Credit

Good Day For Credit, With Rates Down And Little Movement In Spreads

In the primary market, banks were among the big dollar issuers on Monday with JP Morgan printing US$ 4.5bn in 3 tranches and UBS US$ 3bn in 3 tranches, both including SOFR-based floaters

Published ET

Peru Sovereign 5-Year US$ CDS Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.30% today, with investment grade up 0.31% and high yield up 0.25% (YTD total return: -2.93%)

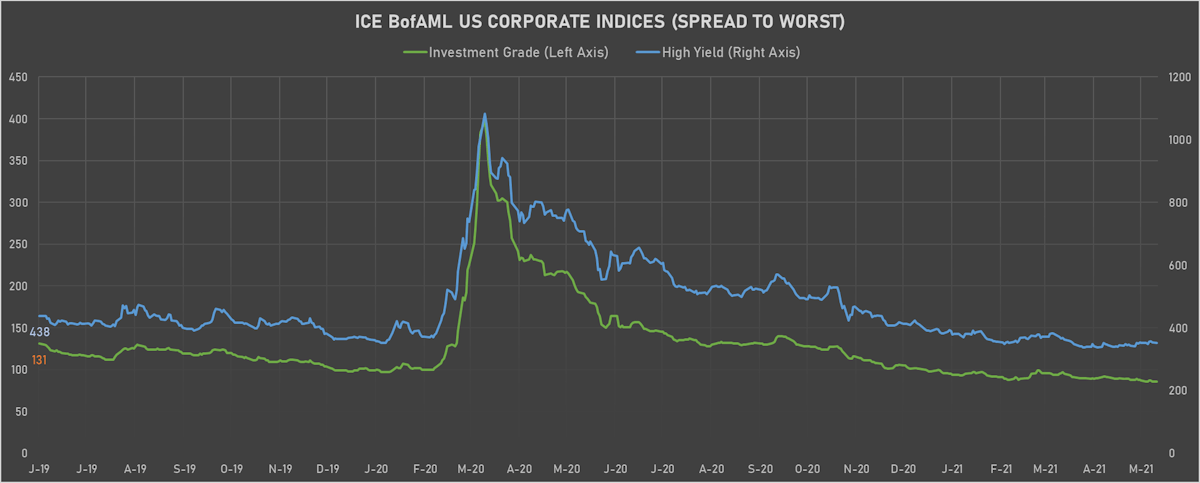

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 352.0 bp (YTD change: -38.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.2% today (YTD total return: +1.9%)

- New issues: US$ 20.8bn in dollars and € 1.8bn in euros

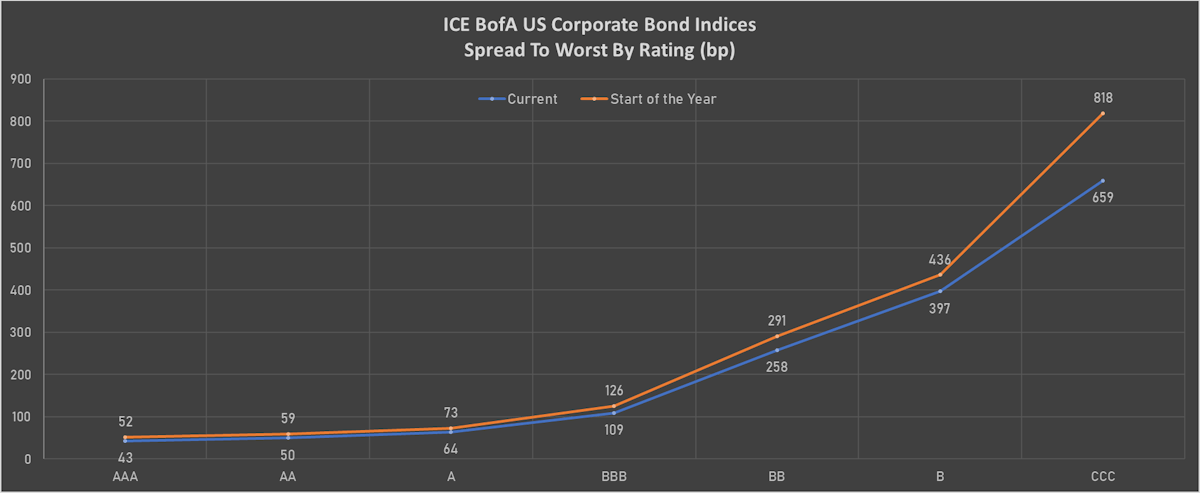

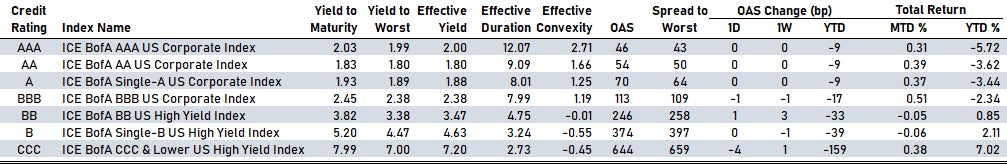

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA unchanged at 54 bp

- A unchanged at 70 bp

- BBB down by -1 bp at 113 bp

- BB up by 1 bp at 246 bp

- B unchanged at 374 bp

- CCC down by -4 bp at 644 bp

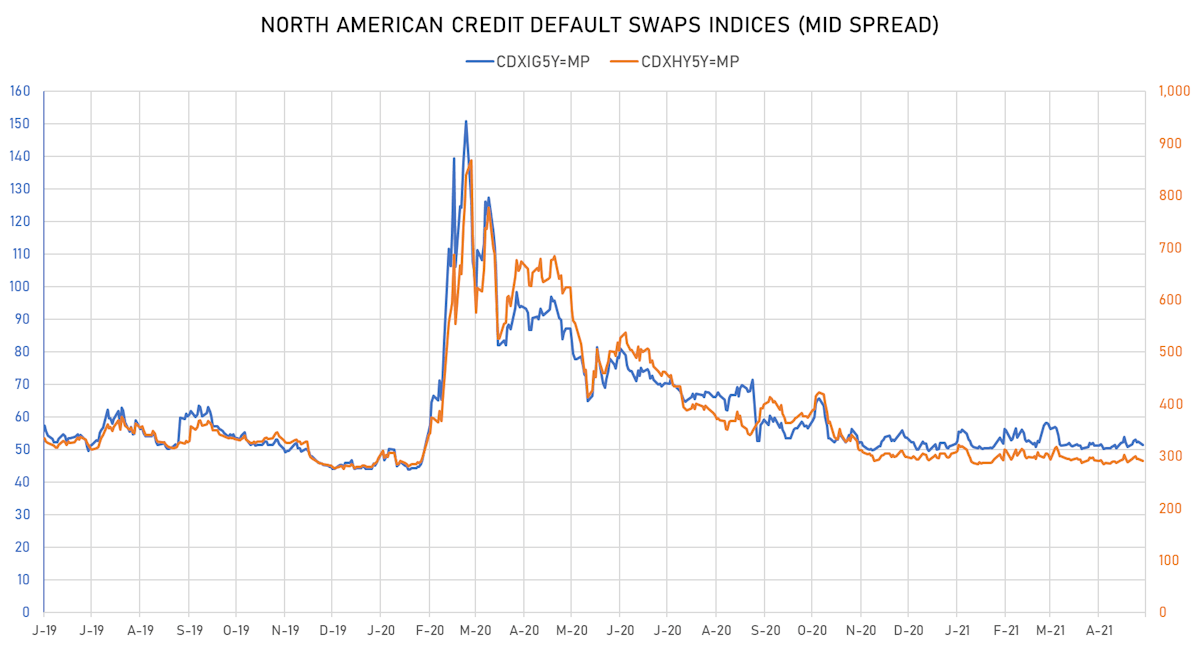

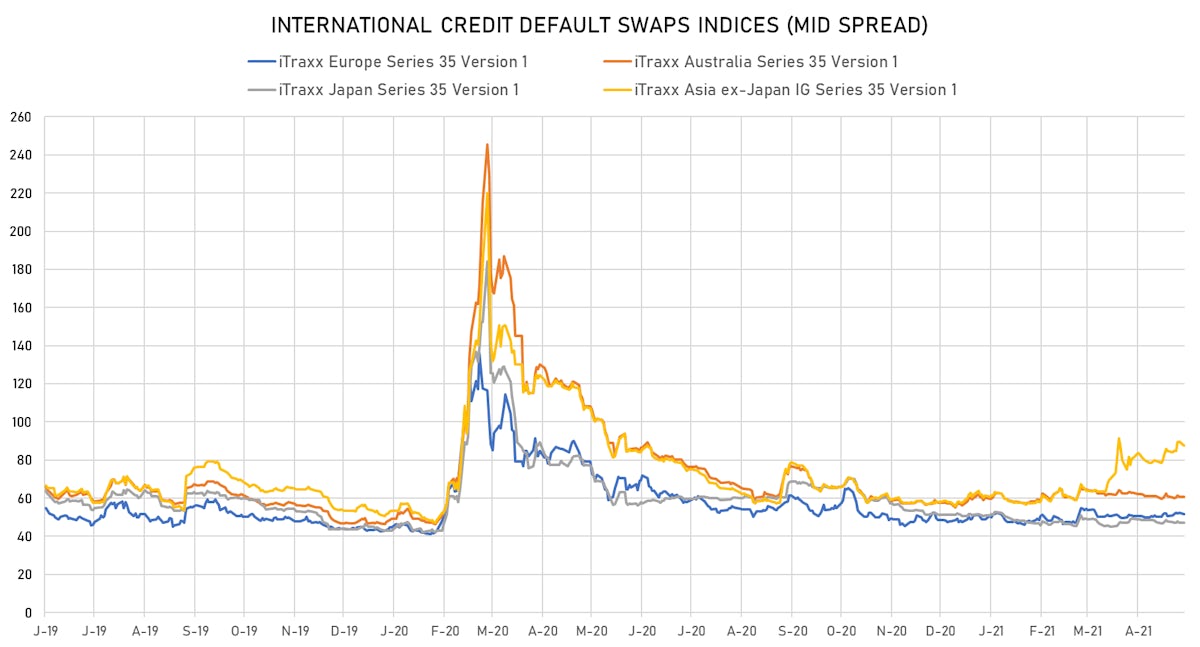

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.0 bp, now at 51bp

- Markit CDX.NA.HY 5Y down 3.3 bp, now at 291bp

- Markit iTRAXX Europe unchanged at 52bp (YTD change: +3.7bp)

- Markit iTRAXX Japan down 0.4 bp, now at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan down 1.5 bp, now at 86bp (YTD change: +28.0bp)

TOP BONDS MOVERS - USD HY

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/4/2023 | Rating: BB- | ISIN: USU8759MAA28 | Option-adjusted spread up by 14.2 bp to 146.7 bp, with the yield to worst at 1.5% and the bond now trading down to 106.8 cents on the dollar (1Y price range: 105.3-112.0).

- Issuer: Oleoducto Central SA (Bogota, Colombia) | Coupon: 4.00% | Maturity: 14/7/2027 | Rating: BB+ | ISIN: USP7358RAD81 | Option-adjusted spread up by 5.9 bp to 223.5 bp, with the yield to worst at 3.2% and the bond now trading down to 103.7 cents on the dollar (1Y price range: 103.1-108.9).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Option-adjusted spread up by 2.4 bp to 294.4 bp, with the yield to worst at 3.9% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 105.0-113.3).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.25% | Maturity: 1/6/2027 | Rating: BB- | ISIN: USC67111AJ05 | Option-adjusted spread down by 1.9 bp to 286.5 bp (CDS basis: 14.0bp), with the yield to worst at 3.7% and the bond now trading up to 107.0 cents on the dollar (1Y price range: 101.6-107.6).

- Issuer: Trans Allegheny Interstate Line Co (United States) | Coupon: 3.85% | Maturity: 1/6/2025 | Rating: BB+ | ISIN: USU89341AC26 | Option-adjusted spread down by 1.9 bp to 100.8 bp, with the yield to worst at 1.6% and the bond now trading up to 108.1 cents on the dollar (1Y price range: 107.0-109.3).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 3.60% | Maturity: 1/6/2029 | Rating: BB+ | ISIN: USU70842AD86 | Option-adjusted spread down by 3.3 bp to 147.9 bp (CDS basis: -56.1bp), with the yield to worst at 2.8% and the bond now trading up to 105.4 cents on the dollar (1Y price range: 104.2-109.5).

- Issuer: DISH DBS Corp (Englewood, Colorado (US)) | Coupon: 5.13% | Maturity: 1/6/2029 | Rating: B- | ISIN: USU25486AP38 | Option-adjusted spread down by 3.4 bp to 395.8 bp (CDS basis: 48.4bp), with the yield to worst at 5.2% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 99.3-99.5).

- Issuer: Royal Caribbean Cruises Ltd (Miami) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Option-adjusted spread down by 4.0 bp to 360.2 bp (CDS basis: 67.1bp), with the yield to worst at 4.6% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 100.1-105.1).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Option-adjusted spread down by 19.9 bp to 312.2 bp, with the yield to worst at 3.5% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 103.0-109.4).

TOP BONDS MOVERS - EUR HY

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB | ISIN: XS2154325489 | Option-adjusted spread up by 9.6 bp to 170.7 bp, with the yield to worst at 1.4% and the bond now trading down to 108.7 cents on the dollar (1Y price range: 102.3-109.6).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Option-adjusted spread up by 6.2 bp to 136.7 bp, with the yield to worst at 1.0% and the bond now trading down to 101.2 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: G4S International Finance PLC (London, United Kingdom) | Coupon: 1.50% | Maturity: 2/6/2024 | Rating: B | ISIN: XS1619992883 | Option-adjusted spread up by 5.7 bp to 191.8 bp, with the yield to worst at 1.4% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 99.4-100.5).

- Issuer: Leonardo SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 8/1/2026 | Rating: BB+ | ISIN: XS2199716304 | Option-adjusted spread up by 4.8 bp to 166.7 bp (CDS basis: -11.4bp), with the yield to worst at 1.2% and the bond now trading down to 104.1 cents on the dollar (1Y price range: 102.8-105.2).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Option-adjusted spread down by 4.1 bp to 229.3 bp, with the yield to worst at 2.1% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 98.4-101.8).

- Issuer: Wienerberger AG (Wien, Austria) | Coupon: 2.75% | Maturity: 4/6/2025 | Rating: BB+ | ISIN: AT0000A2GLA0 | Option-adjusted spread down by 6.4 bp to 111.1 bp (CDS basis: 272.2bp), with the yield to worst at 0.6% and the bond now trading up to 107.3 cents on the dollar (1Y price range: 106.2-107.8).

- Issuer: TechnipFMC PLC (London, United Kingdom) | Coupon: 4.50% | Maturity: 30/6/2025 | Rating: BB | ISIN: XS2197326437 | Option-adjusted spread down by 9.7 bp to 266.5 bp (CDS basis: 20.1bp), with the yield to worst at 2.2% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 103.4-108.2).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Option-adjusted spread down by 10.2 bp to 393.7 bp, with the yield to worst at 3.5% and the bond now trading up to 108.4 cents on the dollar (1Y price range: 99.6-108.5).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 2.88% | Maturity: 22/2/2024 | Rating: B+ | ISIN: DE000A2TEDB8 | Option-adjusted spread down by 25.5 bp to 244.7 bp (CDS basis: -31.6bp), with the yield to worst at 2.0% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 100.3-102.8).

NEW USD BOND ISSUES

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$200m Certificate of Deposit (XS2347208055), fixed rate (0.33% coupon) maturing on 27 May 2022, priced at 100.00, non callable

- Antero Midstream Partners LP (Gas Utility - Pipelines | Denver, Colorado, United States | Rating: BB-): US$750m Senior Note (US03690AAH95), fixed rate (5.38% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 398 bp), callable (8nc3)

- Bank of America Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,250m Senior Note (US06051GJX88), floating rate maturing on 28 May 2024, priced at 100.00, callable (3nc2)

- Bausch Health Companies Inc (Pharmaceuticals | Laval, Quebec, Canada | Rating: BB): US$1,600m Note (US071734AN72), fixed rate (4.88% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 359 bp), callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EMC830), fixed rate (2.50% coupon) maturing on 2 June 2036, priced at 100.00, callable (15nc3m)

- Flex Intermediate HoldCo LLC (Financial - Other | Houston, Texas, United States | Rating: BB): US$450m Note (US33939HAB50), fixed rate (4.32% coupon) maturing on 30 December 2039, priced at 100.00 (original spread of 210 bp), callable (19nc18)

- Flex Intermediate HoldCo LLC (Financial - Other | Houston, Texas, United States | Rating: BB): US$800m Note (US33939HAA77), fixed rate (3.36% coupon) maturing on 30 June 2031, priced at 100.00 (original spread of 175 bp), callable (10nc10)

- Guoren Property and Casualty Insurance Co Ltd (Property and Casualty Insurance | Shenzhen, Guangdong, China (Mainland) | Rating: BBB+): US$560m Senior Note (XS2287540053), fixed rate (3.35% coupon) maturing on 1 June 2026, priced at 99.74 (original spread of 260 bp), non callable

- Huntsman International LLC (Chemicals | The Woodlands, Texas, United States | Rating: BB+): US$400m Senior Note (US44701QBF81), fixed rate (2.95% coupon) maturing on 15 June 2031, priced at 99.93 (original spread of 135 bp), callable (10nc10)

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB-): US$750m Senior Note (US46115HBS58), fixed rate (4.95% coupon) maturing on 1 June 2042, priced at 100.00 (original spread of 275 bp), callable (21nc20)

- Intesa Sanpaolo SpA (Banking | Torino, Torino, Italy | Rating: BBB-): US$750m Senior Note (US46115HBQ92), fixed rate (4.20% coupon) maturing on 1 June 2032, priced at 100.00 (original spread of 260 bp), callable (11nc10)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$500m Senior Note (US46647PCG90), floating rate (SOFR + 53.5 bp) maturing on 1 June 2025, priced at 100.00, callable (4nc3)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,000m Senior Note (US46647PCH73), floating rate maturing on 1 June 2025, priced at 100.00 to yield 0.824% (T+50bp), callable (4nc3)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$2,000m Senior Note (US46647PCJ30), floating rate maturing on 1 June 2029, priced at 100.00 to yield 2.069% (T+80bp), callable (8nc8)

- Kaisa Group Holdings Ltd (Service - Other | Shenzhen, Guangdong, China (Mainland) | Rating: B): US$300m Note (XS2347581873), fixed rate (11.65% coupon) maturing on 1 June 2026, priced at 100.00, callable (5nc3)

- Mizuho Bank Ltd (Hong Kong Branch) (Banking | Japan | Rating: NR): US$150m Certificate of Deposit (XS2347623030), fixed rate (0.16% coupon) maturing on 1 September 2021, priced at 100.00, non callable

- Mizuho Bank Ltd (Hong Kong Branch) (Banking | Japan | Rating: NR): US$150m Certificate of Deposit (XS2347621414), fixed rate (0.16% coupon) maturing on 27 August 2021, priced at 100.00, non callable

- NSTAR Electric Co (Utility - Other | Boston, Massachusetts, United States | Rating: A): US$300m Senior Debenture (US67021CAQ06), fixed rate (3.10% coupon) maturing on 1 June 2051, priced at 99.09 (original spread of 83 bp), callable (30nc30)

- Nielsen Finance LLC (Service - Other | New York City, New York, United States | Rating: NR): US$625m Senior Note (US65409QBK76), fixed rate (4.75% coupon) maturing on 15 July 2031, priced at 100.00 (original spread of 314 bp), callable (10nc5)

- Nielsen Finance LLC (Service - Other | New York City, New York, United States | Rating: NR): US$625m Senior Note (US65409QBH48), fixed rate (4.50% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 310 bp), callable (8nc3)

- OGE Energy Corp (Utility - Other | Oklahoma City, Oklahoma, United States | Rating: BBB): US$500m Senior Note (US670837AC70), fixed rate (0.70% coupon) maturing on 26 May 2023, priced at 100.00 (original spread of 55 bp), callable (2nc6m)

- Oklahoma Gas And Electric Co (Utility - Other | Oklahoma City, Oklahoma, United States | Rating: A-): US$500m Senior Note (US678858BW07), fixed rate (0.55% coupon) maturing on 26 May 2023, priced at 100.00 (original spread of 40 bp), callable (2nc6m)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): US$125m Senior Note (XS2314208948), fixed rate (2.36% coupon) maturing on 25 May 2031, priced at 100.00, callable (10nc1)

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$150m Certificate of Deposit (XS2347395811), fixed rate (0.15% coupon) maturing on 25 August 2021, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$200m Certificate of Deposit (XS2347772035), fixed rate (0.15% coupon) maturing on 26 August 2021, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$1,000m Senior Note (US902674YH70), fixed rate (1.25% coupon) maturing on 1 June 2026, priced at 99.61 (original spread of 53 bp), non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$1,000m Senior Note (US902674YG97), floating rate (SOFR + 32.0 bp) maturing on 1 June 2023, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$1,000m Senior Note (US902674YF15), fixed rate (0.38% coupon) maturing on 1 June 2023, priced at 99.89 (original spread of 28 bp), non callable

NEW EUR BOND ISSUES

- Arabella Finance Ltd (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €351m Asset Backed Commercial Paper (XS2347404233) zero coupon maturing on 27 May 2021, non callable

- Austria, Republic of (Government) (Sovereign | Wien, Wien, Austria | Rating: AA+): €300m All Commercial Paper (XS2347284312) zero coupon maturing on 26 November 2021, priced at 100.00, non callable

- CVC Cordatus Loan Fund XX DAC (Financial - Other | Dublin, Ireland | Rating: NR): €277m Bond (XS2339004355), floating rate maturing on 22 June 2034, priced at 100.00, non callable

- First Abu Dhabi Bank PJSC (London Branch) (Banking | London, United Arab Emirates | Rating: NR): €337m Certificate of Deposit (XS2347657285) zero coupon maturing on 6 July 2021, non callable

- Managed and Enhanced Tap Magenta Funding ST SA (Securities | Paris, Ile-De-France, France | Rating: NR): €110m Asset Backed Commercial Paper (XS2347638657) zero coupon maturing on 26 May 2021, non callable

- MDGH GMTN BV (Financial - Other | Amsterdam, Noord-Holland, United Arab Emirates | Rating: NR): €145m Unsecured Note (XS2348029682), fixed rate (0.24% coupon) maturing on 1 June 2026, priced at 100.00, non callable

- Swedbank AB (Banking | Sundbyberg, Stockholm, Sweden | Rating: A+): €125m All Commercial Paper (XS2347621760) zero coupon maturing on 26 November 2021, non callable

- The Norinchukin Bank (London Branch) (Banking | London, Japan | Rating: NR): €180m Certificate of Deposit (XS2347661808) zero coupon maturing on 27 September 2021, non callable