Credit

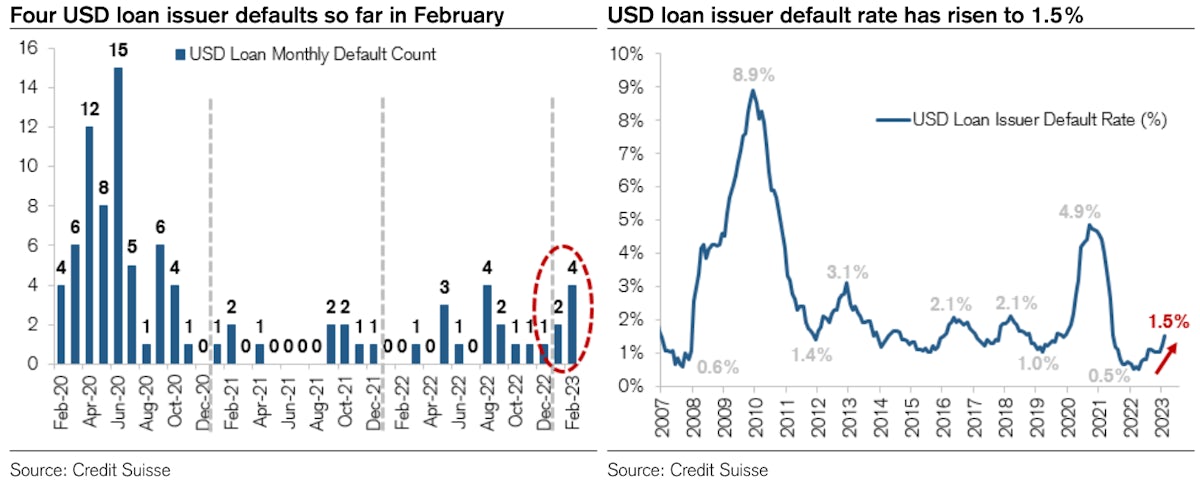

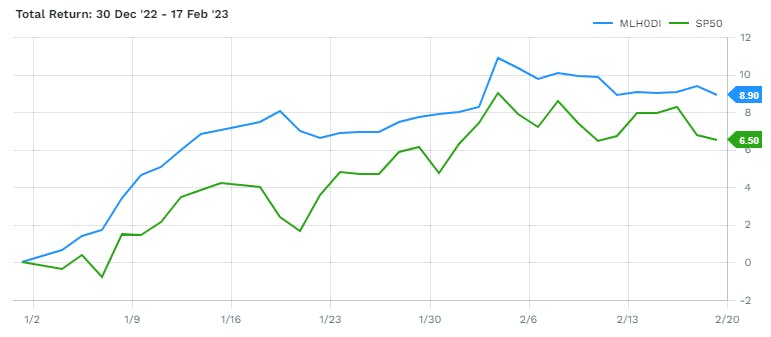

With Default Rates Still At Very Low Levels, Distressed USD HY Is Overperforming US Equities YTD

A strong week for investment grade USD bond issuance: 42 tranches for $54.175bn in IG (2023 YTD volume $245.075bn vs 2022 YTD $216.041bn), no new issuance in HY (2023 YTD volume $31.475bn vs 2022 YTD $30.686bn)

Published ET

USD Loans Defaults | Source: Credit Suisse

DAILY SUMMARY

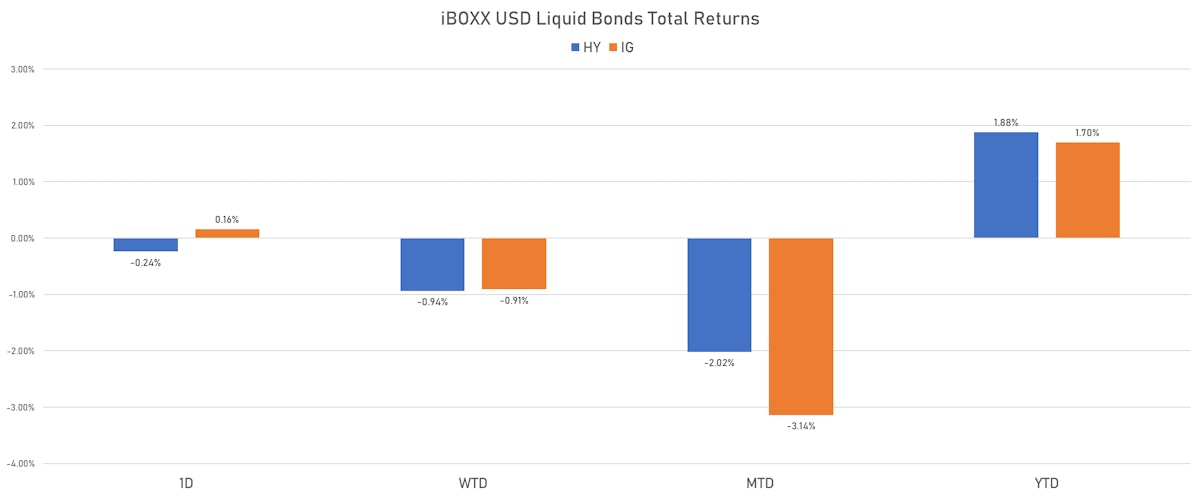

- S&P 500 Bond Index was up 0.11% today, with investment grade up 0.14% and high yield down -0.24% (YTD total return: +1.52%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.158% today (Week-to-date: -0.91%; Month-to-date: -3.14%; Year-to-date: 1.70%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.239% today (Week-to-date: -0.94%; Month-to-date: -2.02%; Year-to-date: 1.88%)

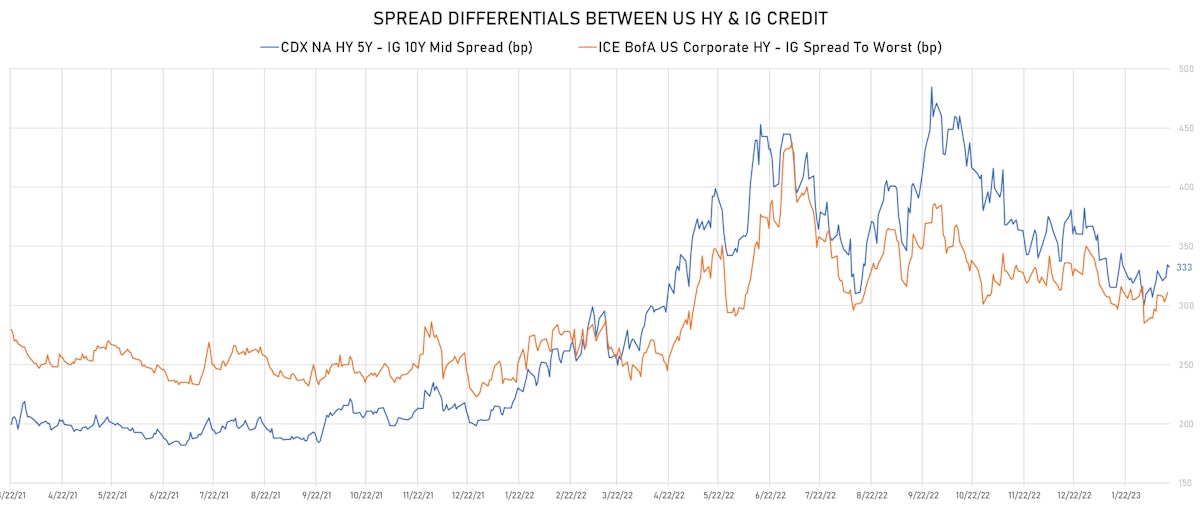

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 125.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 436.0 bp (YTD change: -52.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.18% today (YTD total return: +3.3%)

ICE BofA US Distressed HY vs S&P 500 Total Returns YTD | Source: FactSet

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA up by 1 bp at 57 bp

- AA up by 2 bp at 74 bp

- A up by 3 bp at 102 bp

- BBB up by 3 bp at 157 bp

- BB up by 12 bp at 297 bp

- B up by 14 bp at 456 bp

- ≤ CCC up by 17 bp at 1,022 bp

CDS INDICES TODAY (mid-spreads)

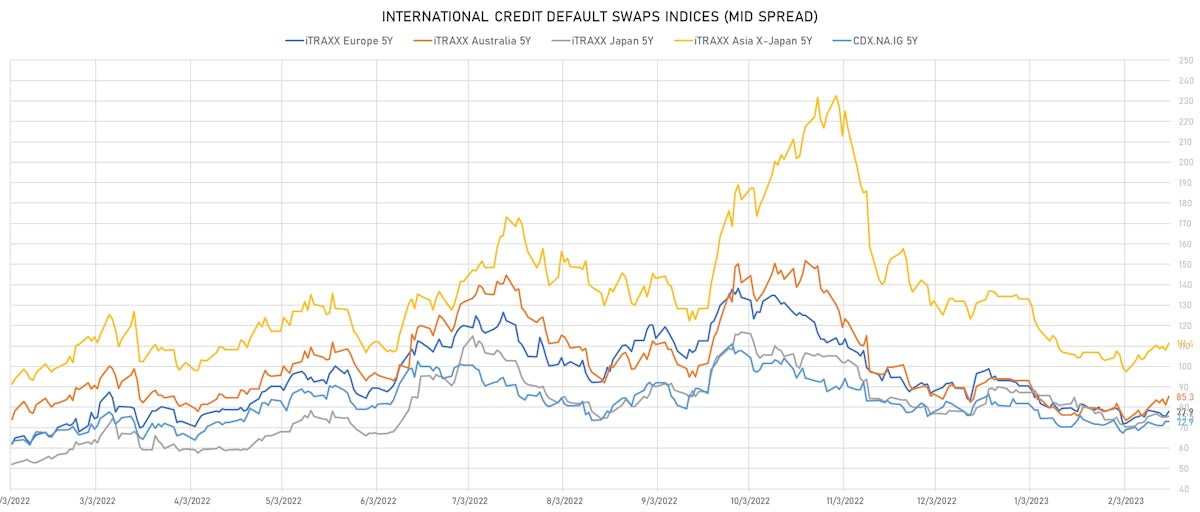

- Markit CDX.NA.IG 5Y down 0.3 bp, now at 73bp (1W change: +0.1bp; YTD change: -9.0bp)

- Markit CDX.NA.IG 10Y down 0.4 bp, now at 113bp (1W change: +0.2bp; YTD change: -5.2bp)

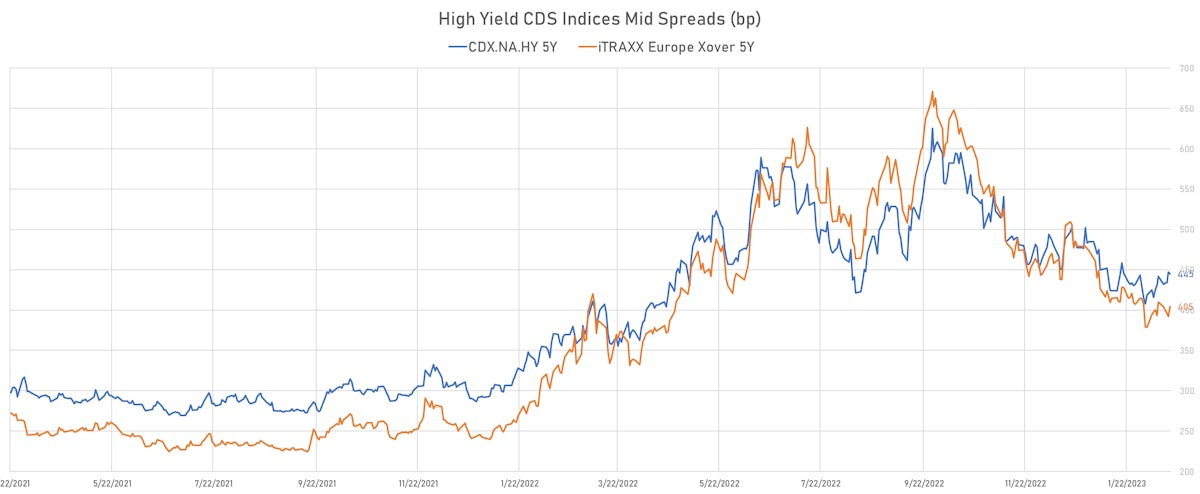

- Markit CDX.NA.HY 5Y down 2.1 bp, now at 445bp (1W change: +3.7bp; YTD change: -39.6bp)

- Markit iTRAXX Europe 5Y up 2.4 bp, now at 78bp (1W change: -0.7bp; YTD change: -12.6bp)

- Markit iTRAXX Europe Crossover 5Y up 12.3 bp, now at 405bp (1W change: -5.2bp; YTD change: -69.4bp)

- Markit iTRAXX Japan 5Y up 0.4 bp, now at 75bp (1W change: +0.2bp; YTD change: -11.7bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 3.5 bp, now at 111bp (1W change: +4.5bp; YTD change: -21.6bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Avis Budget Group Inc (Country: US; rated: A2): down 30.9 bp to 327.4bp (1Y range: 269-591bp)

- Gap Inc (Country: US; rated: Ba2): down 28.0 bp to 495.4bp (1Y range: 302-819bp)

- Transocean Inc (Country: KY; rated: Caa1): up 22.1 bp to 791.4bp (1Y range: 674-2,858bp)

- Onemain Finance Corp (Country: US; rated: Ba2): up 29.1 bp to 384.3bp (1Y range: 121-1,042bp)

- American Airlines Group Inc (Country: US; rated: NR): up 29.8 bp to 803.8bp (1Y range: 607-1,644bp)

- Aramark Services Inc (Country: US; rated: Ba3): up 32.3 bp to 213.9bp (1Y range: 175-389bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 33.1 bp to 583.3bp (1Y range: 548-739bp)

- Staples Inc (Country: US; rated: B3): up 34.3 bp to 1,709.4bp (1Y range: 1,014-1,986bp)

- Nabors Industries Inc (Country: US; rated: BB-): up 36.3 bp to 495.7bp (1Y range: 390-887bp)

- Tegna Inc (Country: US; rated: Ba3): up 36.8 bp to 481.7bp (1Y range: 182-786bp)

- Carnival Corp (Country: US; rated: LGD4 - 66%): up 37.1 bp to 955.5bp (1Y range: 434-2,117bp)

- Amkor Technology Inc (Country: US; rated: A1): up 40.9 bp to 179.6bp (1Y range: 126-375bp)

- Pitney Bowes Inc (Country: US; rated: B-): up 67.8 bp to 1,026.0bp (1Y range: 625-1,783bp)

- Liberty Interactive LLC (Country: US; rated: B1): up 140.4 bp to 2,410.9bp (1Y range: 571-2,584bp)

- Lumen Technologies Inc (Country: US; rated: WR): up 182.1 bp to 1,612.0bp (1Y range: 195-1,612bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ceconomy AG (Country: DE; rated: BB): down 198.4 bp to 779.6bp (1Y range: 269-1,763bp)

- Air France KLM SA (Country: FR; rated: C): down 63.2 bp to 466.1bp (1Y range: 419-990bp)

- Hammerson PLC (Country: GB; rated: A2): down 56.0 bp to 303.3bp (1Y range: 187-482bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: b1): down 27.3 bp to 361.6bp (1Y range: 355-790bp)

- Elo SA (Country: FR; rated: ): up 11.2 bp to 221.8bp (1Y range: 83-242bp)

- thyssenkrupp AG (Country: DE; rated: Ba3): up 11.7 bp to 359.8bp (1Y range: 281-705bp)

- TUI AG (Country: DE; rated: B3-PD): up 11.7 bp to 726.6bp (1Y range: 628-1,725bp)

- ArcelorMittal SA (Country: LU; rated: WD): up 11.9 bp to 189.8bp (1Y range: 133-353bp)

- Credit Suisse Group AG (Country: CH; rated: A+): up 15.2 bp to 334.7bp (1Y range: 82-442bp)

- Novafives SAS (Country: FR; rated: Caa1): up 15.2 bp to 974.3bp (1Y range: 618-2,936bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 15.6 bp to 1,116.6bp (1Y range: 566-1,739bp)

- Ineos Group Holdings SA (Country: LU; rated: WR): up 18.6 bp to 273.4bp (1Y range: 134-420bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 30.3 bp to 768.7bp (1Y range: 428-1,296bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 36.8 bp to 717.2bp (1Y range: 369-1,254bp)

- Casino Guichard Perrachon SA (Country: FR; rated: CCC): up 323.4 bp to 2,531.2bp (1Y range: 820-4,917bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 3.00% | Maturity: 15/2/2027 | Rating: BB+ | CUSIP: 674599CM5 | OAS up by 71.3 bp to 169.3 bp (CDS basis: -81.2bp), with the yield to worst at 5.7% and the bond now trading down to 89.5 cents on the dollar (1Y price range: 89.5-93.3).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB- | CUSIP: 81725WAH6 | OAS up by 69.0 bp to 130.5 bp, with the yield to worst at 5.9% and the bond now trading down to 98.9 cents on the dollar (1Y price range: 98.8-100.5).

- Issuer: United Airlines Holdings Inc (Chicago, Illinois (US)) | Coupon: 4.88% | Maturity: 15/1/2025 | Rating: B- | CUSIP: 910047AK5 | OAS up by 55.3 bp to 165.6 bp, with the yield to worst at 6.0% and the bond now trading down to 97.0 cents on the dollar (1Y price range: 96.0-98.6).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 3.40% | Maturity: 15/4/2026 | Rating: BB+ | CUSIP: 674599CH6 | OAS up by 48.5 bp to 147.5 bp (CDS basis: -79.0bp), with the yield to worst at 5.6% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 92.5-95.8).

- Issuer: Fluor Corp (Irving, Texas (US)) | Coupon: 3.50% | Maturity: 15/12/2024 | Rating: BB+ | CUSIP: 343412AC6 | OAS up by 43.8 bp to 83.2 bp, with the yield to worst at 5.8% and the bond now trading down to 95.9 cents on the dollar (1Y price range: 95.9-98.3).

- Issuer: Howmet Aerospace Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.88% | Maturity: 1/5/2025 | Rating: BB+ | CUSIP: 443201AA6 | OAS up by 42.5 bp to 127.2 bp, with the yield to worst at 5.7% and the bond now trading down to 101.3 cents on the dollar (1Y price range: 101.3-103.4).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 5.88% | Maturity: 1/9/2025 | Rating: BB+ | CUSIP: 674599EB7 | OAS down by 30.8 bp to 91.4 bp (CDS basis: -48.2bp), with the yield to worst at 5.3% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 99.5-101.9).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 2.05% | Maturity: 1/3/2025 | Rating: BB+ | CUSIP: 337932AK3 | OAS down by 34.8 bp to 59.7 bp (CDS basis: -25.6bp), with the yield to worst at 5.4% and the bond now trading up to 93.3 cents on the dollar (1Y price range: 92.3-94.4).

- Issuer: Occidental Petroleum Corp (Houston, Texas (US)) | Coupon: 6.95% | Maturity: 1/7/2024 | Rating: BB+ | CUSIP: 674599DB8 | OAS down by 42.5 bp to 38.8 bp (CDS basis: 12.4bp), with the yield to worst at 4.8% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 101.0-102.8).

- Issuer: FirstEnergy Corp (Akron, Ohio (US)) | Coupon: 1.60% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 337932AN7 | OAS down by 48.4 bp to 87.6 bp (CDS basis: -43.2bp), with the yield to worst at 5.3% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 88.0-90.5).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 4.35% | Maturity: 1/10/2024 | Rating: B | CUSIP: 44106MAZ5 | OAS down by 94.2 bp to 218.9 bp, with the yield to worst at 6.7% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 90.9-96.5).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 7.50% | Maturity: 15/9/2025 | Rating: B+ | CUSIP: 81761LAA0 | OAS down by 112.4 bp to 273.3 bp, with the yield to worst at 7.1% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 95.0-100.3).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 3.95% | Maturity: 15/1/2028 | Rating: B | CUSIP: 44106MAX0 | OAS down by 159.6 bp to 456.9 bp, with the yield to worst at 8.4% and the bond now trading up to 81.3 cents on the dollar (1Y price range: 71.1-82.0).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 5.25% | Maturity: 15/2/2026 | Rating: B | CUSIP: 44106MAV4 | OAS down by 167.7 bp to 362.1 bp, with the yield to worst at 7.8% and the bond now trading up to 92.3 cents on the dollar (1Y price range: 83.8-92.3).

- Issuer: Service Properties Trust (Newton, Massachusetts (US)) | Coupon: 4.50% | Maturity: 15/3/2025 | Rating: B | CUSIP: 44106MAT9 | OAS down by 178.2 bp to 257.2 bp, with the yield to worst at 7.0% and the bond now trading up to 94.3 cents on the dollar (1Y price range: 87.0-94.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS up by 55.8 bp to 547.2 bp (CDS basis: 111.7bp), with the yield to worst at 8.4% and the bond now trading down to 94.7 cents on the dollar (1Y price range: 88.4-97.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: B+ | ISIN: XS1172951508 | OAS up by 54.5 bp to 547.4 bp (CDS basis: -96.4bp), with the yield to worst at 8.5% and the bond now trading down to 80.0 cents on the dollar (1Y price range: 77.8-83.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 4.50% | Maturity: 15/1/2026 | Rating: B+ | ISIN: XS1881005976 | OAS up by 53.6 bp to 445.3 bp (CDS basis: 119.0bp), with the yield to worst at 7.4% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 85.3-94.9).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.63% | Maturity: 30/4/2026 | Rating: BB | ISIN: XS2332589972 | OAS up by 43.5 bp to 215.1 bp, with the yield to worst at 5.1% and the bond now trading down to 89.1 cents on the dollar (1Y price range: 88.5-91.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: B+ | ISIN: XS1568888777 | OAS up by 41.3 bp to 573.2 bp (CDS basis: -89.4bp), with the yield to worst at 8.7% and the bond now trading down to 84.5 cents on the dollar (1Y price range: 81.2-88.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | OAS up by 41.3 bp to 387.7 bp, with the yield to worst at 6.9% and the bond now trading down to 88.5 cents on the dollar (1Y price range: 86.2-92.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 3.75% | Maturity: 16/4/2026 | Rating: B+ | ISIN: XS1057659838 | OAS up by 39.1 bp to 414.9 bp (CDS basis: -8.5bp), with the yield to worst at 7.3% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 87.6-92.8).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS up by 39.0 bp to 415.8 bp, with the yield to worst at 7.4% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 88.0-97.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: B+ | ISIN: XS1824424706 | OAS up by 35.5 bp to 589.9 bp (CDS basis: -78.1bp), with the yield to worst at 8.8% and the bond now trading down to 81.0 cents on the dollar (1Y price range: 77.7-85.1).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | OAS up by 28.1 bp to 269.2 bp, with the yield to worst at 5.7% and the bond now trading down to 85.9 cents on the dollar (1Y price range: 81.4-88.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | OAS up by 26.0 bp to 386.0 bp, with the yield to worst at 6.8% and the bond now trading down to 75.9 cents on the dollar (1Y price range: 73.9-79.3).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: B+ | ISIN: XS1698218523 | OAS down by 26.3 bp to 280.2 bp (CDS basis: 20.6bp), with the yield to worst at 5.6% and the bond now trading up to 85.8 cents on the dollar (1Y price range: 83.0-87.0).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: B+ | ISIN: XS1419869885 | OAS down by 27.1 bp to 200.9 bp (CDS basis: 36.8bp), with the yield to worst at 5.0% and the bond now trading up to 95.1 cents on the dollar (1Y price range: 92.3-95.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: B+ | ISIN: XS1846631049 | OAS down by 28.5 bp to 214.7 bp (CDS basis: 7.0bp), with the yield to worst at 5.2% and the bond now trading up to 93.1 cents on the dollar (1Y price range: 90.8-93.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.00% | Maturity: 30/9/2025 | Rating: B+ | ISIN: XS1497606365 | OAS down by 32.9 bp to 157.2 bp (CDS basis: 48.2bp), with the yield to worst at 4.7% and the bond now trading up to 95.2 cents on the dollar (1Y price range: 92.7-95.3).

RECENT DOMESTIC USD BOND ISSUES

- AT&T Inc (Telecommunications | Dallas, United States | Rating: BBB): US$1,750m Senior Note (US00206RMP46), fixed rate (5.54% coupon) maturing on 20 February 2026, priced at par (original spread of 120 bp), callable (3nc1)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): US$1,200m Senior Note (US025816DC04), fixed rate (4.90% coupon) maturing on 13 February 2026, priced at 99.92 (original spread of 74 bp), callable (3nc3)

- American Express Co (Banking | New York City, New York, United States | Rating: BBB+): US$300m Senior Note (US025816DD86), floating rate (SOFR + 76.0 bp) maturing on 13 February 2026, priced at 100.00, callable (3nc3)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$2,750m Senior Note (US031162DU18), fixed rate (5.75% coupon) maturing on 2 March 2063, priced at 99.07 (original spread of 248 bp), callable (40nc40)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$4,250m Senior Note (US031162DR88), fixed rate (5.25% coupon) maturing on 2 March 2033, priced at 99.69 (original spread of 150 bp), callable (10nc10)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$3,750m Senior Note (US031162DP23), fixed rate (5.15% coupon) maturing on 2 March 2028, priced at 99.83 (original spread of 115 bp), callable (5nc5)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$1,500m Senior Note (US031162DN74), fixed rate (5.51% coupon) maturing on 2 March 2026, priced at 100.00 (original spread of 120 bp), callable (3nc1)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$2,750m Senior Note (US031162DQ06), fixed rate (5.25% coupon) maturing on 2 March 2030, priced at 99.77 (original spread of 135 bp), callable (7nc7)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$2,750m Senior Note (US031162DS61), fixed rate (5.60% coupon) maturing on 2 March 2043, priced at 99.44 (original spread of 199 bp), callable (20nc20)

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$2,000m Senior Note (US031162DM91), fixed rate (5.25% coupon) maturing on 2 March 2025, priced at 99.93 (original spread of 65 bp), with a special call

- Amgen Inc (Pharmaceuticals | Thousand Oaks, California, United States | Rating: BBB+): US$4,250m Senior Note (US031162DT45), fixed rate (5.65% coupon) maturing on 2 March 2053, priced at 99.86 (original spread of 220 bp), callable (30nc30)

- CVS Health Corp (Health Care Facilities | Woonsocket, Rhode Island, United States | Rating: BBB): US$1,250m Senior Note (US126650DV97), fixed rate (5.63% coupon) maturing on 21 February 2053, priced at 99.86 (original spread of 234 bp), callable (30nc30)

- CVS Health Corp (Health Care Facilities | Woonsocket, Rhode Island, United States | Rating: BBB): US$1,500m Senior Note (US126650DT42), fixed rate (5.13% coupon) maturing on 21 February 2030, priced at 99.33 (original spread of 140 bp), callable (7nc7)

- CVS Health Corp (Health Care Facilities | Woonsocket, Rhode Island, United States | Rating: BBB): US$1,750m Senior Note (US126650DU15), fixed rate (5.25% coupon) maturing on 21 February 2033, priced at 99.82 (original spread of 160 bp), callable (10nc10)

- CVS Health Corp (Health Care Facilities | Woonsocket, Rhode Island, United States | Rating: BBB): US$1,500m Senior Note (US126650DS68), fixed rate (5.00% coupon) maturing on 20 February 2026, priced at 99.66 (original spread of 90 bp), callable (3nc3)

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A): US$700m First Mortgage Bond (US210518DU76), fixed rate (4.63% coupon) maturing on 15 May 2033, priced at 99.45 (original spread of 106 bp), callable (10nc10)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$850m Senior Note (US30161NBK63), fixed rate (5.30% coupon) maturing on 15 March 2033, priced at 99.90 (original spread of 145 bp), callable (10nc10)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$1,000m Senior Note (US30161NBJ90), fixed rate (5.15% coupon) maturing on 15 March 2028, priced at 99.83 (original spread of 113 bp), callable (5nc5)

- Exelon Corp (Utility - Other | Chicago, United States | Rating: BBB): US$650m Senior Note (US30161NBL47), fixed rate (5.60% coupon) maturing on 15 March 2053, priced at 99.69 (original spread of 170 bp), callable (30nc30)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$135m Bond (US3133EPBM69), fixed rate (4.13% coupon) maturing on 23 August 2027, priced at 99.68, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPBJ31), fixed rate (4.38% coupon) maturing on 23 February 2026, priced at 99.81 (original spread of 4 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$460m Bond (US3133EPBH74), fixed rate (4.75% coupon) maturing on 21 February 2025, priced at 99.96 (original spread of 6 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EPBQ73), floating rate (SOFR + 13.5 bp) maturing on 24 February 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$310m Bond (US3130AUYN87), fixed rate (5.48% coupon) maturing on 26 February 2025, priced at 100.00 (original spread of 102 bp), callable (2nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$165m Bond (US3130AUYX69), fixed rate (5.25% coupon) maturing on 21 February 2025, priced at 100.00 (original spread of 68 bp), callable (2nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$150m Bond (US3130AUZ986), fixed rate (6.00% coupon) maturing on 13 March 2028, priced at 100.00 (original spread of 200 bp), callable (5nc1m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$369m Bond (US3130AUXL31), fixed rate (6.00% coupon) maturing on 24 February 2028, priced at 100.00 (original spread of 200 bp), callable (5nc1m)

- Jacobs Engineering Group Inc (Service - Other | Dallas, Texas, United States | Rating: BBB-): US$500m Senior Note (US469814AA50), fixed rate (5.90% coupon) maturing on 1 March 2033, priced at 99.90 (original spread of 220 bp), callable (10nc10)

- Kimberly-Clark Corp (Health Care Supply | Irving, Texas, United States | Rating: A): US$350m Senior Note (US494368CE11), fixed rate (4.50% coupon) maturing on 16 February 2033, priced at 99.85 (original spread of 84 bp), callable (10nc10)

- Leidos Inc (Service - Other | Reston, United States | Rating: BBB-): US$750m Senior Note (US52532XAJ46), fixed rate (5.75% coupon) maturing on 15 March 2033, priced at 99.30 (original spread of 200 bp), callable (10nc10)

- Mckesson Corp (Pharmaceuticals | Irving, Texas, United States | Rating: BBB+): US$500m Senior Note (US581557BS37), fixed rate (5.25% coupon) maturing on 15 February 2026, priced at 99.80 (original spread of 110 bp), callable (3nc1)

- Morgan Stanley Finance LLC (Financial - Other | New York City, New York, United States | Rating: A-): US$125m Unsecured Note (XS2059821590) zero coupon maturing on 5 May 2028, non callable

- PepsiCo Inc (Beverage/Bottling | Purchase, New York, United States | Rating: A+): US$500m Senior Note (US713448FT00), fixed rate (4.65% coupon) maturing on 15 February 2053, priced at 99.94 (original spread of 127 bp), callable (30nc30)

- PepsiCo Inc (Beverage/Bottling | Purchase, New York, United States | Rating: A+): US$500m Senior Note (US713448FQ60), fixed rate (4.55% coupon) maturing on 13 February 2026, priced at 99.94 (original spread of 35 bp), callable (3nc3)

- PepsiCo Inc (Beverage/Bottling | Purchase, New York, United States | Rating: A+): US$350m Senior Note (US713448FP87), floating rate (SOFR + 40.0 bp) maturing on 13 February 2026, priced at 100.00, non callable

- PepsiCo Inc (Beverage/Bottling | Purchase, New York, United States | Rating: A+): US$650m Senior Note (US713448FR44), fixed rate (4.45% coupon) maturing on 15 May 2028, priced at 99.87 (original spread of 56 bp), callable (5nc5)

- PepsiCo Inc (Beverage/Bottling | Purchase, New York, United States | Rating: A+): US$1,000m Senior Note (US713448FS27), fixed rate (4.45% coupon) maturing on 15 February 2033, priced at 99.86 (original spread of 78 bp), callable (10nc10)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,500m Senior Note (US718172DA46), fixed rate (5.13% coupon) maturing on 15 February 2030, priced at 99.18 (original spread of 145 bp), callable (7nc7)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,500m Senior Note (US718172DB29), fixed rate (5.38% coupon) maturing on 15 February 2033, priced at 99.79 (original spread of 170 bp), callable (10nc10)

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,250m Senior Note (US718172CY31), fixed rate (4.88% coupon) maturing on 13 February 2026, priced at 99.65 (original spread of 80 bp), with a make whole call

- Philip Morris International Inc (Tobacco | Stamford, Connecticut, United States | Rating: A-): US$1,000m Senior Note (US718172CZ06), fixed rate (4.88% coupon) maturing on 15 February 2028, priced at 99.41 (original spread of 119 bp), callable (5nc5)

- Union Pacific Corp (Railroads | Omaha, Nebraska, United States | Rating: A-): US$500m Senior Note (US907818GE22), fixed rate (4.75% coupon) maturing on 21 February 2026, priced at 99.93 (original spread of 55 bp), callable (3nc3)

- Union Pacific Corp (Railroads | Omaha, Nebraska, United States | Rating: A-): US$500m Senior Note (US907818GF96), fixed rate (4.95% coupon) maturing on 15 May 2053, priced at 99.86 (original spread of 170 bp), callable (30nc30)

- Whirlpool Corp (Electronics | Benton Harbor, Michigan, United States | Rating: BBB): US$300m Senior Note (US963320BA33), fixed rate (5.50% coupon) maturing on 1 March 2033, priced at 99.91 (original spread of 179 bp), callable (10nc10)

RECENT INTERNATIONAL USD BOND ISSUES

- ABG Sundal Collier Holding ASA (Financial - Other | Oslo, Oslo, Norway | Rating: NR): US$150m Bond (NO0012847674), fixed rate (12.00% coupon) maturing on 2 March 2026 (original spread of 946 bp), non callable

- Chindata Group Holdings Ltd (Service - Other | Beijing, Beijing, China (Mainland) | Rating: BBB-): US$300m Senior Note (XS2587754909), fixed rate (10.50% coupon) maturing on 23 February 2026, priced at 99.06 (original spread of 644 bp), non callable

- Cibanco SA Institucion de Banca Multiple (Financial - Other | Miguel Hidalgo, Mexico, D.F., Mexico | Rating: NR): US$149m Capital Development Certificates (MX1RAI080011) maturing on 16 February 2073, priced at 100.00, non callable

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): US$305m Senior Note (XS2587358461), floating rate (SOFR + 8.5 bp) maturing on 29 June 2026, priced at 100.00, callable (3nc2m)

- HDFC Bank (Gandhinagar Branch) (Financial - Other | Gandhinagar, India | Rating: NR): US$750m Unsecured Note (XS2592031475), fixed rate (1.00% coupon) maturing on 28 February 2028, priced at 100.00, non callable

- HDFC Bank (Gandhinagar Branch) (Financial - Other | Gandhinagar, India | Rating: NR): US$750m Unsecured Note (XS2592028091), fixed rate (1.00% coupon) maturing on 27 February 2026, priced at 100.00, non callable

- Henderson Land MTN Ltd (Financial - Other | Hong Kong | Rating: NR): US$103m Unsecured Note (XS2590996760), fixed rate (5.00% coupon) maturing on 23 February 2025, priced at 100.00, non callable

- Huantaihu International Investment Co Ltd (Financial - Other | Huzhou, Zhejiang, China (Mainland) | Rating: NR): US$200m Senior Note (XS2540489338), fixed rate (7.30% coupon) maturing on 16 February 2026, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB): US$200m Unsecured Note (XS2591231191), fixed rate (5.20% coupon) maturing on 24 February 2025, priced at 100.00, non callable

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AA-): US$1,000m Bond (US50065RAK32), fixed rate (4.63% coupon) maturing on 24 February 2028, priced at 99.45 (original spread of 81 bp), non callable

- Korea Housing Finance Corp (Agency | Busan, Busan, South Korea | Rating: AA-): US$300m Bond (US50065RAL15), fixed rate (4.63% coupon) maturing on 24 February 2033, priced at 99.34 (original spread of 91 bp), non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,250m Senior Note (US606822CX09), fixed rate (5.44% coupon) maturing on 22 February 2034, priced at 100.00, callable (11nc10)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (US606822CT96), fixed rate (5.48% coupon) maturing on 22 February 2031, priced at 100.00, callable (8nc7)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,000m Senior Note (US606822CS14), fixed rate (5.42% coupon) maturing on 22 February 2029, priced at 100.00, callable (6nc5)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,650m Senior Note (US606822CV43), fixed rate (5.72% coupon) maturing on 20 February 2026, priced at 100.00, callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$600m Senior Note (US606822CW26), floating rate (SOFR + 94.0 bp) maturing on 20 February 2026, priced at 100.00, callable (3nc2)

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$1,500m Senior Note (XS2591009688), fixed rate (4.88% coupon) maturing on 24 February 2025, priced at 99.93 (original spread of 27 bp), non callable

- SK Hynix Inc (Electronics | Icheon, South Korea | Rating: BBB): US$300m Senior Note (HK0000905163), floating rate maturing on 17 November 2025, non callable

- Sharjah, Emirate of (Official and Muni | Sharjah, Sharjah, United Arab Emirates | Rating: BB+): US$1,000m Senior Note (US38381CAE21), fixed rate (6.50% coupon) maturing on 23 November 2032, priced at 99.18 (original spread of 280 bp), non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: AA-): US$250m Senior Note (US89114YQH70), floating rate maturing on 18 February 2025, priced at 100.00, non callable

- Trane Technologies Financing Ltd (Financial - Other | Dublin, Ireland | Rating: BBB): US$700m Senior Note (US892938AA96), fixed rate (5.25% coupon) maturing on 3 March 2033, priced at 99.87 (original spread of 142 bp), callable (10nc10)

- Tucson Electric Power Co (Utility - Other | Tucson, Arizona, Canada | Rating: A-): US$375m Senior Note (US898813AV23), fixed rate (5.50% coupon) maturing on 15 April 2053, priced at 99.72 (original spread of 207 bp), callable (30nc30)

- UBS Bank USA (Banking | Salt Lake City, Utah, Switzerland | Rating: A+): US$105m Certificate of Deposit - Retail (US90355GBJ40), fixed rate (4.55% coupon) maturing on 18 February 2025, priced at par, non callable

RECENT EURO BOND ISSUES

- ALD SA (Leasing | Reuil-Malmaison, Ile-De-France, France | Rating: BBB): €500m Bond (FR001400G0W1), floating rate (EU03MLIB + 55.0 bp) maturing on 21 February 2025, priced at par, non callable

- BAT Netherlands Finance BV (Financial - Other | Amstelveen, Noord-Holland, United Kingdom | Rating: BBB): €800m Senior Note (XS2589367528), fixed rate (5.38% coupon) maturing on 16 February 2031, priced at 99.84 (original spread of 313 bp), callable (8nc8)

- BNP Paribas SA (Banking | Paris, Ile-De-France, France | Rating: A+): €1,000m Bond (FR001400G3A1), floating rate maturing on 23 February 2029, priced at 99.82 (original spread of 140 bp), callable (6nc5)

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €750m Senior Note (XS2589727168), fixed rate (5.13% coupon) maturing on 22 February 2033, priced at 99.85 (original spread of 270 bp), non callable

- Belgium, Kingdom of (Government) (Sovereign | Brussels, Belgium | Rating: AA-): €5,000m Obligation Lineaire (BE0000358672), fixed rate (3.30% coupon) maturing on 22 June 2054, priced at 99.07 (original spread of 8 bp), non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €1,500m Senior Note (XS2590764713), fixed rate (3.00% coupon) maturing on 23 February 2028, priced at 99.56 (original spread of 58 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €200m Bond (IT0005532749), fixed rate (4.00% coupon) maturing on 27 February 2028, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €130m Bond (IT0005532756), fixed rate (3.00% coupon) maturing on 27 August 2025, priced at 100.00, non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FZ32), fixed rate (3.13% coupon) maturing on 22 February 2033, priced at 99.28 (original spread of 86 bp), non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FZ24), fixed rate (3.13% coupon) maturing on 22 June 2027, priced at 99.76 (original spread of 75 bp), non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: BBB+): €500m Senior Note (XS2589907653), fixed rate (5.50% coupon) maturing on 20 August 2026, priced at 99.71 (original spread of 317 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A): €550m Inhaberschuldverschreibung (DE000DW6C2F9), floating rate (EU03MLIB + 44.0 bp) maturing on 28 February 2025, priced at 100.00, non callable

- Delivery Hero SE (Service - Other | Berlin, Berlin, Germany | Rating: B-): €1,000m Bond (DE000A30V5R1), fixed rate (3.25% coupon) maturing on 21 February 2030, priced at 100.00, non callable, convertible

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VBE0), fixed rate (2.85% coupon) maturing on 10 March 2025, priced at 100.00, non callable

- Douro Finance BV (Financial - Other | Amsterdam, Noord-Holland, Netherlands | Rating: NR): €101m Unsecured Note (XS2590260241) zero coupon maturing on 22 June 2032, priced at 100.00, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: BBB+): €750m Senior Note (XS2589260723), fixed rate (4.00% coupon) maturing on 20 February 2031, priced at 98.88 (original spread of 188 bp), callable (8nc8)

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: BBB+): €750m Senior Note (XS2589260996), fixed rate (4.50% coupon) maturing on 20 February 2043, priced at 97.67 (original spread of 228 bp), callable (20nc20)

- East Japan Railway Co (Railroads | Shibuya-Ku, Tokyo-To, Japan | Rating: A+): €750m Senior Note (XS2588859376), fixed rate (4.11% coupon) maturing on 22 February 2043, priced at 100.00 (original spread of 163 bp), non callable

- Etablissementen Franz Colruyt NV (Retail Stores - Food/Drug | Halle (Hal), Vlaams-Brabant, Belgium | Rating: NR): €250m Bond (BE0002920016), fixed rate (4.25% coupon) maturing on 21 February 2028, priced at 101.88 (original spread of 167 bp), non callable

- Fastighets AB Balder (Home Builders | Goeteborg, Vastra Gotalands, Sweden | Rating: BBB-): €480m Bond (), fixed rate (3.50% coupon) maturing on 23 February 2028, priced at 100.00, non callable, convertible

- FinecoBank Banca Fineco SpA (Banking | Reggio Nell'Emilia, Reggio Emilia, Italy | Rating: BBB): €300m Note (XS2590759986), floating rate maturing on 23 February 2029, priced at 99.94 (original spread of 214 bp), callable (6nc5)

- Fomento Economico Mexicano SAB de CV (Beverage/Bottling | Monterrey, Mexico | Rating: BBB+): €500m Bond (XS2590764127), fixed rate (2.63% coupon) maturing on 24 February 2026, priced at 100.00, non callable, convertible

- ING Groep NV (Banking | Amsterdam, Noord-Holland, Netherlands | Rating: BBB): €500m Subordinated Note (XS2588986997), fixed rate (5.00% coupon) maturing on 20 February 2035, priced at 99.34 (original spread of 291 bp), callable (12nc7)

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BB+): €1,000m Subordinated Note (XS2589361240), fixed rate (6.18% coupon) maturing on 20 February 2034, priced at 100.00 (original spread of 385 bp), callable (11nc6)

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €5,000m Buono del Tesoro Poliennali (IT0005534141), fixed rate (4.50% coupon) maturing on 1 October 2053, priced at 99.56 (original spread of 216 bp), non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): €500m Senior Note (XS2572499726), fixed rate (3.38% coupon) maturing on 22 February 2028, priced at 99.81 (original spread of 91 bp), non callable

- KBC Bank NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: AAA): €1,000m Belgian Mortgage Pandbrieven (Covered Bond) (BE0002924059), fixed rate (3.13% coupon) maturing on 22 February 2027, priced at 99.90 (original spread of 75 bp), non callable

- Kuntarahoitus Oyj (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): €1,000m Senior Note (XS2590268814), fixed rate (3.00% coupon) maturing on 25 September 2028, priced at 99.86 (original spread of 62 bp), non callable

- Landesbank Baden-Wurttemberg (London Branch) (Banking | London, Germany | Rating: NR): €450m Inhaberschuldverschreibung (DE000LB3N5M5), fixed rate (2.60% coupon) maturing on 13 March 2026, priced at 100.00, non callable

- Landesbank Baden-Wurttemberg (London Branch) (Banking | London, Germany | Rating: NR): €200m Inhaberschuldverschreibung (DE000LB3NDY4), fixed rate (3.00% coupon) maturing on 13 March 2025, priced at 100.00, non callable

- Landesbank Baden-Wurttemberg (London Branch) (Banking | London, Germany | Rating: NR): €200m Inhaberschuldverschreibung (DE000LB3NE22), fixed rate (3.15% coupon) maturing on 13 March 2029, priced at 100.00, non callable

- Landesbank Baden-Wurttemberg (London Branch) (Banking | London, Germany | Rating: NR): €200m Inhaberschuldverschreibung (DE000LB3NE14), fixed rate (3.10% coupon) maturing on 15 March 2027, priced at 100.00, non callable

- Landesbank Baden-Wurttemberg (London Branch) (Banking | London, Germany | Rating: NR): €450m Inhaberschuldverschreibung (DE000LB3N5N3), fixed rate (2.65% coupon) maturing on 13 March 2028, priced at 100.00, non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Baden-Wuerttemberg, Germany | Rating: AA+): €330m Inhaberschuldverschreibung (DE000A3MQUG8), floating rate maturing on 27 February 2026, priced at 102.57, non callable

- Lower Saxony, State of (Official and Muni | Hannover, Niedersachsen, Germany | Rating: AAA): €1,500m Jumbo Landesschatzanweisung (DE000A30V877), fixed rate (2.88% coupon) maturing on 18 April 2028, priced at 99.89 (original spread of 52 bp), non callable

- Madrid, Community of (Official and Muni | Madrid, Madrid, Spain | Rating: A-): €1,000m Bond (ES00001010K8), fixed rate (3.60% coupon) maturing on 30 April 2033, priced at 100.00 (original spread of 124 bp), non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €750m Senior Note (XS2589713614), fixed rate (4.42% coupon) maturing on 20 May 2033 (original spread of 195 bp), non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €600m Senior Note (XS2589712996), fixed rate (4.16% coupon) maturing on 20 May 2028, priced at 100.00 (original spread of 164 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000NWB1W36), fixed rate (2.75% coupon) maturing on 21 February 2029, priced at 99.49 (original spread of 60 bp), non callable

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Niedersachsen, Germany | Rating: NR): €500m Hypothekenpfandbrief (Covered Bond) (DE000NLB4RJ4), fixed rate (3.13% coupon) maturing on 20 February 2026, priced at 99.78 (original spread of 67 bp), non callable

- Nordea Kiinnitysluottopankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €1,000m Covered Bond (Other) (XS2589317697), fixed rate (3.00% coupon) maturing on 20 February 2030 (original spread of 78 bp), non callable

- Nykredit Realkredit A/S (Mortgage Banking | Kobenhavn V, Denmark | Rating: A): €750m Bond (DK0030045703), fixed rate (4.00% coupon) maturing on 17 July 2028 (original spread of 181 bp), non callable

- Oberbank AG (Banking | Linz, Oberoesterreich, Austria | Rating: A): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A32S78), fixed rate (3.25% coupon) maturing on 23 August 2030, priced at 99.39 (original spread of 99 bp), non callable

- Prologis International Funding II SA (Financial - Other | Luxembourg, Luxembourg | Rating: A-): €600m Senior Note (XS2589820294), fixed rate (4.63% coupon) maturing on 21 February 2035, priced at 99.02 (original spread of 231 bp), callable (12nc12)

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Steiermark, Austria | Rating: A-): €200m Inhaberschuldverschreibung (AT000B093927), fixed rate (3.50% coupon) maturing on 27 August 2026, priced at 100.00, non callable

- Raiffeisenverband Salzburg Egen (Banking | Salzburg, Salzburg, Austria | Rating: A-): €325m Hypothekenpfandbrief (Covered Bond) (AT0000A32SJ1), fixed rate (3.38% coupon) maturing on 24 February 2028, priced at 99.69 (original spread of 97 bp), non callable

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €1,250m Senior Note (XS2589790109), fixed rate (3.38% coupon) maturing on 24 August 2031, priced at 99.67 (original spread of 101 bp), callable (9nc8)

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €500m Senior Note (XS2589792220), fixed rate (3.50% coupon) maturing on 24 February 2036, priced at 98.59 (original spread of 109 bp), callable (13nc13)

- Siemens Financieringsmaatschappij NV (Financial - Other | Den Haag, Zuid-Holland, Germany | Rating: A+): €750m Senior Note (XS2589790018), fixed rate (3.63% coupon) maturing on 24 February 2043, priced at 98.18 (original spread of 123 bp), callable (20nc20)

- Slovak Republic (Government) (Sovereign | Bratislava, Bratislavsky Kraj, Slovakia | Rating: A): €2,000m Bond (SK4000022539), fixed rate (3.75% coupon) maturing on 23 February 2035, priced at 99.53, non callable

- Slovak Republic (Government) (Sovereign | Bratislava, Bratislavsky Kraj, Slovakia | Rating: A): €1,500m Bond (SK4000022547), fixed rate (4.00% coupon) maturing on 23 February 2043, priced at 99.85, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FZ81), fixed rate (3.13% coupon) maturing on 24 February 2032, priced at 99.71 (original spread of 86 bp), non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: NR): €750m Obligation de Financement de l'Habitat (Covered Bond) (FR001400FZ73), fixed rate (3.13% coupon) maturing on 24 February 2026, priced at 99.82 (original spread of 66 bp), non callable

- Telia Company AB (Telecommunications | Solna, Sweden | Rating: BBB+): €500m Senior Note (XS2589828941), fixed rate (3.63% coupon) maturing on 22 February 2032, priced at 98.84 (original spread of 131 bp), callable (9nc9)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €1,250m Oeffentlicher Pfandbrief Jumbo (Covered Bond) (DE000HV2AZG5), fixed rate (3.13% coupon) maturing on 20 August 2025, priced at 99.80 (original spread of 50 bp), non callable

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: AAA): €750m Covered Bond (Other) (AT000B049945), fixed rate (3.13% coupon) maturing on 21 September 2029, priced at 99.53 (original spread of 91 bp), non callable

- Unicaja Banco SA (Banking | Malaga, Malaga, Spain | Rating: BBB-): €500m Bond (ES0280907033), floating rate maturing on 21 February 2029, priced at 99.91 (original spread of 283 bp), callable (6nc5)

- Wuestenrot Bausparkasse AG (Banking | Ludwigsburg, Baden-Wuerttemberg, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000WBP0BJ1), fixed rate (3.13% coupon) maturing on 22 February 2030, priced at 99.84 (original spread of 77 bp), non callable

RECENT LOANS

- Aggreko Ltd (United Kingdom), signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 08/16/26 and initial pricing is set at EURIBOR +525.0bp

- Aggreko Ltd (United Kingdom), signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 08/16/26 and initial pricing is set at Term SOFR +550.0bp

- Alliant Holdings I Inc (United States of America), signed a US$ 1,250m Term Loan B, to be used for general corporate purposes. It matures on 02/21/27 and initial pricing is set at Term SOFR +350.0bp

- AmWINS Group Inc (United States of America | B-), signed a US$ 850m Term Loan B, to be used for 125. It matures on 02/10/28 and initial pricing is set at Term SOFR +275.0bp

- American Electric Power Co Inc (United States of America | BBB+), signed a US$ 500m Term Loan, to be used for general corporate purposes. It matures on 02/08/24 and initial pricing is set at Term SOFR +85.0bp

- Cequence Energy Ltd (Canada), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 02/17/30 and initial pricing is set at Term SOFR +325.0bp

- Constellation Energy (United States of America), signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 02/08/24.

- Feeco Hldg Lp (United States of America), signed a US$ 1,040m Term Loan B, to be used for general corporate purposes. It matures on 02/28/28 and initial pricing is set at Term SOFR +500.0bp

- Florida Power & Light Co (United States of America | A), signed a US$ 2,920m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/08/28 and initial pricing is set at Term SOFR +97.5bp

- HB Reavis Holding SA (Luxembourg), signed a € 475m Term Loan, to be used for real estate acqusition

- Hoegh Frsu Refinancing (Germany), signed a US$ 343m Term Loan, to be used for project finance. It matures on 02/10/33.

- Hoegh Frsu Refinancing (Germany), signed a US$ 343m Term Loan, to be used for project finance. It matures on 02/10/33.

- Imcd Grp Bv (Netherlands), signed a € 600m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 02/08/28.

- Infrabuild (Australia), signed a US$ 300m Term Loan B, to be used for general corporate purposes.

- Jabil Inc (United States of America | BBB-), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/22/27 and initial pricing is set at Term SOFR +125.0bp

- Jabil Inc (United States of America | BBB-), signed a US$ 1,200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/22/25 and initial pricing is set at Term SOFR +125.0bp

- KEB Hana Bank (South Korea | A+), signed a US$ 200m Term Loan, to be used for general corporate purposes. It matures on 02/10/26 and initial pricing is set at Term SOFR +79.0bp

- KEB Hana Bank (South Korea | A+), signed a US$ 200m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 02/10/28 and initial pricing is set at Term SOFR +100.0bp

- NextEra Energy Capital Hldg (United States of America | BBB+), signed a US$ 3,264m 364d Revolver, to be used for general corporate purposes. It matures on 02/07/24 and initial pricing is set at Term SOFR +135.0bp

- NextEra Energy Capital Hldg (United States of America | BBB+), signed a US$ 5,474m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/08/28 and initial pricing is set at Term SOFR +135.0bp

- NextEra Energy US Partners (United States of America), signed a US$ 2,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 02/08/28 and initial pricing is set at Term SOFR +185.0bp

- Transdigm Inc (United States of America | B+), signed a US$ 4,559m Term Loan, to be used for general corporate purposes. It matures on 08/10/28 and initial pricing is set at Term SOFR +325.0bp

- Trimco International Holdings (Hong Kong), signed a US$ 217m Term Loan, to be used for general corporate purposes. It matures on 10/18/26 and initial pricing is set at LIBOR +350.0bp

- United Talent Agency Inc (United States of America | B+), signed a US$ 250m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 07/07/28 and initial pricing is set at Term SOFR +400.0bp

- Yunneng Wind Power Co Ltd (Taiwan), signed a € 99m Term Loan, to be used for general corporate purposes. It matures on 05/24/37.

RECENT STRUCTURED CREDIT

- Apidos CLO Xliii Ltd issued a floating-rate CLO in 8 tranches, for a total of US$ 504 m. Highest-rated tranche offering a spread over the floating rate of 175bp, and the lowest-rated tranche a spread of 911bp. Bookrunners: Deutsche Bank Securities Inc

- Avid Automobile Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 132 m. Highest-rated tranche offering a coupon of 6.63%, and the lowest-rated tranche a yield to maturity of 8.92%. Bookrunners: JP Morgan & Co Inc, Capital One Securities Inc

- Capital One Prime Auto Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,250 m. Highest-rated tranche offering a yield to maturity of 4.76%, and the lowest-rated tranche a yield to maturity of 5.20%. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc, Bank of America Merrill Lynch

- Exeter Automobile Receivables Trust 2023-1 issued a floating-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 524 m. Highest-rated tranche offering a spread over the floating rate of 27bp, and the lowest-rated tranche a spread of 825bp. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc, Mizuho Securities USA Inc

- Farm 2023-1 Mortgage Trust issued a floating-rate Agency RMBS in 2 tranches, for a total of US$ 284 m. Highest-rated tranche offering a spread over the floating rate of 190bp, and the lowest-rated tranche a spread of 190bp. Bookrunners: Apollo Global Securities LLC

- Homes 2023-Nqm1 Trust issued a fixed-rate RMBS in 4 tranches, for a total of US$ 308 m. Highest-rated tranche offering a coupon of 7.05%, and the lowest-rated tranche a yield to maturity of 7.45%. Bookrunners: Morgan Stanley International Ltd

- Honda Auto Receivables 2023-1 Owner Trust issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,500 m. Highest-rated tranche offering a yield to maturity of 4.97%, and the lowest-rated tranche a yield to maturity of 5.22%. Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Mizuho Securities USA Inc, BNP Paribas Securities Corp

- Lendbuzz Securitization Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 188 m. Highest-rated tranche offering a yield to maturity of 5.38%, and the lowest-rated tranche a yield to maturity of 8.61%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc

- Onemain Direct Auto Receivables Trust 2023-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 749 m. Highest-rated tranche offering a yield to maturity of 5.43%, and the lowest-rated tranche a yield to maturity of 7.07%. Bookrunners: Barclays Capital Group, HSBC Securities (USA) Inc, Truist Securities Inc

- Owl Rock Clo X issued a floating-rate CLO in 3 tranches, for a total of US$ 397 m. Highest-rated tranche offering a spread over the floating rate of 245bp, and the lowest-rated tranche a spread of 360bp. Bookrunners: Deutsche Bank Securities Inc