Commodities

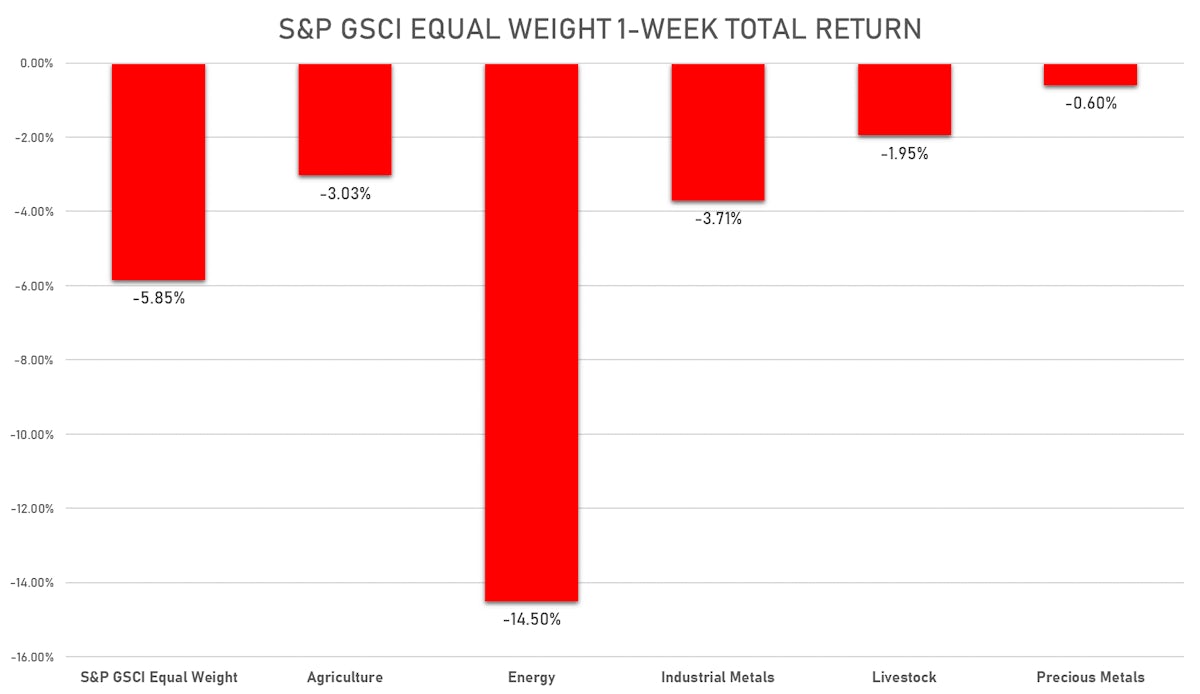

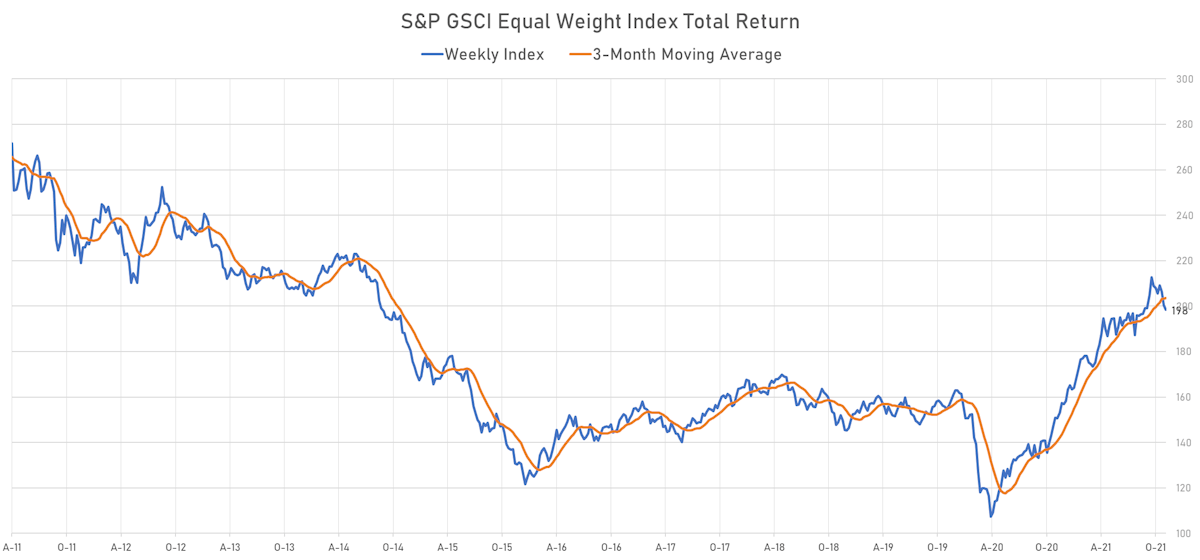

Terrible Week For Major Commodities, With Large Losses Throughout The Complex

Crude oil and natural gas prices were mostly driven by Putin's efforts to gain acceptance for Nord Stream 2: he favored increasing OPEC+ supply further to please Washington, though the group left the meeting unadjourned with no changes to their existing agreement

Published ET

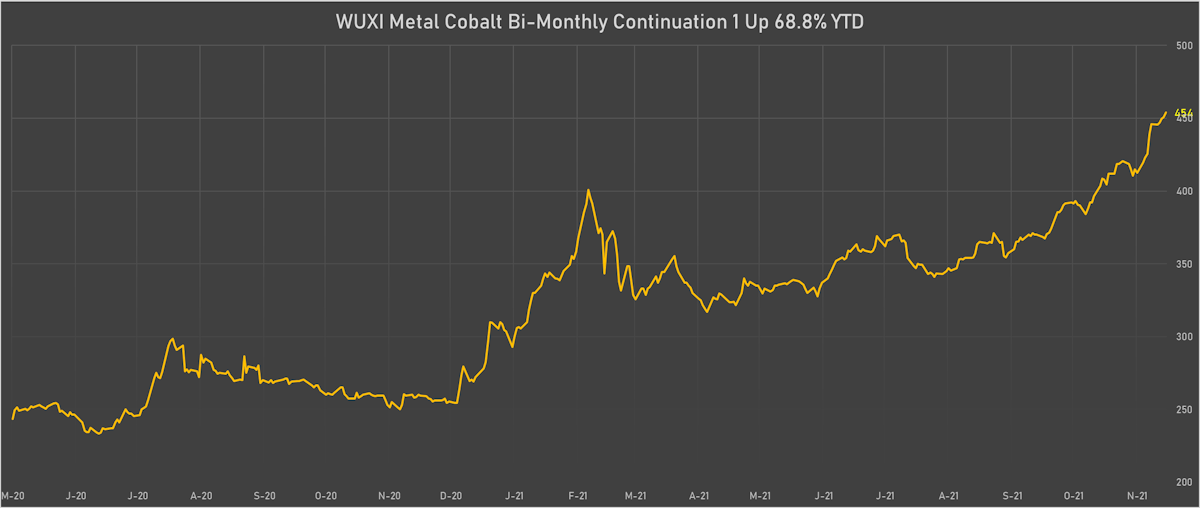

Wuxi Cobalt Front-Month Futures Prices | Sources: ϕpost, Refinitiv data

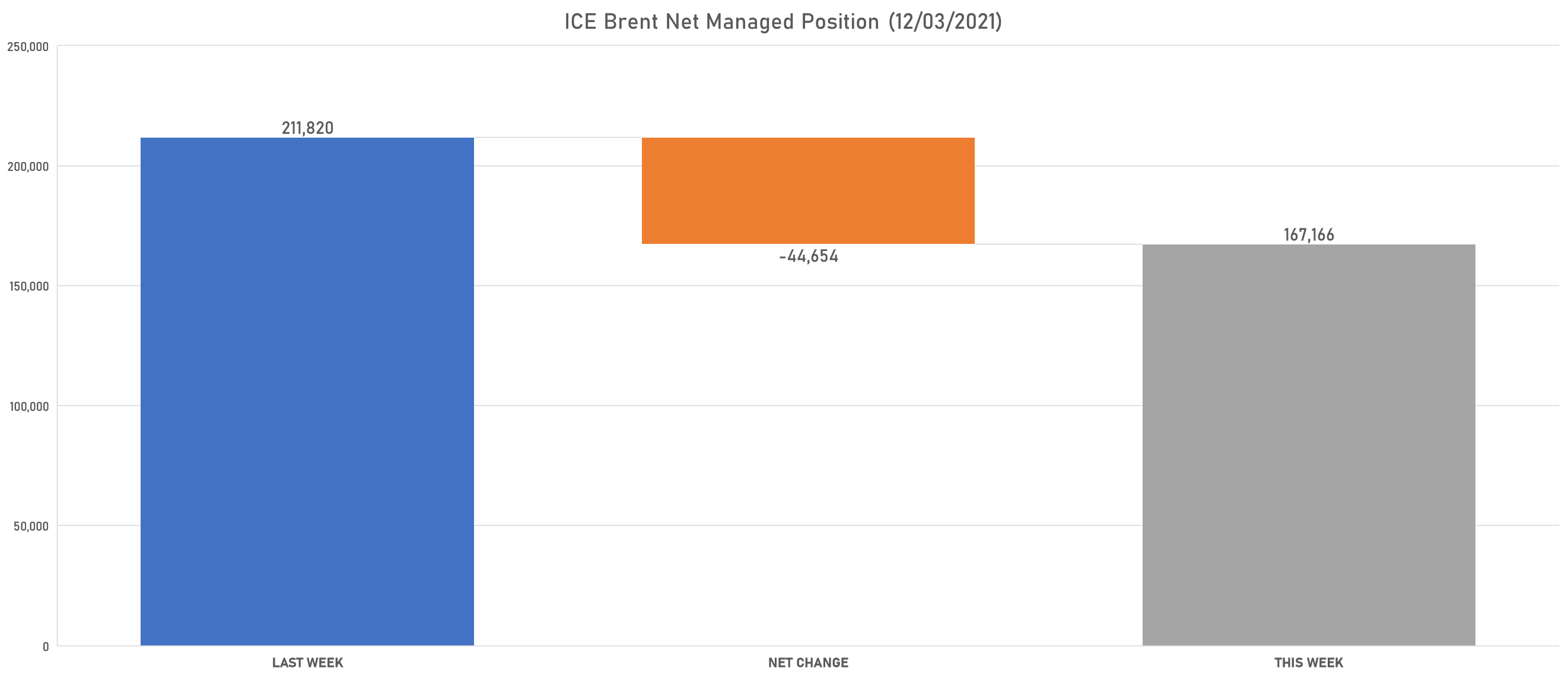

NET POSITIONS OF MANAGED MONEY (WEEKLY COTR)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum reduced net long position

- Palladium increased net short position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net long position

- Corn reduced net long position

- Rough Rice increased net long position

- Oats increased net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle turned to net long

- Cocoa turned to net short

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice reduced net short position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

NOTABLE GAINERS THIS WEEK

- CME Random Length Lumber up 18.3% (YTD: 3.8%), now at 906.70

- CME Dry Whey up 8.9% (YTD: 44.2%), now at 63.75

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 7.6% (YTD: -34.9%), now at 101.82

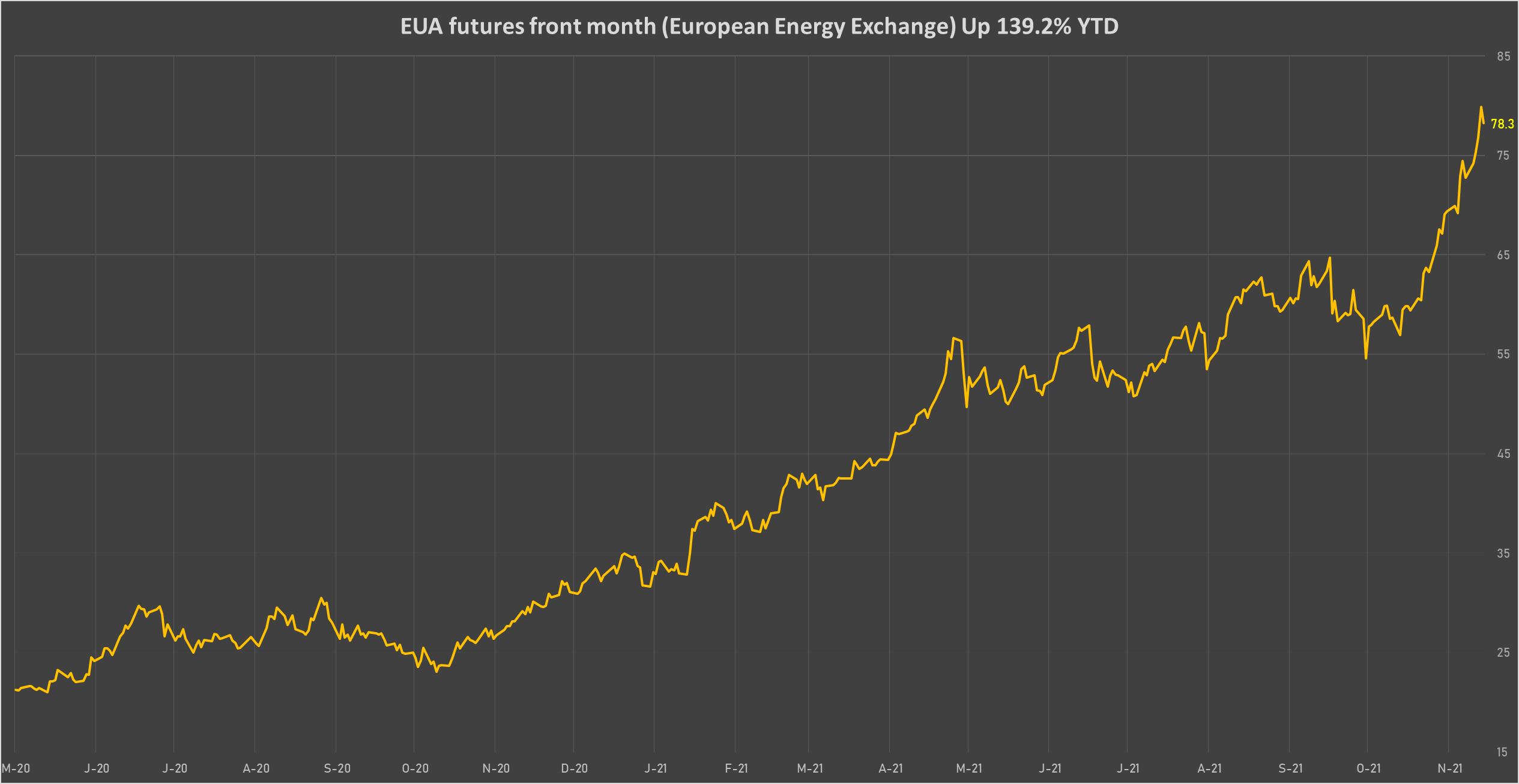

- EEX European-Carbon- Secondary Trading up 7.5% (YTD: 144.1%), now at 78.62

- Intercontinental Exchange Endex European Union Allowance (EUA) Yearly up 7.5% (YTD: 139.2%), now at 78.25

- WUXI Metal Cobalt Bi-Monthly up 6.7% (YTD: 66.9%), now at 450.50

- SGX Iron Ore 62% China CFR Swap Monthly up 4.9% (YTD: -35.4%), now at 100.72

- ICE-US Cocoa up 4.1% (YTD: -6.5%), now at 2,421.00

- CME Non-Fat Dry Milk up 3.8% (YTD: 36.0%), now at 153.50

- DCE Coking Coal Continuation Month 1 up 3.6% (YTD: 78.3%), now at 2,675.00

- CME Class III Milk up 3.6% (YTD: 17.7%), now at 18.60

- DCE Iron Ore Continuation Month 1 up 3.3% (YTD: -43.9%), now at 605.50

- CBoT Soybean Meal up 3.2% (YTD: -15.4%), now at 367.70

- CME Cash settled Butter up 3.2% (YTD: 35.8%), now at 200.25

- Palladium spot up 2.9% (YTD: -25.8%), now at 1,813.68

NOTABLE LOSERS THIS WEEK

- NYMEX Henry Hub Natural Gas down -18.5% (YTD: 62.7%), now at 04.13

- NYMEX RBOB Gasoline down -15.8% (YTD: 38.7%), now at 01.95

- NYMEX Light Sweet Crude Oil (WTI) down -15.5% (YTD: 36.6%), now at 66.26

- Crude Oil WTI Cushing US FOB down -15.2% (YTD: 37.3%), now at 66.29

- NYMEX NY Harbor ULSD down -11.9% (YTD: 42.1%), now at 02.10

- DCE Coke down -11.7% (YTD: -7.3%), now at 2,760.00

- SHFE Bitumen Continuation Month 1 down -7.7% (YTD: 14.3%), now at 2,766.00

- Shanghai International Exchange TSR 20 down -6.9% (YTD: 12.4%), now at 11,230.00

- ICE-US Cotton No. 2 down -6.3% (YTD: 39.9%), now at 109.00

- SHFE Rubber down -4.4% (YTD: 6.5%), now at 14,360.00

- COMEX Copper down -4.3% (YTD: 21.4%), now at 04.28

- ICE Europe Brent Crude down -3.9% (YTD: 34.9%), now at 69.88

- CBoT Wheat down -3.8% (YTD: 24.0%), now at 794.50

- Johnson Matthey Iridium New York 0930 down -3.5% (YTD: 59.6%), now at 4,150.00

- Coffee Arabica Colombia Excelso EP spot down -3.4% (YTD: 79.2%), now at 5,673.00

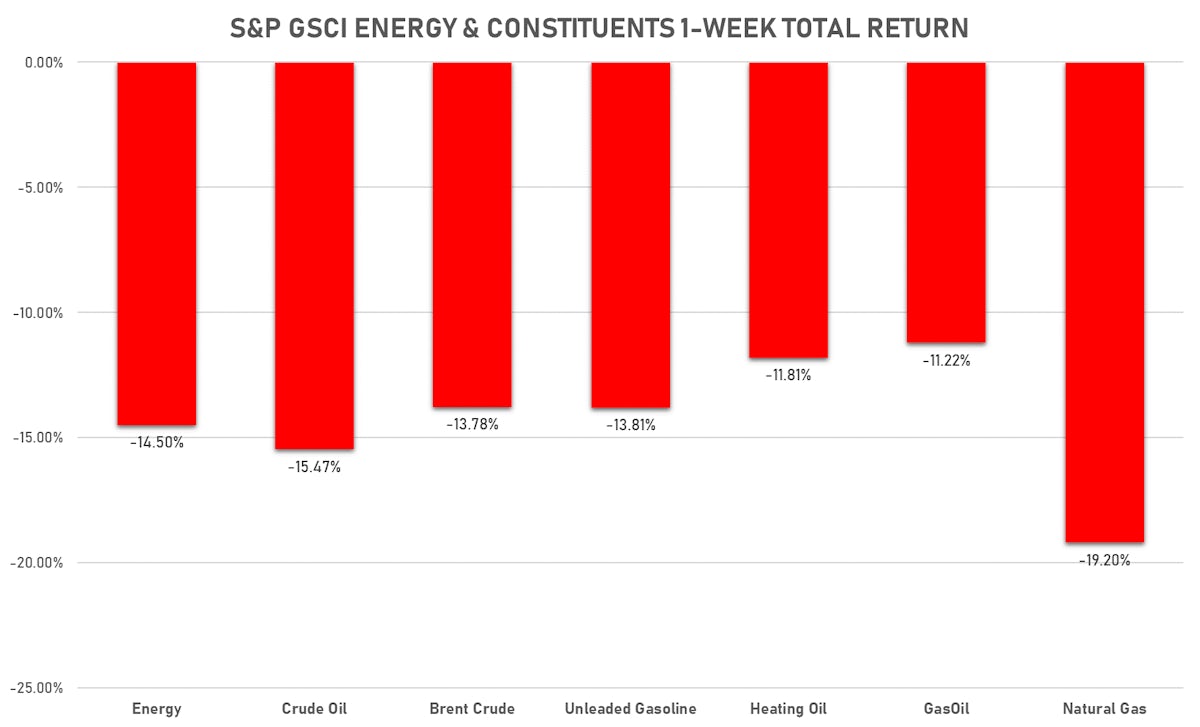

ENERGY THIS WEEK

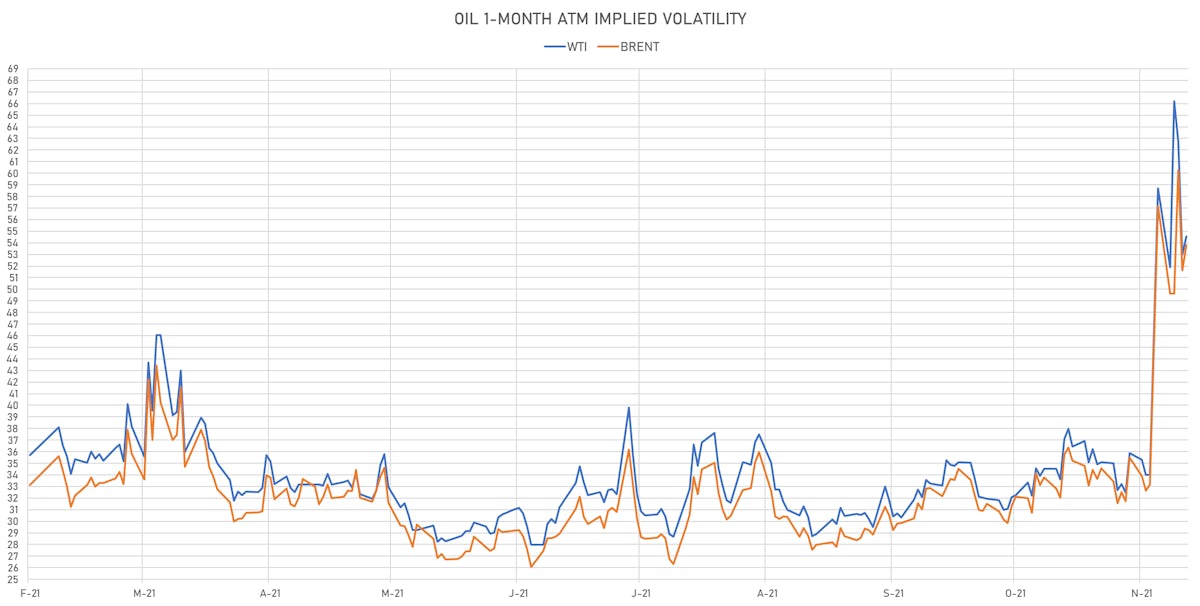

- WTI crude front month currently at US$ 66.26 per barrel, down -15.5% (YTD: +36.6%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 69.88 per barrel, down -3.9% (YTD: +34.9%); 6-month term structure in tightening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 155.25 per tonne, down -1.4% (YTD: +92.9%)

- Natural Gas (Henry Hub) currently at US$ 4.13 per MMBtu, down -18.5% (YTD: +62.7%)

- Gasoline (NYMEX) currently at US$ 1.95 per gallon, down -15.8% (YTD: +38.7%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 619.00 per tonne, up 2.4% (YTD: +47.1%)

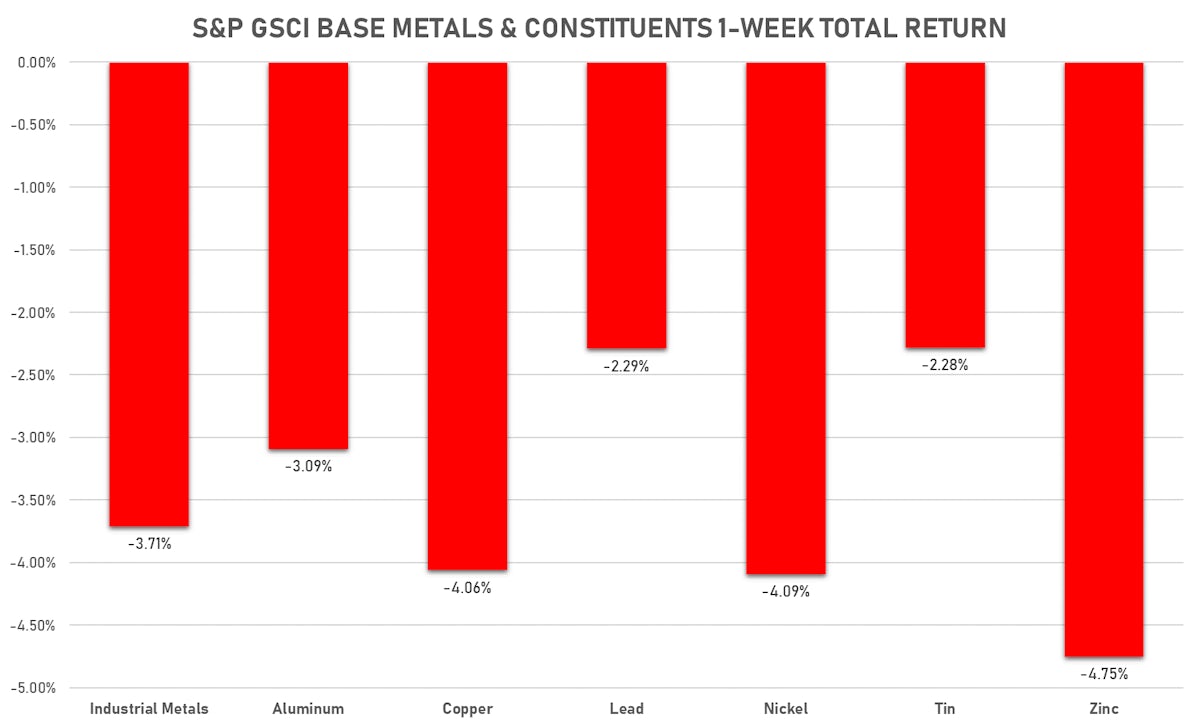

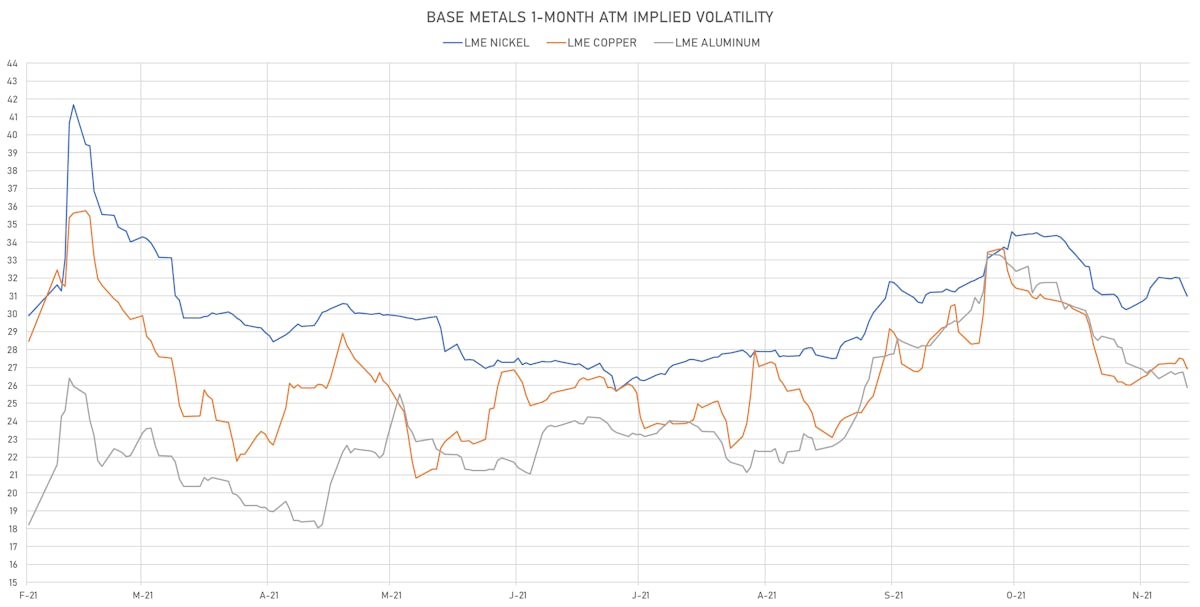

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.28 per pound, down -4.3% (YTD: +21.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 605.50 per tonne, up 3.3% (YTD: -43.9%)

- Aluminum (Shanghai) currently at CNY 18,930 per tonne, down -2.1% (YTD: +19.8%)

- Nickel (Shanghai) currently at CNY 148,850 per tonne, down -2.1% (YTD: +20.6%)

- Lead (Shanghai) currently at CNY 14,905 per tonne, up 0.1% (YTD: +3.1%)

- Rebar (Shanghai) currently at CNY 4,301 per tonne, down -1.1% (YTD: +1.9%)

- Tin (Shanghai) currently at CNY 290,170 per tonne, up 0.9% (YTD: +93.1%)

- Zinc (Shanghai) currently at CNY 22,860 per tonne, down -2.2% (YTD: +10.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 445,500 per tonne, up 5.2% (YTD: +62.6%)

- Lithium (Shanghai) spot price currently at CNY 1,135,000 per tonne, up 5.6% (YTD: +134.0%)

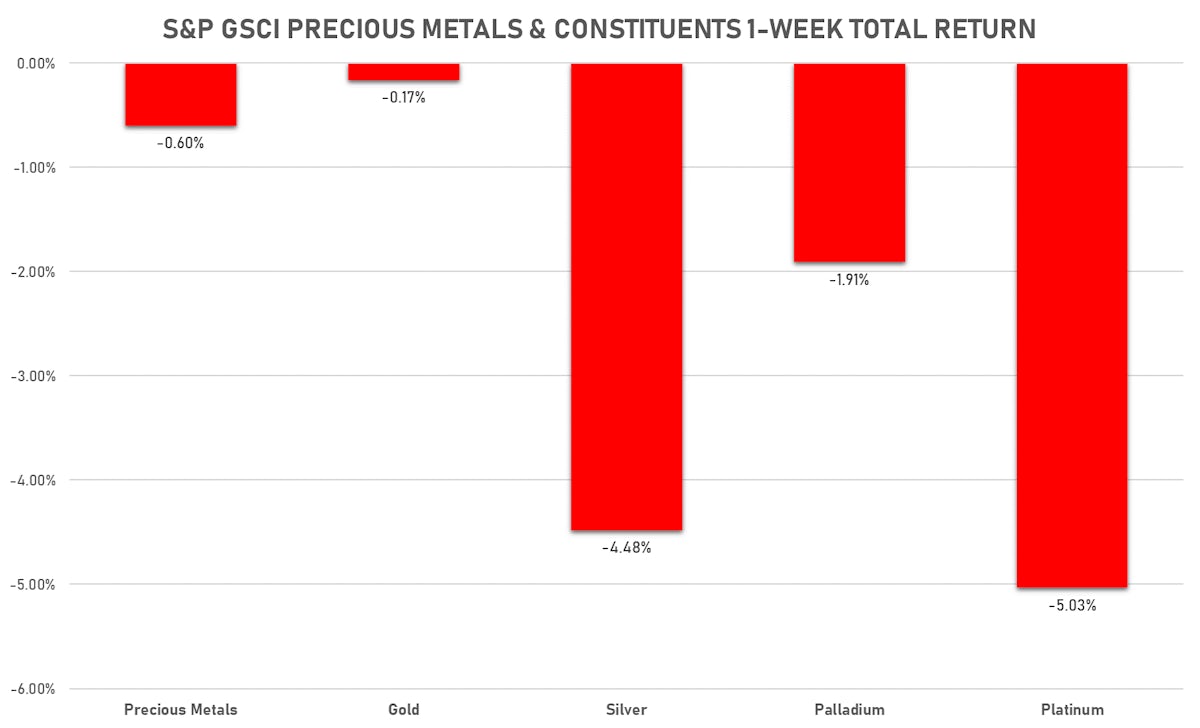

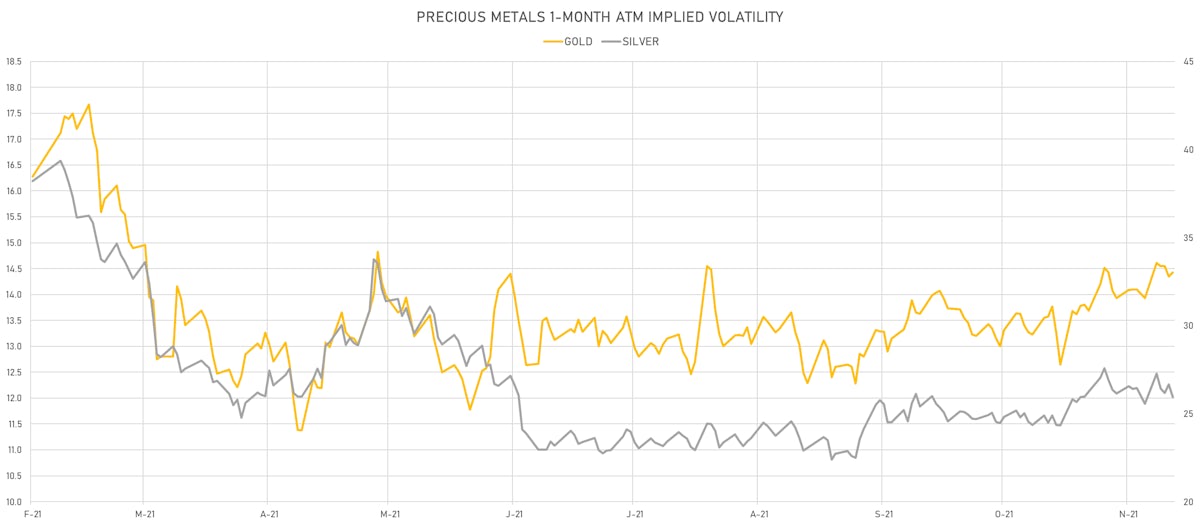

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,782.87 per troy ounce, down -0.5% (YTD: -6.0%)

- Gold 1-Month ATM implied volatility currently at 14.00, up 3.6% (YTD: -10.4%)

- Silver spot currently at US$ 22.52 per troy ounce, down -2.6% (YTD: -14.6%)

- Silver 1-Month ATM implied volatility currently at 24.66, up 1.5% (YTD: -39.0%)

- Palladium spot currently at US$ 1,813.68 per troy ounce, up 2.9% (YTD: -25.8%)

- Platinum spot currently at US$ 931.87 per troy ounce, down -2.5% (YTD: -12.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,000 per troy ounce, up 2.2% (YTD: -17.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,150 per troy ounce, down -3.5% (YTD: +59.6%)

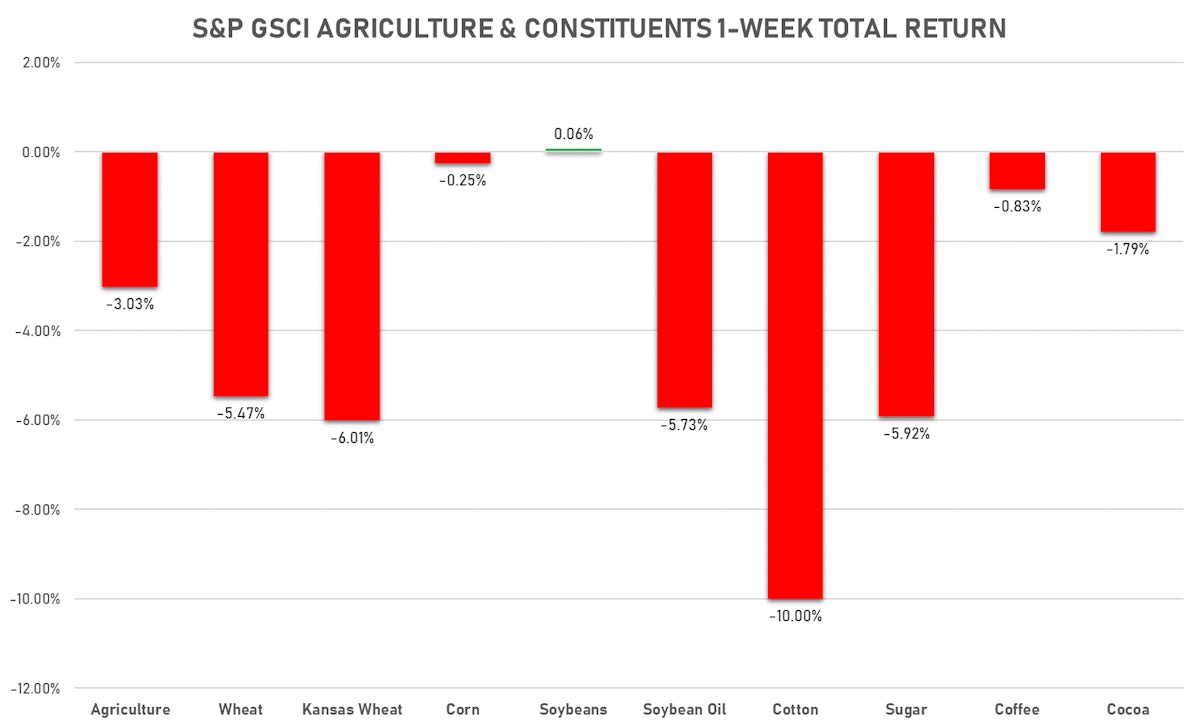

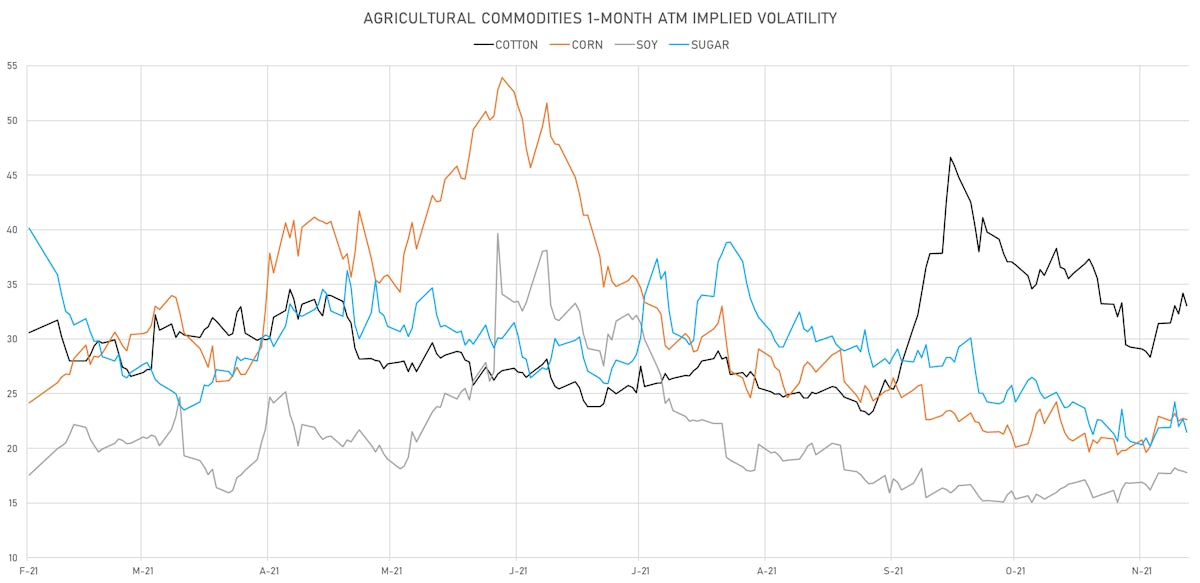

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 137.68 cents per pound, down 0.3% (YTD: +21.9%)

- Lean Hogs (CME) currently at US$ 74.00 cents per pound, up 1.1% (YTD: +5.3%)

- Rough Rice (CBOT) currently at US$ 14.07 cents per hundredweight, down -1.6% (YTD: +13.4%)

- Soybeans Composite (CBOT) currently at US$ 1,267.25 cents per bushel, up 1.2% (YTD: -3.6%)

- Corn (CBOT) currently at US$ 586.00 cents per bushel, down -0.1% (YTD: +21.1%)

- Wheat Composite (CBOT) currently at US$ 794.50 cents per bushel, down -3.8% (YTD: +24.0%)

- Sugar No.11 (ICE US) currently at US$ 18.79 cents per pound, down -3.1% (YTD: +21.0%)

- Cotton No.2 (ICE US) currently at US$ 109.00 cents per pound, down -6.3% (YTD: +39.9%)

- Cocoa (ICE US) currently at US$ 2,421 per tonne, up 4.1% (YTD: -6.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,673 per tonne, down -3.4% (YTD: +79.2%)

- Random Length Lumber (CME) currently at US$ 906.70 per 1,000 board feet, up 18.3% (YTD: +3.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,230 per tonne, down -6.9% (YTD: +12.4%)

- Soybean Oil Composite (CBOT) currently at US$ 57.10 cents per pound, down -3.3% (YTD: +31.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,173 per tonne, down -3.0% (YTD: +33.0%)

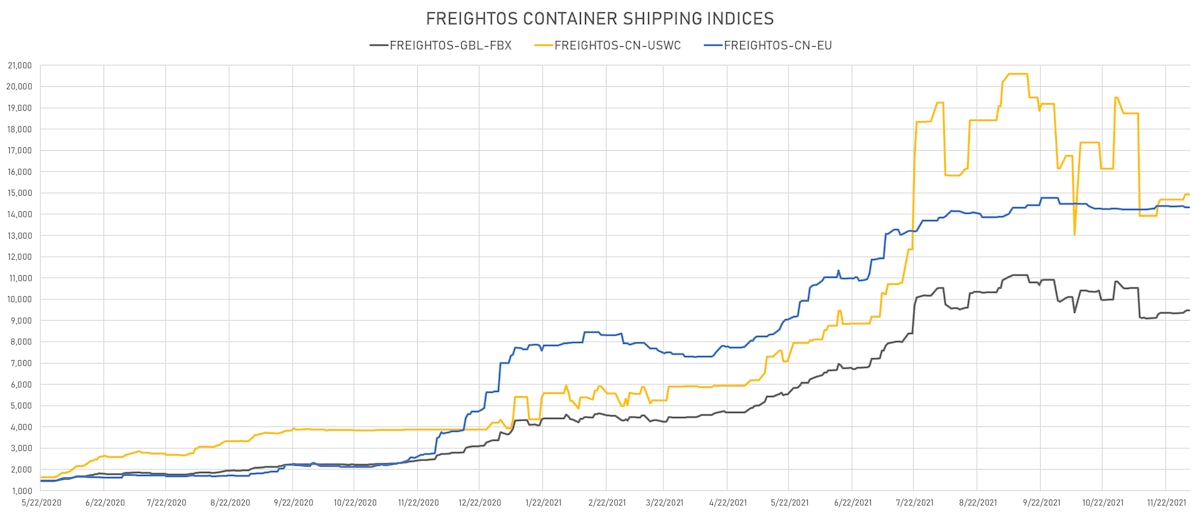

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 3,115, up 16.3% (YTD: +128.0%)

- Freightos China To North America West Coast Container Index currently at 14,924, up 1.7% (YTD: +255.4%)

- Freightos North America West Coast To China Container Index currently at 909, up 8.9% (YTD: +75.6%)

- Freightos North America East Coast To Europe Container Index currently at 471, down -19.2% (YTD: +29.8%)

- Freightos Europe To North America East Coast Container Index currently at 7,318, down -1.8% (YTD: +291.5%)

- Freightos China To North Europe Container Index currently at 14,320, down -0.3% (YTD: +152.9%)

- Freightos North Europe To China Container Index currently at 1,287, down -2.6% (YTD: -6.4%)

- Freightos Europe To South America West Coast Container Index currently at 6,968, up 26.7% (YTD: +311.9%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 78.25 per tonne, up 7.5% (YTD: +139.2%)