Commodities

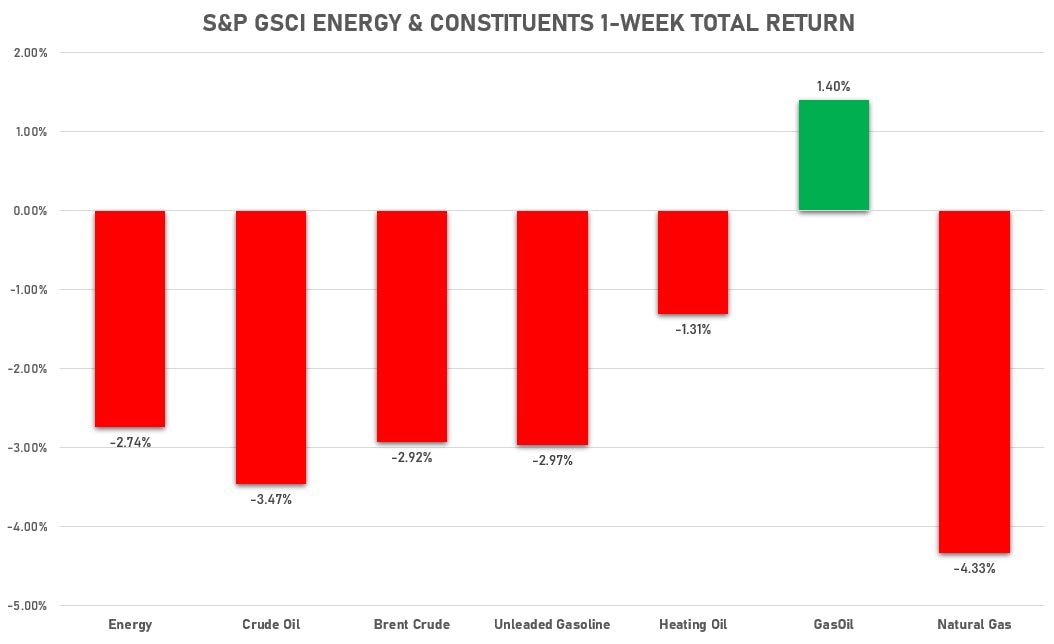

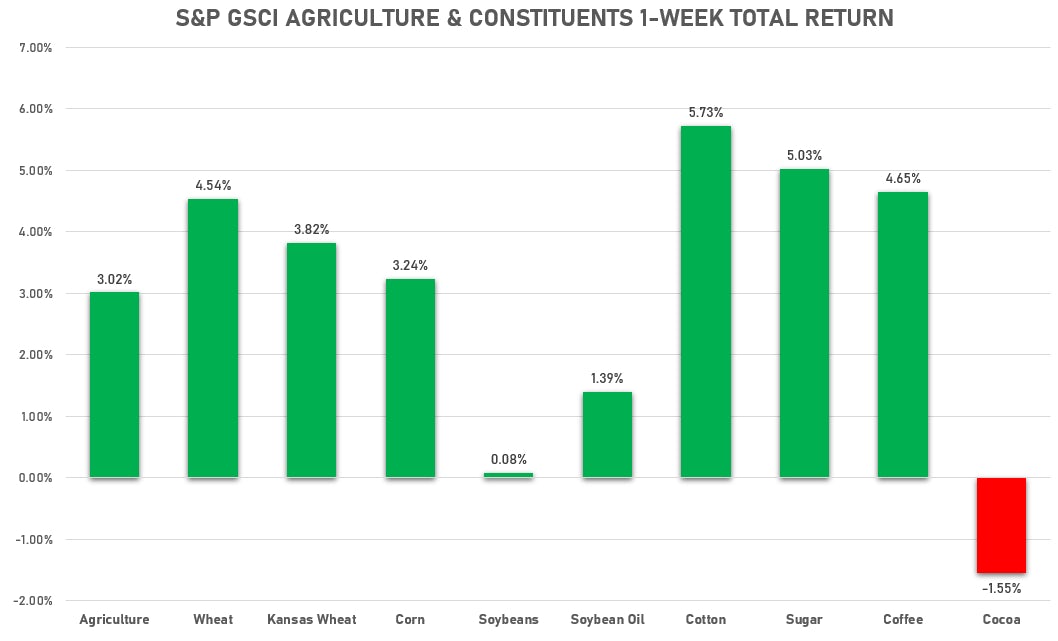

Agriculture shines this week and energy falls

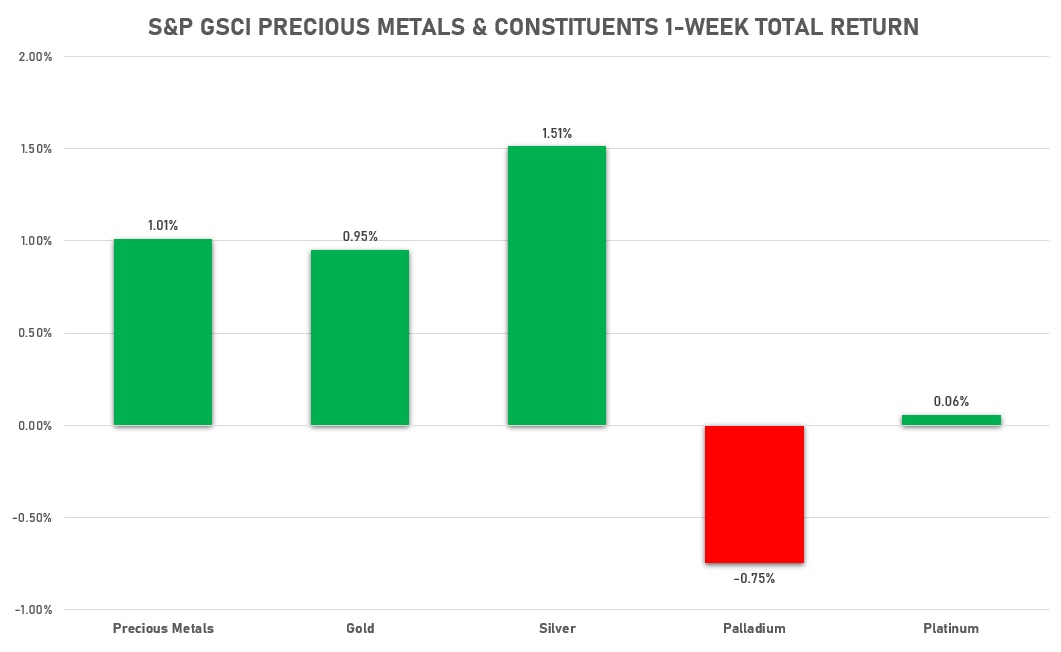

Lumber, cotton, wheat, coffee sugar did particularly well, while natural gas and palladium did not

Published ET

Sources: ϕpost analysis, Factset data

HEADLINES

- EIA forecasts and OPEC+ supply weigh on crude prices this week, with the front months doing worse (leading to a smaller backwardation)

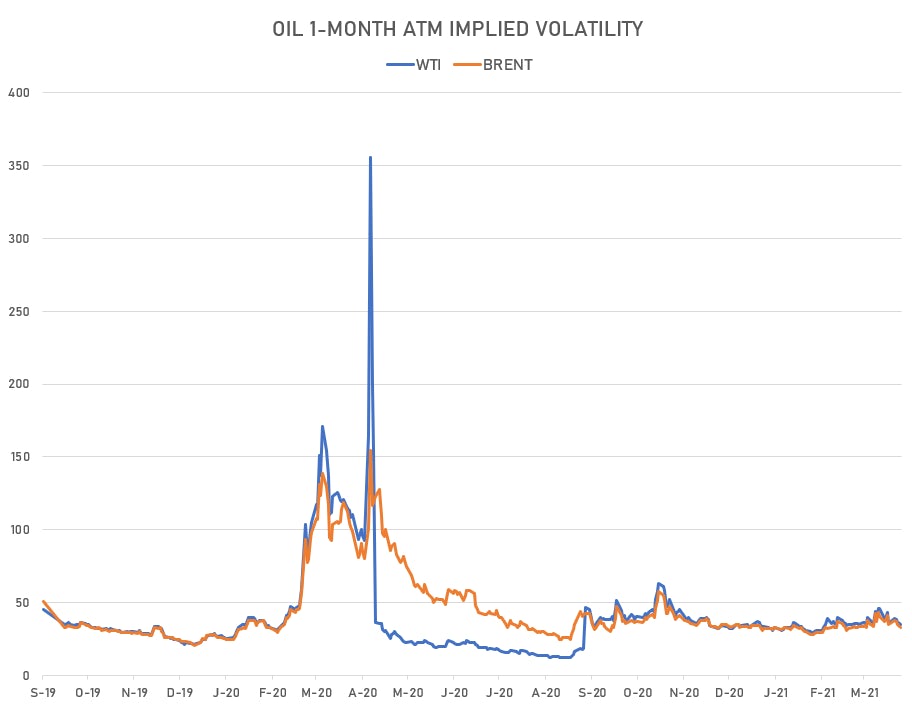

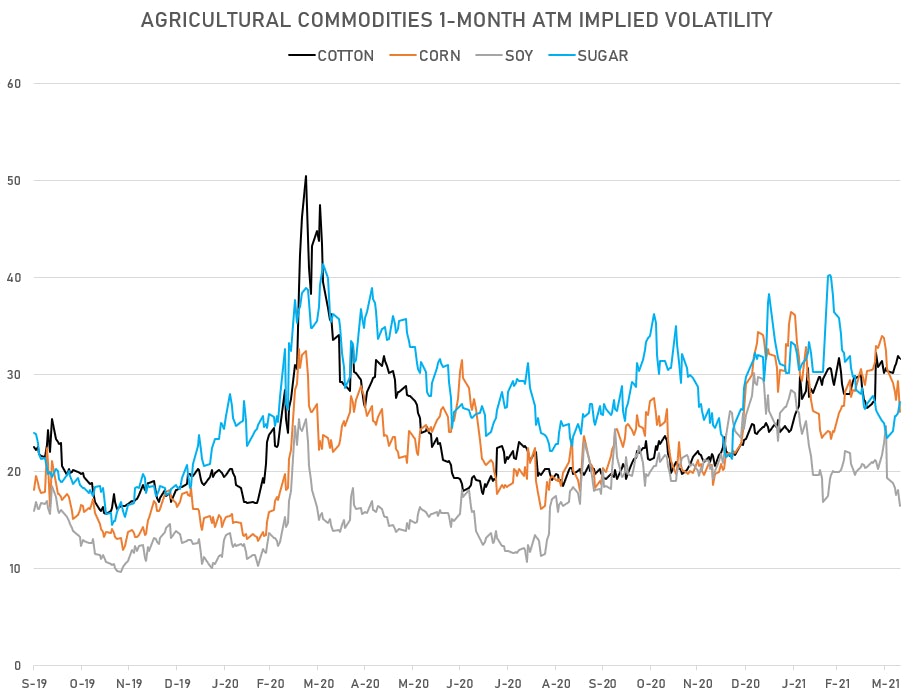

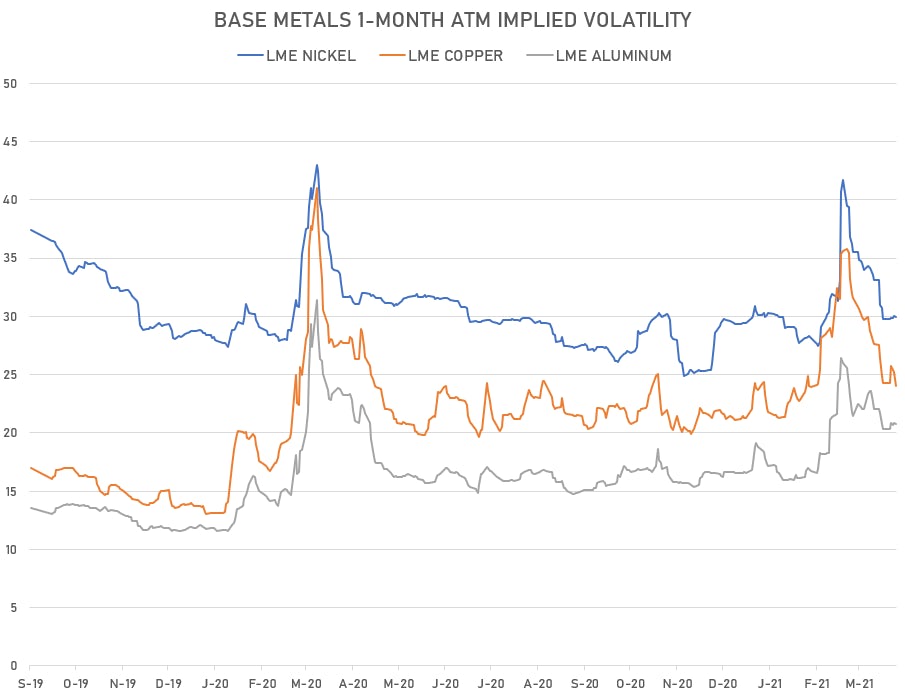

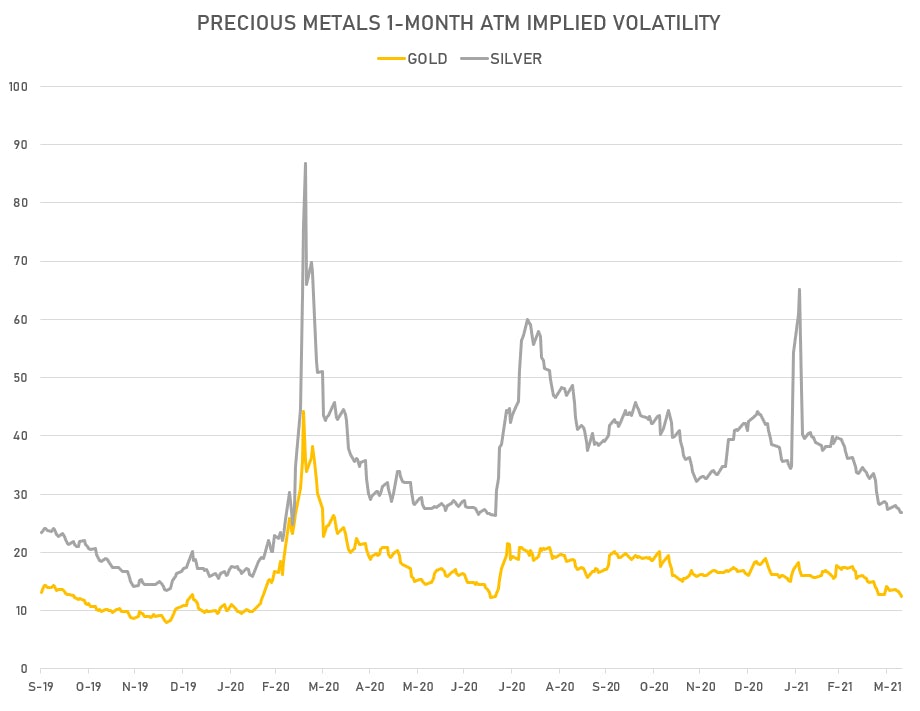

- Speculative interest, measured by the implied volatility, was down in most commodities (notably corn, soy, crude oil, copper, gold, silver)

- In addition to agricultural commodities, CME Lumber futures were up 9.7%

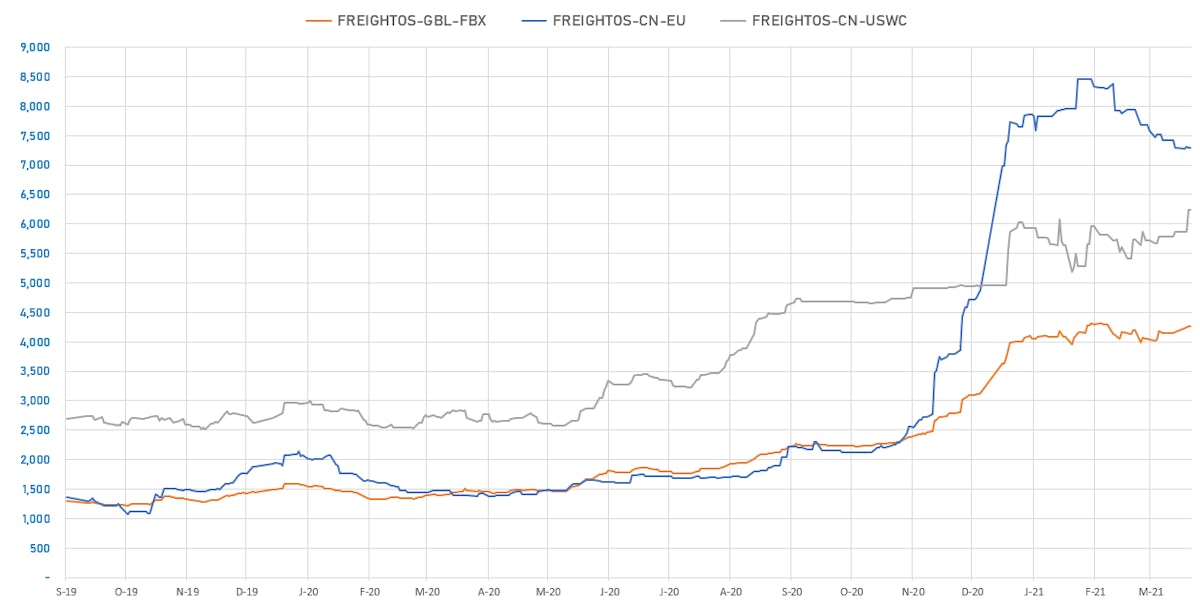

- Freight benchmark prices (from Freightos) up again, especially ships returning from the US East Coast to Europe (up 40.2% on the week) and to China (up 36.4% on the week)

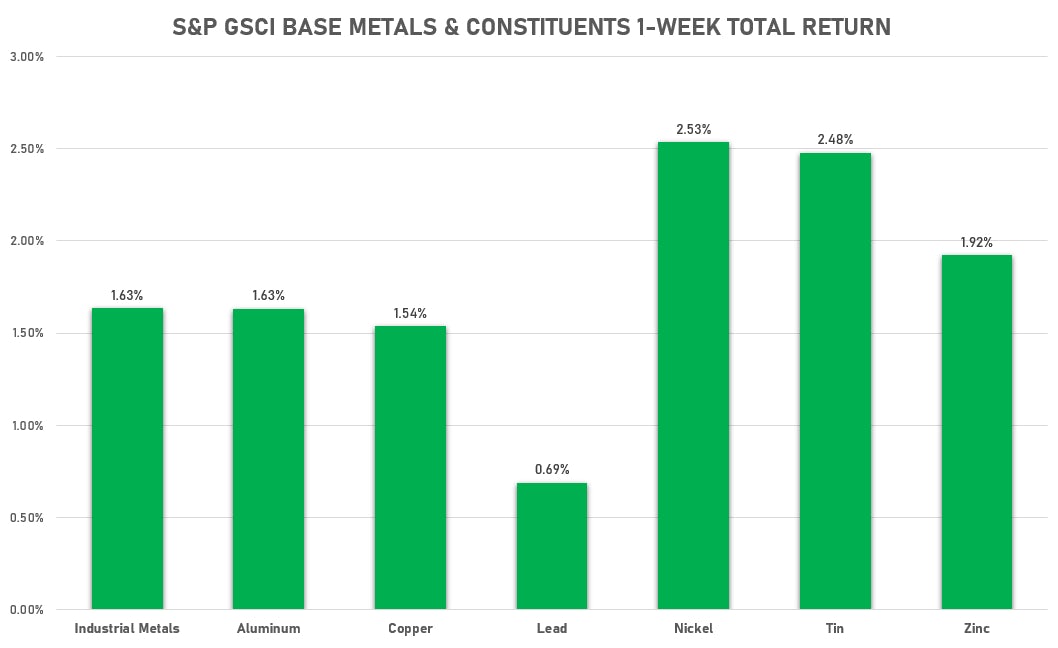

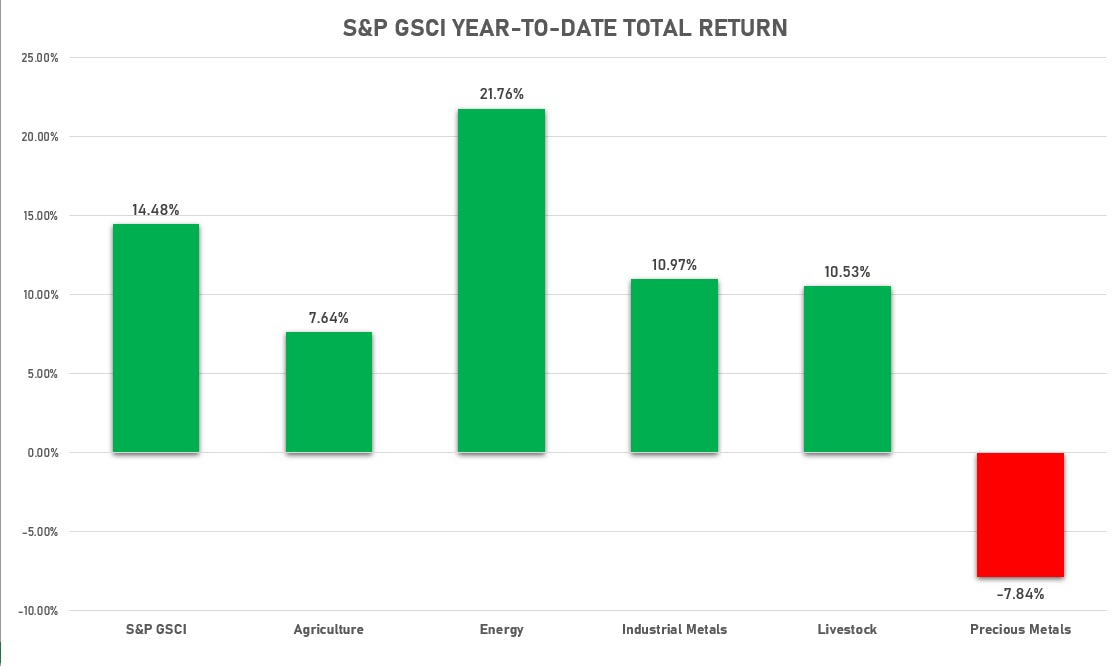

BREAKDOWN OF PERFORMANCE BY S&P GSCI SUB-INDEX

IMPLIED VOLATILITIES MOSTLY DOWN

ENERGY AND FREIGHT PRICES STILL THE BIG GAINERS THIS YEAR

(in terms of individual commodities, Rhodium, Tin, Unleaded Gasoline and Lean Hogs are the leaders YTD)