Credit

High Yield Spreads Rise, Investment Grade Unchanged

Air Liquide, Ericsson, Repsol among the euro bonds priced on a light day for corporate issuance

Published ET

Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.27% today, with investment grade down -0.26% and high yield down -0.33% (YTD total return: -3.54%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 7.0 bp, now at 356.0 bp (YTD change: -34.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.7%)

- New issues: US$ 4.0bn in dollars and € 5.3bn in euros

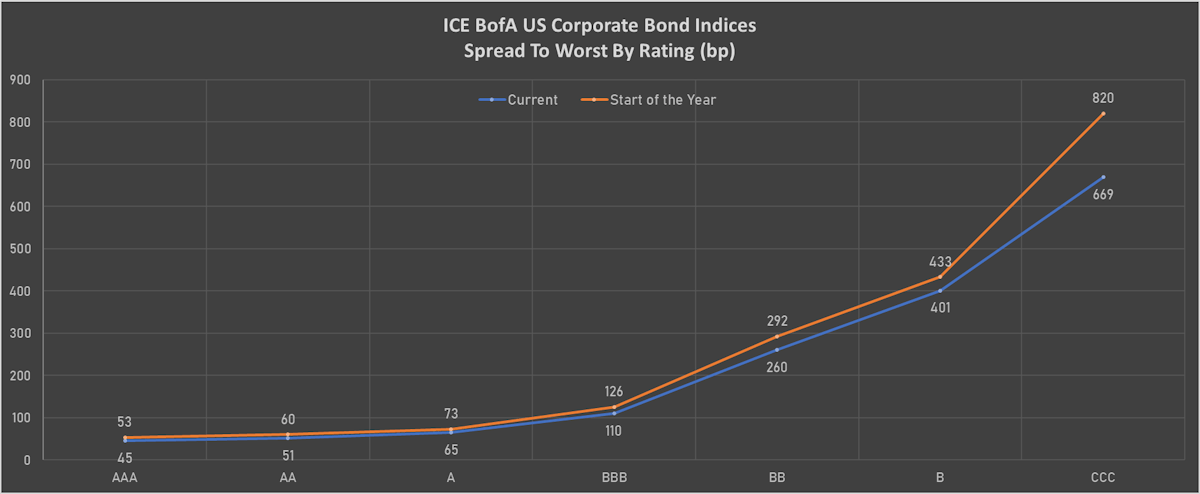

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 54 bp

- A unchanged at 71 bp

- BBB unchanged at 114 bp

- BB up by 5 bp at 247 bp

- B up by 7 bp at 381 bp

- CCC up by 11 bp at 652 bp

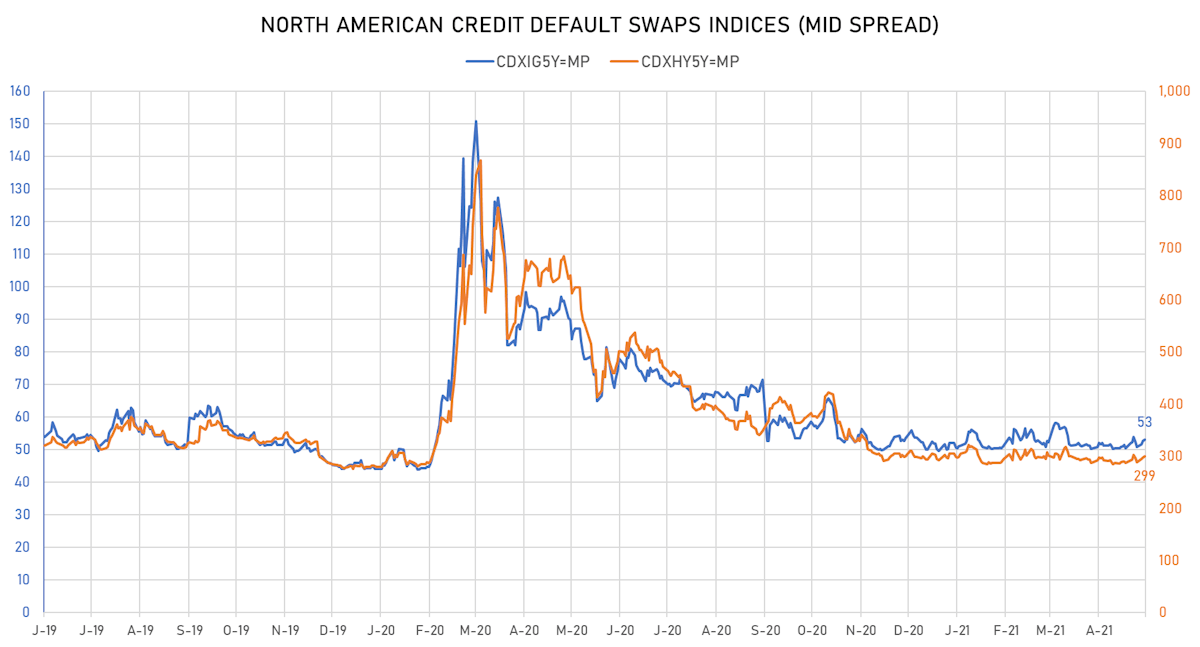

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.5 bp, now at 53bp (YTD change: +3.0bp)

- Markit CDX.NA.HY 5Y up 2.1 bp, now at 299bp (YTD change: +5.9bp)

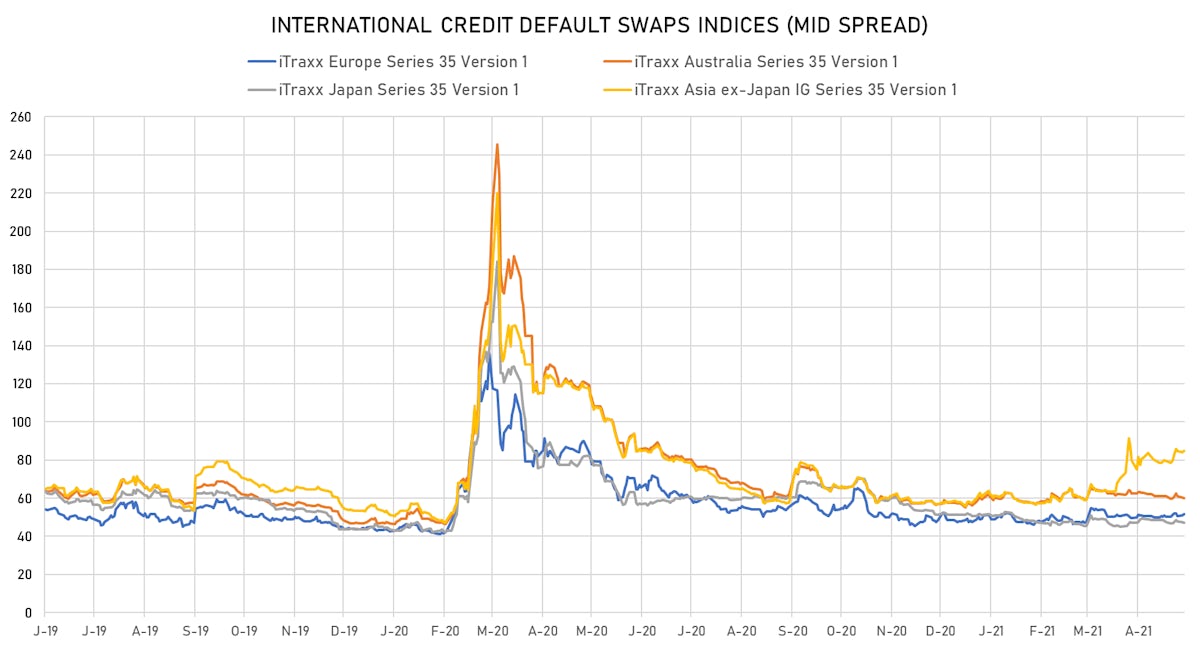

- Markit iTRAXX Europe up 0.9 bp, now at 52bp (YTD change: +4.5bp)

- Markit iTRAXX Japan up 0.1 bp, now at 47bp (YTD change: -4.2bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 85bp (YTD change: +26.8bp)

TOP BONDS MOVERS - USD HY

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Option-adjusted spread up by 21.7 bp to 703.0 bp (CDS basis: -40.0bp), with the yield to worst at 7.4% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 71.0-89.5).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Option-adjusted spread up by 20.2 bp to 857.4 bp, with the yield to worst at 8.9% and the bond now trading down to 99.1 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.00% | Maturity: 1/5/2025 | Rating: BB- | ISIN: USC67111AG65 | Option-adjusted spread up by 18.2 bp to 265.5 bp (CDS basis: -55.3bp), with the yield to worst at 3.1% and the bond now trading down to 105.9 cents on the dollar (1Y price range: 101.4-107.2).

- Issuer: MHP SE (Kiev, Cyprus) | Coupon: 7.75% | Maturity: 10/5/2024 | Rating: B | ISIN: XS1577965004 | Option-adjusted spread up by 18.0 bp to 507.7 bp, with the yield to worst at 5.3% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 103.4-110.0).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Option-adjusted spread up by 14.4 bp to 288.6 bp, with the yield to worst at 3.9% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 105.0-113.3).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.63% | Maturity: 15/6/2035 | Rating: BB- | ISIN: US71656MAE93 | Option-adjusted spread down by 15.5 bp to 547.5 bp (CDS basis: -58.1bp), with the yield to worst at 7.0% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 93.2-100.6).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Option-adjusted spread down by 17.5 bp to 311.6 bp, with the yield to worst at 3.2% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Yapi ve Kredi Bankasi AS (Istanbul, Turkey) | Coupon: 5.85% | Maturity: 21/6/2024 | Rating: B | ISIN: XS1634372954 | Option-adjusted spread down by 28.9 bp to 475.8 bp, with the yield to worst at 5.0% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 97.8-104.0).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Option-adjusted spread down by 43.5 bp to 744.3 bp, with the yield to worst at 7.6% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 67.5-99.8).

TOP BONDS MOVERS - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Option-adjusted spread up by 10.1 bp to 266.7 bp, with the yield to worst at 2.2% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 103.1-105.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Option-adjusted spread up by 7.4 bp to 355.1 bp, with the yield to worst at 3.4% and the bond now trading down to 87.8 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Option-adjusted spread up by 7.3 bp to 213.9 bp (CDS basis: -28.5bp), with the yield to worst at 1.7% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 100.4-103.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Option-adjusted spread up by 6.6 bp to 279.5 bp (CDS basis: -45.0bp), with the yield to worst at 2.6% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 98.7-100.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Option-adjusted spread up by 6.5 bp to 485.2 bp (CDS basis: -71.6bp), with the yield to worst at 4.7% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: TechnipFMC PLC (London, United Kingdom) | Coupon: 4.50% | Maturity: 30/6/2025 | Rating: BB | ISIN: XS2197326437 | Option-adjusted spread down by 11.4 bp to 267.5 bp (CDS basis: 19.5bp), with the yield to worst at 2.2% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 103.4-108.2).

USD BOND ISSUES

- Assured Guaranty US Holdings Inc (Financial - Other | New York City, Bermuda | Rating: A): US$500m Senior Note (US04621WAD20), fixed rate (3.15% coupon) maturing on 15 June 2031, priced at 99.72 (original spread of 152 bp), callable (10nc10)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$300m Unsecured Note (XS1273452877), fixed rate (1.00% coupon) maturing on 18 June 2028, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$300m Bond (US3130AMMN99), fixed rate (1.07% coupon) maturing on 28 May 2026, priced at 100.00 (original spread of 103 bp), callable (5nc1m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$100m Bond (US3130AMN328), fixed rate (0.45% coupon) maturing on 1 November 2024, priced at 100.00, callable (3nc5m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$850m Bond (US3130AMMK50), floating rate (SOFR + 3.5 bp) maturing on 19 May 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$120m Bond (US3130AMMM17), fixed rate (0.38% coupon) maturing on 3 June 2024, priced at 100.00 (original spread of 35 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$125m Bond (US3130AMME90), fixed rate (1.00% coupon) maturing on 26 May 2026, priced at 100.00, callable (5nc6m)

- Kommuninvest i Sverige AB (Agency | Orebro, Sweden | Rating: AAA): US$1,000m Senior Note (US50046PBT12), fixed rate (0.25% coupon) maturing on 15 September 2023, priced at 99.88 (original spread of 16 bp), non callable

- NFP Corp (Life Insurance | New York City, New York, United States | Rating: B): US$325m Note (US65342RAE09), fixed rate (4.88% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 353 bp), callable (7nc2)

- QIB Sukuk Ltd (Financial - Other | George Town, Qatar | Rating: NR): US$150m Unsecured Note (XS2346238269), fixed rate (1.95% coupon) maturing on 27 October 2027, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$100m Unsecured Note (XS2025072989), floating rate maturing on 1 June 2025, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$100m Unsecured Note (XS2025073102), floating rate maturing on 1 June 2026, priced at 100.00, non callable

EUR BOND ISSUES

- Air Liquide Finance SA (Financial - Other | Paris, France | Rating: AAA): €500m Senior Note (FR0014003N69), fixed rate (0.38% coupon) maturing on 27 May 2031, priced at 99.16 (original spread of 58 bp), callable (10nc10)

- Finland, Republic of (Government) (Sovereign | Helsinki, Finland | Rating: AA+): €3,000m Bond (FI4000507231), fixed rate (0.13% coupon) maturing on 15 September 2031, priced at 99.61 (original spread of 29 bp), non callable

- Kojamo Oyj (Service - Other | Helsinki, Finland | Rating: BBB): €350m Senior Note (XS2345877497), fixed rate (0.88% coupon) maturing on 28 May 2029, priced at 99.04 (original spread of 129 bp), callable (8nc8)

- Marcolin SpA (Consumer Products | Longarone, Belluno | Rating: B-): €350m Note (XS2346563500), fixed rate (6.13% coupon) maturing on 15 November 2026, priced at 100.00 (original spread of 662 bp), callable (5nc2)

- NATWEST MARKETS PLC (Banking | Edinburgh, United Kingdom | Rating: A-): €200m Unsecured Note (XS2346730174), floating rate maturing on 26 May 2023, priced at 100.00, non callable

- Raiffeisen Centrobank AG (Banking | Wien, Wien, Austria | Rating: NR): €100m Index Linked Security (AT0000A2REN5) zero coupon maturing on 30 June 2026, priced at 100.00, non callable

- Repsol International Finance BV (Financial - Other | S-Gravenhage, Spain | Rating: NR): €300m Unsecured Note (XS2343835315), floating rate maturing on 19 May 2023, priced at 100.00, non callable

- Telefonaktiebolaget LM Ericsson (Telecommunications | Stockholm, Sweden | Rating: BBB-): €500m Senior Note (XS2345996743), fixed rate (1.00% coupon) maturing on 26 May 2029, priced at 99.50 (original spread of 136 bp), callable (8nc8)

NEW ISSUES IN LOANS

- Boels Topholding BV, signed a € 1,450m Term Loan B, to be used for general corporate purposes. It matures on 02/08/27 and initial pricing is set at EURIBOR +325.000bps

- ONGC Videsh Ltd (INDIA / BBB-), signed a US$ 600m Revolving Credit / Term Loan, to be used for refinancing bank debt. It matures on 05/19/26.