Commodities

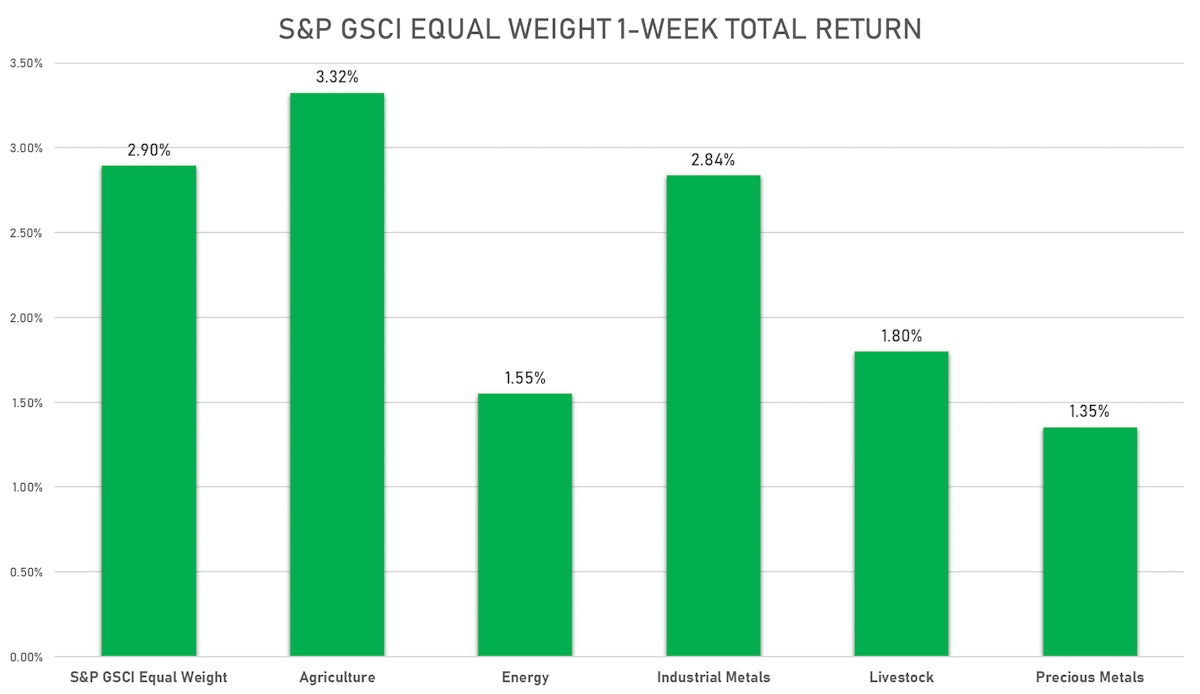

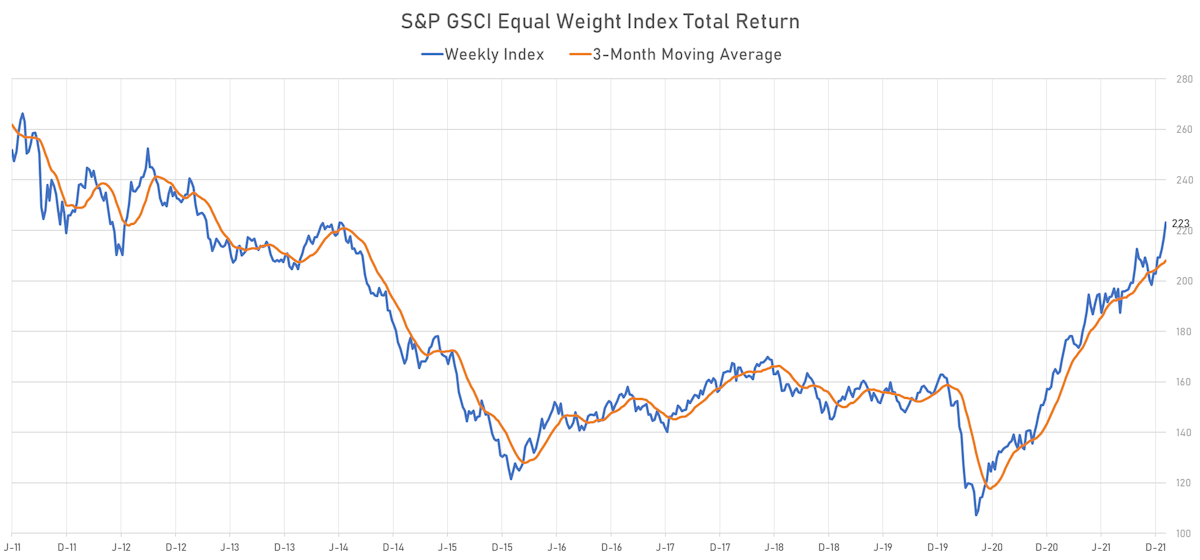

Good Week Across The Commodities Complex, With All S&P GSCI Indices Moving Higher

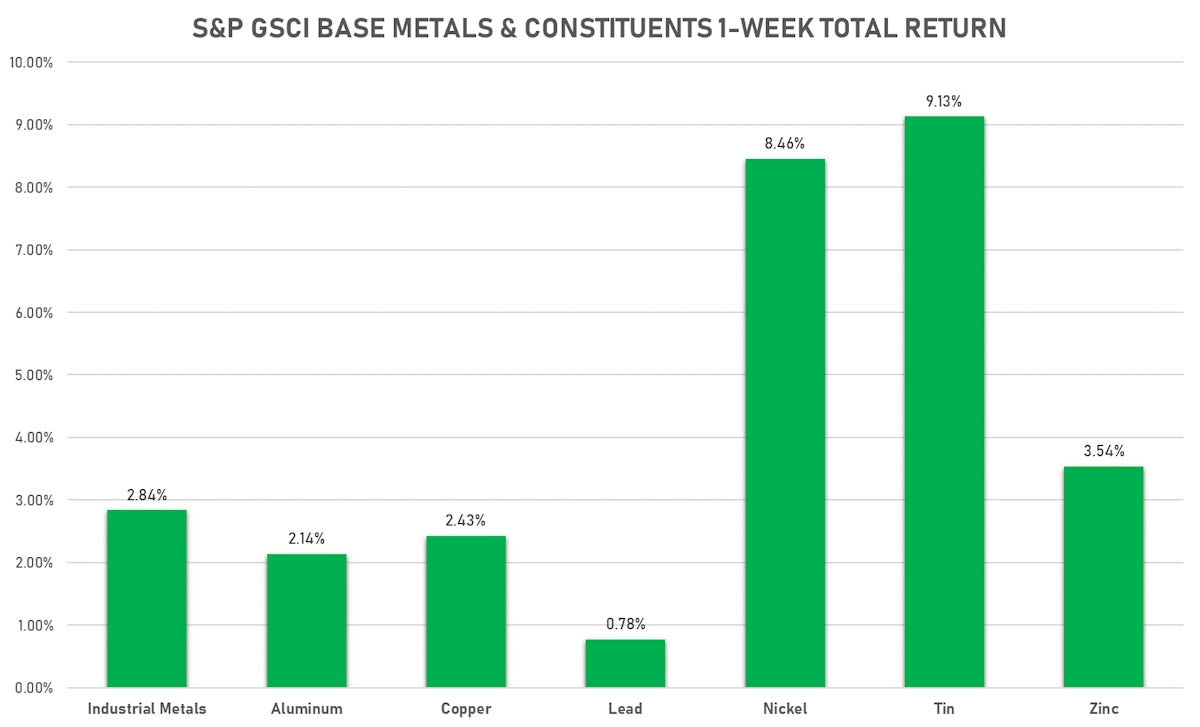

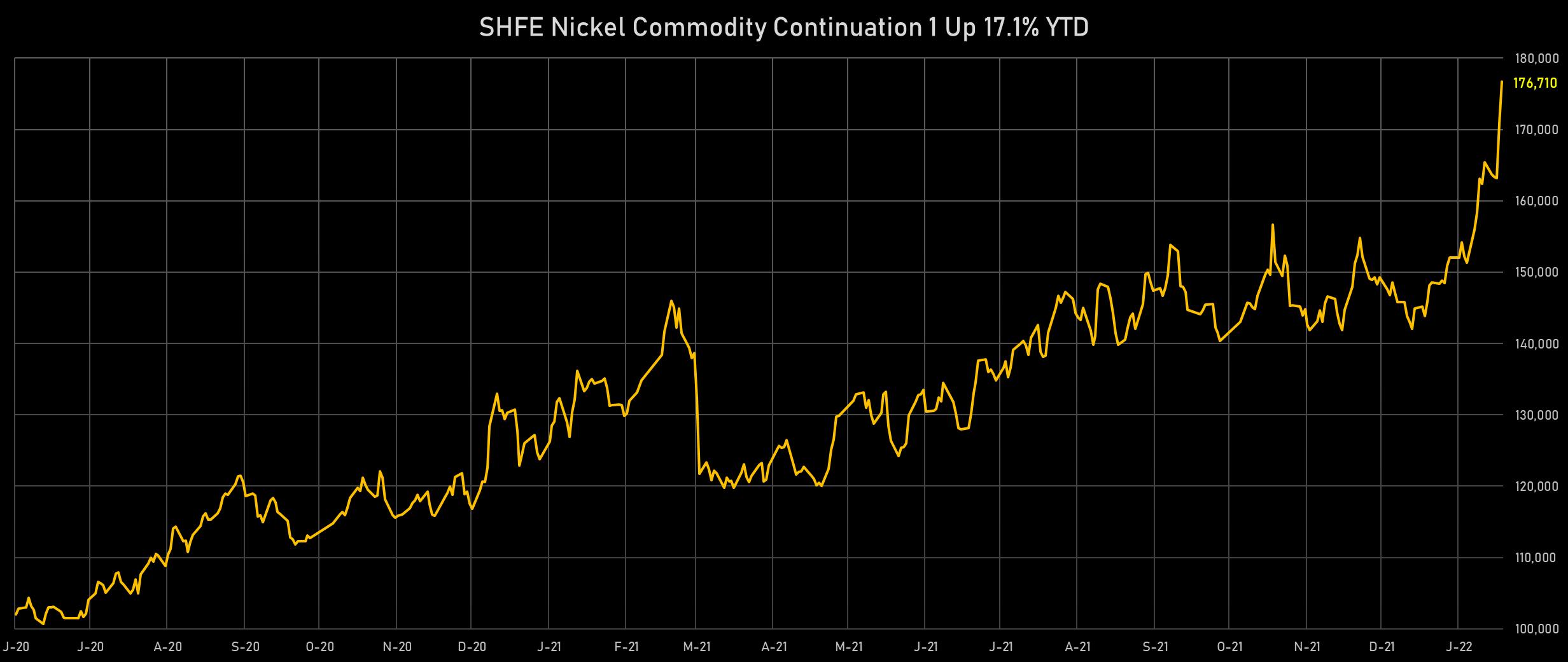

Industrial metals are rising on the back of the loosening monetary policy in China, with nickel futures in Shanghai up nearly 9% this week and lithium up 16%

Published ET

Brent December 2025 Future Prices Are Nearly $22 / bbl Cheaper Than Brent Spot Prices | Source: Refinitiv

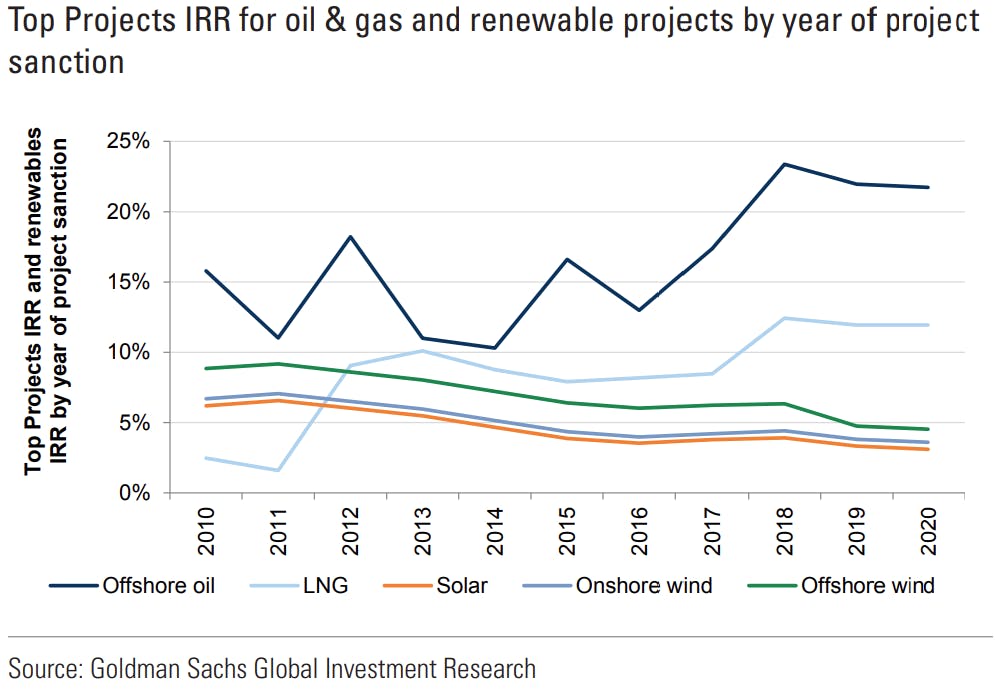

WHY MANY ON THE SELL-SIDE NOW SEE HIGHER CRUDE PRICES

- Some of the largest brokers on Wall Street are forecasting much higher prices for crude oil: BofA Merrill sees Brent at $120 / bbl in mid-2022, while Goldman Sachs has a target of $105 / bbl

- Demand for energy commodities is resilient: the latest IEA report sees global demand on track to exceed pre-pandemic levels this year

- Supply is proving much less abundant and elastic than initially thought

- OPEC+ producers are struggling / failing to reach their allocated quotas (Russia for example)

- The focus of politicians and financiers on ESG and decarbonization has made investments in traditional energy more difficult, much riskier and less profitable (with higher costs and a shorter payback period)

- In this context, shale producers have proven much more prudent than in the past and have not materially increased their supply despite the much higher price.

- In short, the swing producers are waiting it out: they see that the lack of investments over the past years could bring much higher prices (why sell now, when there's potentially a nice squeeze ahead).

NOTABLE GAINERS THIS WEEK

- Palladium spot up 12.0% (YTD: 7.2%), now at 2,106.13

- CME Lean Hogs up 10.7% (YTD: 4.2%), now at 86.20

- SHFE Bitumen Continuation Month 1 up 8.9% (YTD: 11.3%), now at 3,546.00

- SHFE Nickel up 8.8% (YTD: 17.1%), now at 180,780.00

- CBoT Soybean Oil up 8.3% (YTD: 12.8%), now at 63.00

- DCE Coking Coal Continuation Month 1 up 6.2% (YTD: 19.3%), now at 2,575.00

- Platinum spot up 6.2% (YTD: 7.0%), now at 1,029.50

- Silver spot up 5.8% (YTD: 5.4%), now at 24.27

- CBoT Rough Rice up 5.6% (YTD: 1.9%), now at 14.85

- CBoT Corn up 4.9% (YTD: 3.4%), now at 616.25

- ICE-US Sugar No. 11 up 4.5% (YTD: 0.6%), now at 18.89

- CBoT Wheat up 4.5% (YTD: 0.0%), now at 780.00

- Crude Oil WTI Cushing US FOB up 3.9% (YTD: 10.8%), now at 85.11

- SHFE Stannum up 3.7% (YTD: 10.9%), now at 331,260.00

- NYMEX Light Sweet Crude Oil (WTI) up 3.7% (YTD: 10.6%), now at 85.14

NOTABLE LOSERS THIS WEEK

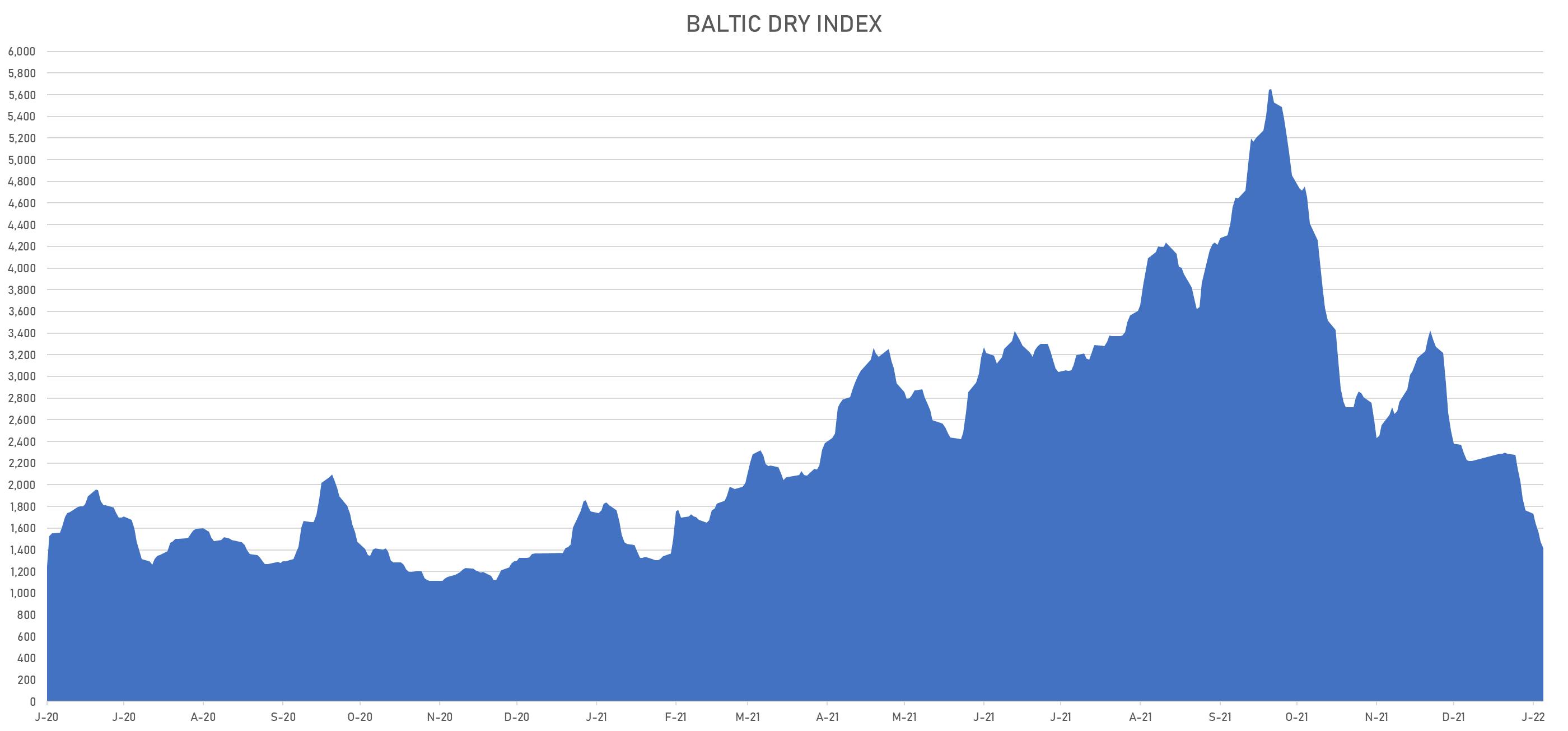

- Baltic Exchange Capesize Index down -40.4% (YTD: -62.1%), now at 891.00

- Baltic Exchange Dry Index down -19.8% (YTD: -36.2%), now at 1,415.00

- Baltic Exchange Panamax Index down -15.4% (YTD: -20.1%), now at 2,010.00

- Baltic Exchange Supramax Index down -7.8% (YTD: -24.1%), now at 1,749.00

- Baltic Exchange Handysize Index down -7.5% (YTD: -25.4%), now at 1,103.00

- CBoT Soybean Meal down -7.3% (YTD: -5.1%), now at 392.70

- Baltic Clean Tank Index down -7.1% (YTD: -30.5%), now at 551.00

- CME Random Length Lumber down -6.9% (YTD: -1.2%), now at 1,143.70

- NYMEX Henry Hub Natural Gas down -6.3% (YTD: 12.3%), now at 04.00

- CME Cattle (Feeder) down -1.6% (YTD: -3.6%), now at 160.28

- ICE-US Cocoa down -1.3% (YTD: 0.7%), now at 2,591.00

- Johnson Matthey Iridium New York 0930 down -1.3% (YTD: -1.3%), now at 3,950.00

- SHFE Copper down -1.0% (YTD: 1.8%), now at 71,130.00

- Baltic Dirty Tank Index down -0.9% (YTD: -12.2%), now at 692.00

- SHFE Rubber down -0.8% (YTD: 0.3%), now at 14,285.00

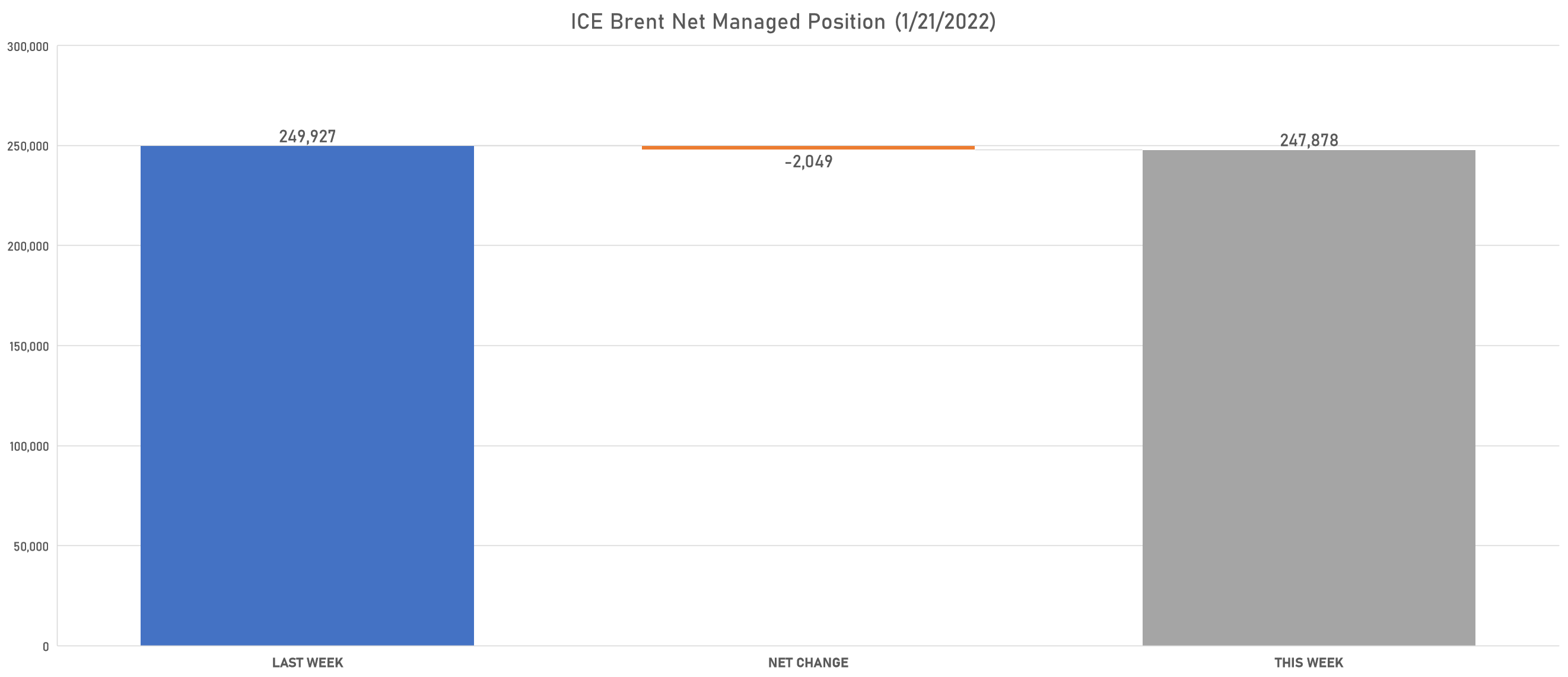

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- ICE Brent reduced net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- ICE Gasoil increased net long position

- Henry Hub Ice increased net long position

METALS

- Gold reduced net long position

- Silver increased net long position

- Platinum reduced net short position

- Palladium increased net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat reduced net short position

- Corn reduced net long position

- Rough Rice reduced net long position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil increased net long position

- Soybean Meal reduced net long position

- Lean Hogs reduced net long position

- Live Cattle increased net long position

- Feeder Cattle reduced net long position

- Cocoa increased net long position

- Coffee C increased net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar increased net long position

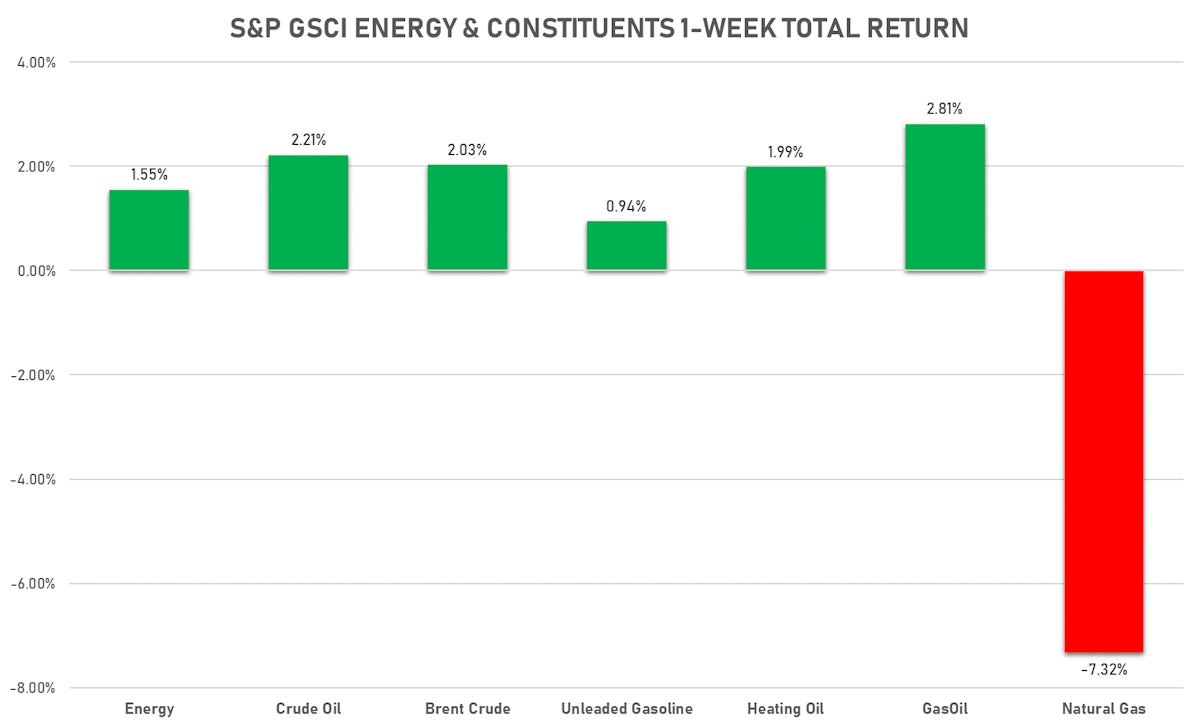

ENERGY THIS WEEK

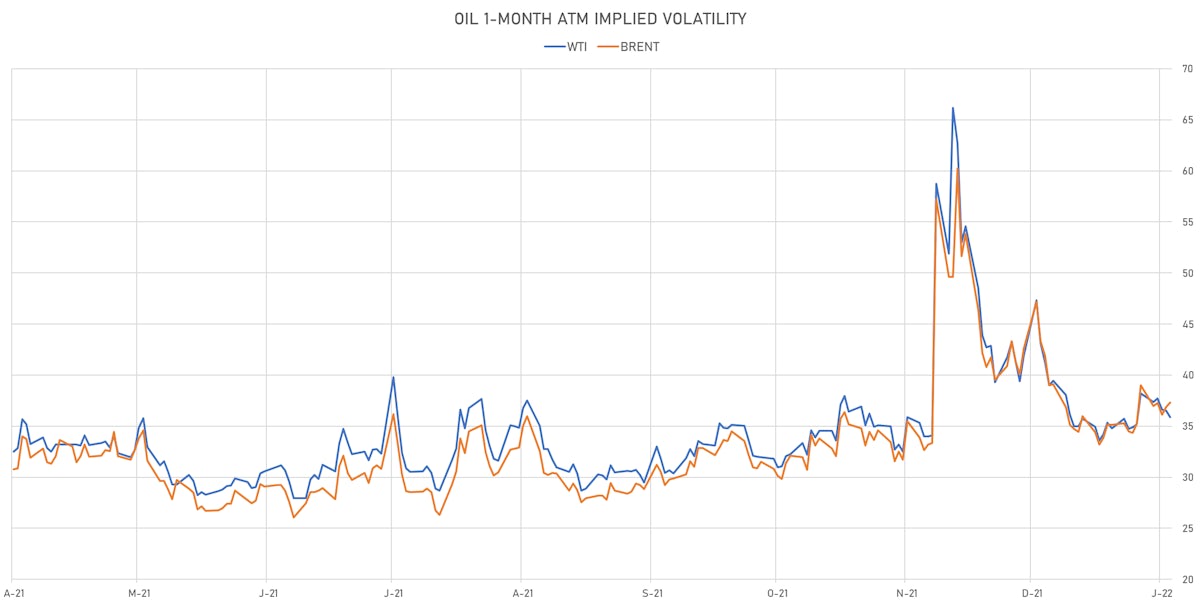

- WTI crude front month currently at US$ 85.14 per barrel, up 3.7% (YTD: +10.6%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 87.89 per barrel, up 2.1% (YTD: +10.8%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 224.60 per tonne, up 3.6% (YTD: +32.0%)

- Natural Gas (Henry Hub) currently at US$ 4.00 per MMBtu, down -6.3% (YTD: +12.3%)

- Gasoline (NYMEX) currently at US$ 2.44 per gallon, up 2.4% (YTD: +6.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 769.25 per tonne, up 2.7% (YTD: +13.5%)

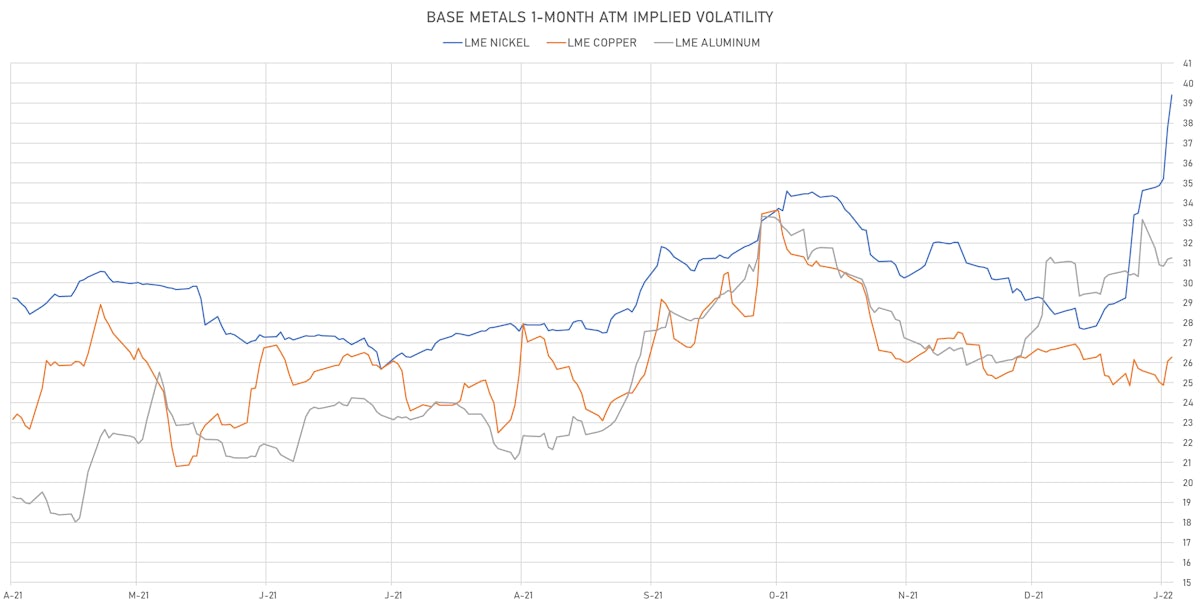

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.52 per pound, down -0.5% (YTD: +2.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 768.50 per tonne, up 3.0% (YTD: +10.8%)

- Aluminum (Shanghai) currently at CNY 21,210 per tonne, down -0.1% (YTD: +6.2%)

- Nickel (Shanghai) currently at CNY 180,780 per tonne, up 8.8% (YTD: +17.1%)

- Lead (Shanghai) currently at CNY 15,760 per tonne, up 1.9% (YTD: +2.1%)

- Rebar (Shanghai) currently at CNY 4,737 per tonne, up 2.2% (YTD: +3.8%)

- Tin (Shanghai) currently at CNY 331,260 per tonne, up 3.7% (YTD: +10.9%)

- Zinc (Shanghai) currently at CNY 25,015 per tonne, up 1.7% (YTD: +5.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 500,000 per tonne, unchanged (YTD: +2.7%)

- Lithium (Shanghai) spot price currently at CNY 1,865,000 per tonne, up 16.2% (YTD: +39.7%)

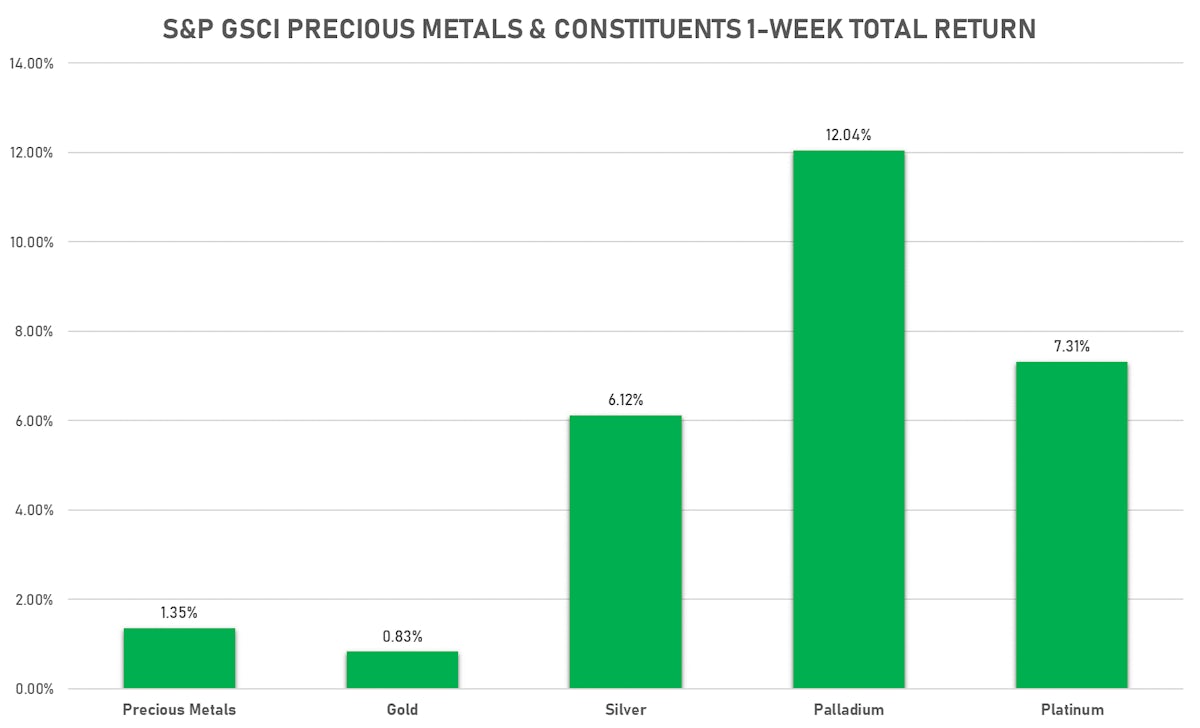

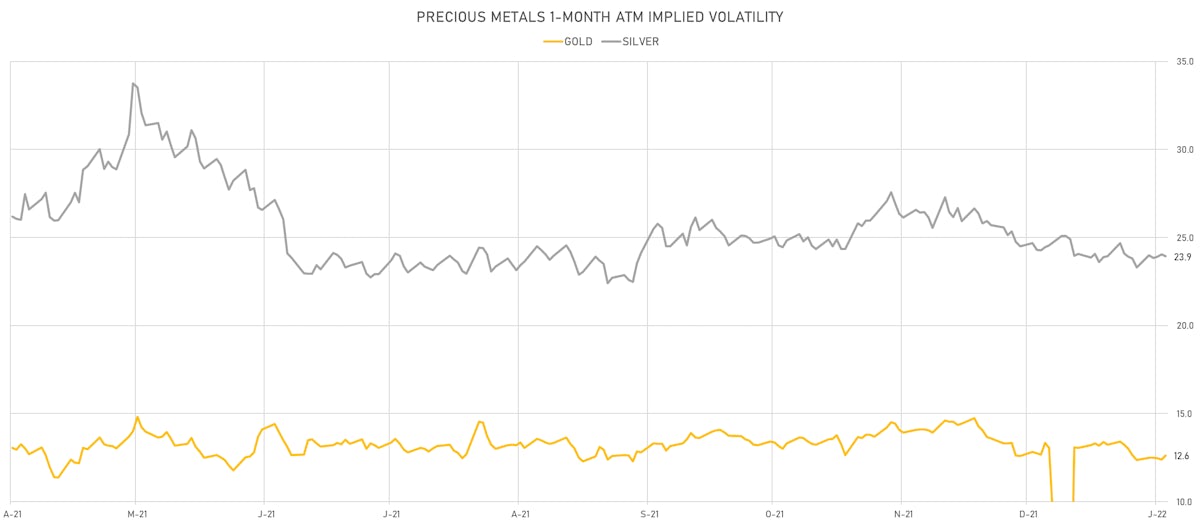

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,834.20 per troy ounce, up 0.9% (YTD: +1.1%)

- Gold 1-Month ATM implied volatility currently at 12.23, up 2.1% (YTD: -3.5%)

- Silver spot currently at US$ 24.27 per troy ounce, up 5.8% (YTD: +5.4%)

- Silver 1-Month ATM implied volatility currently at 22.69, up 2.7% (YTD: -0.1%)

- Palladium spot currently at US$ 2,106.13 per troy ounce, up 12.0% (YTD: +7.2%)

- Platinum spot currently at US$ 1,029.50 per troy ounce, up 6.2% (YTD: +7.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 16,650 per troy ounce, up 1.5% (YTD: +18.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 3,950 per troy ounce, down -1.3% (YTD: -1.3%)

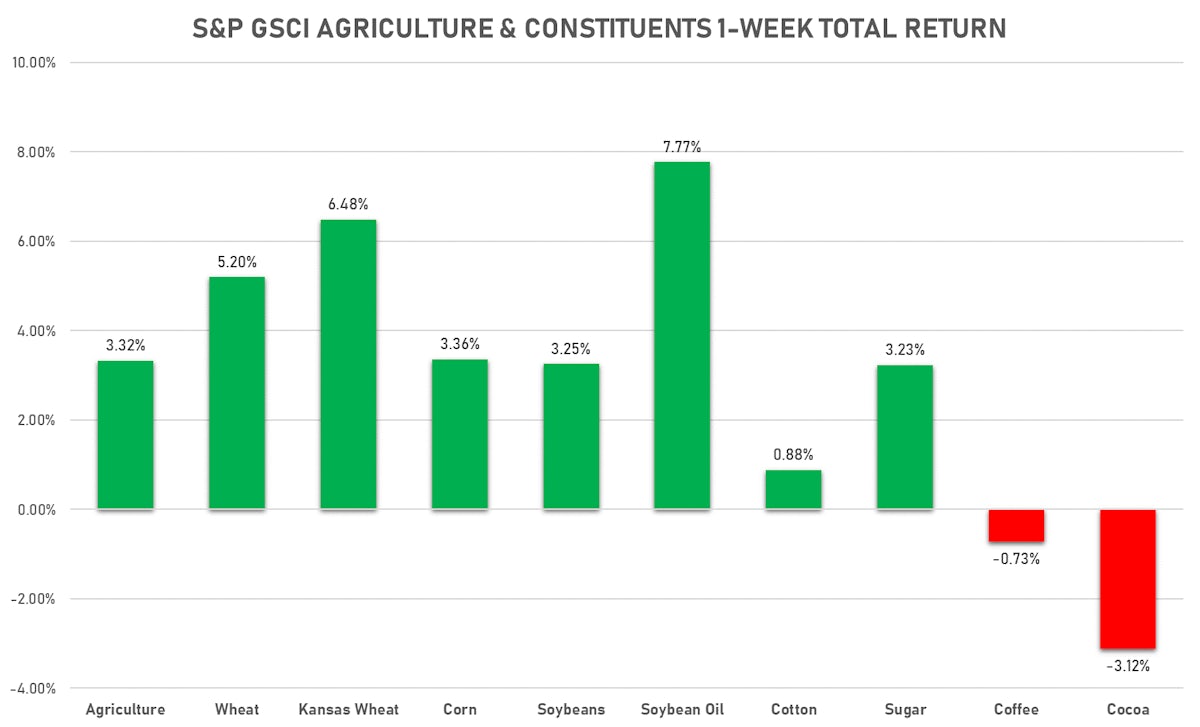

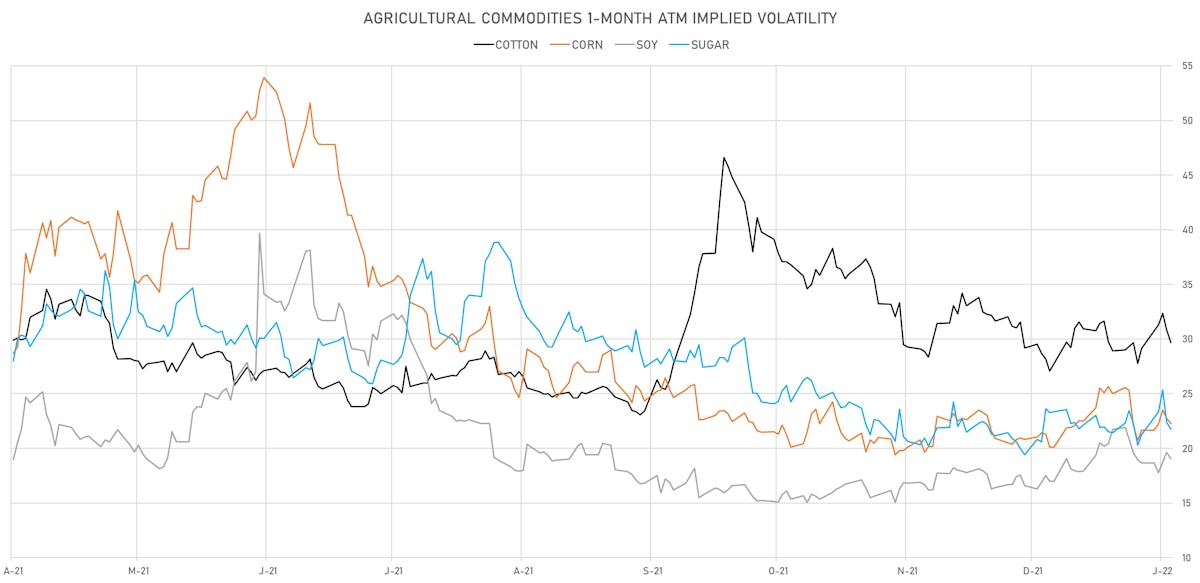

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 137.93 cents per pound, up 0.7% (YTD: -0.8%)

- Lean Hogs (CME) currently at US$ 86.20 cents per pound, up 10.7% (YTD: +4.2%)

- Rough Rice (CBOT) currently at US$ 14.85 cents per hundredweight, up 5.6% (YTD: +1.9%)

- Soybeans Composite (CBOT) currently at US$ 1,414.25 cents per bushel, up 3.6% (YTD: +6.5%)

- Corn (CBOT) currently at US$ 616.25 cents per bushel, up 4.9% (YTD: +3.4%)

- Wheat Composite (CBOT) currently at US$ 780.00 cents per bushel, up 4.5% (YTD: +0.0%)

- Sugar No.11 (ICE US) currently at US$ 18.89 cents per pound, up 4.5% (YTD: +0.6%)

- Cotton No.2 (ICE US) currently at US$ 121.08 cents per pound, up 3.3% (YTD: +5.6%)

- Cocoa (ICE US) currently at US$ 2,591 per tonne, down -1.3% (YTD: +0.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,816 per tonne, up 3.5% (YTD: +5.6%)

- Random Length Lumber (CME) currently at US$ 1,143.70 per 1,000 board feet, down -6.9% (YTD: -1.2%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,505 per tonne, up 0.9% (YTD: +2.3%)

- Soybean Oil Composite (CBOT) currently at US$ 63.00 cents per pound, up 8.3% (YTD: +12.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,504 per tonne, up 3.3% (YTD: +6.9%)

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 1,415, down -19.8% (YTD: -36.2%)

- Freightos China To North America West Coast Container Index currently at 15,171, up 3.3% (YTD: +10.7%)

- Freightos North America West Coast To China Container Index currently at 1,101, unchanged (YTD: +25.8%)

- Freightos North America East Coast To Europe Container Index currently at 563, up 25.7% (YTD: +4.3%)

- Freightos Europe To North America East Coast Container Index currently at 7,436, up 9.8% (YTD: +4.7%)

- Freightos China To North Europe Container Index currently at 15,061, up 5.6% (YTD: +6.0%)

- Freightos North Europe To China Container Index currently at 1,014, unchanged (YTD: -10.3%)

- Freightos Europe To South America West Coast Container Index currently at 8,411, down -1.4% (YTD: +7.7%)

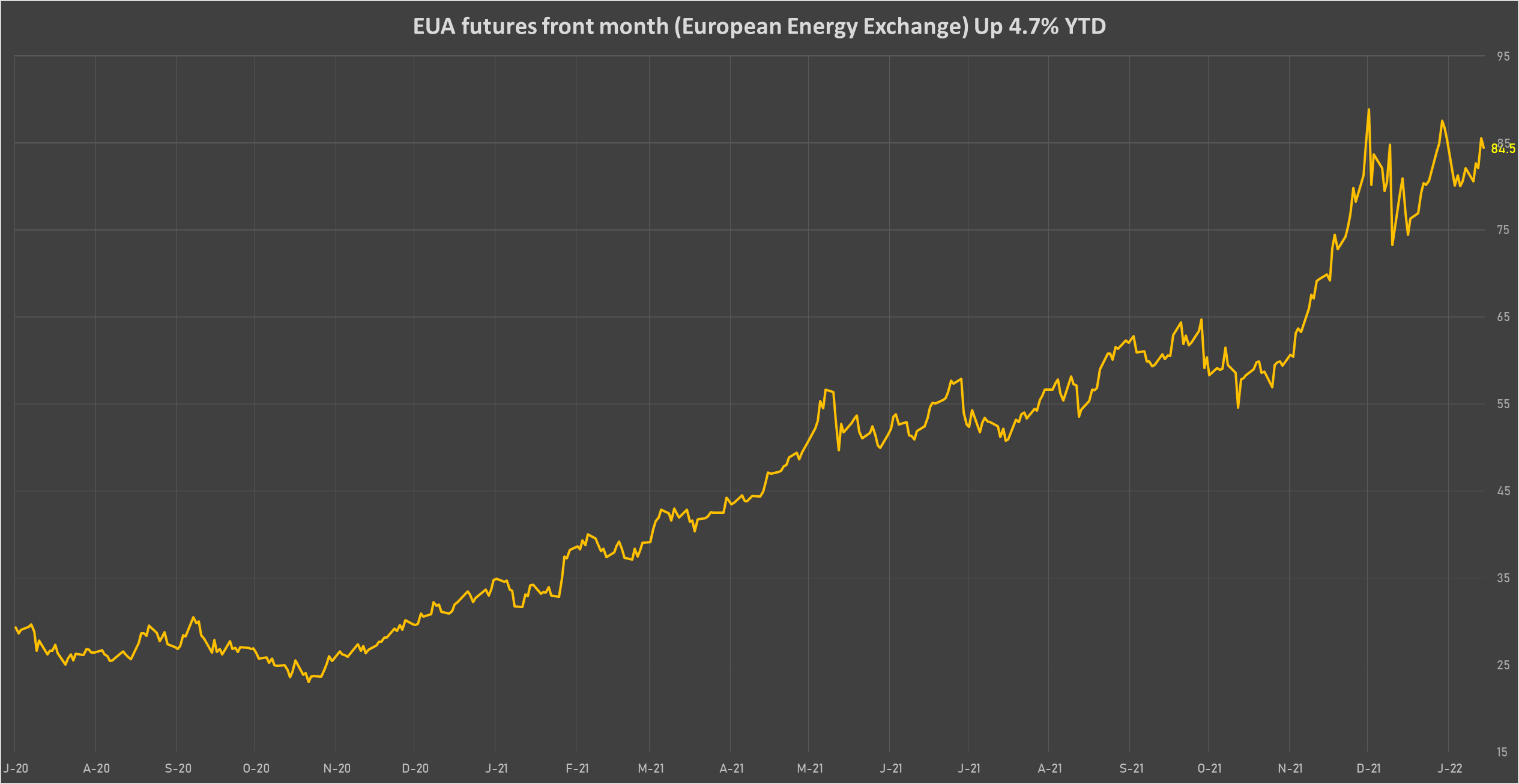

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 84.47 per tonne, up 2.9% (YTD: +5.4%)