Credit

Credit Spreads Narrow As Market Expects Continued Support From The Fed

Pretty quiet primary market, though a few European companies priced €500m+ bonds on Friday

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 342.0 bp (YTD change: -48.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.6%)

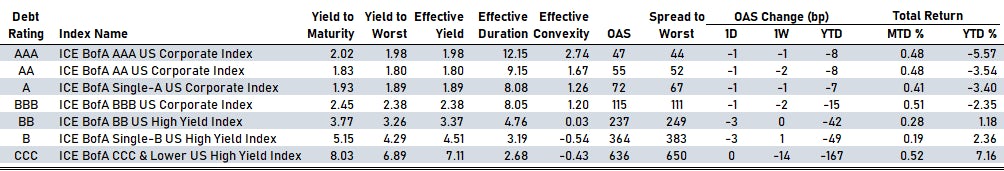

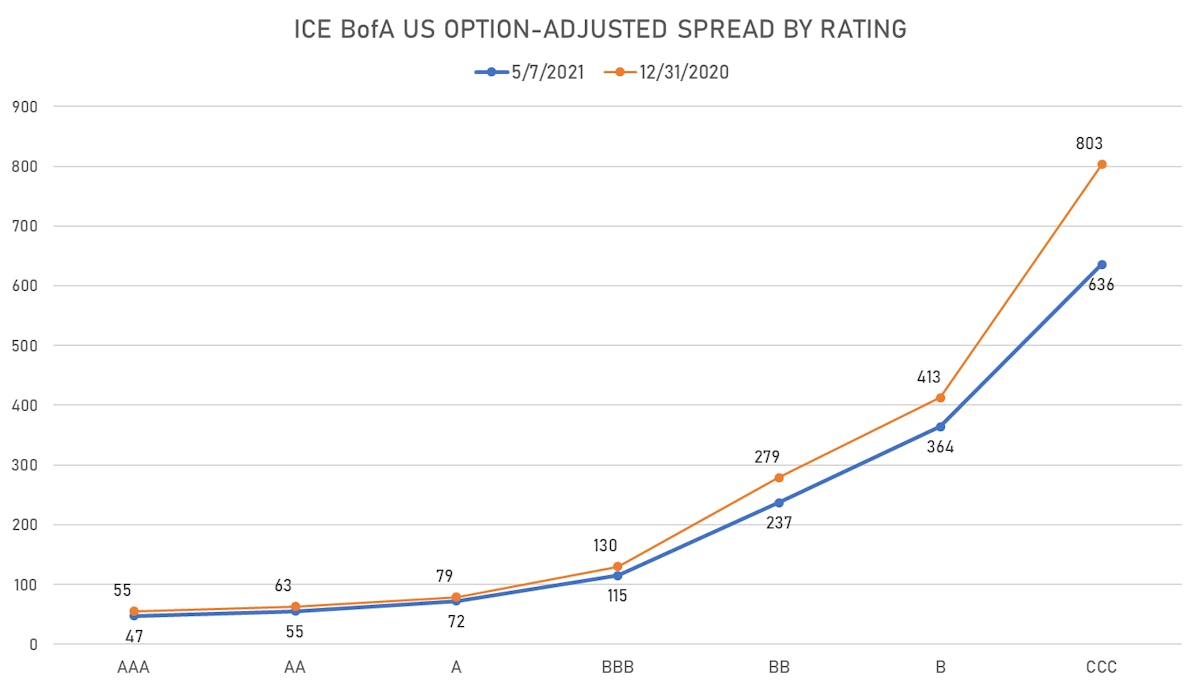

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA down by -1 bp at 55 bp

- A down by -1 bp at 72 bp

- BBB down by -1 bp at 115 bp

- BB down by -3 bp at 237 bp

- B down by -3 bp at 364 bp

- CCC unchanged at 636 bp

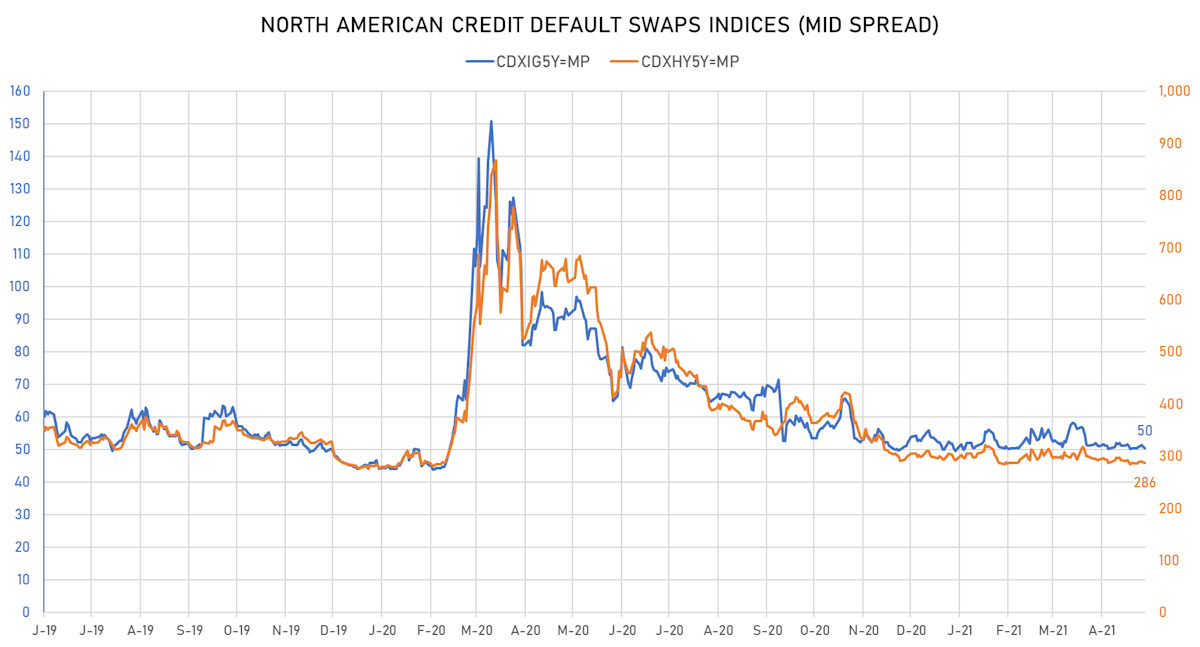

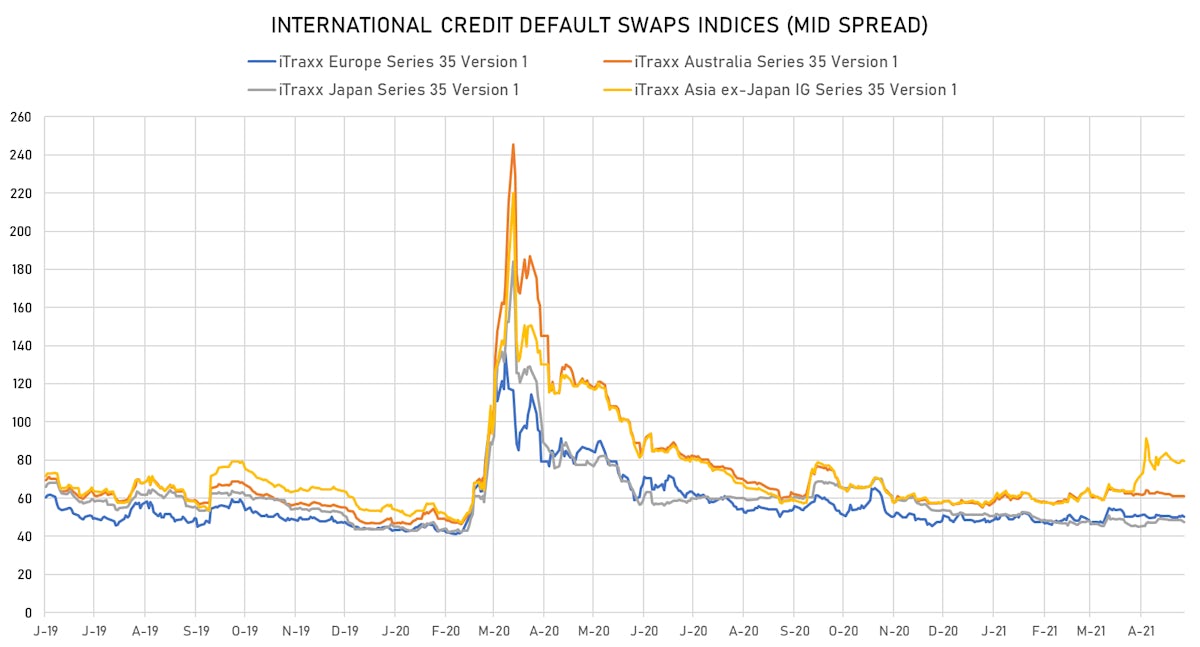

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down -0.9 bp, now at 50bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y up -3.0 bp, now at 286bp (YTD change: -6.8bp)

- Markit iTRAXX Europe down -0.8 bp, now at 50bp (YTD change: +2.3bp)

- Markit iTRAXX Japan down -0.5 bp, now at 48bp (YTD change: -3.8bp)

- Markit iTRAXX Asia Ex-Japan down -0.5 bp, now at 80bp (YTD change: +21.5bp)

USD BOND ISSUES

- Athomstart Invest 555 AS (Financial - Other | Oslo, Norway | Rating: NR): US$165m Bond (NO0010991987), floating rate (USD 3M LIBOR + 850.0 bp) maturing on 12 May 2025, callable (4nc2)

- CSI Financial Products Ltd (Financial - Other | China (Mainland) | Rating: NR): US$133m Unsecured Note (XS2342524613) zero coupon maturing on 10 May 2023, priced at 100.00, non callable

- Hyundai Motor Securities Co Ltd (Securities | Seoul, South Korea | Rating: NR): US$100m Index Linked Security (KR6HM0000380) zero coupon maturing on 9 May 2024, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$100m Unsecured Note (XS2217033161), fixed rate (2.24% coupon) maturing on 20 June 2026, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$209m Unsecured Note (XS2342623274) zero coupon maturing on 20 March 2051, priced at 47.90, non callable

EUR BOND ISSUES

- Andalucia, Autonomous Community of (Official and Muni | Sevilla, Sevilla, Spain | Rating: BBB-): €125m Bond (ES0000090862), fixed rate (1.55% coupon) maturing on 11 May 2051, priced at 100.00, non callable

- Andalucia, Autonomous Community of (Official and Muni | Sevilla, Sevilla, Spain | Rating: BBB): €100m Bond (ES0000090870), fixed rate (1.85% coupon) maturing on 13 May 2061, priced at 100.00, non callable

- BNP Paribas Fortis Funding SA (Financial - Other | Luxembourg, France | Rating: NR): €100m Unsecured Note (XS2342233306) zero coupon maturing on 14 July 2031, priced at 100.00, non callable

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): €156m Unsecured Note (XS1273453412) zero coupon maturing on 20 May 2056, priced at 44.35, non callable

- EQT AB (Financial - Other | Stockholm, Stockholm, Sweden | Rating: A-): €500m Senior Note (XS2338570331), fixed rate (0.88% coupon) maturing on 14 May 2031, priced at 99.20 (original spread of 118 bp), callable (10nc10)

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): €500m Inhaberschuldverschreibung (AT0000A2RAA0), fixed rate (0.13% coupon) maturing on 17 May 2028, priced at 99.23 (original spread of 72 bp), non callable

- Golden Goose SpA (Retail Stores - Other | Milan, United Kingdom | Rating: B-): €480m Note (XS2342638033), floating rate (EU03MLIB + 487.5 bp) maturing on 14 May 2027, priced at 98.00, callable (6nc2)

- Mahle GmbH (Industrials - Other | Stuttgart, Baden-Wuerttemberg, Germany | Rating: BB+): €750m Senior Note (XS2341724172), fixed rate (2.38% coupon) maturing on 14 May 2028, priced at 100.00 (original spread of 300 bp), callable (7nc7)

- Nord Lb Covered Finance Bank SA (Banking | Findel, Luxembourg | Rating: NR): €150m Unsecured Note (XS2342987711), floating rate maturing on 12 May 2023, priced at 100.00, non callable

- Region of Bruxelles-Capitale (Official and Muni | Brussels, Bruxelles-Capitale, Belgium | Rating: AA-): €131m Bond (BE0002790716), fixed rate (1.22% coupon) maturing on 23 June 2053, non callable

- Rexel SA (Retail Stores - Other | Paris, Ile-De-France, France | Rating: BB): €100m Senior Note (XS2342579278), fixed rate (2.13% coupon) maturing on 15 June 2028, priced at 100.88, callable (7nc3)

NEW ISSUES IN LOANS

- Univision Communications (B), signed a US$ 1,050m Term Loan, to be used for acquisition financing. It matures on 05/07/28 and initial pricing is set at LIBOR +325bps

- Mack-Cali Realty Corp (B+), signed a US$ 150m Term Loan, as well as a US$ 250m Revolving Credit Facility, both to be used for general corporate purposes.

- Ivy Hill Middle Market XVII, signed a US$ 250m Revolving Credit Facility, to be used for acquisition financing. It matures on 02/24/26 and initial pricing is set at LIBOR +237.5bps

- Aliplast Belgium SA/NV, signed a € 629m Term Loan B, to be used for a leveraged buyout. It matures on 05/21/28.

NEW ISSUES IN STRUCTURED CREDIT

- Upstart Securitization Trust 2021-2 issued a fixed-rate CLO in 3 tranches, for a total of US$ 476 m. Highest-rated tranche offering a yield to maturity of 0.91%, and the lowest-rated tranche a yield to maturity of 3.61%. Bookrunners: Goldman Sachs & Co

- Trinity Green Railcar 2021-1 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 355 m. Highest-rated tranche offering a yield to maturity of 2.07%, and the lowest-rated tranche a yield to maturity of 3.06%. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc, Wells Fargo Securities LLC, Credit Agricole Corporate & Investment Bank

- Wepco Environmental Trust Finance I LLC issued a fixed-rate ABS backed by certificates in 1 tranche, offering a yield to maturity of 1.58%. Bookrunners: Barclays Capital Group

- Freddie Mac Spc Series K-F110 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 850 m, offering a spread over the floating rate of 24bp. Bookrunners: Morgan Stanley International Ltd, Bank of America Merrill Lynch

- Freddie Mac Spc K-742 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 788 m. Highest-rated tranche offering a yield to maturity of 0.86%, and the lowest-rated tranche a yield to maturity of 1.30%. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group

TOP BONDS MOVERS - USD IG

- Issuer: Inversiones CMPC SA (Cayman Islands Branch) (Cayman Islands) | Coupon: 4.38% | Maturity: 15/5/2023 | Rating: BBB- | ISIN: USP58072AG71 | Option-adjusted spread up by 20.6 bp to 104.9 bp, with the yield to worst at 1.2% and the bond now trading down to 105.4 cents on the dollar (1Y price range: 104.1-106.6).

- Issuer: Falabella SA (Santiago, Chile) | Coupon: 3.75% | Maturity: 30/4/2023 | Rating: BBB | ISIN: USP82290AA81 | Option-adjusted spread up by 19.9 bp to 119.1 bp, with the yield to worst at 1.2% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: Telefonica Chile SA (Providencia, Chile) | Coupon: 3.88% | Maturity: 12/10/2022 | Rating: BBB- | ISIN: USP9047EAA66 | Option-adjusted spread up by 18.0 bp to 118.6 bp, with the yield to worst at 1.3% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.2-105.1).

- Issuer: China Huadian Overseas Development 2018 Ltd (Beijing, British Virgin Islands) | Coupon: 3.88% | Maturity: 17/5/2023 | Rating: A | ISIN: XS1822346646 | Option-adjusted spread up by 17.8 bp to 102.2 bp, with the yield to worst at 1.2% and the bond now trading down to 105.2 cents on the dollar (1Y price range: 105.1-106.3).

- Issuer: Nan Fung Treasury Ltd (British Virgin Islands) | Coupon: 4.50% | Maturity: 20/9/2022 | Rating: BBB- | ISIN: XS0831371264 | Option-adjusted spread down by 19.2 bp to 139.7 bp, with the yield to worst at 1.5% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 103.2-104.3).

- Issuer: Lukoil International Finance BV (Amsterdam, Netherlands) | Coupon: 6.66% | Maturity: 7/6/2022 | Rating: BBB | ISIN: XS0304274599 | Option-adjusted spread down by 23.4 bp to 82.6 bp, with the yield to worst at 0.8% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 105.7-108.0).

- Issuer: Shuifa International Holdings BVI Co Ltd (Jinan, British Virgin Islands) | Coupon: 4.15% | Maturity: 17/9/2022 | Rating: BBB+ | ISIN: XS2049886174 | Option-adjusted spread down by 27.9 bp to 459.8 bp, with the yield to worst at 4.7% and the bond now trading up to 99.2 cents on the dollar (1Y price range: 98.5-101.7).

- Issuer: Fujian Zhanglong Group Co Ltd (Zhangzhou, China (Mainland)) | Coupon: 5.88% | Maturity: 26/8/2022 | Rating: BBB- | ISIN: XS2040322898 | Option-adjusted spread down by 29.5 bp to 300.3 bp, with the yield to worst at 2.9% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 103.0-104.3).

- Issuer: Consorcio Transmantaro SA (San Isidro, Peru) | Coupon: 4.38% | Maturity: 7/5/2023 | Rating: BBB- | ISIN: USP3083SAC90 | Option-adjusted spread down by 30.5 bp to 182.1 bp, with the yield to worst at 1.8% and the bond now trading up to 104.5 cents on the dollar (1Y price range: 102.9-106.8).

TOP BONDS MOVERS - USD HY

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Option-adjusted spread up by 15.5 bp to 635.7 bp, with the yield to worst at 6.5% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 93.6-100.4).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 5.00% | Maturity: 30/4/2023 | Rating: BB- | ISIN: USU2928LAA36 | Option-adjusted spread up by 15.1 bp to 202.0 bp, with the yield to worst at 2.0% and the bond now trading down to 104.6 cents on the dollar (1Y price range: 103.8-105.8).

- Issuer: Uralkali Finance DAC (DUBLIN, Ireland) | Coupon: 4.00% | Maturity: 22/10/2024 | Rating: BB- | ISIN: XS2010040397 | Option-adjusted spread up by 14.2 bp to 226.4 bp, with the yield to worst at 2.6% and the bond now trading down to 104.1 cents on the dollar (1Y price range: 103.1-104.4).

- Issuer: Banco Bradesco SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 3.20% | Maturity: 27/1/2025 | Rating: BB- | ISIN: US05947LAZ13 | Option-adjusted spread down by 17.1 bp to 181.3 bp (CDS basis: 0.1bp), with the yield to worst at 2.2% and the bond now trading up to 102.9 cents on the dollar (1Y price range: 101.8-105.0).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Option-adjusted spread down by 17.6 bp to 262.0 bp, with the yield to worst at 2.7% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 104.0-108.3).

- Issuer: Turk Telekomunikasyon AS (Istanbul, Turkey) | Coupon: 6.88% | Maturity: 28/2/2025 | Rating: BB- | ISIN: XS1955059420 | Option-adjusted spread down by 21.0 bp to 360.0 bp, with the yield to worst at 3.9% and the bond now trading up to 109.5 cents on the dollar (1Y price range: 105.1-112.4).

- Issuer: MHP SE (Kiev, Ukraine) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Option-adjusted spread down by 24.3 bp to 508.5 bp, with the yield to worst at 5.2% and the bond now trading up to 106.4 cents on the dollar (1Y price range: 103.4-110.0).

- Issuer: Grupo Aval Ltd (GEORGE TOWN, Cayman Islands) | Coupon: 4.38% | Maturity: 4/2/2030 | Rating: BB | ISIN: USG42045AC15 | Option-adjusted spread down by 25.2 bp to 313.6 bp, with the yield to worst at 4.4% and the bond now trading up to 98.9 cents on the dollar (1Y price range: 96.3-106.8).

- Issuer: Turkiye Is Bankasi AS (Istanbul, Turkey) | Coupon: 6.13% | Maturity: 25/4/2024 | Rating: B- | ISIN: XS1578203462 | Option-adjusted spread down by 38.9 bp to 470.0 bp (CDS basis: 125.6bp), with the yield to worst at 4.7% and the bond now trading up to 102.9 cents on the dollar (1Y price range: 97.0-105.0).

TOP BONDS MOVERS - EUR IG

- Issuer: Zapadoslovenska Energetika as (Bratislava, Slovakia) | Coupon: 4.00% | Maturity: 14/10/2023 | Rating: A- | ISIN: XS0979598462 | Option-adjusted spread up by 1.6 bp to 80.9 bp (CDS basis: -56.1 bp), with the yield to worst at 0.3% and the bond now trading down to 108.8 cents on the dollar (1Y price range: 108.6-110.9).

- Issuer: Sumitomo Mitsui Financial Group Inc (Chiyoda-Ku, Japan) | Coupon: 0.82% | Maturity: 23/7/2023 | Rating: A- | ISIN: XS1839105662 | Option-adjusted spread down by 1.4 bp to 24.4 bp, with the yield to worst at -0.2% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 102.1-102.6).

- Issuer: Lansforsakringar Bank AB (Stockholm, Sweden) | Coupon: 0.88% | Maturity: 25/9/2023 | Rating: A | ISIN: XS1883278183 | Option-adjusted spread down by 1.5 bp to 26.1 bp, with the yield to worst at -0.2% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 102.2-102.7).

- Issuer: KBC Groep NV (Brussels, Belgium) | Coupon: 0.75% | Maturity: 18/10/2023 | Rating: BBB+ | ISIN: BE0002266352 | Option-adjusted spread down by 1.6 bp to 23.0 bp, with the yield to worst at -0.3% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 102.1-102.6).

- Issuer: Daimler AG (Stuttgart, Germany) | Coupon: 1.63% | Maturity: 22/8/2023 | Rating: BBB+ | ISIN: DE000A289XH6 | Option-adjusted spread down by 1.6 bp to 30.5 bp (CDS basis: -6.6 bp), with the yield to worst at -0.2% and the bond now trading up to 104.1 cents on the dollar (1Y price range: 104.0-104.5).

- Issuer: Telstra Corporation Ltd (Melbourne, Australia) | Coupon: 2.50% | Maturity: 15/9/2023 | Rating: A- | ISIN: XS0903136736 | Option-adjusted spread down by 1.7 bp to 21.7 bp (CDS basis: 0.5 bp), with the yield to worst at -0.3% and the bond now trading up to 106.4 cents on the dollar (1Y price range: 106.2-107.2).

- Issuer: Iberdrola International BV (Amsterdam, Netherlands) | Coupon: 1.75% | Maturity: 17/9/2023 | Rating: BBB+ | ISIN: XS1291004270 | Option-adjusted spread down by 1.8 bp to 17.5 bp (CDS basis: 0.4 bp), with the yield to worst at -0.3% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 104.7-105.3).

- Issuer: SSE PLC (Perth, United Kingdom) | Coupon: 1.75% | Maturity: 8/9/2023 | Rating: BBB+ | ISIN: XS1287779208 | Option-adjusted spread down by 1.9 bp to 24.4 bp (CDS basis: -2.8 bp), with the yield to worst at -0.2% and the bond now trading up to 104.6 cents on the dollar (1Y price range: 104.5-105.2).

- Issuer: Deutsche Bahn Finance GmbH (Berlin, Germany) | Coupon: 2.50% | Maturity: 12/9/2023 | Rating: AA- | ISIN: XS0969368934 | Option-adjusted spread down by 2.5 bp to 15.9 bp (CDS basis: -3.8 bp), with the yield to worst at -0.3% and the bond now trading up to 106.6 cents on the dollar (1Y price range: 106.5-107.4).

TOP BONDS MOVERS - EUR HY

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Option-adjusted spread up by 8.1 bp to 134.2 bp, with the yield to worst at 0.9% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Option-adjusted spread up by 7.4 bp to 382.1 bp, with the yield to worst at 3.4% and the bond now trading down to 91.0 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Option-adjusted spread up by 5.0 bp to 364.2 bp (CDS basis: -10.7bp), with the yield to worst at 3.2% and the bond now trading down to 81.1 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: Metro AG (Dusseldorf, Germany) | Coupon: 1.50% | Maturity: 19/3/2025 | Rating: BB+ | ISIN: XS1203941775 | Option-adjusted spread down by 4.9 bp to 93.7 bp, with the yield to worst at 0.5% and the bond now trading up to 103.5 cents on the dollar (1Y price range: 103.0-103.7).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Option-adjusted spread down by 5.3 bp to 298.6 bp, with the yield to worst at 2.7% and the bond now trading up to 107.8 cents on the dollar (1Y price range: 105.2-111.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Option-adjusted spread down by 5.9 bp to 475.4 bp (CDS basis: -68.5bp), with the yield to worst at 4.5% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Option-adjusted spread down by 6.0 bp to 443.3 bp (CDS basis: -57.6bp), with the yield to worst at 4.1% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | Option-adjusted spread down by 6.7 bp to 292.9 bp, with the yield to worst at 2.5% and the bond now trading up to 113.7 cents on the dollar (1Y price range: 110.1-116.4).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Option-adjusted spread down by 18.3 bp to 187.6 bp, with the yield to worst at 1.4% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 98.9-102.9).