Credit

Credit Spreads Drop On Friday, In Line With Rates

According to the IFR, 2021 year-to-date totals for primary issuance are US$649.245bn for IG (vs. US$937.38bn in 2020), and US$225.498bn for HY (vs. US$134.314bn in 2020)

Published ET

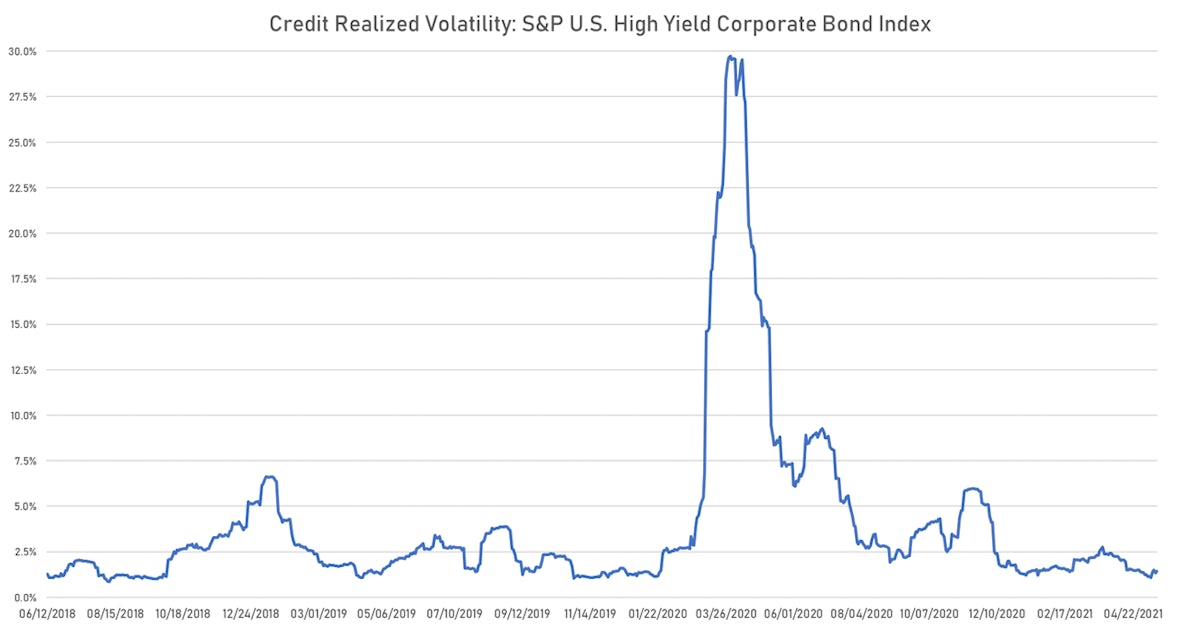

HY Credit Volatility | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.4% today, with investment grade up 0.4% and high yield up 0.2% (YTD total return: -3.3%)

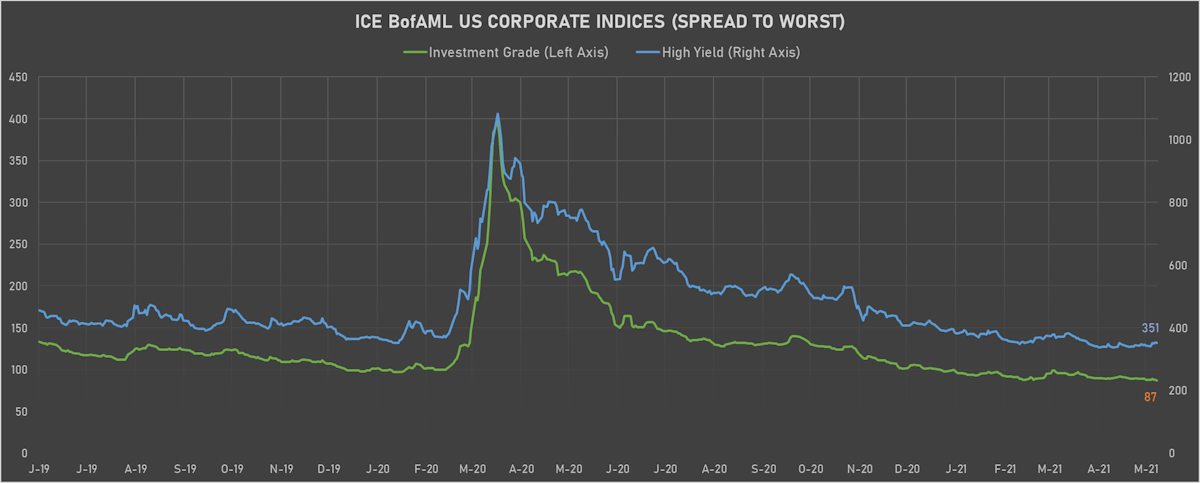

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.1% today (YTD total return: +1.7%)

- Very little issuance on Friday in the US and Europe

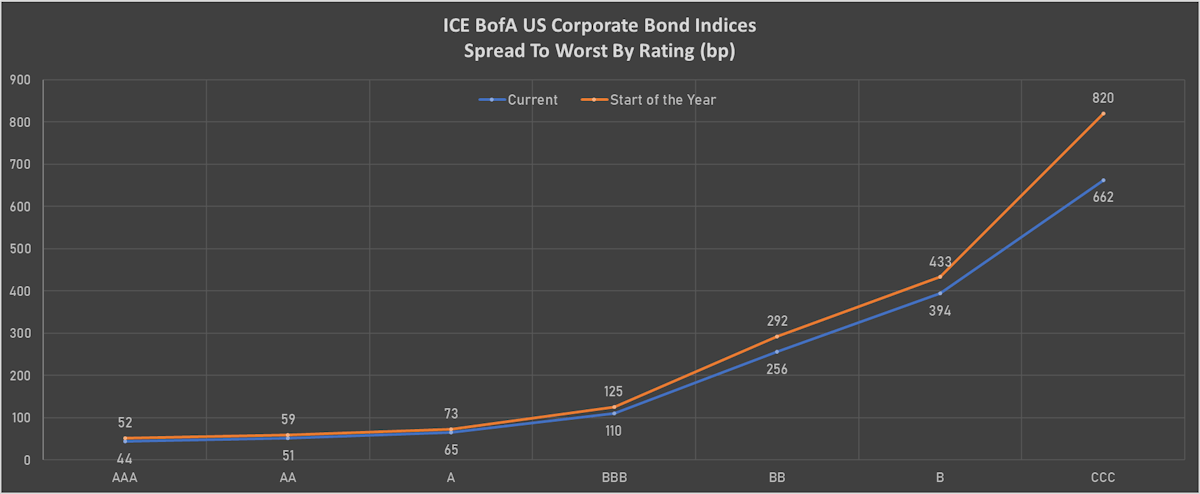

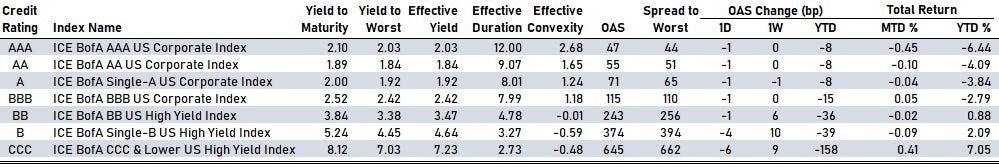

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA down by -1 bp at 55 bp

- A down by -1 bp at 71 bp

- BBB down by -1 bp at 115 bp

- BB down by -1 bp at 243 bp

- B down by -4 bp at 374 bp

- CCC down by -6 bp at 645 bp

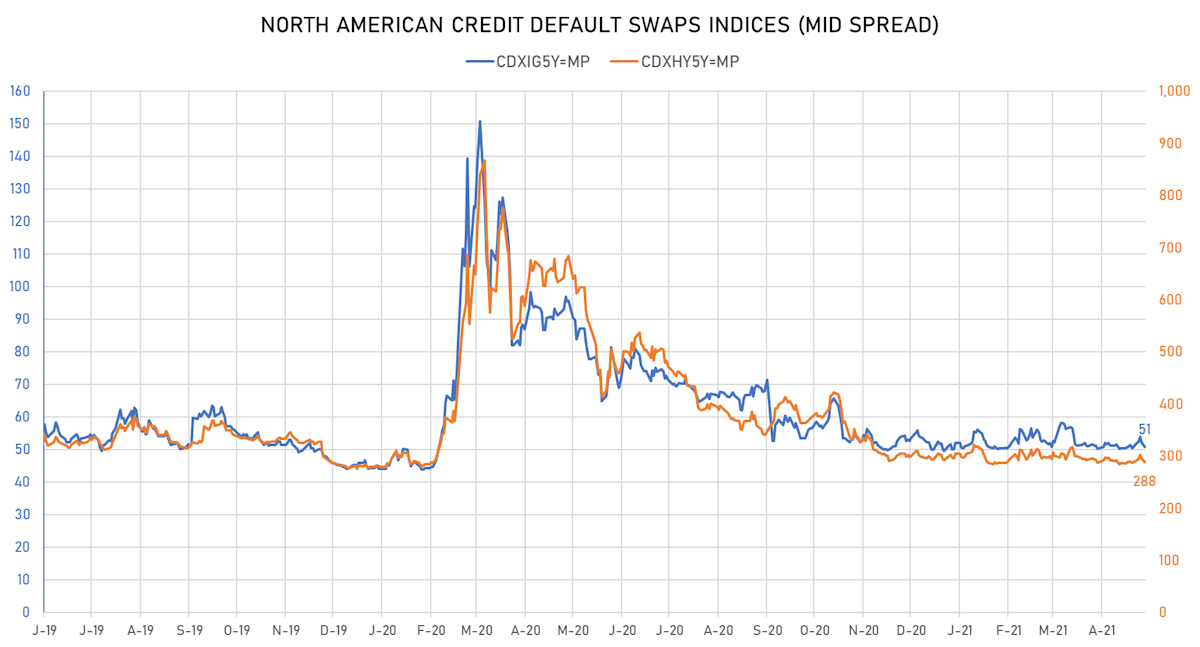

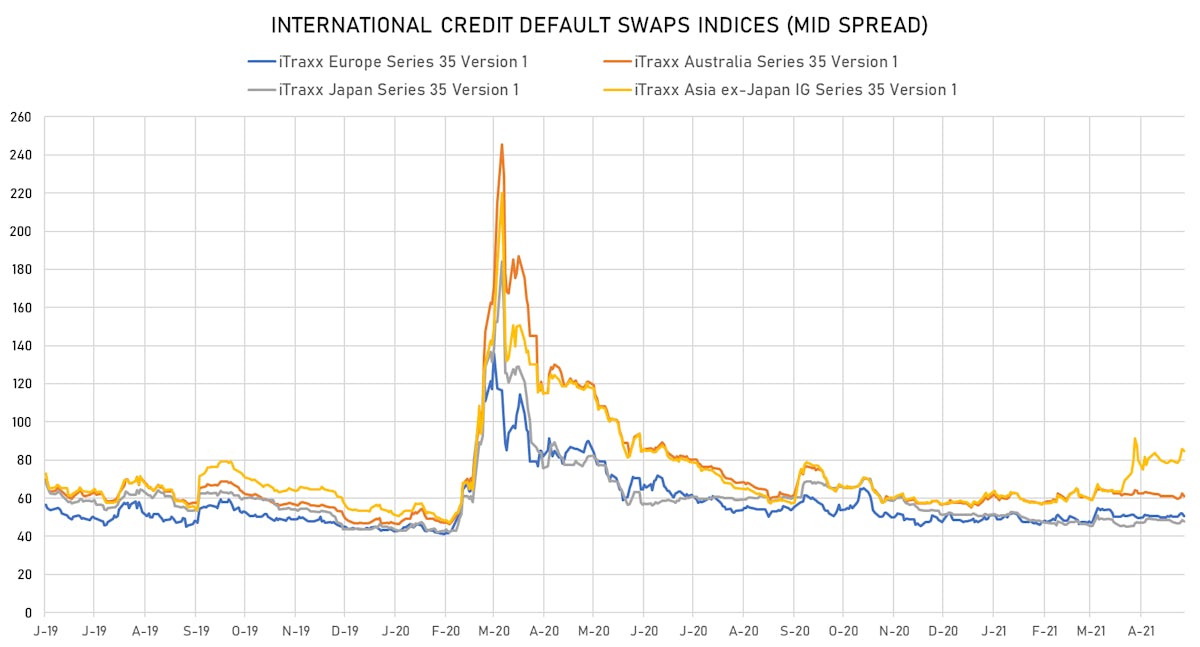

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.6 bp, now at 51bp (YTD change: +0.7bp)

- Markit CDX.NA.HY 5Y down 6.9 bp, now at 288bp (YTD change: -4.9bp)

- Markit iTRAXX Europe down 1.4 bp, now at 50bp (YTD change: +2.5bp)

- Markit iTRAXX Japan down 0.7 bp, now at 48bp (YTD change: -3.6bp)

- Markit iTRAXX Asia Ex-Japan down 1.3 bp, now at 85bp (YTD change: +26.6bp)

TOP BONDS MOVERS - USD HY

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Option-adjusted spread up by 28.5 bp to 334.9 bp, with the yield to worst at 3.5% and the bond now trading down to 103.9 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Jersey Central Power & Light Co (Akron, Ohio (US)) | Coupon: 4.70% | Maturity: 1/4/2024 | Rating: BB+ | ISIN: USU04536AC95 | Option-adjusted spread up by 26.0 bp to 101.2 bp (CDS basis: -51.8bp), with the yield to worst at 1.3% and the bond now trading down to 108.5 cents on the dollar (1Y price range: 107.9-109.8).

- Issuer: Chelpipe Finance Designated Activity Co (DUBLIN, Ireland) | Coupon: 4.50% | Maturity: 19/9/2024 | Rating: BB- | ISIN: XS2010044548 | Option-adjusted spread up by 24.7 bp to 289.4 bp, with the yield to worst at 3.0% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 102.6-104.1).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 5.00% | Maturity: 30/4/2023 | Rating: BB- | ISIN: USU2928LAA36 | Option-adjusted spread up by 14.3 bp to 191.5 bp, with the yield to worst at 1.9% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 103.8-105.8).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 3.60% | Maturity: 15/5/2025 | Rating: BB | ISIN: USU75111AK72 | Option-adjusted spread up by 13.8 bp to 265.8 bp, with the yield to worst at 3.1% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 98.8-103.3).

- Issuer: Centrais Eletricas Brasileiras SA (Brasilia, Brazil) | Coupon: 3.63% | Maturity: 4/2/2025 | Rating: BB- | ISIN: USP22835AA30 | Option-adjusted spread down by 14.1 bp to 219.2 bp (CDS basis: -78.7bp), with the yield to worst at 2.6% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 100.2-104.1).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Option-adjusted spread down by 19.6 bp to 177.2 bp, with the yield to worst at 2.0% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 106.5-108.8).

- Issuer: Banco Do Brasil SA (Cayman Islands Branch) (GEORGE TOWN, Cayman Islands) | Coupon: 4.75% | Maturity: 20/3/2024 | Rating: BB- | ISIN: USP1R027AA25 | Option-adjusted spread down by 22.1 bp to 166.9 bp (CDS basis: -0.2bp), with the yield to worst at 1.7% and the bond now trading up to 107.4 cents on the dollar (1Y price range: 104.6-108.5).

- Issuer: EVRAZ plc (London, United Kingdom) | Coupon: 5.25% | Maturity: 2/4/2024 | Rating: BB | ISIN: XS1843443273 | Option-adjusted spread down by 23.5 bp to 178.0 bp, with the yield to worst at 1.9% and the bond now trading up to 107.9 cents on the dollar (1Y price range: 106.8-109.8).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Option-adjusted spread down by 40.2 bp to 834.4 bp, with the yield to worst at 8.5% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 67.5-99.8).

TOP BONDS MOVERS - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 25/5/2026 | Rating: BB | ISIN: XS1419869885 | Option-adjusted spread up by 4.9 bp to 167.4 bp (CDS basis: 14.4bp), with the yield to worst at 1.3% and the bond now trading down to 110.5 cents on the dollar (1Y price range: 109.3-111.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Option-adjusted spread down by 4.9 bp to 375.2 bp, with the yield to worst at 3.4% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Option-adjusted spread down by 5.4 bp to 226.8 bp, with the yield to worst at 2.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 98.4-101.8).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 3.00% | Maturity: 23/10/2029 | Rating: BB+ | ISIN: XS2010039894 | Option-adjusted spread down by 5.6 bp to 249.0 bp, with the yield to worst at 2.4% and the bond now trading up to 103.5 cents on the dollar (1Y price range: 100.4-105.6).

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Option-adjusted spread down by 6.1 bp to 136.3 bp, with the yield to worst at 1.1% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 100.4-101.5).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Option-adjusted spread down by 7.9 bp to 254.7 bp, with the yield to worst at 2.3% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 105.4-110.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Option-adjusted spread down by 8.1 bp to 230.5 bp, with the yield to worst at 2.1% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 99.0-103.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Option-adjusted spread down by 8.2 bp to 210.7 bp, with the yield to worst at 1.8% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 99.8-101.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 1.36% | Maturity: 7/2/2025 | Rating: BB | ISIN: XS1767930586 | Option-adjusted spread down by 8.6 bp to 207.7 bp (CDS basis: -39.4bp), with the yield to worst at 1.6% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.2-100.0).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Option-adjusted spread down by 9.8 bp to 397.1 bp, with the yield to worst at 3.5% and the bond now trading up to 108.3 cents on the dollar (1Y price range: 99.6-108.5).

USD BOND ISSUES

- Artex SAC Ltd (Financial - Other | Hamilton, United States | Rating: NR): US$200m Bond (XS2341656408), floating rate maturing on 20 December 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$100m Bond (US3130AMKT87), fixed rate (2.00% coupon) maturing on 27 May 2031, priced at 100.00 (original spread of 194 bp), callable (10nc3m)

EUR BOND ISSUES

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): €100m Index Linked Security (AT0000A2REB0) zero coupon maturing on 25 June 2026, priced at 100.00, non callable

NEW ISSUES IN STRUCTURED CREDIT

- GSMS 2021-Ross issued a floating-rate CMBS in 8 tranches, for a total of US$ 656 m. Highest-rated tranche offering a spread over the floating rate of 115bp, and the lowest-rated tranche a spread of 590bp. Bookrunners: Goldman Sachs & Co

- BDS 2021-Fl7 issued a floating-rate RMBS in 5 tranches, for a total of US$ 476 m. Highest-rated tranche offering a spread over the floating rate of 107bp, and the lowest-rated tranche a spread of 280bp. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Wells Fargo Securities LLC