Credit

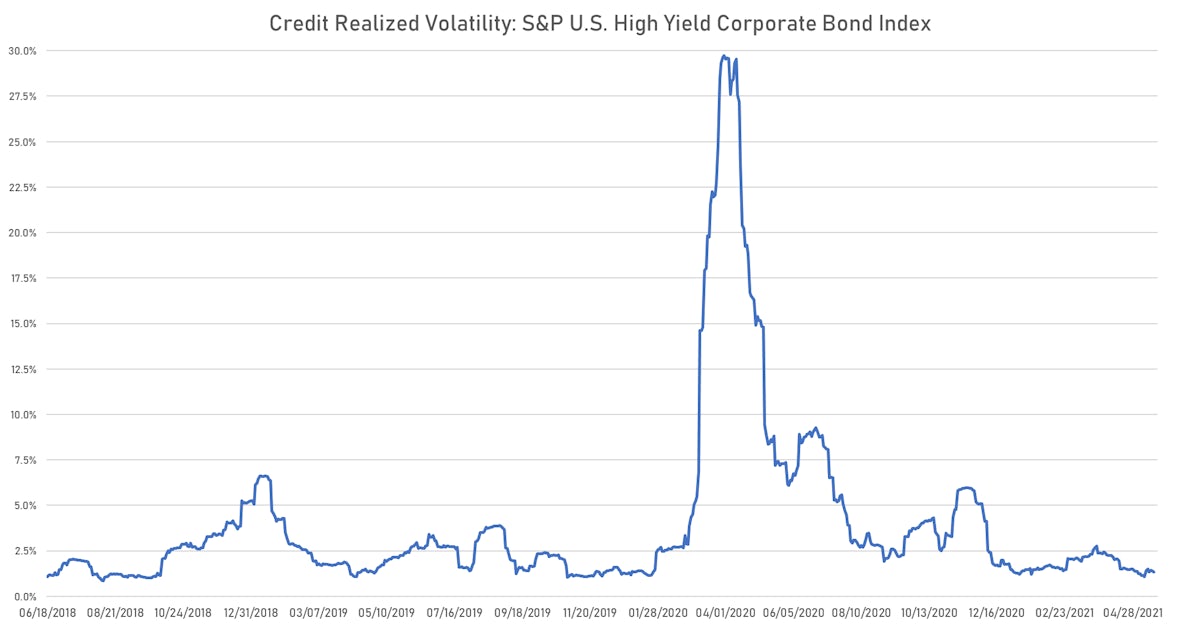

Low Credit Volatility Allows For Ample Primary Issuance

In the high-yield secondary market, Taylor Morrison, SoftBank and TerraForm Power bonds saw their option-adjusted spreads widen by double digits

Published ET

Implied DP | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.05% and high yield down -0.06% (YTD total return: -3.32%)

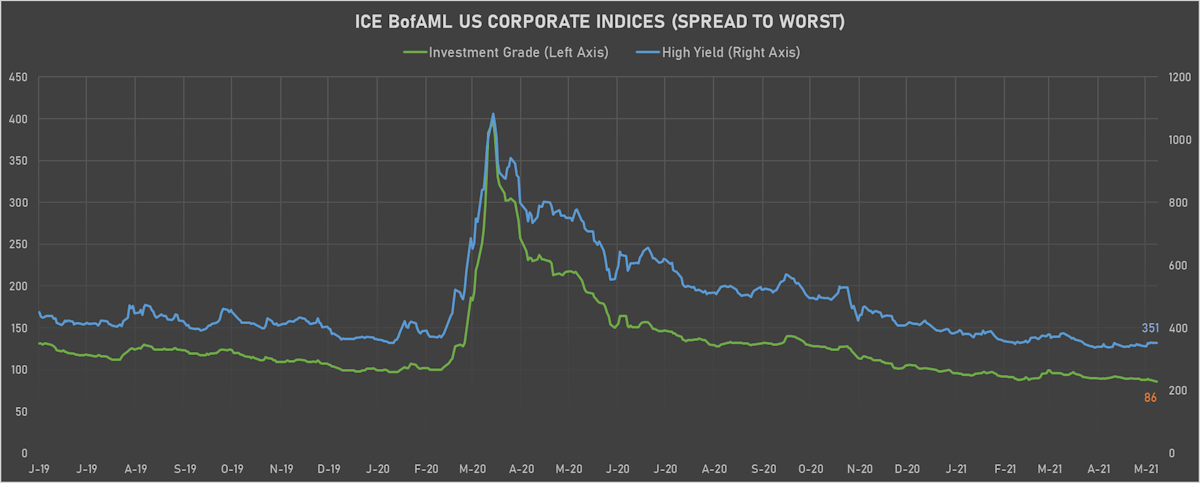

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 349.0 bp (YTD change: -41.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.8%)

- New issues: US$ 16.4bn in dollars and € 20.9bn in euros

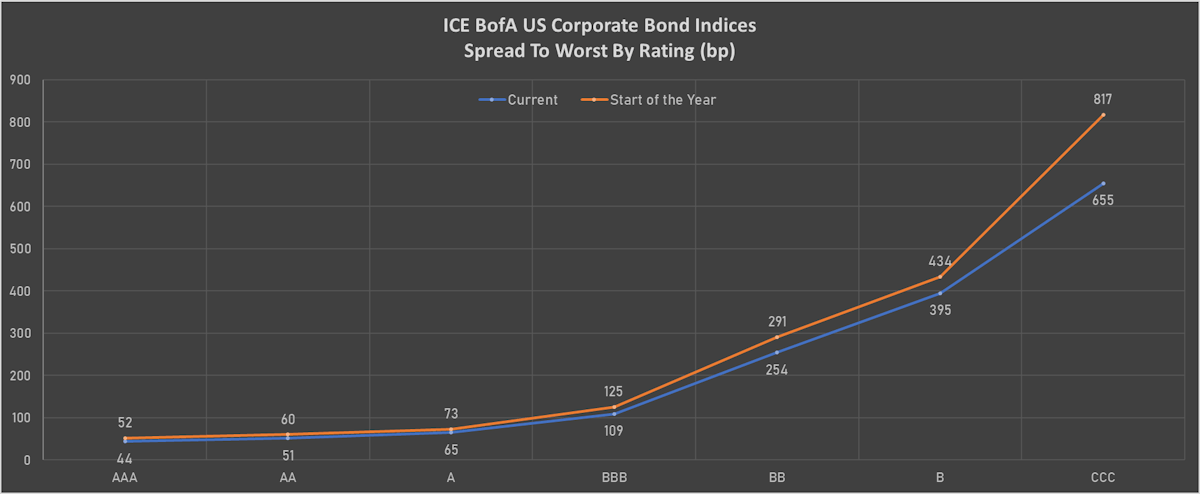

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 47 bp

- AA unchanged at 54 bp

- A up by 1 bp at 71 bp

- BBB unchanged at 114 bp

- BB down by -1 bp at 242 bp

- B down by -1 bp at 374 bp

- CCC down by -2 bp at 641 bp

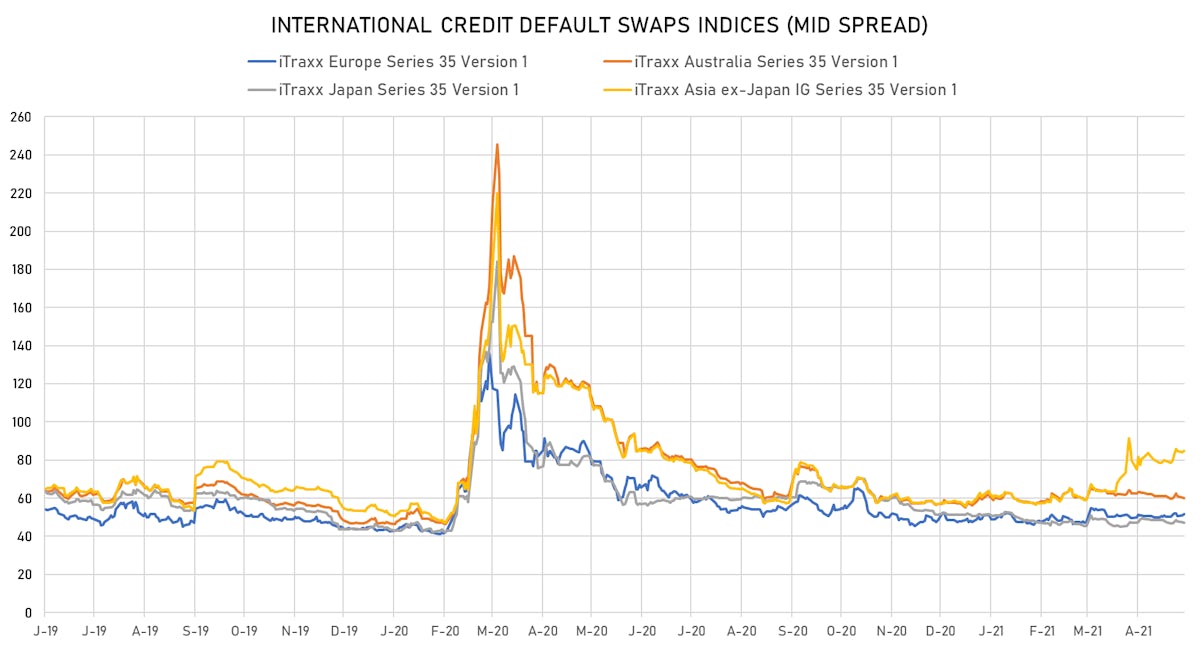

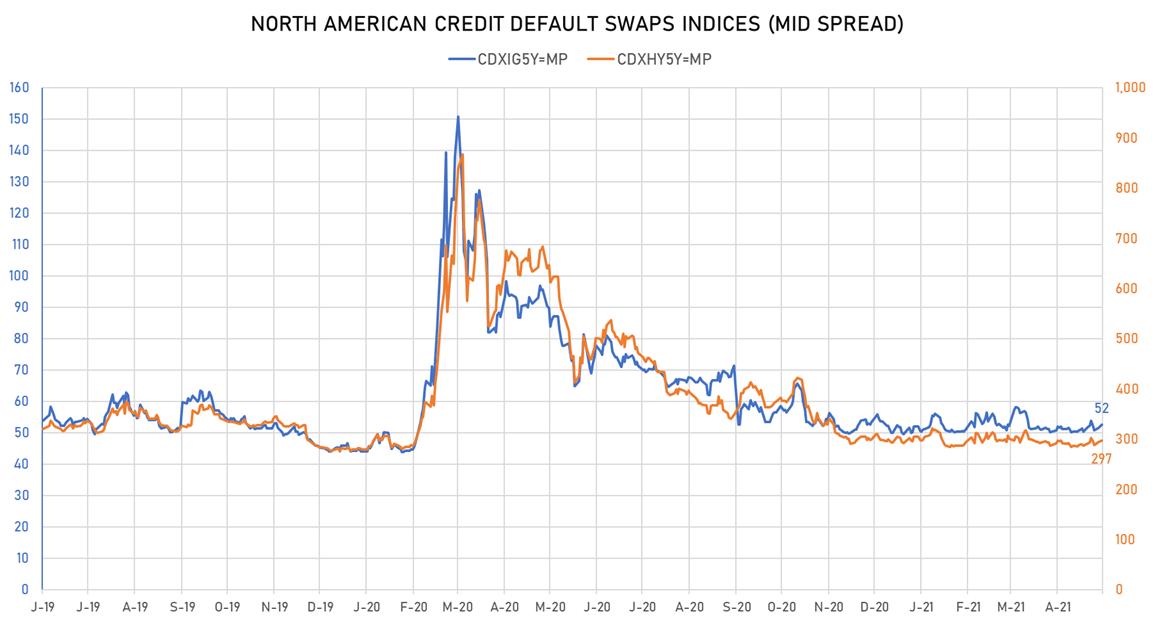

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.0 bp, now at 52bp (YTD change: +2.5bp)

- Markit CDX.NA.HY 5Y up 3.4 bp, now at 297bp (YTD change: +3.8bp)

- Markit iTRAXX Europe up 0.5 bp, now at 52bp (YTD change: +3.6bp)

- Markit iTRAXX Japan down 0.2 bp, now at 47bp (YTD change: -4.3bp)

- Markit iTRAXX Asia Ex-Japan up 0.8 bp, now at 85bp (YTD change: +26.8bp)

TOP BONDS MOVERS - USD HY

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 4.75% | Maturity: 19/9/2024 | Rating: BB- | ISIN: XS1684384511 | Option-adjusted spread up by 16.2 bp to 212.1 bp, with the yield to worst at 2.5% and the bond now trading down to 106.4 cents on the dollar (1Y price range: 104.4-108.0).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Option-adjusted spread up by 15.7 bp to 288.0 bp, with the yield to worst at 3.9% and the bond now trading down to 105.3 cents on the dollar (1Y price range: 105.3-113.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/4/2023 | Rating: BB- | ISIN: USU8759MAA28 | Option-adjusted spread up by 14.7 bp to 128.4 bp, with the yield to worst at 1.3% and the bond now trading down to 107.1 cents on the dollar (1Y price range: 105.3-107.8).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Option-adjusted spread up by 14.5 bp to 1,232.4 bp, with the yield to worst at 12.6% and the bond now trading down to 74.7 cents on the dollar (1Y price range: 74.0-92.1).

- Issuer: Bank of Baroda (London Branch) (London, United Kingdom) | Coupon: 3.88% | Maturity: 4/4/2024 | Rating: BB+ | ISIN: XS1972573007 | Option-adjusted spread down by 11.1 bp to 134.9 bp, with the yield to worst at 1.6% and the bond now trading up to 105.9 cents on the dollar (1Y price range: 105.4-106.4).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Option-adjusted spread down by 17.3 bp to 314.1 bp, with the yield to worst at 3.3% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Turk Telekomunikasyon AS (Istanbul, Turkey) | Coupon: 4.88% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1028951264 | Option-adjusted spread down by 29.7 bp to 306.9 bp, with the yield to worst at 3.2% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 99.8-104.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 5.00% | Maturity: 1/6/2022 | Rating: CCC | ISIN: USU0242AAC63 | Option-adjusted spread down by 39.2 bp to 539.5 bp (CDS basis: -102.2bp), with the yield to worst at 5.5% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 87.8-99.5).

TOP BONDS MOVERS - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.88% | Maturity: 28/1/2026 | Rating: BB | ISIN: XS1846631049 | Option-adjusted spread up by 5.7 bp to 174.6 bp (CDS basis: -10.2bp), with the yield to worst at 1.3% and the bond now trading down to 106.0 cents on the dollar (1Y price range: 104.4-107.2).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Option-adjusted spread down by 5.6 bp to 136.0 bp, with the yield to worst at 1.0% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Option-adjusted spread down by 5.6 bp to 203.5 bp, with the yield to worst at 1.6% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 102.7-105.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Option-adjusted spread down by 7.3 bp to 348.3 bp, with the yield to worst at 3.3% and the bond now trading up to 88.2 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2202907510 | Option-adjusted spread down by 10.0 bp to 305.8 bp (CDS basis: 86.7bp), with the yield to worst at 2.7% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 101.4-106.3).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Option-adjusted spread down by 10.3 bp to 391.5 bp, with the yield to worst at 3.4% and the bond now trading up to 108.4 cents on the dollar (1Y price range: 99.6-108.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Option-adjusted spread down by 12.7 bp to 426.8 bp (CDS basis: -29.7bp), with the yield to worst at 3.9% and the bond now trading up to 113.4 cents on the dollar (1Y price range: 102.3-115.5).

USD BOND ISSUES

- Atkore Inc (Electronics | Harvey, Cayman Islands | Rating: BB-): US$400m Senior Note (US047649AA63), fixed rate (4.25% coupon) maturing on 1 June 2031, priced at 100.00 (original spread of 288 bp), callable (10nc5)

- CDP Financial Inc (Financial - Other | Montreal, Canada | Rating: AAA): US$1,000m Senior Note (US125094AV47), fixed rate (1.00% coupon) maturing on 26 May 2026, priced at 99.97 (original spread of 19 bp), non callable

- Caisse Amortissement de la Dette Sociale (Agency | Paris, France | Rating: AA): US$4,000m Senior Note (US12802D2E51), fixed rate (0.38% coupon) maturing on 27 May 2024, priced at 99.69 (original spread of 15 bp), non callable

- Charter Communications Operating LLC (Cable/Media | St. Louis, United States | Rating: BBB-): US$1,400m Note (US161175CC60), fixed rate (4.40% coupon) maturing on 1 December 2061, priced at 99.91 (original spread of 250 bp), callable (41nc40)

- DNB Bank ASA (Banking | Oslo, Norway | Rating: AA-): US$1,000m Note (US23329PAG54), floating rate maturing on 25 May 2027, priced at 100.00, callable (6nc5)

- Emirates NBD Bank PJSC (Banking | Dubai, United Arab Emirates | Rating: A+): US$125m Senior Note (XS2346140531), fixed rate (1.84% coupon) maturing on 25 May 2026, priced at 99.91, non callable

- Erste Abwicklungsanstalt (Agency | Dusseldorf, Germany | Rating: AA): US$1,000m Senior Note (XS2345827120), fixed rate (0.25% coupon) maturing on 25 August 2023, priced at 99.87 (original spread of 15 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133EMB501), fixed rate (1.94% coupon) maturing on 27 May 2031, priced at 100.00 (original spread of 37 bp), callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$135m Bond (US3133EMB683), fixed rate (2.00% coupon) maturing on 27 May 2031, priced at 100.00 (original spread of 42 bp), callable (10nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$210m Bond (US3130AMLQ30), floating rate (SOFR + 6.0 bp) maturing on 20 May 2024, priced at 100.00, non callable

- Federation of Caisses Desjardins Du Quebec (Banking | Levis, Canada | Rating: A): US$500m Senior Note (US31429KAF03), floating rate (SOFR + 43.0 bp) maturing on 21 May 2024, priced at 100.00, non callable

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$900m Unsecured Note (XS2061793092), fixed rate (8.40% coupon) maturing on 26 May 2026, priced at 100.00, non callable

- Hilong Holding Ltd (Oilfield Machinery and Services | Shanghai, United Kingdom | Rating: NR): US$379m Bond (XS2344083139), fixed rate (9.75% coupon) maturing on 18 November 2024, priced at 100.00, non callable

- International Bank for Reconstruction and Development (Supranational | Washington, United States | Rating: AAA): US$2,500m Bond (US459058JX27), fixed rate (0.88% coupon) maturing on 15 July 2026, priced at 99.56 (original spread of 14 bp), non callable

- Microchip Technology Inc (Electronics | Chandler, United States | Rating: BBB-): US$1,000m Note (US595017AX27), fixed rate (0.98% coupon) maturing on 1 September 2024, priced at 100.00 (original spread of 65 bp), with a make whole call

- NH Investment & Securities Co Ltd (Securities | Seoul, South Korea | Rating: BBB+): US$100m Index Linked Security (KR6NH0001220) zero coupon maturing on 27 May 2041, priced at 100.00, non callable

- QIB Sukuk Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$150m Unsecured Note (XS2346238269), fixed rate (1.95% coupon) maturing on 27 October 2027, priced at 100.00, non callable

- Tenet Healthcare Corp (Health Care Facilities | Dallas, United States | Rating: B+): US$1,400m Note (US88033GDL14), fixed rate (4.25% coupon) maturing on 1 June 2029, priced at 100.00 (original spread of 282 bp), callable (8nc3)

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$100m Unsecured Note (XS2025072989), floating rate maturing on 1 June 2025, priced at 100.00, non callable

EUR BOND ISSUES

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB+): €750m Senior Note (XS2346207892), fixed rate (0.88% coupon) maturing on 21 May 2029, priced at 99.92 (original spread of 117 bp), callable (8nc8)

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB+): €750m Senior Note (XS2346206902), fixed rate (0.45% coupon) maturing on 15 January 2027, priced at 99.78 (original spread of 98 bp), callable (6nc5)

- American Tower Corp (Real Estate Investment Trust | Boston, United States | Rating: BBB+): €500m Senior Note (XS2346208197), fixed rate (1.25% coupon) maturing on 21 May 2033, priced at 99.37 (original spread of 142 bp), callable (12nc12)

- Caixabank SA (Banking | Barcelona, Spain | Rating: BBB+): €1,000m Note (XS2346253730), floating rate maturing on 26 May 2028, priced at 99.32 (original spread of 133 bp), callable (7nc6)

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €8,137m Senior Note (EU000A3KRJQ6) zero coupon maturing on 4 July 2029, priced at 99.85 (original spread of 32 bp), non callable

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €6,000m Senior Note (EU000A3KRJR4), fixed rate (0.75% coupon) maturing on 4 January 2047, priced at 99.84 (original spread of 41 bp), non callable

- Landesbank Saar (Banking | Saarbruecken, Germany | Rating: A+): €250m Pfandbrief Anleihe (Covered Bond) (DE000SLB4238), fixed rate (0.20% coupon) maturing on 26 May 2031, priced at 99.85 (original spread of 33 bp), non callable

- Raiffeisen Landesbank Steiermark AG (Banking | Graz, Austria | Rating: BBB+): €500m Fundierte Namensschuldverschreibung (covered bond) (AT000B093547), fixed rate (0.50% coupon) maturing on 27 May 2041, priced at 97.86 (original spread of 44 bp), non callable

- Repsol International Finance BV (Financial - Other | S-Gravenhage, Spain | Rating: NR): €300m Unsecured Note (XS2343835315), floating rate maturing on 19 May 2023, priced at 100.00, non callable

- Ryanair DAC (Airline | Swords, Ireland | Rating: BBB): €1,200m Senior Note (XS2344385815), fixed rate (0.88% coupon) maturing on 25 May 2026, priced at 99.49 (original spread of 149 bp), non callable

- SBB Treasury Oyj (Financial - Other | Helsinki, Sweden | Rating: NR): €750m Senior Note (XS2346224806), fixed rate (1.13% coupon) maturing on 26 November 2029, priced at 98.62 (original spread of 154 bp), callable (9nc8)

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): €750m Covered Bond (Other) (XS2345845882), fixed rate (0.10% coupon) maturing on 25 May 2029, priced at 99.81 (original spread of 43 bp), non callable

NEW ISSUES IN LOANS

- Federal International Finance PT (Indonesia), signed a US$ 250m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 05/18/24.

NEW ISSUES IN STRUCTURED CREDIT

- New Residential MSR NZES 2021-FNT2 issued a fixed-rate RMBS in 1 tranche, for a total of US$ 358 m, with a yield to maturity of 3.23%. Bookrunners: Nomura Securities Co Ltd, Credit Suisse, Amherst Securities Corp., Goldman Sachs & Co, Citigroup Global Markets Inc