Commodities

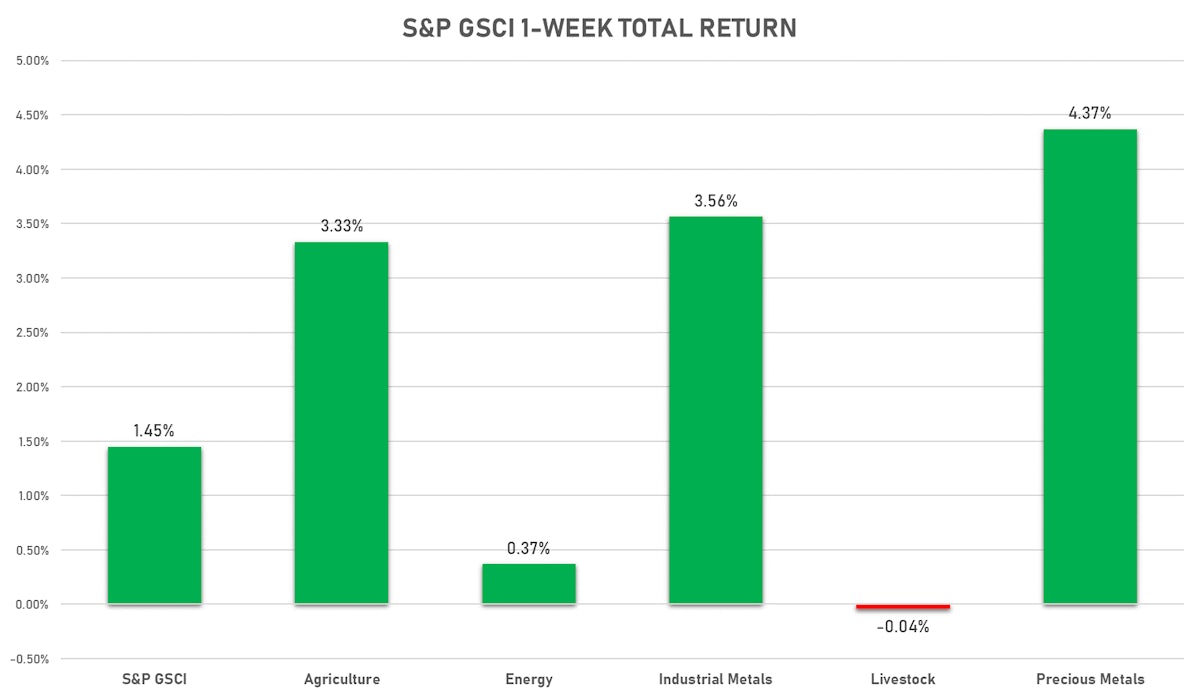

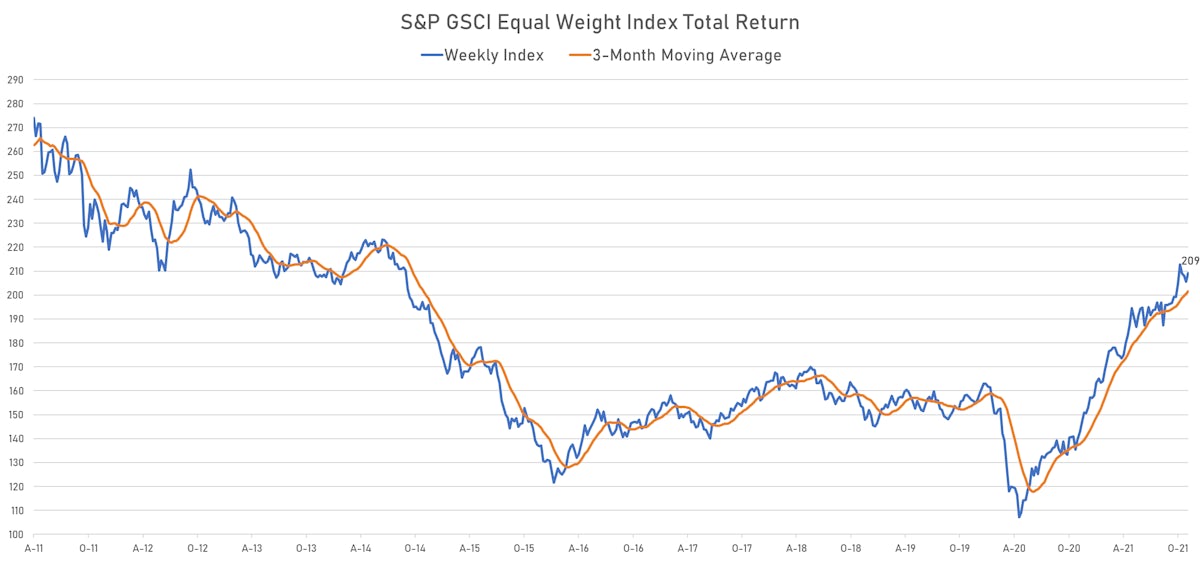

Good Week For Precious And Industrial Metals, Helped By Inflationary Pressures And A Rebound In Chinese Real Estate

The big losers this week were natural gas, thermal coal, coke, and iron ore, as energy supply worries disappear and the market is now concerned with weaker Chinese demand growth in 2022

Published ET

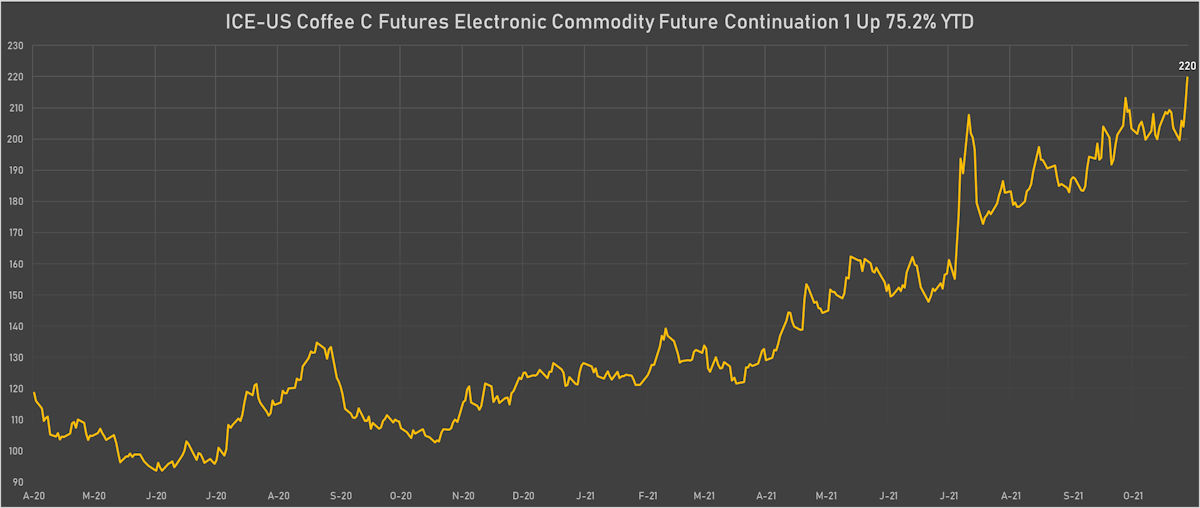

ICE Front-Month Coffee C Future Prices At Seven-Year High Up, Now Up 75% YTD | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS THIS WEEK

- CBoT Soybean Meal up 8.8% (YTD: -16.6%), now at 362.10

- ICE-US Coffee C up 7.9% (YTD: 71.3%), now at 219.55

- DCE Iron Ore Continuation Month 1 up 7.9% (YTD: -41.3%), now at 554.00

- CBoT Wheat up 6.6% (YTD: 27.6%), now at 817.00

- ICE European Union Allowance (EUA) Yearly up 6.5% (YTD: 93.4%), now at 63.27

- EEX European-Carbon- Secondary Trading up 6.5% (YTD: 97.4%), now at 63.69

- Coffee Robusta Vietnam Grade 1 Wet Pol spot up 5.3% (YTD: 47.0%), now at 2,035.00

- SHFE Bitumen Continuation Month 1 up 4.8% (YTD: 28.3%), now at 3,078.00

- Silver spot up 4.7% (YTD: -4.1%), now at 25.29

- CBoT Rough Rice up 4.6% (YTD: 12.1%), now at 14.12

- Platinum spot up 4.6% (YTD: 1.1%), now at 1,081.04

- CBoT Corn up 4.4% (YTD: 19.3%), now at 577.25

- DCE RBD Palm Oil up 4.0% (YTD: 47.9%), now at 10,028.00

- Palladium spot up 3.7% (YTD: -13.7%), now at 2,110.18

- SHFE Aluminum up 3.5% (YTD: 23.6%), now at 19,600.00

NOTABLE LOSERS THIS WEEK

- Zhengzhou Exchange Thermal Coal down -15.1% (YTD: 27.0%), now at 1,004.80

- NYMEX Henry Hub Natural Gas down -13.1% (YTD: 88.7%), now at 04.79

- CME Random Length Lumber down -12.2% (YTD: -38.1%), now at 540.10

- DCE Coke down -4.2% (YTD: 39.3%), now at 3,422.00

- ICE Europe Newcastle Coal Monthly down -3.5% (YTD: 86.3%), now at 150.00

- SHFE Hot Rolled Coil down -3.2% (YTD: 7.1%), now at 4,860.00

- SHFE Rebar down -3.1% (YTD: 3.1%), now at 4,350.00

- ICE Europe Low Sulphur Gasoil down -3.1% (YTD: 66.0%), now at 698.50

- Johnson Matthey Iridium New York 0930 down -2.2% (YTD: 69.2%), now at 4,400.00

- NYMEX NY Harbor ULSD down -2.1% (YTD: 62.8%), now at 02.40

- SGX Iron Ore 62% China CFR Swap Monthly down -1.7% (YTD: -40.9%), now at 92.10

- CME Cattle(Feeder) down -1.7% (YTD: 12.5%), now at 156.25

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -1.1% (YTD: -40.1%), now at 93.63

- CME Lean Hogs down -0.9% (YTD: 8.0%), now at 75.88

- ICE Europe Brent Crude down -0.7% (YTD: 58.6%), now at 82.17

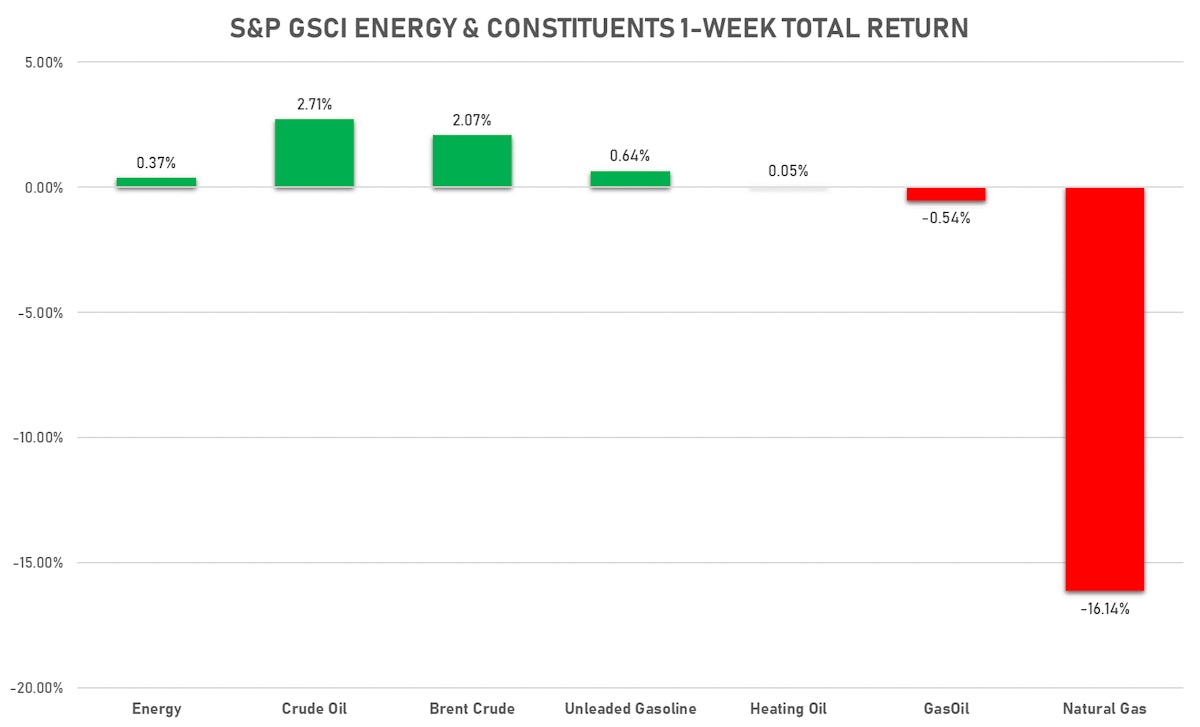

ENERGY THIS WEEK

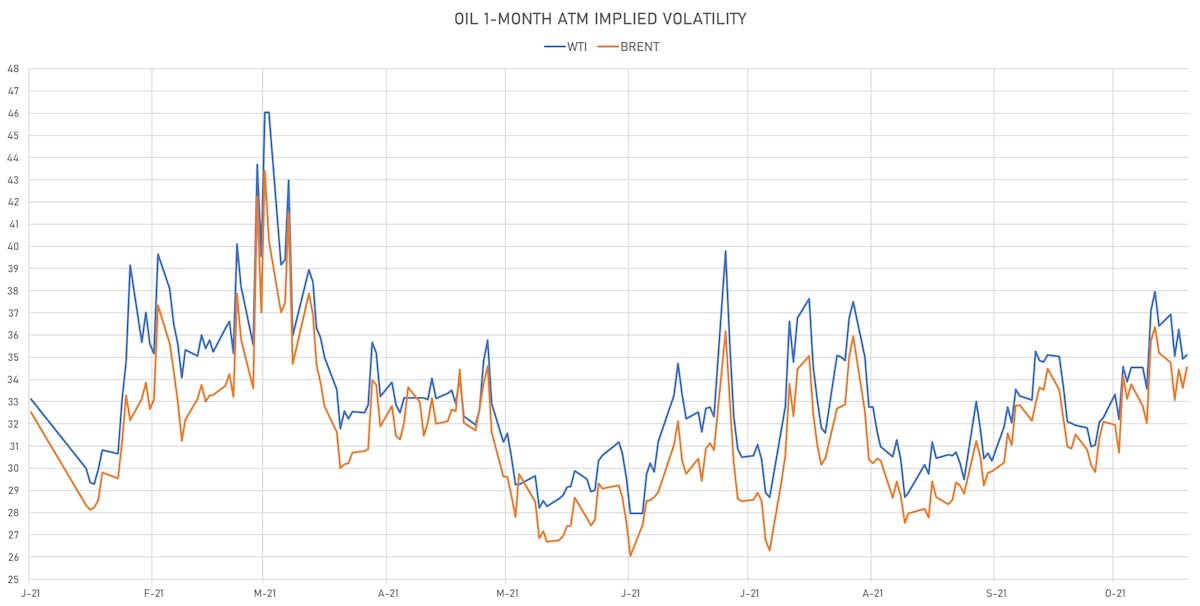

- WTI crude front month currently at US$ 80.79 per barrel, down -0.6% (YTD: +66.5%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 82.17 per barrel, down -0.7% (YTD: +58.6%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 150.00 per tonne, down -3.5% (YTD: +86.3%)

- Natural Gas (Henry Hub) currently at US$ 4.79 per MMBtu, down -13.1% (YTD: +88.7%)

- Gasoline (NYMEX) currently at US$ 2.31 per gallon, down -0.4% (YTD: +64.1%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 698.50 per tonne, down -3.1% (YTD: +66.0%)

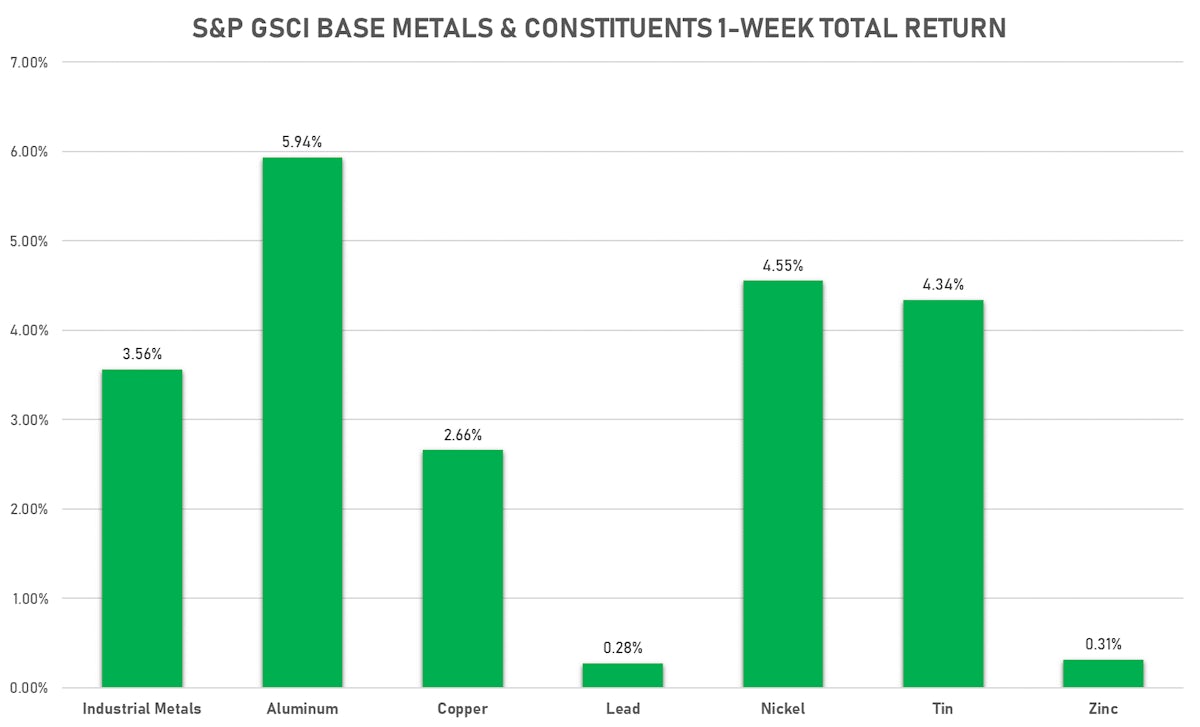

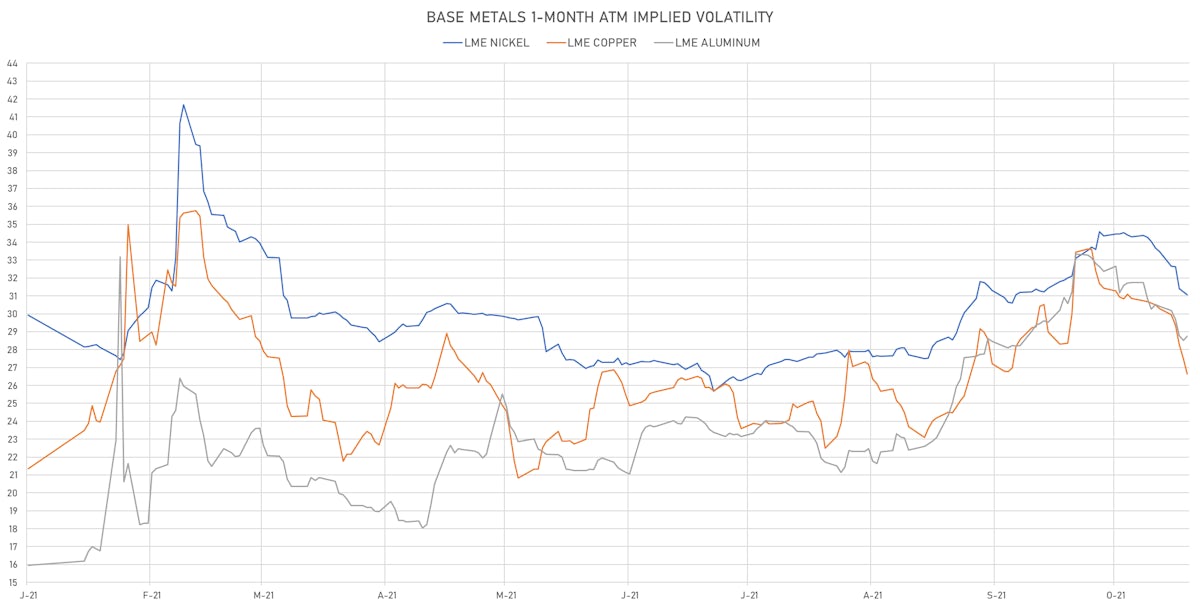

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.46 per pound, up 2.4% (YTD: +26.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 554.00 per tonne, up 7.9% (YTD: -41.3%)

- Aluminum (Shanghai) currently at CNY 19,600 per tonne, up 3.5% (YTD: +23.6%)

- Nickel (Shanghai) currently at CNY 146,580 per tonne, up 3.4% (YTD: +18.4%)

- Lead (Shanghai) currently at CNY 15,470 per tonne, down -0.6% (YTD: +5.3%)

- Rebar (Shanghai) currently at CNY 4,350 per tonne, down -3.1% (YTD: +3.1%)

- Tin (Shanghai) currently at CNY 298,000 per tonne, up 2.5% (YTD: +98.6%)

- Zinc (Shanghai) currently at CNY 23,330 per tonne, up 2.1% (YTD: +12.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 413,500 per tonne, up 0.6% (YTD: +50.9%)

- Lithium (Shanghai) spot price currently at CNY 1,055,000 per tonne, up 3.9% (YTD: +117.5%)

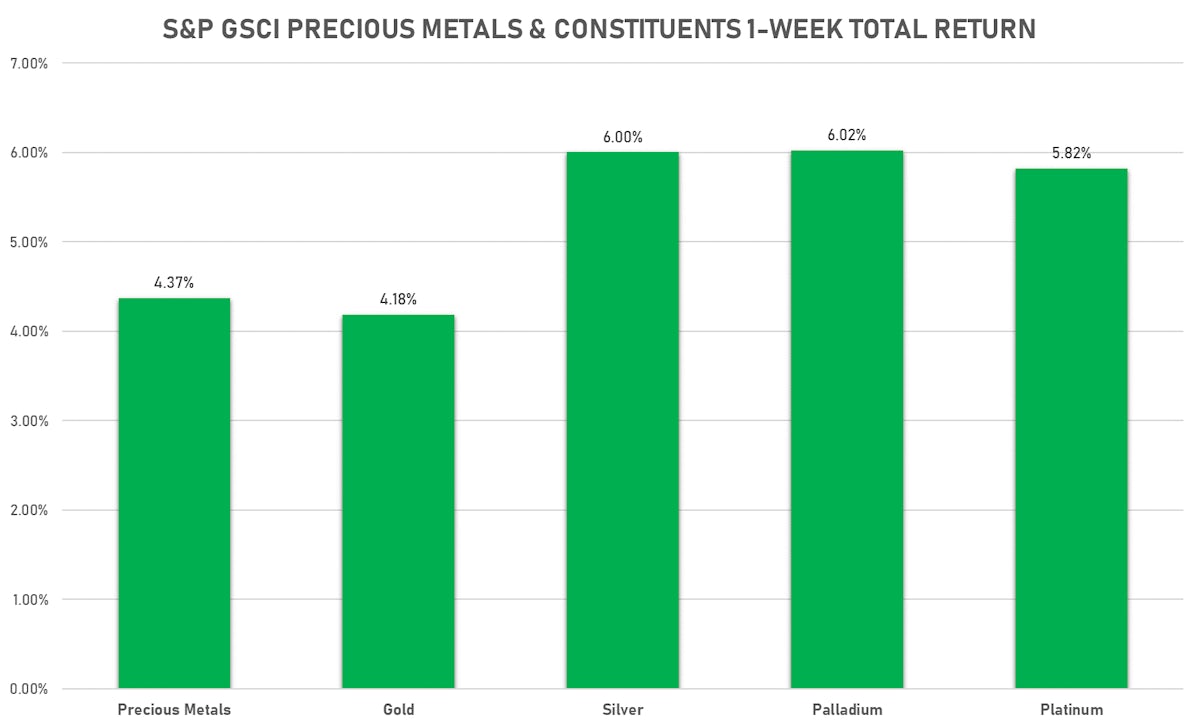

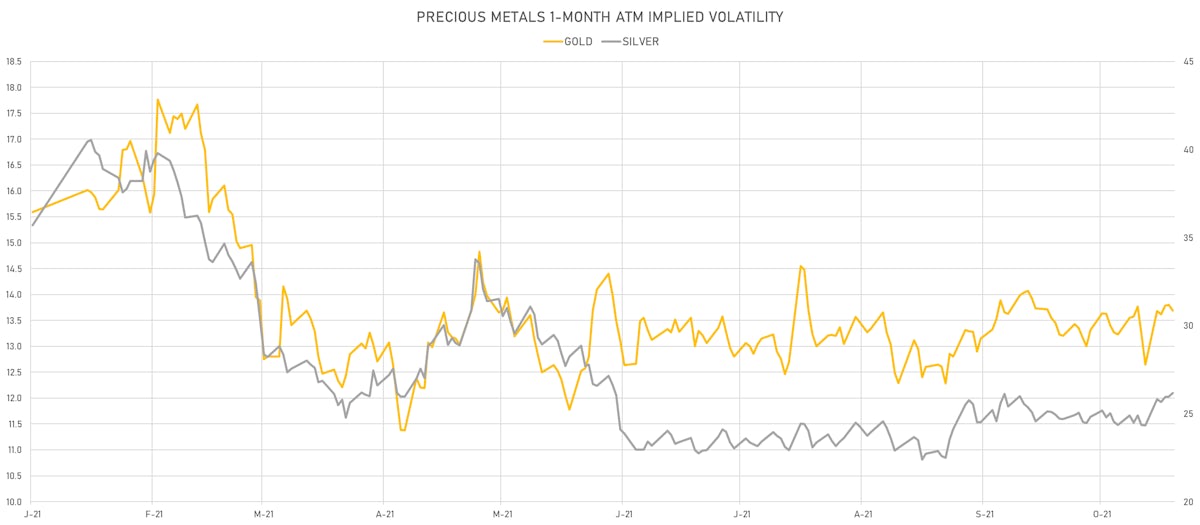

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,864.47 per troy ounce, up 2.6% (YTD: -1.7%)

- Gold 1-Month ATM implied volatility currently at 13.32, up 8.2% (YTD: -15.0%)

- Silver spot currently at US$ 25.29 per troy ounce, up 4.7% (YTD: -4.1%)

- Silver 1-Month ATM implied volatility currently at 24.95, up 7.8% (YTD: -38.3%)

- Palladium spot currently at US$ 2,110.18 per troy ounce, up 3.7% (YTD: -13.7%)

- Platinum spot currently at US$ 1,081.04 per troy ounce, up 4.6% (YTD: +1.1%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,350 per troy ounce, unchanged (YTD: -15.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,400 per troy ounce, down -2.2% (YTD: +69.2%)

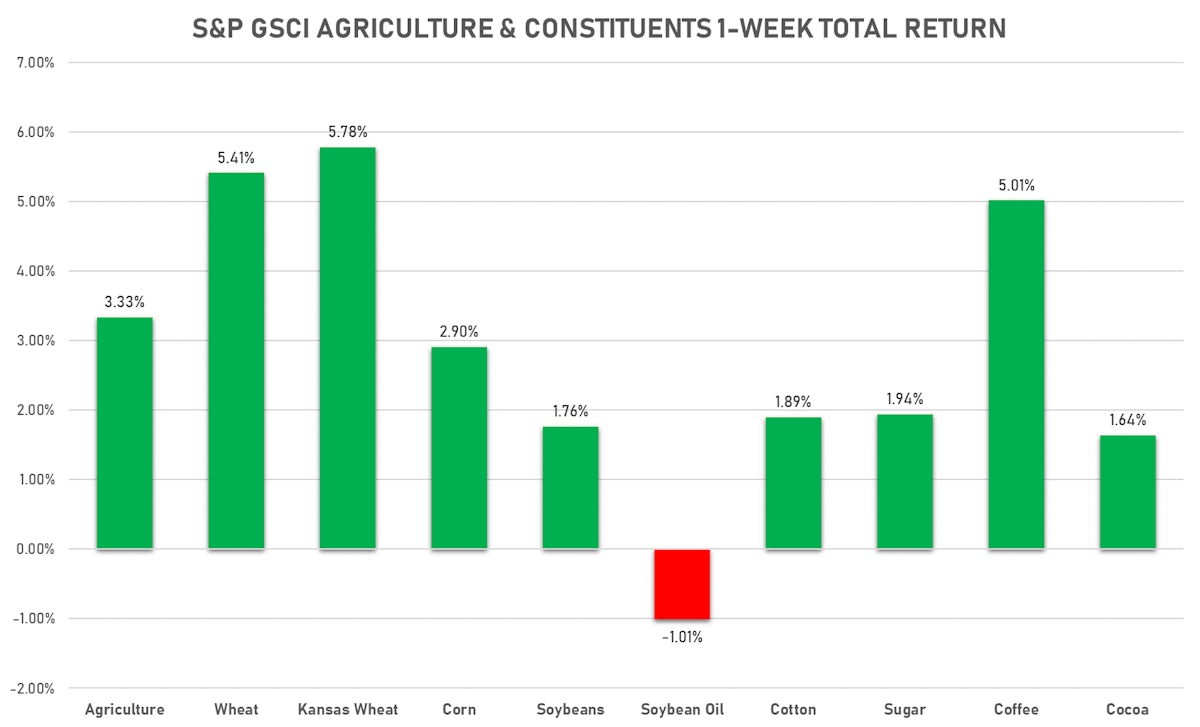

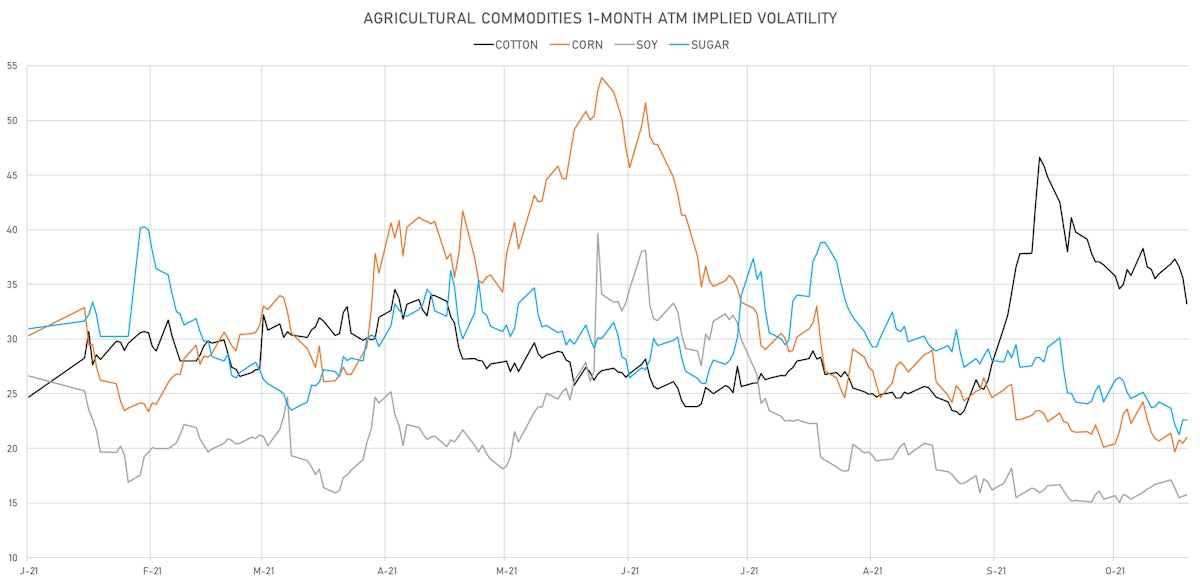

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 132.13 cents per pound, up 0.2% (YTD: +17.0%)

- Lean Hogs (CME) currently at US$ 75.88 cents per pound, down -0.9% (YTD: +8.0%)

- Rough Rice (CBOT) currently at US$ 14.12 cents per hundredweight, up 4.6% (YTD: +12.1%)

- Soybeans Composite (CBOT) currently at US$ 1,244.25 cents per bushel, up 3.5% (YTD: -6.2%)

- Corn (CBOT) currently at US$ 577.25 cents per bushel, up 4.4% (YTD: +19.3%)

- Wheat Composite (CBOT) currently at US$ 817.00 cents per bushel, up 6.6% (YTD: +27.6%)

- Sugar No.11 (ICE US) currently at US$ 20.01 cents per pound, up 0.4% (YTD: +29.2%)

- Cotton No.2 (ICE US) currently at US$ 117.50 cents per pound, up 0.7% (YTD: +50.7%)

- Cocoa (ICE US) currently at US$ 2,462 per tonne, up 3.0% (YTD: -5.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,137 per tonne, up 1.9% (YTD: +62.3%)

- Random Length Lumber (CME) currently at US$ 540.10 per 1,000 board feet, down -12.2% (YTD: -38.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,140 per tonne, up 0.5% (YTD: +11.5%)

- Soybean Oil Composite (CBOT) currently at US$ 58.97 cents per pound, up 0.3% (YTD: +36.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,405 per tonne, up 1.6% (YTD: +38.9%)

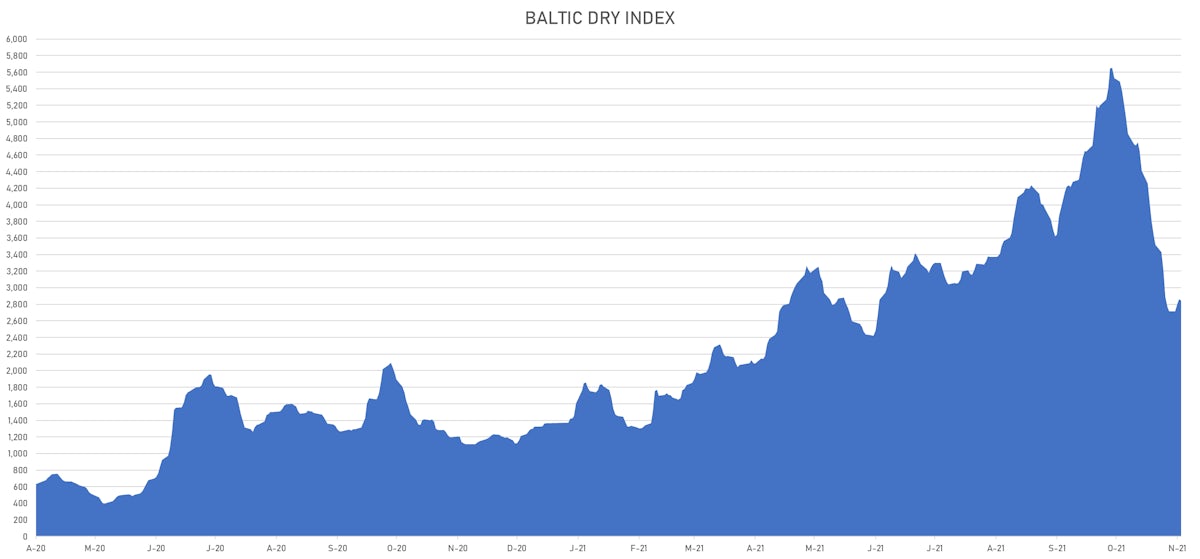

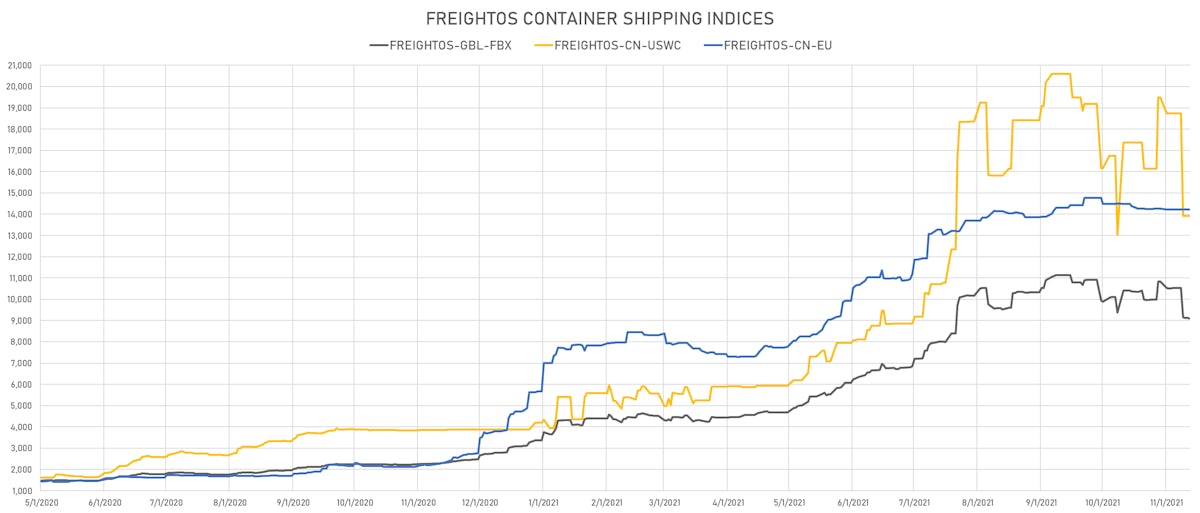

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,844, up 2.7% (YTD: +108.2%)

- Freightos China To North America West Coast Container Index currently at 13,924, down -25.7% (YTD: +231.6%)

- Freightos North America West Coast To China Container Index currently at 800, down -30.9% (YTD: +54.5%)

- Freightos North America East Coast To Europe Container Index currently at 495, up 24.7% (YTD: +36.4%)

- Freightos Europe To North America East Coast Container Index currently at 7,447, up 1.9% (YTD: +298.4%)

- Freightos China To North Europe Container Index currently at 14,219, unchanged (YTD: +151.1%)

- Freightos North Europe To China Container Index currently at 1,303, up 1.0% (YTD: -5.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,501, up 5.2% (YTD: +225.2%)

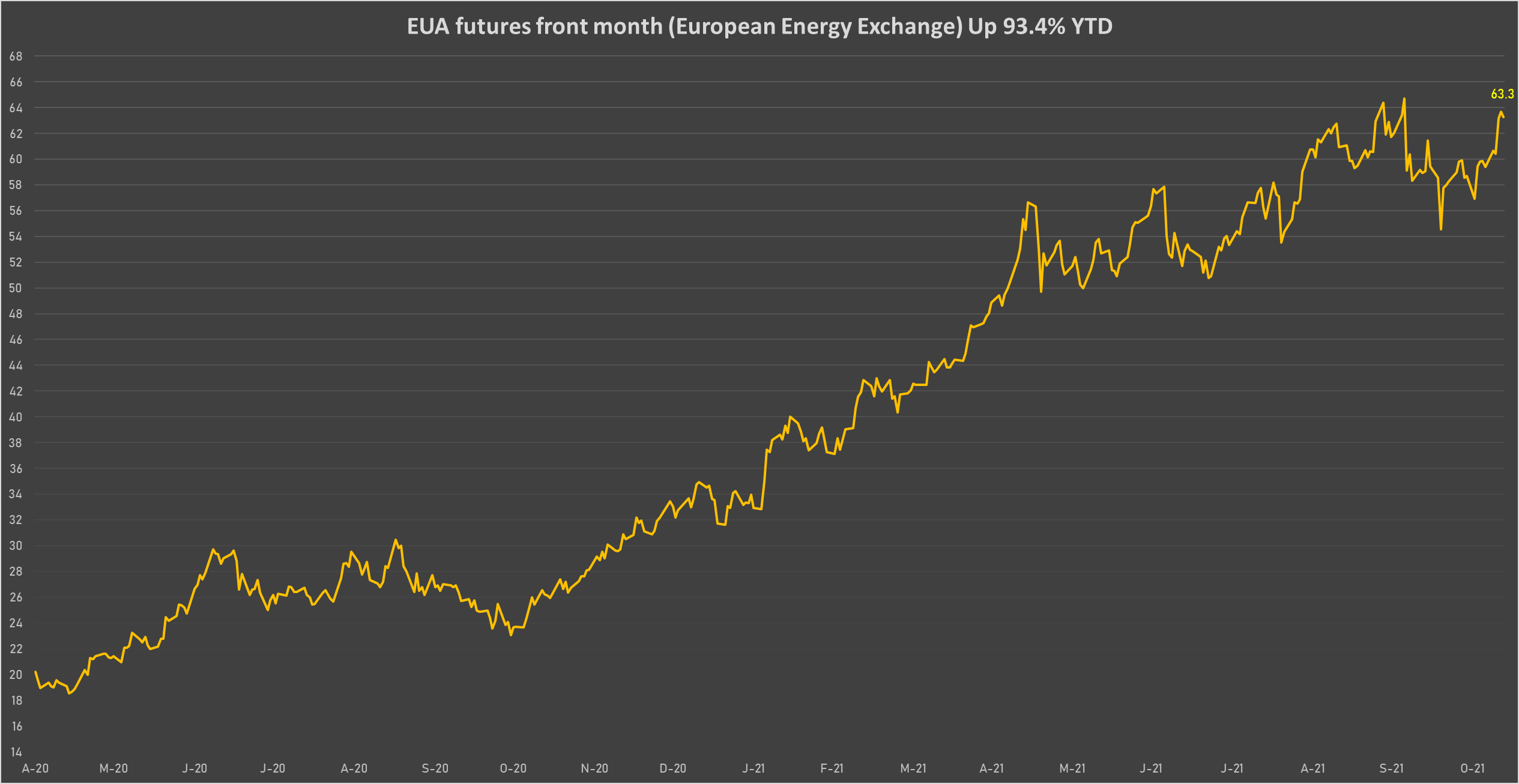

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 63.27 per tonne, up 6.5% (YTD: +93.4%)