Credit

US Corporate Bonds Largely Unchanged Today

Credit Suisse strategists note that high-yield is more attractive than IG at this point, with the ratio of HY cash spreads to IG cash spreads close to all-time highs

Published ET

Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.09% today, with investment grade up 0.09% and high yield up 0.07% (YTD total return: -1.33%)

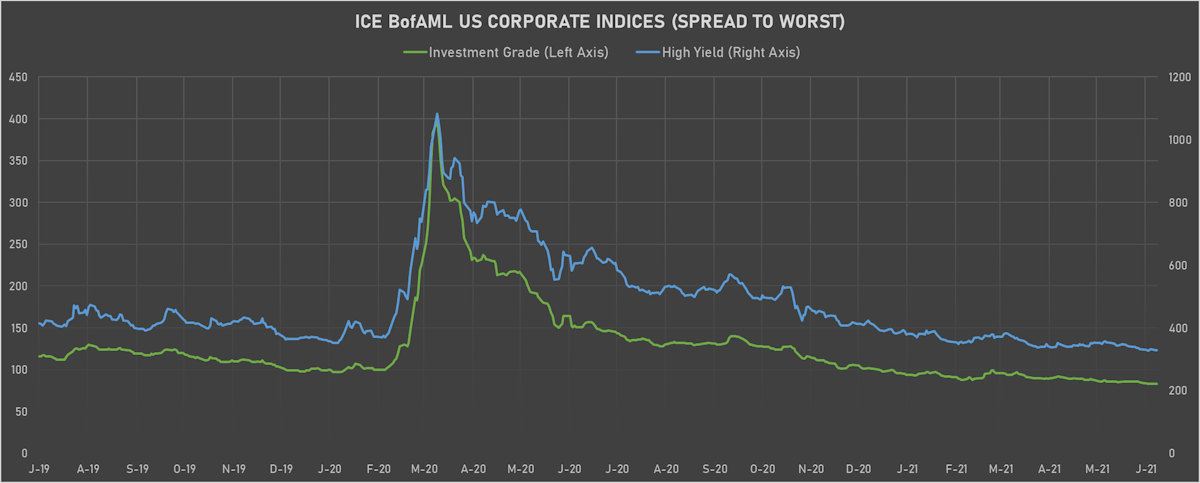

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 329.0 bp (YTD change: -61.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.05% today (YTD total return: +2.1%)

- New issues: US$ 8.0bn in dollars and € 11.4bn in euros

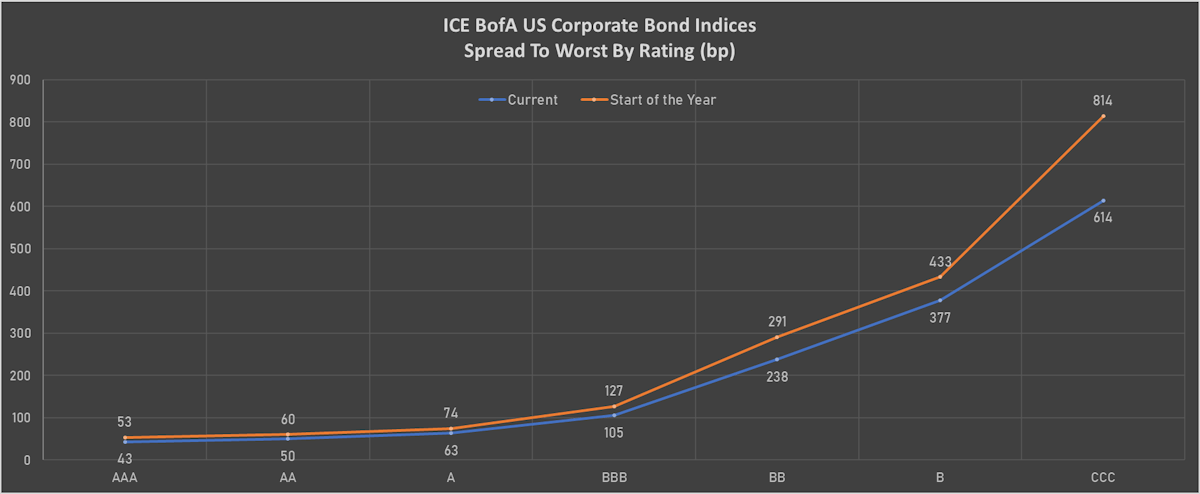

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 45 bp

- AA unchanged at 53 bp

- A up by 1 bp at 68 bp

- BBB unchanged at 108 bp

- BB up by 1 bp at 226 bp

- B up by 2 bp at 357 bp

- CCC down by -1 bp at 603 bp

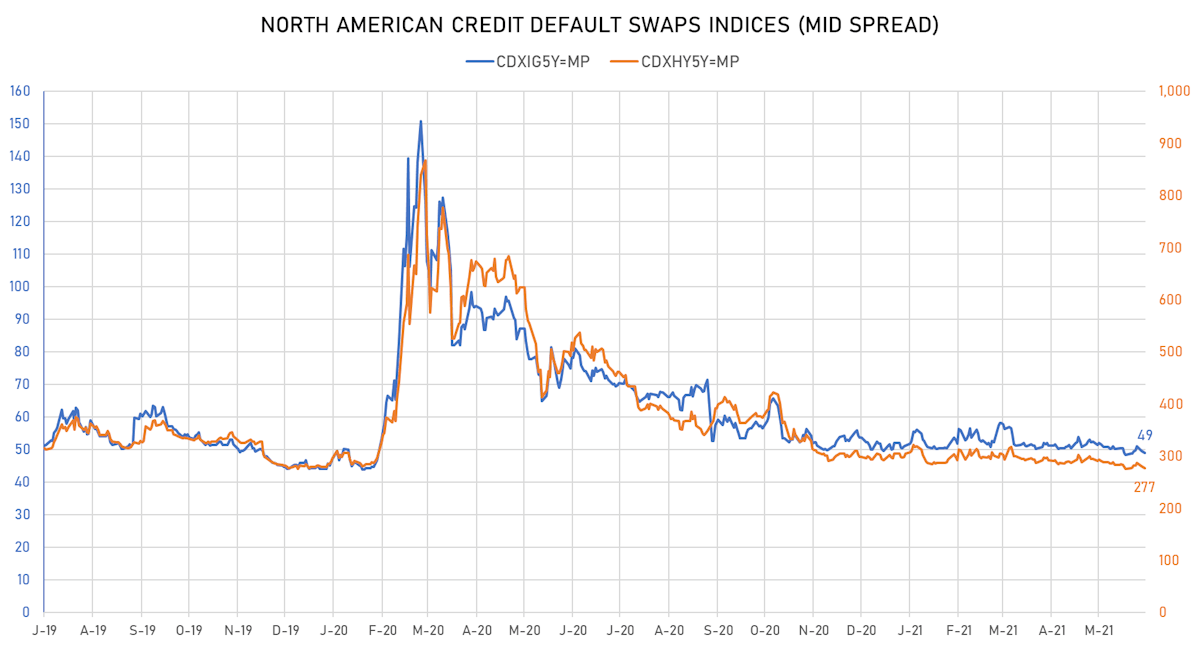

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 49bp (YTD change: -1.1bp)

- Markit CDX.NA.HY 5Y down 3.2 bp, now at 277bp (YTD change: -16.4bp)

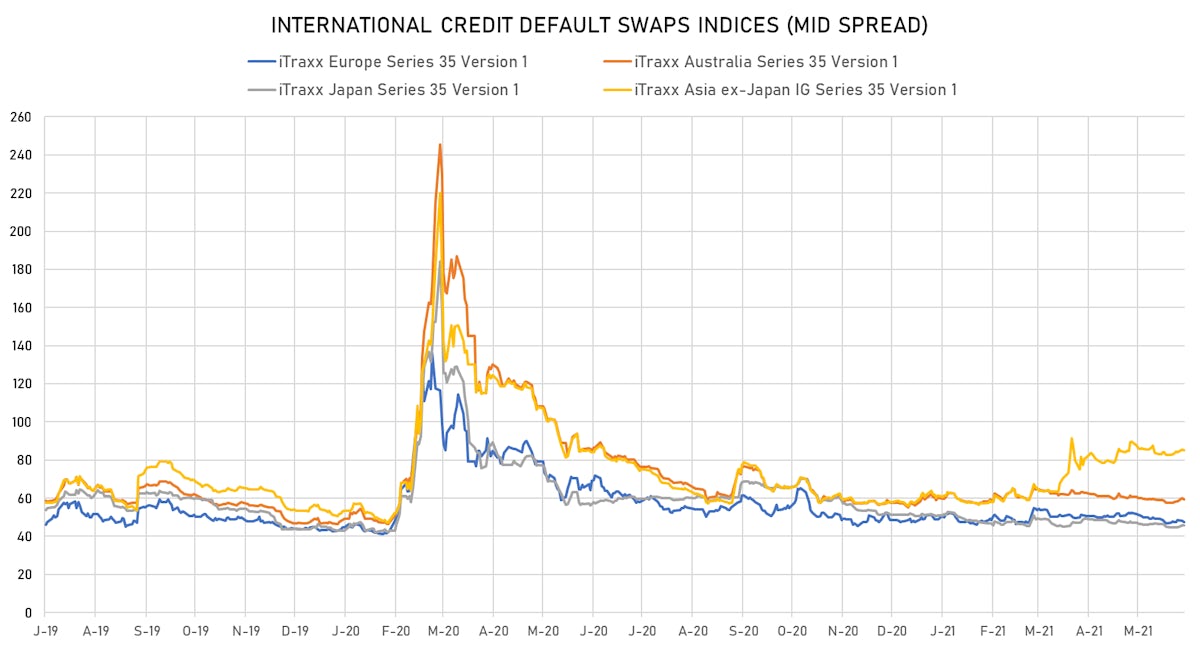

- Markit iTRAXX Europe down 0.7 bp, now at 47bp (YTD change: -0.6bp)

- Markit iTRAXX Japan down 0.3 bp, now at 46bp (YTD change: -5.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 85bp (YTD change: +26.9bp)

TOP BONDS MOVERS - USD HY

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 40.5 bp to 707.2 bp, with the yield to worst at 7.4% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 104.8-109.9).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 40.0 bp to 614.0 bp, with the yield to worst at 6.7% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 98.9-104.8).

- Issuer: Georgian railway JSC (Tbilisi, Georgia) | Coupon: 4.00% | Maturity: 17/6/2028 | Rating: B+ | ISIN: XS2340149439 | Z-spread up by 33.7 bp to 294.4 bp, with the yield to worst at 3.9% and the bond now trading down to 99.6 cents on the dollar (1Y price range: 99.6-101.4).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread up by 27.4 bp to 305.7 bp, with the yield to worst at 3.5% and the bond now trading down to 107.9 cents on the dollar (1Y price range: 103.0-109.4).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread up by 27.0 bp to 645.9 bp, with the yield to worst at 6.7% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 93.6-100.4).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.75% | Maturity: 17/10/2029 | Rating: B | ISIN: XS2056723468 | Z-spread up by 26.2 bp to 480.9 bp, with the yield to worst at 5.9% and the bond now trading down to 110.9 cents on the dollar (1Y price range: 99.6-111.6).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.00% | Maturity: 1/5/2025 | Rating: BB- | ISIN: USC67111AG65 | Z-spread up by 22.9 bp to 243.5 bp (CDS basis: -41.7bp), with the yield to worst at 2.9% and the bond now trading down to 106.4 cents on the dollar (1Y price range: 101.4-107.7).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 6.00% | Maturity: 23/1/2025 | Rating: B- | ISIN: XS2100270508 | Z-spread up by 21.6 bp to 500.8 bp, with the yield to worst at 5.3% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 96.0-103.5).

- Issuer: Uzpromstroybank AKB (Tashkent, Uzbekistan) | Coupon: 5.75% | Maturity: 2/12/2024 | Rating: BB- | ISIN: XS2083131859 | Z-spread up by 21.2 bp to 335.2 bp, with the yield to worst at 3.8% and the bond now trading down to 105.8 cents on the dollar (1Y price range: 102.4-106.8).

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Z-spread up by 20.4 bp to 446.1 bp, with the yield to worst at 5.0% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 98.3-100.5).

- Issuer: Turkiye Petrol Rafinerileri AS (KOCAELI, Turkey) | Coupon: 4.50% | Maturity: 18/10/2024 | Rating: B | ISIN: XS1686704948 | Z-spread up by 20.0 bp to 385.1 bp, with the yield to worst at 4.1% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 95.5-101.3).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread down by 28.0 bp to 262.2 bp, with the yield to worst at 2.8% and the bond now trading up to 106.2 cents on the dollar (1Y price range: 104.5-106.2).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Z-spread down by 28.9 bp to 257.1 bp, with the yield to worst at 2.7% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread down by 31.8 bp to 603.2 bp, with the yield to worst at 6.3% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 67.5-104.5).

- Issuer: QNB Finansbank AS (Istanbul, Turkey) | Coupon: 6.88% | Maturity: 7/9/2024 | Rating: B | ISIN: XS1959391019 | Z-spread down by 47.7 bp to 359.9 bp (CDS basis: -315.6bp), with the yield to worst at 4.0% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 103.3-110.5).

TOP BONDS MOVERS - EUR HY

- Issuer: Crown European Holdings SA (France) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 25.5 bp to 313.3 bp, with the yield to worst at 2.7% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.3-105.8).

- Issuer: PHOENIX PIB Dutch Finance BV (Maarssen, Netherlands) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 14.6 bp to 246.9 bp, with the yield to worst at 2.0% and the bond now trading down to 104.1 cents on the dollar (1Y price range: 103.1-105.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread up by 13.9 bp to 253.0 bp, with the yield to worst at 2.2% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 98.1-100.2).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread up by 13.8 bp to 267.7 bp, with the yield to worst at 2.5% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 94.1-98.9).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB- | ISIN: XS2332589972 | Z-spread up by 13.5 bp to 214.0 bp, with the yield to worst at 1.7% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.3-100.3).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 13.1 bp to 353.5 bp, with the yield to worst at 3.3% and the bond now trading down to 88.4 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 1.75% | Maturity: 19/11/2025 | Rating: BB+ | ISIN: XS2082324018 | Z-spread down by 15.3 bp to 73.6 bp (CDS basis: 34.9bp), with the yield to worst at 0.4% and the bond now trading up to 105.4 cents on the dollar (1Y price range: 102.8-105.7).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 16.8 bp to 357.2 bp, with the yield to worst at 3.4% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 97.5-101.1).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 19.4 bp to 283.7 bp, with the yield to worst at 2.3% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.9-101.1)

USD BOND ISSUES

- Ameren Illinois Co (Utility - Other | Collinsville, Illinois, United States | Rating: A+): US$350m First Mortgage Bond (US02361DAX84), fixed rate (2.90% coupon) maturing on 15 June 2051, priced at 99.58 (original spread of 118 bp), callable (30nc29)

- Block Financial LLC (Financial - Other | Kansas City, Missouri, United States | Rating: BBB): US$500m Senior Note (US093662AJ37), fixed rate (2.50% coupon) maturing on 15 July 2028, priced at 99.54 (original spread of 142 bp), callable (7nc7)

- Duquesne Light Holdings Inc (Utility - Other | Pittsburgh, Pennsylvania, United States | Rating: BBB-): US$400m Senior Note (US266233AJ47), fixed rate (2.78% coupon) maturing on 7 January 2032, priced at 100.00 (original spread of 133 bp), callable (11nc10)

- Essential Properties LP (Financial - Other | Princeton, New Jersey, United States | Rating: BBB-): US$400m Senior Note (US29670VAA70), fixed rate (2.95% coupon) maturing on 15 July 2031, priced at 99.80 (original spread of 155 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$220m Bond (US3133EMN241), fixed rate (1.94% coupon) maturing on 30 June 2031, priced at 100.00 (original spread of 53 bp), callable (10nc1)

- Ford Motor Credit Company LLC (Financial - Other | Dearborn, Michigan, United States | Rating: BB+): US$1,000m Senior Note (US345397B694), fixed rate (3.63% coupon) maturing on 17 June 2031, priced at 100.00, callable (10nc10)

- Freedom Mortgage Corp (Financial - Other | Mount Laurel, New Jersey, United States | Rating: B): US$650m Senior Note (US35640YAG26), fixed rate (6.63% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 578 bp), callable (6nc3)

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$110m Unsecured Note (XS2354254166), fixed rate (10.75% coupon) maturing on 30 June 2029, priced at 100.00, non callable

- Bocom International Blossom Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$500m Senior Note (XS2357034755), fixed rate (1.75% coupon) maturing on 28 June 2026, priced at 99.94 (original spread of 90 bp), non callable

- Emirates NBD Bank PJSC (Banking | Dubai, Dubai, United Arab Emirates | Rating: A+): US$250m Senior Note (XS2358709595), fixed rate (1.85% coupon) maturing on 8 July 2026, priced at 100.00, non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US302154DK23), fixed rate (2.50% coupon) maturing on 29 June 2041, priced at 99.22 (original spread of 50 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$750m Senior Note (US302154DH93), fixed rate (0.63% coupon) maturing on 29 June 2024, priced at 99.95 (original spread of 20 bp), non callable

- PSP Capital Inc (Financial - Other | Montreal, Quebec, Canada | Rating: AAA): US$1,000m Senior Note (US69375V2A07), fixed rate (1.00% coupon) maturing on 29 June 2026, priced at 99.99 (original spread of 14 bp), non callable

- RHB Bank Bhd (Banking | Kuala Lumpur, Wilayah Persekutuan, Malaysia | Rating: A-): US$500m Senior Note (XS2356379102), fixed rate (1.66% coupon) maturing on 29 June 2026, priced at 100.00, non callable

- Vmed O2 Uk Financing I PLC (Financial - Other | London, United Kingdom | Rating: BB-): US$850m Note (US92858RAB69), fixed rate (4.75% coupon) maturing on 15 July 2031, priced at 100.00 (original spread of 344 bp), callable (10nc5)

EUR BOND ISSUES

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB): €300m Subordinated Note (XS2358835036), fixed rate (2.88% coupon) maturing on 29 June 2031, priced at 99.78 (original spread of 348 bp), callable (10nc5)

- Gecina SA (Real Estate Investment Trust | Paris, Ile-De-France, France | Rating: A-): €500m Bond (FR00140049A8), fixed rate (0.88% coupon) maturing on 30 June 2036, priced at 98.35 (original spread of 96 bp), callable (15nc15)

- KBC Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €450m Bond (BE0002805860), floating rate (EU03MLIB + 65.0 bp) maturing on 23 June 2024, priced at 100.45 (original spread of 100,000 bp), non callable

- Premium Green PLC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €150m Unsecured Note (XS2357747554), floating rate maturing on 25 June 2026, priced at 100.00, non callable

- SASA Polyester Sanayi AS (Industrials - Other | Adana, Turkey | Rating: NR): €200m Bond (XS2357838601), fixed rate (2.50% coupon) maturing on 30 June 2026, priced at 100.00, non callable, convertible

- SES SA (Service - Other | Betzdorf, Luxembourg | Rating: BBB-): €150m Senior Note (XS2358724123), fixed rate (1.63% coupon) maturing on 22 March 2026, priced at 106.67 (original spread of 72 bp), callable (5nc4)

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR00140045Q2), fixed rate (0.65% coupon) maturing on 23 June 2035, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): €500m Senior Note (XS2358287238), fixed rate (0.01% coupon) maturing on 29 June 2026, priced at 99.80 (original spread of 103 bp), non callable

- Yorkshire Building Society (Banking | Bradford, West Yorkshire, United Kingdom | Rating: A-): €600m Note (XS2358471246), fixed rate (0.50% coupon) maturing on 1 July 2028, priced at 99.84 (original spread of 96 bp), non callable

NEW LOANS

- The Topps Co Inc (B), signed a US$ 200m Term Loan B, to be used for general corporate purposes. It matures on 07/07/28

- McAfee LLC (BB-), signed a US$ 900m Term Loan B, to be used for acquisition financing

- McAfee LLC (BB-), signed a US$ 165m Term Loan, to be used for acquisition financing

- Aveanna Healthcare LLC (B-), signed a US$ 200m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 07/07/28.

- Aveanna Healthcare LLC (B-), signed a US$ 860m Term Loan B, to be used for general corporate purposes. It matures on 07/07/28.

- Resource Label Group LLC, signed a US$ 110m Term Loan, to be used for leveraged buyout. It matures on 07/01/29.

- Resource Label Group LLC, signed a US$ 405m Term Loan B, to be used for leveraged buyout. It matures on 07/01/28.

NEW ISSUES IN SECURITIZED CREDIT

- Mercedes-Benz Auto Lease Trust 2021-B issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 1,025 m. Highest-rated tranche offering a yield to maturity of 0.22%, and the lowest-rated tranche a yield to maturity of 0.51%. Bookrunners: JP Morgan & Co Inc, SG Americas Securities LLC, BNP Paribas Securities Corp

- Five Guys Funding LLC Series 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche, for a total of US$ 200 m. Highest-rated tranche offering a yield to maturity of 2.49%, and the lowest-rated tranche a yield to maturity of 2.49%. Bookrunners: Guggenheim Securities LLC

- Blackbird Capital Ii Aircraft Lease Ltd 2021-1 issued a fixed-rate ABS backed by aircraft leases in 2 tranches, for a total of US$ 745 m. Highest-rated tranche offering a yield to maturity of 2.44%, and the lowest-rated tranche a yield to maturity of 3.45%. Bookrunners: Goldman Sachs & Co

- Fifth Third Securities Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, SG Americas Securities LLC, Bank of America Merrill Lynch, Mizuho Securities USA Inc, BNP Paribas Securities Corp, MUFG Securities Americas Inc

- Iowa Student Loan Liquidity Corp 2021-1 Ffelp issued a floating-rate ABS backed by student loans in 2 tranches, for a total of US$ 340 m. Highest-rated tranche offering a spread over the floating rate of 67bp, and the lowest-rated tranche a spread of 67bp. Bookrunners: RBC Capital Markets