Credit

High Yield USD Cash Credit Has Outperformed Equities Over The Month Of August On A Vol Adjusted Basis

Very little activity in the USD primary bond market this week: 4 tranches for $3.45bn in IG (2023 YTD volume $873.694bn vs 2022 YTD $936.09bn), no new issue in HY (2023 YTD volume $111.332bn vs 2022 YTD $77.37)

Published ET

Ratio of S&P 500 to iBOXX USD HY | Source: Refinitiv

DAILY SUMMARY

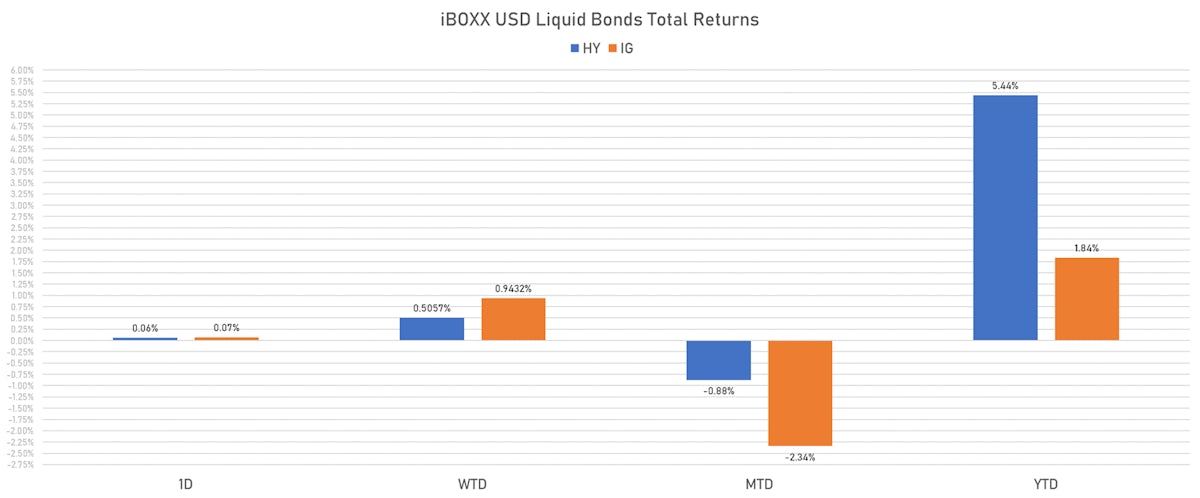

- S&P 500 Bond Index was up 0.06% today, with investment grade up 0.06% and high yield down -0.02% (YTD total return: +1.91%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.075% today (Week-to-date: 0.94%; Month-to-date: -2.34%; Year-to-date: 1.84%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.064% today (Week-to-date: 0.51%; Month-to-date: -0.88%; Year-to-date: 5.44%)

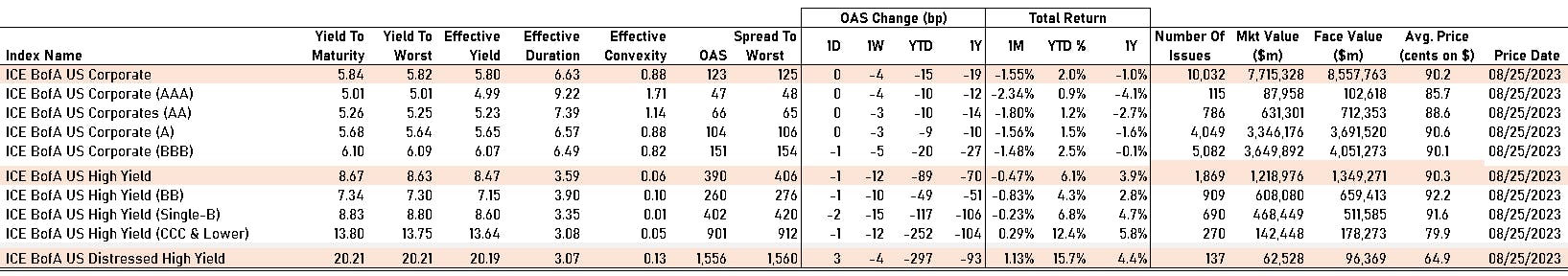

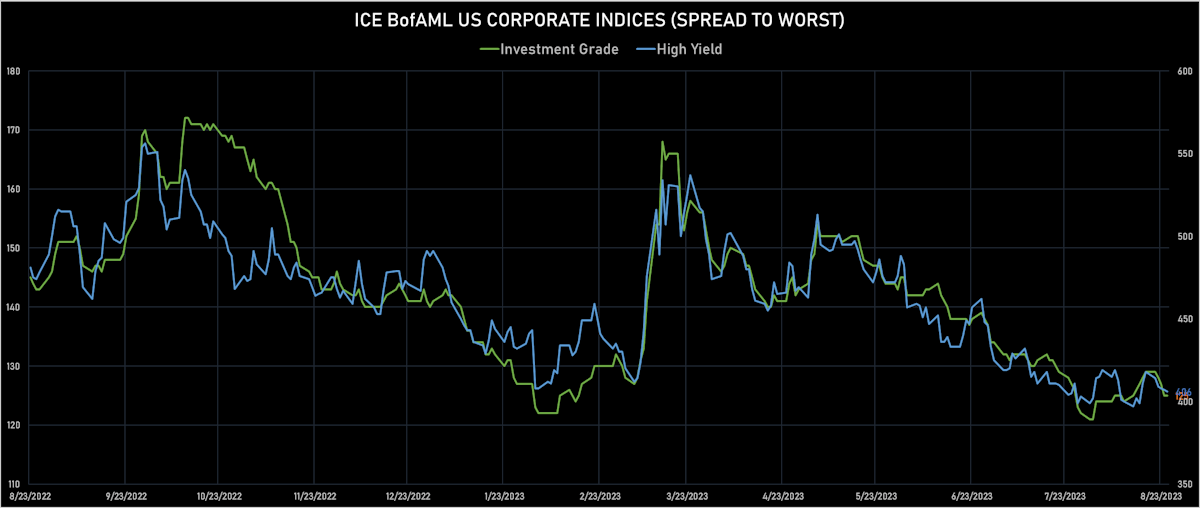

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 125.0 bp (WTD change: -4.0 bp; YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 406.0 bp (WTD change: -12.0 bp; YTD change: -82.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +8.4%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA unchanged at 47 bp

- AA unchanged at 66 bp

- A unchanged at 104 bp

- BBB down by -1 bp at 151 bp

- BB down by -1 bp at 260 bp

- B down by -2 bp at 402 bp

- ≤ CCC down by -1 bp at 901 bp

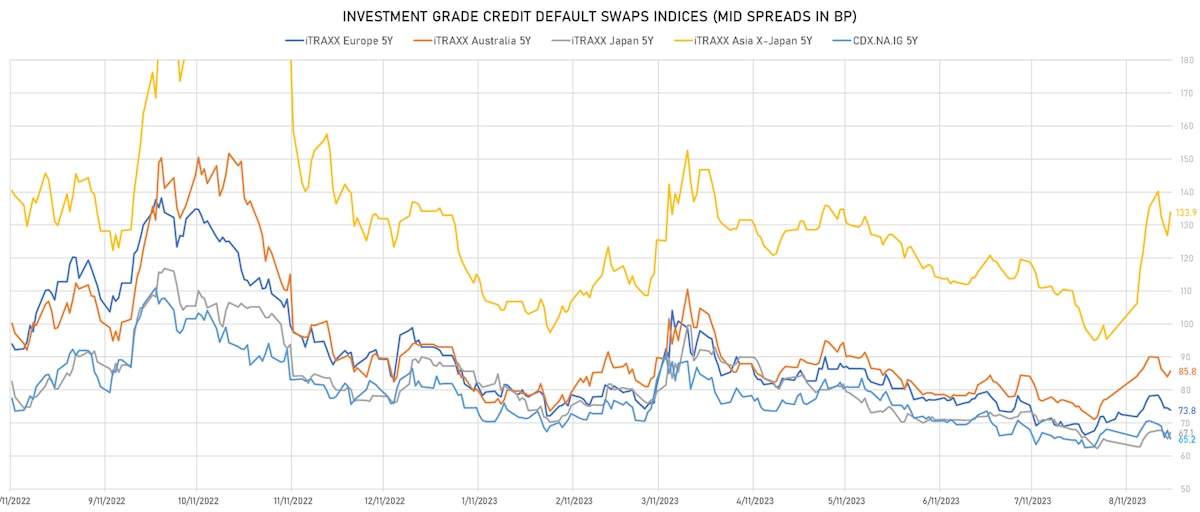

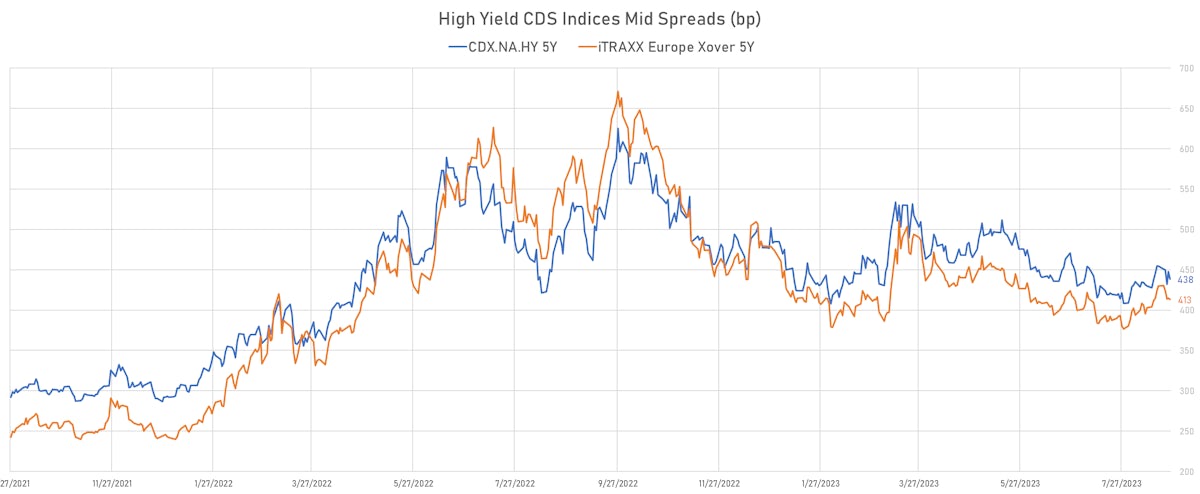

CDS INDICES TODAY (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.5 bp, now at 65bp (1W change: -5.4bp; YTD change: -16.6bp)

- Markit CDX.NA.IG 10Y down 2.4 bp, now at 106bp (1W change: -5.0bp; YTD change: -12.1bp)

- Markit CDX.NA.HY 5Y down 9.5 bp, now at 438bp (1W change: -16.6bp; YTD change: -46.5bp)

- Markit iTRAXX Europe 5Y down 0.7 bp, now at 74bp (1W change: -4.3bp; YTD change: -16.6bp)

- Markit iTRAXX Europe Crossover 5Y down 1.6 bp, now at 413bp (1W change: -16.7bp; YTD change: -60.9bp)

- Markit iTRAXX Japan 5Y up 1.8 bp, now at 67bp (1W change: -0.1bp; YTD change: -20.1bp)

- Markit iTRAXX Asia Ex-Japan 5Y up 7.1 bp, now at 134bp (1W change: -1.5bp; YTD change: +0.9bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Pitney Bowes Inc (Country: US; rated: NR): down 48.3 bp to 1,559.6bp (1Y range: 747-1,783bp)

- DISH DBS Corp (Country: US; rated: Caa1): down 47.3 bp to 2,060.1bp (1Y range: 1,138-3,084bp)

- Sabre Holdings Corp (Country: US; rated: B3): down 45.9 bp to 1,379.8bp (1Y range: 548-1,785bp)

- Goodyear Tire & Rubber Co (Country: US; rated: NR): down 32.0 bp to 354.1bp (1Y range: 281-552bp)

- United States Steel Corp (Country: US; rated: BBB-): down 29.1 bp to 237.8bp (1Y range: 237-752bp)

- American Axle & Manufacturing Inc (Country: US; rated: B1): down 25.4 bp to 534.6bp (1Y range: 428-772bp)

- Kohls Corp (Country: US; rated: Ba2): down 19.7 bp to 518.9bp (1Y range: 444-783bp)

- Anywhere Real Estate Group LLC (Country: US; rated: B1): up 15.8 bp to 1,067.1bp (1Y range: 278-1,067bp)

- Louisiana-Pacific Corp (Country: US; rated: WR): up 17.9 bp to 140.6bp (1Y range: 104-315bp)

- Transocean Inc (Country: KY; rated: Caa1): up 26.0 bp to 525.0bp (1Y range: 448-1,885bp)

- Macy's Inc (Country: US; rated: A1): up 33.5 bp to 435.5bp (1Y range: 300-619bp)

- Nordstrom Inc (Country: US; rated: NR): up 46.7 bp to 578.4bp (1Y range: 429-685bp)

- Community Health Systems Inc (Country: US; rated: NR): up 95.0 bp to 2,323.1bp (1Y range: 1,258-4,371bp)

- Liberty Interactive LLC (Country: US; rated: CCC+): up 167.9 bp to 5,577.6bp (1Y range: 1,221-5,578bp)

- Staples Inc (Country: US; rated: B3): up 175.9 bp to 4,883.9bp (1Y range: 1,411-4,884bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Boparan Finance PLC (Country: GB; rated: Caa1): down 143.7 bp to 1,655.5bp (1Y range: 1,286-2,910bp)

- Altice Finco SA (Country: LU; rated: Caa2): down 59.0 bp to 1,316.3bp (1Y range: 401-1,316bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B3): down 40.2 bp to 581.1bp (1Y range: 186-581bp)

- thyssenkrupp AG (Country: DE; rated: NR): down 35.7 bp to 224.9bp (1Y range: 217-705bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 25.4 bp to 711.4bp (1Y range: 632-1,254bp)

- Renault SA (Country: FR; rated: Ba1): down 19.6 bp to 240.7bp (1Y range: 219-453bp)

- Lanxess AG (Country: DE; rated: WR): down 16.2 bp to 179.5bp (1Y range: 121-303bp)

- Valeo SE (Country: FR; rated: NR): down 15.2 bp to 245.2bp (1Y range: 210-389bp)

- Volvo Car AB (Country: SE; rated: WR): down 13.4 bp to 247.7bp (1Y range: 248-272bp)

- ArcelorMittal SA (Country: LU; rated: WD): down 12.0 bp to 203.8bp (1Y range: 181-353bp)

- PostNL NV (Country: NL; rated: WR): down 9.8 bp to 108.5bp (1Y range: 93-203bp)

- Rolls-Royce PLC (Country: GB; rated: Ba2): down 9.1 bp to 191.7bp (1Y range: 187-523bp)

- Stonegate Pub Company Financing Ltd (Country: GB; rated: WR): down 9.1 bp to 546.5bp (1Y range: 370-758bp)

- Glencore International AG (Country: CH; rated: WR): down 8.9 bp to 165.1bp (1Y range: 138-250bp)

- Banco de Sabadell SA (Country: ES; rated: Baa3): up 12.7 bp to 227.4bp (1Y range: 130-227bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 3.50% | Maturity: 1/3/2029 | Rating: BB | CUSIP: 38869AAC1 | OAS up by 62.0 bp to 221.9 bp, with the yield to worst at 6.5% and the bond now trading down to 85.3 cents on the dollar (1Y price range: 85.0-89.5).

- Issuer: Howmet Aerospace Inc (Pittsburgh, United States) | Coupon: 6.75% | Maturity: 15/1/2028 | Rating: BB+ | CUSIP: 022249AU0 | OAS up by 44.5 bp to 209.2 bp, with the yield to worst at 6.2% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.0-105.5).

- Issuer: Bath & Body Works Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB | CUSIP: 501797AU8 | OAS up by 40.1 bp to 192.3 bp, with the yield to worst at 6.6% and the bond now trading down to 104.3 cents on the dollar (1Y price range: 104.3-108.0).

- Issuer: Ball Corp (Westminster, Colorado (US)) | Coupon: 4.88% | Maturity: 15/3/2026 | Rating: BB+ | CUSIP: 058498AV8 | OAS down by 22.3 bp to 109.2 bp (CDS basis: -84.1bp), with the yield to worst at 5.6% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 95.3-99.3).

- Issuer: Delta Air Lines Inc (Atlanta, Georgia (US)) | Coupon: 7.38% | Maturity: 15/1/2026 | Rating: BB+ | CUSIP: 247361ZZ4 | OAS down by 25.0 bp to 101.3 bp (CDS basis: -51.8bp), with the yield to worst at 6.0% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 101.8-105.9).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | CUSIP: 303250AE4 | OAS down by 25.8 bp to 134.9 bp, with the yield to worst at 6.1% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 95.4-99.9).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 5.63% | Maturity: 1/11/2024 | Rating: BB | CUSIP: 81725WAH6 | OAS down by 29.7 bp to 130.1 bp, with the yield to worst at 6.1% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 97.8-100.5).

- Issuer: KB Home (Los Angeles, California (US)) | Coupon: 6.88% | Maturity: 15/6/2027 | Rating: BB | CUSIP: 48666KAX7 | OAS down by 35.1 bp to 168.7 bp (CDS basis: -78.9bp), with the yield to worst at 6.3% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 99.3-103.3).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 5.50% | Maturity: 15/9/2025 | Rating: BB | CUSIP: 81211KAX8 | OAS down by 37.9 bp to 114.6 bp (CDS basis: -76.8bp), with the yield to worst at 6.0% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 97.3-100.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 6.95% | Maturity: 10/6/2026 | Rating: BB+ | CUSIP: 345397D26 | OAS down by 39.5 bp to 198.7 bp (CDS basis: -87.7bp), with the yield to worst at 6.9% and the bond now trading up to 99.7 cents on the dollar (1Y price range: 47.1-101.4).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.38% | Maturity: 13/11/2025 | Rating: BB+ | CUSIP: 345397B28 | OAS down by 39.7 bp to 185.8 bp (CDS basis: -97.4bp), with the yield to worst at 7.0% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 71.7-94.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.70% | Maturity: 10/8/2026 | Rating: BB+ | CUSIP: 345397B77 | OAS down by 40.9 bp to 194.3 bp (CDS basis: -71.3bp), with the yield to worst at 6.8% and the bond now trading up to 89.0 cents on the dollar (1Y price range: 36.0-90.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.54% | Maturity: 1/8/2026 | Rating: BB+ | CUSIP: 345397ZW6 | OAS down by 41.8 bp to 203.5 bp (CDS basis: -85.4bp), with the yield to worst at 6.9% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 39.1-96.2).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | CUSIP: 26885BAH3 | OAS down by 42.4 bp to 202.2 bp, with the yield to worst at 6.7% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 93.8-99.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 4.13% | Maturity: 4/8/2025 | Rating: BB+ | CUSIP: 345397XL2 | OAS down by 49.1 bp to 218.6 bp (CDS basis: -91.2bp), with the yield to worst at 6.9% and the bond now trading up to 94.8 cents on the dollar (1Y price range: 90.2-96.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Euronet Worldwide Inc (Leawood, Kansas (US)) | Coupon: 1.38% | Maturity: 22/5/2026 | Rating: BB | ISIN: XS2001315766 | OAS up by 515.5 bp to 162.8 bp, with the yield to worst at 4.9% and the bond now trading down to 90.5 cents on the dollar (1Y price range: 87.4-91.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB | ISIN: XS2361255057 | OAS up by 60.0 bp to 395.1 bp, with the yield to worst at 7.0% and the bond now trading down to 82.6 cents on the dollar (1Y price range: 71.9-86.5).

- Issuer: Standard Building Solutions Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: B+ | ISIN: XS2080766475 | OAS up by 51.7 bp to 299.9 bp, with the yield to worst at 5.9% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 84.3-89.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | OAS up by 44.1 bp to 242.6 bp, with the yield to worst at 5.7% and the bond now trading down to 89.9 cents on the dollar (1Y price range: 83.7-92.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB+ | ISIN: XS2013574384 | OAS up by 42.4 bp to 149.0 bp (CDS basis: -3.8bp), with the yield to worst at 4.8% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 89.8-94.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB+ | ISIN: XS2296203123 | OAS up by 34.8 bp to 224.1 bp (CDS basis: -24.2bp), with the yield to worst at 5.4% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 88.2-95.2).

- Issuer: Citycon Treasury BV (Amsterdam, Netherlands) | Coupon: 2.38% | Maturity: 15/1/2027 | Rating: BB+ | ISIN: XS1822791619 | OAS down by 37.7 bp to 472.3 bp, with the yield to worst at 7.8% and the bond now trading up to 83.5 cents on the dollar (1Y price range: 78.0-87.7).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | OAS down by 46.4 bp to 339.2 bp (CDS basis: 29.4bp), with the yield to worst at 6.6% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 88.4-103.2).

- Issuer: Telecom Italia Finance SA (Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: B+ | ISIN: XS0161100515 | OAS down by 46.6 bp to 385.0 bp (CDS basis: 23.6bp), with the yield to worst at 6.8% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 101.6-107.4).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | OAS down by 90.2 bp to 239.3 bp, with the yield to worst at 5.6% and the bond now trading up to 85.7 cents on the dollar (1Y price range: 76.6-87.3).

- Issuer: PPF Telecom Group BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 27/3/2026 | Rating: BB+ | ISIN: XS1969645255 | OAS down by 90.6 bp to 119.9 bp, with the yield to worst at 4.7% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 92.3-96.6).

- Issuer: International Consolidated Airlines Group SA (Harmondsworth, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | OAS down by 117.1 bp to 332.4 bp, with the yield to worst at 6.3% and the bond now trading up to 87.2 cents on the dollar (1Y price range: 76.1-88.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | OAS down by 140.4 bp to 412.4 bp, with the yield to worst at 6.9% and the bond now trading up to 84.4 cents on the dollar (1Y price range: 74.8-88.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | OAS down by 154.9 bp to 300.2 bp, with the yield to worst at 6.0% and the bond now trading up to 84.0 cents on the dollar (1Y price range: 75.4-87.2).

- Issuer: Webuild SpA (Rozzano, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | OAS down by 433.8 bp to 250.4 bp, with the yield to worst at 6.2% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 88.0-99.6).

RECENT DOMESTIC USD BOND ISSUES

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A-): US$1,000m Senior Note (US808513CG89), fixed rate (5.88% coupon) maturing on 24 August 2026, priced at 99.92 (original spread of 134 bp), callable (3nc3)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A-): US$1,350m Senior Note (US808513CH62), floating rate maturing on 24 August 2034, priced at 100.00, callable (11nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPUX14), fixed rate (5.36% coupon) maturing on 5 September 2028, priced at 100.00, callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$675m Bond (US3133EPUN32), fixed rate (4.50% coupon) maturing on 28 August 2028, priced at 99.83 (original spread of 34 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPUW31), fixed rate (4.75% coupon) maturing on 1 September 2026, priced at 99.93, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$325m Bond (US3133EPUG80), floating rate (PRQ + -302.0 bp) maturing on 25 August 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$105m Bond (US3133EPUU74), fixed rate (6.38% coupon) maturing on 27 August 2038, priced at 100.00, callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPUK92), fixed rate (5.54% coupon) maturing on 28 August 2025, priced at 100.00 (original spread of 75 bp), callable (2nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$475m Bond (US3133EPUJ20), floating rate (SOFR + 15.5 bp) maturing on 28 August 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,000m Bond (US3130AWZJ23), floating rate (SOFR + 15.5 bp) maturing on 22 August 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$310m Bond (US3130AWYQ74), fixed rate (5.55% coupon) maturing on 28 August 2025, priced at 100.00 (original spread of 63 bp), callable (2nc1)

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Senior Note (US3134H1AZ69), fixed rate (5.57% coupon) maturing on 28 August 2025, priced at 100.00 (original spread of 10 bp), callable (2nc1)

- Pacific Life Global Funding II (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$600m Note (US6944PM2Y26), fixed rate (5.50% coupon) maturing on 28 August 2026, priced at 99.97 (original spread of 115 bp), non callable

- Pricoa Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: AA-): US$500m Note (US74153XBJ54), fixed rate (5.55% coupon) maturing on 28 August 2026, priced at 99.90 (original spread of 91 bp), non callable

- Purecycle (Service - Other | Orlando, Florida, United States | Rating: NR): US$250m Bond (US74623VAA17), fixed rate (7.25% coupon) maturing on 15 August 2030, priced at 90.00, non callable, convertible

- Akamai Tech (Service - Other | Cambridge, Massachusetts, United States | Rating: BBB): US$1,100m Bond (US00971TAM36), fixed rate (1.13% coupon) maturing on 15 February 2029, priced at 100.00, non callable, convertible

- Apollo Global Management Inc (Financial - Other | New York City, New York, United States | Rating: BBB): US$600m Junior Subordinated Note (US03769M2052), fixed rate (7.63% coupon) maturing on 15 September 2053 (original spread of 352 bp), callable (30nc5)

- Bank of America NA (Banking | Charlotte, North Carolina, United States | Rating: A+): US$2,000m Senior Note (US06428CAA27), fixed rate (5.53% coupon) maturing on 18 August 2026, priced at 100.00 (original spread of 104 bp), callable (3nc3)

- Bank of America NA (Banking | Charlotte, North Carolina, United States | Rating: A+): US$600m Senior Note (US06428CAB00), floating rate (SOFR + 102.0 bp) maturing on 18 August 2026, priced at 100.00, callable (3nc3)

- Bank of America NA (Banking | Charlotte, North Carolina, United States | Rating: A+): US$400m Senior Note (US06428CAD65), floating rate (SOFR + 78.0 bp) maturing on 18 August 2025, priced at 100.00, callable (2nc2)

- Bank of America NA (Banking | Charlotte, North Carolina, United States | Rating: A+): US$2,000m Senior Note (US06428CAC82), fixed rate (5.65% coupon) maturing on 18 August 2025, priced at 100.00 (original spread of 76 bp), callable (2nc2)

- Entergy Arkansas LLC (Utility - Other | Little Rock, Arkansas, United States | Rating: A): US$300m First Mortgage Bond (US29366MAE84), fixed rate (5.30% coupon) maturing on 15 September 2033, priced at 99.44 (original spread of 149 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$925m Bond (US3133EPTT21), floating rate (SOFR + 15.5 bp) maturing on 18 August 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EPTZ80), fixed rate (5.00% coupon) maturing on 22 August 2025, priced at 99.95 (original spread of 15 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EPUD59), fixed rate (4.75% coupon) maturing on 28 May 2026, priced at 100.00 (original spread of 11 bp), non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$875m Bond (US3130AWWV87), floating rate (SOFR + 15.5 bp) maturing on 21 August 2025, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$1,200m Bond (US3130AWXD70), floating rate (SOFR + 15.5 bp) maturing on 22 August 2025, priced at 100.00, non callable

- Fiserv Inc (Information/Data Technology | Brookfield, Wisconsin, United States | Rating: BBB): US$1,300m Senior Note (US337738BH05), fixed rate (5.63% coupon) maturing on 21 August 2033, priced at 99.17 (original spread of 177 bp), callable (10nc10)

- Fiserv Inc (Information/Data Technology | Brookfield, Wisconsin, United States | Rating: BBB): US$700m Senior Note (US337738BG22), fixed rate (5.38% coupon) maturing on 21 August 2028, priced at 99.74 (original spread of 129 bp), callable (5nc5)

- Huntington Bancshares Inc (Banking | Columbus, Ohio, United States | Rating: BBB+): US$1,250m Senior Note (US446150BC73), floating rate maturing on 21 August 2029, priced at 100.00, callable (6nc5)

- Jacobs Engineering Group Inc (Service - Other | Dallas, Texas, United States | Rating: BBB): US$600m Senior Note (US469814AB34), fixed rate (6.35% coupon) maturing on 18 August 2028, priced at 99.95 (original spread of 213 bp), callable (5nc5)

- Otis Worldwide Corp (Industrials - Other | Farmington, Connecticut, United States | Rating: BBB): US$750m Senior Note (US68902VAP22), fixed rate (5.25% coupon) maturing on 16 August 2028, priced at 99.64 (original spread of 115 bp), callable (5nc5)

- PBF Holding Company LLC (Oil and Gas | Parsippany, New Jersey, United States | Rating: BB): US$500m Senior Note (USU70453AG75), fixed rate (7.88% coupon) maturing on 15 September 2030, priced at 99.32 (original spread of 410 bp), callable (7nc3)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$750m Senior Note (US693475BS39), floating rate maturing on 18 August 2034, priced at 100.00, callable (11nc10)

- Tenneco Inc (Vehicle Parts | Skokie, Illinois, United States | Rating: B): US$1,900m Note (US880349AU90), fixed rate (8.00% coupon) maturing on 17 November 2028, priced at 85.00 (original spread of 909 bp), callable (5nc1)

- Tetra Tech (Service - Other | Pasadena, California, United States | Rating: NR): US$500m Bond (US88162GAA13), fixed rate (2.25% coupon) maturing on 15 August 2028, priced at 100.00, non callable, convertible

- Workiva (Information/Data Technology | Ames, Iowa, United States | Rating: NR): US$625m Bond (US98139AAC99), fixed rate (1.25% coupon) maturing on 15 August 2028, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$4,000m Senior Note (US045167FZ16), fixed rate (4.50% coupon) maturing on 25 August 2028, priced at 99.96 (original spread of 15 bp), non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$500m Senior Note (XS2673392796), floating rate (SOFR + 60.0 bp) maturing on 30 August 2026, priced at 100.00, non callable

- Bank of Communications Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$120m Unsecured Note (XS2673632183), floating rate maturing on 30 August 2026, priced at 100.00, non callable

- Costa Rica, Republic of (Government) (Sovereign | San Jose, San Jose, Costa Rica | Rating: B): US$175m Bond (CRG0000B33J2), fixed rate (6.35% coupon) maturing on 23 November 2033, priced at 98.30, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): US$500m Note (XS0460040602), fixed rate (4.80% coupon) maturing on 15 September 2025, priced at 100.00, non callable

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$600m Senior Note (XS2672410821), fixed rate (5.13% coupon) maturing on 1 September 2026, priced at 99.82 (original spread of 59 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$4,000m Senior Note (US298785JY36), fixed rate (4.50% coupon) maturing on 16 October 2028, priced at 99.58 (original spread of 12 bp), non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$198m Senior Note (XS2673287657), floating rate maturing on 25 August 2028, priced at 100.00, non callable

- Fuyuan Worldwide Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$130m Bond (XS2648984396), fixed rate (8.00% coupon) maturing on 24 August 2026, priced at 100.00 (original spread of 375 bp), non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$750m Senior Note (US471068AY28), fixed rate (5.13% coupon) maturing on 1 September 2026, priced at 99.96 (original spread of 59 bp), non callable

- Kommunalbanken AS (Agency | Oslo, Oslo, Norway | Rating: AAA): US$1,250m Senior Note (XS2673978487), fixed rate (4.50% coupon) maturing on 1 September 2028, priced at 99.56 (original spread of 47 bp), non callable

- Opportunity SAS (Information/Data Technology | Paris, Ile-De-France, United Kingdom | Rating: NR): US$500m Bond (XS2665991969), fixed rate (5.50% coupon) maturing on 31 December 2200, priced at 100.00, non callable

- QIB Sukuk Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$500m Unsecured Note (XS2582389669), fixed rate (1.00% coupon) maturing on 22 February 2028, priced at 100.00, non callable

- Zhejiang Baron (BVI) Company Ltd (Financial - Other | Tortola, China (Mainland) | Rating: BBB-): US$200m Bond (XS2661086483), fixed rate (5.85% coupon) maturing on 25 August 2026, priced at 100.00, non callable

- Alexander Fndg 2 (Financial - Other | Rating: BBB-): US$500m Senior Note (US014916AA85), fixed rate (7.47% coupon) maturing on 31 July 2028, priced at 100.00 (original spread of 324 bp), callable (5nc5)

- Assured Guaranty US Holdings Inc (Financial - Other | New York City, New York, Bermuda | Rating: BBB+): US$350m Senior Note (US04621WAF77), fixed rate (6.13% coupon) maturing on 15 September 2028, priced at 99.46 (original spread of 189 bp), callable (5nc5)

- CMB International Leasing Management Ltd (Financial - Other | China (Mainland) | Rating: A-): US$300m Senior Note (XS2670330641), floating rate maturing on 23 August 2026, priced at 99.64, non callable

- Chile Electricit (Financial - Other | Luxembourg | Rating: NR): US$784m Senior Note (US168829AA77), fixed rate (6.01% coupon) maturing on 20 January 2033, priced at 100.08 (original spread of 196 bp), non callable

- Chile Electricity Lux MPC SARL (Financial - Other | Luxembourg | Rating: NR): US$784m Senior Note (USL15669AA91), fixed rate (6.01% coupon) maturing on 20 January 2033, priced at 100.08 (original spread of 199 bp), non callable

- Continuum Energy Aura Pte Ltd (Utility - Other | Rating: B+): US$435m Note (USY1758JAD55), fixed rate (9.50% coupon) maturing on 24 February 2027, priced at 100.00, callable (4nc2)

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$700m Unsecured Note (XS2672410821), fixed rate (5.00% coupon) maturing on 1 September 2026, priced at 100.00, non callable

- Export-Import Bank of China (Agency | Beijing, Beijing, China (Mainland) | Rating: A+): US$200m Senior Note (XS2671308091), floating rate maturing on 22 August 2028, priced at 100.00, non callable

- Fuyuan Worldwide Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$320m Bond (XS2648984396) maturing on 31 July 2026, priced at 100.00, non callable

- Maxim Crane Works Holdings Capital LLC (Financial - Other | Rating: CCC+): US$500m Note (US57779EAA64), fixed rate (11.50% coupon) maturing on 1 September 2028, priced at 98.16 (original spread of 759 bp), callable (5nc2)

RECENT EURO BOND ISSUES

- Bavaria, State of (Official and Muni | Muenchen, Bayern, Germany | Rating: AAA): €150m Landesschatzanweisung (DE0001053775), fixed rate (3.06% coupon) maturing on 29 August 2053, priced at 100.00 (original spread of 50 bp), non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): €1,000m Senior Note (XS2673570995), fixed rate (3.25% coupon) maturing on 29 August 2033, priced at 99.15 (original spread of 72 bp), non callable

- Clydesdale Bank PLC (Banking | Glasgow, Strathclyde, United Kingdom | Rating: A-): €500m Covered Bond (Other) (XS2641928382), fixed rate (3.75% coupon) maturing on 22 August 2028, priced at 99.64 (original spread of 121 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Hessen, Germany | Rating: AAA): €1,250m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000CZ43Z72), fixed rate (3.38% coupon) maturing on 28 August 2028, priced at 99.48 (original spread of 82 bp), non callable

- Commonwealth Bank of Australia (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,500m Covered Bond (Other) (XS2673140633), fixed rate (3.77% coupon) maturing on 31 August 2027, priced at 100.00 (original spread of 102 bp), non callable

- Continental AG (Vehicle Parts | Hannover, Niedersachsen, Germany | Rating: BBB): €500m Senior Note (XS2672452237), fixed rate (4.00% coupon) maturing on 1 March 2027, priced at 99.66 (original spread of 139 bp), callable (4nc3)

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400KFO8), fixed rate (3.38% coupon) maturing on 4 September 2028, priced at 99.69 (original spread of 96 bp), non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €250m Bond (IT0005558256), fixed rate (3.75% coupon) maturing on 31 August 2025, priced at 100.00, non callable

- Credit Agricole Italia SpA (Banking | Parma, Parma, France | Rating: NR): €150m Bond (IT0005558264), fixed rate (3.00% coupon) maturing on 31 August 2025, priced at 100.00, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR001400KDS4), floating rate maturing on 28 August 2033, priced at 99.57 (original spread of 296 bp), callable (10nc5)

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C8Q3), fixed rate (3.70% coupon) maturing on 19 September 2030, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C8P5), fixed rate (3.25% coupon) maturing on 18 September 2026, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C8R1), fixed rate (3.90% coupon) maturing on 19 September 2033, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €250m Inhaberschuldverschreibung (DE000DW6C8N0), fixed rate (3.05% coupon) maturing on 19 September 2025, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): €200m Inhaberschuldverschreibung (DE000DW6C8T7), fixed rate (3.00% coupon) maturing on 3 October 2028, priced at 100.00, non callable

- Danske Kiinnitysluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Denmark | Rating: NR): €1,000m Covered Bond (Other) (XS2673564832), fixed rate (3.50% coupon) maturing on 29 January 2029, priced at 99.68 (original spread of 99 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9VJA1), fixed rate (3.40% coupon) maturing on 14 September 2026, priced at 100.00, non callable

- E ON SE (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €750m Senior Note (XS2673536541), fixed rate (3.75% coupon) maturing on 1 March 2029, priced at 99.65 (original spread of 126 bp), callable (6nc5)

- E ON SE (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €750m Senior Note (XS2673547746), fixed rate (4.00% coupon) maturing on 29 August 2033, priced at 99.09 (original spread of 149 bp), callable (10nc10)

- European Financial Stability Facility SA (Supranational | Luxembourg, Luxembourg | Rating: NR): €2,000m Senior Note (EU000A2SCAK5), fixed rate (3.38% coupon) maturing on 30 August 2038, priced at 99.08 (original spread of 76 bp), non callable

- Finland, Republic of (Government) (Sovereign | Helsinki, Etela-Suomen, Finland | Rating: AA+): €3,000m Bond (FI4000557525), fixed rate (2.88% coupon) maturing on 15 April 2029, priced at 99.42 (original spread of 50 bp), non callable

- HSBC Continental Europe SA (Banking | Paris, Ile-De-France, United Kingdom | Rating: A+): €209m Bond (FR001400KEB8), fixed rate (4.18% coupon) maturing on 25 August 2025, priced at 100.00, non callable

- HSBC Continental Europe SA (Banking | Paris, Ile-De-France, United Kingdom | Rating: A+): €145m Bond (FR001400KEC6), floating rate (EU03MLIB + 80.0 bp) maturing on 25 August 2026, priced at 100.00, non callable

- Hypo Noe Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Niederoesterreich, Austria | Rating: A): €500m Hypothekenpfandbrief (Covered Bond) (AT0000A36WE5), fixed rate (3.63% coupon) maturing on 2 March 2026, priced at 99.79 (original spread of 89 bp), non callable

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €750m Note (XS2673808486), fixed rate (4.38% coupon) maturing on 29 August 2027, priced at 99.63 (original spread of 177 bp), with a regulatory call

- Intesa Sanpaolo SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,500m Note (XS2673808726), fixed rate (5.13% coupon) maturing on 29 August 2031, priced at 99.28 (original spread of 266 bp), with a regulatory call

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €4,000m Inhaberschuldverschreibung (DE000A351MT2), fixed rate (3.13% coupon) maturing on 10 October 2028, priced at 99.73 (original spread of 54 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: AA-): €1,000m Oeffentlicher Pfandbrief Jumbo (Covered Bond) (XS2673929944), fixed rate (3.38% coupon) maturing on 20 January 2028, priced at 99.77 (original spread of 80 bp), non callable

- Lloyds Bank Corporate Markets PLC (Banking | London, United Kingdom | Rating: A): €230m Unsecured Note (XS2673928037) zero coupon maturing on 29 August 2025, non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): €750m Senior Note (XS2672418055), fixed rate (4.61% coupon) maturing on 28 August 2030, priced at 100.00 (original spread of 203 bp), non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000NWB1W44), fixed rate (3.50% coupon) maturing on 30 August 2038, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,000m Inhaberschuldverschreibung (DE000NWB9114), fixed rate (3.13% coupon) maturing on 30 August 2028, priced at 99.71 (original spread of 66 bp), non callable

- Nord Lb Covered Finance Bank SA (Banking | Findel, Luxembourg | Rating: NR): €150m Unsecured Note (XS2675673797) zero coupon maturing on 8 September 2025, priced at 100.00, non callable

- Nordea Kiinnitysluottopankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €1,000m Senior Note (XS2673972795), fixed rate (3.50% coupon) maturing on 31 August 2026, priced at 99.94 (original spread of 87 bp), non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: A): €250m Inhaberschuldverschreibung (AT000B130224), fixed rate (3.75% coupon) maturing on 2 October 2025, priced at 100.00, non callable

- Slovenska Sporitelna as (Banking | Bratislava, Bratislavsky Kraj, Austria | Rating: A): €500m Covered Bond (Other) (SK4000023636), fixed rate (3.88% coupon) maturing on 30 September 2027, priced at 99.79 (original spread of 121 bp), non callable

- Swedish Export Credit Corp (Agency | Stockholm, Stockholm, Sweden | Rating: AA+): €600m Note (XS2673978644), fixed rate (3.38% coupon) maturing on 30 August 2030, priced at 99.99 (original spread of 92 bp), non callable

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Noord-Holland, Japan | Rating: A+): €500m Senior Note (XS2675093285), floating rate (EU03MLIB + 34.0 bp) maturing on 29 August 2025, priced at 100.00, non callable

- Volvo Treasury AB (Financial - Other | Goeteborg, Vastra Gotalands, Sweden | Rating: A): €700m Senior Note (XS2671621402), fixed rate (3.88% coupon) maturing on 29 August 2026, priced at 99.74 (original spread of 120 bp), callable (3nc3)

- Vseobecna Uverova Banka as (Banking | Bratislava, Bratislavsky Kraj, Italy | Rating: NR): €500m Covered Bond (Other) (SK4000023685), fixed rate (3.88% coupon) maturing on 5 September 2028, priced at 99.77 (original spread of 144 bp), non callable

RECENT LOANS

- American Cruise Lines Inc (United States of America), signed a US$ 120m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/18/28 and initial pricing is set at Term SOFR +225.0bp

- American Cruise Lines Inc (United States of America), signed a US$ 200m Term Loan A, to be used for general corporate purposes. It matures on 08/18/28 and initial pricing is set at Term SOFR +225.0bp

- Boeing Co (United States of America | BBB-), signed a US$ 800m 364d Revolver, to be used for general corporate purposes. It matures on 08/22/24 and initial pricing is set at Term SOFR +125.0bp

- Boeing Co (United States of America | BBB-), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/24/28 and initial pricing is set at Term SOFR +120.0bp

- Broadridge Finl Solutions Inc (United States of America | BBB), signed a US$ 1,300m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 08/17/26 and initial pricing is set at Term SOFR +100.0bp

- Cronimet Holding GmbH (Germany), signed a € 700m Term Loan, to be used for general corporate purposes. It matures on 09/16/26.

- Ford Motor Co (United States of America | BB+), signed a US$ 4,000m Revolving Credit Facility, to be used for working capital. It matures on 08/15/24.

- GAW Capital Partners (Hong Kong), signed a US$ 275m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 08/18/26.

- Hoganas AB (Sweden), signed a € 400m Revolving Credit Facility, to be used for general corporate purposes.

- Hoganas AB (Sweden), signed a US$ 110m Term Loan, to be used for general corporate purposes.

- Hybar-SMS Arkansas Steel Mill (United States of America), signed a US$ 150m Term Loan, to be used for project finance.

- Lakeshore Intermediate LLC (United States of America), signed a US$ 580m Term Loan B, to be used for general corporate purposes. It matures on 10/01/28 and initial pricing is set at Term SOFR +350.0bp

- Lakeshore Intermediate LLC (United States of America), signed a US$ 150m Term Loan B, to be used for 125. It matures on 10/01/28 and initial pricing is set at Term SOFR +350.0bp

- NRRM LLC (United States of America), signed a US$ 350m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/15/26 and initial pricing is set at Term SOFR +350.0bp

- Nigerian National Petroleum Co (Nigeria), signed a US$ 3,000m Term Loan, to be used for general corporate purposes.

- PT Agro Murni (Indonesia), signed a US$ 120m Term Loan, to be used for working capital.

- Portland General Electric Co (United States of America | A), signed a US$ 750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/10/28 and initial pricing is set at Term SOFR +110.0bp

- Standard Bank Group Ltd (South Africa), signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 08/18/30.

- The Chemours Co LLC (United States of America | BB), signed a € 415m Term Loan B, to be used for general corporate purposes. It matures on 08/15/28 and initial pricing is set at EURIBOR +400.0bp

- The Chemours Co LLC (United States of America | BB), signed a US$ 900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 10/07/26 and initial pricing is set at Term SOFR +200.0bp

- The Chemours Co LLC (United States of America | BB), signed a US$ 1,070m Term Loan B, to be used for general corporate purposes. It matures on 08/18/28 and initial pricing is set at Term SOFR +350.0bp

RECENT STRUCTURED CREDIT

- DC Commercial Mortgage Trust 2023-Dc issued a fixed-rate CMBS in 5 tranches, for a total of US$ 975 m. Highest-rated tranche offering a yield to maturity of 6.31%, and the lowest-rated tranche a yield to maturity of 7.43%. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Citigroup Global Markets Inc

- Exeter Automobile Receivables Trust 2023-4 issued a fixed-rate ABS backed by certificates in 7 tranches, for a total of US$ 592 m. Highest-rated tranche offering a yield to maturity of 5.61%, and the lowest-rated tranche a yield to maturity of 9.57%. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC