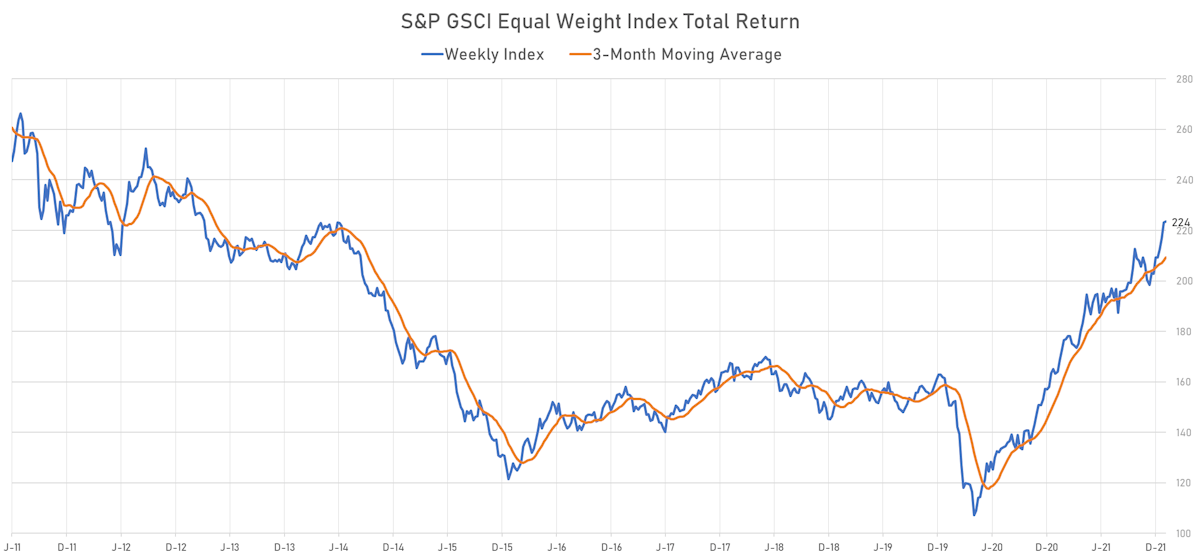

Commodities

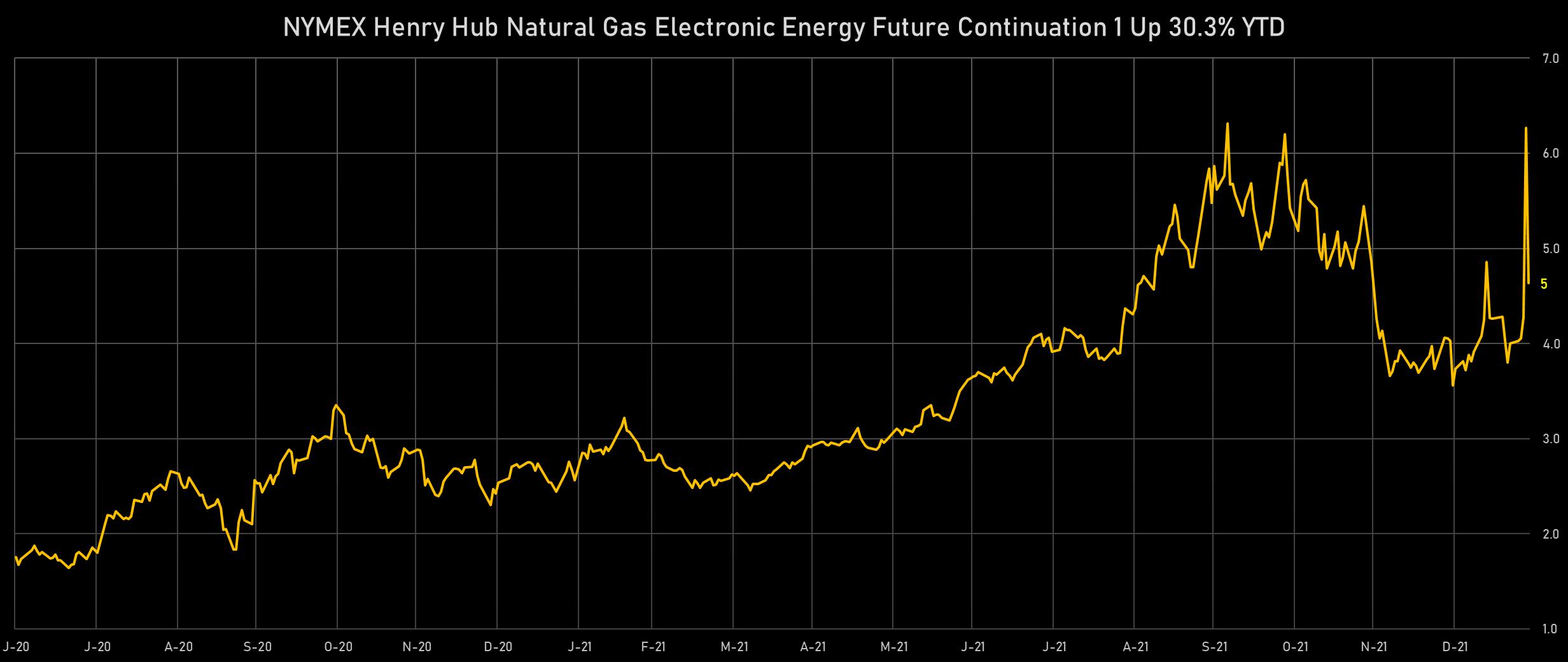

Energy Was The Big Story Again This Week In Commodities, With Brent Spot Above $90 And Nat Gas Up 16%

The failure of many countries OPEC+ to meet their quotas, combined with the slow / patient approach of shale producers is driving backwardation to levels where the back end of the curve will have to start catching up ($25/bbl spread between spot Brent Sullom Voe and December 2025 future)

Published ET

Brent Crude Spot Price And December 2024 Calendar Spread | Source: Refinitiv

NOTABLE GAINERS THIS WEEK

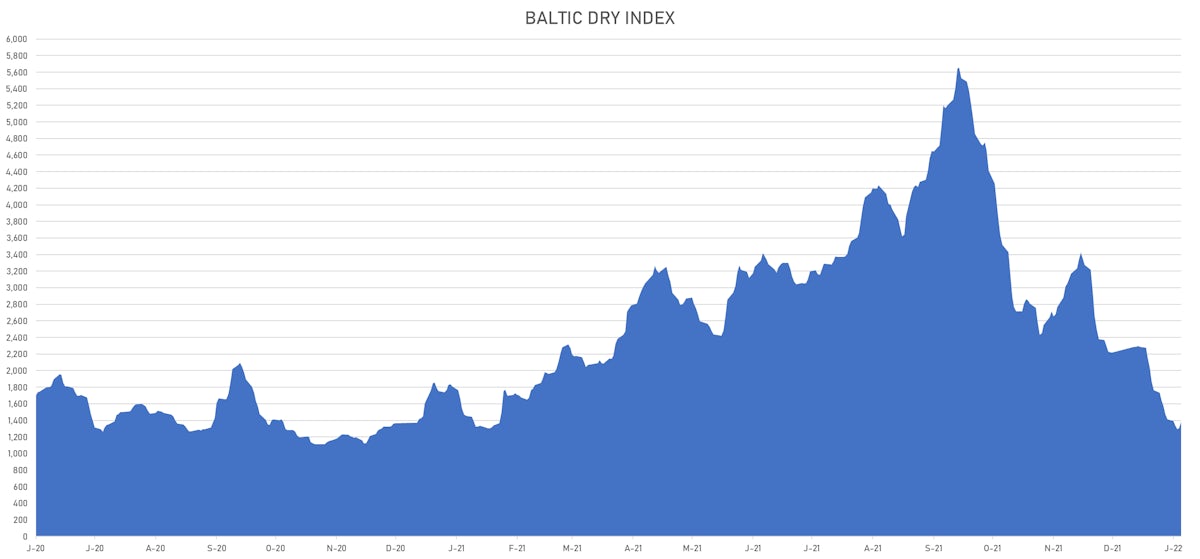

- Baltic Exchange Capesize Index up 20.7% (YTD: -54.3%), now at 1,075.00

- NYMEX Henry Hub Natural Gas up 16.0% (YTD: 30.3%), now at 04.64

- Palladium spot up 12.8% (YTD: 21.0%), now at 2,376.18

- DCE Coking Coal Continuation Month 1 up 7.7% (YTD: 28.5%), now at 2,658.00

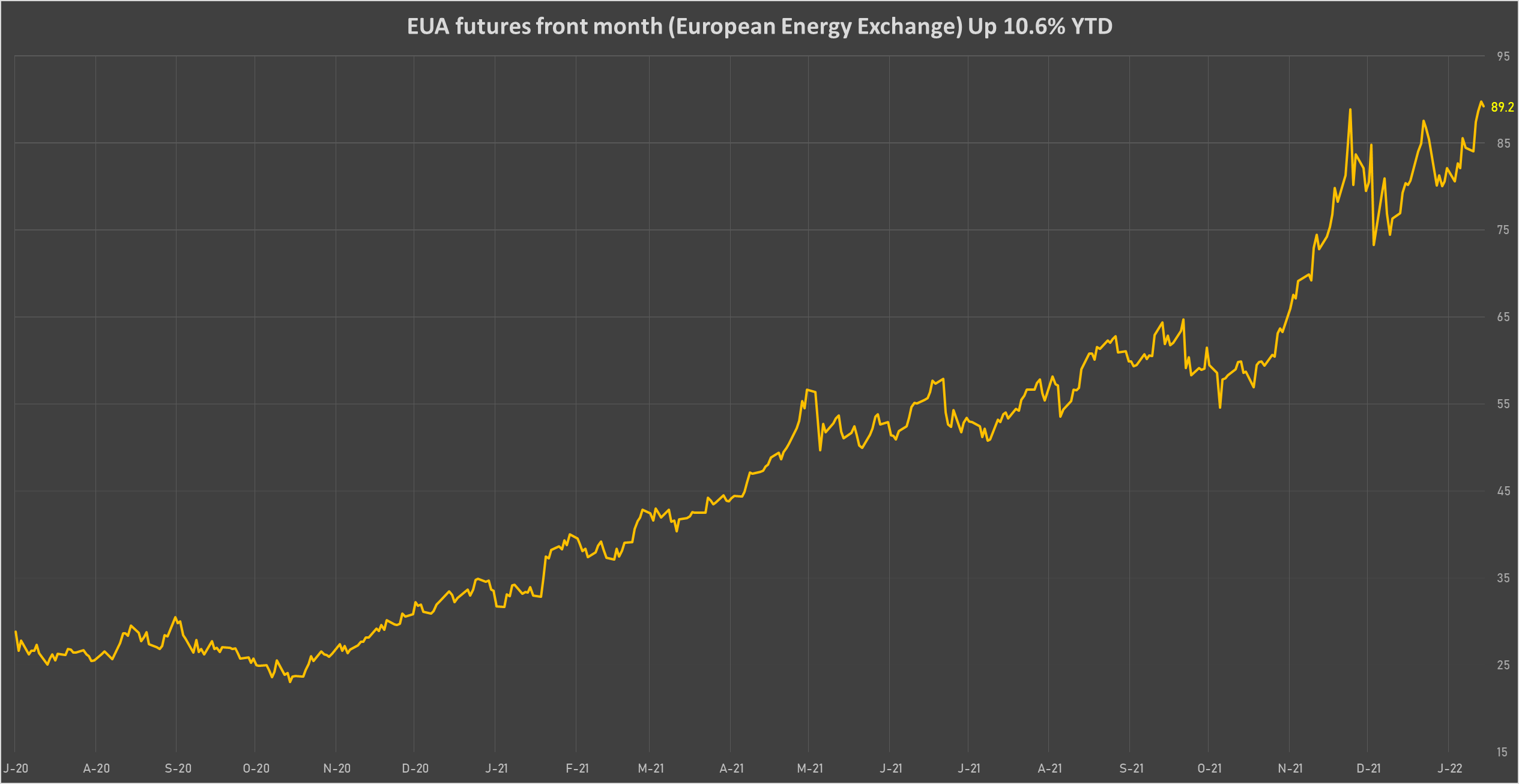

- EEX EEX European Union Aviation Allowance Continuation Month 1 up 5.7% (YTD: 11.3%), now at 89.14

- Intercontinental Exchange Endex European Union Allowance (EUA) Yearly up 5.6% (YTD: 11.3%), now at 89.22

- EEX European-Carbon- Secondary Trading up 5.6% (YTD: 11.6%), now at 89.39

- DCE Iron Ore Continuation Month 1 up 5.5% (YTD: 16.8%), now at 801.50

- Bursa Malaysia Crude Palm Oil up 5.4% (YTD: 12.7%), now at 5,810.00

- DCE RBD Palm Oil up 5.0% (YTD: 17.5%), now at 11,042.00

- CBoT Soybean Meal up 4.7% (YTD: -0.6%), now at 411.20

- DCE Coke up 4.5% (YTD: 11.4%), now at 3,250.00

- ICE Europe Low Sulphur Gasoil up 4.3% (YTD: 18.3%), now at 802.00

- NYMEX RBOB Gasoline up 4.1% (YTD: 10.7%), now at 02.54

- CBoT Soybeans up 3.9% (YTD: 10.7%), now at 1,470.00

NOTABLE LOSERS THIS WEEK

- CME Random Length Lumber down -10.4% (YTD: -11.5%), now at 1,024.90

- Baltic Exchange Supramax Index down -8.7% (YTD: -30.7%), now at 1,597.00

- Baltic Exchange Panamax Index down -8.5% (YTD: -26.8%), now at 1,840.00

- Baltic Exchange Handysize Index down -8.3% (YTD: -31.6%), now at 1,011.00

- Silver spot down -7.5% (YTD: -2.5%), now at 22.45

- SHFE Nickel down -5.3% (YTD: 10.9%), now at 167,300.00

- COMEX Copper down -4.6% (YTD: -1.9%), now at 04.32

- SHFE Rubber down -4.2% (YTD: -3.9%), now at 13,945.00

- ICE-US Sugar No. 11 down -3.7% (YTD: -3.1%), now at 18.22

- ICE-US Cocoa down -3.2% (YTD: -2.5%), now at 2,496.00

- Coffee Robusta Vietnam Grade 1 Wet Pol spot down -2.9% (YTD: -12.2%), now at 1,908.00

- BALTIC EXCH DRY down -2.4% (YTD: -37.8%), now at 1,381.00

- Gold spot down -2.3% (YTD: -1.3%), now at 1,791.29

- SHFE Lead Continuation Month 1 down -2.3% (YTD: -0.3%), now at 15,255.00

- WUXI Metal Cobalt Bi-Monthly down -2.0% (YTD: 0.5%), now at 489.00

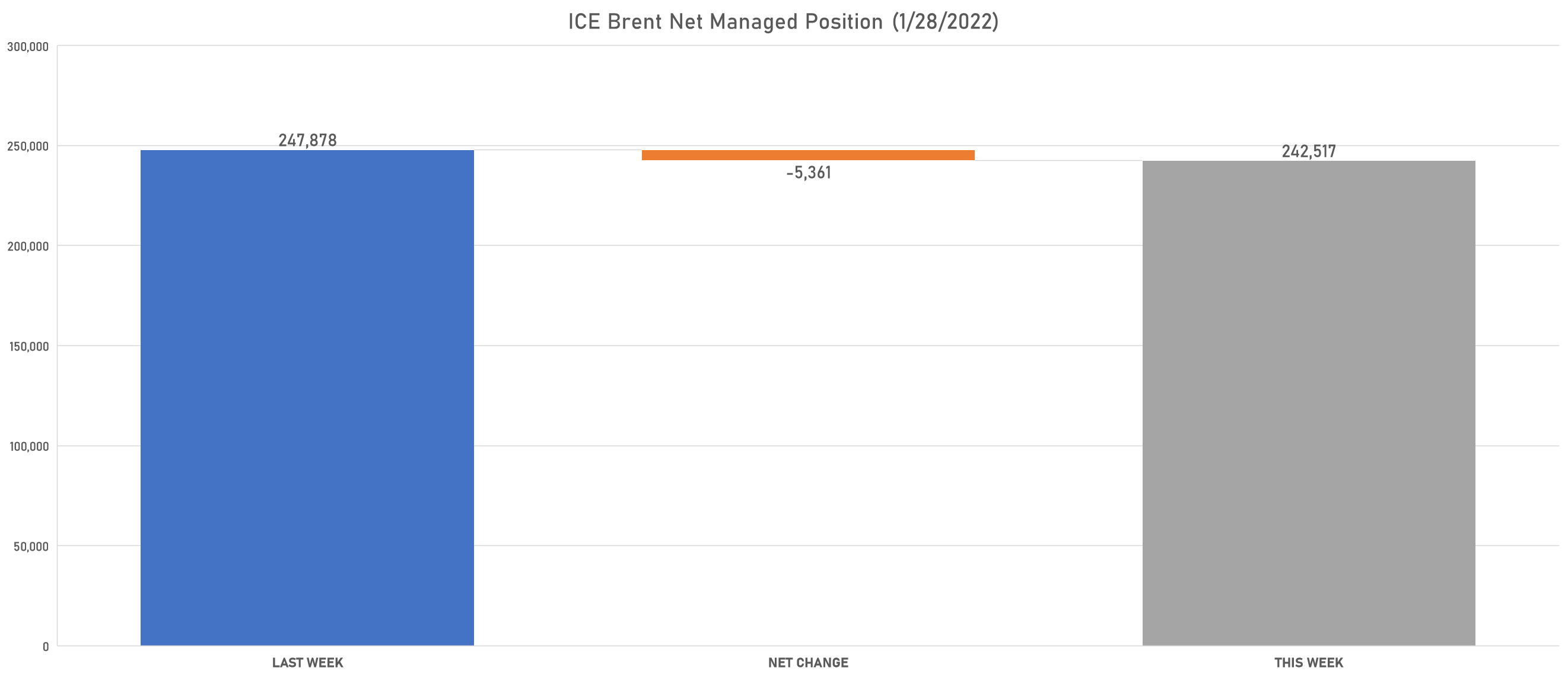

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil increased net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum turned to net long

- Palladium reduced net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat reduced net short position

- Corn increased net long position

- Rough Rice increased net long position

- Oats reduced net long position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position

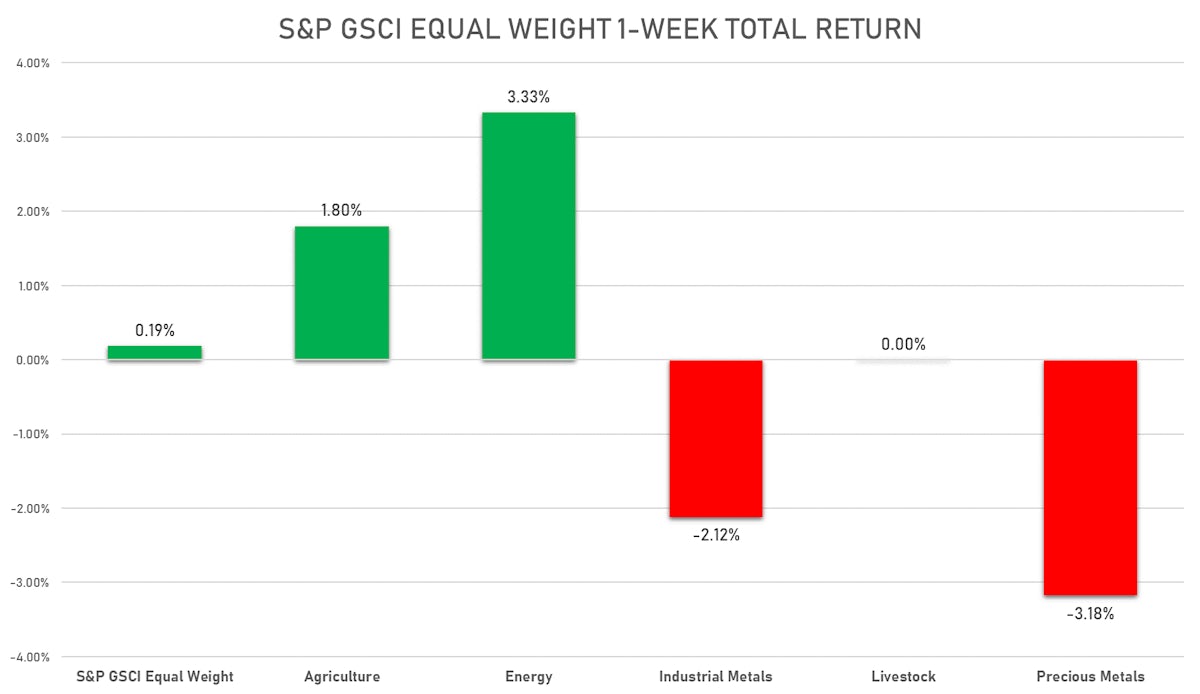

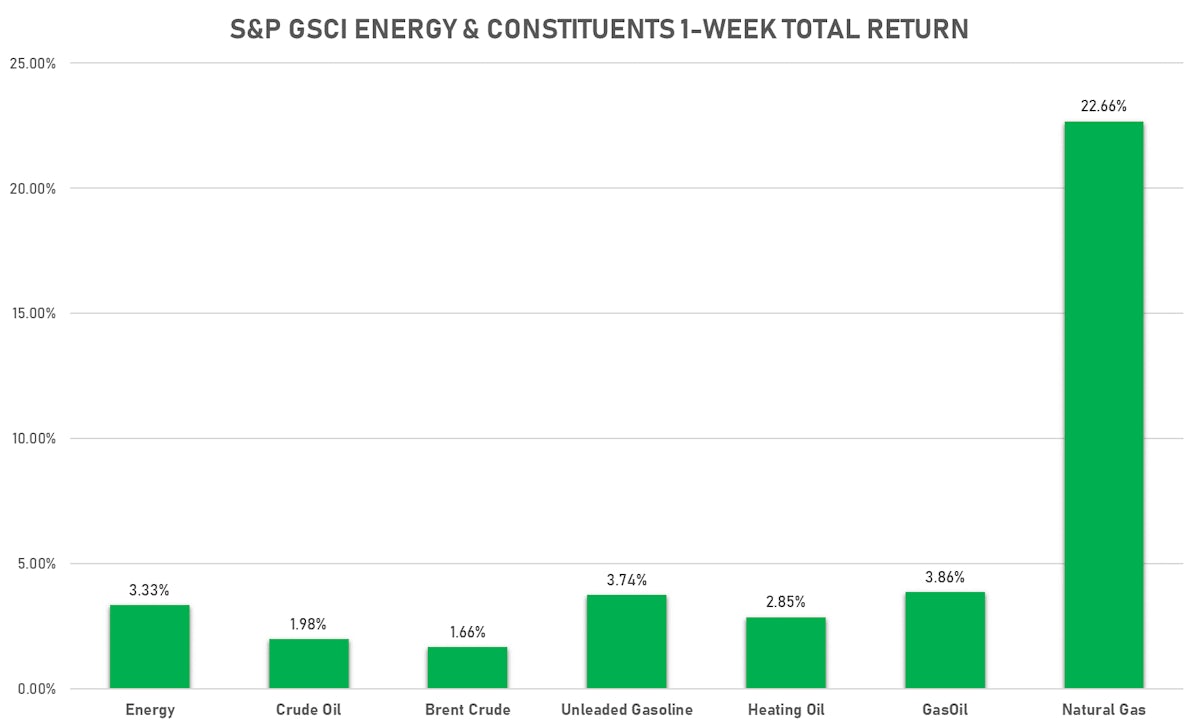

ENERGY UP BROADLY THIS WEEK

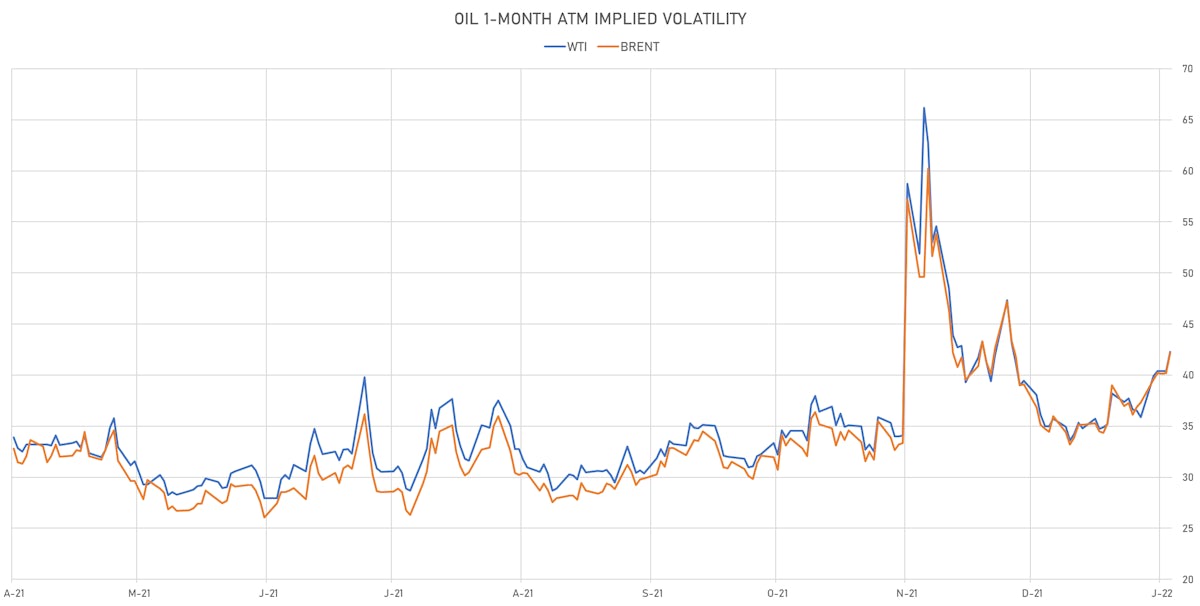

- WTI crude front month currently at US$ 86.82 per barrel, up 2.0% (YTD: +12.8%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 90.03 per barrel, up 2.4% (YTD: +13.5%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 226.25 per tonne, up 1.4% (YTD: +33.8%)

- Natural Gas (Henry Hub) currently at US$ 4.64 per MMBtu, up 16.0% (YTD: +30.3%)

- Gasoline (NYMEX) currently at US$ 2.54 per gallon, up 4.1% (YTD: +10.7%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 802.00 per tonne, up 4.3% (YTD: +18.3%)

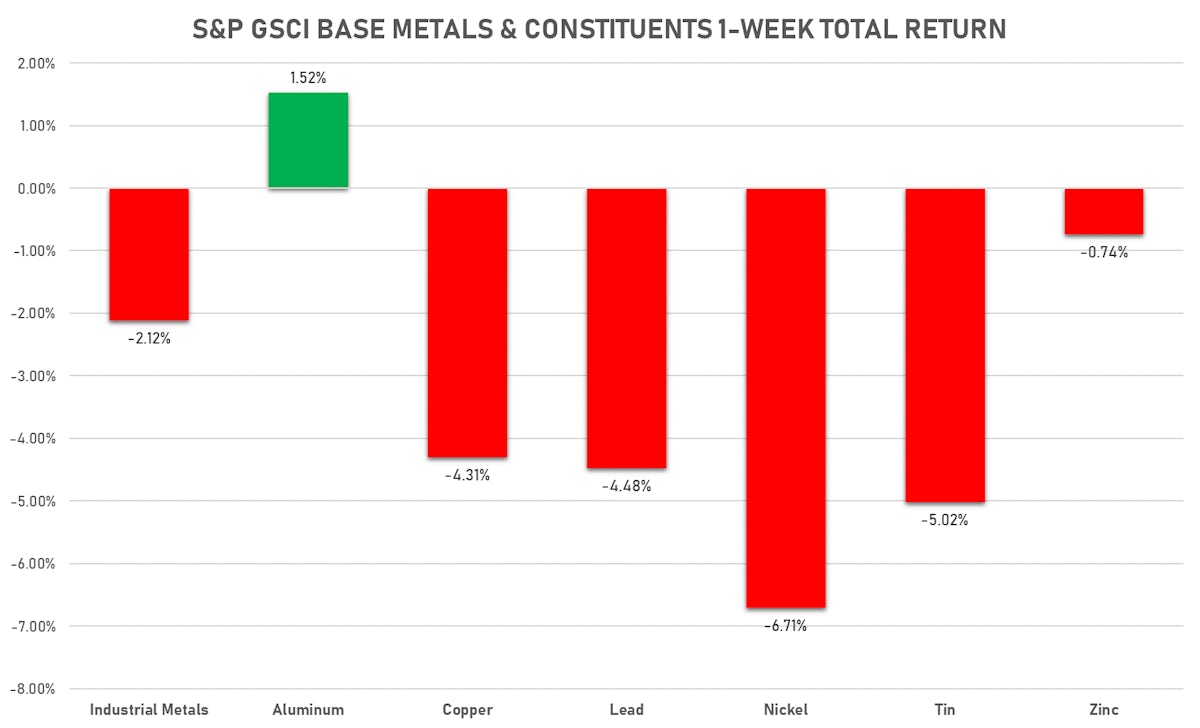

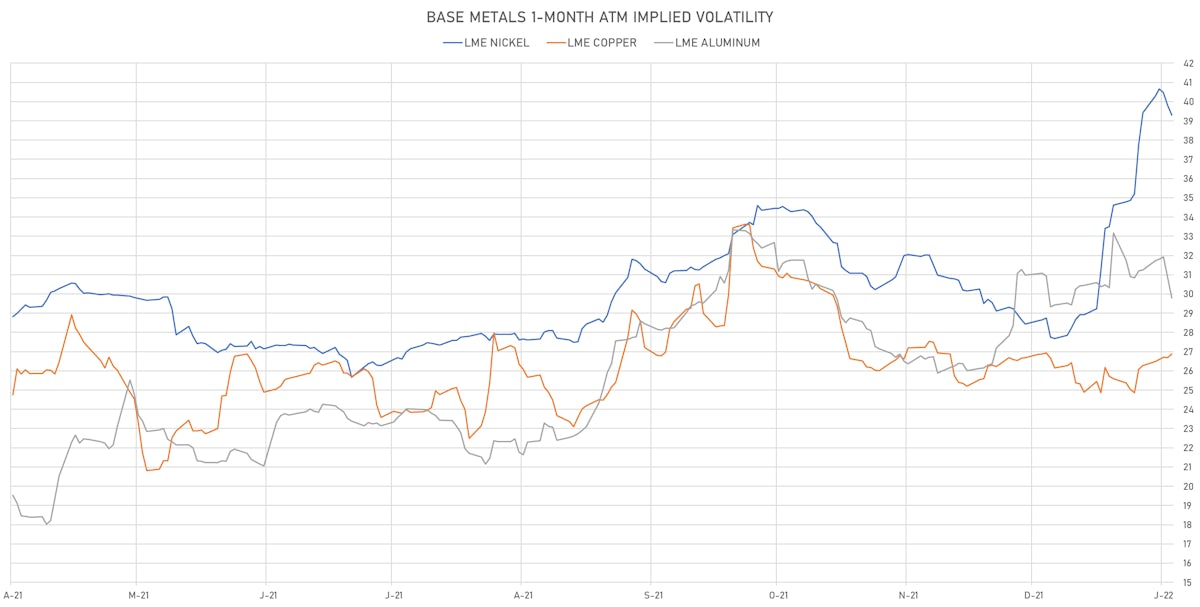

BASE METALS MOSTLY DOWN THIS WEEK

- Copper (COMEX) currently at US$ 4.32 per pound, down -4.6% (YTD: -1.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 801.50 per tonne, up 5.5% (YTD: +16.8%)

- Aluminum (Shanghai) currently at CNY 21,625 per tonne, up 0.7% (YTD: +6.9%)

- Nickel (Shanghai) currently at CNY 167,300 per tonne, down -5.3% (YTD: +10.9%)

- Lead (Shanghai) currently at CNY 15,255 per tonne, down -2.3% (YTD: -0.3%)

- Rebar (Shanghai) currently at CNY 4,778 per tonne, up 0.7% (YTD: +4.6%)

- Tin (Shanghai) currently at CNY 331,280 per tonne, down -0.4% (YTD: +10.5%)

- Zinc (Shanghai) currently at CNY 25,250 per tonne, up 0.3% (YTD: +5.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 499,000 per tonne, down -0.2% (YTD: +2.5%)

- Lithium (Shanghai) spot price currently at CNY 1,930,000 per tonne, up 3.5% (YTD: +44.6%)

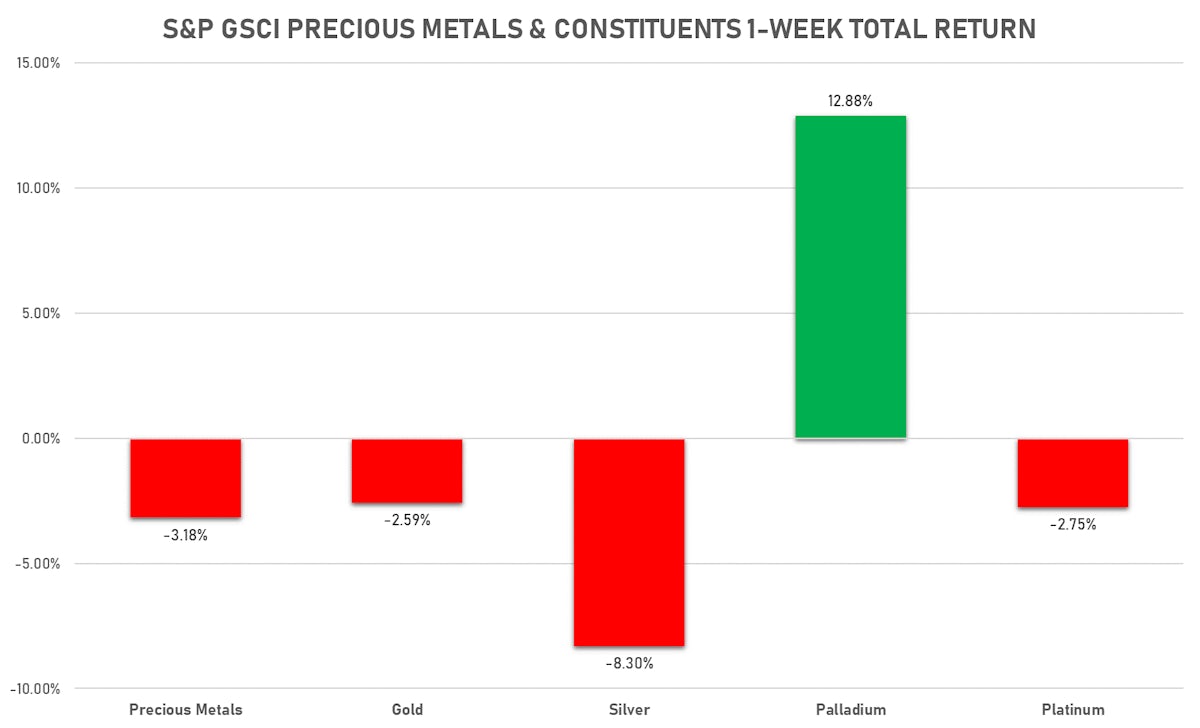

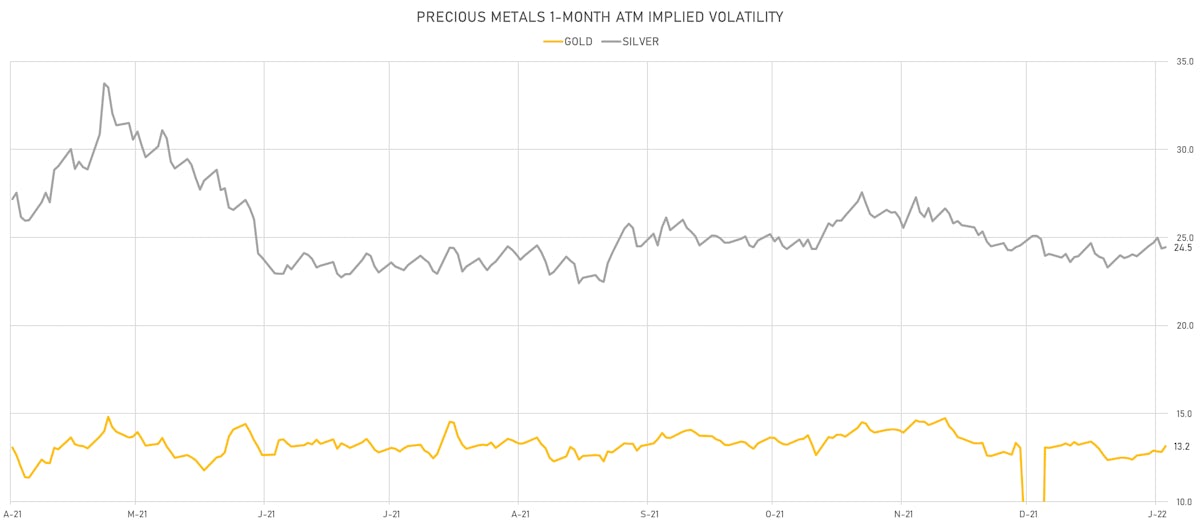

PRECIOUS METALS FELL THIS WEEK

- Gold spot currently at US$ 1,791.29 per troy ounce, down -2.3% (YTD: -1.3%)

- Gold 1-Month ATM implied volatility currently at 12.79, up 4.2% (YTD: +0.6%)

- Silver spot currently at US$ 22.45 per troy ounce, down -7.5% (YTD: -2.5%)

- Silver 1-Month ATM implied volatility currently at 23.23, up 2.2% (YTD: +2.1%)

- Palladium spot currently at US$ 2,376.18 per troy ounce, up 12.8% (YTD: +21.0%)

- Platinum spot currently at US$ 1,011.25 per troy ounce, down -1.8% (YTD: +5.1%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 16,850 per troy ounce, up 1.2% (YTD: +19.5%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 3,950 per troy ounce, unchanged (YTD: -1.3%)

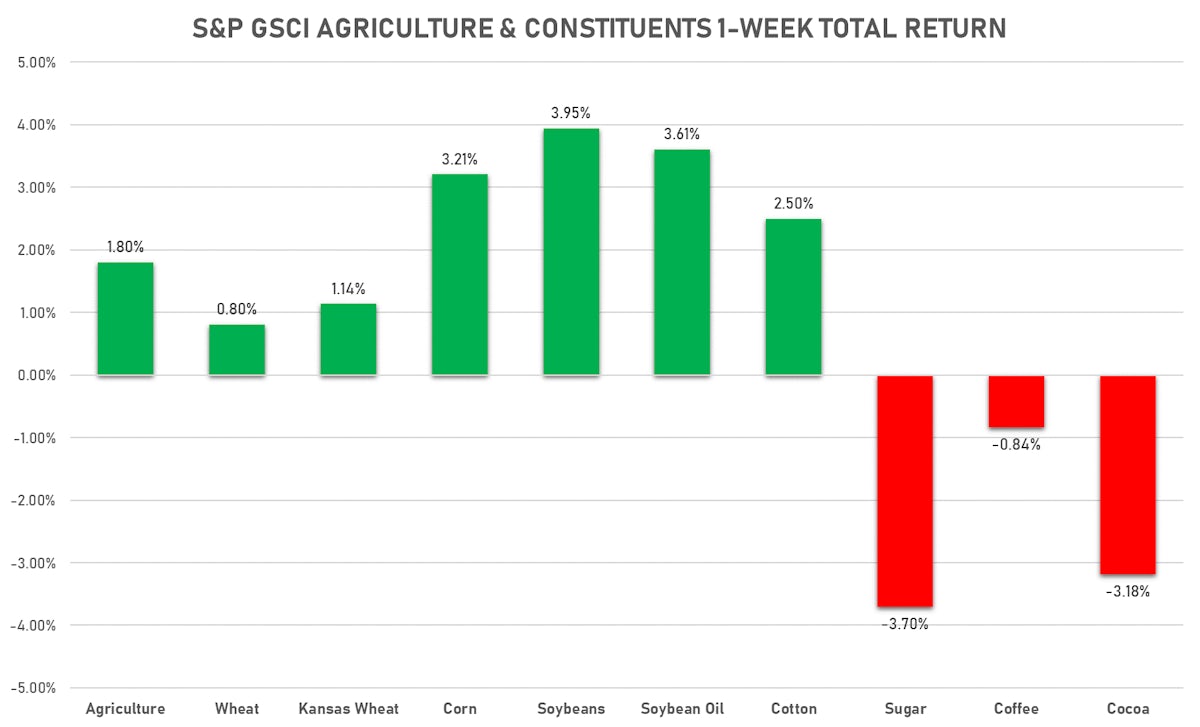

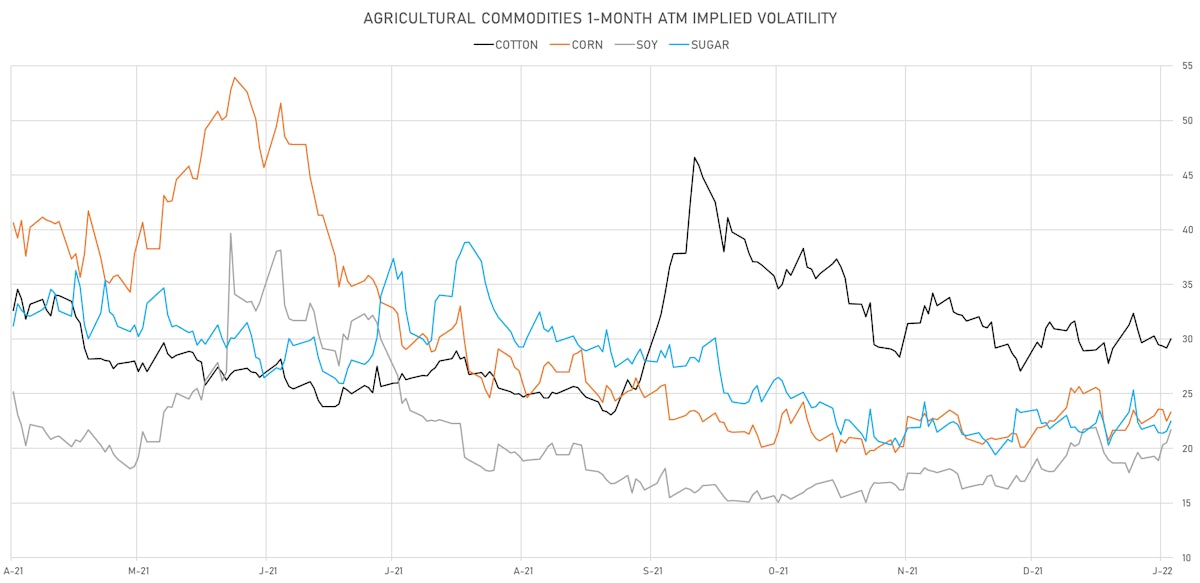

AGS MIXED THIS WEEK

- Live Cattle (CME) currently at US$ 138.70 cents per pound, up 0.6% (YTD: -0.3%)

- Lean Hogs (CME) currently at US$ 87.93 cents per pound, up 2.0% (YTD: +6.3%)

- Rough Rice (CBOT) currently at US$ 14.98 cents per hundredweight, up 0.8% (YTD: +2.7%)

- Soybeans Composite (CBOT) currently at US$ 1,470.00 cents per bushel, up 3.9% (YTD: +10.7%)

- Corn (CBOT) currently at US$ 636.00 cents per bushel, up 3.2% (YTD: +6.7%)

- Wheat Composite (CBOT) currently at US$ 786.25 cents per bushel, up 0.8% (YTD: +0.8%)

- Sugar No.11 (ICE US) currently at US$ 18.22 cents per pound, down -3.7% (YTD: -3.1%)

- Cotton No.2 (ICE US) currently at US$ 123.56 cents per pound, up 2.5% (YTD: +8.2%)

- Cocoa (ICE US) currently at US$ 2,496 per tonne, down -3.2% (YTD: -2.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,732 per tonne, down -1.5% (YTD: +4.0%)

- Random Length Lumber (CME) currently at US$ 1,024.90 per 1,000 board feet, down -10.4% (YTD: -11.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,505 per tonne, down -2.0% (YTD: +0.3%)

- Soybean Oil Composite (CBOT) currently at US$ 65.27 cents per pound, up 3.6% (YTD: +16.9%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,810 per tonne, up 5.4% (YTD: +12.7%)

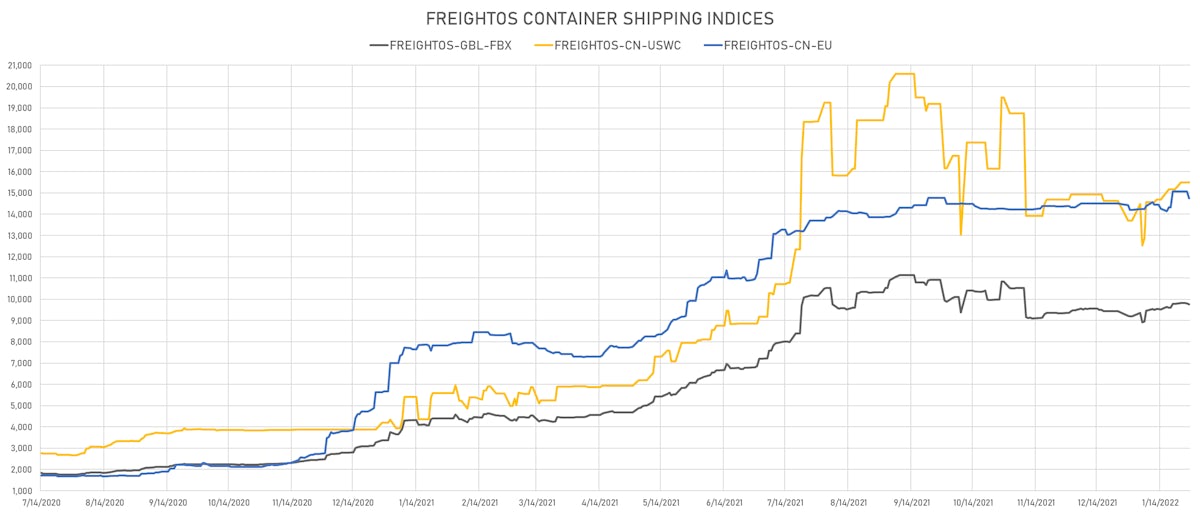

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 1,381, down -2.4% (YTD: -37.8%)

- Freightos China To North America West Coast Container Index currently at 15,485, up 2.1% (YTD: +13.0%)

- Freightos North America West Coast To China Container Index currently at 1,086, down -1.4% (YTD: +24.1%)

- Freightos North America East Coast To Europe Container Index currently at 442, down -21.5% (YTD: -18.1%)

- Freightos Europe To North America East Coast Container Index currently at 7,232, down -2.7% (YTD: +1.9%)

- Freightos China To North Europe Container Index currently at 14,751, down -2.1% (YTD: +3.8%)

- Freightos North Europe To China Container Index currently at 1,054, up 3.9% (YTD: -6.7%)

- Freightos Europe To South America West Coast Container Index currently at 8,411, unchanged (YTD: +7.7%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 89.22 per tonne, up 5.6% (YTD: +11.3%)