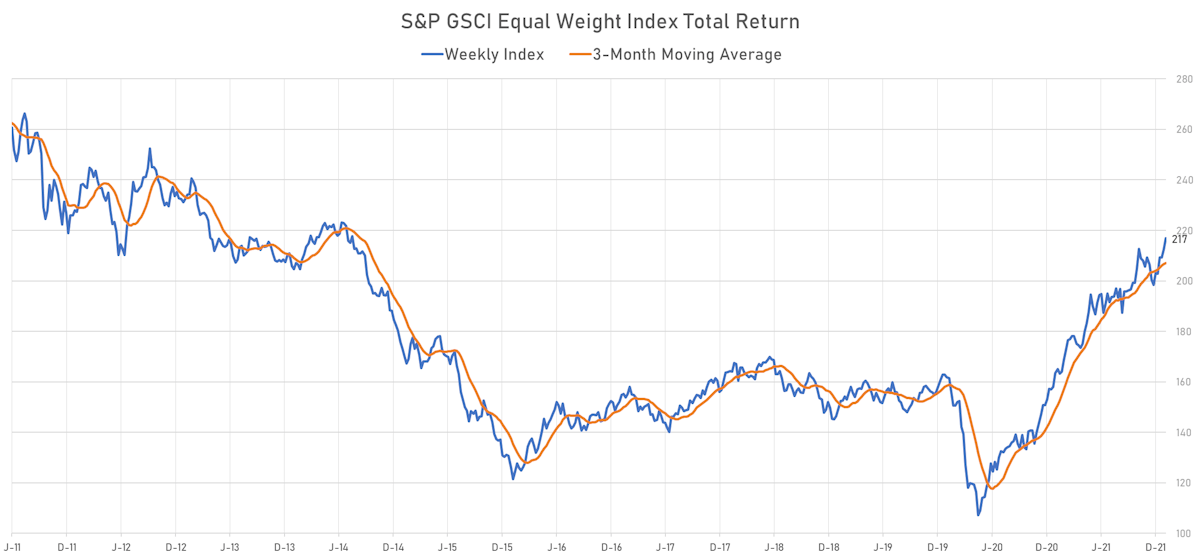

Commodities

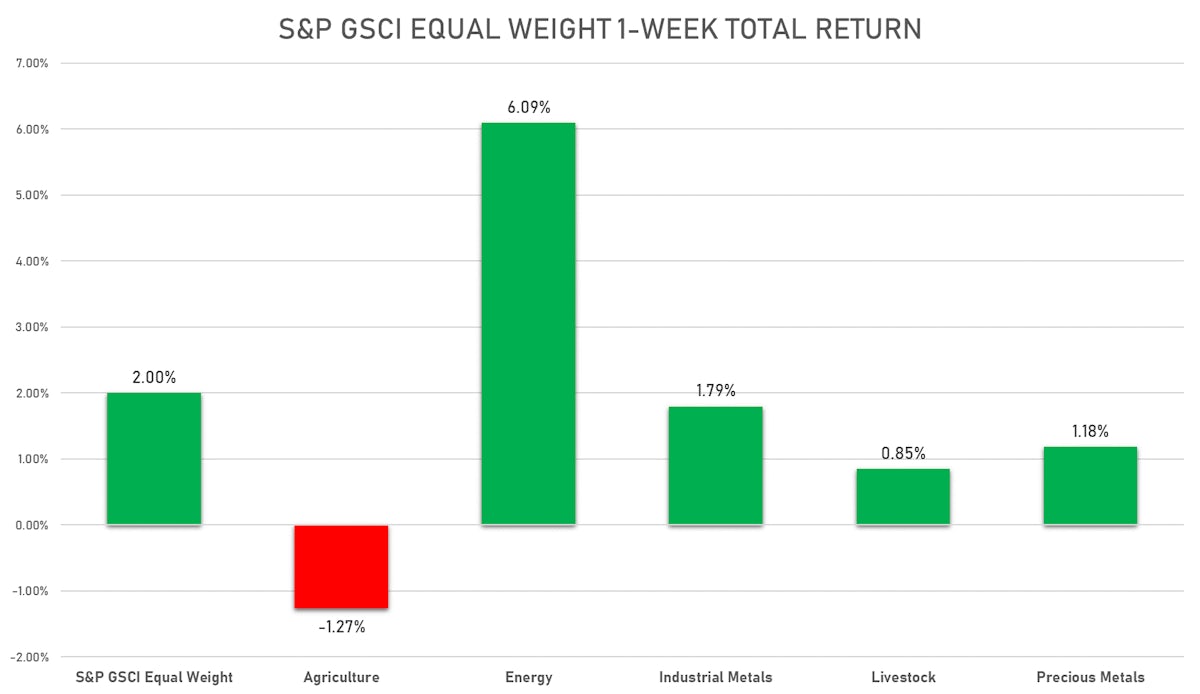

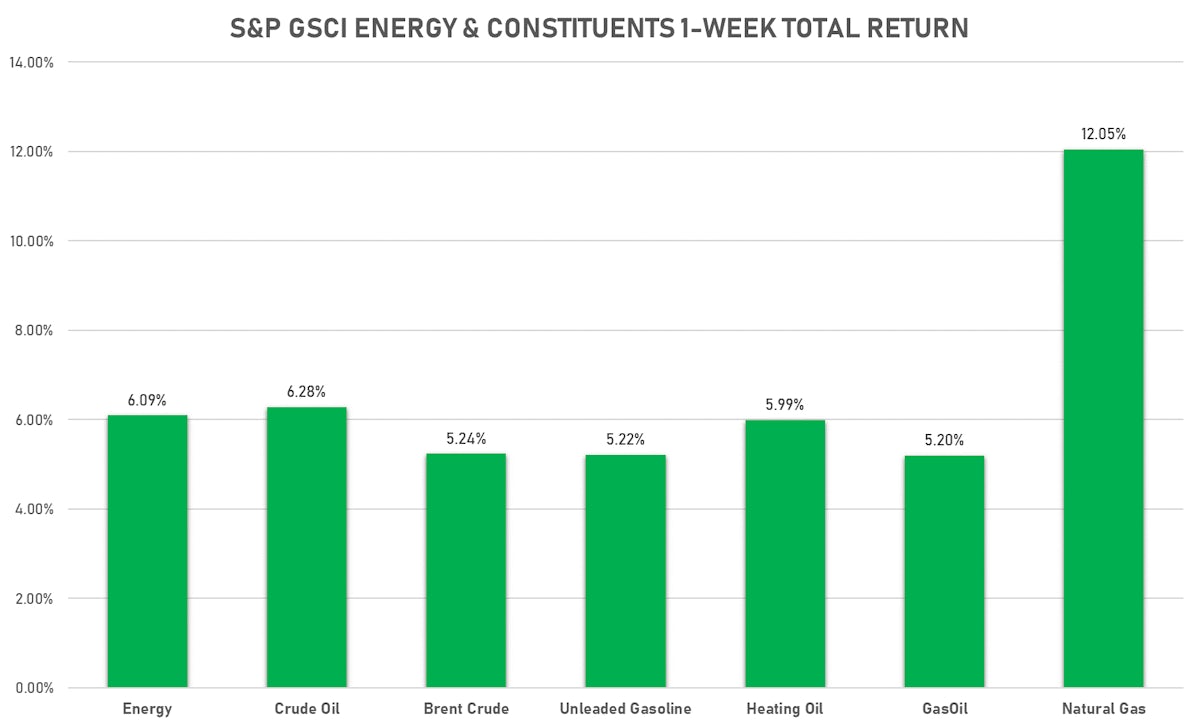

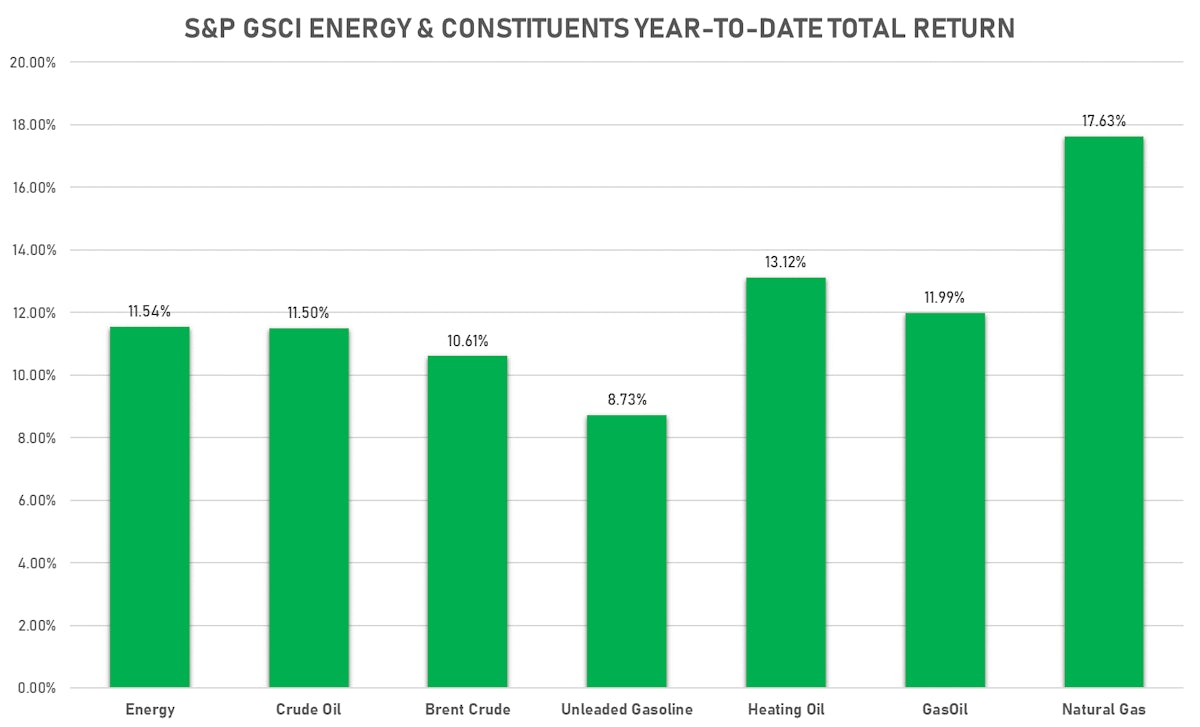

Looking At GSCI Sub-Indices, Energy Is Off To A Great Start This Year, Led By Natural Gas And Heating Oil

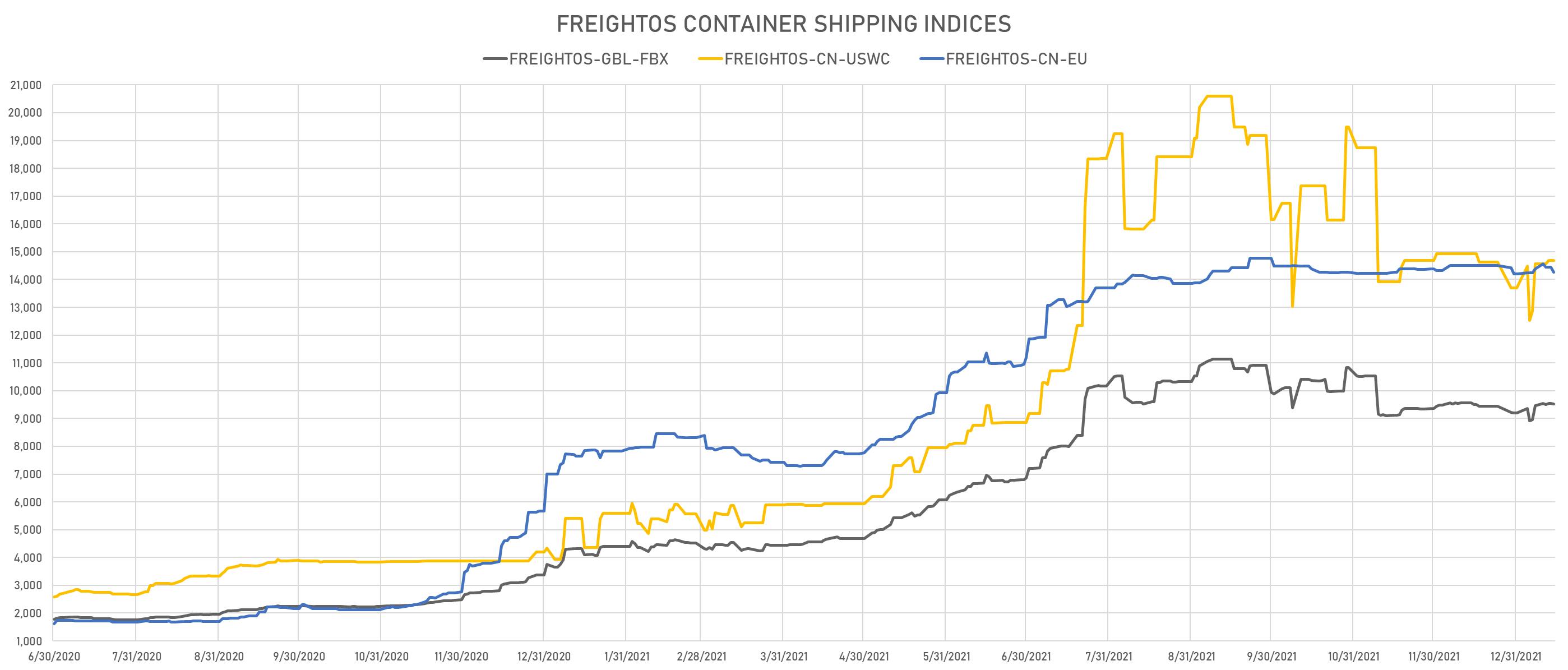

Among macro trends, shipping has seen a continued slide since the beginning of the year (Baltic dry index down 20% YTD and down 69% since October), while EV-related base metals have done really well (Lithium up 20% and Nickel up 10% YTD)

Published ET

S&P GSCI Energy Year-To-Date Performance By Sub-Indices | Sources: ϕpost, FactSet

NOTABLE GAINERS THIS WEEK

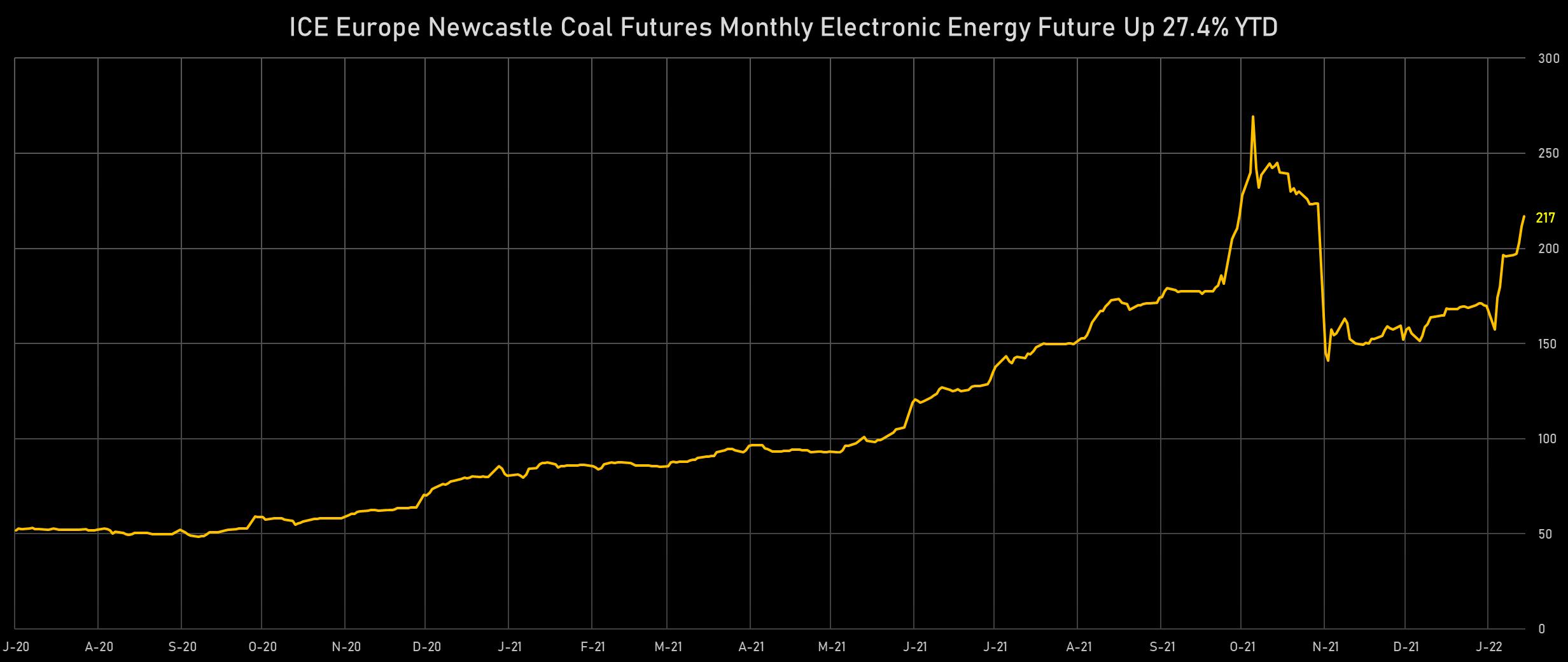

- ICE Europe Newcastle Coal Monthly up 10.6% (YTD: 27.8%), now at 216.75

- Zhengzhou Exchange Thermal Coal up 10.0% (YTD: 0.6%), now at 710.00

- SHFE Nickel up 9.3% (YTD: 8.8%), now at 165,200.00

- NYMEX Henry Hub Natural Gas up 8.8% (YTD: 14.3%), now at 04.26

- DCE Coking Coal Continuation Month 1 up 8.2% (YTD: 15.2%), now at 2,366.00

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 6.6% (YTD: 12.6%), now at 88.48

- NYMEX Light Sweet Crude Oil (WTI) up 6.2% (YTD: 11.4%), now at 83.82

- Brent Forties and Oseberg Dated FOB North Sea Crude up 6.2% (YTD: 13.2%), now at 87.54

- NYMEX NY Harbor ULSD up 6.1% (YTD: 13.1%), now at 02.63

- Crude Oil WTI Cushing US FOB up 6.1% (YTD: 11.3%), now at 83.77

- ICE-US Cocoa up 5.5% (YTD: 5.5%), now at 2,680.00

- ICE Europe Brent Crude up 5.3% (YTD: 10.6%), now at 86.06

- NYMEX RBOB Gasoline up 5.2% (YTD: 8.5%), now at 02.42

- ICE Europe Low Sulphur Gasoil up 5.2% (YTD: 12.3%), now at 749.25

- CME Random Length Lumber up 4.1% (YTD: 7.8%), now at 1,308.70

NOTABLE LOSERS THIS WEEK

- Baltic Exchange Capesize Index down -38.5% (YTD: -35.3%), now at 1,496.00

- Baltic exchange dry index down -22.9% (YTD: -20.4%), now at 1,764.00

- Baltic Exchange Panamax Index down -19.7% (YTD: -7.7%), now at 2,375.00

- Baltic Exchange Supramax Index down -8.5% (YTD: -17.2%), now at 1,897.00

- Baltic Exchange Handysize Index down -8.3% (YTD: -18.7%), now at 1,192.00

- Johnson Matthey Rhodium New York 0930 down -6.3% (YTD: 15.9%), now at 16,400.00

- Baltic Exchange clean tank index down -5.4% (YTD: -24.7%), now at 593.00

- Coffee Robusta Vietnam Grade 1 Wet Pol spot down -5.1% (YTD: 0.0%), now at 1,922.00

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -3.9%, now at 82.08

- EEX European-Carbon- Secondary Trading down -3.8% (YTD: 0.0%), now at 80.23

- CBoT Soybeans down -3.2% (YTD: 2.1%), now at 1,369.75

- Palladium spot down -2.7% (YTD: -0.9%), now at 1,880.84

- CBoT Rough Rice down -2.5% (YTD: -3.0%), now at 14.56

- CBoT Wheat down -2.2% (YTD: -3.8%), now at 741.50

- CBoT Corn down -1.7% (YTD: 0.5%), now at 596.25

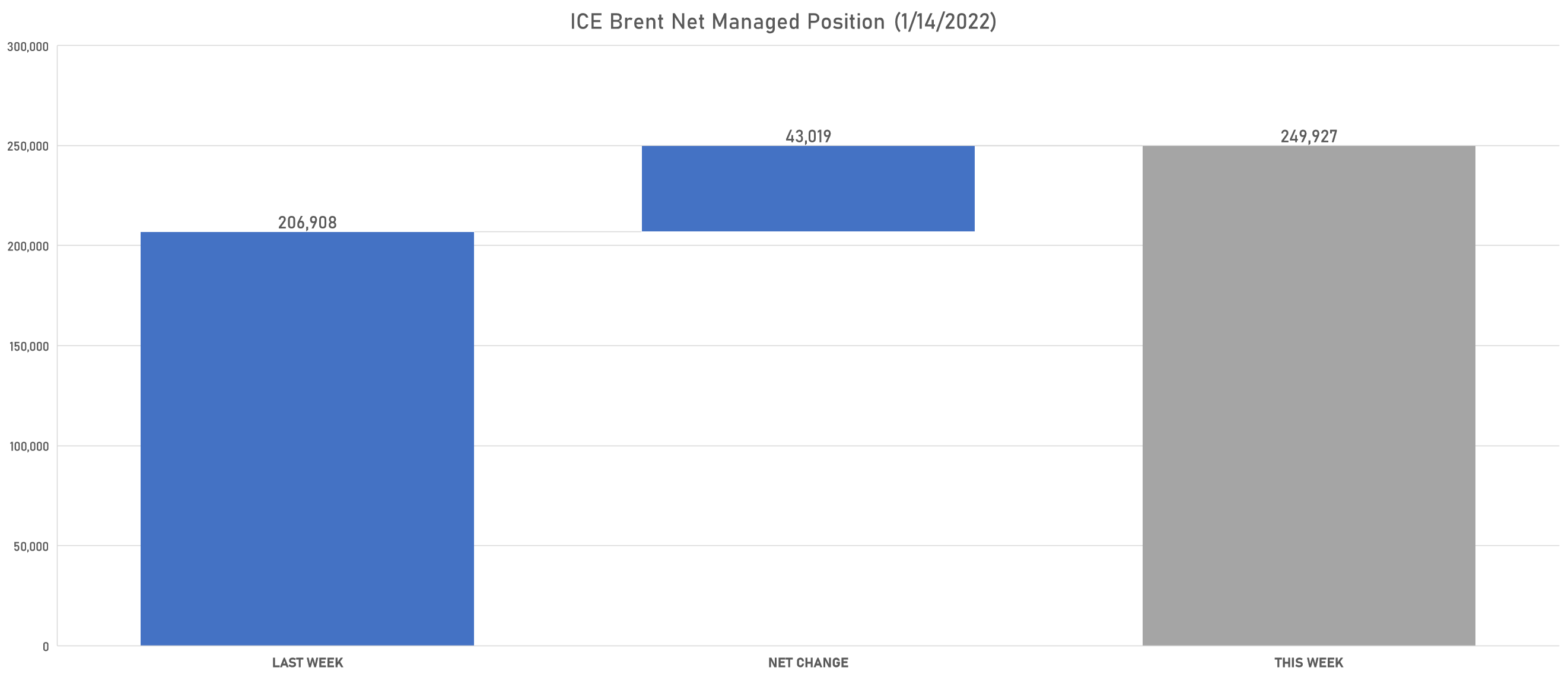

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent increased net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil increased net long position

- Henry Hub Ice increased net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum increased net short position

- Palladium reduced net short position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat increased net short position

- Corn reduced net long position

- Rough Rice reduced net long position

- Oats reduced net long position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa turned to net long

- Coffee C increased net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

ENERGY THIS WEEK

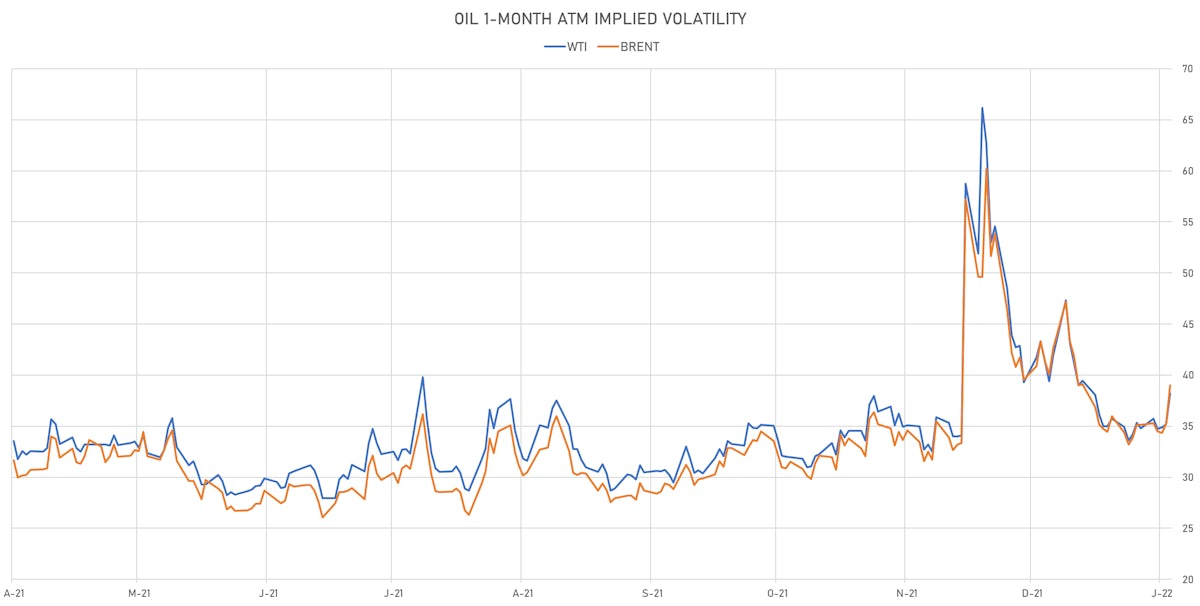

- WTI crude front month currently at US$ 83.82 per barrel, up 6.2% (YTD: +8.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 86.06 per barrel, up 5.3% (YTD: +8.5%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 216.75 per tonne, up 10.6% (YTD: +27.4%)

- Natural Gas (Henry Hub) currently at US$ 4.26 per MMBtu, up 8.8% (YTD: +19.7%)

- Gasoline (NYMEX) currently at US$ 2.42 per gallon, up 5.2% (YTD: +5.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 749.25 per tonne, up 5.2% (YTD: +10.5%)

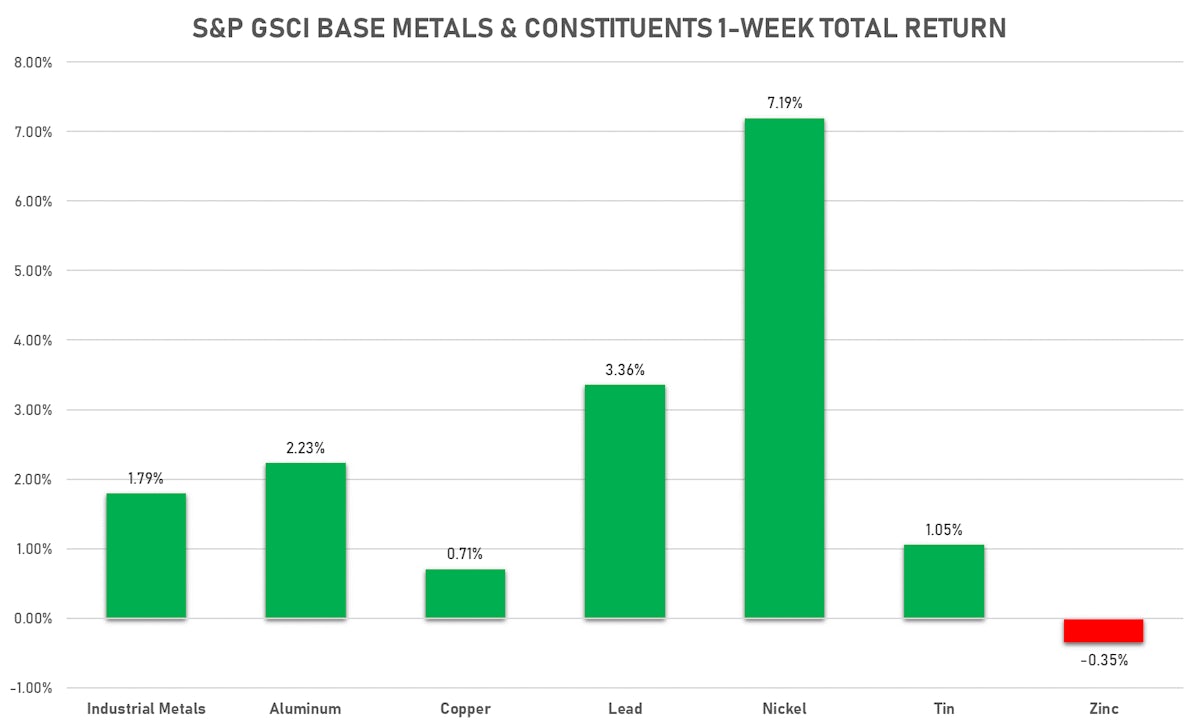

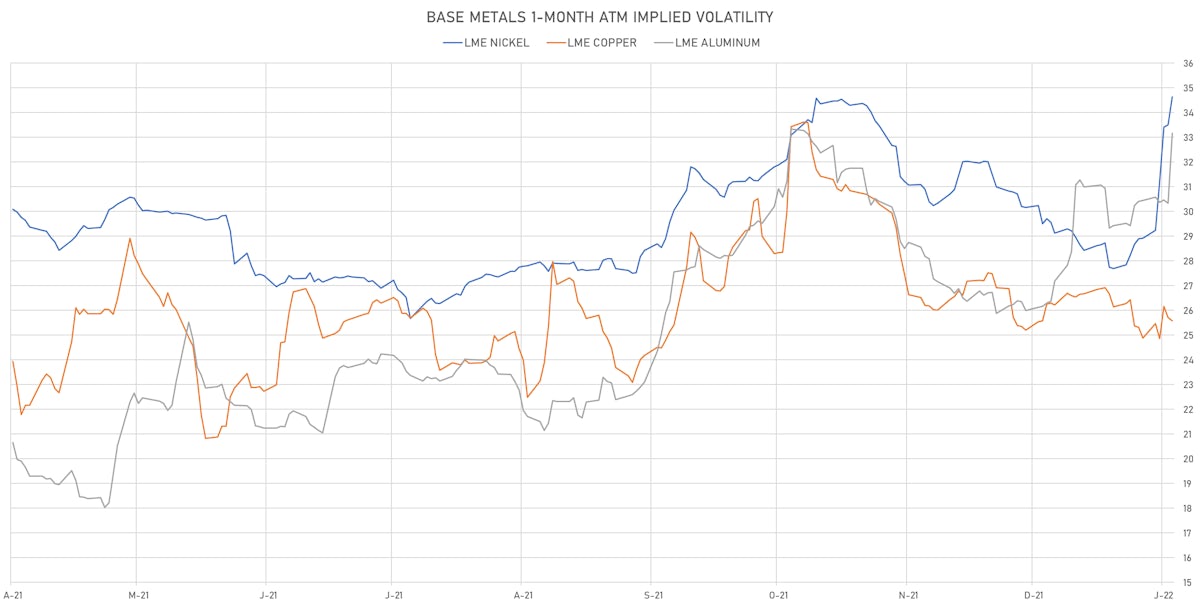

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.41 per pound, up 0.2% (YTD: +0.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 721.50 per tonne, up 3.1% (YTD: +5.2%)

- Aluminum (Shanghai) currently at CNY 21,070 per tonne, up 1.0% (YTD: +4.8%)

- Nickel (Shanghai) currently at CNY 165,200 per tonne, up 9.3% (YTD: +9.6%)

- Lead (Shanghai) currently at CNY 15,600 per tonne, up 2.1% (YTD: +1.6%)

- Rebar (Shanghai) currently at CNY 4,620 per tonne, up 0.6% (YTD: +2.4%)

- Tin (Shanghai) currently at CNY 315,180 per tonne, up 3.0% (YTD: +5.5%)

- Zinc (Shanghai) currently at CNY 24,445 per tonne, up 1.0% (YTD: +3.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 500,000 per tonne, up 1.2% (YTD: +2.7%)

- Lithium (Shanghai) spot price currently at CNY 1,605,000 per tonne, up 3.9% (YTD: +20.2%)

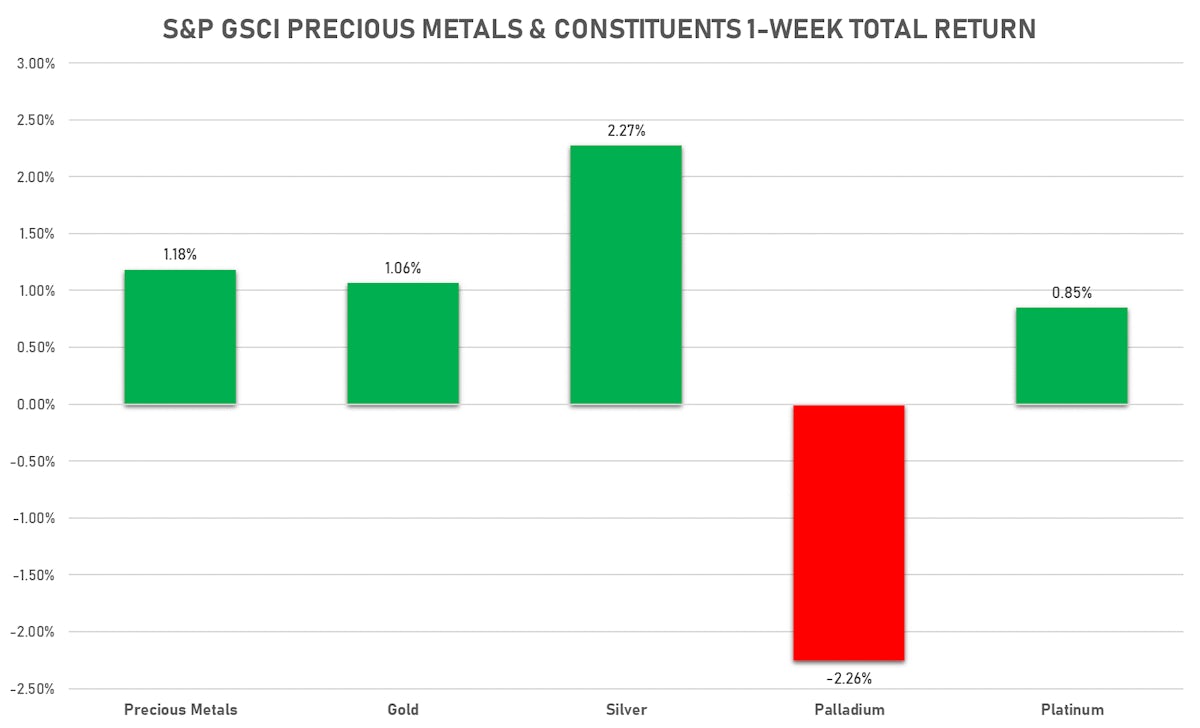

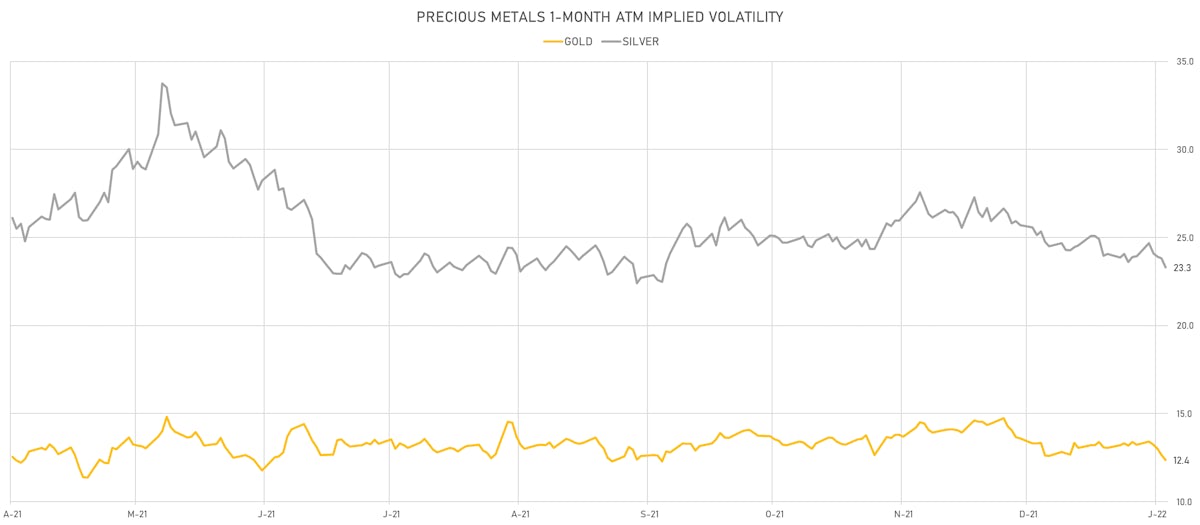

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,817.35 per troy ounce, up 1.2% (YTD: +0.2%)

- Gold 1-Month ATM implied volatility currently at 11.98, down -6.5% (YTD: -5.4%)

- Silver spot currently at US$ 22.94 per troy ounce, up 2.6% (YTD: -0.4%)

- Silver 1-Month ATM implied volatility currently at 21.90, down -2.7% (YTD: -2.7%)

- Palladium spot currently at US$ 1,880.84 per troy ounce, down -2.7% (YTD: -4.3%)

- Platinum spot currently at US$ 969.50 per troy ounce, up 1.3% (YTD: +0.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 16,400 per troy ounce, down -6.3% (YTD: +16.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,000 per troy ounce

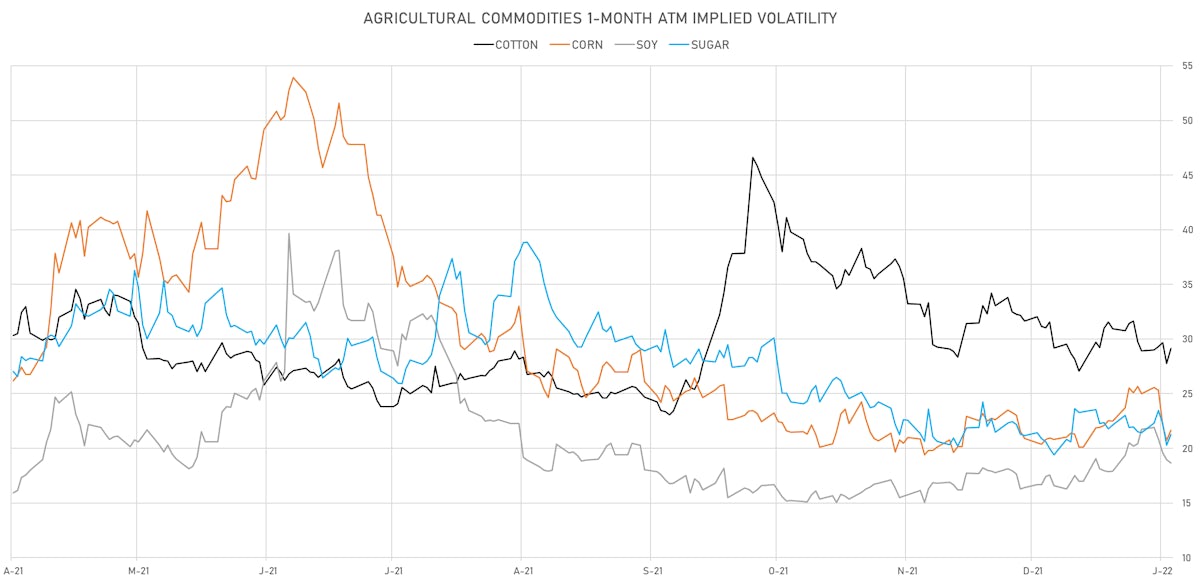

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 137.98 cents per pound, up 0.5% (YTD: -0.8%)

- Lean Hogs (CME) currently at US$ 80.90 cents per pound, up 1.6% (YTD: -2.2%)

- Rough Rice (CBOT) currently at US$ 14.56 cents per hundredweight, down -2.5% (YTD: -2.6%)

- Soybeans Composite (CBOT) currently at US$ 1,369.75 cents per bushel, down -3.2% (YTD: +2.2%)

- Corn (CBOT) currently at US$ 596.25 cents per bushel, down -1.7% (YTD: +0.0%)

- Wheat Composite (CBOT) currently at US$ 741.50 cents per bushel, down -2.2% (YTD: -4.9%)

- Sugar No.11 (ICE US) currently at US$ 18.33 cents per pound, up 1.4% (YTD: -2.5%)

- Cotton No.2 (ICE US) currently at US$ 119.77 cents per pound, up 4.0% (YTD: +4.7%)

- Cocoa (ICE US) currently at US$ 2,680 per tonne, up 5.5% (YTD: +3.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,617 per tonne, up 1.4% (YTD: +2.0%)

- Random Length Lumber (CME) currently at US$ 1,308.70 per 1,000 board feet, up 4.1% (YTD: +6.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,630 per tonne, up 0.6% (YTD: +1.4%)

- Soybean Oil Composite (CBOT) currently at US$ 58.46 cents per pound, down -0.8% (YTD: +4.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,280 per tonne, down -0.6% (YTD: +2.9%)

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 1,764, down -22.9% (YTD: -20.5%)

- Freightos China To North America West Coast Container Index currently at 14,681, up 0.7% (YTD: +7.1%)

- Freightos North America West Coast To China Container Index currently at 1,101, up 4.3% (YTD: +25.8%)

- Freightos North America East Coast To Europe Container Index currently at 448, unchanged (YTD: -17.0%)

- Freightos Europe To North America East Coast Container Index currently at 6,771, up 11.6% (YTD: -4.6%)

- Freightos China To North Europe Container Index currently at 14,268, down -0.8% (YTD: +0.4%)

- Freightos North Europe To China Container Index currently at 1,014, down -20.0% (YTD: -10.3%)

- Freightos Europe To South America West Coast Container Index currently at 8,529, up 6.8% (YTD: +9.2%)

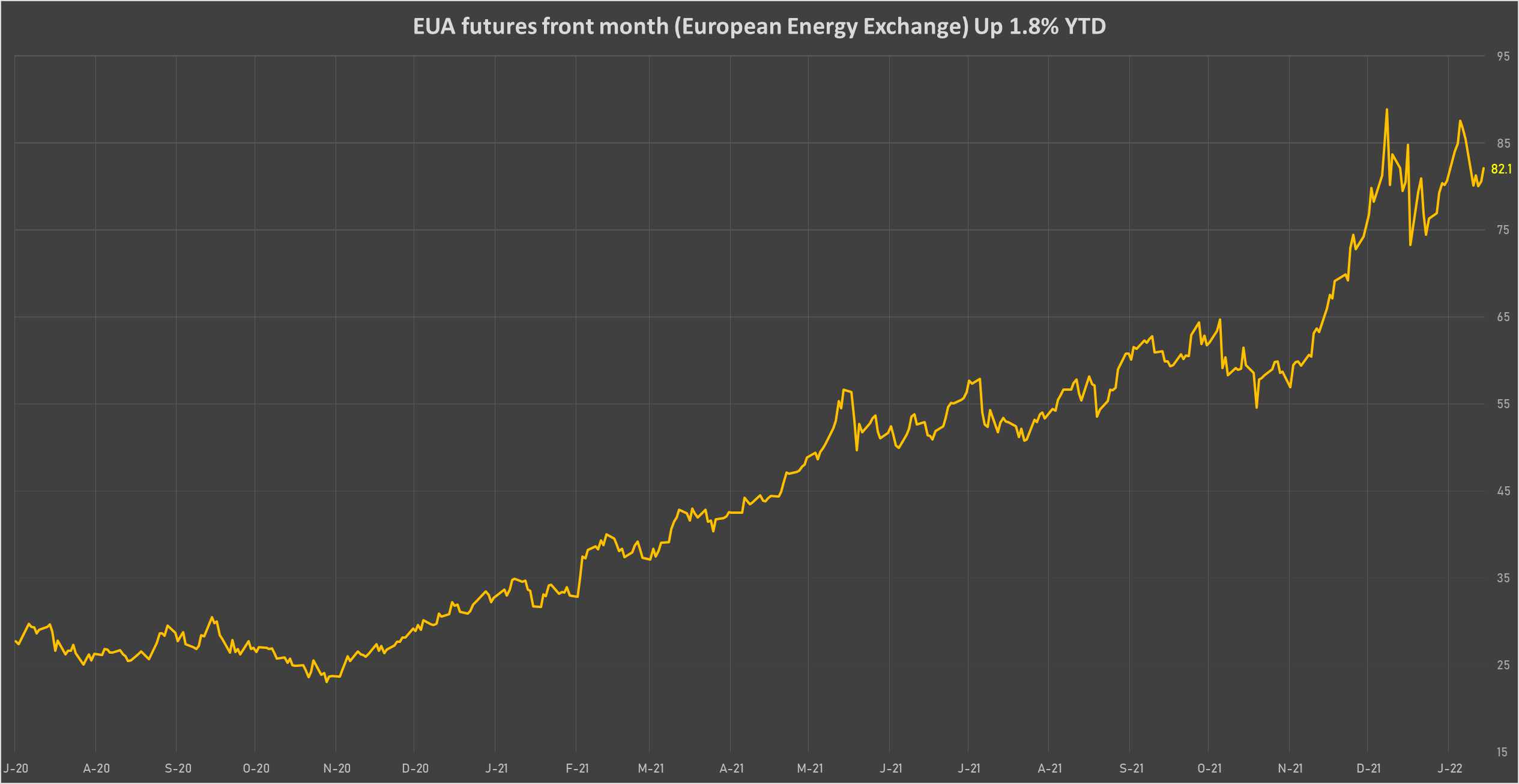

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month futures (ICE) currently at EUR 82.08 per tonne, down -3.9% (YTD: +2.4%)