Commodities

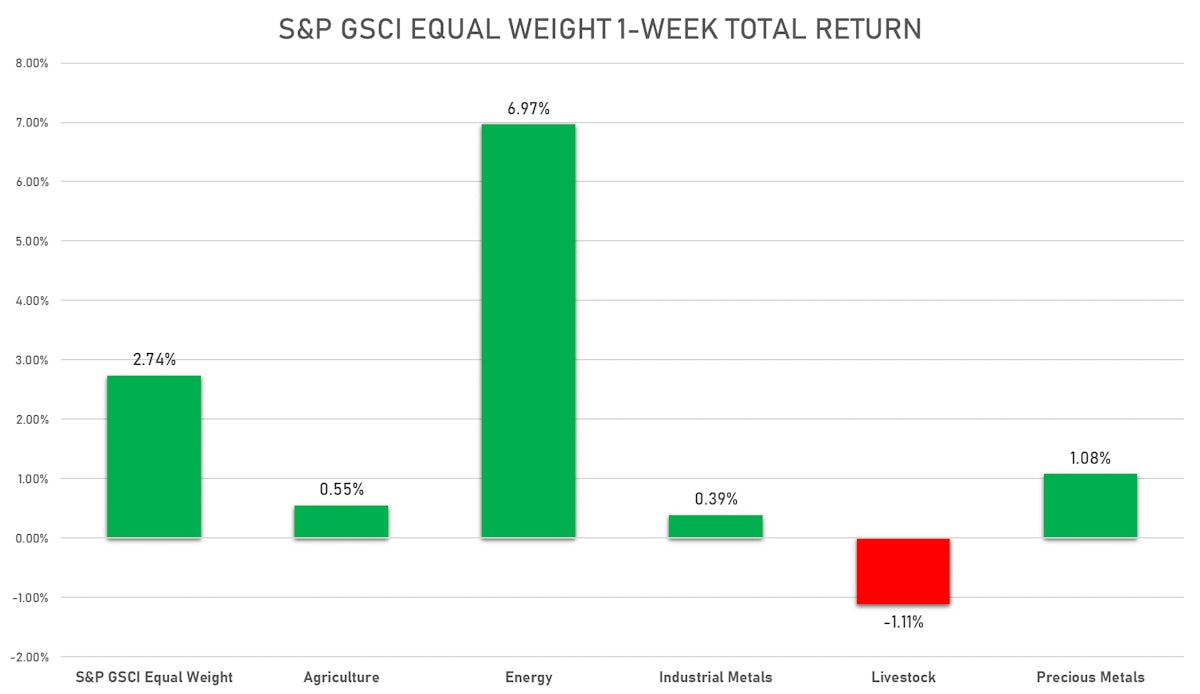

Good Week For Commodities, Led By Energy, With A Significant Rebound In The Prices Of Crude Oil And Gasoline

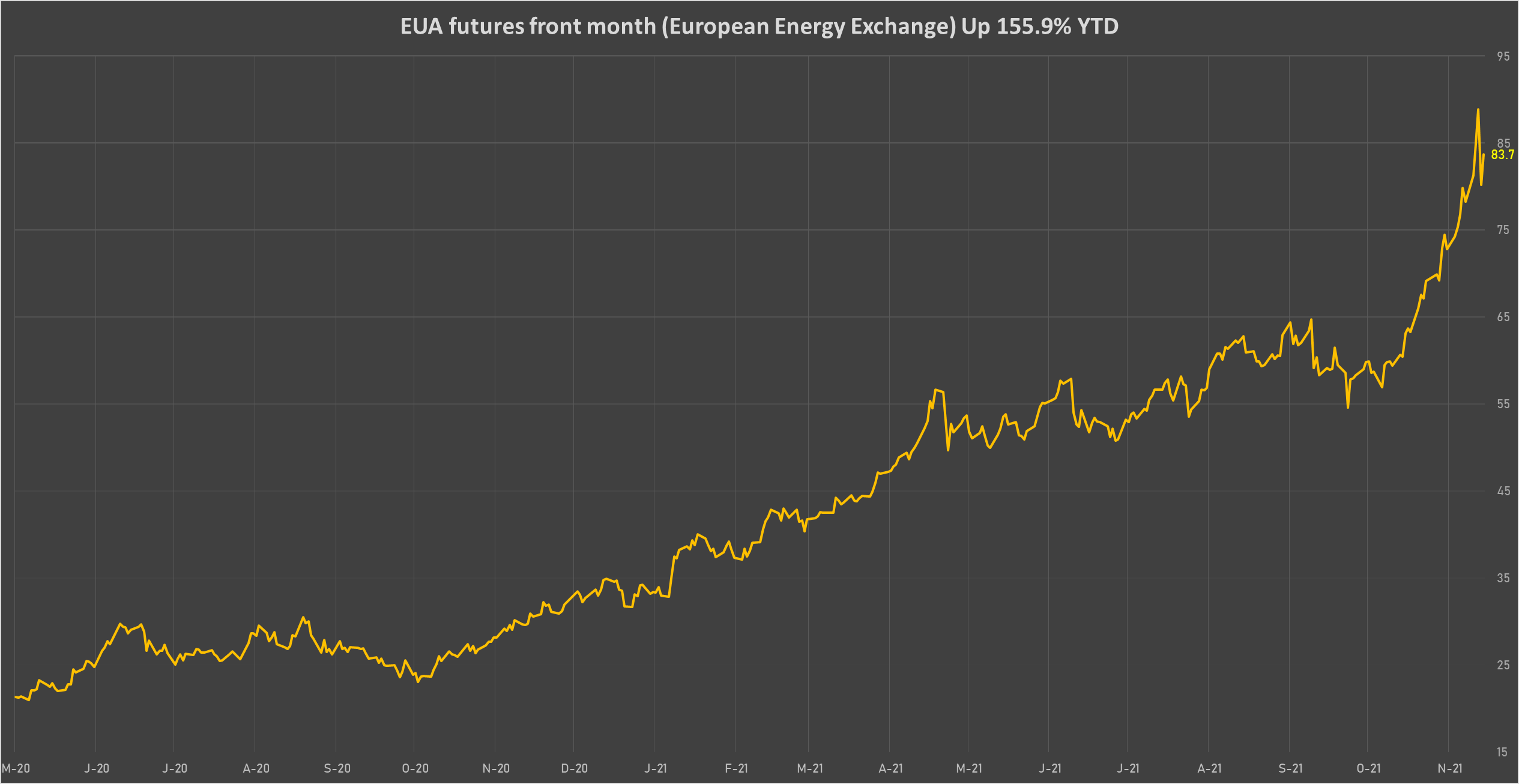

Carbon allowances have been some of the most profitable longs this year, with European CO2 permits having almost tripled in 2021 (EEX front month up 161% year to date)

Published ET

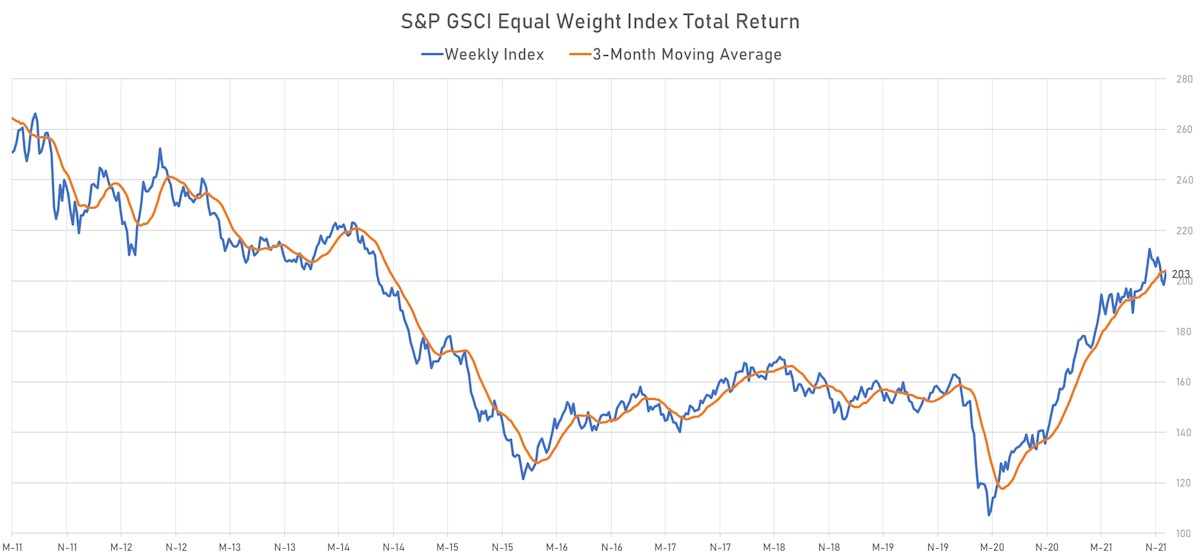

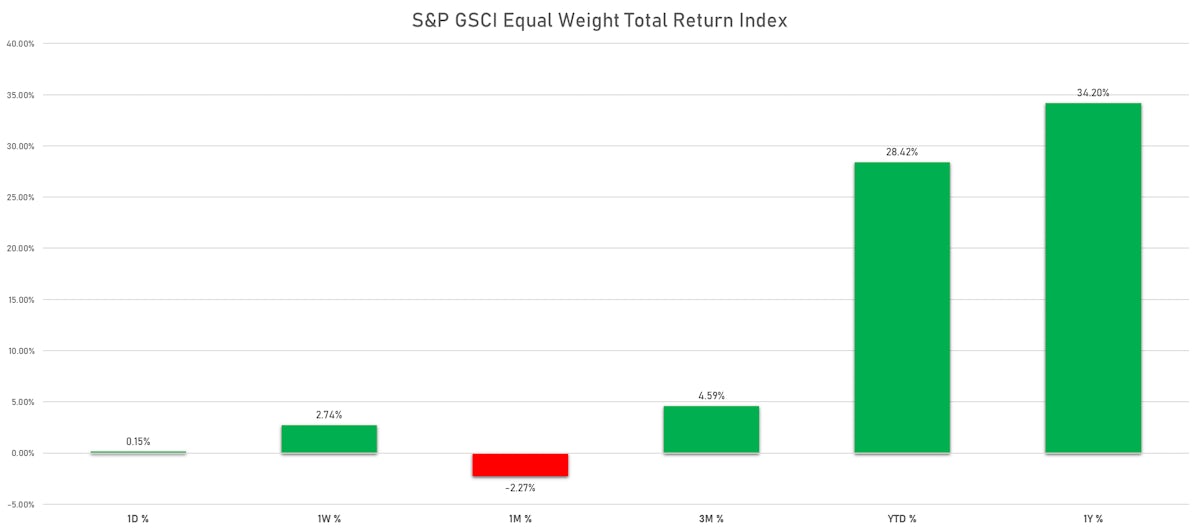

Performance Of The S&P GSCI Equal Weight Total Return Index | Sources: ϕpost, FactSet data

NOTABLE GAINERS THIS WEEK

- Baltic Exchange Clean Tank Index up 28.7% (YTD: 117.7%), now at 838.00

- CME Random Length Lumber up 17.9% (YTD: 22.5%), now at 1,069.30

- NYMEX RBOB Gasoline up 9.4% (YTD: 51.7%), now at 02.14

- NYMEX Light Sweet Crude Oil (WTI) up 8.2% (YTD: 47.7%), now at 71.67

- Crude Oil WTI Cushing US FOB up 8.0% (YTD: 48.3%), now at 71.61

- ICE Europe Brent Crude up 7.5% (YTD: 45.1%), now at 75.15

- NYMEX NY Harbor ULSD up 7.3% (YTD: 52.5%), now at 02.25

- EEX European-Carbon- Secondary Trading up 7.0% (YTD: 161.2%), now at 83.25

- Intercontinental Exchange Endex European Union Allowance (EUA) Yearly up 7.0% (YTD: 155.9%), now at 83.73

- Baltic Exchange Dirty Tank Index up 6.5% (YTD: 68.5%), now at 785.00

- WUXI Metal Cobalt Bi-Monthly up 5.9% (YTD: 76.8%), now at 478.50

- Brent Forties and Oseberg Dated FOB North sea Crude up 5.9% (YTD: 46.7%), now at 75.03

- ICE Europe Low Sulphur Gasoil up 5.5% (YTD: 55.3%), now at 646.25

- ICE Europe Newcastle Coal Monthly up 5.5% (YTD: 103.4%), now at 163.75

- ICE-US Sugar No. 11 up 5.1% (YTD: 27.2%), now at 19.69

NOTABLE LOSERS THIS WEEK

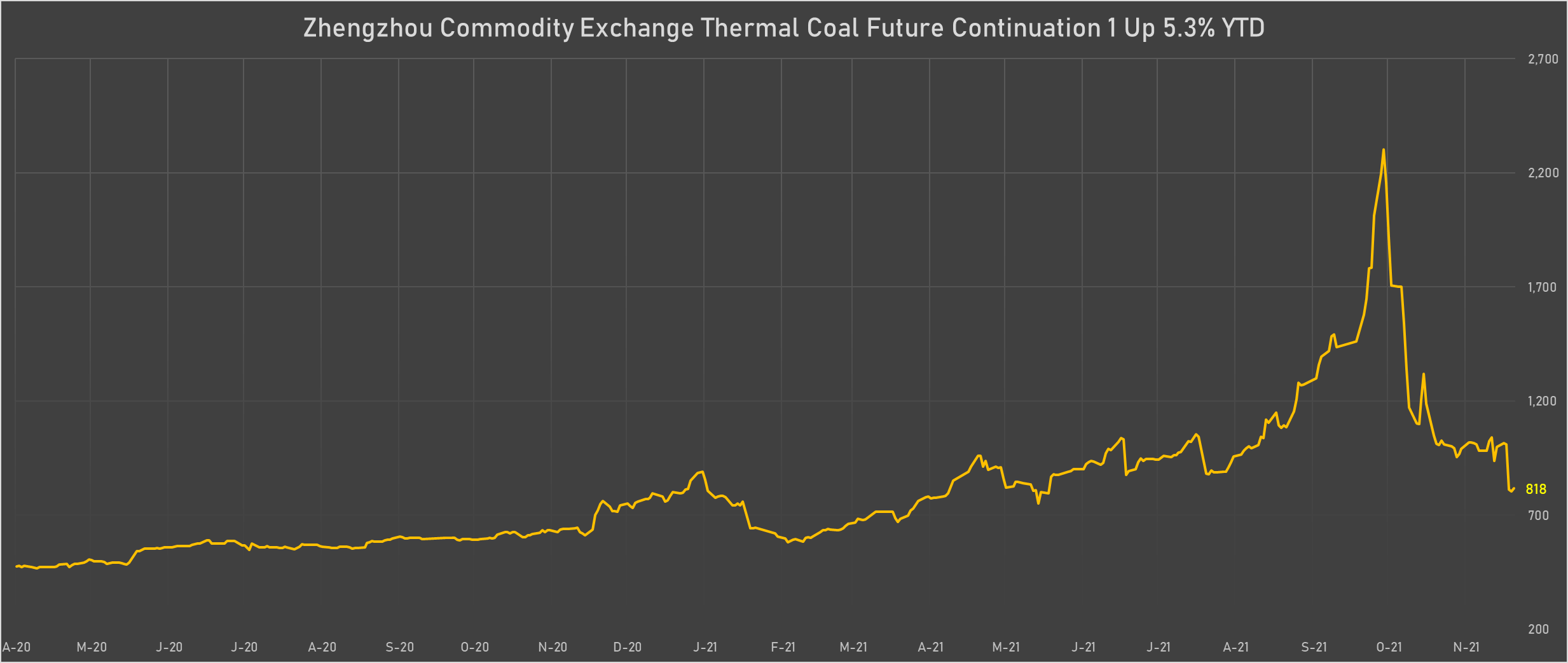

- Zhengzhou Exchange Thermal Coal down -18.1% (YTD: 2.9%), now at 815.00

- DCE Coking Coal Continuation Month 1 down -6.5% (YTD: 66.6%), now at 2,500.00

- CBoT Soybean Oil down -6.1% (YTD: 23.7%), now at 53.59

- NYMEX Henry Hub Natural Gas down -5.0% (YTD: 54.6%), now at 03.93

- ICE-US Coffee C down -4.7% (YTD: 81.4%), now at 235.00

- Palladium spot down -2.9% (YTD: -28.0%), now at 1,761.54

- ICE-US Cotton No. 2 down -2.8% (YTD: 36.0%), now at 106.12

- Johnson Matthey Iridium New York 0930 down -2.4% (YTD: 55.8%), now at 4,050.00

- SHFE Nickel down -2.3% (YTD: 17.8%), now at 145,400.00

- Baltic Exchange Panamax Index down -1.9% (YTD: 131.5%), now at 3,068.00

- CBoT Rough Rice down -1.7% (YTD: 11.5%), now at 13.83

- CBoT Wheat down -1.6% (YTD: 22.1%), now at 782.00

- SHFE Rubber down -1.6% (YTD: 4.9%), now at 14,405.00

- Silver spot down -1.6% (YTD: -15.9%), now at 22.17

- CME Lean Hogs down -1.3% (YTD: 3.9%), now at 73.05

NET POSITIONS OF MANAGED MONEY (WEEKLY COTR REPORT)

ENERGY

- Light Sweet Crude increased net long position

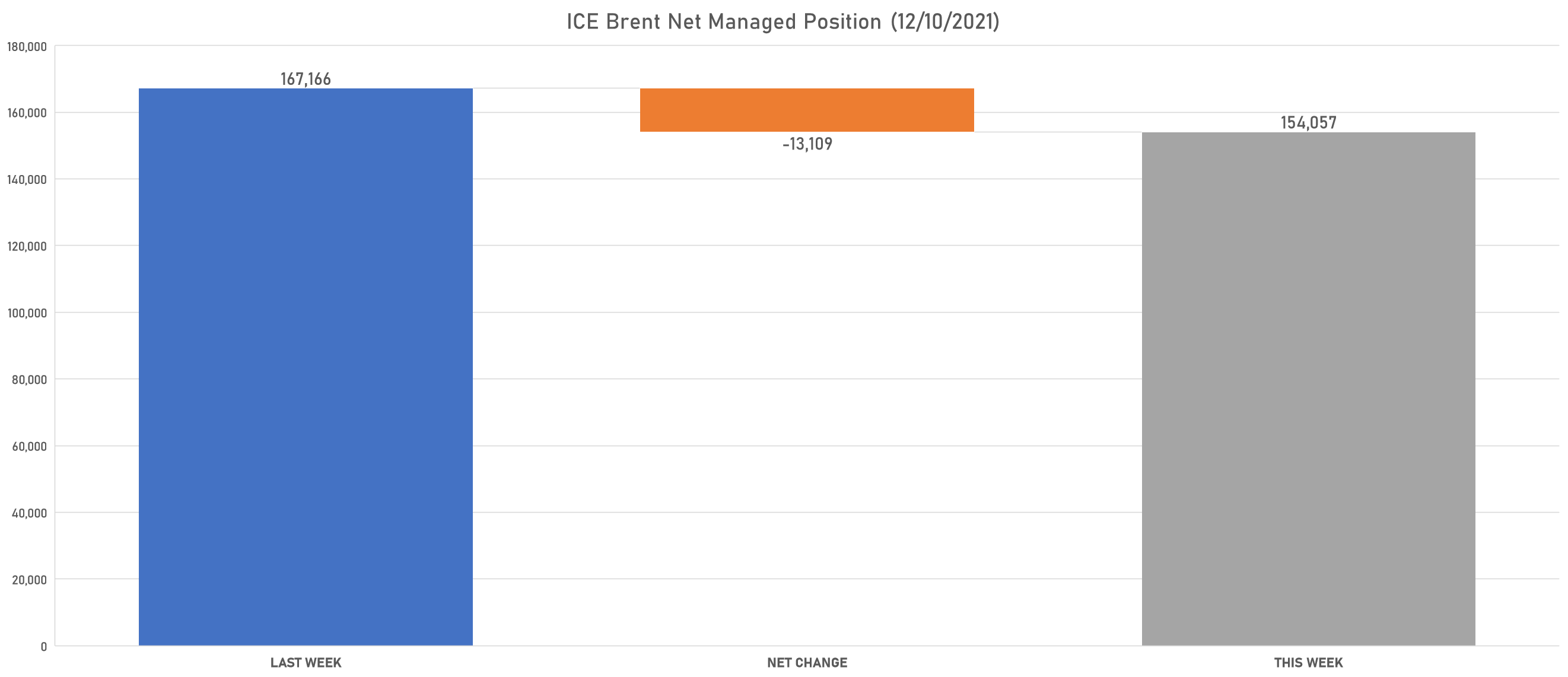

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum turned to net short

- Palladium reduced net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat reduced net long position

- Corn increased net long position

- Rough Rice reduced net long position

- Oats increased net long position

- Soybeans increased net long position

- Soybean Oil reduced net long position

- Soybean Meal reduced net long position

- Lean Hogs reduced net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa increased net short position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net short position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

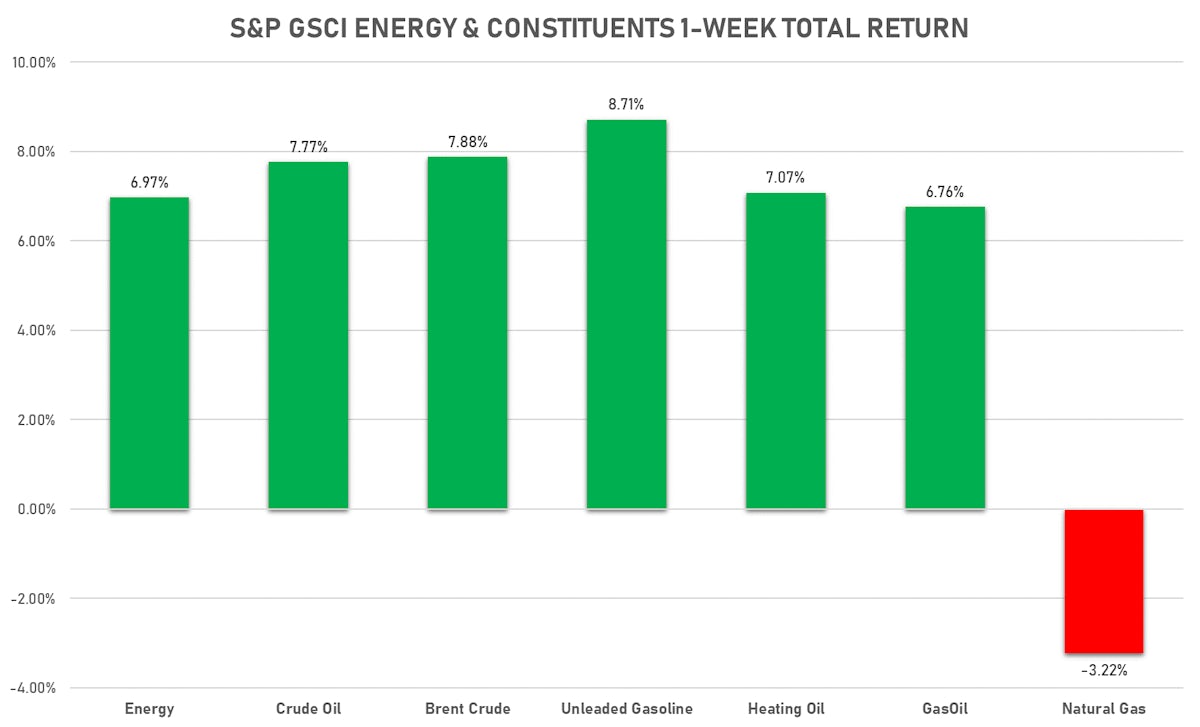

ENERGY THIS WEEK

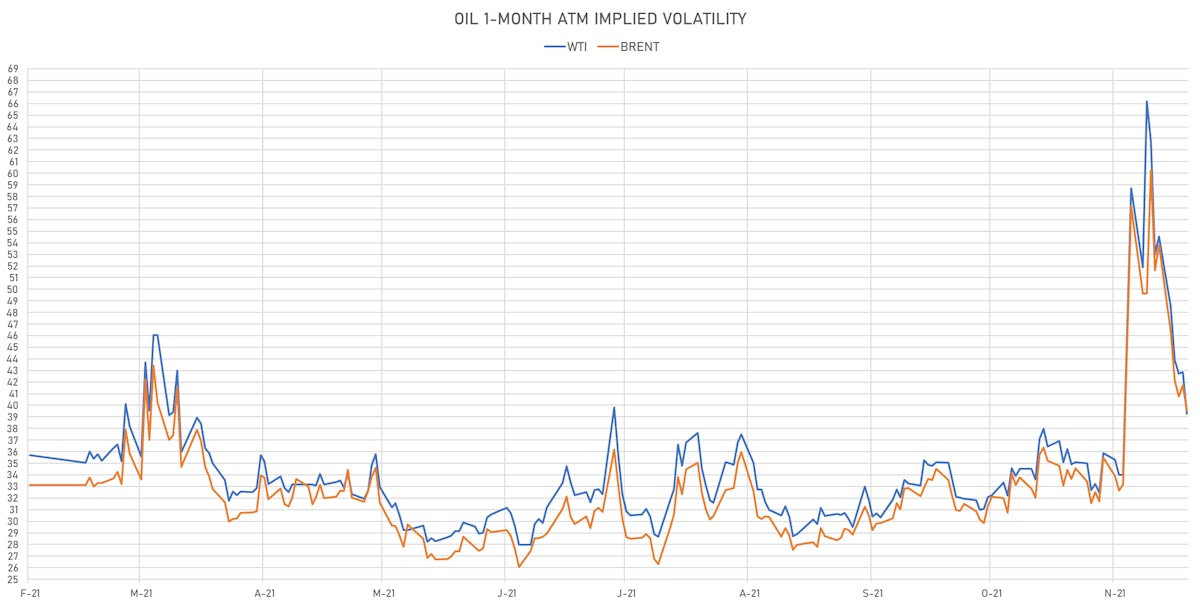

- WTI crude front month currently at US$ 71.67 per barrel, up 8.2% (YTD: +47.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.15 per barrel, up 7.5% (YTD: +45.1%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 163.75 per tonne, up 5.5% (YTD: +103.4%)

- Natural Gas (Henry Hub) currently at US$ 3.93 per MMBtu, down -5.0% (YTD: +54.6%)

- Gasoline (NYMEX) currently at US$ 2.14 per gallon, up 9.4% (YTD: +51.7%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 646.25 per tonne, up 5.5% (YTD: +55.3%)

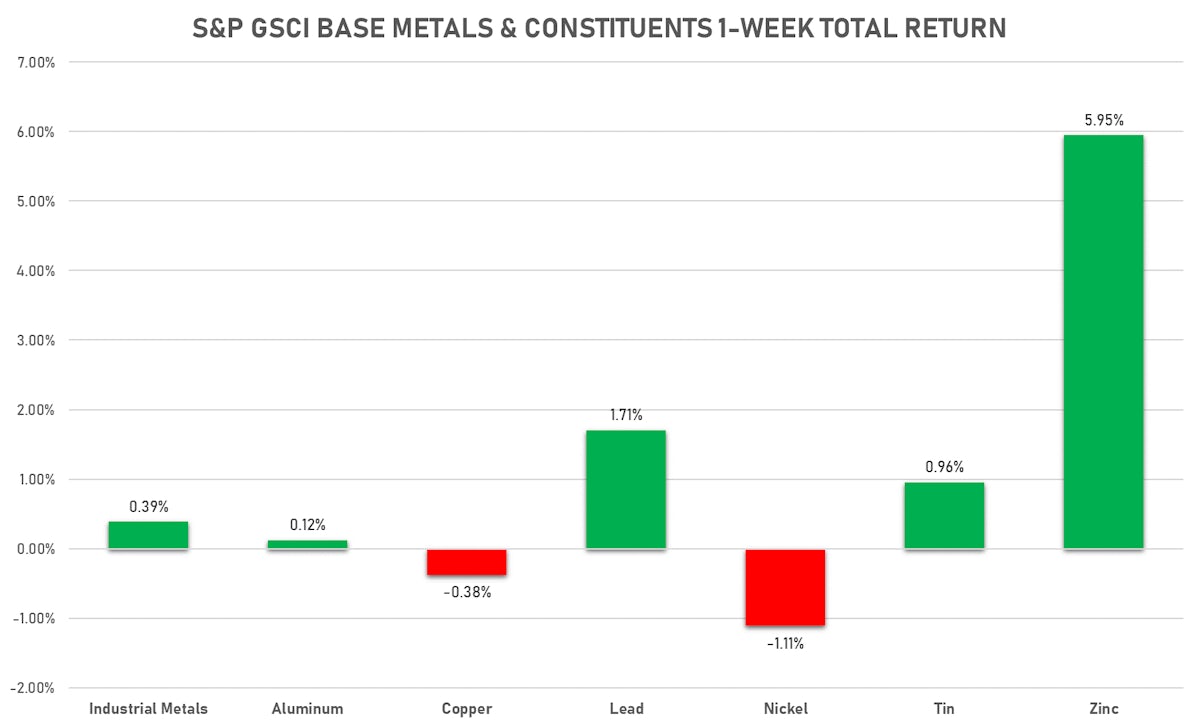

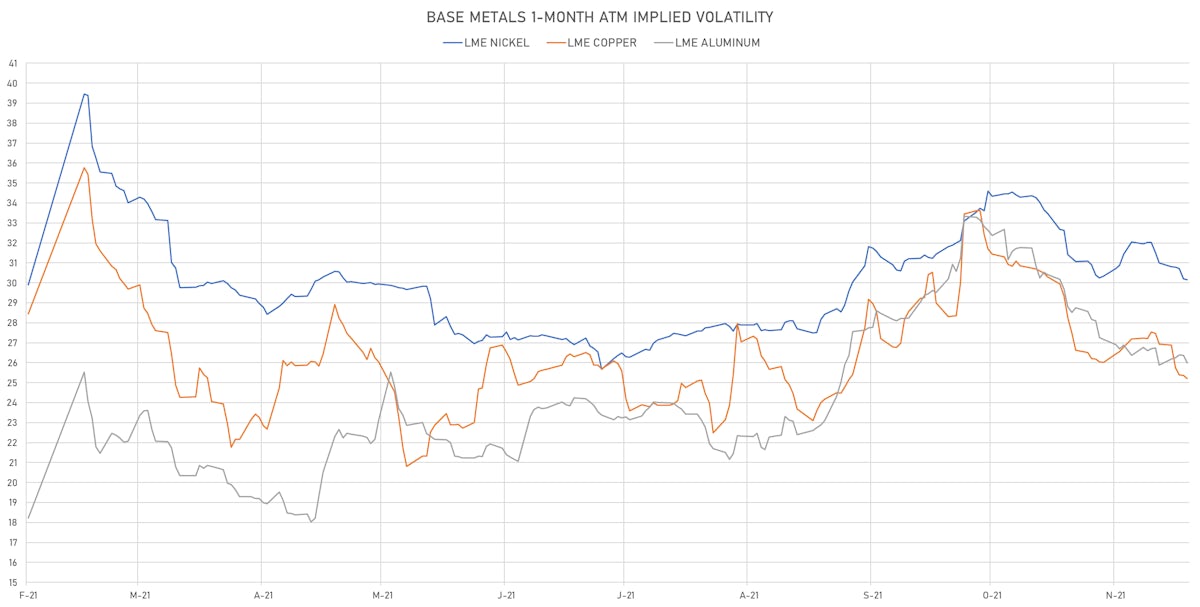

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.29 per pound, up 0.4% (YTD: +21.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 635.00 per tonne, up 4.5% (YTD: -41.3%)

- Aluminum (Shanghai) currently at CNY 18,710 per tonne, up 0.2% (YTD: +20.1%)

- Nickel (Shanghai) currently at CNY 145,400 per tonne, down -2.3% (YTD: +17.8%)

- Lead (Shanghai) currently at CNY 15,655 per tonne, up 1.7% (YTD: +4.9%)

- Rebar (Shanghai) currently at CNY 4,303 per tonne, up 0.0% (YTD: +2.0%)

- Tin (Shanghai) currently at CNY 294,880 per tonne, up 0.9% (YTD: +94.9%)

- Zinc (Shanghai) currently at CNY 23,460 per tonne, up 1.3% (YTD: +12.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 466,500 per tonne, up 4.7% (YTD: +70.3%)

- Lithium (Shanghai) spot price currently at CNY 1,155,000 per tonne, up 1.8% (YTD: +138.1%)

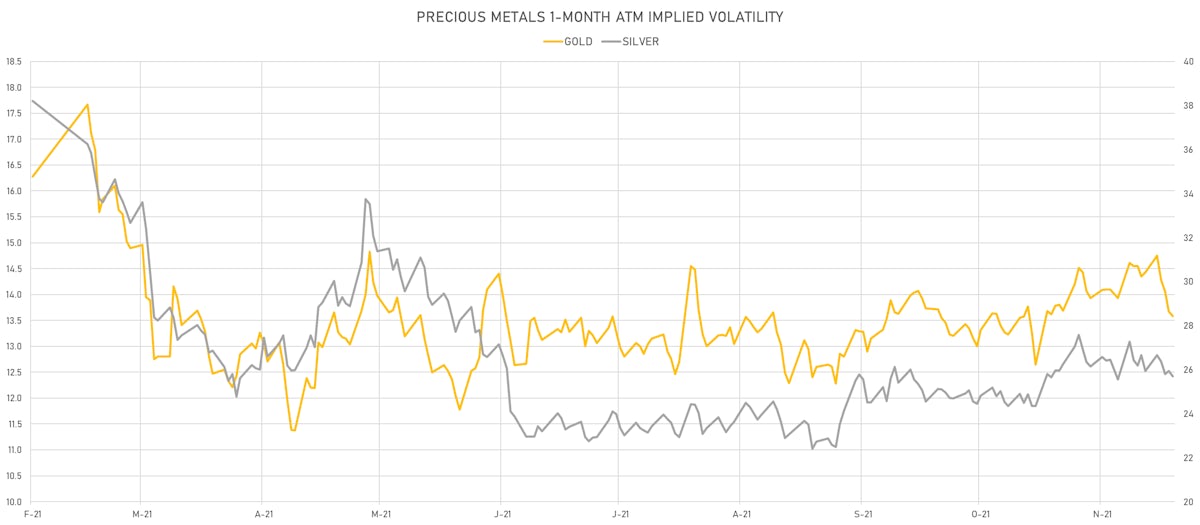

PRECIOUS METALS THIS WEEK

- Gold spot unchanged at US$ 1,782.65 per troy ounce (YTD: -6.0%)

- Gold 1-Month ATM implied volatility currently at 13.21, down -5.8% (YTD: -15.6%)

- Silver spot currently at US$ 22.17 per troy ounce, down -1.6% (YTD: -15.9%)

- Silver 1-Month ATM implied volatility currently at 24.48, down -0.9% (YTD: -39.5%)

- Palladium spot currently at US$ 1,761.54 per troy ounce, down -2.9% (YTD: -28.0%)

- Platinum spot currently at US$ 941.81 per troy ounce, up 1.1% (YTD: -11.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,000 per troy ounce, unchanged (YTD: -17.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,050 per troy ounce, down -2.4% (YTD: +55.8%)

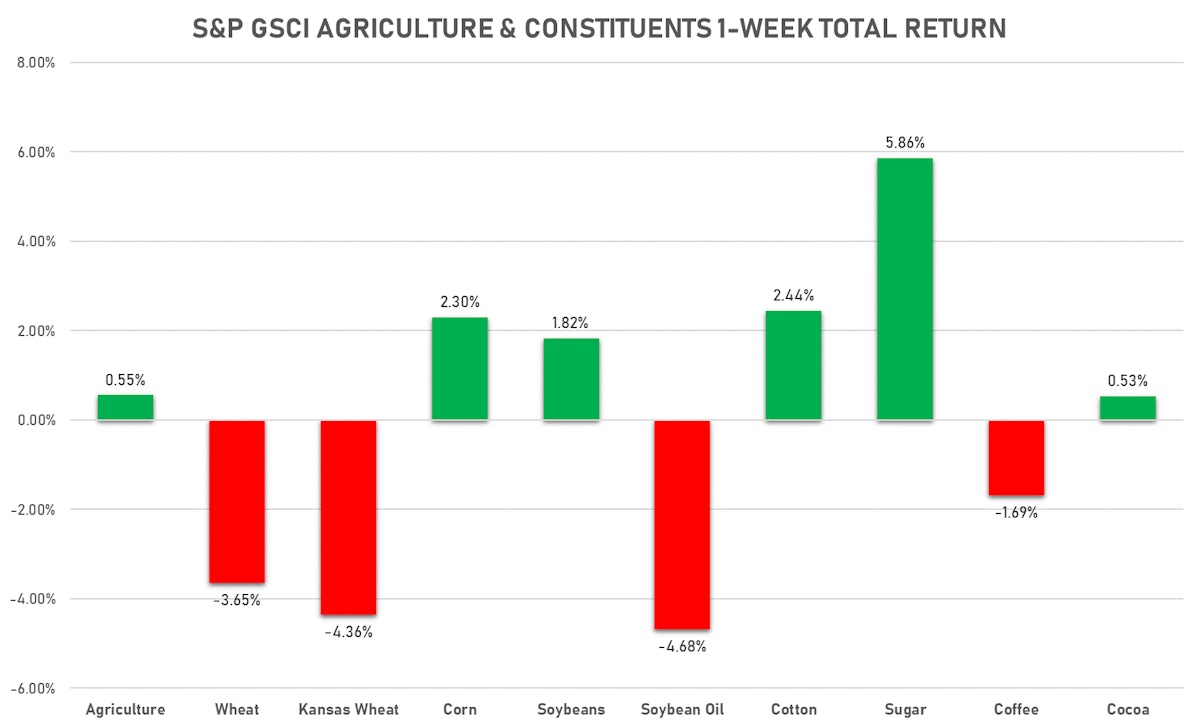

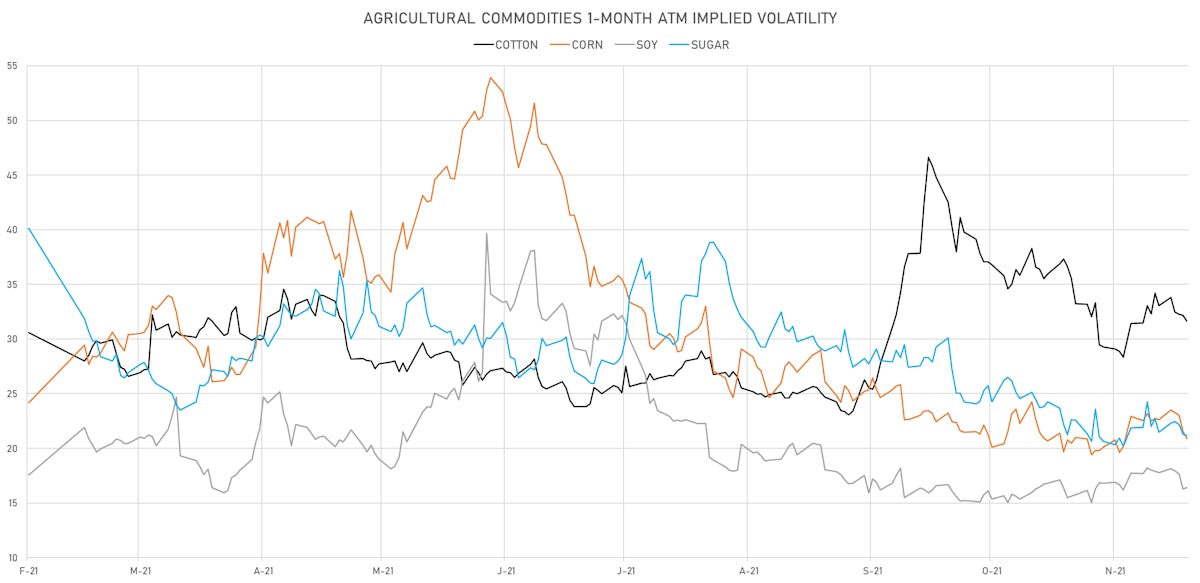

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 136.85 cents per pound, down 0.6% (YTD: +21.2%)

- Lean Hogs (CME) currently at US$ 73.05 cents per pound, down -1.3% (YTD: +3.9%)

- Rough Rice (CBOT) currently at US$ 13.83 cents per hundredweight, down -1.7% (YTD: +11.5%)

- Soybeans Composite (CBOT) unchanged at US$ 1,267.75 cents per bushel (YTD: -3.6%)

- Corn (CBOT) currently at US$ 588.50 cents per bushel, up 0.4% (YTD: +21.6%)

- Wheat Composite (CBOT) currently at US$ 782.00 cents per bushel, down -1.6% (YTD: +22.1%)

- Sugar No.11 (ICE US) currently at US$ 19.69 cents per pound, up 5.1% (YTD: +27.2%)

- Cotton No.2 (ICE US) currently at US$ 106.12 cents per pound, down -2.8% (YTD: +36.0%)

- Cocoa (ICE US) currently at US$ 2,447 per tonne, up 1.1% (YTD: -5.4%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,725 per tonne, up 2.0% (YTD: +80.9%)

- Random Length Lumber (CME) currently at US$ 1,069.30 per 1,000 board feet, up 17.9% (YTD: +22.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,150 per tonne, down -0.6% (YTD: +11.7%)

- Soybean Oil Composite (CBOT) currently at US$ 53.59 cents per pound, down -6.1% (YTD: +23.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,243 per tonne, up 1.3% (YTD: +34.7%)

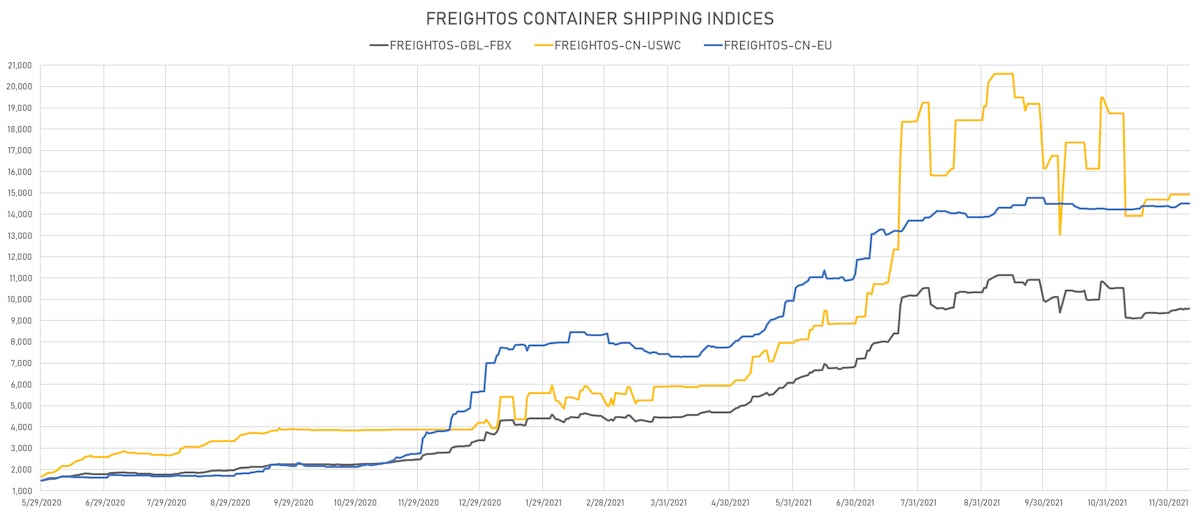

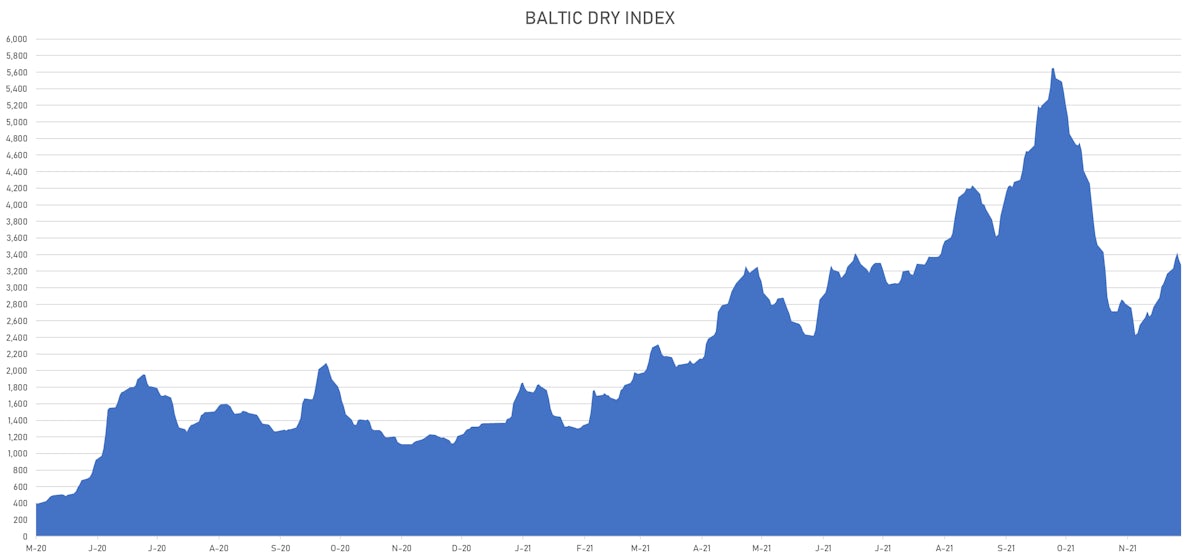

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 3,272, up 3.2% (YTD: +139.5%)

- Freightos China To North America West Coast Container Index currently at 14,924, unchanged (YTD: +255.4%)

- Freightos North America West Coast To China Container Index currently at 887, down -2.4% (YTD: +71.3%)

- Freightos North America East Coast To Europe Container Index currently at 471, unchanged (YTD: +29.8%)

- Freightos Europe To North America East Coast Container Index currently at 7,173, down -2.0% (YTD: +283.8%)

- Freightos China To North Europe Container Index currently at 14,498, up 1.2% (YTD: +156.0%)

- Freightos North Europe To China Container Index currently at 1,129, down -12.3% (YTD: -17.9%)

- Freightos Europe To South America West Coast Container Index currently at 7,695, up 10.4% (YTD: +354.9%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 83.73 per tonne, up 7.0% (YTD: +155.9%)