Commodities

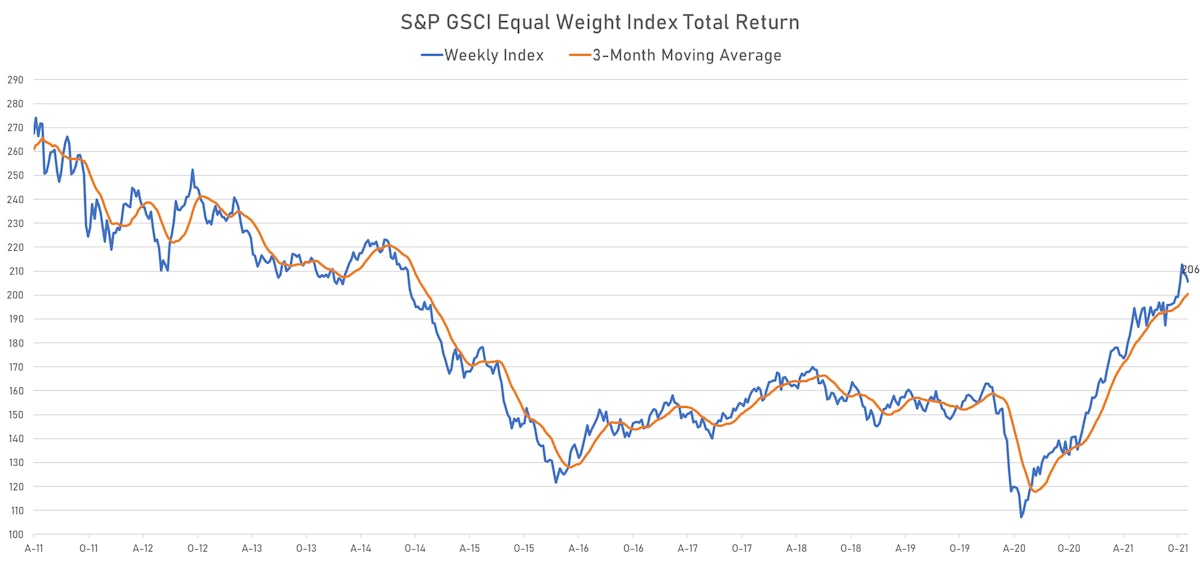

Industrials Commodities Fell This Week On Unimpressive Economic Growth, Dip In Long-Term Inflation Expectations

Crude oil started the week much lower ahead of the November OPEC+ meeting and rose into the weekend, as the cartel pointed to lower demand in 2022 to keep its current monthly increases unchanged

Published ET

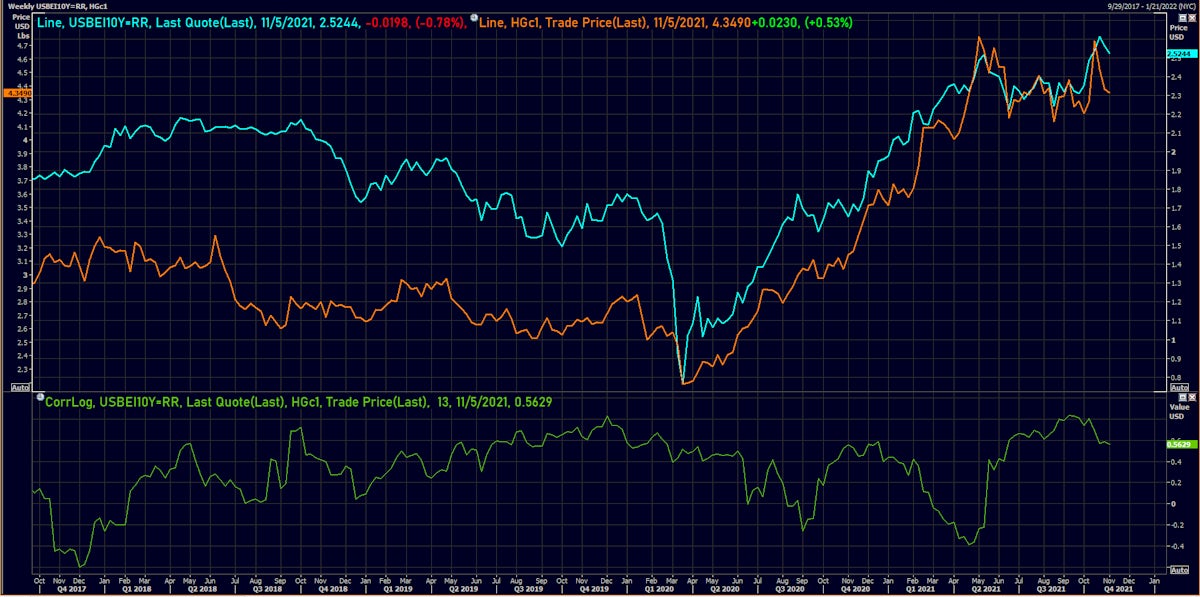

Copper Weekly Front-Month Futures Prices vs. US 10Y TIPS Inflation Breakeven | Source: Refinitiv

NOTABLE GAINERS THIS WEEK

- CME Cash settled Butter up 9.3% (YTD: 31.2%), now at 193.50

- SHFE Stannum (Tin) up 8.3% (YTD: 93.9%), now at 291,630.00

- CME Non Fat Dry Milk up 7.7% (YTD: 29.8%), now at 146.50

- CME Dry Whey up 7.0% (YTD: 32.5%), now at 58.55

- DCE Coke up 5.1% (YTD: 45.3%), now at 4,359.00

- CME Random Length Lumber up 4.0% (YTD: -29.6%), now at 615.00

- WUXI Metal Cobalt Bi-Monthly up 3.9% (YTD: 51.5%), now at 409.00

- ICE-US Sugar No. 11 up 3.5% (YTD: 28.7%), now at 19.98

- CME Live Cattle up 3.5% (YTD: 16.7%), now at 131.80

- Coffee Arabica Colombia Excelso EP spot up 3.3% (YTD: 59.3%), now at 5,043.00

- Baltic Exchange Dirty Tank up 2.5% (YTD: 75.3%), now at 817.00

- Gold spot up 2.0% (YTD: -4.2%), now at 1,817.63

- Johnson Matthey Rhodium New York 0930 up 1.8% (YTD: -15.8%), now at 14,350.00

- ICE-US Cotton No. 2 up 1.8% (YTD: 49.6%), now at 117.09

- NYMEX Henry Hub Natural Gas up 1.7% (YTD: 117.3%), now at 05.52

NOTABLE LOSERS THIS WEEK

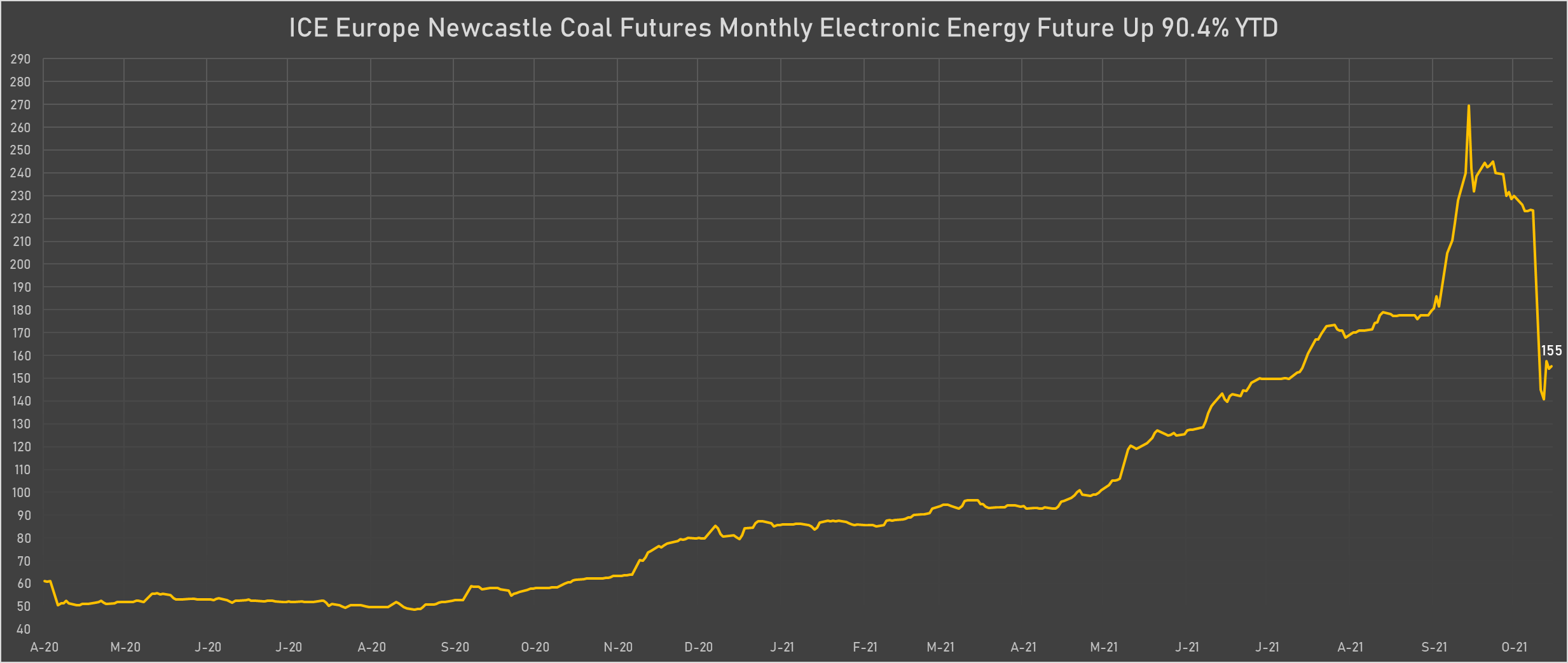

- ICE Europe Newcastle Coal Monthly down -30.5% (YTD: 93.0%), now at 155.40

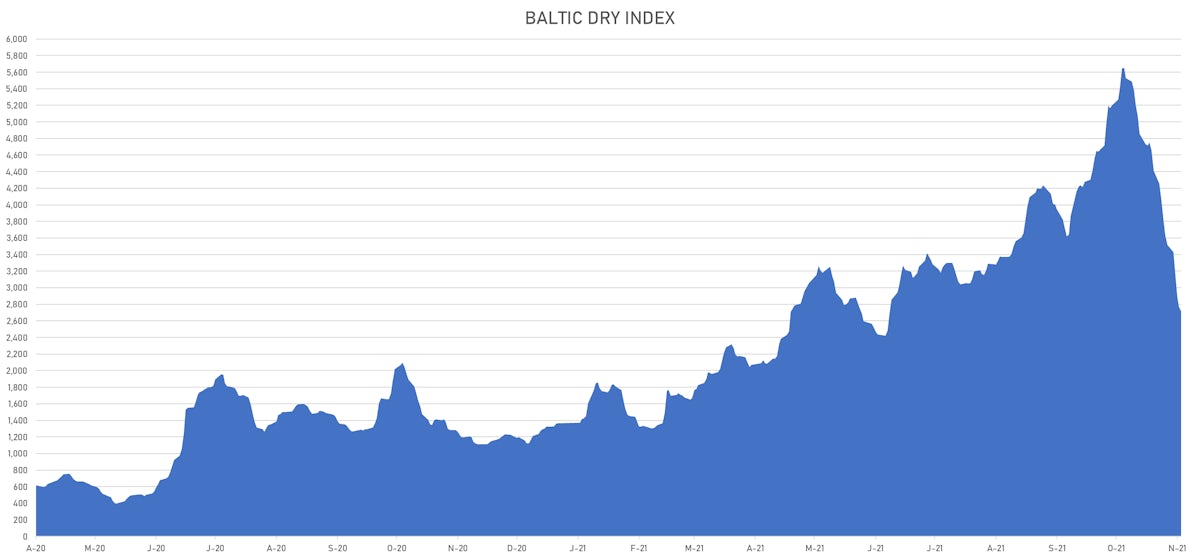

- Baltic Exchange Capesize Index down -24.6% (YTD: 63.5%), now at 3,280.00

- Baltic Exchange Dry index down -22.8% (YTD: 98.8%), now at 2,715.00

- SGX Iron Ore 62% China CFR Swap Monthly down -22.7% (YTD: -39.9%), now at 93.72

- Baltic Exchange Supramax Index down -22.2% (YTD: 132.5%), now at 2,416.00

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -22.1% (YTD: -39.4%), now at 97.17

- Baltic Exchange Panamax Index down -21.2% (YTD: 131.8%), now at 3,071.00

- Baltic Exchange Handysize Index down -12.5% (YTD: 154.9%), now at 1,726.00

- DCE Iron Ore Continuation Month 1 down -8.6% (YTD: -45.6%), now at 586.50

- SHFE Aluminium down -7.5% (YTD: 19.4%), now at 19,095.00

- SHFE Rubber down -6.6% (YTD: -5.0%), now at 12,795.00

- SHFE Rebar down -6.6% (YTD: 6.4%), now at 4,600.00

- ICE-US Cocoa down -5.8% (YTD: -7.9%), now at 2,401.00

- DCE Coking Coal Continuation Month 1 down -5.8% (YTD: 126.6%), now at 3,400.00

- Shanghai International Exchange TSR 20 Rubber down -5.7% (YTD: 10.9%), now at 10,850.00

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

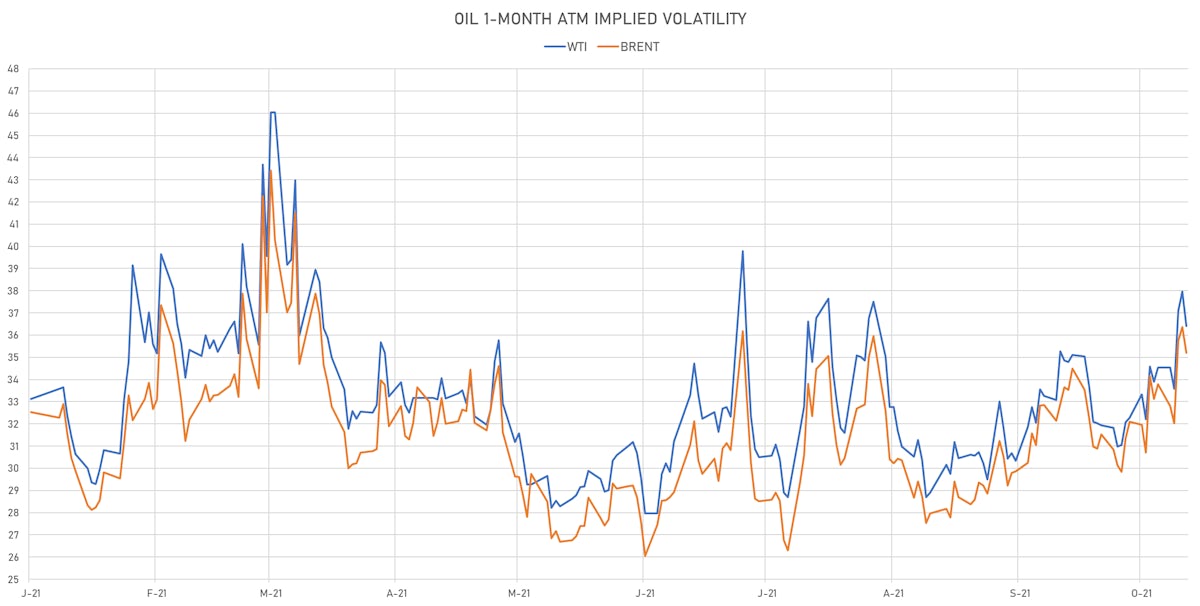

ENERGY

- Light Sweet Crude reduced net long position

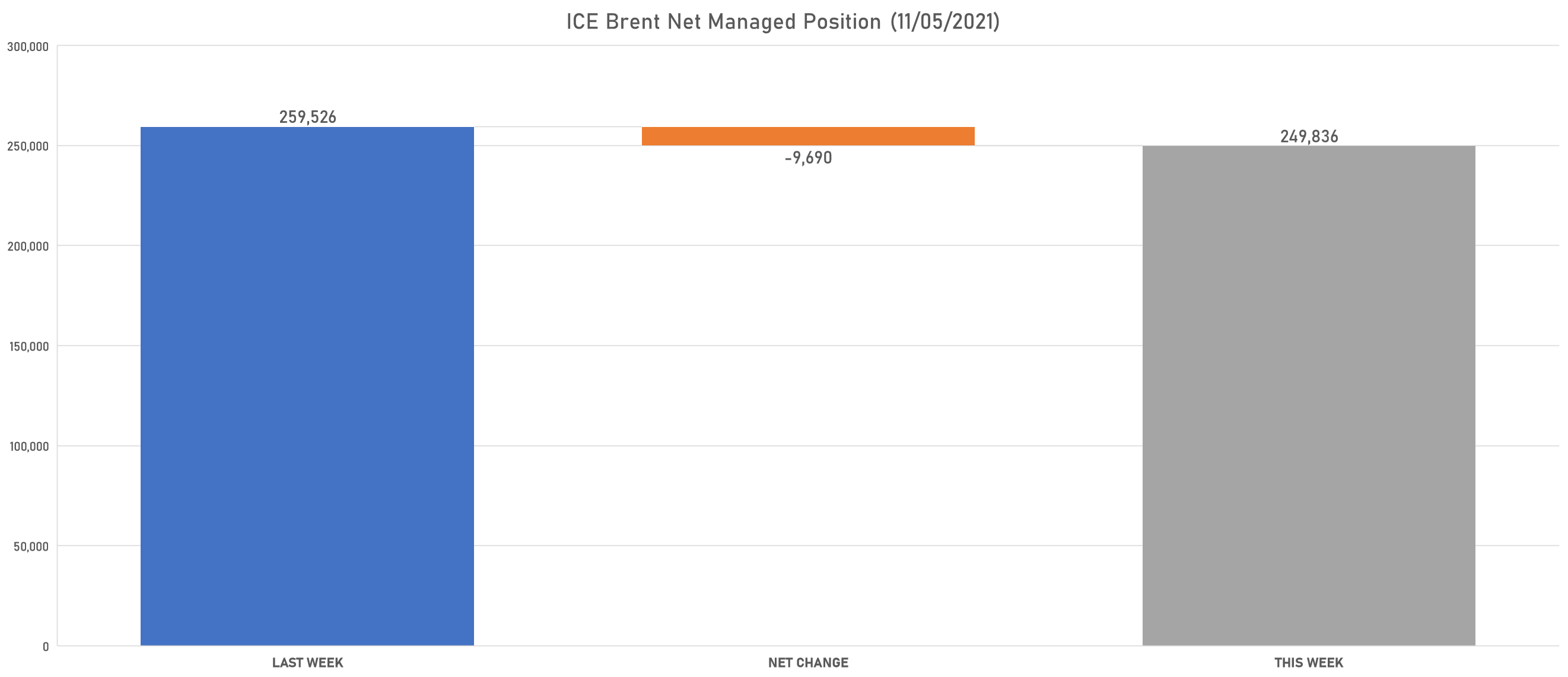

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum increased net long position

- Palladium increased net short position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat turned to net long

- Corn increased net long position

- Rough Rice turned to net short

- Oats increased net long position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal reduced net short position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle increased net short position

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net short position

- Sugar No.11 increased net long position

- White Sugar increased net long position

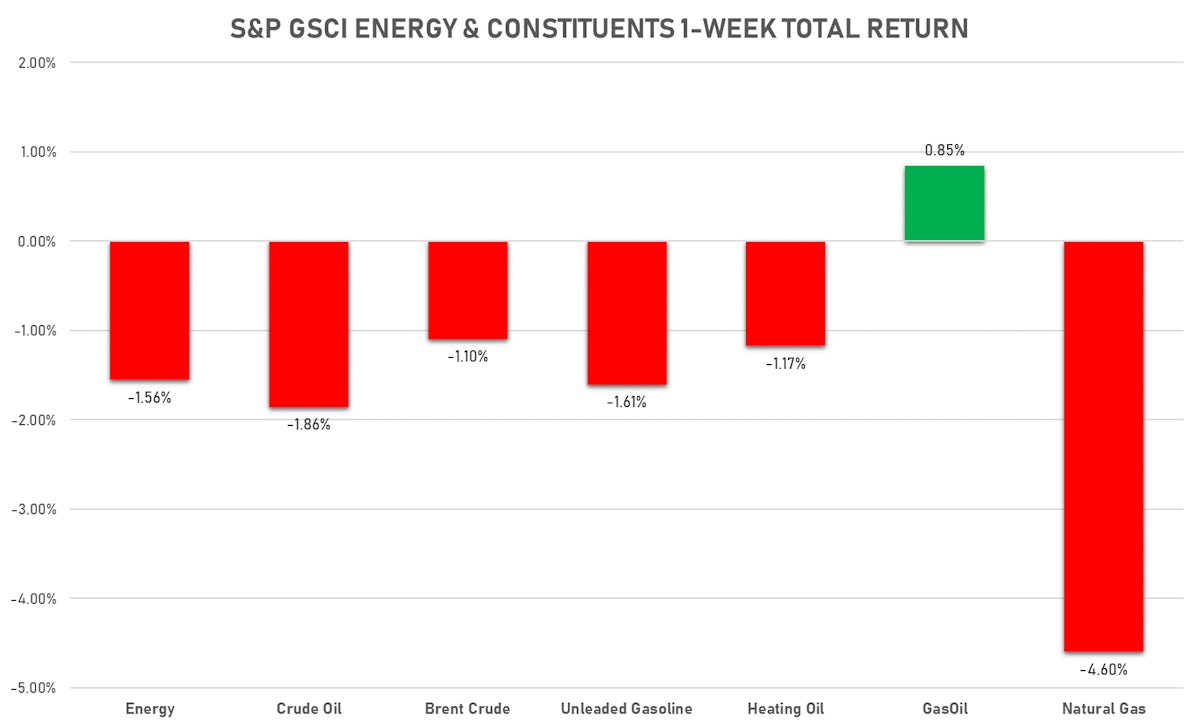

ENERGY THIS WEEK

- WTI crude front month currently at US$ 81.27 per barrel, down -2.8% (YTD: +67.5%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 82.74 per barrel, down -1.9% (YTD: +59.7%); 6-month term structure in tightening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 155.40 per tonne, down -30.5% (YTD: +93.0%)

- Natural Gas (Henry Hub) currently at US$ 5.52 per MMBtu, up 1.7% (YTD: +117.3%)

- Gasoline (NYMEX) currently at US$ 2.32 per gallon, down -5.7% (YTD: +64.8%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 720.75 per tonne, up 0.3% (YTD: +71.3%)

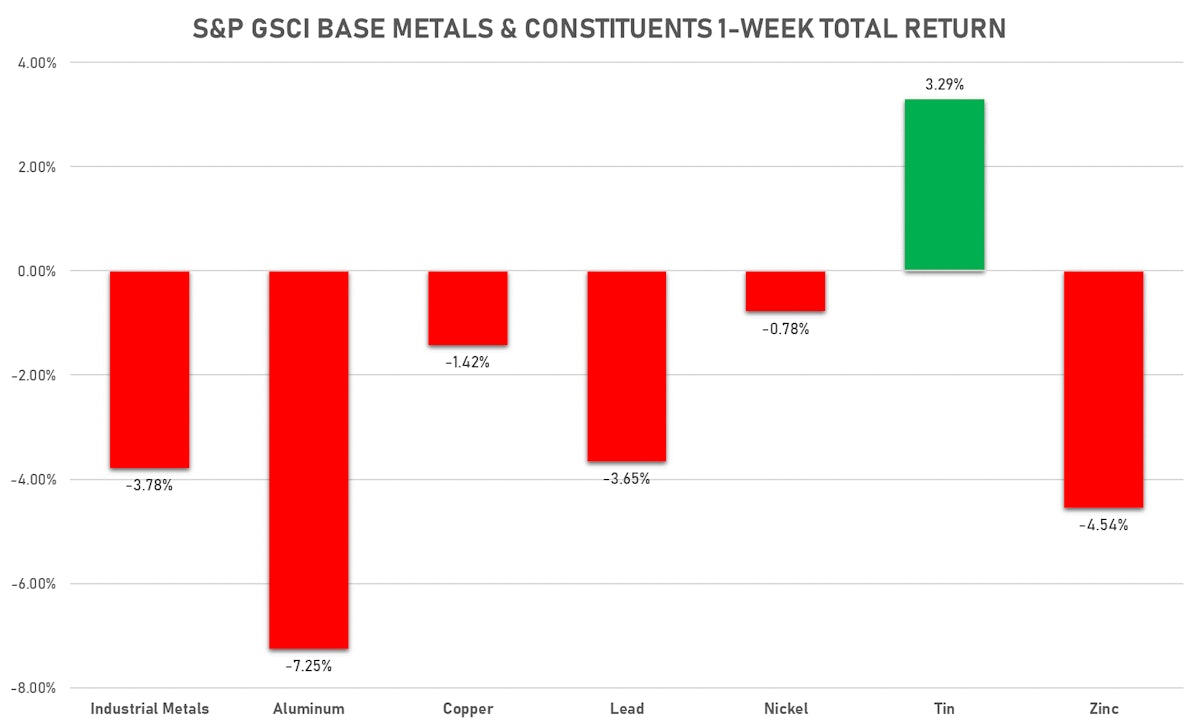

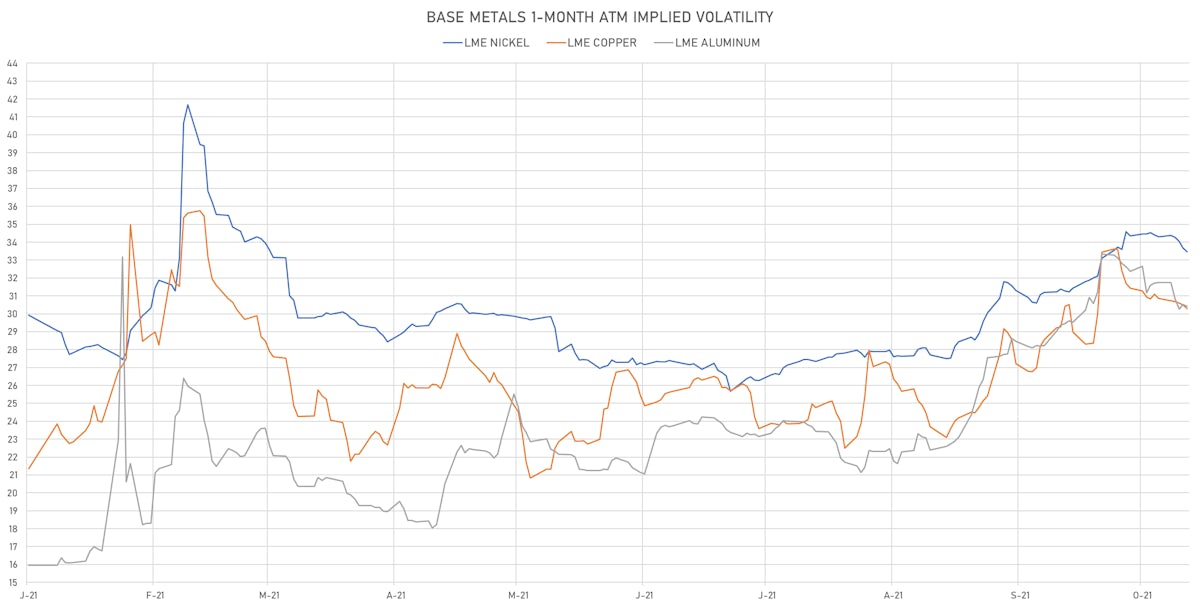

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.35 per pound, down -0.6% (YTD: +23.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 586.50 per tonne, down -8.6% (YTD: -45.6%)

- Aluminium (Shanghai) currently at CNY 19,095 per tonne, down -7.5% (YTD: +19.4%)

- Nickel (Shanghai) currently at CNY 143,980 per tonne, down -2.4% (YTD: +14.6%)

- Lead (Shanghai) currently at CNY 15,610 per tonne, down -1.3% (YTD: +5.9%)

- Rebar (Shanghai) currently at CNY 4,600 per tonne, down -6.6% (YTD: +6.4%)

- Tin (Shanghai) currently at CNY 291,630 per tonne, up 8.3% (YTD: +93.9%)

- Zinc (Shanghai) currently at CNY 22,960 per tonne, down -2.9% (YTD: +10.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 411,000 per tonne, up 1.7% (YTD: +50.0%)

- Lithium (Shanghai) spot price currently at CNY 1,015,000 per tonne, up 6.3% (YTD: +109.3%)

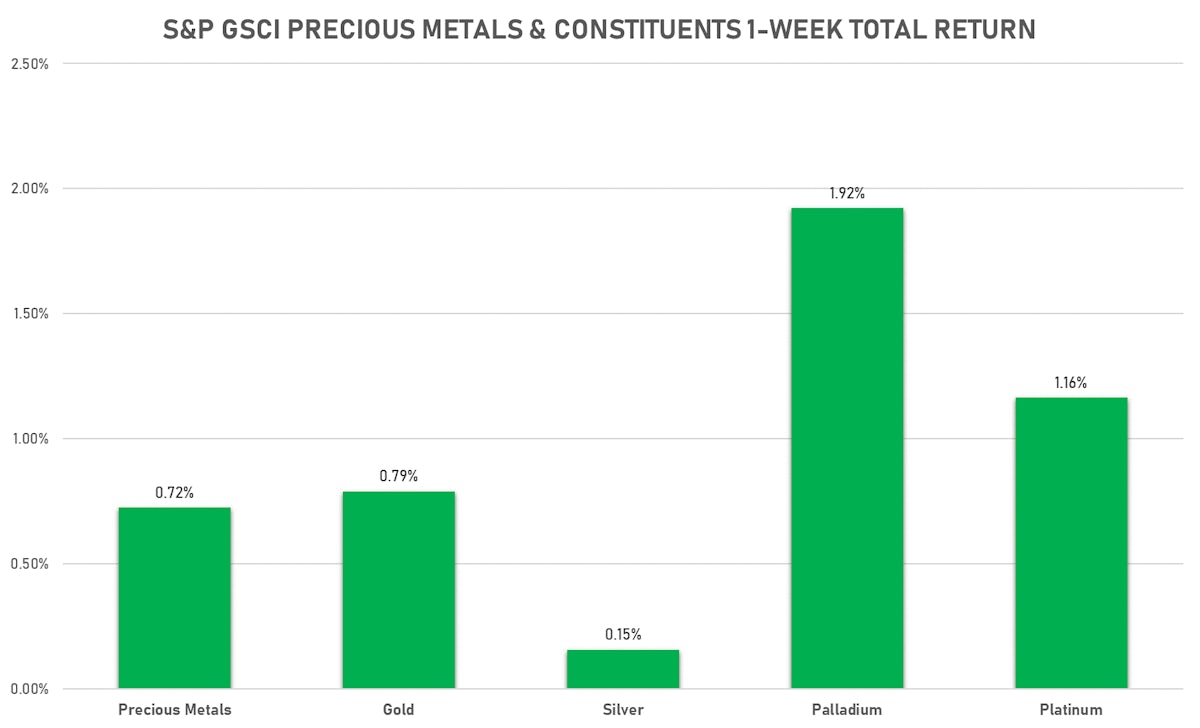

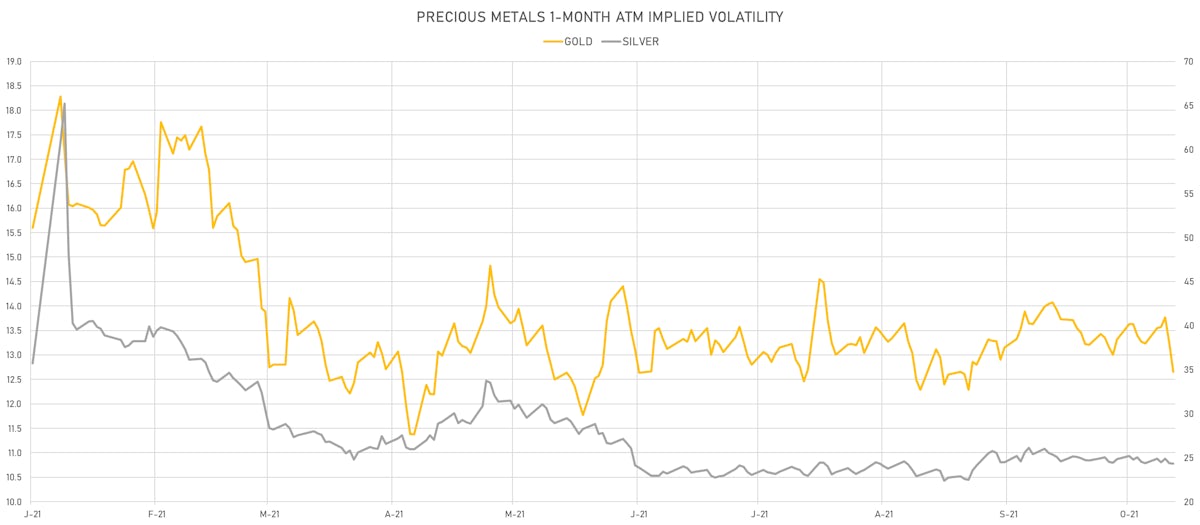

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,817.63 per troy ounce, up 2.0% (YTD: -4.2%)

- Gold 1-Month ATM implied volatility currently at 12.25, down -4.4% (YTD: -21.4%)

- Silver spot currently at US$ 24.15 per troy ounce, up 1.1% (YTD: -8.4%)

- Silver 1-Month ATM implied volatility currently at 23.10, down 0.0% (YTD: -42.7%)

- Palladium spot currently at US$ 2,034.57 per troy ounce, up 1.5% (YTD: -16.8%)

- Platinum spot currently at US$ 1,033.30 per troy ounce, up 1.5% (YTD: -3.3%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,350 per troy ounce, up 1.8% (YTD: -15.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,500 per troy ounce, unchanged (YTD: +73.1%)

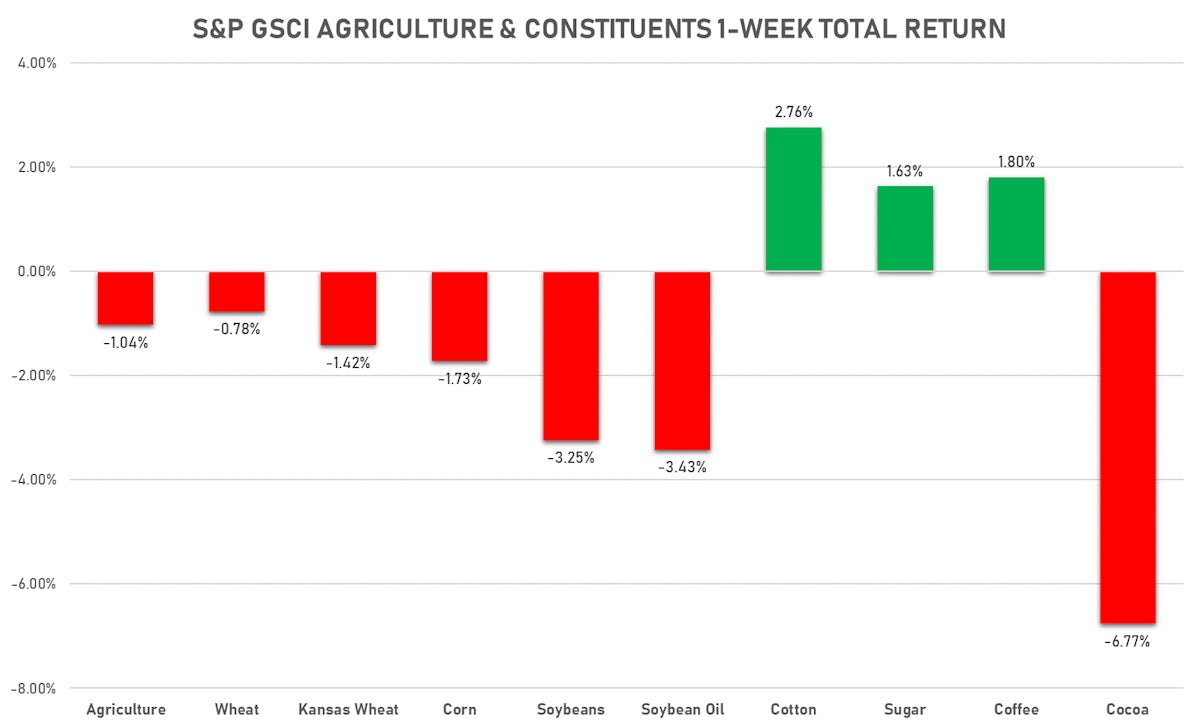

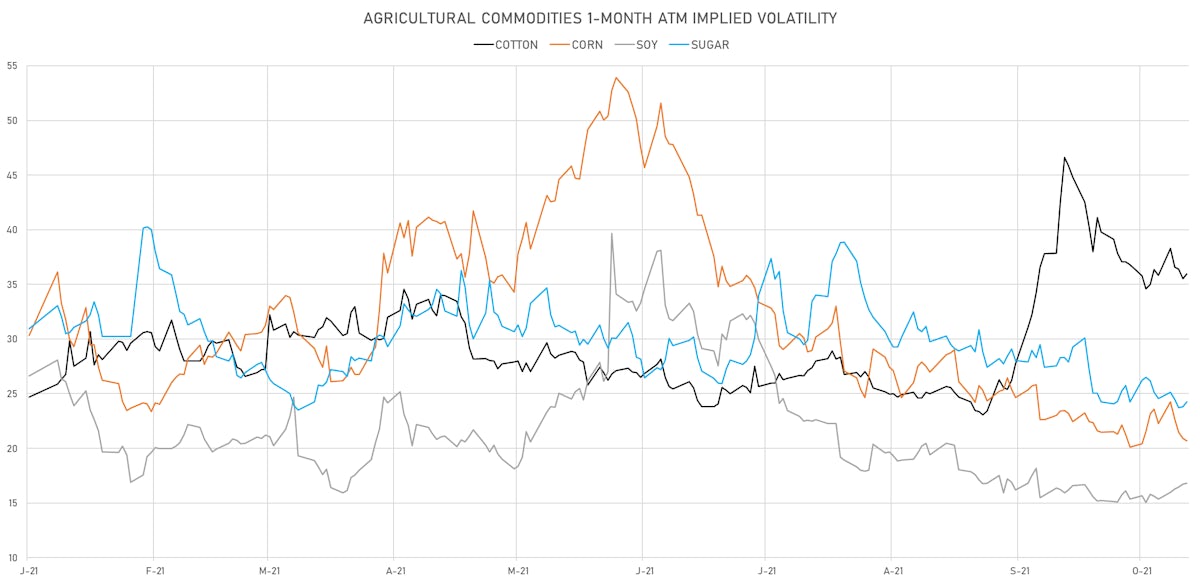

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 131.80 cents per pound, up 3.5% (YTD: +16.7%)

- Lean Hogs (CME) currently at US$ 76.55 cents per pound, up 0.6% (YTD: +8.9%)

- Rough Rice (CBOT) currently at US$ 13.29 cents per hundredweight, up 0.1% (YTD: +7.2%)

- Soybeans Composite (CBOT) currently at US$ 1,192.25 cents per bushel, down -3.5% (YTD: -9.4%)

- Corn (CBOT) currently at US$ 553.00 cents per bushel, down -2.7% (YTD: +14.3%)

- Wheat Composite (CBOT) currently at US$ 766.50 cents per bushel, down -0.8% (YTD: +19.7%)

- Sugar No.11 (ICE US) currently at US$ 19.98 cents per pound, up 3.5% (YTD: +28.7%)

- Cotton No.2 (ICE US) currently at US$ 117.09 cents per pound, up 1.8% (YTD: +49.6%)

- Cocoa (ICE US) currently at US$ 2,401 per tonne, down -5.8% (YTD: -7.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,043 per tonne, up 3.3% (YTD: +59.3%)

- Random Length Lumber (CME) currently at US$ 615.00 per 1,000 board feet, up 4.0% (YTD: -29.6%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,850 per tonne, down -5.7% (YTD: +10.9%)

- Soybean Oil Composite (CBOT) currently at US$ 58.78 cents per pound, down -4.1% (YTD: +35.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,330 per tonne, up 0.2% (YTD: +36.7%)

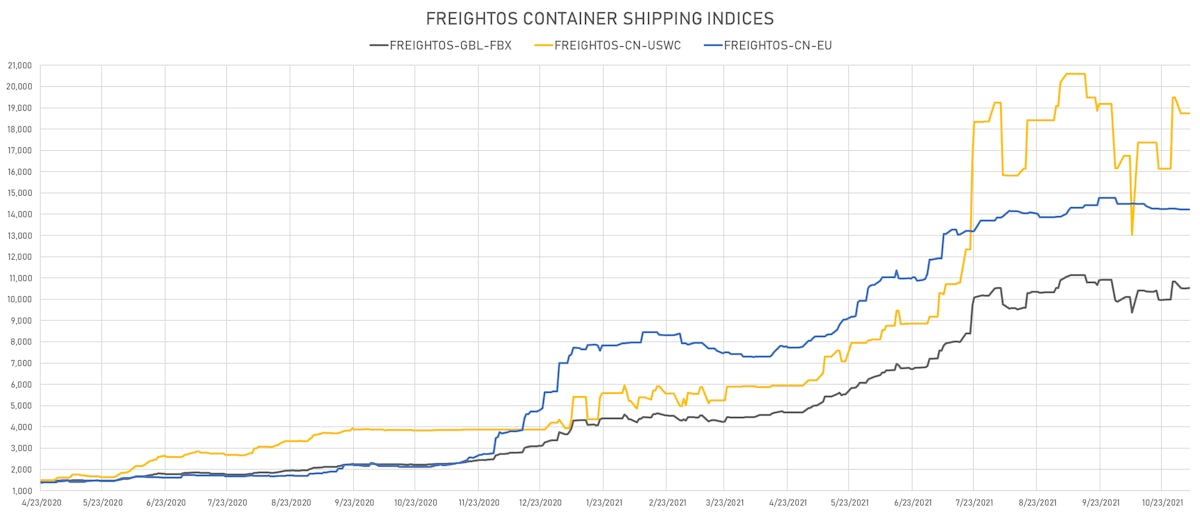

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,715, down -22.8% (YTD: +98.8%)

- Freightos China To North America West Coast Container Index currently at 18,730, down -3.8% (YTD: +346.0%)

- Freightos North America West Coast To China Container Index currently at 1,158, up 8.8% (YTD: +123.7%)

- Freightos North America East Coast To Europe Container Index currently at 397, unchanged (YTD: +9.4%)

- Freightos Europe To North America East Coast Container Index currently at 7,305, up 0.9% (YTD: +290.8%)

- Freightos China To North Europe Container Index currently at 14,219, down -0.3% (YTD: +151.1%)

- Freightos North Europe To China Container Index currently at 1,290, down -3.2% (YTD: -6.2%)

- Freightos Europe To South America West Coast Container Index currently at 5,227, down -6.0% (YTD: +209.0%)

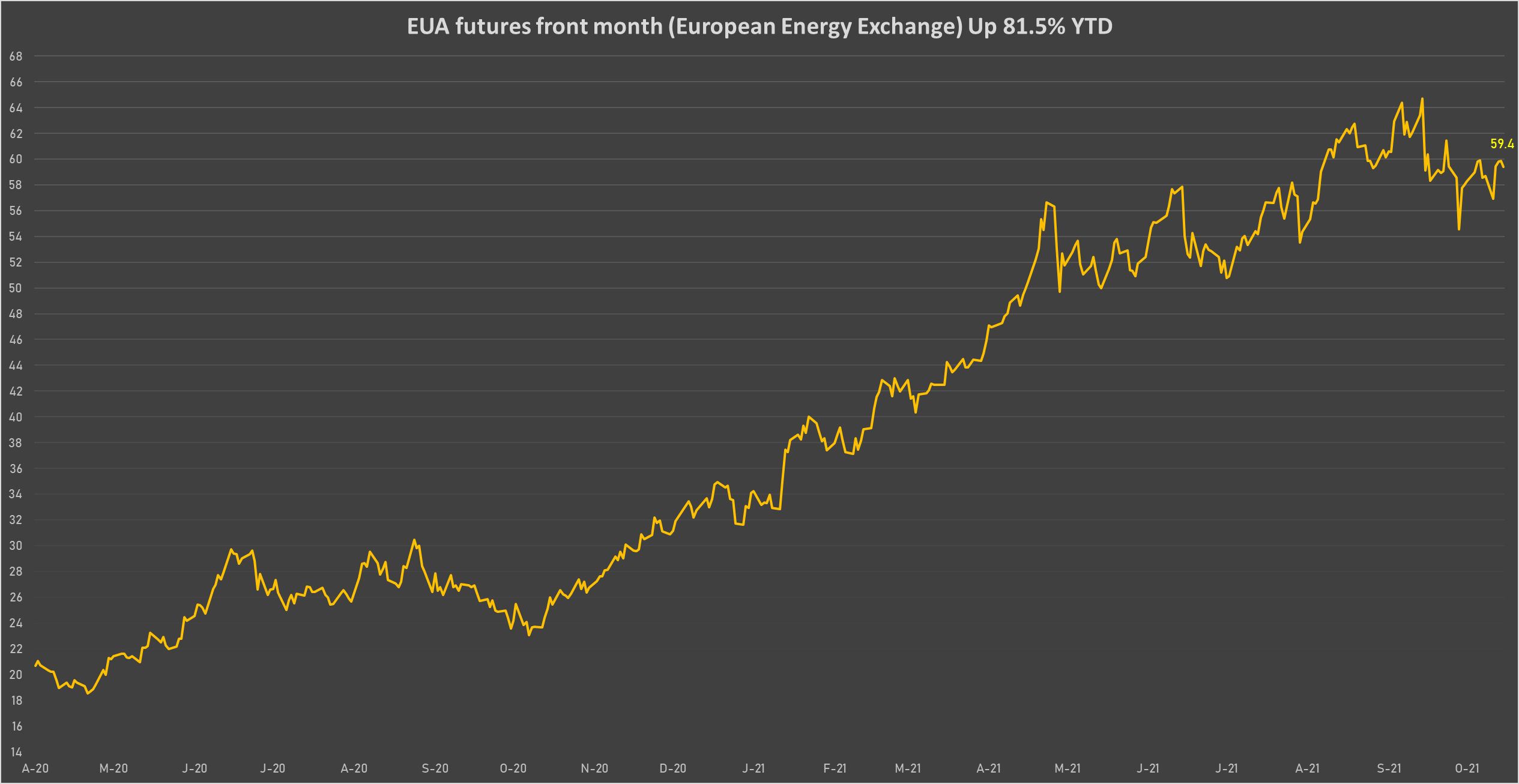

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 59.39 per tonne, up 1.2% (YTD: +81.5%)