Credit

US High-Yield Bond Spreads Widen, Led By Single-Bs And BBs

All the talk of "peak growth", "peak profits" (whatever those phrases mean) might have found some resonance as equities fell as well

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.1% today, with investment grade up 0.1% and high yield up 0.1% (YTD total return: -3.1%)

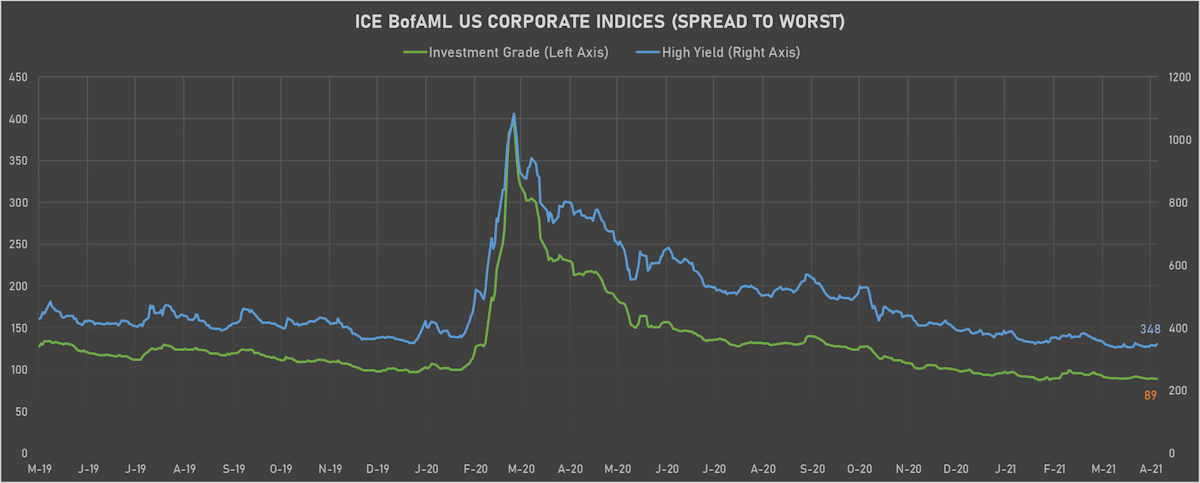

- ICE BofA US Corporate Index (Investment Grade) spread to worst down unchanged at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 348.0 bp (YTD change: -42.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +1.5%)

- New issues: US$ 5.4bn in dollars and € 1.9bn in euros

CDS INDICES (mid-spreads)

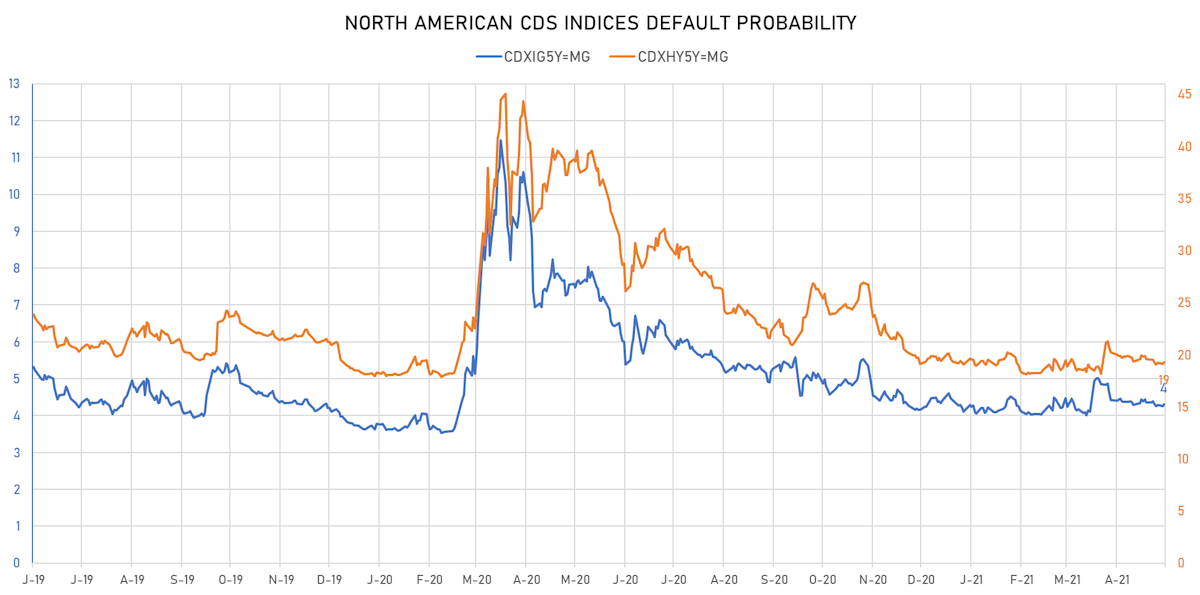

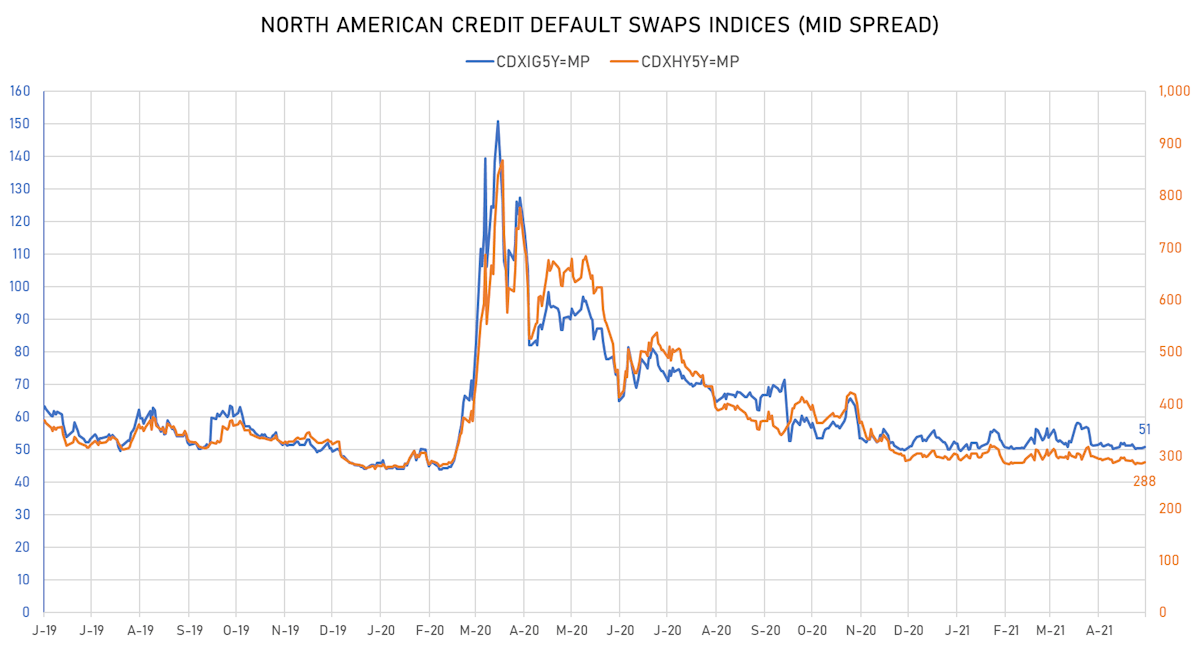

- Markit CDX.NA.IG 5Y up 0.5 bp, now at 51bp (YTD change: +0.8bp)

- Markit CDX.NA.HY 5Y up 3.2 bp, now at 288bp (YTD change: -5.0bp)

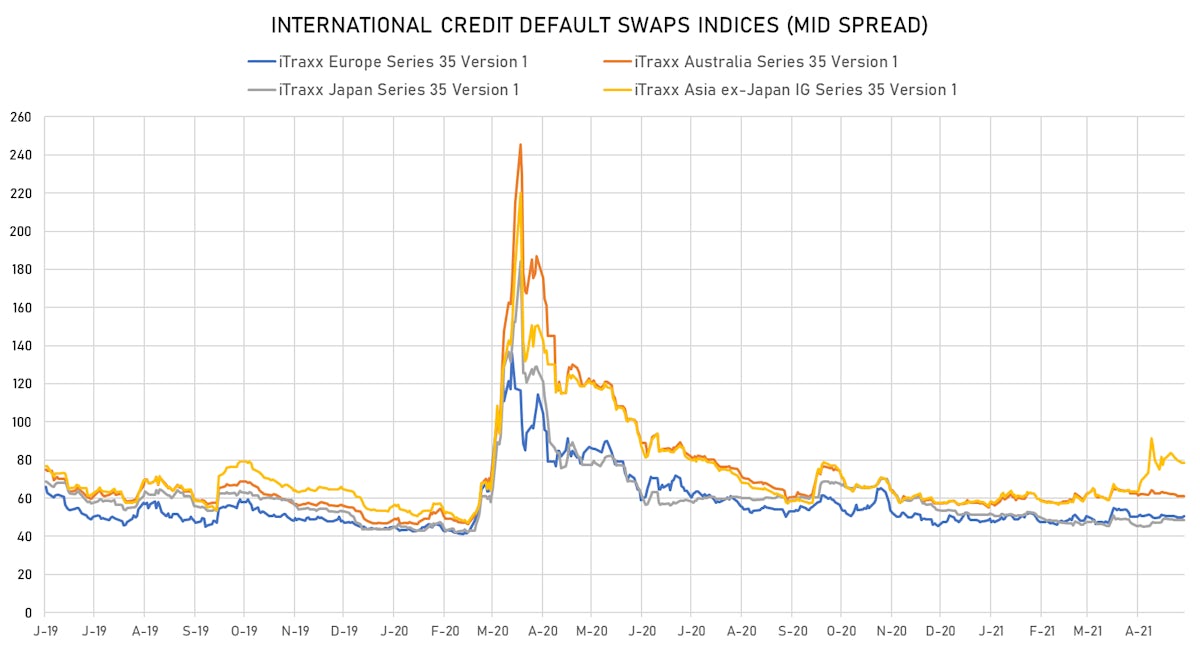

- Markit iTRAXX Europe up 0.8 bp, now at 50.76 bp (YTD change: +2.8bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 78.59 bp (YTD change: +20.5bp)

USD CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Road King Infrastructure Ltd (Country: HK; rated: WR): up 61.3 bp to 631.1bp (1Y range: 482-805bp)

- Domtar Corp (Country: US; rated: Baa3): up 21.6 bp to 100.0bp (1Y range: 44-100bp)

- American Airlines Group Inc (Country: US; rated: B2): up 19.7 bp to 782.8bp (1Y range: 763-7,278bp)

- Meritor Inc (Country: US; rated: LGD5 - 75%): up 15.0 bp to 238.2bp (1Y range: 164-307bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): up 14.8 bp to 344.3bp (1Y range: 292-1,408bp)

- NRG Energy Inc (Country: US; rated: Ba1): up 10.1 bp to 197.8bp (1Y range: 108-231bp)

- Apache Corp (Country: US; rated: Ba1): down 8.2 bp to 249.0bp (1Y range: 205-453bp)

- Beazer Homes USA Inc (Country: US; rated: B3): down 9.9 bp to 295.3bp (1Y range: 231-780bp)

- Talen Energy Supply LLC (Country: US; rated: BB): down 21.6 bp to 1,099.7bp (1Y range: 875-1,710bp)

- Transocean Inc (Country: KY; rated: Caa3): down 56.4 bp to 1,558.7bp (1Y range: 1,459-7,695bp)

EUR CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Novafives SAS (Country: FR; rated: Caa1): up 7.9 bp to 797.1bp (1Y range: 716-2,335bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 6.1 bp to 219.0bp (1Y range: 188-350bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: B): up 3.5 bp to 373.9bp (1Y range: 355-1,456bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 3.4 bp to 257.9bp (1Y range: 206-630bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 3.1 bp to 130.1bp (1Y range: -130bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 4.5 bp to 285.0bp (1Y range: 233-457bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 5.0 bp to 226.5bp (1Y range: 141-312bp)

- Abertis Infraestructuras SA (Country: ES; rated: BBB): down 6.9 bp to 114.8bp (1Y range: 95-156bp)

- Koninklijke KPN NV (Country: NL; rated: BB+): down 9.3 bp to 107.4bp (1Y range: 55-117bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 17.3 bp to 881.0bp (1Y range: 590-2,880bp)

NEW USD BOND ISSUES

- Avnet Inc (Electronics | Phoenix, United States | Rating: BBB-): US$300m Senior Note (US053807AU73), fixed rate (3.00% coupon) maturing on 15 May 2031, priced at 99.22 (original spread of 152 bp), callable (10nc10)

- Carlyle Finance LLC (Financial - Other | Rating: BBB-): US$400m Subordinated Note (US14314C1053), fixed rate (4.63% coupon) maturing on 15 May 2061, priced at 100.00, callable (40nc5)

- Community Health Systems Inc (Health Care Facilities | Franklin, United States | Rating: CC): US$1,440m Note (US12543DBL38), fixed rate (6.13% coupon) maturing on 1 April 2030, priced at 100.00 (original spread of 463 bp), callable (9nc4)

- Coronado Finance Pty Ltd (Financial - Other | Brisbane, United States | Rating: B): US$350m Note (US21979LAA44), fixed rate (10.75% coupon) maturing on 15 May 2026, priced at 98.12 (original spread of 1,044 bp), callable (5nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EMYW63), fixed rate (0.23% coupon) maturing on 13 November 2023, priced at 100.00 (original spread of 21 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$100m Bond (US3130AMFA51), fixed rate (0.35% coupon) maturing on 28 June 2024, priced at 100.00, callable (3nc1)

- NXP BV (Electronics | Eindhoven, Netherlands | Rating: BBB-): US$1,000m Senior Note (US62954HAG39), fixed rate (2.50% coupon) maturing on 11 May 2031, priced at 99.66 (original spread of 95 bp), callable (10nc10)

- NXP BV (Electronics | Eindhoven, Netherlands | Rating: BBB-): US$1,000m Senior Note (US62954HAF55), fixed rate (3.25% coupon) maturing on 11 May 2041, priced at 99.26 (original spread of 115 bp), callable (20nc20)

- PACCAR Financial Corp (Financial - Other | Bellevue, United States | Rating: A+): US$300m Senior Note (US69371RR324), fixed rate (1.10% coupon) maturing on 11 May 2026, priced at 99.93 (original spread of 30 bp), non callable

- Sarana Multi Infrastruktur (Persero) PT (Financial - Other | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB-): US$300m Senior Note (XS2340901607), fixed rate (2.05% coupon) maturing on 11 May 2026, priced at 100.00, non callable

NEW EUR BOND ISSUES

- Bank of Ireland (Banking | Dublin, Ireland | Rating: A-): US$500m Subordinated Note (XS2340236327), fixed rate (1.38% coupon) maturing on 11 August 2031, priced at 99.95 (original spread of 200 bp), callable (10nc5)

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Austria | Rating: A): US$500m Covered Bond (Other) (XS2340854848), fixed rate (0.10% coupon) maturing on 12 May 2031, priced at 99.78 (original spread of 33 bp), non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: A+): US$100m Inhaberschuldverschreibung (DE000DFK0KF4), fixed rate (0.01% coupon) maturing on 28 November 2025, priced at 100.03, non callable

- Raiffeisen Centrobank AG (Banking | Wien, Austria | Rating: NR): US$100m Index Linked Security (AT0000A2R9X6) zero coupon maturing on 18 June 2029, priced at 100.00, non callable

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): US$100m Index Linked Security (AT0000A2RA10) zero coupon maturing on 6 July 2026, priced at 100.00, non callable

- Saxony, State of (Official and Muni | Dresden, Germany | Rating: AAA): US$500m Jumbo Landesschatzanweisung (DE0001789345), fixed rate (0.40% coupon) maturing on 12 May 2036, priced at 99.71 (original spread of 32 bp), non callable

- Wallonie, State of (Official and Muni | Namur, Belgium | Rating: A): US$100m Senior Note (BE0002792738), fixed rate (1.00% coupon) maturing on 22 June 2045, non callable

NEW ISSUES IN STRUCTURED CREDIT

- North Westerly VII ESG CLO Designated Activity Company issued a floating-rate CLO in 7 tranches, for a total of € 446 m. Highest-rated tranche offering a spread over the floating rate of 84 bp, lowest-rate tranche offering a spread of 814 bp. Bookrunners: Deutsche Bank Securities Inc