Commodities

Daily Commodities Summary

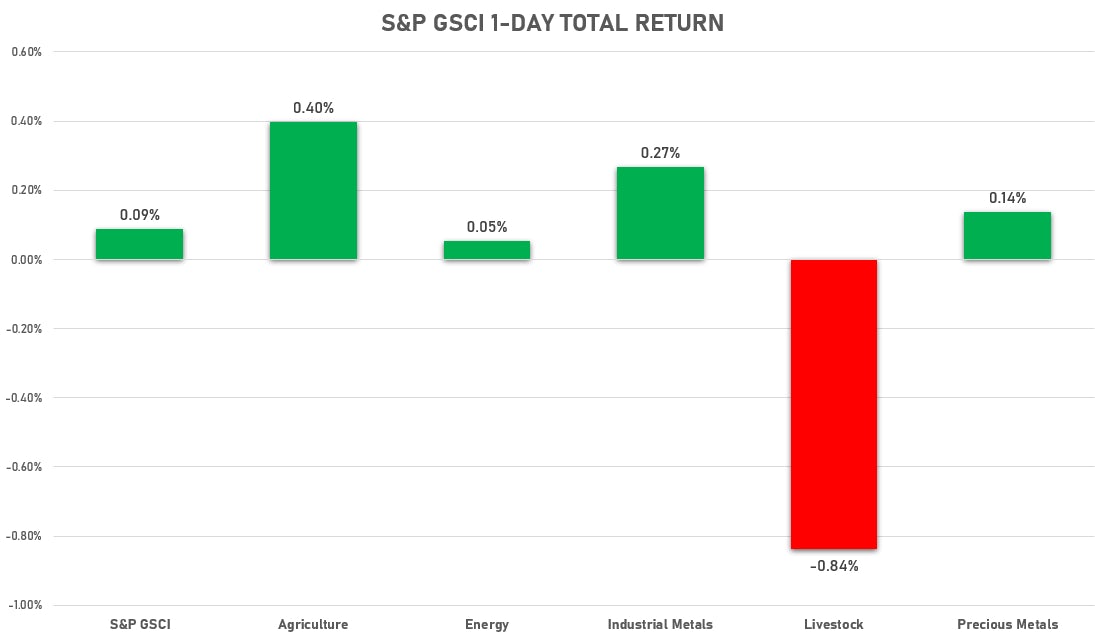

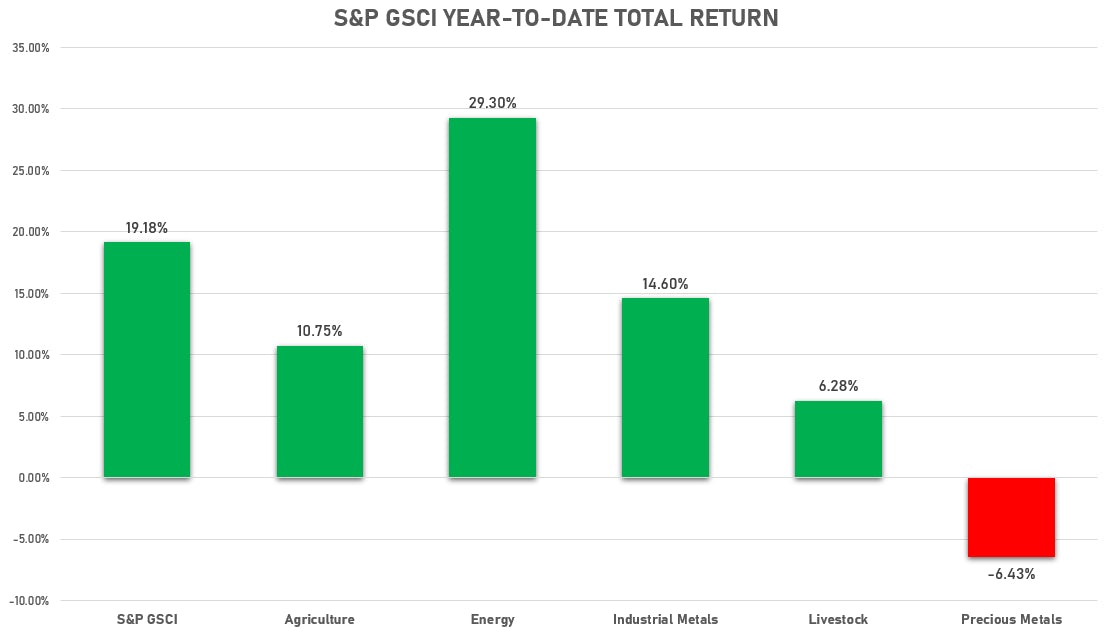

Energy, base metals and agriculture doing broadly well, while precious metals keep sagging

Published ET

Sources: ϕpost analysis, Refinitiv data

NOTABLE BACKGROUND STORIES

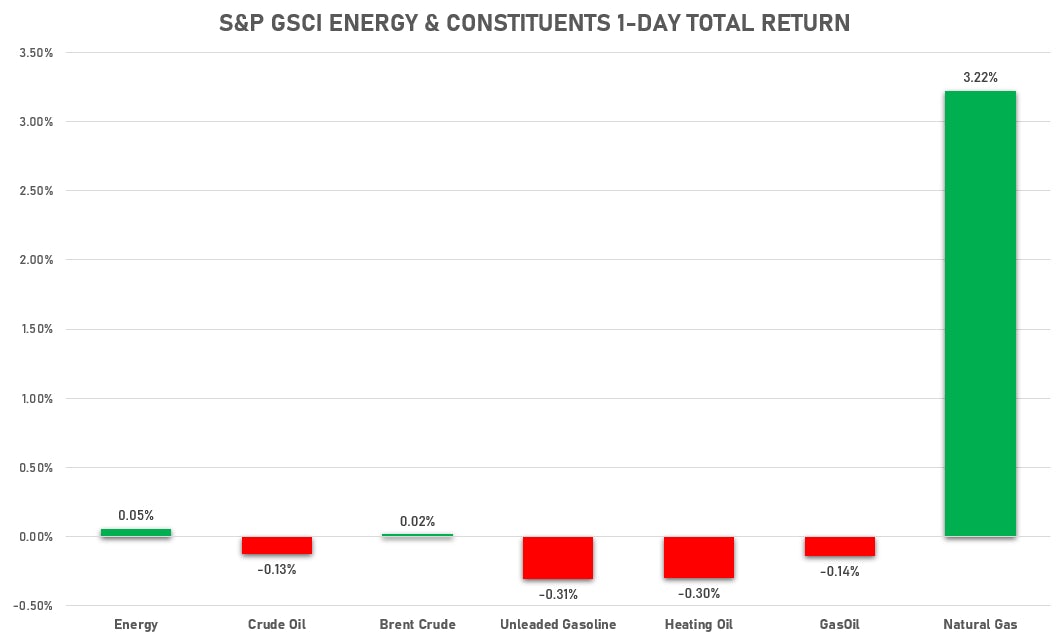

- NOAA temperature forecast leads natural gas higher: "Probabilities for below normal temperatures are elevated across southern Oregon, California, Nevada, western Arizona, and from the Northern Great Basin and Northern Rockies eastward to the western Great Lakes."

- USDA reports higher prices for most pork cuts and an increase in the volume of slaughter

- Crop Progress data from the USDA reported that many states were behind schedule in plantings due to unusually cold temperatures

NOTABLE GAINERS

- Lean Hogs up 3.1% (YTD: +50.3%)

- NYMEX Henry Hub Natural Gas up 2.6% (YTD: +8.3%)

- CME Random Length Lumber up 2.5% (YTD: +52.0%)

- Thermal Coal (Zhengzhou Commodity Exchange) up 2.2% (YTD: -2.0%)

NOTABLE LOSERS

- Erbium Oxide (rare earth) spot price down -3.4% (YTD: +27.2%)

- Sugar No. 11 (ICE-US ) down -2.6% (YTD: +5.2%)

- Coffee Arabica (Colombia Excelso) down -2.4% (YTD: +2.7%)

- TSR 20 Rubber (Shanghai) down -1.5% (YTD: +5.9%)

ENERGY

- WTI crude spot currently at US$ 63.28 per barrel, up 0.3% on the day (YTD: +31.0%); 6-month term structure in widening backwardation

- Brent crude spot currently at US$ 66.25 per barrel, up 0.7% on the day (YTD: +30.3%); 6-month term structure in widening backwardation

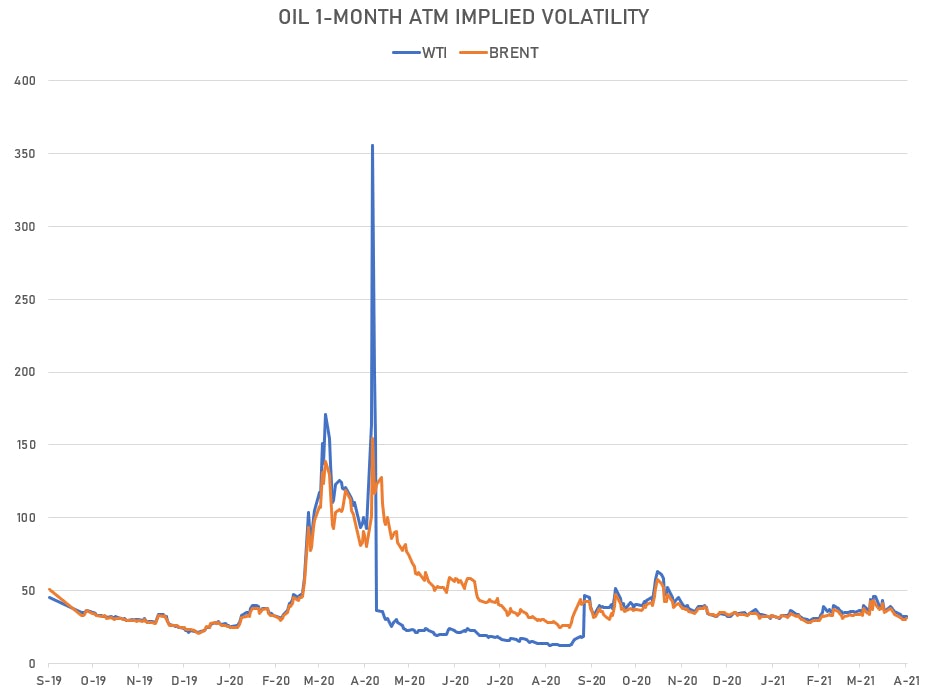

- Brent volatility at 30.7, up 1.6% on the day (12-month range: 24.7 - 154.3)

- Newcastle Coal (ICE Europe) currently at US$ 94.35 per tonne, up 0.1% on the day (YTD: +17.2%)

- Natural Gas (Henry Hub) currently at US$ 2.74 per MMBtu, up 2.6% on the day (YTD: +8.3%); 6-month term structure in tightening backwardation

- Gasoline (NYMEX) currently at US$ 2.05 per gallon, up 0.2% on the day (YTD: +45.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 531.00 per tonne, down -0.5% on the day (YTD: +25.7%); 6-month term structure in widening backwardation

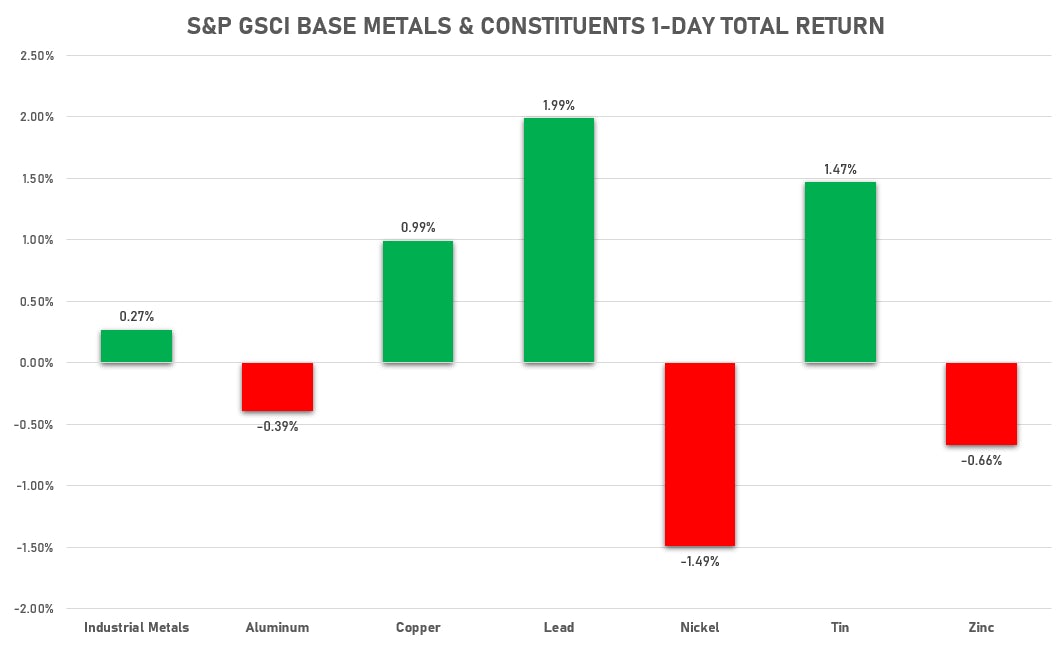

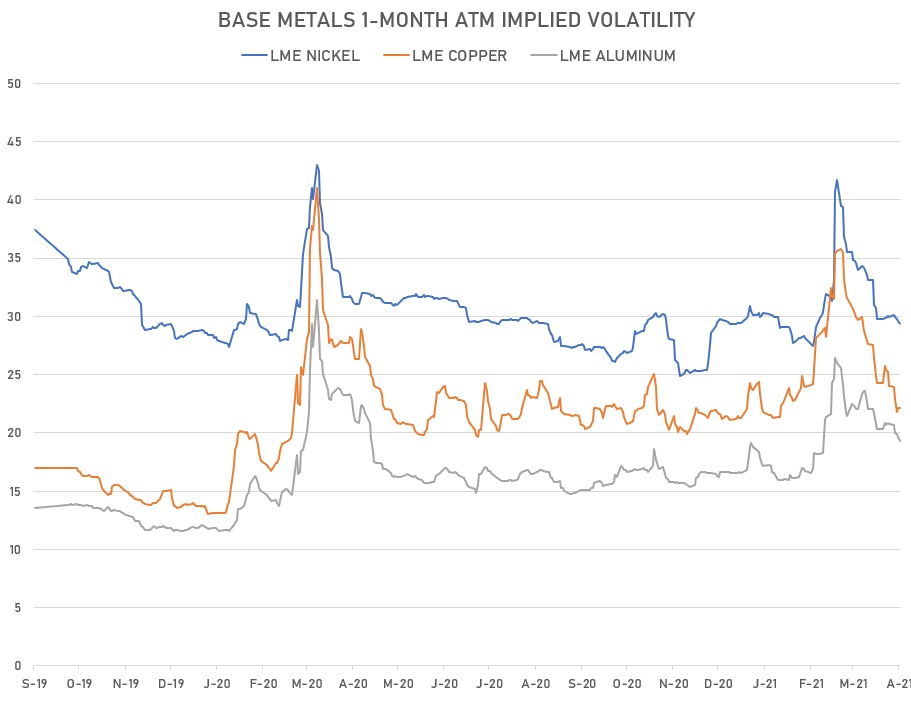

BASE METALS

- Copper (COMEX) currently at US$ 4.25 per pound, up 1.7% on the day (YTD: +20.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,200.00 per tonne, up 1.0% on the day (YTD: +10.0%)

- Aluminium (Shanghai) currently at CNY 18,135 per tonne, down -0.7% on the day (YTD: +15.2%)

- Nickel (Shanghai) currently at CNY 121,150 per tonne, down -1.0% on the day (YTD: -1.9%)

- Lead (Shanghai) currently at CNY 15,240 per tonne, up 0.6% on the day (YTD: +2.4%)

- Rebar (Shanghai) currently at CNY 5,105 per tonne, down -0.4% on the day (YTD: +21.3%)

- Tin (Shanghai) currently at CNY 183,200 per tonne, up 1.5% on the day (YTD: +23.0%)

- Zinc (Shanghai) currently at CNY 21,810 per tonne, up 0.3% on the day (YTD: +5.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 356,500 per tonne, down 0.0% on the day (YTD: +30.1%)

- Lithium (Shanghai) spot price currently at CNY 585,000 per tonne, down 0.0% on the day (YTD: +20.6%)

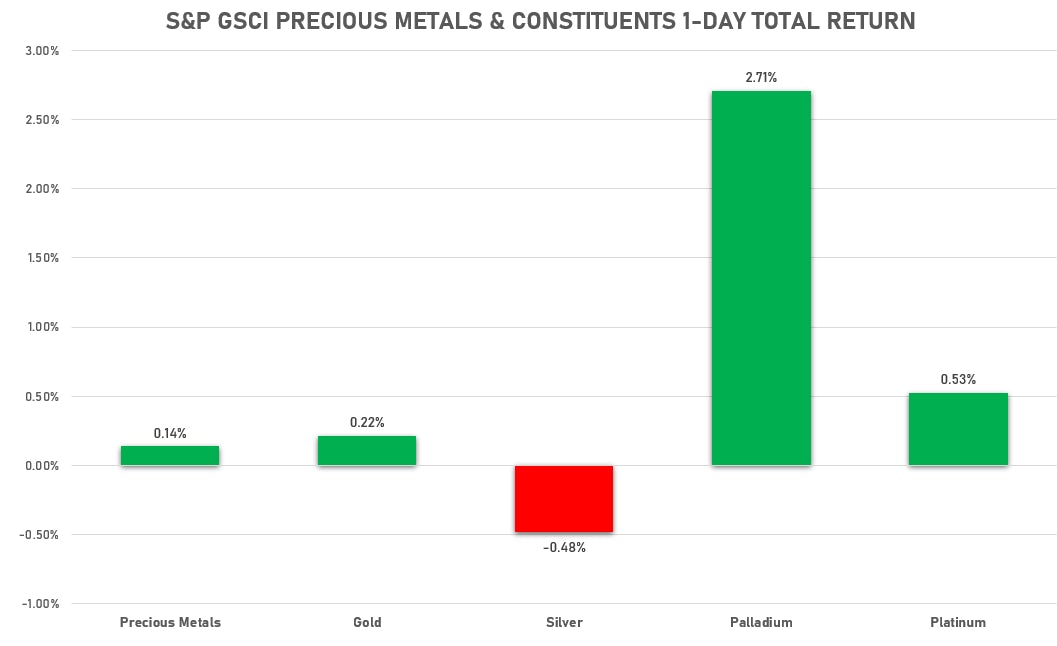

PRECIOUS METALS

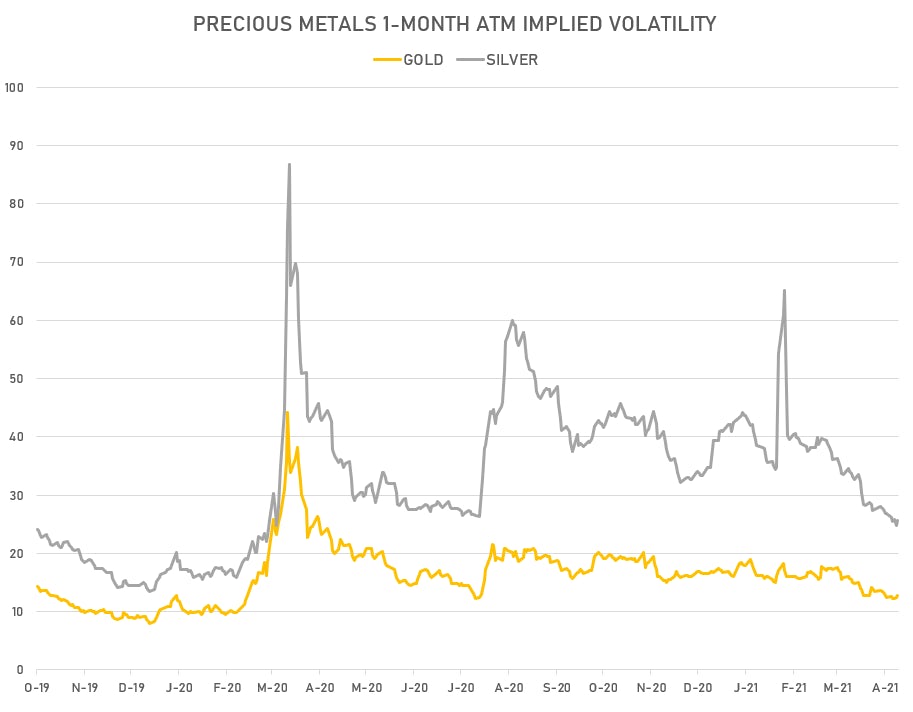

- Gold spot currently at US$ 1,768.19 per troy ounce, down -0.3% on the day (YTD: -6.7%)

- Gold 1-Month ATM implied volatility currently at 12.78, up 1.6% on the day (YTD: -18.9%)

- Silver spot currently at US$ 25.75 per troy ounce, down -0.6% on the day (YTD: -2.2%)

- Silver 1-Month ATM implied volatility currently at 25.15, up 2.3% on the day (YTD: -38.4%)

- Palladium spot currently at US$ 2,794.74 per troy ounce, up 1.0% on the day (YTD: +14.6%)

- Platinum spot currently at US$ 1,205.25 per troy ounce, up 0.6% on the day (YTD: +12.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 29,500 per troy ounce, up 1.4% on the day (YTD: +73.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,250 per troy ounce, unchanged (YTD: +140.4%)

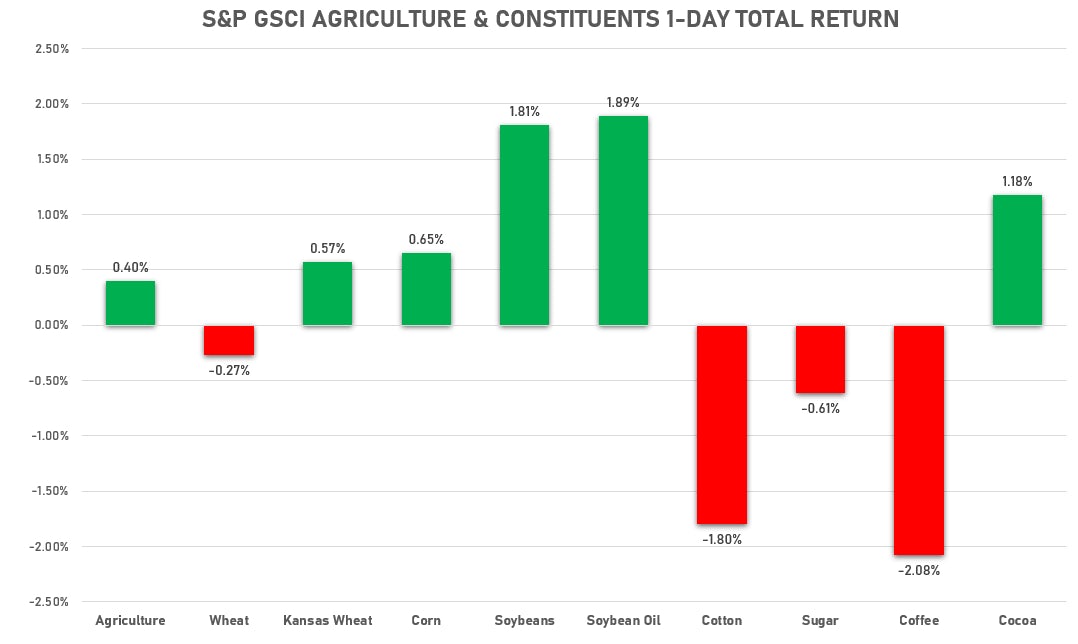

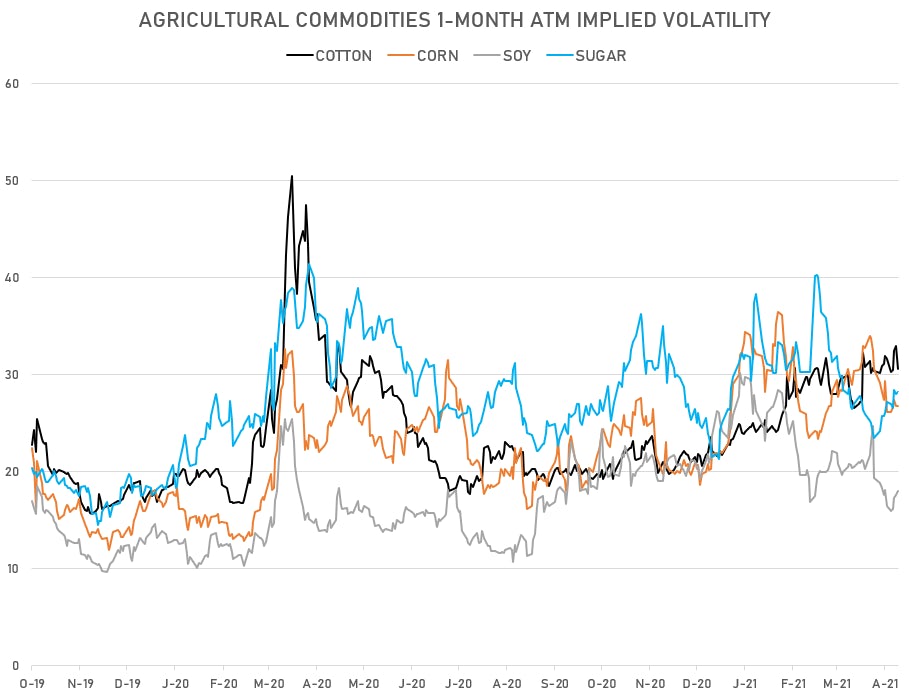

AGRICULTURAL COMMODITIES

- Live Cattle (CME) currently at US$ 120.35 cents per pound, down -0.4% on the day (YTD: +6.6%)

- Lean Hogs (CME) currently at US$ 105.65 cents per pound, up 3.1% on the day (YTD: +50.3%)

- Rough Rice (CBOT) currently at US$ 12.85 cents per hundredweight, down -0.3% on the day (YTD: +3.6%)

- Soybeans Composite (CBOT) currently at US$ 1,453.50 cents per bushel, up 1.2% on the day (YTD: +10.2%)

- Corn (CBOT) currently at US$ 594.00 cents per bushel, up 1.1% on the day (YTD: +22.3%)

- Wheat Composite (CBOT) currently at US$ 652.00 cents per bushel, down 0.0% on the day (YTD: +1.8%)

- Sugar No.11 (ICE US) currently at US$ 16.29 cents per pound, down -2.6% on the day (YTD: +5.2%)

- Cotton No.2 (ICE US) currently at US$ 83.54 cents per pound, down -0.5% on the day (YTD: +6.6%)

- Cocoa (ICE US) currently at US$ 2,437 per tonne, up 1.2% on the day (YTD: -6.4%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,250 per tonne, down -2.4% on the day (YTD: +2.7%)

- Random Length Lumber (CME) currently at US$ 1,326.70 per 1,000 board feet, up 2.5% on the day (YTD: +52.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,840 per tonne, down -1.5% on the day (YTD: +5.9%)

- Soybean Oil Composite (CBOT) currently at US$ 56.36 cents per pound, down -0.1% on the day (YTD: +29.9%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,180 per tonne, down -0.3% on the day (YTD: +7.4%)

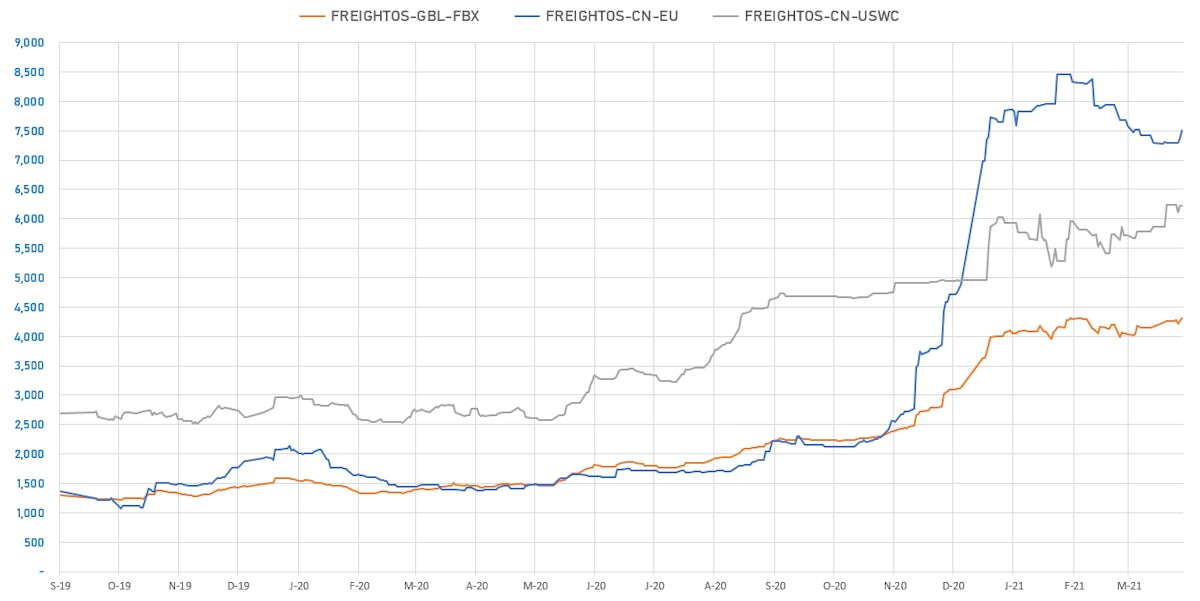

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,432, up 2.0% on the day (YTD: +78.0%)

- Freightos China To North America West Coast Container Index currently at 4,854, unchanged (YTD: +25.3%)

- Freightos North America West Coast To China Container Index currently at 894, unchanged (YTD: +72.7%)

- Freightos North America East Coast To Europe Container Index currently at 495, unchanged (YTD: +47.3%)

- Freightos Europe To North America East Coast Container Index currently at 3,305, unchanged (YTD: +71.8%)

- Freightos China To North Europe Container Index currently at 7,802, up 3.9% on the day (YTD: +59.8%)

- Freightos North Europe To China Container Index currently at 1,516, unchanged (YTD: +10.3%)

- Freightos Europe To South America West Coast Container Index currently at 2,998, unchanged (YTD: +77.2%)

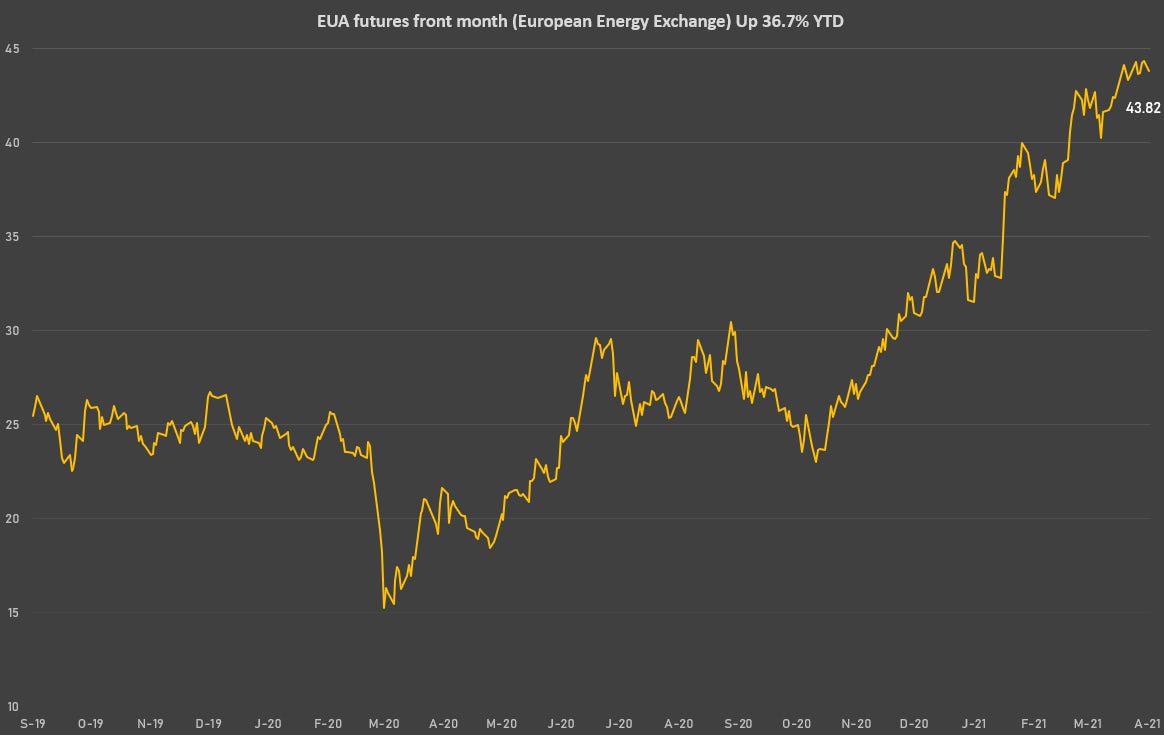

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 44.35 per tonne, down -1.2% on the day (YTD: +36.7%)