Credit

Spreads Wider Across The Credit Complex, With Single-Bs and CCCs Up By Double Digits

Another decent day for the primary market, with multi-tranches offerings from Charles Schwab, CenterPoint Energy, Volkswagen

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.3% today, with investment grade down -0.2% and high yield down -0.3% (YTD total return: -3.3%)

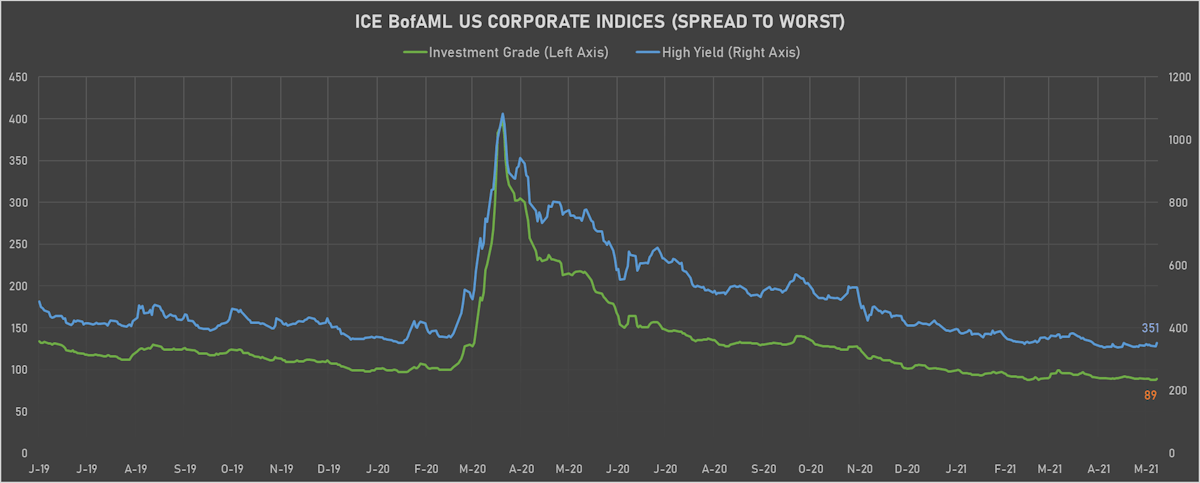

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst up 10.0 bp, now at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.1% today (YTD total return: +1.6%)

- New issues: US$ 17.6bn in dollars and € 12.2bn in euros

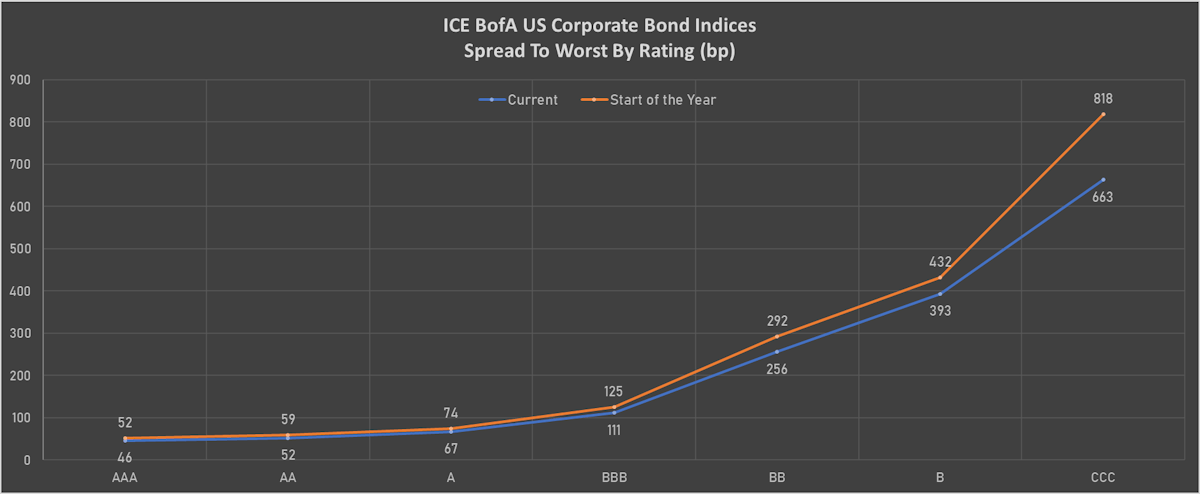

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 49 bp

- AA up by 1 bp at 56 bp

- A unchanged at 72 bp

- BBB up by 1 bp at 116 bp

- BB up by 7 bp at 243 bp

- B up by 13 bp at 374 bp

- CCC up by 11 bp at 648 bp

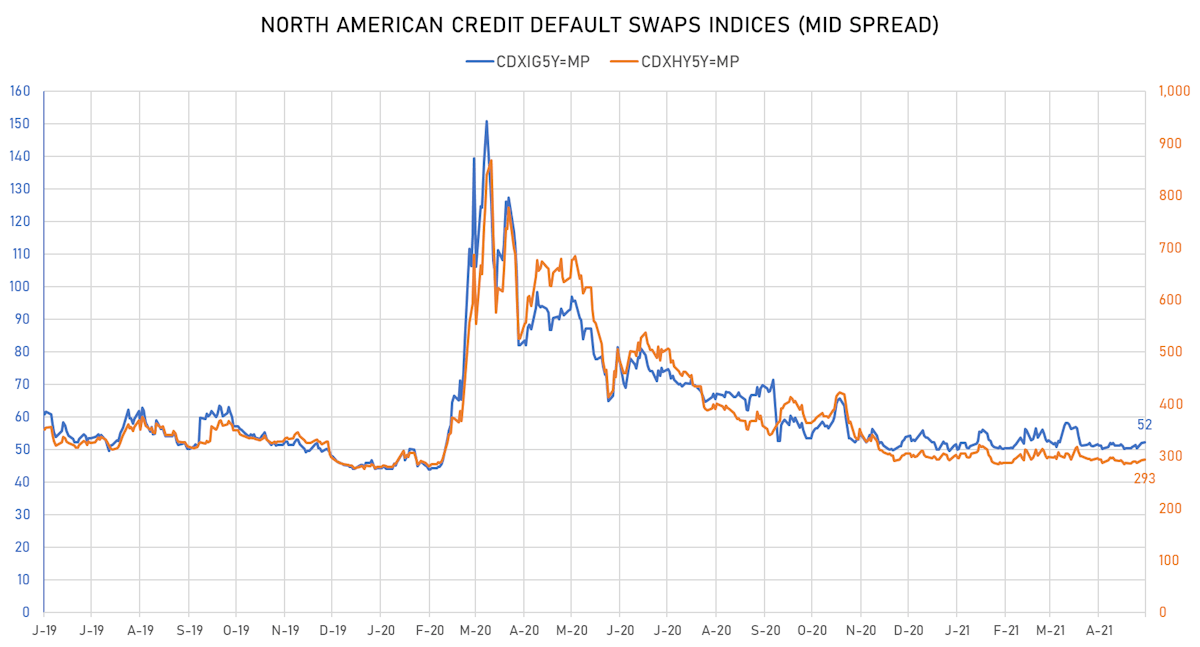

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 52bp (YTD change: +2.2bp)

- Markit CDX.NA.HY 5Y up 2.1 bp, now at 293bp (YTD change: +0.1bp)

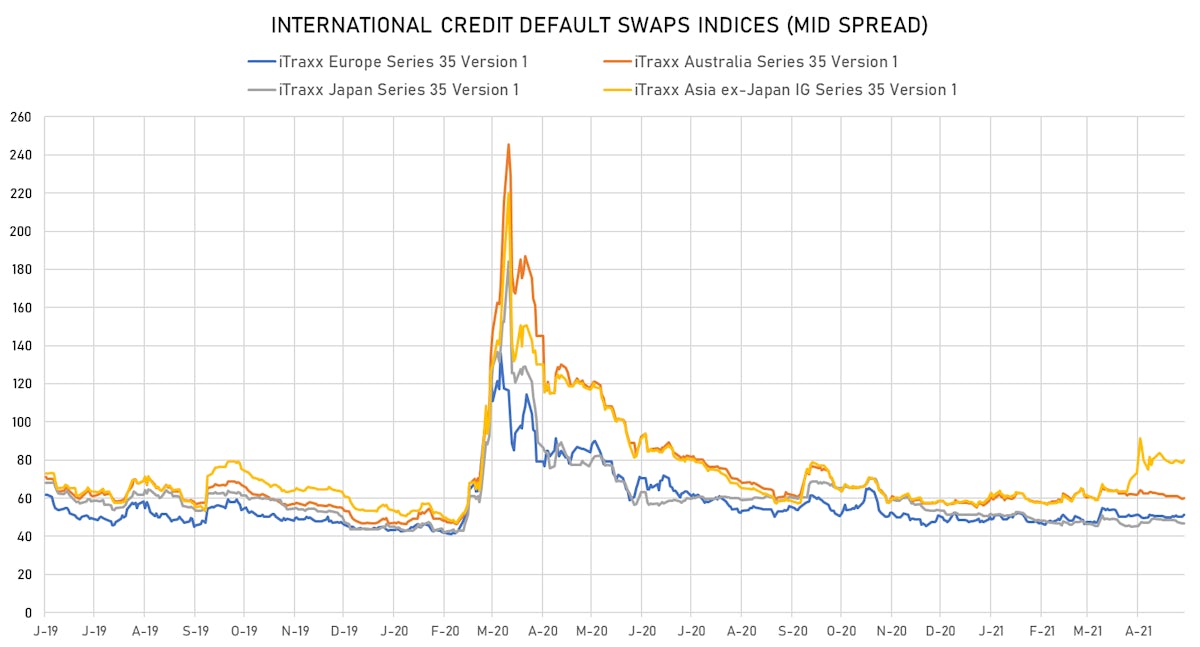

- Markit iTRAXX Europe up 1.1 bp, now at 51bp (YTD change: +3.3bp)

- Markit iTRAXX Japan up 0.3 bp, now at 47bp (YTD change: -4.4bp)

- Markit iTRAXX Asia Ex-Japan up 1.4 bp, now at 80bp (YTD change: +21.9bp)

NEW USD BOND ISSUES

- Automatic Data Processing Inc (Service - Other | Roseland, New Jersey, United States | Rating: AA-): US$1,000m Senior Note (US053015AG87), fixed rate (1.70% coupon) maturing on 15 May 2028, priced at 99.70 (original spread of 48 bp), callable (7nc7)

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$2,000m Senior Note (US05591F2K56), fixed rate (0.88% coupon) maturing on 18 May 2026, priced at 99.79 (original spread of 12 bp), non callable

- Brookfield Residential Properties Inc (Home Builders | Calgary, Alberta, Canada | Rating: B+): US$350m Senior Note (US11283YAG52), fixed rate (5.00% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 358 bp), callable (8nc3)

- Canada (Government) (Sovereign | Ottawa, Ontario, Canada | Rating: AAA): US$3,500m Bond (US427028AB18), fixed rate (0.75% coupon) maturing on 19 May 2026, priced at 99.49 (original spread of 6 bp), non callable

- CenterPoint Energy Inc (Utility - Other | Houston, Texas, United States | Rating: BBB): US$500m Senior Note (US15189TBA43), fixed rate (1.45% coupon) maturing on 1 June 2026, priced at 99.77 (original spread of 70 bp), callable (5nc5)

- CenterPoint Energy Inc (Utility - Other | Houston, United States | Rating: BBB): US$500m Senior Note (US15189TBB26), fixed rate (2.65% coupon) maturing on 1 June 2031, priced at 99.81 (original spread of 105 bp), callable (10nc10)

- CenterPoint Energy Inc (Utility - Other | Houston, Texas, United States | Rating: BBB): US$700m Senior Note (US15189TAZ03), floating rate (SOFR + 65.0 bp) maturing on 13 May 2024, priced at 100.00, callable (3nc1)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A): US$1,000m Senior Note (US808513BR53), fixed rate (1.15% coupon) maturing on 13 May 2026, priced at 99.77 (original spread of 40 bp), callable (5nc5)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A): US$750m Senior Note (US808513BS37), fixed rate (2.30% coupon) maturing on 13 May 2031, priced at 99.81 (original spread of 70 bp), callable (10nc10)

- Charles Schwab Corp (Securities | Westlake, Texas, United States | Rating: A): US$500m Senior Note (US808513BQ70), floating rate (SOFR + 52.0 bp) maturing on 13 May 2026, priced at 100.00, callable (5nc5)

- Citigroup Global Markets Funding Luxembourg SCA (Financial - Other | Bertrange, United States | Rating: A+): US$100m Unsecured Note (XS2338430759), fixed rate (5.03% coupon) maturing on 20 May 2036, priced at 100.00, non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$500m Senior Note (US29878TFE91), floating rate (SOFR + 100.0 bp) maturing on 21 May 2028, priced at 105.13, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$225m Bond (US3133EMZN55), floating rate (AB3DM + 3.5 bp) maturing on 17 May 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$300m Bond (US3133EMZM72), floating rate (FFQ + 0.0 bp) maturing on 17 February 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$280m Bond (US3133EMZP04), fixed rate (0.14% coupon) maturing on 18 May 2023, priced at 100.00, callable (2nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$600m Bond (US3133EMZL99), floating rate (SOFR + 2.0 bp) maturing on 14 March 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$100m Bond (US3130AMHQ85), fixed rate (0.63% coupon) maturing on 27 February 2025, priced at 100.00 (original spread of 61 bp), callable (4nc3m)

- Goldman Sachs International (Financial - Other | London, United States | Rating: A+): US$100m Unsecured Note (XS2230893484) zero coupon maturing on 26 May 2041, non callable

- Jiayuan International Group Ltd (Industrials - Other | Rating: B-): US$130m Senior Note (XS2333154867), fixed rate (11.00% coupon) maturing on 17 February 2024, priced at 96.64, non callable

- Kaiser Aluminum Corp (Metals/Mining | Foothill Ranch, California, United States | Rating: BB): US$550m Senior Note (US483007AL48), fixed rate (4.50% coupon) maturing on 1 June 2031, priced at 100.00 (original spread of 288 bp), callable (10nc5)

- Korea Development Bank (London Branch) (Banking | South Korea | Rating: AA-): US$200m Unsecured Note (XS2343844903), fixed rate (1.15% coupon) maturing on 18 May 2026, priced at 100.00, non callable

- Ngd Holdings BV (Financial - Other | Amsterdam, Noord-Holland, Netherlands | Rating: NR): US$425m Bond (XS2342932576), fixed rate (6.75% coupon) maturing on 31 December 2200, priced at 100.00, non callable

- Oaktree Specialty Lending Corp (Financial - Other | Los Angeles, California, United States | Rating: BBB-): US$350m Senior Note (US67401PAC23), fixed rate (2.70% coupon) maturing on 15 January 2027, priced at 99.72 (original spread of 195 bp), with a make whole call

- Park Intermediate Holdings LLC (Financial - Other | Tysons Corner, United States | Rating: NR): US$750m Note (US70052LAC72), fixed rate (4.88% coupon) maturing on 15 May 2029, priced at 100.00 (original spread of 346 bp), callable (8nc3)

- Polar Us Borrower LLC (Financial - Other | Rating: CCC+): US$300m Senior Note (US73103PAA57), fixed rate (6.75% coupon) maturing on 15 May 2026, priced at 100.00 (original spread of 608 bp), callable (5nc2)

- Rady Children's Hospital San Diego (Health Care Facilities | San Diego, California, United States | Rating: NR): US$300m Bond (US75063MAA53), fixed rate (3.15% coupon) maturing on 15 August 2051, priced at 100.00 (original spread of 80 bp), callable (30nc29)

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): US$100m Index Linked Security (AT0000A2RAR4) zero coupon maturing on 1 July 2026, priced at 100.00, non callable

- Samsung Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$100m Index Linked Security (KR6SS0001E12) zero coupon maturing on 20 May 2036, priced at 100.00, non callable

- Studio City Finance Ltd (Financial - Other | Tortola, Hong Kong | Rating: NR): US$350m Senior Note (USG85381AH78), fixed rate (5.00% coupon) maturing on 15 January 2029, priced at 101.50, callable (8nc3)

- Tokyo Metropolitan Government (Official and Muni | Shinjuku, Tokyo-To, Japan | Rating: A+): US$1,000m Bond (US59173LAE02), fixed rate (1.13% coupon) maturing on 20 May 2026, priced at 99.96 (original spread of 33 bp), non callable

NEW EUR BOND ISSUES

- Afflelou SAS (Financial - Other | Paris, Ile-De-France | Rating: B): €410m Note (XS2342910929), fixed rate (4.25% coupon) maturing on 19 May 2026, priced at 100.00 (original spread of 480 bp), callable (5nc2)

- Asb Finance Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €750m Covered Bond (Other) (XS2343772724), fixed rate (0.25% coupon) maturing on 21 May 2031, priced at 99.76 (original spread of 44 bp), non callable

- Bank of Ireland (Banking | Dublin, Dublin, Ireland | Rating: BBB+): €500m Unsecured Note (XS2342034449), fixed rate (1.68% coupon) maturing on 11 August 2031, priced at 100.00, non callable

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: AA): €750m Hypothekenpfandbrief (Covered Bond) (DE000BHY0HW9), fixed rate (0.25% coupon) maturing on 19 May 2033, priced at 99.86 (original spread of 43 bp), non callable

- Eurofins Scientific SE (Service - Other | Luxembourg, Luxembourg | Rating: BBB-): €750m Bond (XS2343114687), fixed rate (0.88% coupon) maturing on 19 May 2031, priced at 98.50 (original spread of 120 bp), callable (10nc10)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €3,000m Euro Area Reference Note (XS2343538372) zero coupon maturing on 28 September 2028, priced at 101.12 (original spread of 24 bp), non callable

- Finnair Oyj (Airline | Vantaa, Etela-Suomen, Finland | Rating: NR): €400m Bond (FI4000507132), fixed rate (4.25% coupon) maturing on 19 May 2025, priced at 99.72 (original spread of 503 bp), callable (4nc4)

- International Consolidated Airlines Group SA (Airline | London, United Kingdom | Rating: BB): €825m Bond (XS2343113101), fixed rate (1.13% coupon) maturing on 18 May 2028, priced at 100.00, non callable, convertible

- Kellogg Co (Food Processors | Battle Creek, Michigan, United States | Rating: BBB): €300m Senior Note (XS2343510520), fixed rate (0.50% coupon) maturing on 20 May 2029, priced at 99.58 (original spread of 89 bp), callable (8nc8)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23R1), fixed rate (0.75% coupon) maturing on 17 June 2033, priced at 100.00, callable (12nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23U5), fixed rate (0.55% coupon) maturing on 25 June 2030, priced at 100.00, callable (9nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23S9), fixed rate (1.00% coupon) maturing on 18 June 2035, priced at 100.00, callable (14nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23T7), fixed rate (0.40% coupon) maturing on 25 June 2029, priced at 100.00, callable (8nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23P5), fixed rate (0.59% coupon) maturing on 21 May 2031, priced at 100.00 (original spread of 50 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23Q3), fixed rate (0.50% coupon) maturing on 18 June 2031, priced at 100.00, callable (10nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23V3), fixed rate (0.65% coupon) maturing on 25 June 2031, priced at 100.00, callable (10nc1)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): €500m Unsecured Note (XS2343850033), fixed rate (1.00% coupon) maturing on 21 May 2029, priced at 100.00, non callable

- OTE PLC (Financial - Other | London, Greece | Rating: NR): €200m Unsecured Note (XS2343873837), fixed rate (0.63% coupon) maturing on 12 May 2028, priced at 100.00, non callable

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): €100m Index Linked Security (AT0000A2RAN3), fixed rate (3.00% coupon) maturing on 17 June 2026, priced at 100.00, non callable

- Volkswagen Leasing GmbH (Leasing | Braunschweig, Niedersachsen, Germany | Rating: NR): €1,250m Senior Note (XS2343821794) zero coupon maturing on 19 July 2024, priced at 99.82 (original spread of 73 bp), non callable

- Volkswagen Leasing GmbH (Leasing | Braunschweig, Niedersachsen, Germany | Rating: NR): €1,000m Senior Note (XS2343822842), fixed rate (0.38% coupon) maturing on 20 July 2026, priced at 99.87 (original spread of 95 bp), non callable

- Volkswagen Leasing GmbH (Leasing | Braunschweig, Niedersachsen, Germany | Rating: NR): €750m Senior Note (XS2343822503), fixed rate (0.63% coupon) maturing on 19 July 2029, priced at 99.25 (original spread of 106 bp), non callable

NEW LOANS

- Sabre Industries Inc (B), signed a US$ 875m Term Loan B, maturing on 05/24/28 and initial pricing is set at LIBOR +375.000bps

- Metronet Holdings LLC (B-), signed a US$ 585m Term Loan B, to be used for a leveraged buyout.

- Atkore International Inc (BB-), signed a US$ 325m Revolving Credit Facility (maturing on 05/17/26) and a US$ 400m Term Loan B (maturing on 05/17/28), both to be used for general corporate purposes.

NEW ISSUES IN STRUCTURED CREDIT

- Lmrec 2021-Cre4 issued a fixed-rate CMBS in 1 tranche, for a total of US$ 277 m

- Willis Engine Structured Trust Vi issued a fixed-rate ABS backed by aircraft leases in 3 tranches, for a total of US$ 337 m. Highest-rated tranche offering a yield to maturity of 3.10%, and the lowest-rated tranche a yield to maturity of 7.39%. Bookrunners: Wells Fargo Securities LLC, Bank of America Merrill Lynch, MUFG Securities Americas Inc