Credit

US High Yield: Bond Spreads Tick Up, CDS Spreads Go The Other Way

In the USD secondary market, high-profile South American issuers like Banco Do Brasil and Colombia Telecomunicaciones see spreads widen

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.3% today, with investment grade down -0.4% and high yield down -0.3% (YTD total return: -3.6%)

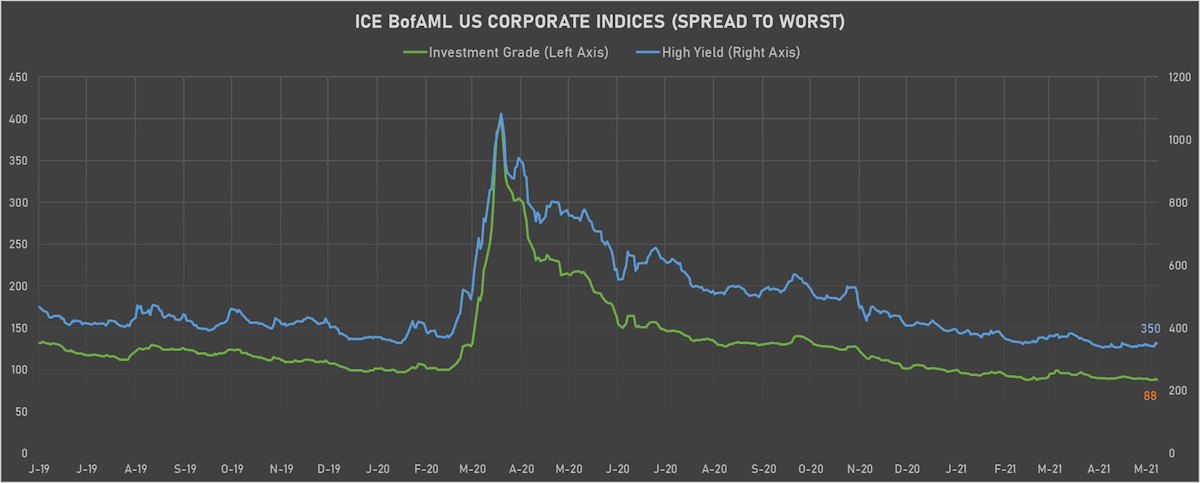

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 354.0 bp (YTD change: -36.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +1.6%)

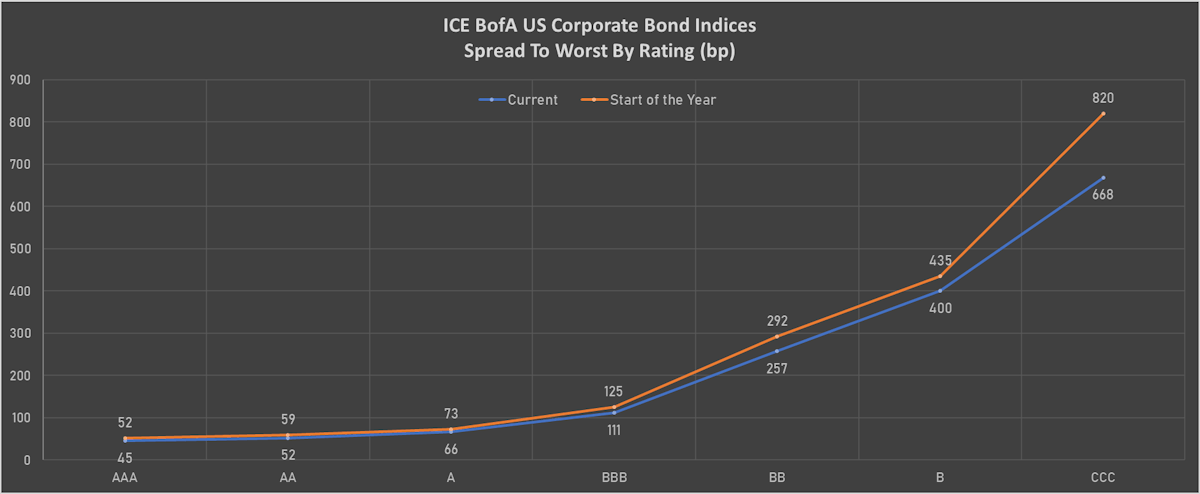

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 48 bp

- AA up by 1 bp at 56 bp

- A unchanged at 72 bp

- BBB up by 1 bp at 116 bp

- BB up by 3 bp at 244 bp

- B up by 5 bp at 378 bp

- CCC up by 2 bp at 651 bp

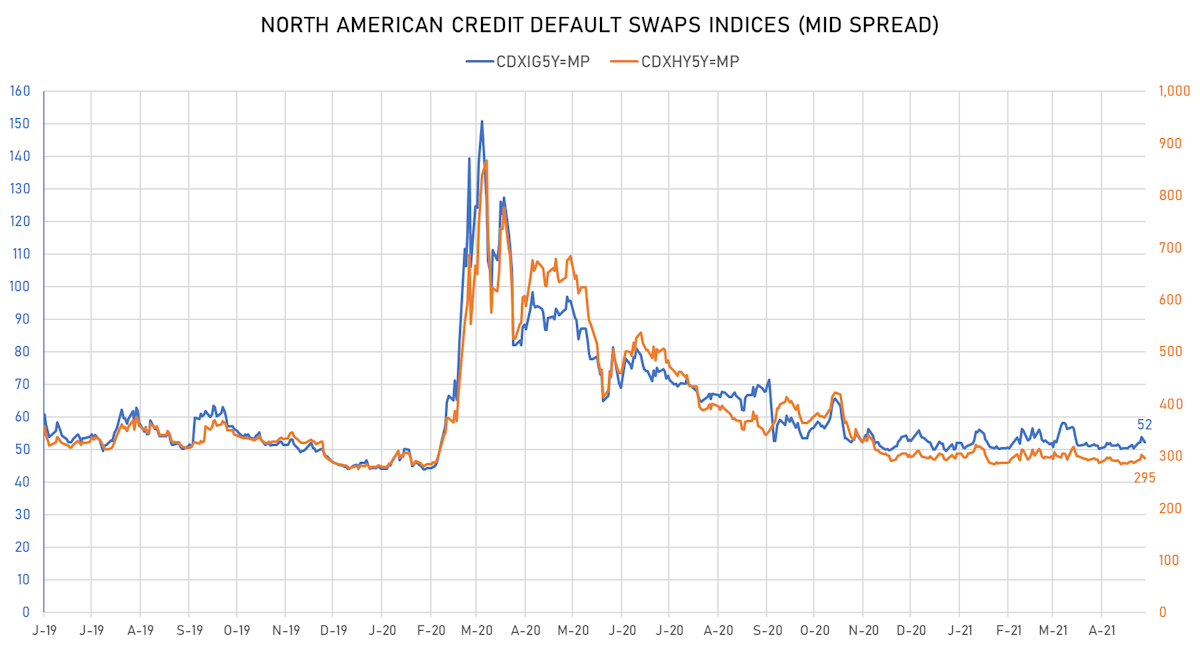

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.5 bp, now at 52bp (YTD change: +2.3bp)

- Markit CDX.NA.HY 5Y down 6.2 bp, now at 295bp (YTD change: +2.0bp)

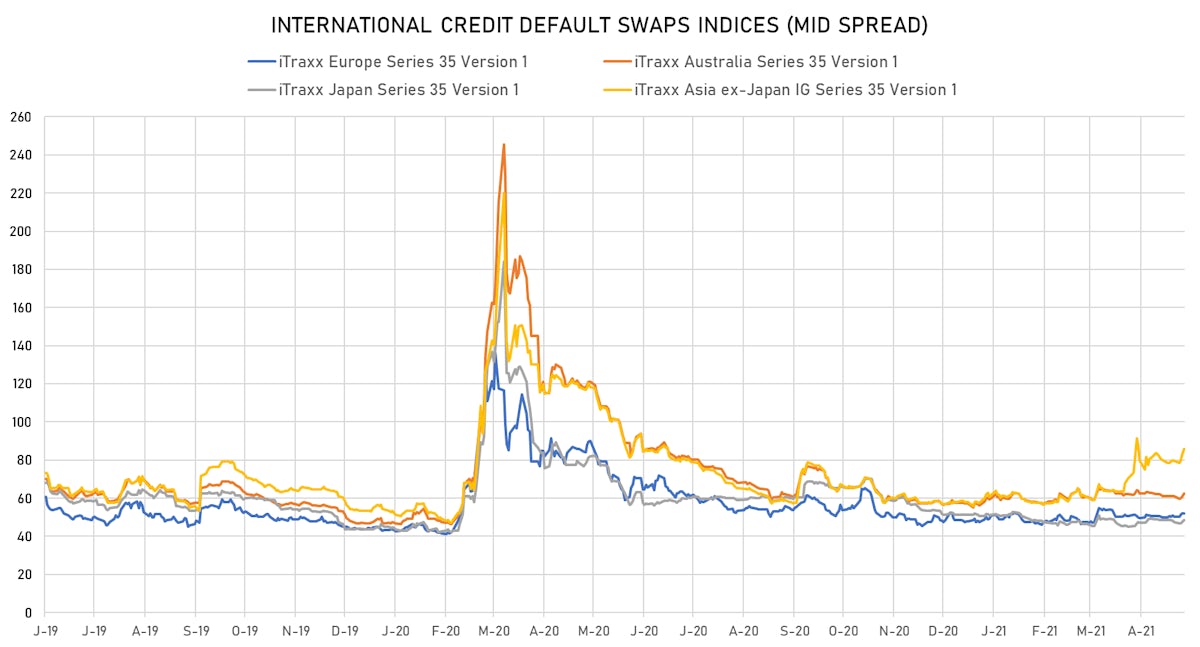

- Markit iTRAXX Europe down 0.3 bp, now at 52bp (YTD change: +3.9bp)

- Markit iTRAXX Japan up 1.0 bp, now at 48bp (YTD change: -2.9bp)

- Markit iTRAXX Asia Ex-Japan up 3.1 bp, now at 86bp (YTD change: +27.8bp)

TOP BONDS MOVERS - USD HY

- Issuer: Banco Do Brasil SA (Cayman Islands Branch) (GEORGE TOWN, Cayman Islands) | Coupon: 4.75% | Maturity: 20/3/2024 | Rating: BB- | ISIN: USP1R027AA25 | Option-adjusted spread up by 26.5 bp to 167.2 bp (CDS basis: -0.5bp), with the yield to worst at 1.7% and the bond now trading down to 107.4 cents on the dollar (1Y price range: 104.6-108.5).

- Issuer: GTLK Europe DAC (DUBLIN, Ireland) | Coupon: 5.13% | Maturity: 31/5/2024 | Rating: BB | ISIN: XS1577961516 | Option-adjusted spread up by 19.1 bp to 266.1 bp, with the yield to worst at 2.7% and the bond now trading down to 105.9 cents on the dollar (1Y price range: 105.5-107.3).

- Issuer: Colombia Telecomunicaciones SA ESP (Bogota, Colombia) | Coupon: 4.95% | Maturity: 17/7/2030 | Rating: BB | ISIN: USP28768AC69 | Option-adjusted spread up by 17.9 bp to 294.7 bp, with the yield to worst at 4.3% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 102.8-111.1).

- Issuer: Graphic Packaging International LLC (Atlanta, Georgia (US)) | Coupon: 4.75% | Maturity: 15/7/2027 | Rating: BB | ISIN: USU41441AA10 | Option-adjusted spread up by 15.8 bp to 214.1 bp, with the yield to worst at 2.9% and the bond now trading down to 108.3 cents on the dollar (1Y price range: 108.3-111.0).

- Issuer: Oil and Gas Holding Company BSC (Closed) (Manama, Bahrain) | Coupon: 8.38% | Maturity: 7/11/2028 | Rating: B+ | ISIN: XS1903485800 | Option-adjusted spread up by 15.8 bp to 448.8 bp (CDS basis: -146.1bp), with the yield to worst at 5.5% and the bond now trading down to 116.5 cents on the dollar (1Y price range: 115.8-120.0).

- Issuer: Centrais Eletricas Brasileiras SA (Brasilia, Brazil) | Coupon: 4.63% | Maturity: 4/2/2030 | Rating: BB- | ISIN: USP22835AB13 | Option-adjusted spread up by 13.7 bp to 293.3 bp (CDS basis: -51.1bp), with the yield to worst at 4.2% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 98.9-107.4).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.95% | Maturity: 3/4/2026 | Rating: B | ISIN: XS1713469911 | Option-adjusted spread up by 12.2 bp to 518.1 bp, with the yield to worst at 5.8% and the bond now trading down to 103.8 cents on the dollar (1Y price range: 99.5-109.8).

- Issuer: Klabin Austria GmbH (Wien, Austria) | Coupon: 5.75% | Maturity: 3/4/2029 | Rating: BB+ | ISIN: USA35155AA77 | Option-adjusted spread up by 9.8 bp to 268.4 bp, with the yield to worst at 3.8% and the bond now trading down to 111.5 cents on the dollar (1Y price range: 110.9-116.4).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USU83854AB29 | Option-adjusted spread down by 7.9 bp to 383.8 bp, with the yield to worst at 3.9% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 99.0-100.5).

- Issuer: Gtlk Europe Capital DAC (Ireland) | Coupon: 4.95% | Maturity: 18/2/2026 | Rating: BB | ISIN: XS2010044381 | Option-adjusted spread down by 14.4 bp to 279.9 bp, with the yield to worst at 3.4% and the bond now trading up to 105.9 cents on the dollar (1Y price range: 104.5-107.4).

TOP BONDS MOVERS - EUR HY

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Option-adjusted spread up by 11.1 bp to 211.4 bp (CDS basis: -34.1bp), with the yield to worst at 1.6% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 97.2-100.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.75% | Maturity: 30/7/2025 | Rating: BB- | ISIN: XS1266662334 | Option-adjusted spread up by 8.9 bp to 223.0 bp, with the yield to worst at 1.7% and the bond now trading down to 110.8 cents on the dollar (1Y price range: 108.2-112.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB+ | ISIN: XS2248826294 | Option-adjusted spread up by 8.6 bp to 272.2 bp, with the yield to worst at 2.4% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 101.0-103.2).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Option-adjusted spread up by 8.5 bp to 298.4 bp, with the yield to worst at 2.7% and the bond now trading down to 107.4 cents on the dollar (1Y price range: 105.2-111.3).

- Issuer: Leonardo SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 8/1/2026 | Rating: BB+ | ISIN: XS2199716304 | Option-adjusted spread up by 7.8 bp to 166.0 bp (CDS basis: -0.6bp), with the yield to worst at 1.2% and the bond now trading down to 104.2 cents on the dollar (1Y price range: 102.8-105.2).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Option-adjusted spread up by 7.3 bp to 441.8 bp (CDS basis: -35.2bp), with the yield to worst at 4.0% and the bond now trading down to 112.8 cents on the dollar (1Y price range: 102.3-115.5).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.74% | Maturity: 19/7/2024 | Rating: BB | ISIN: XS2116728895 | Option-adjusted spread up by 6.7 bp to 192.1 bp (CDS basis: -24.9bp), with the yield to worst at 1.5% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 98.7-101.5).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Option-adjusted spread up by 6.4 bp to 449.3 bp (CDS basis: -58.9bp), with the yield to worst at 4.2% and the bond now trading down to 91.9 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB+ | ISIN: XS1713464524 | Option-adjusted spread up by 6.3 bp to 239.3 bp, with the yield to worst at 2.0% and the bond now trading down to 103.8 cents on the dollar (1Y price range: 103.0-105.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Option-adjusted spread up by 6.3 bp to 263.7 bp, with the yield to worst at 2.2% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 103.1-105.4).

USD BOND ISSUES

- Asb Finance Ltd (London Branch) (Financial - Other | London, Australia | Rating: AA-): US$200m Senior Note (XS2344384339), fixed rate (1.90% coupon) maturing on 19 May 2028, priced at 100.00, non callable

- Citigroup Global Markets Funding Luxembourg SCA (Financial - Other | Bertrange, United States | Rating: A+): US$100m Unsecured Note (XS2338430759), fixed rate (5.03% coupon) maturing on 20 May 2036, priced at 100.00, non callable

- Goldman Sachs International (Financial - Other | London, United States | Rating: A+): US$100m Unsecured Note (XS2230893484) zero coupon maturing on 26 May 2041, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$450m Unsecured Note (XS2217021661), floating rate maturing on 20 June 2026, priced at 100.00, non callable

EUR BOND ISSUES

- Aedas Homes OPCO SL (Financial - Other | Madrid, Madrid, Anguilla | Rating: NR): €325m Note (XS2343873597), fixed rate (4.00% coupon) maturing on 15 August 2026, priced at 100.00 (original spread of 451 bp), callable (5nc1)

- Aggregate Holdings SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €250m Inhaberschuldverschreibung (DE000A3KPTS1), fixed rate (5.50% coupon) maturing on 17 May 2024, non callable

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: NR): €100m Inhaberschuldverschreibung (DE000BLB9PC6), fixed rate (0.62% coupon) maturing on 14 May 2031, priced at 100.00 (original spread of 53 bp), non callable

- Borgwarner Inc (Vehicle Parts | Auburn Hills, Michigan, United States | Rating: BBB): €1,000m Senior Note (XS2343846940), fixed rate (1.00% coupon) maturing on 19 May 2031, priced at 98.94 (original spread of 125 bp), callable (10nc10)

- Chrome Bidco SAS (Financial - Other | Paris, Ile-De-France, Switzerland | Rating: B): €420m Note (XS2343000241), fixed rate (3.50% coupon) maturing on 31 May 2028, priced at 100.00 (original spread of 403 bp), callable (7nc3)

- Chrome Holdco SAS (Financial - Other | Paris, Ile-De-France, Switzerland | Rating: CCC+): €325m Senior Note (XS2343001991), fixed rate (5.00% coupon) maturing on 31 May 2029, priced at 100.00 (original spread of 550 bp), callable (8nc3)

- Cyrusone Europe Finance DAC (Financial - Other | Leinster, United States | Rating: BBB-): €500m Senior Note (XS2342250227), fixed rate (1.13% coupon) maturing on 26 May 2028, priced at 98.67 (original spread of 171 bp), callable (7nc7)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U4E7), floating rate maturing on 7 June 2028, priced at 100.00, non callable

- Fair Oaks Loan Funding I DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €217m Bond (XS2332239727), floating rate maturing on 15 April 2034, priced at 100.00, non callable

- GreenRock Energy AG (Service - Other | Berlin, Berlin, Germany | Rating: NR): €100m Inhaberschuldverschreibung (DE000A3E5SE0), fixed rate (6.50% coupon) maturing on 1 July 2031, priced at 100.00, callable (10nc3)

- International Design Group SpA (Financial - Other | Milan, Milano, Luxembourg | Rating: B): €470m Note (XS2344474320), floating rate (EU03MLIB + 425.0 bp) maturing on 15 May 2026, priced at 100.00, callable (5nc1)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €3,000m Inhaberschuldverschreibung (DE000A3H3KE9), fixed rate (0.38% coupon) maturing on 20 May 2036, priced at 99.86 (original spread of 23 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23Y7), fixed rate (1.15% coupon) maturing on 23 June 2036, priced at 100.00, callable (15nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23Z4), fixed rate (0.50% coupon) maturing on 1 July 2036, priced at 100.00 (original spread of 171 bp), callable (15nc1)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB23X9), fixed rate (0.15% coupon) maturing on 23 June 2027, priced at 100.00 (original spread of 37 bp), callable (6nc1)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): €500m Senior Note (XS2343850033), fixed rate (0.95% coupon) maturing on 21 May 2031, priced at 99.54 (original spread of 122 bp), non callable

- MAS Securities BV (Financial - Other | S-Gravenhage, Zuid-Holland, Isle Of Man | Rating: NR): €300m Senior Note (XS2339025277), fixed rate (4.25% coupon) maturing on 19 May 2026, priced at 98.90 (original spread of 513 bp), callable (5nc5)

- Ontario Teachers Finance Trust (Financial - Other | North York, Ontario, Canada | Rating: AA+): €1,250m Senior Note (XS2344384842), fixed rate (0.90% coupon) maturing on 20 May 2041, priced at 99.51 (original spread of 77 bp), non callable

- Ontario Teachers Finance Trust (Financial - Other | North York, Ontario, Canada | Rating: AA+): €1,250m Senior Note (XS2344384768), fixed rate (0.10% coupon) maturing on 19 May 2028, priced at 99.88 (original spread of 51 bp), non callable

- Permanent TSB Group Holdings PLC (Banking | Dublin, Dublin, Ireland | Rating: BB-): €250m Subordinated Note (XS2321520525), fixed rate (3.00% coupon) maturing on 19 August 2031, priced at 100.00 (original spread of 353 bp), callable (10nc5)

- Primrose Residential 2021-1 DAC (Financial - Other | Dublin, Ireland | Rating: AAA): €672m Bond (XS2328004614), floating rate maturing on 24 March 2061, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: BBB+): €100m Inhaberschuldverschreibung (AT000B078670), fixed rate (0.15% coupon) maturing on 27 May 2026, priced at 100.00, non callable

- Raiffeisenlandesbank Niederoesterreich Wien AG (Banking | Wien, Wien, Austria | Rating: BBB+): €100m Inhaberschuldverschreibung (AT000B078688), floating rate maturing on 28 May 2029, priced at 100.00, non callable

- Rhineland-Palatinate, State of (Official and Muni | Mainz, Germany | Rating: AAA): €600m Inhaberschuldverschreibung (DE000RLP1304), fixed rate (0.01% coupon) maturing on 29 May 2024, priced at 101.53 (original spread of 19 bp), non callable

- Rhineland-Palatinate, State of (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €250m Landesschatzanweisung (DE000RLP1296), floating rate (EU03MLIB + 200.0 bp) maturing on 29 May 2024, priced at 106.36, non callable

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €1,000m Note (XS2343563214), fixed rate (0.30% coupon) maturing on 20 May 2027, priced at 99.81 (original spread of 85 bp), callable (6nc5)

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Noord-Holland, Japan | Rating: A+): €200m Senior Note (XS2344317735) zero coupon maturing on 20 May 2024, non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €500m Hypothekenpfandbrief (Covered Bond) (DE000HV2AYJ2), fixed rate (0.01% coupon) maturing on 21 May 2029, priced at 100.26 (original spread of 33 bp), non callable

NEW ISSUES IN LOANS

- HP Inc (BBB), signed a US$ 5,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/20/26 and initial pricing is set at LIBOR +125.000bps

- Cwgs Grp Llc (BB-), signed a US$ 1,100m Term Loan B, to be used for general corporate purposes. It matures on 01/00/00.

- Ampac Packaging LLC (B), signed a US$ 1,814m Term Loan B, to be used for general corporate purposes. It matures on 11/21/25.

- BOCOM Intl Hldg Co Ltd, signed a US$ 322m Revolving Credit / Term Loan, to be used for refinancing bank debt. It matures on 05/12/24 and initial pricing is set at LIBOR +100.000bps

- Sucafina SA, signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/12/23.

- Quanta Computer Inc, is seeking to refinance two tranches of a Revolving Credit Facility: US$ 284m priced at LIBOR +83.000bps, and US$ 596m priced at LIBOR +75.000bps. Proceeds to be used for working capital and refinancing bank debt.

NEW ISSUES IN STRUCTURED CREDIT

- Starwood Mortgage Residential Trust 2021-2 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 231 m. Highest-rated tranche offering a yield to maturity of 0.94%, and the lowest-rated tranche a yield to maturity of 2.18%. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc, Performance Trust Capital