Credit

US High Yield Spreads Close To The Lowest Levels In The Last Decade

A lot of bonds in both USD and EUR primary market, with issuers taking advantage of low rates before they start to rise

Published ET

ICE BofA US HIGH YIELD OPTION-ADJUSTED SPREADS | Source: Refinitiv

QUICK SUMMARY

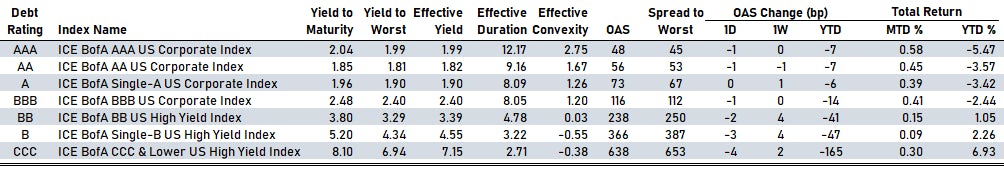

- S&P 500 Bond Index was up 0.1% today, with investment grade up 0.1% and high yield up 0.1% (YTD total return: -2.9%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst down 4.0 bp, now at 344.0 bp (YTD change: -46.0 bp)

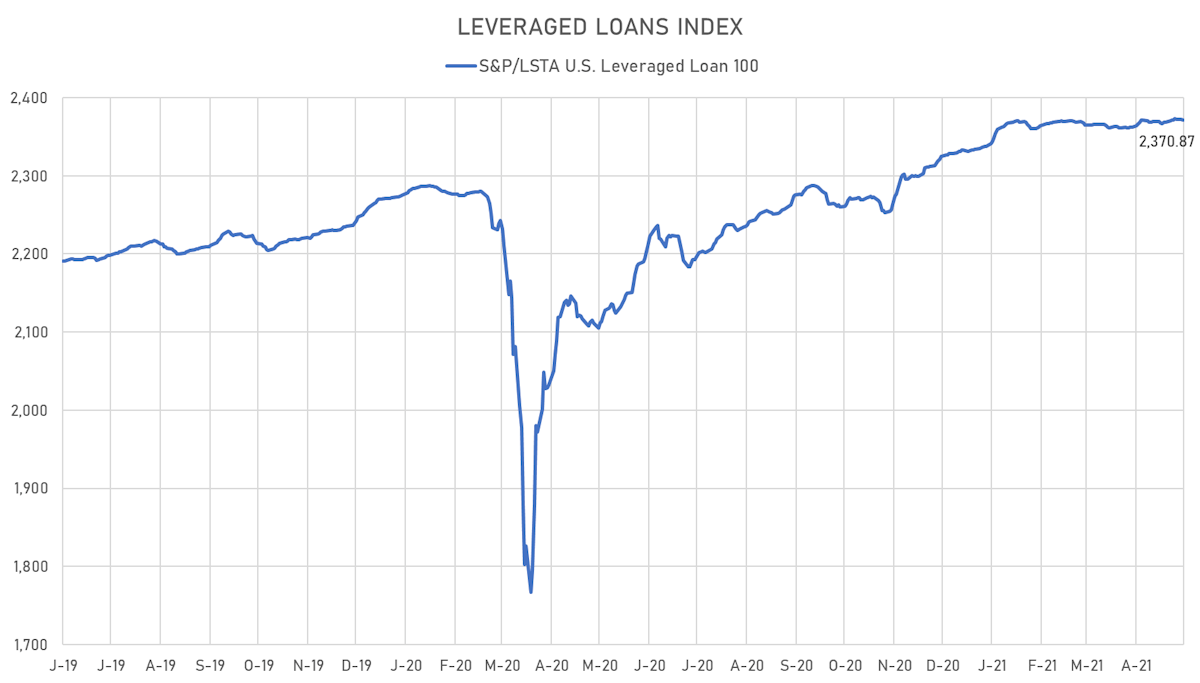

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.1% today (YTD total return: +1.5%)

- New issues: US$ 8.5bn in dollars and € 9.2bn in euros

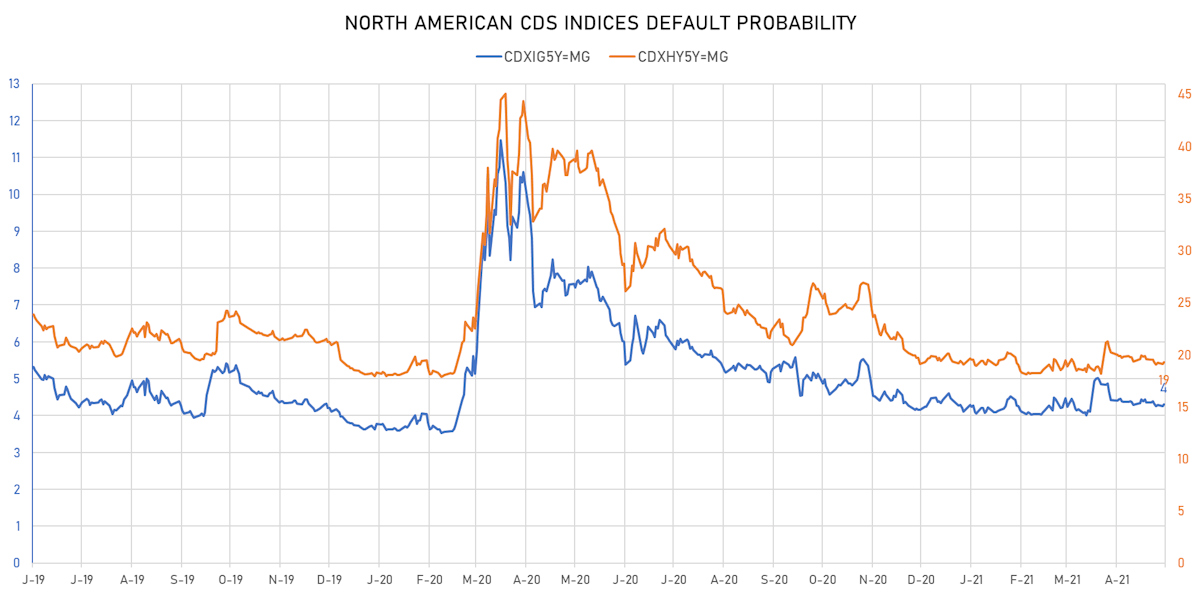

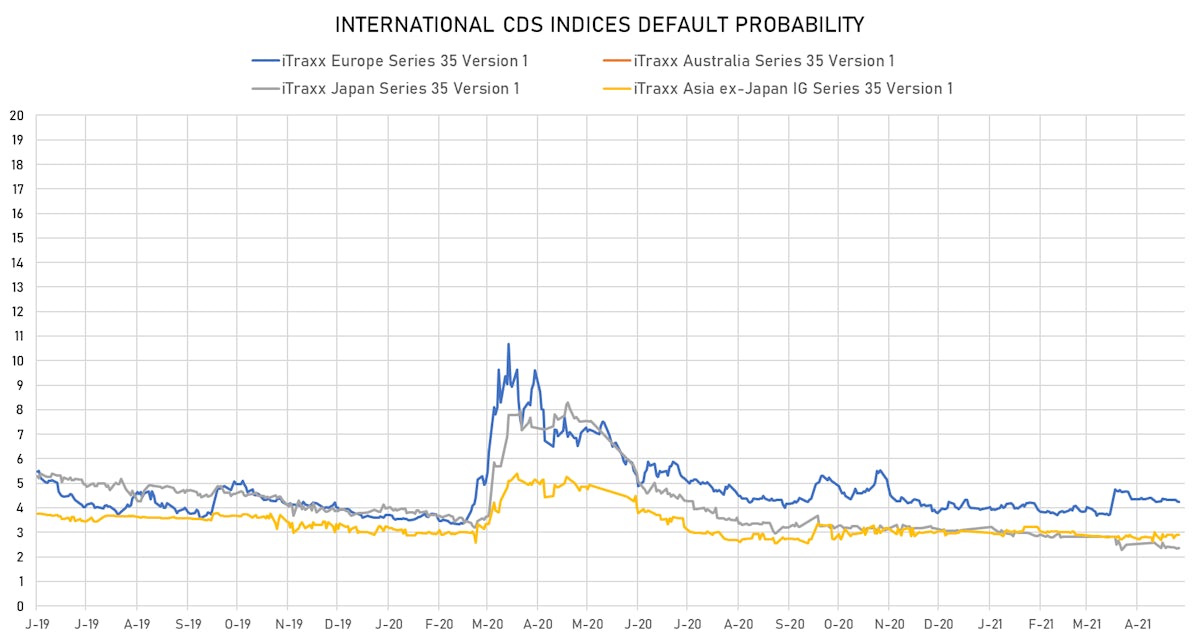

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 51bp (YTD change: +1.0bp)

- Markit CDX.NA.HY 5Y up 0.2 bp, now at 288bp (YTD change: -4.8bp)

- Markit iTRAXX Europe down -0.4 bp, now at 50bp (YTD change: +2.4bp)

- Markit iTRAXX Japan unchanged at 48bp (YTD change: -2.9bp)

- Markit iTRAXX Asia Ex-Japan up 0.7 bp, now at 79bp (YTD change: +21.2bp)

USD CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Transocean Inc (Country: KY; rated: Caa3): up 27.7 bp to 1,586.3bp (1Y range: 1,459-7,695bp)

- Genworth Holdings Inc (Country: US; rated: Caa2): up 21.9 bp to 500.0bp (1Y range: 476-1,070bp)

- Nabors Industries Inc (Country: US; rated: B+): up 16.9 bp to 952.3bp (1Y range: 808-4,514bp)

- Power Finance Corporation Ltd (Country: IN; rated: BBB-): up 14.6 bp to 233.2bp (1Y range: 154-258bp)

- International Game Technology (Country: US; rated: Ba3): up 9.5 bp to 283.8bp (1Y range: 272-297bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 6.9 bp to 523.1bp (1Y range: 447-1,448bp)

- Cummins Inc (Country: US; rated: A2): up 6.0 bp to 64.7bp (1Y range: 56-65bp)

- Corning Inc (Country: US; rated: P-2): up 5.9 bp to 85.3bp (1Y range: 72-85bp)

- Sberbank Rossii PAO (Country: RU; rated: BBB): down 6.2 bp to 157.7bp (1Y range: 149-231bp)

EUR CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Hammerson PLC (Country: GB; rated: Baa3): up 6.8 bp to 243.0bp (1Y range: 236-604bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): up 5.3 bp to 116.1bp (1Y range: 75-209bp)

- Danske Bank A/S (Country: DK; rated: A low): up 4.8 bp to 34.9bp (1Y range: 26-45bp)

- Standard Chartered PLC (Country: GB; rated: BBB+): up 4.6 bp to 50.8bp (1Y range: 36-68bp)

- Telefonaktiebolaget LM Ericsson (Country: SE; rated: Ba1): up 2.0 bp to 65.4bp (1Y range: 59-112bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 2.0 bp to 65.4bp (1Y range: 52-76bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 2.0 bp to 269.1bp (1Y range: 249-668bp)

- Renault SA (Country: FR; rated: A-): down 2.4 bp to 197.9bp (1Y range: 168-320bp)

- TDC A/S (Country: DK; rated: ): down 2.4 bp to 151.8bp (1Y range: 127-247bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 18.9 bp to 862.1bp (1Y range: 590-2,880bp)

USD BOND ISSUES

- Agree LP (Real Estate Investment Trust | Farmington Hills, United States | Rating: BBB): US$300m Senior Note (US008513AC74), fixed rate (2.60% coupon) maturing on 15 June 2033, priced at 99.14 (original spread of 112 bp), callable (12nc12)

- Agree LP (Real Estate Investment Trust | Farmington Hills, United States | Rating: BBB): US$350m Senior Note (US008513AB91), fixed rate (2.00% coupon) maturing on 15 June 2028, priced at 99.27 (original spread of 85 bp), callable (7nc7)

- Allied Universal Holdco LLC (Service - Other | Santa Ana, United States | Rating: NR): US$1,225m Note (US019579AA90), fixed rate (4.63% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 379 bp), callable (7nc3)

- Allied Universal Holdco LLC (Service - Other | Santa Ana, United States | Rating: NR): US$960m Senior Note (US019576AC18), fixed rate (6.00% coupon) maturing on 1 June 2029, priced at 100.00 (original spread of 495 bp), callable (8nc3)

- Atlas Luxco 4 SARL (Financial - Other | Luxembourg, United States | Rating: BB-): US$775m Note (US049362AA49), fixed rate (4.63% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 379 bp), callable (7nc3)

- CBQ Finance Ltd (Financial - Other | Hamilton, Qatar | Rating: NR): US$700m Senior Note (XS2341197536), fixed rate (2.00% coupon) maturing on 12 May 2026, priced at 99.75 (original spread of 125 bp), non callable

- Extra Space Storage LP (Real Estate Investment Trust | Salt Lake City, United States | Rating: BBB): US$450m Senior Note (US30225VAF40), fixed rate (2.55% coupon) maturing on 1 June 2031, priced at 99.85 (original spread of 102 bp), callable (10nc10)

- Highmark Inc (Life Insurance | Pittsburgh, United States | Rating: A-): US$400m Senior Note (US431116AD45), fixed rate (1.45% coupon) maturing on 10 May 2026, priced at 99.87 (original spread of 68 bp), callable (5nc5)

- Highmark Inc (Life Insurance | Pittsburgh, United States | Rating: A-): US$400m Senior Note (US431116AE28), fixed rate (2.55% coupon) maturing on 10 May 2031, priced at 99.97 (original spread of 102 bp), callable (10nc10)

- Naver Corp (Information/Data Technology | Seongnam, Gyeonggi-Do, South Korea | Rating: A-): US$300m Senior Note (XS2338090041), fixed rate (1.50% coupon) maturing on 29 March 2026, priced at 99.14 (original spread of 85 bp), non callable

- Santander International Products PLC (Financial - Other | Spain | Rating: NR): US$100m Unsecured Note (XS2342038606) zero coupon maturing on 28 May 2061, non callable

- Tacora Resources Inc (Metals/Mining | Grand Rapids, United States | Rating: B): US$175m Note (US87356LAA89), fixed rate (8.25% coupon) maturing on 15 May 2026, priced at 100.00, callable (5nc2)

- Vistra Operations Company LLC (Utility - Other | Irving, Texas, United States | Rating: BB): US$1,250m Senior Note (US92840VAH50), fixed rate (4.38% coupon) maturing on 1 May 2029, priced at 100.00 (original spread of 298 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$1,000m Bond (US3133EMYX47), fixed rate (0.13% coupon) maturing on 10 May 2023, priced at 100.00 (original spread of 2 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133EMYY20), fixed rate (1.60% coupon) maturing on 11 May 2029, priced at 100.00 (original spread of 155 bp), callable (8nc1)

EUR BOND ISSUES

- Greece, Republic of (Government) (Sovereign | Athina, Greece | Rating: BB-): €3,000m Senior Note (GR0114032577) zero coupon maturing on 12 February 2026, priced at 99.19 (original spread of 78 bp), non callable

- Akelius Residential Property AB (publ) (Home Builders | Stockholm, Bahamas | Rating: BBB): €500m Senior Note (XS2342244253), floating rate (EU03MLIB + 55.0 bp) maturing on 12 May 2023, priced at 100.06, callable (2nc1)

- Aker BP ASA (Oil and Gas | Lysaker, Norway | Rating: BBB-): €750m Senior Note (XS2341269970), fixed rate (1.13% coupon) maturing on 12 May 2029, priced at 99.36 (original spread of 161 bp), callable (8nc8)

- Atlas Luxco 4 SARL (Financial - Other | Luxembourg, United States | Rating: NR): €813m Senior Note (XS2342057572), fixed rate (3.63% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 409 bp), callable (7nc3)

- Barclays Bank UK PLC (Financial - Other | London, United Kingdom | Rating: A): €1,250m Senior Note (XS2342060360), floating rate maturing on 12 May 2032, priced at 100.00 (original spread of 134 bp), callable (11nc10)

- Barclays Bank UK PLC (Financial - Other | London, United Kingdom | Rating: A): €750m Senior Note (XS2342059784), floating rate (EU03MLIB + 100.0 bp) maturing on 12 May 2026, priced at 101.42, callable (5nc4)

- BNP Paribas Fortis Funding SA (Financial - Other | Luxembourg, France | Rating: NR): €100m Unsecured Note (XS2342233306) zero coupon maturing on 14 July 2031, priced at 100.00, non callable

- DNB Boligkreditt AS (Financial - Other | Oslo, Norway | Rating: NR): €1,000m Covered Bond (Other) (XS2341719503), fixed rate (0.01% coupon) maturing on 12 May 2028, priced at 100.88 (original spread of 36 bp), non callable

- Holding d'Infrastructures de Transport SAS (Service - Other | Issy-Les-Moulineaux, Italy | Rating: BBB-): €600m Senior Note (XS2342058117), fixed rate (0.63% coupon) maturing on 14 September 2028, priced at 98.70 (original spread of 125 bp), callable (7nc7)

- Italian Wine Brands SpA (Beverage/Bottling | Milan, Italy | Rating: NR): €130m Bond (XS2331288212), fixed rate (2.50% coupon) maturing on 13 May 2027, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): €100m Unsecured Note (XS2342206591), fixed rate (1.00% coupon) maturing on 13 May 2031, priced at 100.00, non callable

NEW ISSUES IN LOANS

- Slovenska Industrija Jekla DD, signed a € 148m Term Loan, to be used for general corporate purposes.

- Mehilainen Oy, signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 08/14/25 and initial pricing is set at EURIBOR +375.000bps

- Norwegian Energy Co ASA, signed a US$ 1,100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/05/28 and initial pricing is set at LIBOR +450.000bps

- Bank Dhofar SAOG, signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 06/15/23 and initial pricing is set at LIBOR +200.000bps