Credit

Top CDS Moves In The Last Week

We rank the top 15 largest moves in credit default swaps across euro and USD corporate issuers

Published ET

Oil rig stock picture

QUICK SUMMARY

- With crude prices rising this week, CDS movers in the US were dominated by oil-related companies, with drillers like Transocean and Nabors Industries seeing the largest moves.

- Travel companies also did well, with American Airlines, Sabre Holdings, Royal Caribbean Cruises all seeing good spread compression.

- Talen Energy (a power company) is one of the rare losers this week, seeing its credit spreads widen on plans to invest hundreds of millions of dollars on crypto-mining data centers (creditors were less enthusiastic about the idea)

- All the top movers in Europe saw their spreads tighten, with many currently sitting at the lowest levels in the past 12 months, like Air France and Jaguar Land Rover. A positive sign that the European economic recovery is catching up with the US.

- Just a note regarding methodology: we rank the moves in terms of the absolute value of the weekly change of 5-year CDS mid-spreads

LARGEST USD CDS MOVERS IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 232.0 bp to 1,776.5bp (1Y range: 1,311-7,695bp)

- Nabors Industries Inc (Country: US; rated: B+): down 228.3 bp to 978.7bp (1Y range: 808-4,514bp)

- Apache Corp (Country: US; rated: Ba1): down 52.7 bp to 192.4bp (1Y range: 192-453bp)

- Occidental Petroleum Corp (Country: US; rated: WD): down 45.0 bp to 236.4bp (1Y range: 236-855bp)

- American Airlines Group Inc (Country: US; rated: B2): down 37.5 bp to 653.2bp (1Y range: 639-3,660bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 25.7 bp to 312.8bp (1Y range: 238-763bp)

- MBIA Inc (Country: US; rated: Ba3): down 23.8 bp to 502.2bp (1Y range: 378-757bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 22.2 bp to 454.6bp (1Y range: 366-1,458bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: B): down 13.1 bp to 199.9bp (1Y range: 175-372bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 11.0 bp to 292.2bp (1Y range: 249-404bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 61%): down 10.4 bp to 319.7bp (1Y range: 319-1,979bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): down 10.1 bp to 383.9bp (1Y range: 337-611bp)

- Macy's Inc (Country: US; rated: Ba3): up 19.7 bp to 323.3bp (1Y range: 291-1,253bp)

- Staples Inc (Country: US; rated: B2): up 21.8 bp to 817.1bp (1Y range: 652-2,081bp)

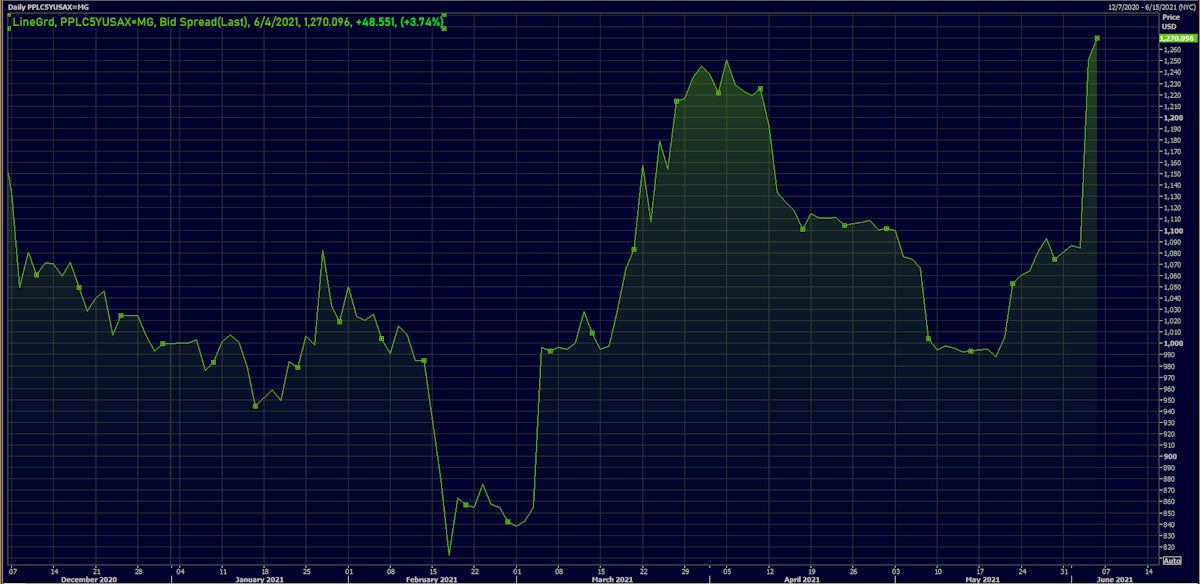

- Talen Energy Supply LLC (Country: US; rated: BB): up 209.9 bp to 1,347.9bp (1Y range: 875-1,710bp)

LARGEST EURO CDS MOVERS IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 41.5 bp to 782.3bp (1Y range: 716-1,409bp)

- Syngenta AG (Country: CH; rated: Ba2): down 23.4 bp to 118.9bp (1Y range: 105-288bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 22.1 bp to 711.8bp (1Y range: 590-1,799bp)

- Atlantia SpA (Country: IT; rated: Ba2): down 20.6 bp to 127.1bp (1Y range: 127-407bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 18.4 bp to 257.2bp (1Y range: 233-421bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 17.6 bp to 433.3bp (1Y range: 358-1,004bp)

- Air France KLM SA (Country: FR; rated: B-): down 17.5 bp to 468.4bp (1Y range: 468-1,211bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 16.9 bp to 558.9bp (1Y range: 516-1,210bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 15.1 bp to 255.1bp (1Y range: 249-516bp)

- CMA CGM SA (Country: FR; rated: B1): down 12.3 bp to 370.0bp (1Y range: 370-1,241bp)

- Stena AB (Country: SE; rated: B2-PD): down 11.9 bp to 545.9bp (1Y range: 534-803bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): down 9.3 bp to 172.3bp (1Y range: 172-237bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 8.6 bp to 352.7bp (1Y range: 353-1,093bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 8.6 bp to 513.5bp (1Y range: 514-984bp)

- Leonardo SpA (Country: IT; rated: Ba1): down 7.0 bp to 153.0bp (1Y range: 153-298bp)