Credit

Credit Spreads Widen As Rates Pull Back

We view this as a potential sign that fixed income markets do not believe giant further stimulus will be realized

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.1% today, with investment grade up 0.1% and high yield up 0.1% (YTD total return: -3.2%)

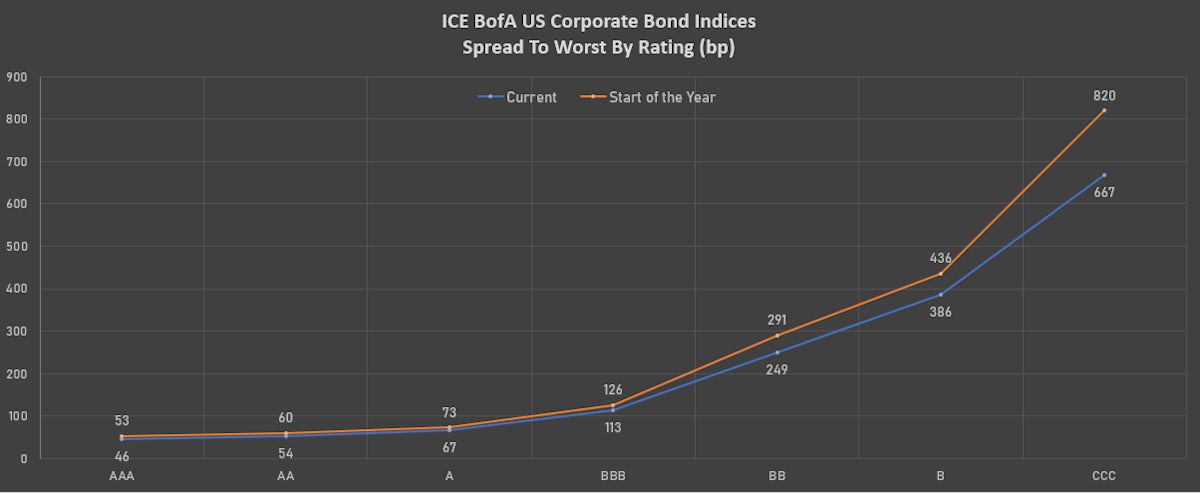

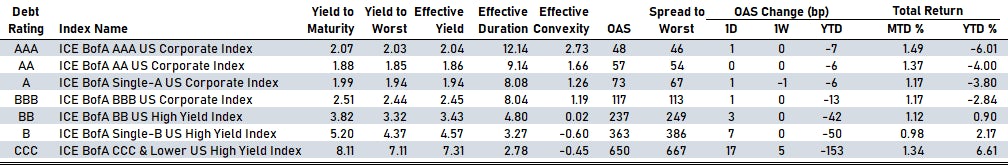

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 90.0 bp (YTD change: -8.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 345.0 bp (YTD change: -45.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +1.5%)

- New issues: US$ 3.3bn in dollars and € 0.9bn in euros

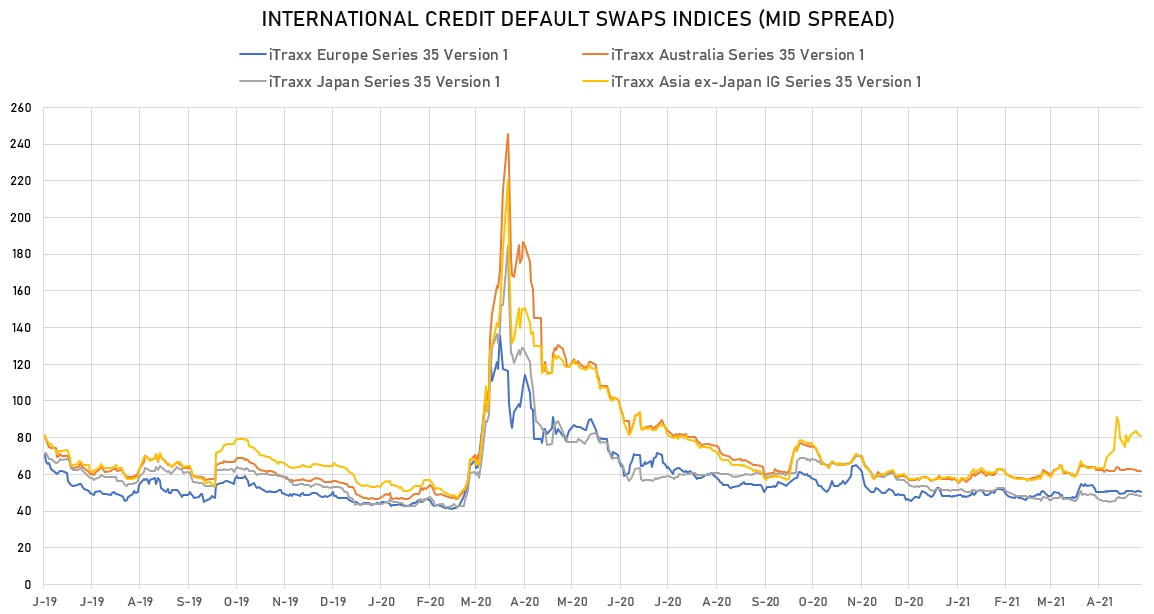

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 50bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y up 2.4 bp, now at 287bp (YTD change: -6.7bp)

- Markit iTRAXX Europe down -0.2 bp, now at 50bp (YTD change: +2.0bp)

- Markit iTRAXX Japan unchanged, now at 48bp (YTD change: -2.9bp)

- Markit iTRAXX Asia Ex-Japan down -0.6 bp, now at 80bp (YTD change: +22.0bp)

USD CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Transocean Inc (Country: KY; rated: Caa3): up 32.6 bp to 1,638.0bp (1Y range: 1,459-7,695bp)

- Genworth Holdings Inc (Country: US; rated: Caa2): up 24.3 bp to 500.0bp (1Y range: 476-1,070bp)

- International Game Technology (Country: US; rated: Ba3): up 9.5 bp to 283.8bp (1Y range: 272-297bp)

- Telefonos de Mexico SAB de CV (Country: MX; rated: Baa1): up 7.4 bp to 99.2bp (1Y range: 83-270bp)

- Nabors Industries Inc (Country: US; rated: B+): up 6.5 bp to 931.6bp (1Y range: 808-4,514bp)

- Staples Inc (Country: US; rated: B2): up 6.5 bp to 711.2bp (1Y range: 652-2,081bp)

- Cummins Inc (Country: US; rated: A2): up 6.0 bp to 64.6bp (1Y range: 56-65bp)

- Mattel Inc (Country: US; rated: Ba2): down 6.7 bp to 230.0bp (1Y range: 229-473bp)

- Power Finance Corporation Ltd (Country: IN; rated: BBB-): down 18.1 bp to 213.0bp (1Y range: 154-258bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 23.8 bp to 471.2bp (1Y range: 447-1,448bp)

EURO CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Danske Bank A/S (Country: DK; rated: A low): up 4.7 bp to 33.8bp (1Y range: 26-45bp)

- Standard Chartered PLC (Country: GB; rated: BBB+): up 4.5 bp to 49.8bp (1Y range: 36-68bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): up 3.9 bp to 116.1bp (1Y range: 75-209bp)

- Hammerson PLC (Country: GB; rated: Baa3): up 3.8 bp to 243.0bp (1Y range: 239-604bp)

- PostNL NV (Country: NL; rated: WR): up 2.3 bp to 37.4bp (1Y range: 33-75bp)

- CNH Industrial NV (Country: GB; rated: NR): up 2.1 bp to 93.9bp (1Y range: 84-248bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 2.0 bp to 65.4bp (1Y range: 59-112bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 2.0 bp to 65.4bp (1Y range: 52-76bp)

- Accor SA (Country: FR; rated: B): down 2.0 bp to 149.0bp (1Y range: 139-292bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 2.1 bp to 272.9bp (1Y range: 249-668bp)

USD BOND ISSUES

- Bank Razvitiya Kazakhstana AO (Agency | Astana, Kazakhstan | Rating: BBB-): US$500m Senior Note (US25159XAD57), fixed rate (2.95% coupon) maturing on 6 May 2031, priced at 99.57, non callable

- Cogent Communications Group Inc (Service - Other | Washington, United States | Rating: BB): US$500m Note (USU19283AG29), fixed rate (3.50% coupon) maturing on 1 May 2026, priced at 100.00 (original spread of 264 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$450m Bond (US3133EMYT35), floating rate (SOFR + 3.0 bp) maturing on 6 April 2023, priced at 100.00, non callable

- Herens Holdco SARL (Financial - Other | Luxembourg | Rating: NR): US$350m Note (US427169AA59), fixed rate (4.75% coupon) maturing on 15 May 2028, priced at 100.00 (original spread of 342 bp), callable (7nc3)

- MSCI Inc (Financial - Other | New York City, United States | Rating: BB+): US$600m Senior Note (USU5521TAK89), fixed rate (3.63% coupon) maturing on 1 November 2031, priced at 100.00 (original spread of 200 bp), callable (10nc5)

- Metis Merger Sub LLC (Financial - Other | Rating: NR): US$720m Senior Note (USU59249AA73), fixed rate (6.50% coupon) maturing on 15 May 2029, priced at 100.00, callable (8nc3)

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): US$100m Inhaberschuldverschreibung (ATSKUS4PREM8), floating rate maturing on 13 December 2027, priced at 100.00, non callable

EUR BOND ISSUES

- Herens Midco SARL (Financial - Other | Luxembourg | Rating: B): US$460m Senior Note (XS2340137426), fixed rate (5.25% coupon) maturing on 15 May 2029, priced at 100.00 (original spread of 563 bp), callable (8nc3)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): US$100m Inhaberschuldverschreibung (DE000HLB23L4), fixed rate (0.23% coupon) maturing on 19 May 2028, priced at 100.00 (original spread of 35 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): US$100m Inhaberschuldverschreibung (DE000HLB23K6), fixed rate (0.50% coupon) maturing on 10 June 2032, priced at 100.00 (original spread of 92 bp), callable (11nc1)

- Standard Profil Automotive GmbH (Financial - Other | Eschborn, Luxembourg | Rating: B-): US$275m Senior Note (XS2339015047), fixed rate (6.25% coupon) maturing on 30 April 2026, priced at 100.00 (original spread of 683 bp), callable (5nc2)

NEW ISSUES IN STRUCTURED CREDIT

- Sba Tower Trust 2021-1 issued a fixed-rate ABS backed by leases in 1 tranche, for a total of US$ 1,165 m. The tranche offers a yield to maturity of 1.63%.

- Ttan 2021-Mhc issued a floating-rate CMBS in 7 tranches, for a total of US$ 335 m. Highest-rated tranche offering a spread over the floating rate of 85bp, and the lowest-rated tranche a spread of 420bp.

- Newrez Warehouse Securitization Trust 2021-1 issued a floating-rate RMBS in 6 tranches, for a total of US$ 750 m. Highest-rated tranche offering a spread over the floating rate of 75bp, and the lowest-rated tranche a spread of 525bp.

- Rlgh 2021-Trot issued a floating-rate CMBS in 3 tranches, for a total of US$ 164 m. Highest-rated tranche offering a spread over the floating rate of 80bp, and the lowest-rated tranche a spread of 135bp.