Credit

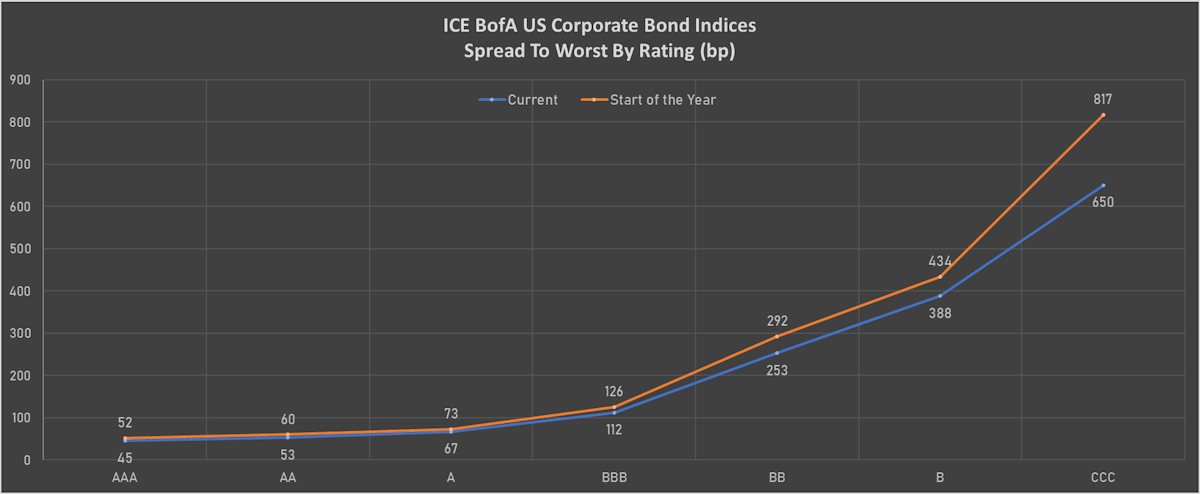

Mixed Bag In US High Yield As BBs, Single-Bs Widen And CCCs Tighten

In the primary market, Tullow Oil PLC printed a US$ 1,800m high yield bond wide of the CCC curve; Emirates Telecommunications and Euronext were the largest euro bond issuers

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.2% today, with investment grade up 0.2% and high yield up 0.2% (YTD total return: -2.8%)

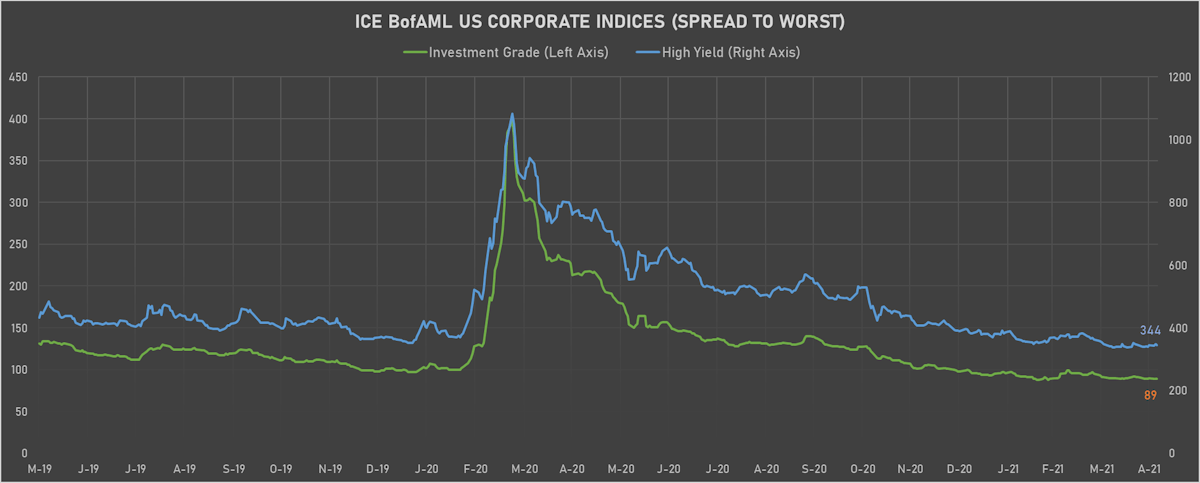

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 346.0 bp (YTD change: -44.0 bp)

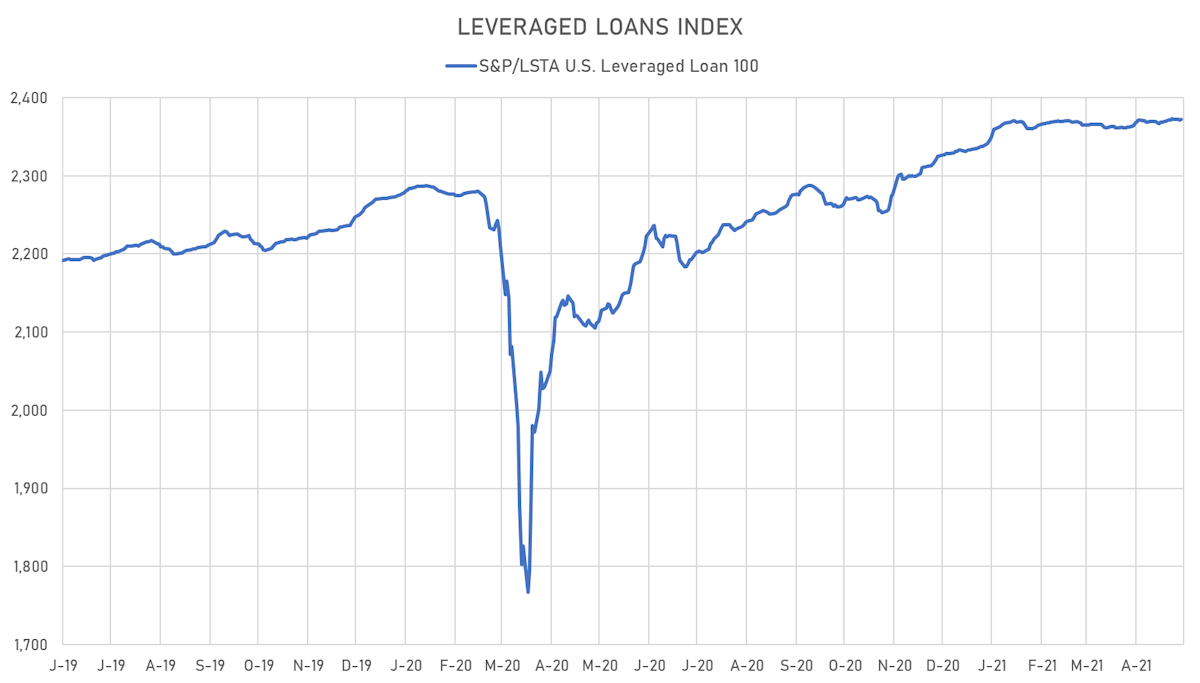

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.1% today (YTD total return: +1.5%)

- Notable new issues of US$ 11.0bn in dollars and € 6.9bn in euros

CDS INDICES (mid-spreads)

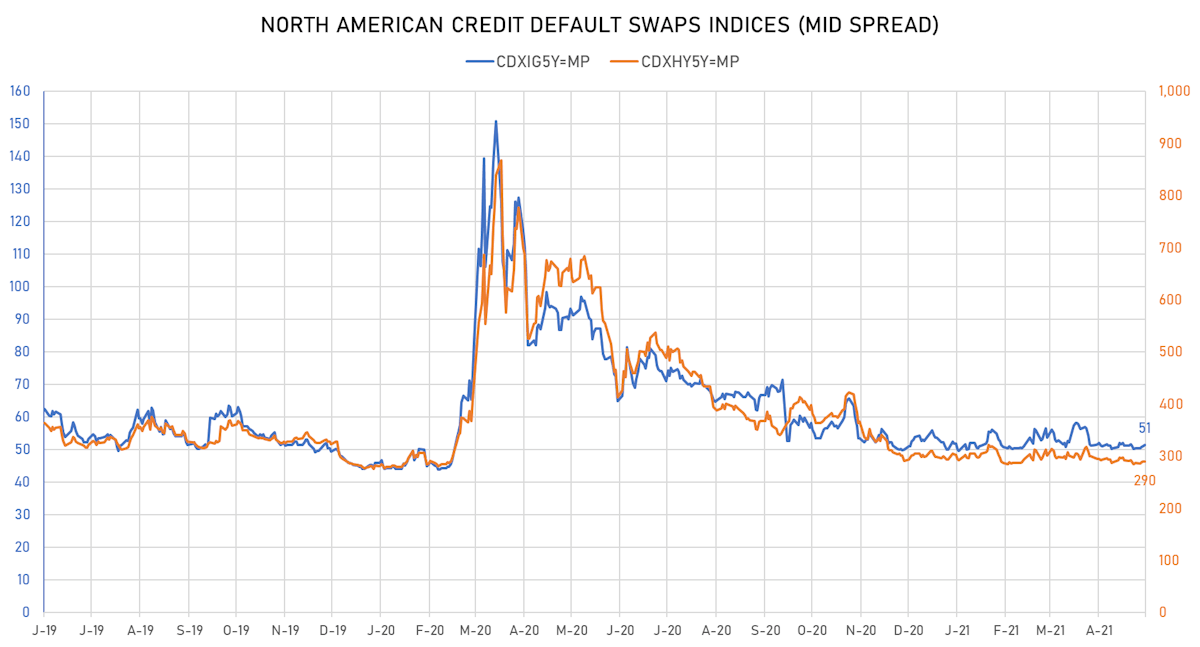

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 51bp (YTD change: +1.3bp)

- Markit CDX.NA.HY 5Y up 1.1 bp, now at 290bp (YTD change: -3.7bp)

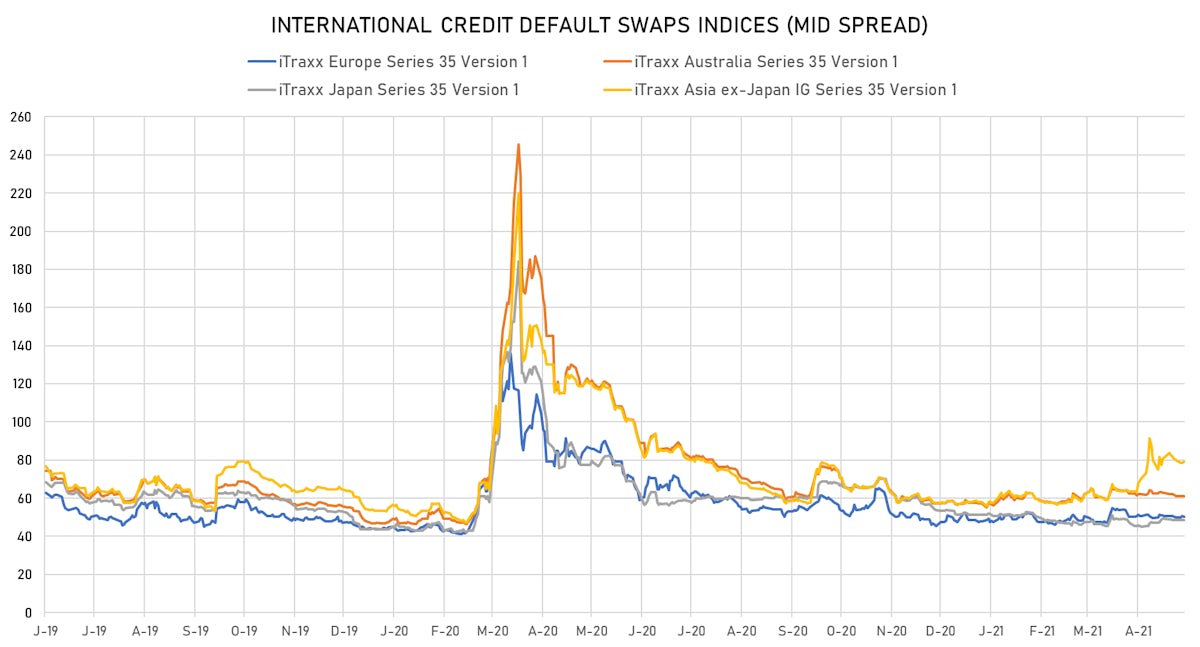

- Markit iTRAXX Europe up 0.7 bp, now at 51bp (YTD change: +3.1bp)

- Markit iTRAXX Japan down -0.4 bp, now at 48bp (YTD change: -3.3bp)

- Markit iTRAXX Asia Ex-Japan up 0.8 bp, now at 80bp (YTD change: +21.9bp)

TOP BONDS MOVERS - USD IG

- Issuer: Chongqing International Logistics Hub Park Construction Co Ltd (Chongqing, China (Mainland)) | Coupon: 4.30% | Maturity: 26/9/2024 | Rating: BBB- | ISIN: XS2050594238 | Option-adjusted spread up by 66.2 bp to 905.3 bp, with the yield to worst at 9.2% and the bond now trading down to 85.6 cents on the dollar (1Y price range: 85.0-100.0).

- Issuer: Shuifa International Holdings BVI Co Ltd (Jinan, British Virgin Islands) | Coupon: 4.30% | Maturity: 8/5/2023 | Rating: BBB+ | ISIN: XS2125151832 | Option-adjusted spread up by 36.5 bp to 624.3 bp, with the yield to worst at 6.3% and the bond now trading down to 96.1 cents on the dollar (1Y price range: 95.0-102.0).

- Issuer: Telefonica Chile SA (Providencia, Chile) | Coupon: 3.88% | Maturity: 12/10/2022 | Rating: BBB- | ISIN: USP9047EAA66 | Option-adjusted spread down by 35.2 bp to 101.0 bp, with the yield to worst at 1.2% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 103.2-105.1).

- Issuer: Huarong Finance 2019 Co Ltd (British Virgin Islands) | Coupon: 2.50% | Maturity: 24/2/2023 | Rating: BBB | ISIN: XS2122990570 | Option-adjusted spread down by 35.4 bp to 1,547.7 bp, with the yield to worst at 15.0% and the bond now trading up to 80.0 cents on the dollar (1Y price range: 62.0-101.8).

- Issuer: Guangxi Financial Investment Group Co Ltd (Nanning, China (Mainland)) | Coupon: 3.60% | Maturity: 18/11/2023 | Rating: BBB | ISIN: XS2226197429 | Option-adjusted spread down by 37.8 bp to 1,005.6 bp, with the yield to worst at 10.0% and the bond now trading up to 85.8 cents on the dollar (1Y price range: 82.0-100.0).

- Issuer: Huarong Finance 2019 Co Ltd (British Virgin Islands) | Coupon: 3.25% | Maturity: 13/11/2024 | Rating: BBB | ISIN: XS2076078513 | Option-adjusted spread down by 38.6 bp to 1,040.2 bp, with the yield to worst at 10.6% and the bond now trading up to 78.0 cents on the dollar (1Y price range: 62.0-105.7).

- Issuer: Huarong Finance II Co Ltd (British Virgin Islands) | Coupon: 5.50% | Maturity: 16/1/2025 | Rating: BBB | ISIN: XS1165659514 | Option-adjusted spread down by 39.8 bp to 1,159.1 bp, with the yield to worst at 11.5% and the bond now trading up to 81.5 cents on the dollar (1Y price range: 63.0-113.2).

- Issuer: Huarong Finance 2019 Co Ltd (British Virgin Islands) | Coupon: 3.75% | Maturity: 29/5/2024 | Rating: BBB | ISIN: XS2001732101 | Option-adjusted spread down by 48.1 bp to 1,236.0 bp, with the yield to worst at 12.0% and the bond now trading up to 78.5 cents on the dollar (1Y price range: 76.8-106.7).

- Issuer: Highmark Inc (Pittsburgh, Pennsylvania (US)) | Coupon: 6.13% | Maturity: 15/5/2041 | Rating: BBB | ISIN: USU43236AC96 | Option-adjusted spread down by 75.0 bp to 211.4 bp, with the yield to worst at 3.9% and the bond now trading up to 130.8 cents on the dollar (1Y price range: 115.1-130.9).

- Issuer: Kunming Traffic Investment Co Ltd (Kunming, China (Mainland)) | Coupon: 6.20% | Maturity: 27/6/2022 | Rating: BBB- | ISIN: XS2011522914 | Option-adjusted spread down by 219.1 bp to 656.4 bp, with the yield to worst at 6.3% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 97.3-101.5).

TOP BONDS MOVERS - USD HY

- Issuer: Grupo Aval Ltd (GEORGE TOWN, Cayman Islands) | Coupon: 4.38% | Maturity: 4/2/2030 | Rating: BB | ISIN: USG42045AC15 | Option-adjusted spread up by 28.0 bp to 350.5 bp, with the yield to worst at 4.8% and the bond now trading down to 96.3 cents on the dollar (1Y price range: 96.3-106.8).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Option-adjusted spread up by 18.6 bp to 259.7 bp, with the yield to worst at 3.6% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 106.3-113.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/4/2023 | Rating: BB- | ISIN: USU8759MAA28 | Option-adjusted spread up by 13.2 bp to 111.6 bp, with the yield to worst at 1.2% and the bond now trading down to 107.5 cents on the dollar (1Y price range: 105.3-107.8).

- Issuer: Turkiye Sise ve Cam Fabrikalari AS (Istanbul, Turkey) | Coupon: 6.95% | Maturity: 14/3/2026 | Rating: B | ISIN: XS1961010987 | Option-adjusted spread up by 12.1 bp to 358.7 bp (CDS basis: 244.4bp), with the yield to worst at 4.1% and the bond now trading down to 110.6 cents on the dollar (1Y price range: 105.1-112.6).

- Issuer: HPCL-Mittal Energy Ltd (Noida, India) | Coupon: 5.25% | Maturity: 28/4/2027 | Rating: BB- | ISIN: XS1599758940 | Option-adjusted spread up by 11.5 bp to 418.2 bp, with the yield to worst at 5.0% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 100.5-104.1).

- Issuer: Turkiye Sinai Kalkinma Bankasi AS (Istanbul, Turkey) | Coupon: 6.00% | Maturity: 23/1/2025 | Rating: B- | ISIN: XS2100270508 | Option-adjusted spread down by 11.0 bp to 541.2 bp, with the yield to worst at 5.6% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 96.0-103.5).

- Issuer: Bharti Airtel International Netherlands BV (Amsterdam, Netherlands) | Coupon: 5.35% | Maturity: 20/5/2024 | Rating: BB+ | ISIN: USN1384FAB15 | Option-adjusted spread down by 12.5 bp to 153.9 bp, with the yield to worst at 1.8% and the bond now trading up to 109.9 cents on the dollar (1Y price range: 109.1-111.3).

- Issuer: Fair Isaac Corp (San Jose, California (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | ISIN: USU2947RAA78 | Option-adjusted spread down by 14.8 bp to 178.1 bp, with the yield to worst at 2.4% and the bond now trading up to 111.8 cents on the dollar (1Y price range: 110.6-114.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Option-adjusted spread down by 19.4 bp to 174.4 bp, with the yield to worst at 1.9% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 106.5-108.8).

NOTABLE USD BOND ISSUES

- BOC Aviation (USA) Corp (Leasing | China (Mainland) | Rating: NR): US$250m Senior Note (US66980Q2B22), fixed rate (1.63% coupon) maturing on 29 April 2024, priced at 100.19 (original spread of 125 bp), callable (3nc3)

- Broadridge Financial Solutions Inc (Information/Data Technology | Lake Success, United States | Rating: BBB+): US$1,000m Senior Note (US11133TAE38), fixed rate (2.60% coupon) maturing on 1 May 2031, priced at 99.96 (original spread of 105 bp), callable (10nc10)

- CSI Financial Products Ltd (Financial - Other | China (Mainland) | Rating: NR): US$133m Unsecured Note (XS2342524613) zero coupon maturing on 10 May 2023, priced at 100.00, non callable

- Enn Clean Energy International Investment Ltd (Financial - Other | Langfang, China (Mainland) | Rating: NR): US$800m Senior Note (USG3065HAB71), fixed rate (3.38% coupon) maturing on 12 May 2026, priced at 99.66 (original spread of 265 bp), callable (5nc3)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$1,500m Senior Note (US298785JN70), fixed rate (1.63% coupon) maturing on 13 May 2031, priced at 99.62 (original spread of 9 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$725m Bond (US3133EMZA35), floating rate (SOFR + 3.5 bp) maturing on 12 May 2023, priced at 100.00, non callable

- Gol Finance SA (Financial - Other | Luxembourg, Brazil | Rating: NR): US$300m Note (USL4441RAD81), fixed rate (8.00% coupon) maturing on 30 June 2026, priced at 100.00, callable (5nc2)

- Golden Energy and Resources Ltd (Metals/Mining | Rating: B+): US$285m Note (XS2342227597), fixed rate (8.50% coupon) maturing on 14 May 2026, priced at 98.51, callable (5nc3)

- HLF Financing SARL LLC (Financial - Other | Los Angeles, Cayman Islands | Rating: BB-): US$600m Senior Note (US40390DAC92), fixed rate (4.88% coupon) maturing on 1 June 2029, priced at 100.00 (original spread of 364 bp), callable (8nc3)

- KB Kookmin Card Co Ltd (Financial - Other | Seoul, Seoul, South Korea | Rating: A): US$300m Senior Note (XS2332357099), fixed rate (1.50% coupon) maturing on 13 May 2026, priced at 99.90 (original spread of 73 bp), non callable

- Nordic Investment Bank (Supranational | Helsinki, Finland | Rating: AAA): US$700m Senior Note (US65562QBR56), floating rate (SOFR + 100.0 bp) maturing on 12 May 2026, priced at 104.09, non callable

- Powerlong Real Estate Holdings Ltd (Service - Other | Shanghai, Shanghai | Rating: BB-): US$200m Note (XS2341882913), fixed rate (4.90% coupon) maturing on 13 May 2026, priced at 99.13, callable (5nc3)

- Renewable Energy Group Inc (Oil and Gas | Ames, United States | Rating: BB): US$550m Note (US75972AAD54), fixed rate (5.88% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 465 bp), callable (7nc3)

- Sagicor Financial Company Ltd (Life Insurance | Saint Michael, Canada | Rating: NR): US$400m Senior Note (US78669QAA85), fixed rate (5.30% coupon) maturing on 13 May 2028, priced at 100.00 (original spread of 409 bp), callable (7nc3)

- Santander International Products PLC (Financial - Other | Spain | Rating: NR): US$100m Unsecured Note (XS2342038606) zero coupon maturing on 28 May 2061, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$209m Unsecured Note (XS2342623274) zero coupon maturing on 20 March 2051, priced at 47.90, non callable

- Tucson Electric Power Co (Utility - Other | Tucson, Canada | Rating: A-): US$325m Senior Note (US898813AT76), fixed rate (3.25% coupon) maturing on 1 May 2051, priced at 99.15 (original spread of 137 bp), callable (30nc29)

- Tullow Oil PLC (Oil and Gas | London, United Kingdom | Rating: CCC+): US$1,800m Note (US899415AG89), fixed rate (10.25% coupon) maturing on 15 May 2026, priced at 100.00 (original spread of 945 bp), callable (5nc2)

- Weir Group PLC (Machinery | Glasgow, United Kingdom | Rating: BB+): US$800m Senior Note (US94876QAA40), fixed rate (2.20% coupon) maturing on 13 May 2026, priced at 99.77 (original spread of 145 bp), callable (5nc5)

NOTABLE EUR BOND ISSUES

- Banque Internationale a Luxembourg SA (Banking | Luxembourg, China (Mainland) | Rating: A-): €100m Subordinated Note (XS2342592297), fixed rate (1.75% coupon) maturing on 18 August 2031, priced at 99.79, callable (10nc5)

- BNP Paribas Fortis Funding SA (Financial - Other | Luxembourg, France | Rating: NR): €100m Unsecured Note (XS2342233306) zero coupon maturing on 14 July 2031, priced at 100.00, non callable

- Emirates Telecommunications Group Company PJSC (Telecommunications | Abu Dhabi, United Arab Emirates | Rating: A+): €500m Senior Note (XS2339427747), fixed rate (0.38% coupon) maturing on 17 May 2028, priced at 99.74 (original spread of 89 bp), callable (7nc7)

- Emirates Telecommunications Group Company PJSC (Telecommunications | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: A+): €500m Senior Note (XS2339427820), fixed rate (0.88% coupon) maturing on 17 May 2033, priced at 98.39 (original spread of 124 bp), callable (12nc12)

- Euronext NV (Securities | Amsterdam, Netherlands | Rating: BBB): €600m Senior Note (DK0030486402), fixed rate (0.75% coupon) maturing on 17 May 2031, priced at 99.95 (original spread of 99 bp), callable (10nc10)

- Euronext NV (Securities | Amsterdam, Netherlands | Rating: BBB): €600m Senior Note (DK0030486592), fixed rate (1.50% coupon) maturing on 17 May 2041, priced at 98.30 (original spread of 153 bp), callable (20nc20)

- Euronext NV (Securities | Amsterdam, Netherlands | Rating: BBB): €600m Senior Note (DK0030485271), fixed rate (0.13% coupon) maturing on 17 May 2026, priced at 99.89 (original spread of 75 bp), callable (5nc5)

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): €100m Unsecured Note (XS2342594822), fixed rate (0.35% coupon) maturing on 19 May 2031, priced at 100.00, non callable

- Imerys SA (Metals/Mining | Paris, Ile-De-France, Belgium | Rating: BBB-): €300m Senior Note (FR0014003GX7), fixed rate (1.00% coupon) maturing on 15 July 2031, priced at 99.37 (original spread of 130 bp), callable (10nc10)

- Kommunalkredit Austria AG (Banking | Wien | Rating: BBB-): €300m Inhaberschuldverschreibung (AT0000A2R9G1), fixed rate (0.25% coupon) maturing on 14 May 2024, priced at 99.72 (original spread of 105 bp), non callable

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): €100m Index Linked Security (AT0000A2RA85) zero coupon maturing on 25 June 2029, priced at 100.00, non callable

- Sagax EURO MTN NL BV (Financial - Other | Rotterdam, Sweden | Rating: NR): €300m Senior Note (XS2342227837), fixed rate (1.00% coupon) maturing on 17 May 2029, priced at 99.66 (original spread of 144 bp), callable (8nc8)

- Sparebank 1 Boligkreditt As (Mortgage Banking | Stavanger, Norway | Rating: A): €1,000m Unsecured Note (XS2342589582), fixed rate (1.00% coupon) maturing on 12 May 2031, priced at 100.00, non callable

- TUI Cruises GmbH (Transportation - Other | Hamburg, Germany | Rating: NR): €300m Senior Note (XS2342247512), fixed rate (6.50% coupon) maturing on 15 May 2026, priced at 100.00 (original spread of 711 bp), callable (5nc2)

- Verallia SAS (Financial - Other | Courbevoie, France | Rating: BB+): €500m Bond (FR0014003G27), fixed rate (1.63% coupon) maturing on 14 May 2028, priced at 100.00 (original spread of 186 bp), callable (7nc7)

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): €1,000m Subordinated Note (XS2342206591), fixed rate (0.77% coupon) maturing on 13 May 2031, priced at 100.00 (original spread of 137 bp), callable (10nc5)

NEW ISSUES IN LOANS

- Altaba, signed a US$ 1,500m Term Loan, to be used for a leveraged buyout, and also signed a US$ 150m Revolving Credit Facility

- SM Prime Holdings Inc, signed a US$ 300m Term Loan, to be used for general corporate purposes. It matures on 05/06/26 and initial pricing is set at Other +165.000bps

NEW ISSUES IN STRUCTURED CREDIT

- Trinity Green Railcar 2021-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 355 m. Highest-rated tranche offering a yield to maturity of 2.07%, and the lowest-rated tranche a yield to maturity of 3.06%. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc,

Wells Fargo Securities LLC,

Credit Agricole Corporate & Investment Bank - Wepco Environmental Trust Finance I LLC issued a fixed-rate ABS backed by certificates in 1 tranche, for a total of US$ 119 m. The single tranche offers a yield to maturity of 1.58%. Bookrunners: Barclays Capital Group

- Freddie Mac Spc K-742 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 788 m. Highest-rated tranche offering a yield to maturity of 0.86%, and the lowest-rated tranche a yield to maturity of 1.30%. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group