Credit

Mixed Day For Corporate Bonds, With Investment Grade Outperforming High Yield

Spreads on North American CDX indices were tighter across the board and implied default probabilities down; Asia ex-Japan sees CDS spreads rise to the highest level in a month

Published ET

CDX North America High Yield 5Y Default Probability | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.10% today, with investment grade up 0.14% and high yield down -0.16% (YTD total return: -3.22%)

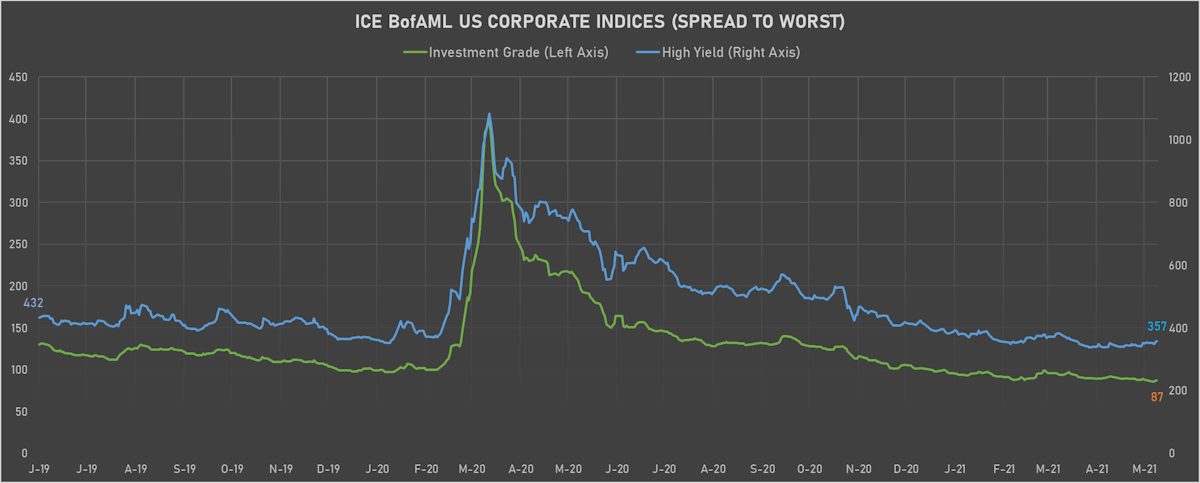

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 357.0 bp (YTD change: -33.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.8%)

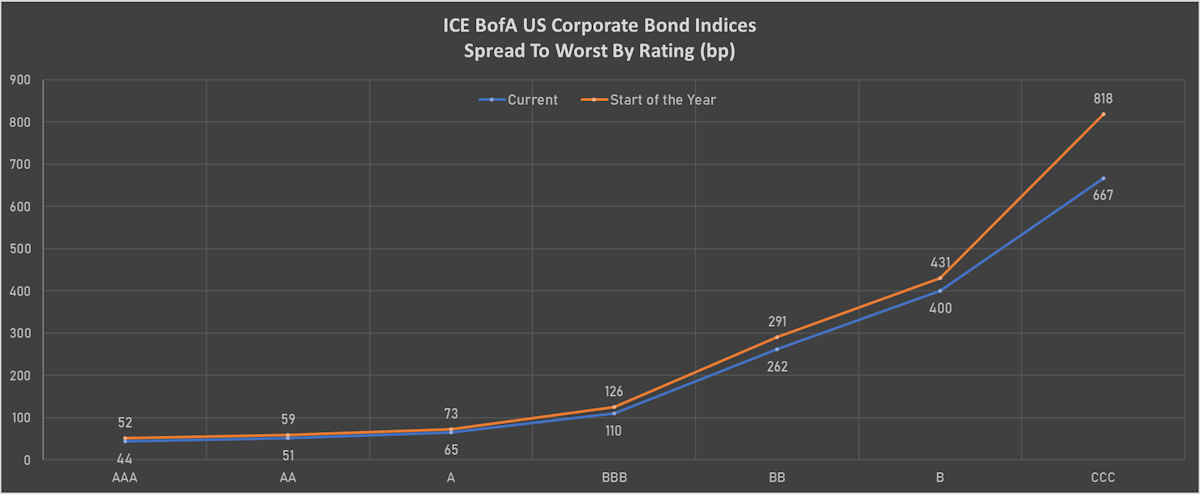

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA up by 1 bp at 55 bp

- A unchanged at 71 bp

- BBB unchanged at 114 bp

- BB up by 3 bp at 250 bp

- B up by 1 bp at 382 bp

- CCC unchanged at 652 bp

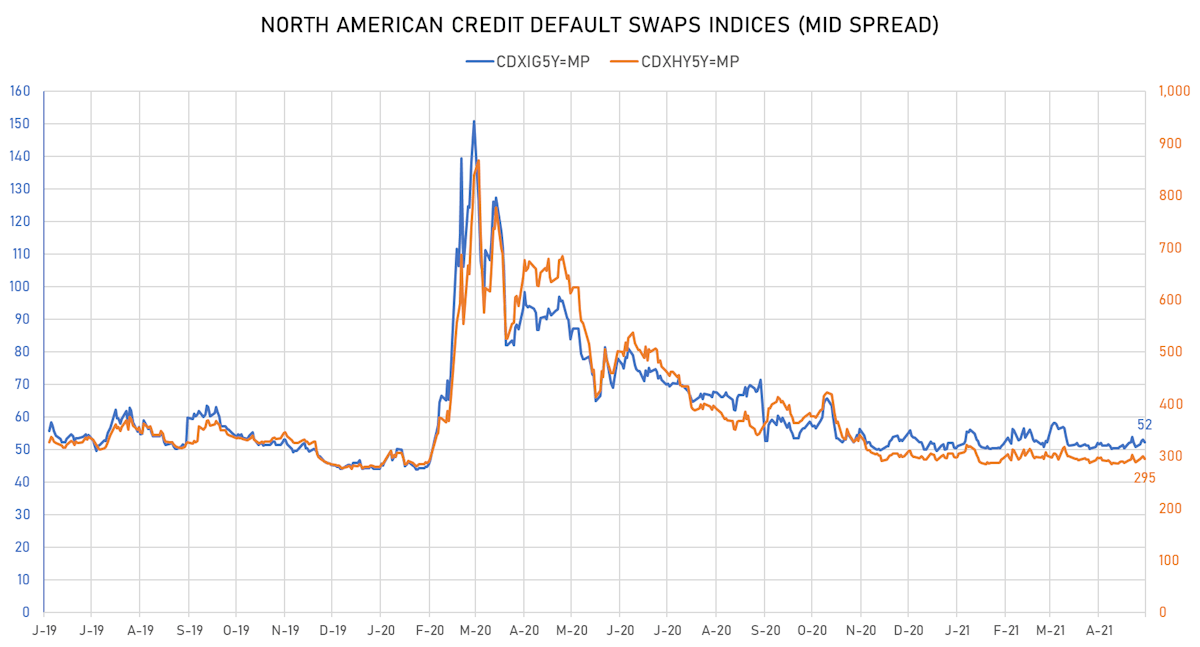

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 52bp (YTD change: +2.3bp)

- Markit CDX.NA.HY 5Y down 4.3 bp, now at 295bp (YTD change: +1.5bp)

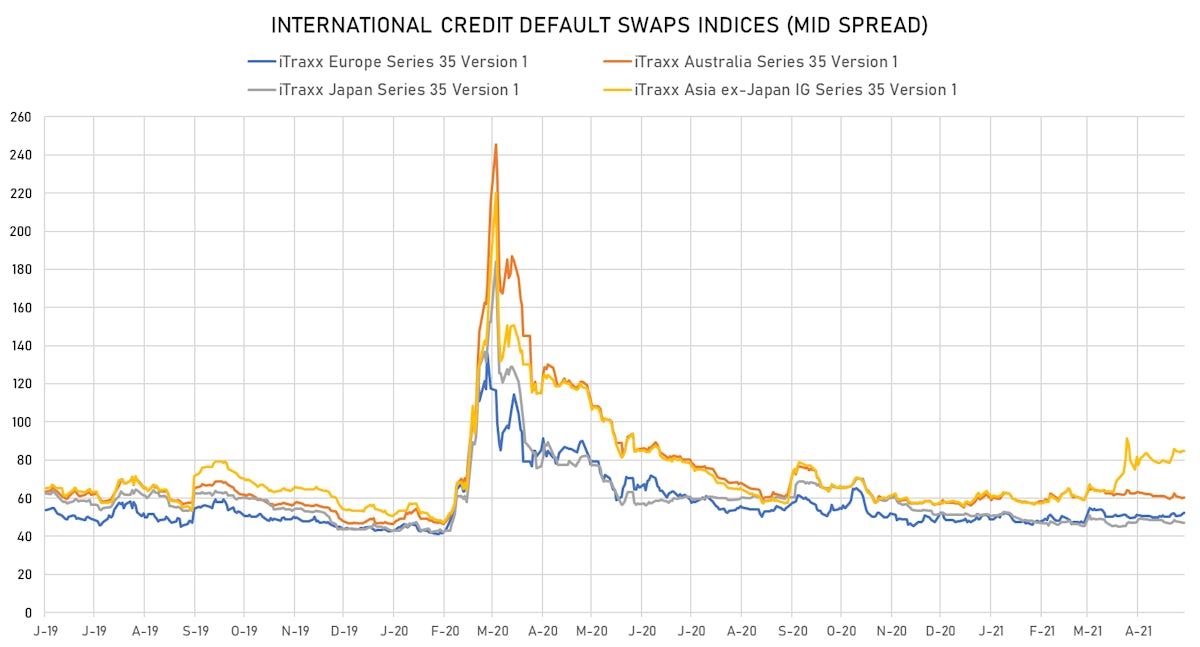

- Markit iTRAXX Europe down 0.5 bp, now at 52bp (YTD change: +4.0bp)

- Markit iTRAXX Japan up 0.8 bp, now at 48bp (YTD change: -3.4bp)

- Markit iTRAXX Asia Ex-Japan up 4.6 bp, now at 89bp (YTD change: +31.4bp)

USD CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Apache Corp (Country: US; rated: Ba1): up 22.4 bp to 269.6bp (1Y range: 205-453bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 21.1 bp to 359.7bp (1Y range: 238-763bp)

- American Airlines Group Inc (Country: US; rated: B2): up 19.3 bp to 721.6bp (1Y range: 702-5,144bp)

- Occidental Petroleum Corp (Country: US; rated: WD): up 18.3 bp to 303.9bp (1Y range: 242-868bp)

- MBIA Inc (Country: US; rated: Ba3): up 14.5 bp to 485.5bp (1Y range: 378-757bp)

- DISH DBS Corp (Country: US; rated: B2): up 13.0 bp to 359.3bp (1Y range: 323-580bp)

- Beazer Homes USA Inc (Country: US; rated: B3): up 10.9 bp to 294.1bp (1Y range: 231-558bp)

- K Hovnanian Enterprises Inc (Country: US; rated: LGD3 - 38%): down 13.0 bp to 631.9bp (1Y range: 606-6,168bp)

- Power Finance Corporation Ltd (Country: IN; rated: BBB-): down 15.6 bp to 227.2bp (1Y range: 154-258bp)

EUR CORPORATE CDS MOVERS - 5Y PAR SPREADS

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 19.4 bp to 475.8bp (1Y range: 358-1,004bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 17.4 bp to 293.0bp (1Y range: 206-479bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 16.7 bp to 884.7bp (1Y range: 478-1,058bp)

- Premier Foods Finance PLC (Country: ; rated: B1): up 15.7 bp to 257.2bp (1Y range: 141-293bp)

- Novafives SAS (Country: FR; rated: Caa1): up 15.4 bp to 878.9bp (1Y range: 716-1,987bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 14.8 bp to 544.0bp (1Y range: 516-984bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): up 13.7 bp to 260.7bp (1Y range: 246-447bp)

- Stena AB (Country: SE; rated: B2-PD): up 11.8 bp to 567.4bp (1Y range: 534-852bp)

- Lagardere SCA (Country: FR; rated: B): up 9.6 bp to 235.7bp (1Y range: 226-350bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 8.7 bp to 846.2bp (1Y range: 590-2,444bp)

NEW EUR BOND ISSUES

- Arcelik AS (Electronics | Istanbul, Turkey | Rating: BB): €350m Senior Note (XS2346972263), fixed rate (3.00% coupon) maturing on 27 May 2026, priced at 100.00 (original spread of 350 bp), callable (5nc5)

- Banco de Credito Social Cooperativo SA (Banking | Madrid, Spain | Rating: BB): €600m Subordinated Note (XS2332590632), floating rate maturing on 27 November 2031, priced at 100.00, callable (11nc5)

- Cimic Finance Ltd (Financial - Other | North Sydney, Spain | Rating: NR): €500m Senior Note (XS2346973741), fixed rate (1.50% coupon) maturing on 28 May 2029, priced at 99.31 (original spread of 188 bp), callable (8nc8)

- Fair Oaks Loan Funding II DAC (Financial - Other | Dublin, Ireland | Rating: NR): €214m Bond (XS2346330827), floating rate maturing on 15 April 2034, priced at 100.00, non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): €600m Senior Note (XS2346225878), fixed rate (0.50% coupon) maturing on 25 May 2029, priced at 99.68 (original spread of 78 bp), non callable

- Polski Koncern Naftowy Orlen SA (Oil and Gas | Plock, Woj. Mazowieckie, Poland | Rating: BBB-): €500m Senior Note (XS2346125573), fixed rate (1.13% coupon) maturing on 27 May 2028, priced at 99.43 (original spread of 150 bp), callable (7nc7)

- Russia, Federation of (Government) (Sovereign | Moscow, Russia | Rating: BBB-): €1,000m Senior Note (RU000A1034K8), fixed rate (2.65% coupon) maturing on 27 May 2036, priced at 100.00, non callable

- SBAB Bank AB (publ) (Banking | Solna, Sweden | Rating: A): €500m Senior Note (XS2346986990), fixed rate (0.13% coupon) maturing on 27 August 2026, priced at 99.66, non callable

- Selp Finance SARL (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €500m Senior Note (XS2344569038), fixed rate (0.88% coupon) maturing on 27 May 2029, priced at 99.42 (original spread of 122 bp), callable (8nc8)

- Virgin Money UK PLC (Banking | Glasgow, United Kingdom | Rating: BBB-): €500m Senior Note (XS2346591113), fixed rate (0.38% coupon) maturing on 27 May 2024, priced at 99.97 (original spread of 106 bp), callable (3nc2)

NEW LOANS

- Univar Solutions Inc (BB+), signed a US$ 1,000m Term Loan B, to be used for general corporate purposes working capital capital expenditures. It matures on 05/26/28 and initial pricing is set at LIBOR +200bps

NEW SECURITIZATIONS

- Store 2021-1 issued a fixed-rate ABS backed by leases in 4 tranches, for a total of US$ 515 m. Highest-rated tranche offering a yield to maturity of 2.12%, and the lowest-rated tranche a yield to maturity of 3.70%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd

- Verus Securitization Trust 2021-R3 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 428 m. Highest-rated tranche offering a yield to maturity of 1.02%, and the lowest-rated tranche a yield to maturity of 4.07%. Bookrunners: Credit Suisse, Barclays Capital Group

- Bravo Residential Funding Trust 2021-He2 issued a floating-rate RMBS in 5 tranches, for a total of US$ 250 m. Highest-rated tranche offering a spread over the floating rate of 75bp, and the lowest-rated tranche a spread of 240bp. Bookrunners: Morgan Stanley International Ltd, JP Morgan & Co Inc, Bank of America Merrill Lynch