Credit

High Yield CDS Spreads Widen In Otherwise Uneventful Day For Credit

Busy day in the bond primary market with over $15bn of issuance, including a $7bn 5-tranche offering from UnitedHealth

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index unchanged (YTD total return: -3.3%)

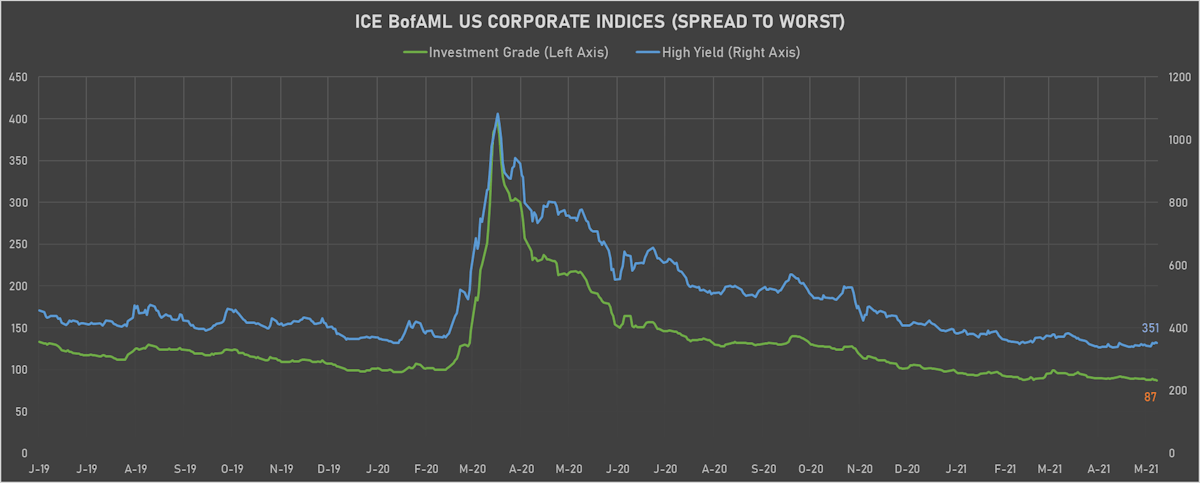

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.7%)

- New issues: US$ 14.9bn in dollars and € 7.0bn in euros

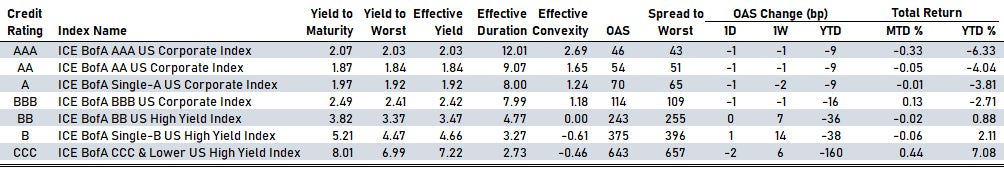

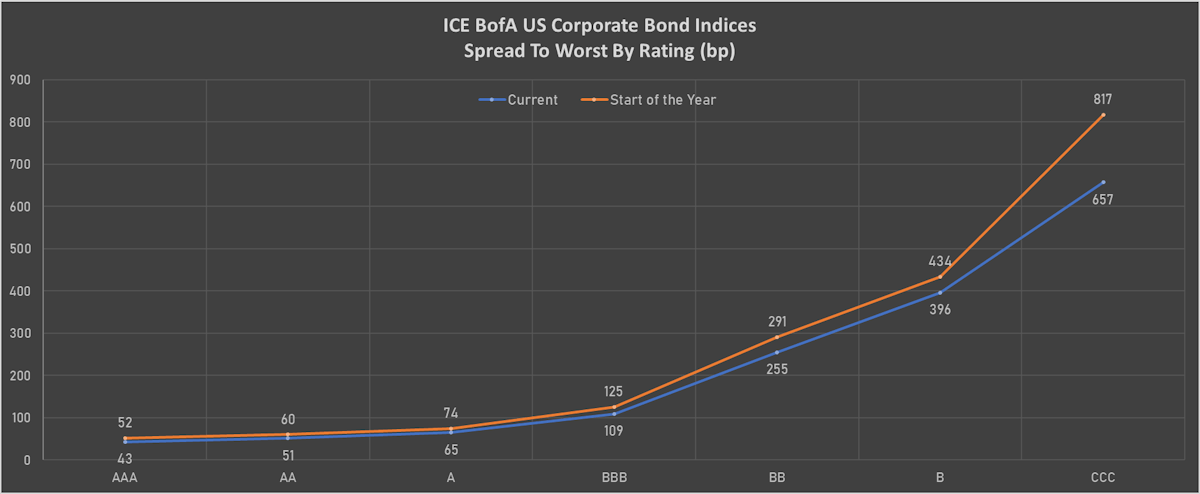

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA down by -1 bp at 54 bp

- A down by -1 bp at 70 bp

- BBB down by -1 bp at 114 bp

- BB unchanged at 243 bp

- B up by 1 bp at 375 bp

- CCC down by -2 bp at 643 bp

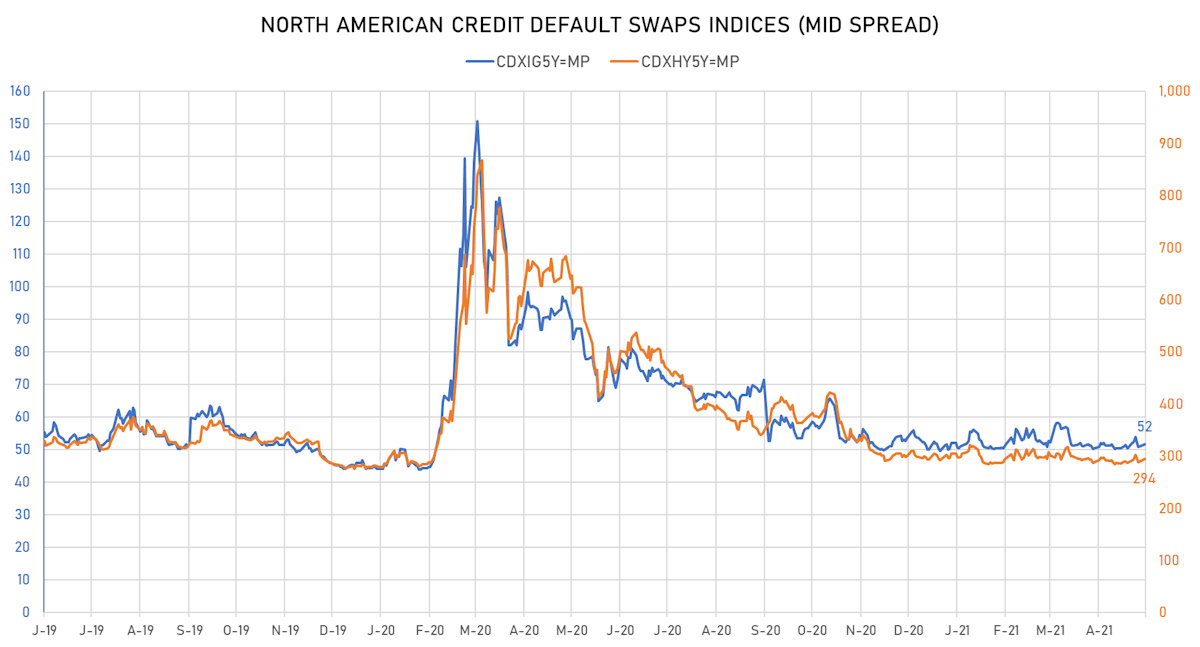

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 52bp (YTD change: +1.6bp)

- Markit CDX.NA.HY 5Y up 5.3 bp, now at 294bp (YTD change: +0.4bp)

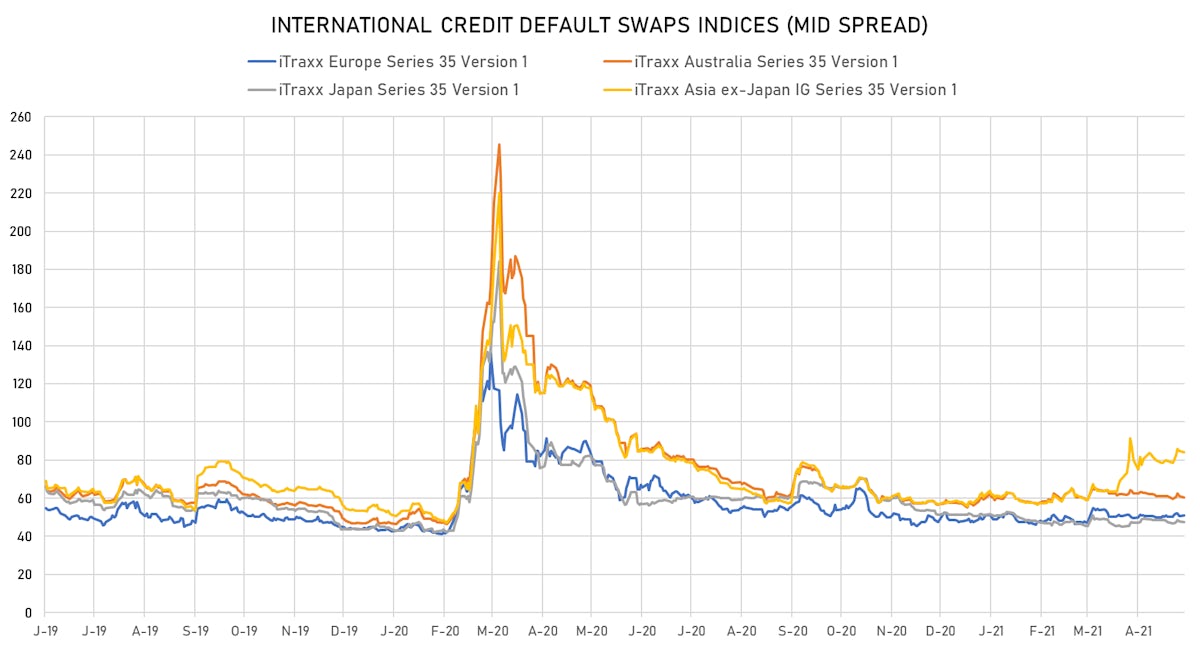

- Markit iTRAXX Europe up 0.6 bp, now at 51bp (YTD change: +3.1bp)

- Markit iTRAXX Japan down 0.5 bp, now at 47bp (YTD change: -4.0bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 84bp (YTD change: +26.0bp)

RECENT USD CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Nabors Industries Inc (Country: US; rated: B+): up 15.1 bp to 1,001.2bp (1Y range: 808-4,514bp)

- Akbank TAS (Country: TR; rated: Ba3): up 14.7 bp to 511.6bp (1Y range: 397-668bp)

- Transocean Inc (Country: KY; rated: Caa3): up 12.4 bp to 1,327.3bp (1Y range: 1,315-7,695bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 61%): down 13.2 bp to 382.3bp (1Y range: 340-2,017bp)

- Nordstrom Inc (Country: US; rated: WR): down 14.5 bp to 231.9bp (1Y range: 219-684bp)

- Macy's Inc (Country: US; rated: Ba3): down 16.5 bp to 384.4bp (1Y range: 327-1,333bp)

- Beazer Homes USA Inc (Country: US; rated: B3): down 17.9 bp to 274.4bp (1Y range: 231-669bp)

- American Airlines Group Inc (Country: US; rated: B2): down 20.5 bp to 728.1bp (1Y range: 703-6,696bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): down 22.4 bp to 373.3bp (1Y range: 292-1,408bp)

- Dillard's Inc (Country: US; rated: BBB-): down 25.5 bp to 156.7bp (1Y range: 157-430bp)

RECENT EUR CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Boparan Finance PLC (Country: GB; rated: B3): up 19.9 bp to 867.2bp (1Y range: 478-1,093bp)

- Bank of Scotland PLC (Country: GB; rated: BBB): up 6.6 bp to 49.6bp (1Y range: 34-52bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 3.4 bp to 285.2bp (1Y range: 233-457bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): down 4.1 bp to 897.1bp (1Y range: 590-2,619bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 4.9 bp to 252.2bp (1Y range: 246-456bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 5.2 bp to 271.2bp (1Y range: 206-548bp)

- CMA CGM SA (Country: FR; rated: B1): down 5.3 bp to 403.0bp (1Y range: 393-1,721bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 7.8 bp to 385.3bp (1Y range: 317-477bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 14.9 bp to 538.0bp (1Y range: 516-984bp)

- Novafives SAS (Country: FR; rated: Caa1): down 19.3 bp to 855.3bp (1Y range: 716-2,335bp)

TOP HIGH YIELD USD BOND MOVERS

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Option-adjusted spread up by 18.6 bp to 418.5 bp, with the yield to worst at 4.8% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.4-100.5).

- Issuer: Cap SA (LAS CONDES, Chile) | Coupon: 3.90% | Maturity: 27/4/2031 | Rating: BB+ | ISIN: USP2316YAA12 | Option-adjusted spread up by 12.3 bp to 254.0 bp, with the yield to worst at 4.0% and the bond now trading down to 98.4 cents on the dollar (1Y price range: 98.0-99.3).

- Issuer: Embraer Netherlands Finance BV (Amsterdam, Netherlands) | Coupon: 6.95% | Maturity: 17/1/2028 | Rating: BB | ISIN: USN29505AA70 | Option-adjusted spread up by 11.8 bp to 349.2 bp, with the yield to worst at 4.4% and the bond now trading down to 113.4 cents on the dollar (1Y price range: 108.7-114.0).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 3.63% | Maturity: 14/10/2025 | Rating: BB- | ISIN: USG76237AB53 | Option-adjusted spread down by 11.8 bp to 271.8 bp (CDS basis: -23.2bp), with the yield to worst at 3.2% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 98.4-101.4).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 6.13% | Maturity: 20/4/2025 | Rating: BB- | ISIN: XS1811213435 | Option-adjusted spread down by 12.9 bp to 247.5 bp, with the yield to worst at 2.8% and the bond now trading up to 110.5 cents on the dollar (1Y price range: 108.9-112.9).

- Issuer: Anadolu Efes Biracilik ve Malt Sanayii AS (Istanbul, Turkey) | Coupon: 3.38% | Maturity: 1/11/2022 | Rating: B | ISIN: XS0848940523 | Option-adjusted spread down by 17.0 bp to 231.1 bp, with the yield to worst at 2.3% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 98.9-102.4).

- Issuer: Chengdu Airport Xingcheng Investment Group Co Ltd (Chengdu, China (Mainland)) | Coupon: 6.50% | Maturity: 18/7/2022 | Rating: BB+ | ISIN: XS2025664306 | Option-adjusted spread down by 21.6 bp to 391.2 bp, with the yield to worst at 4.0% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 102.0-103.0).

- Issuer: Turkiye Petrol Rafinerileri AS (KOCAELI, Turkey) | Coupon: 4.50% | Maturity: 18/10/2024 | Rating: B | ISIN: XS1686704948 | Option-adjusted spread down by 23.7 bp to 419.7 bp, with the yield to worst at 4.4% and the bond now trading up to 99.2 cents on the dollar (1Y price range: 95.5-101.3).

- Issuer: Minsur SA (San Borja, Peru) | Coupon: 6.25% | Maturity: 7/2/2024 | Rating: BB- | ISIN: USP6811TAA36 | Option-adjusted spread down by 24.2 bp to 322.4 bp, with the yield to worst at 3.4% and the bond now trading up to 106.9 cents on the dollar (1Y price range: 100.6-111.4).

- Issuer: Uzpromstroybank AKB (Tashkent, Uzbekistan) | Coupon: 5.75% | Maturity: 2/12/2024 | Rating: BB- | ISIN: XS2083131859 | Option-adjusted spread down by 31.6 bp to 368.1 bp, with the yield to worst at 4.0% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 102.4-105.1).

TOP HIGH YIELD EUR BOND MOVERS

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Option-adjusted spread up by 9.2 bp to 259.2 bp (CDS basis: -47.7bp), with the yield to worst at 2.3% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 98.0-101.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Option-adjusted spread up by 8.8 bp to 395.2 bp, with the yield to worst at 3.5% and the bond now trading down to 108.3 cents on the dollar (1Y price range: 99.6-108.5).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Option-adjusted spread down by 5.5 bp to 158.8 bp, with the yield to worst at 1.1% and the bond now trading up to 101.6 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: PHOENIX PIB Dutch Finance BV (Maarssen, Netherlands) | Coupon: 2.38% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2212959352 | Option-adjusted spread down by 6.1 bp to 183.1 bp, with the yield to worst at 1.4% and the bond now trading up to 103.2 cents on the dollar (1Y price range: 102.2-103.9).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.33% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS1523028436 | Option-adjusted spread down by 6.3 bp to 140.4 bp, with the yield to worst at 1.0% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 106.3-108.8).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Option-adjusted spread down by 7.1 bp to 354.0 bp, with the yield to worst at 3.4% and the bond now trading up to 87.9 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Volvo Car AB (Goeteborg, Sweden) | Coupon: 2.50% | Maturity: 7/10/2027 | Rating: BB+ | ISIN: XS2240978085 | Option-adjusted spread down by 8.4 bp to 125.8 bp, with the yield to worst at 1.0% and the bond now trading up to 108.1 cents on the dollar (1Y price range: 105.3-109.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.25% | Maturity: 30/7/2027 | Rating: BB- | ISIN: XS1266661013 | Option-adjusted spread down by 8.5 bp to 282.2 bp, with the yield to worst at 2.3% and the bond now trading up to 114.3 cents on the dollar (1Y price range: 110.8-115.7).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Option-adjusted spread down by 12.9 bp to 230.9 bp, with the yield to worst at 2.0% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Option-adjusted spread down by 13.5 bp to 365.1 bp, with the yield to worst at 3.3% and the bond now trading up to 91.5 cents on the dollar (1Y price range: 90.5-95.4).

USD BOND ISSUES

- Antero Resources Corp (Oil and Gas | Denver, United States | Rating: BB-): US$600m Senior Note (USU0018LAH34), fixed rate (5.38% coupon) maturing on 1 March 2030, priced at 100.00 (original spread of 385 bp), callable (9nc4)

- Clear Channel Outdoor Holdings Inc (Financial - Other | San Antonio, United States | Rating: CCC): US$1,050m Senior Note (USU1828LAC29), fixed rate (7.50% coupon) maturing on 1 June 2029, priced at 100.00 (original spread of 608 bp), callable (8nc3)

- Coastal Emerald Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB): US$200m Senior Note (XS2339960093), fixed rate (3.95% coupon) maturing on 24 May 2024, priced at 100.00, non callable

- Essex Portfolio LP (Real Estate Investment Trust | Palo Alto, United States | Rating: BBB+): US$300m Senior Note (US29717PAZ09), fixed rate (2.55% coupon) maturing on 15 June 2031, priced at 99.37 (original spread of 98 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$150m Bond (US3133EMA776), floating rate (PRQ + -316.5 bp) maturing on 21 April 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$100m Bond (US3130AML835), fixed rate (1.11% coupon) maturing on 28 May 2026, priced at 100.00, callable (5nc1m)

- Garda World Security Corp (Financial - Other | Montreal, Guernsey | Rating: CCC+): US$500m Senior Note (USC36025AH49), fixed rate (6.00% coupon) maturing on 1 June 2029, priced at 100.00 (original spread of 458 bp), callable (8nc3)

- IDEX Corp (Machinery | Northbrook, United States | Rating: BBB): US$500m Senior Note (US45167RAH75), fixed rate (2.63% coupon) maturing on 15 June 2031, priced at 99.88 (original spread of 100 bp), callable (10nc10)

- Redsun Properties Group Ltd (Service - Other | Nanjing, Jiangsu, China (Mainland) | Rating: B-): US$210m Bond (XS2328508846), fixed rate (7.30% coupon) maturing on 21 May 2024, priced at 99.21, callable (3nc2)

- Sunnova Energy International Inc (Electronics | Houston, Texas, United States | Rating: NR): US$500m Bond (US86745KAE47) zero coupon maturing on 1 December 2026, priced at 100.00, non callable, convertible

- Union Pacific Corp (Railroads | Omaha, United States | Rating: BBB+): US$1,000m Senior Note (US907818FT00), fixed rate (3.20% coupon) maturing on 20 May 2041, priced at 99.97 (original spread of 93 bp), callable (20nc20)

- Union Pacific Corp (Railroads | Omaha, United States | Rating: BBB+): US$850m Senior Note (US907818FU72), fixed rate (2.38% coupon) maturing on 20 May 2031, priced at 100.00 (original spread of 73 bp), callable (10nc10)

- Union Pacific Corp (Railroads | Omaha, United States | Rating: BBB+): US$650m Senior Note (US907818FV55), fixed rate (3.55% coupon) maturing on 20 May 2061, priced at 99.49 (original spread of 120 bp), callable (40nc40)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A): US$1,500m Senior Note (US91324PED06), fixed rate (2.30% coupon) maturing on 15 May 2031, priced at 99.99 (original spread of 65 bp), callable (10nc10)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A): US$2,000m Senior Note (US91324PEF53), fixed rate (3.25% coupon) maturing on 15 May 2051, priced at 99.36 (original spread of 90 bp), callable (30nc30)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A): US$1,000m Senior Note (US91324PEB40), fixed rate (0.55% coupon) maturing on 15 May 2024, priced at 99.90 (original spread of 25 bp), callable (3nc1)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A): US$1,000m Senior Note (US91324PEC23), fixed rate (1.15% coupon) maturing on 15 May 2026, priced at 99.83 (original spread of 35 bp), callable (5nc5)

- UnitedHealth Group Inc (Health Care Facilities | Hopkins, United States | Rating: A): US$1,500m Senior Note (US91324PEE88), fixed rate (3.05% coupon) maturing on 15 May 2041, priced at 99.57 (original spread of 80 bp), callable (20nc20)

EUR BOND ISSUES

- Balder Finland Oyj (Financial - Other | Helsinki, Etela-Suomen, Sweden | Rating: NR): €500m Senior Note (XS2345315142), fixed rate (1.38% coupon) maturing on 24 May 2030, priced at 99.36 (original spread of 165 bp), callable (9nc9)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): €1,500m Senior Note (XS2345784057), floating rate (EU03MLIB + 100.0 bp) maturing on 24 August 2025, priced at 101.82, callable (4nc3)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): €1,500m Senior Note (XS2345798271), floating rate maturing on 24 May 2032, priced at 100.00 (original spread of 121 bp), callable (11nc10)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): €1,000m Senior Note (XS2345799089), floating rate maturing on 24 August 2028, priced at 100.00 (original spread of 101 bp), callable (7nc6)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €100m Unsecured Note (XS2269581000) zero coupon maturing on 6 August 2029, priced at 100.00, non callable

- Constellium SE (Industrials - Other | Paris, Ile-De-France, France | Rating: B): €300m Senior Note (XS2335148024), fixed rate (3.13% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 341 bp), callable (8nc3)

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: A-): €100m Inhaberschuldverschreibung (DE000LB2V569), fixed rate (0.15% coupon) maturing on 20 May 2026, priced at 99.96, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): €100m Inhaberschuldverschreibung (DE000HLB2318), fixed rate (0.16% coupon) maturing on 28 May 2027, priced at 100.00, non callable

- Lower Saxony, State of (Official and Muni | Hannover, Niedersachsen, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A3E5TU4), fixed rate (0.01% coupon) maturing on 26 May 2028, priced at 100.74 (original spread of 29 bp), non callable

- OP Asuntoluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €1,000m Senior Note (XS2345871706), floating rate (EU03MLIB + 100.0 bp) maturing on 24 May 2023, non callable

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): €100m Index Linked Security (AT0000A2REC8) zero coupon maturing on 9 July 2029, priced at 100.00, non callable

- Toyota Motor Finance Netherlands BV (Financial - Other | Amsterdam, Noord-Holland, Japan | Rating: A+): €300m Senior Note (XS2345868744), floating rate (EU03MLIB + 75.0 bp) maturing on 24 May 2023, non callable

NEW ISSUES IN LOANS

- Academy Sports & Outdoors Inc, signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 11/06/27 and initial pricing is set at LIBOR +425.000bps

- Hayward Industries Inc (BB-), signed a US$ 850m Term Loan B, to be used for general corporate purposes. It matures on 05/17/28 and initial pricing is set at LIBOR +275.000bps

- Insight Global Inc, signed a US$ 550m Term Loan B, maturing on 05/23/25.

- US Concrete Inc (BB-), signed a US$ 300m Term Loan B, to be used for general corporate purposes, refinancing. It matures on 05/26/28 and initial pricing is set at LIBOR +300.000bps

- Zijin Mining Group Co Ltd (BB+), signed a US$ 500m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 05/17/24 and initial pricing is set at LIBOR +125.000bps

- Mercuria Energy Trading SA, signed a US$ 850m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/28/22 and initial pricing is set at LIBOR +60.000bps

- Mercuria Energy Trading SA, signed a US$ 400m Term Loan, to be used for general corporate purposes. It matures on 05/28/24 and initial pricing is set at LIBOR +115.000bps

- Mercuria Energy Trading SA, signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/28/22 and initial pricing is set at LIBOR +60.000bps

- Garbe Industrial Re Gmbh, signed a € 380m Term Loan, to be used for real estate acquisitions

NEW ISSUES IN STRUCTURED CREDIT

- Veros Auto Receivables Trust 2021-1 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 220 m. Highest-rated tranche offering a yield to maturity of 0.92%, and the lowest-rated tranche a yield to maturity of 3.64%. Bookrunners: Deutsche Bank Securities Inc

- Ari Fleet Lease Trust 2021-A issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 646 m. Highest-rated tranche offering a yield to maturity of 0.17%, and the lowest-rated tranche a yield to maturity of 1.46%. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch, Mizuho Securities USA Inc, MUFG Securities Americas Inc