Commodities

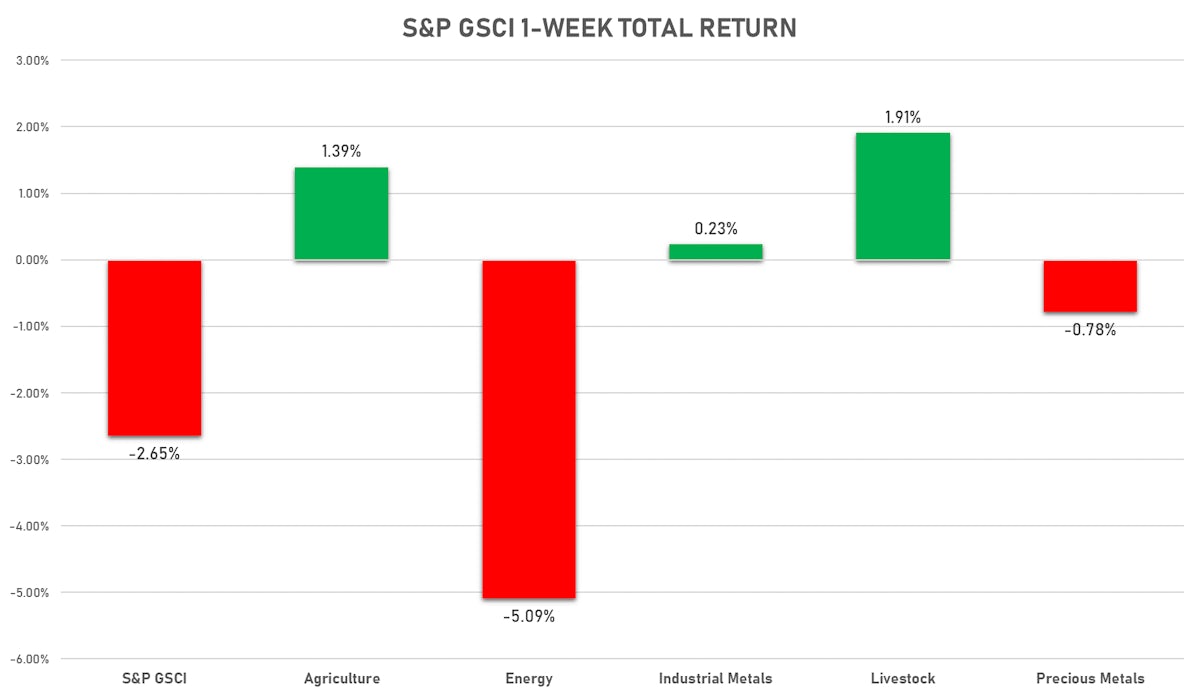

Crude Oil Fell This Week As European Countries Locked Down Again, While Natural Gas Gained As Russia Is Pressured On Ukraine, Nord Stream 2

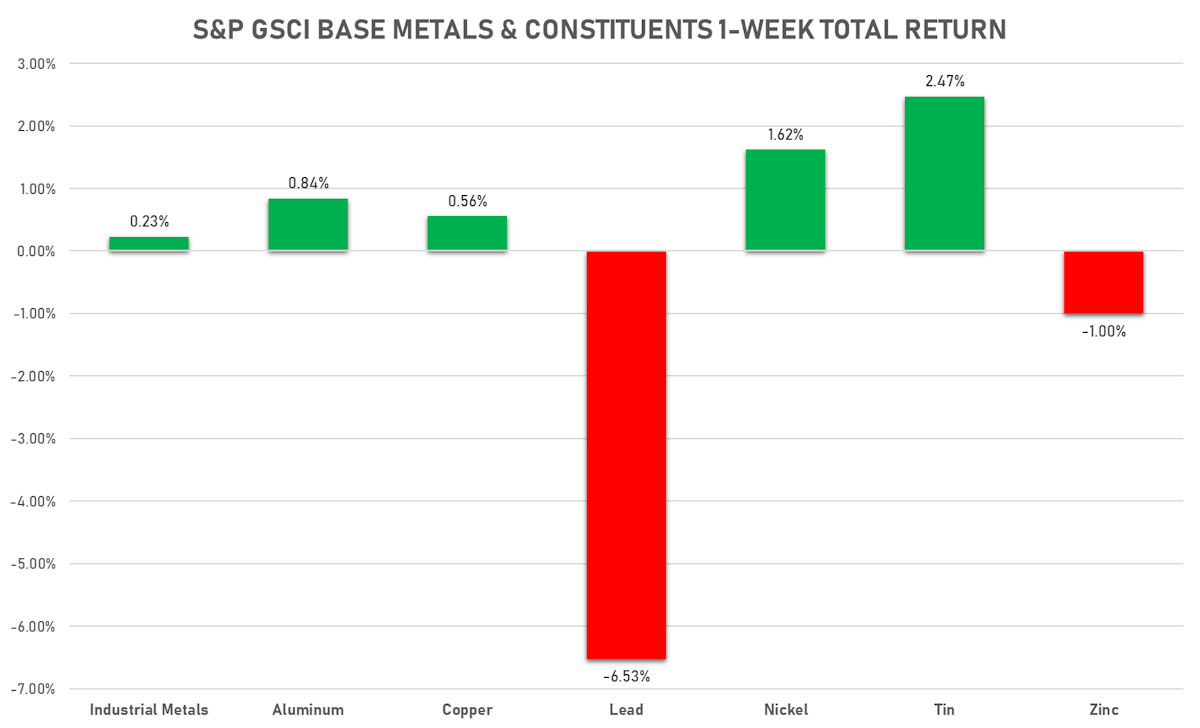

After a poor start this week, base metals ended pretty strong as positive news came out of the Chinese property sector, with rules on land sales being eased and real estate developers regaining market confidence after capital raises

Published ET

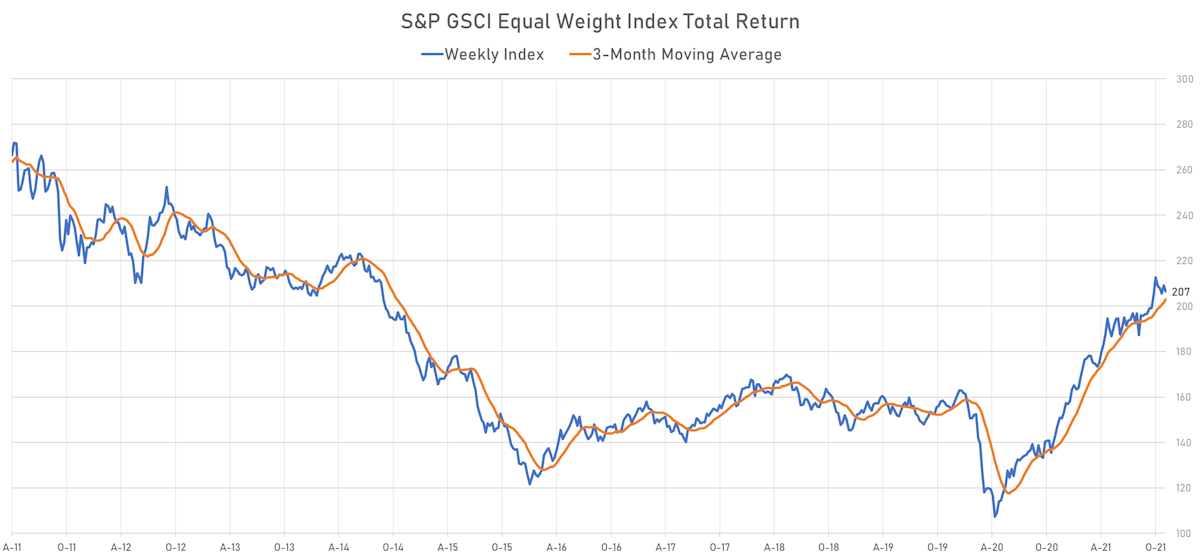

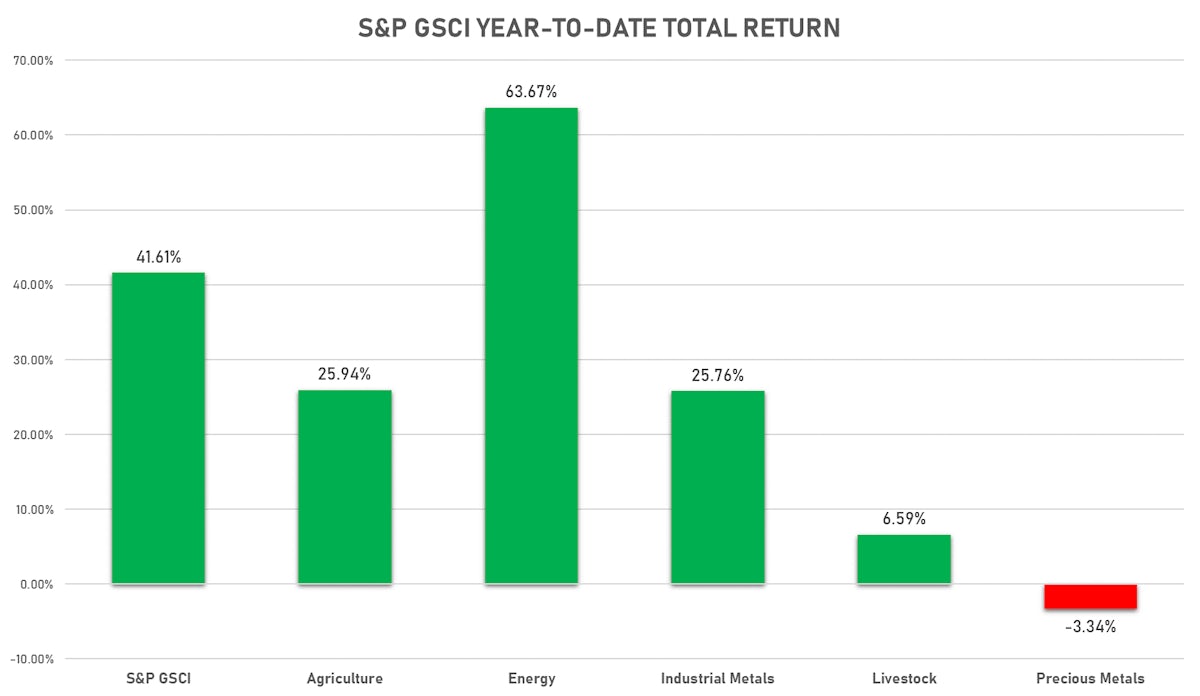

S&P GSCI Sub-Indices Year-To-Date Total Returns | Sources: ϕpost, FactSet data

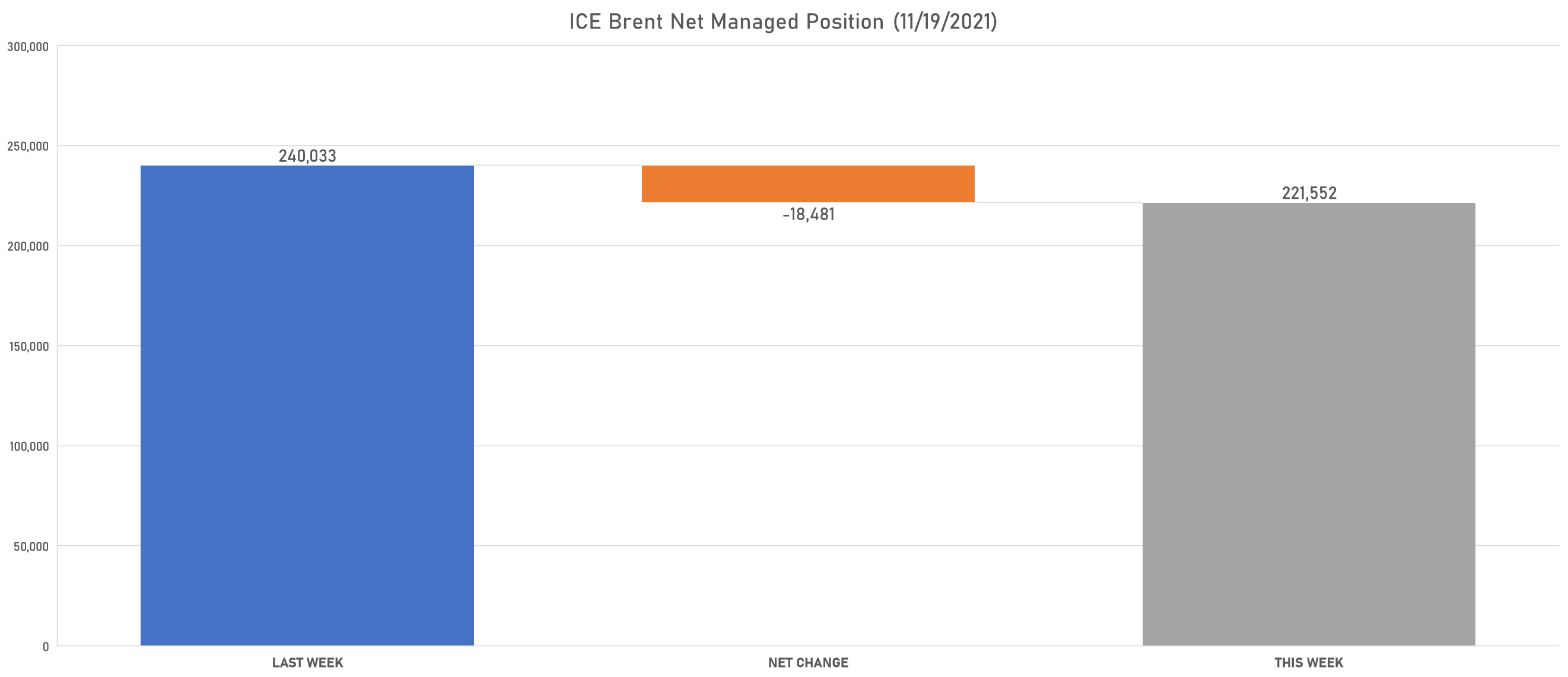

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum increased net long position

- Palladium reduced net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat increased net long position

- Corn increased net long position

- Rough Rice reduced net short position

- Oats increased net long position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle increased net short position

- Cocoa reduced net short position

- Coffee C increased net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice reduced net short position

- Sugar No.11 increased net long position

- White Sugar increased net long position

NOTABLE GAINERS THIS WEEK

- CME Random Length Lumber up 48.5% (YTD: -8.2%), now at 801.90

- SHFE Rubber up 13.1% (YTD: 8.6%), now at 15,210.00

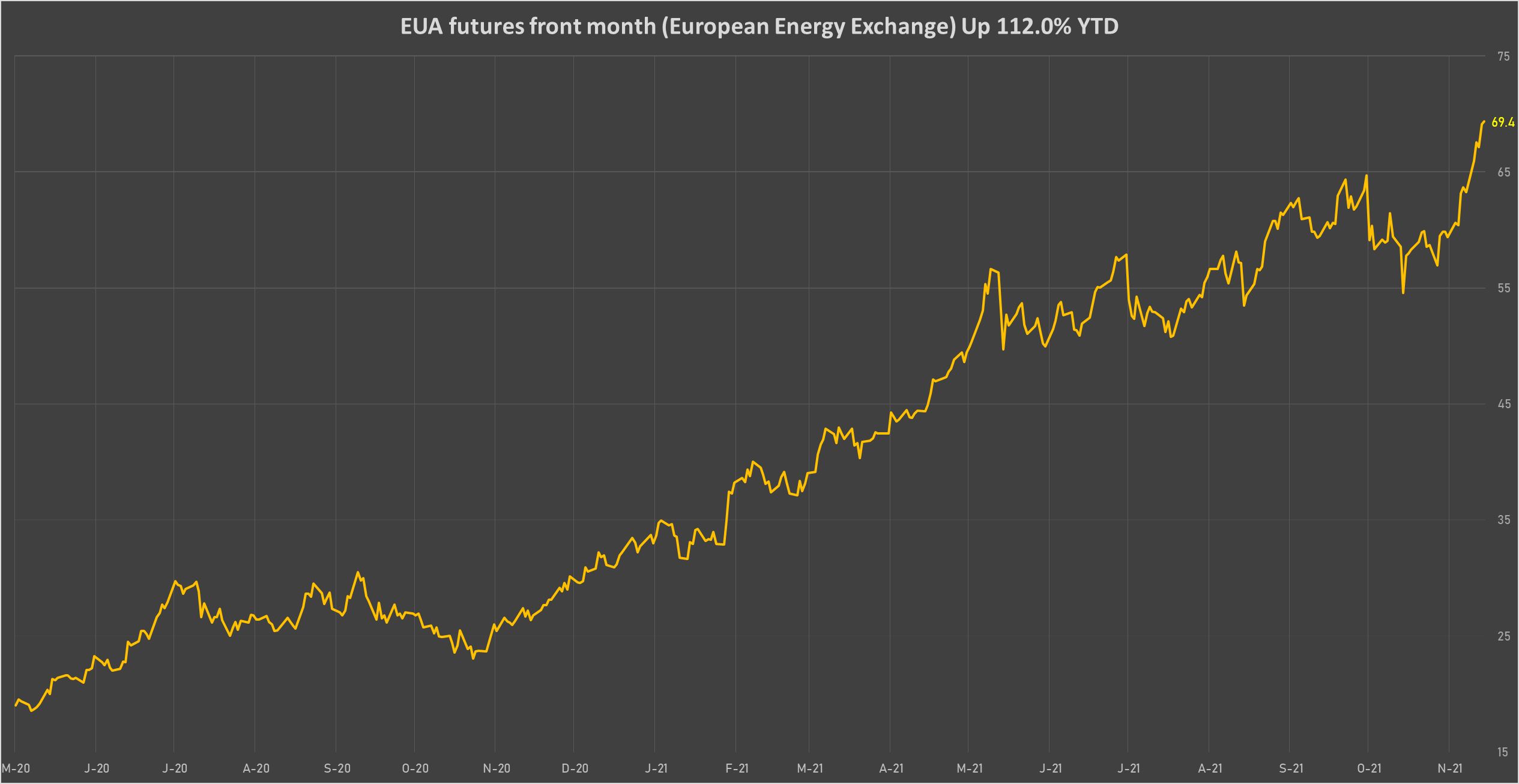

- EEX European-Carbon- Secondary Trading up 9.6% (YTD: 116.4%), now at 69.09

- ICE European Union Allowance (EUA) Yearly up 9.6% (YTD: 112.0%), now at 69.36

- Coffee Arabica Colombia Excelso EP spot up 7.6% (YTD: 74.6%), now at 5,526.00

- ICE-US Coffee C up 6.2% (YTD: 81.9%), now at 233.40

- NYMEX Henry Hub Natural Gas up 5.7% (YTD: 99.5%), now at 05.07

- CBoT Rough Rice up 4.7% (YTD: 17.5%), now at 14.57

- Shanghai International Exchange TSR 20 up 3.2% (YTD: 15.0%), now at 11,840.00

- CME Cattle(Feeder) up 3.0% (YTD: 15.8%), now at 160.93

- CBoT Soybean Meal up 2.7% (YTD: -14.4%), now at 371.80

- CBoT Soybeans up 2.4% (YTD: -4.0%), now at 1,263.25

- ICE Europe Newcastle Coal Monthly up 1.7% (YTD: 89.4%), now at 152.50

- ICE-US Cotton No. 2 up 1.3% (YTD: 52.6%), now at 119.12

- CME Live Cattle up 1.1% (YTD: 18.2%), now at 133.53

NOTABLE LOSERS THIS WEEK

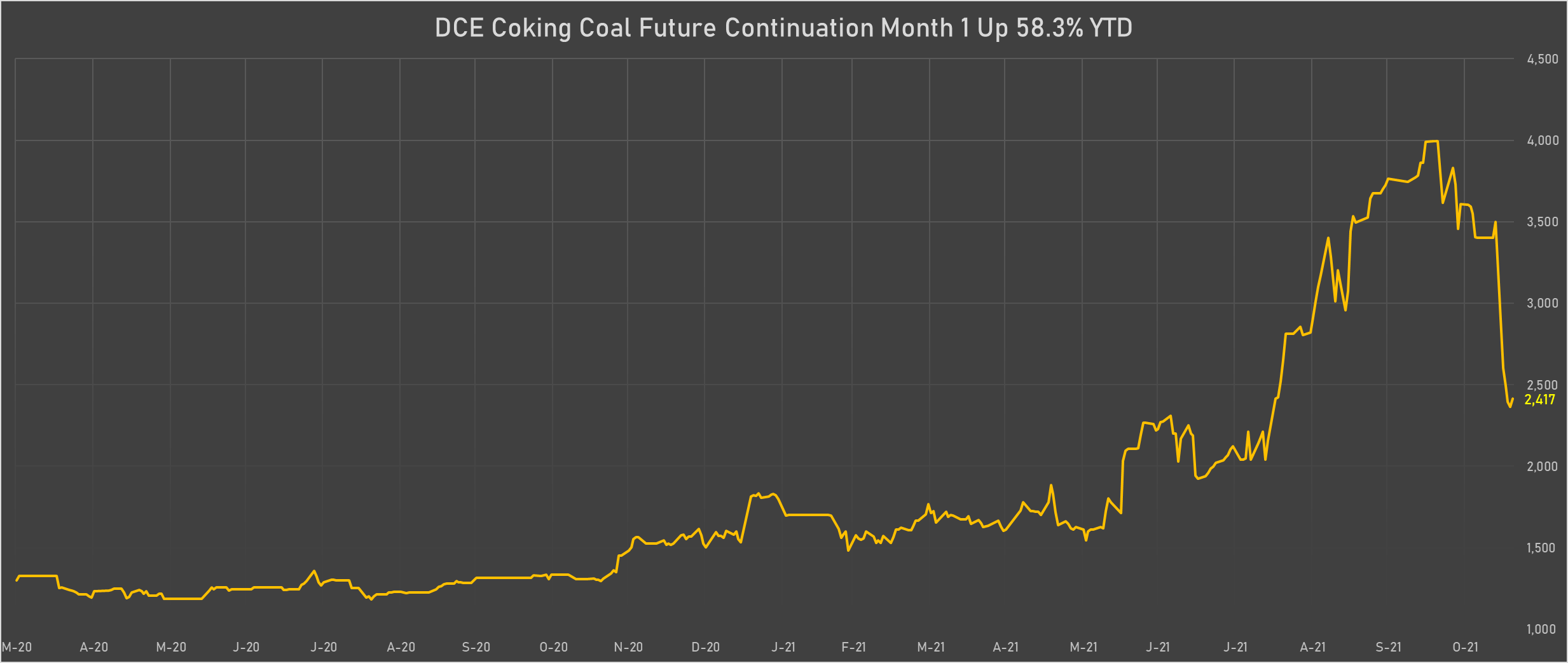

- DCE Coking Coal Continuation Month 1 down -30.9% (YTD: 61.0%), now at 2,466.50

- DCE Coke down -26.2% (YTD: 2.7%), now at 3,090.00

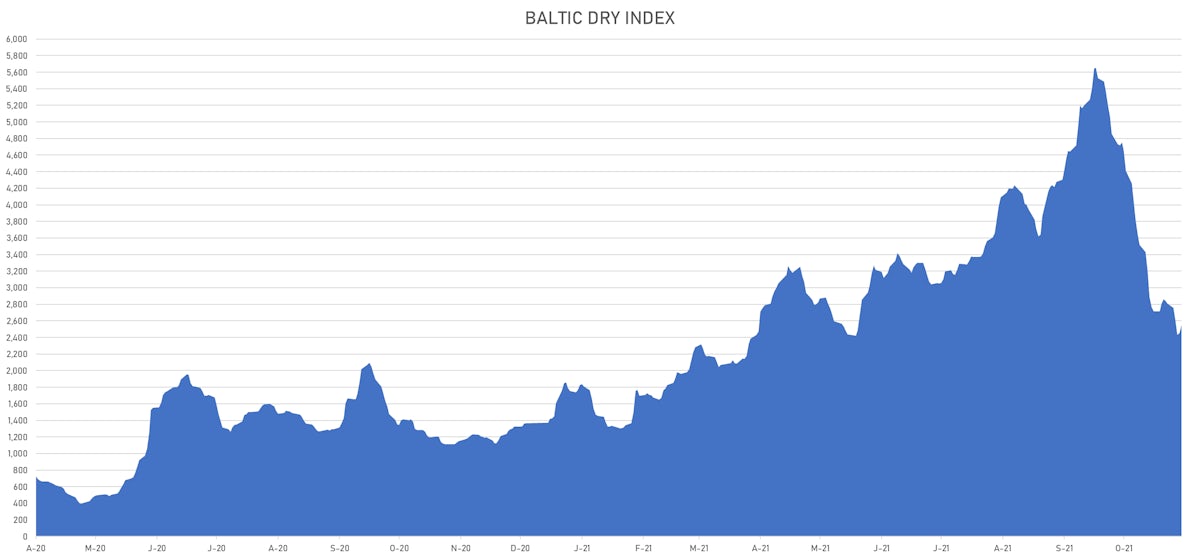

- Baltic Exchange Panamax Index down -22.1% (YTD: 72.2%), now at 2,282.00

- DCE Iron Ore Continuation Month 1 down -16.7% (YTD: -51.1%), now at 544.00

- BALTIC EXCH DRY down -9.1% (YTD: 86.8%), now at 2,552.00

- Baltic Exchange Capesize Index down -5.9% (YTD: 80.0%), now at 3,610.00

- Crude Oil WTI Cushing US FOB down -5.9% (YTD: 57.4%), now at 76.06

- ICE Europe Low Sulphur Gasoil down -5.9% (YTD: 56.3%), now at 657.50

- NYMEX Light Sweet Crude Oil (WTI) down -5.8% (YTD: 56.8%), now at 75.94

- SHFE Hot Rolled Coil down -5.2% (YTD: 1.5%), now at 4,731.00

- Baltic Exchange BALTIC DIRTY TNK down -5.0% (YTD: 67.4%), now at 780.00

- DCE RBD Palm Oil down -4.9% (YTD: 40.6%), now at 10,450.00

- Platinum spot down -4.7% (YTD: -3.7%), now at 1,029.79

- NYMEX NY Harbor ULSD down -4.6% (YTD: 55.3%), now at 02.29

- SHFE Lead Continuation Month 1 down -4.6% (YTD: 0.4%), now at 14,665.00

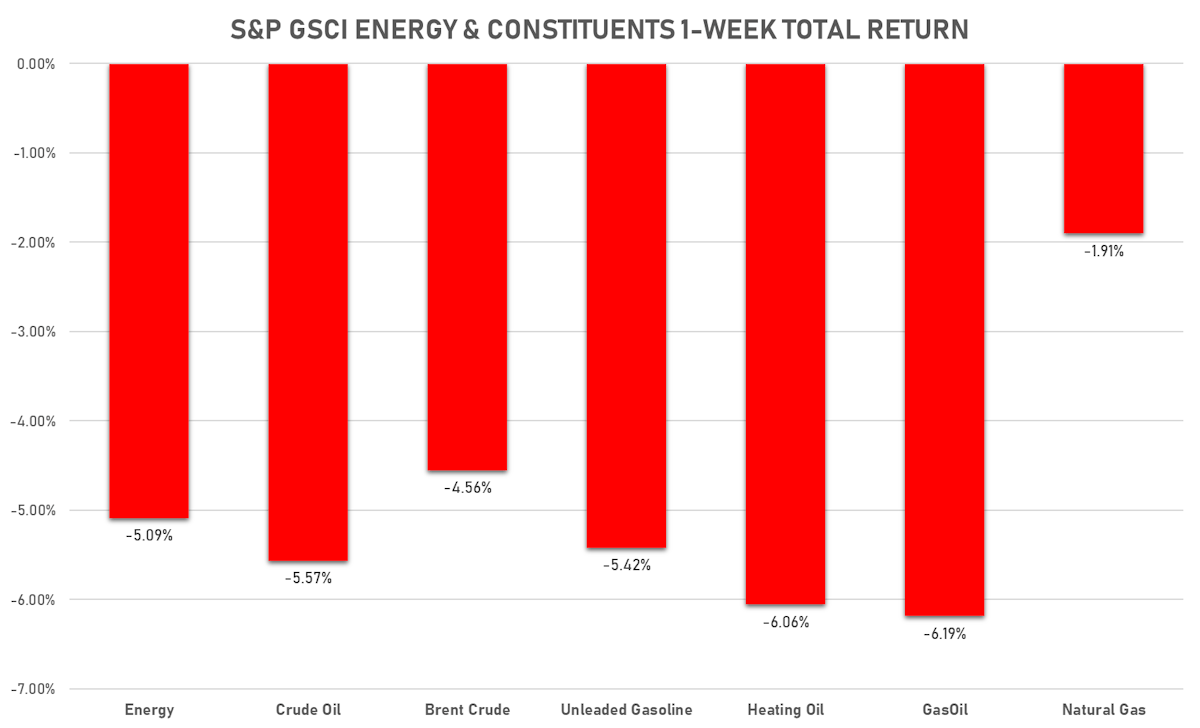

ENERGY THIS WEEK

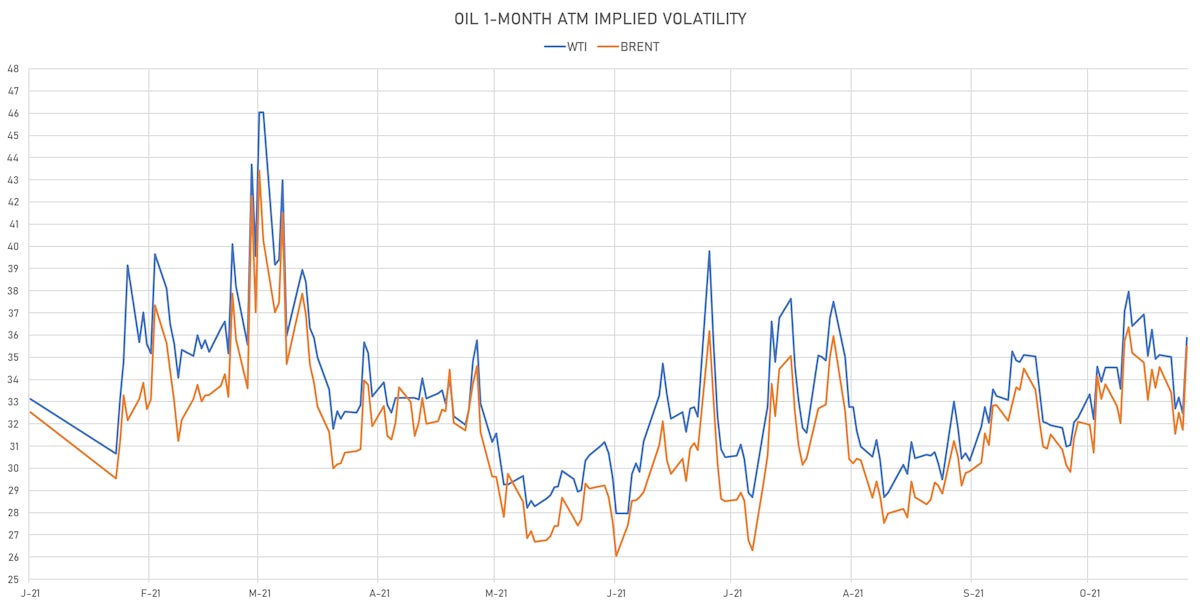

- WTI crude front month currently at US$ 75.94 per barrel, down -5.8% (YTD: +56.8%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 78.89 per barrel, down -4.0% (YTD: +52.3%); 6-month term structure in tightening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 152.50 per tonne, up 1.7% (YTD: +89.4%)

- Natural Gas (Henry Hub) currently at US$ 5.07 per MMBtu, up 5.7% (YTD: +99.5%)

- Gasoline (NYMEX) currently at US$ 2.21 per gallon, down -4.3% (YTD: +57.1%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 657.50 per tonne, down -5.9% (YTD: +56.3%)

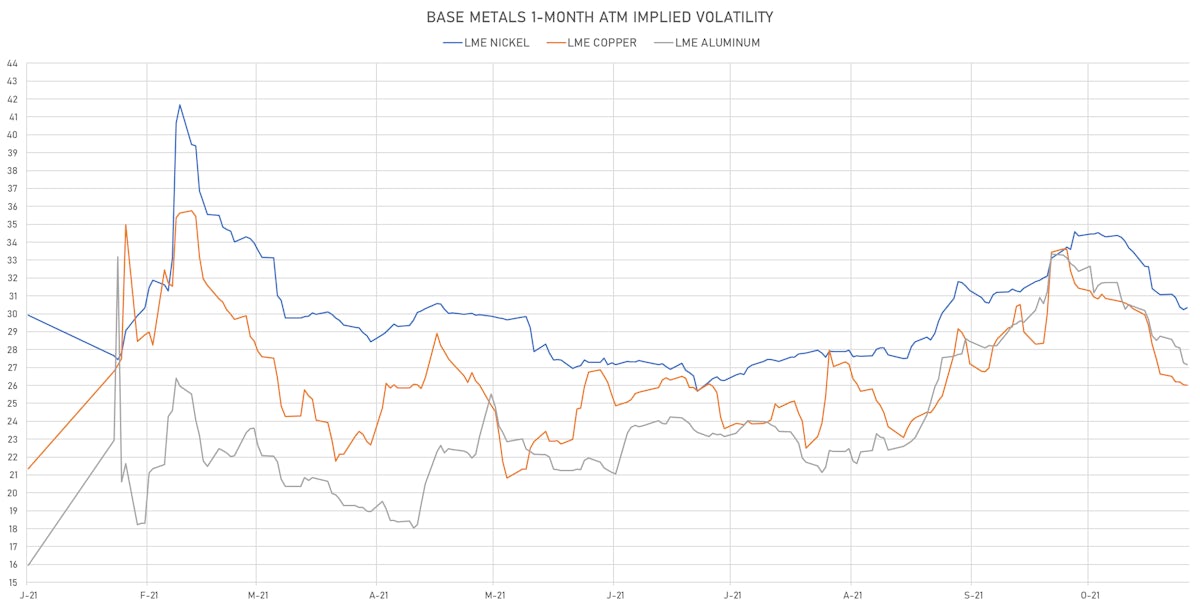

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.39 per pound, down -1.1% (YTD: +25.5%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 544.00 per tonne, down -16.7% (YTD: -51.1%)

- Aluminum (Shanghai) currently at CNY 19,355 per tonne, down -3.2% (YTD: +19.7%)

- Nickel (Shanghai) currently at CNY 148,290 per tonne, down -1.3% (YTD: +16.9%)

- Lead (Shanghai) currently at CNY 14,665 per tonne, down -4.6% (YTD: +0.4%)

- Rebar (Shanghai) currently at CNY 4,340 per tonne, down -1.7% (YTD: +1.3%)

- Tin (Shanghai) currently at CNY 291,870 per tonne, down -3.4% (YTD: +91.8%)

- Zinc (Shanghai) currently at CNY 23,090 per tonne, down -3.4% (YTD: +8.6%)

- Refined Cobalt (Shanghai) spot price currently at CNY 413,500 per tonne, unchanged (YTD: +50.9%)

- Lithium (Shanghai) spot price currently at CNY 1,055,000 per tonne, unchanged (YTD: +117.5%)

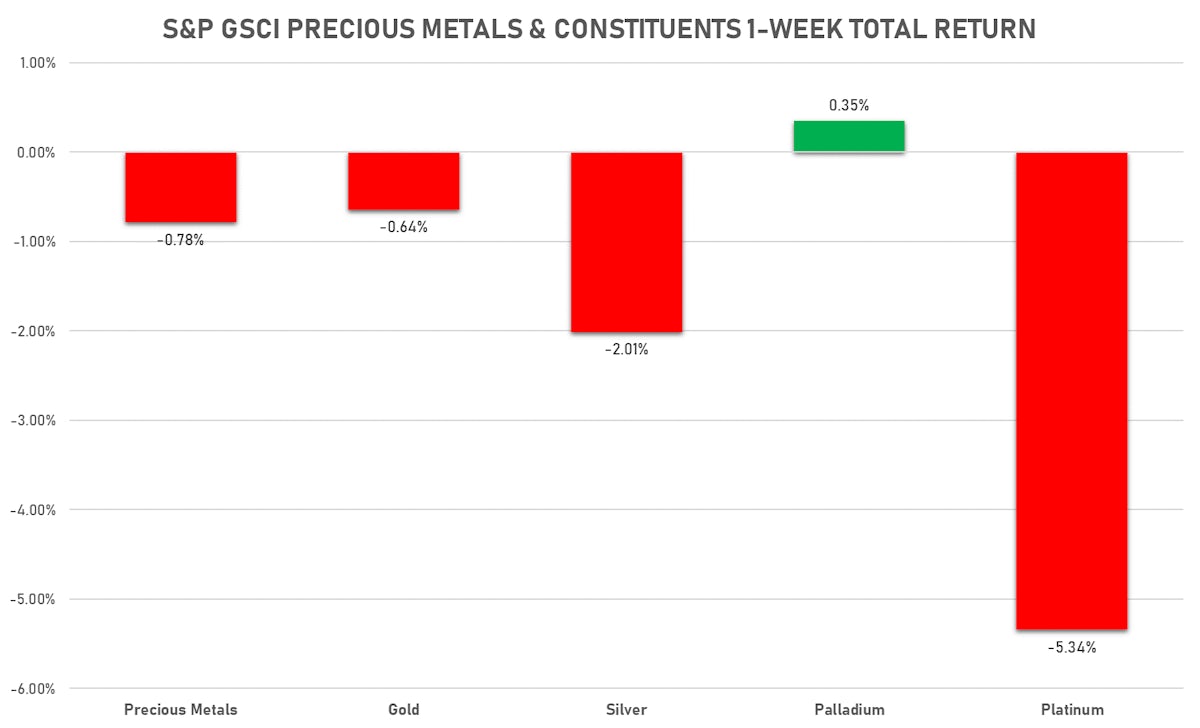

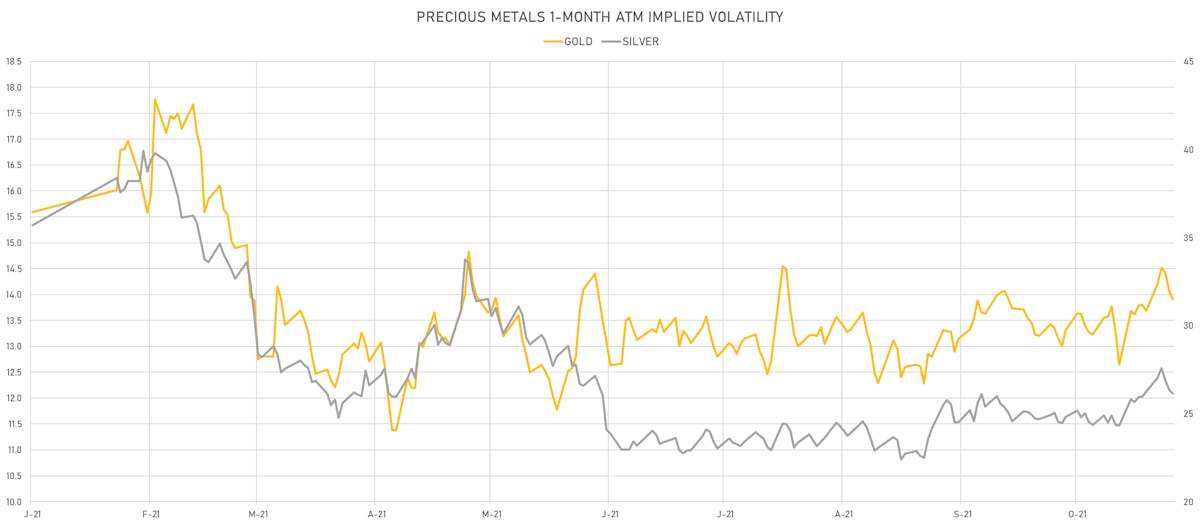

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,845.55 per troy ounce, down -1.0% (YTD: -2.7%)

- Gold 1-Month ATM implied volatility currently at 13.46, up 1.8% (YTD: -13.5%)

- Silver spot currently at US$ 24.61 per troy ounce, down -2.7% (YTD: -6.7%)

- Silver 1-Month ATM implied volatility currently at 24.90, down -0.4% (YTD: -38.5%)

- Palladium spot currently at US$ 2,059.84 per troy ounce, down -2.4% (YTD: -15.8%)

- Platinum spot currently at US$ 1,029.79 per troy ounce, down -4.7% (YTD: -3.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,350 per troy ounce, unchanged (YTD: -15.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,400 per troy ounce, unchanged (YTD: +69.2%)

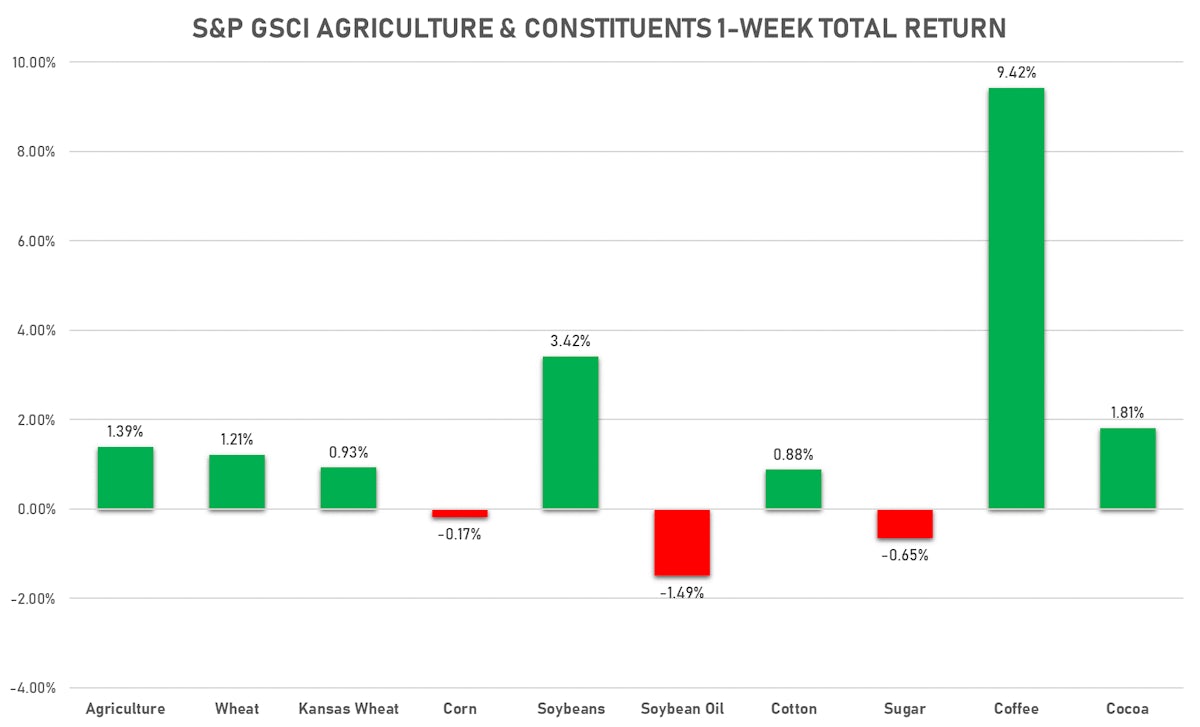

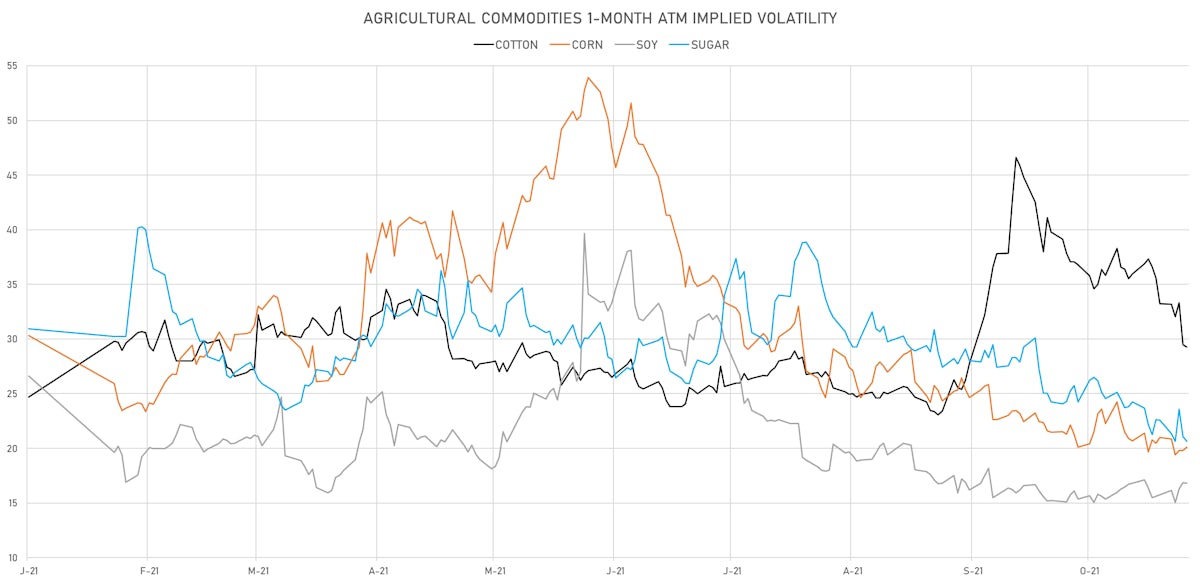

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 133.53 cents per pound, up 1.1% (YTD: +18.2%)

- Lean Hogs (CME) currently at US$ 73.75 cents per pound, down -2.8% (YTD: +4.9%)

- Rough Rice (CBOT) currently at US$ 14.57 cents per hundredweight, up 4.7% (YTD: +17.5%)

- Soybeans Composite (CBOT) currently at US$ 1,263.25 cents per bushel, up 2.4% (YTD: -4.0%)

- Corn (CBOT) currently at US$ 570.75 cents per bushel, down -1.1% (YTD: +17.9%)

- Wheat Composite (CBOT) currently at US$ 823.00 cents per bushel, up 0.7% (YTD: +28.5%)

- Sugar No.11 (ICE US) currently at US$ 20.17 cents per pound, down -0.1% (YTD: +29.1%)

- Cotton No.2 (ICE US) currently at US$ 119.12 cents per pound, up 1.3% (YTD: +52.6%)

- Cocoa (ICE US) currently at US$ 2,493 per tonne, up 0.9% (YTD: -4.2%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,526 per tonne, up 7.6% (YTD: +74.6%)

- Random Length Lumber (CME) currently at US$ 801.90 per 1,000 board feet, up 48.5% (YTD: -8.2%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,840 per tonne, up 3.2% (YTD: +15.0%)

- Soybean Oil Composite (CBOT) currently at US$ 58.16 cents per pound, down -1.4% (YTD: +34.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,439 per tonne, up 0.6% (YTD: +39.7%)

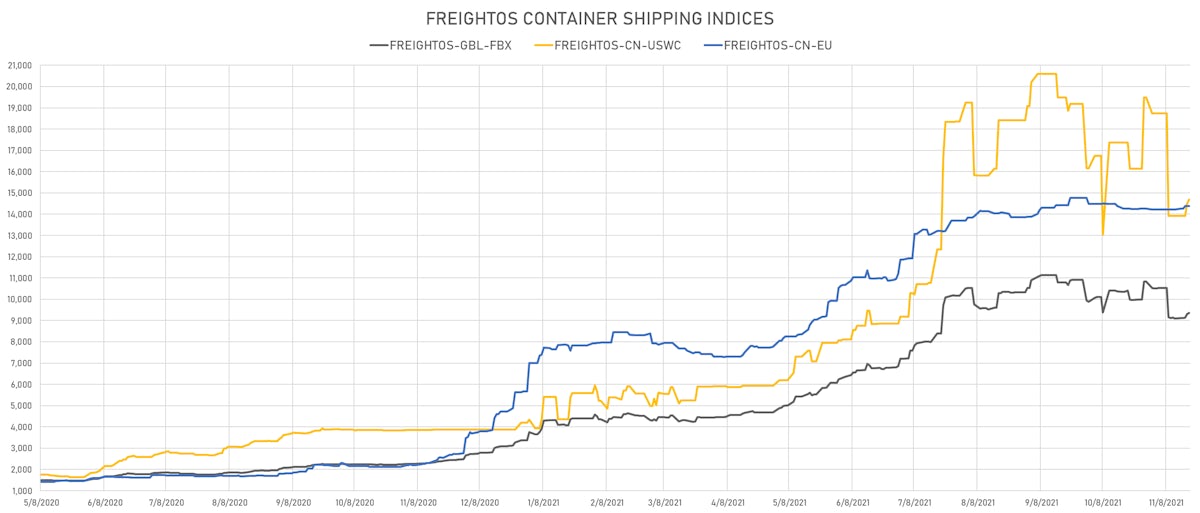

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,552, down -9.1% (YTD: +86.8%)

- Freightos China To North America West Coast Container Index currently at 14,677, up 5.4% (YTD: +249.5%)

- Freightos North America West Coast To China Container Index currently at 865, up 8.1% (YTD: +67.1%)

- Freightos North America East Coast To Europe Container Index currently at 583, up 17.8% (YTD: +60.6%)

- Freightos Europe To North America East Coast Container Index currently at 7,447, unchanged (YTD: +298.4%)

- Freightos China To North Europe Container Index currently at 14,381, up 1.1% (YTD: +154.0%)

- Freightos North Europe To China Container Index currently at 1,328, up 1.9% (YTD: -3.4%)

- Freightos Europe To South America West Coast Container Index currently at 5,501, unchanged (YTD: +225.2%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 69.36 per tonne, up 9.6% (YTD: +112.0%)