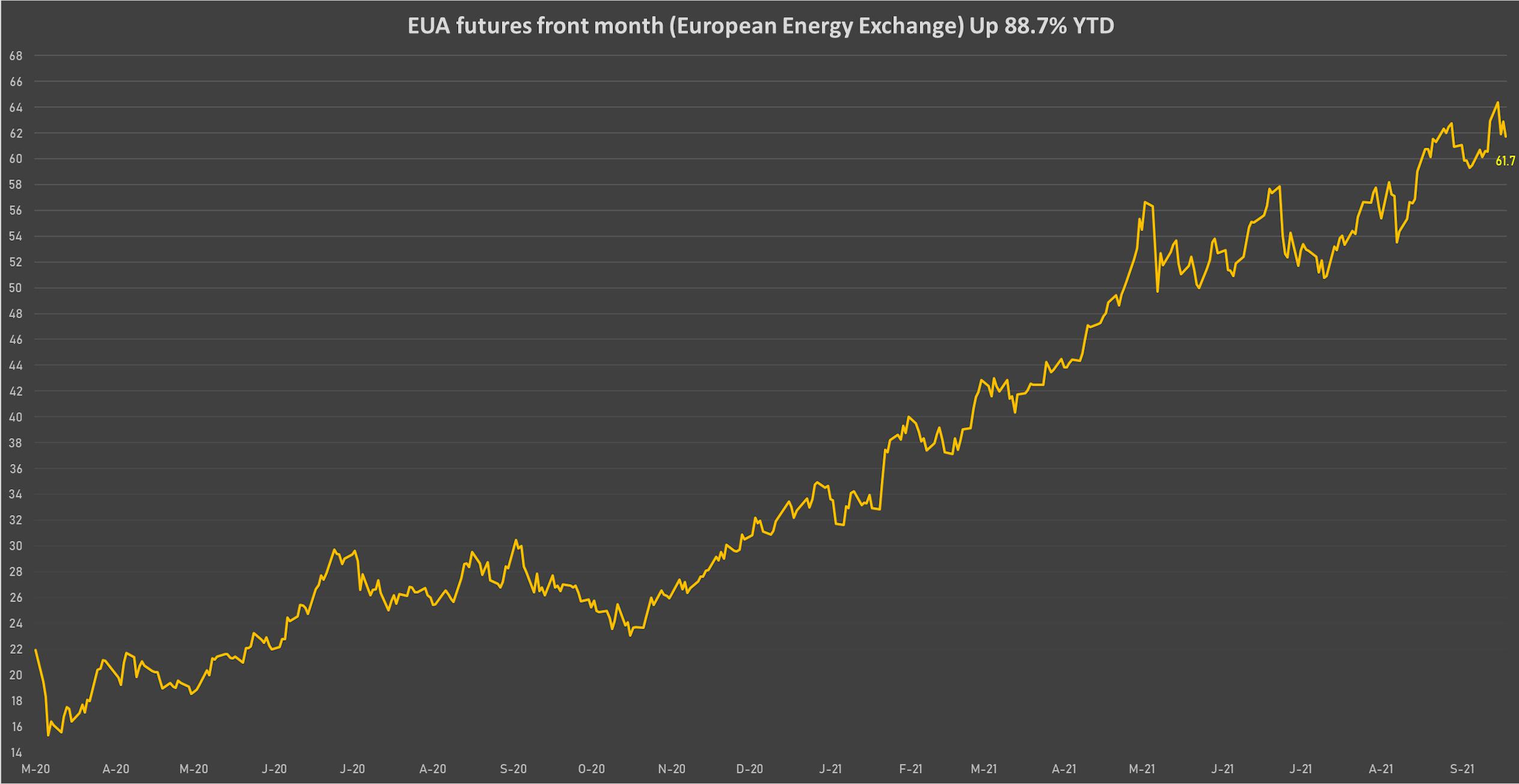

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 61.74 per tonne, down -1.8% (YTD: +88.7%)