Credit

High Yield Rises, With The Spread To Worst On CCCs Down 5bp To Lowest Level Since 2014

A big day for corporate bond issuance with AstraZeneca raising US$ 7bn, Deutsche Bank $US 2.5bn, Hormel $2.3bn and DT Midstream $2.2bn

Published ET

OPTION ADJUSTED SPREAD OF THE ICE BOFAML CCC OR LOWER INDEX | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.38% today, with investment grade up 0.41% and high yield up 0.17% (YTD total return: -2.56%)

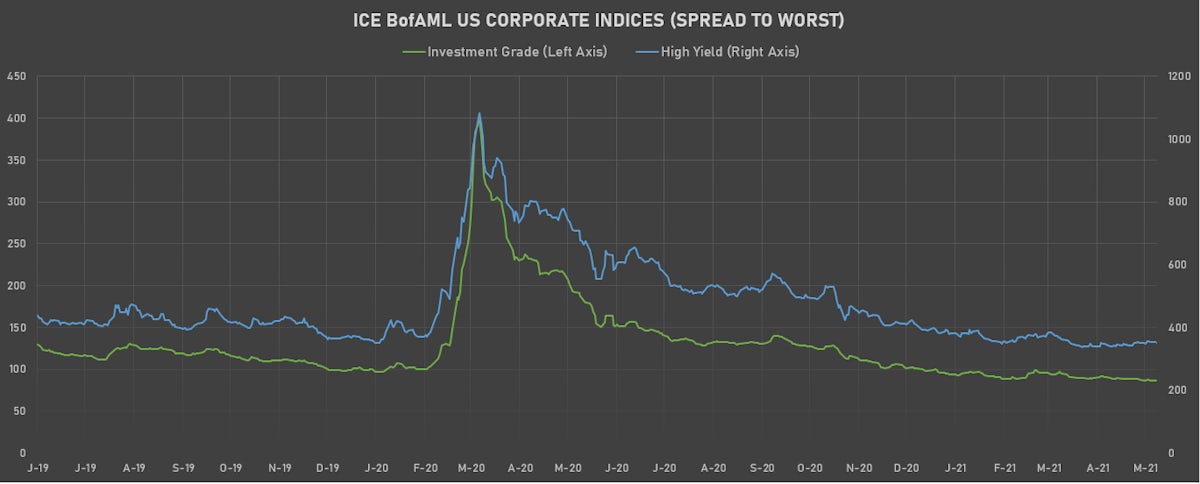

- ICE BofA US Corporate Index (Investment Grade) spread unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 350.0 bp (YTD change: -40.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +2.0%)

- New bond issues: US$ 32.5bn in dollars and € 10.1bn in euros (see details below)

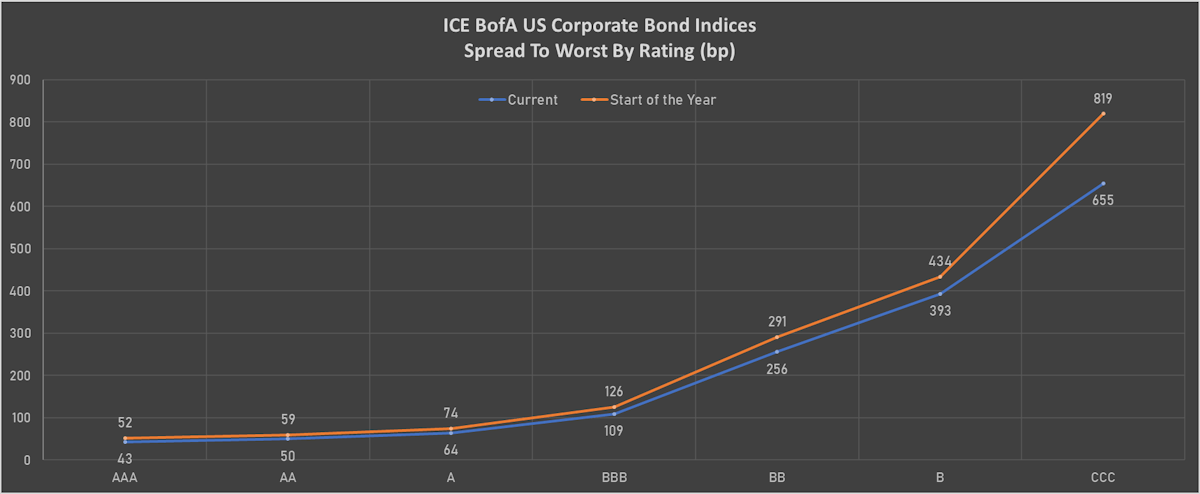

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA unchanged at 54 bp

- A down by -1 bp at 69 bp

- BBB unchanged at 113 bp

- BB down by -2 bp at 244 bp

- B down by -2 bp at 372 bp

- CCC down by -5 bp at 639 bp

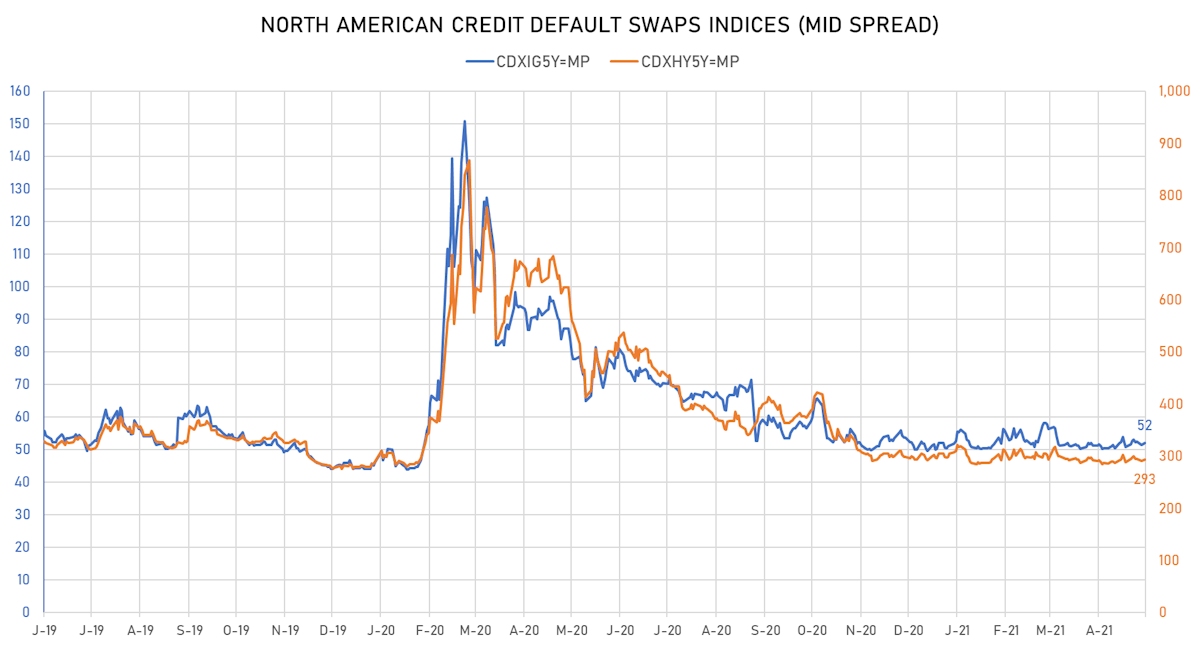

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 52bp (YTD change: +2.0bp)

- Markit CDX.NA.HY 5Y up 2.1 bp, now at 293bp (YTD change: -0.4bp)

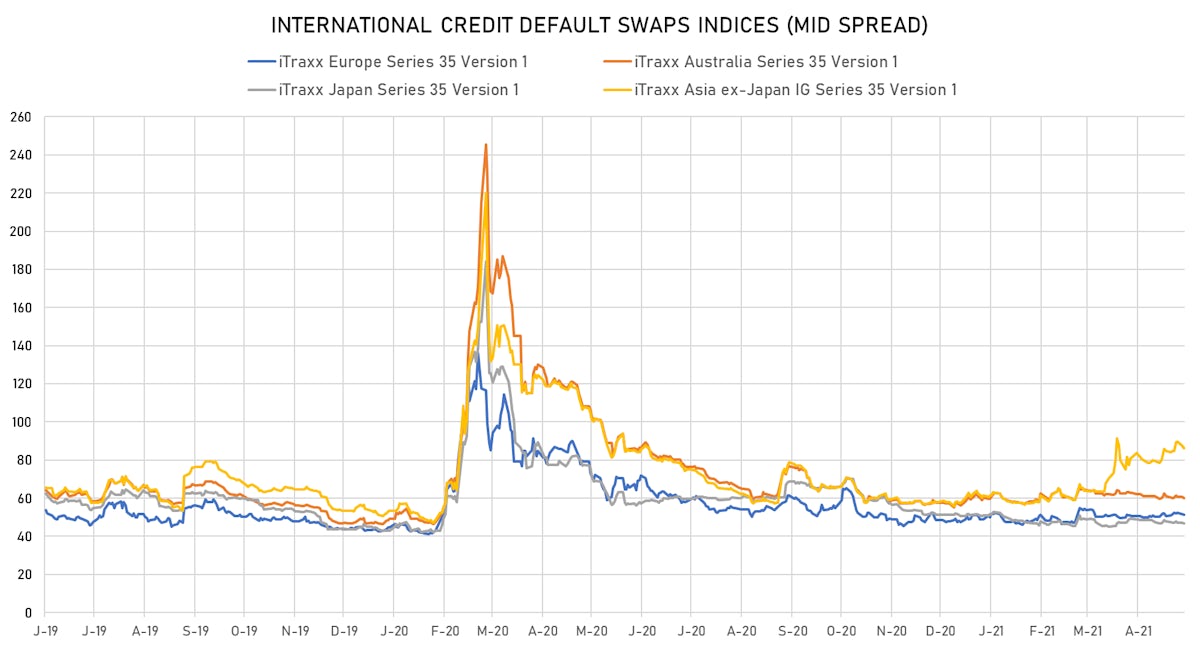

- Markit iTRAXX Europe down 0.5 bp, now at 51bp (YTD change: +3.3bp)

- Markit iTRAXX Japan down 0.3 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 1.3 bp, now at 86bp (YTD change: +28.2bp)

TOP BONDS MOVERS - USD HY

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 4.38% | Maturity: 1/2/2029 | Rating: BB- | ISIN: USU44927AZ18 | Option-adjusted spread up by 5.9 bp to 362.9 bp, with the yield to worst at 4.8% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.3-101.5).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.88% | Maturity: 15/6/2030 | Rating: BB+ | ISIN: USU74079AQ46 | Option-adjusted spread up by 2.4 bp to 163.7 bp, with the yield to worst at 2.9% and the bond now trading down to 114.4 cents on the dollar (1Y price range: 112.5-122.0).

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Option-adjusted spread down by 1.9 bp to 424.7 bp, with the yield to worst at 4.8% and the bond now trading up to 99.4 cents on the dollar (1Y price range: 99.4-100.5).

- Issuer: Sealed Air Corp (Charlotte, North Carolina (US)) | Coupon: 6.88% | Maturity: 15/7/2033 | Rating: BB | ISIN: USU81193AD39 | Option-adjusted spread down by 3.3 bp to 261.5 bp (CDS basis: -45.3bp), with the yield to worst at 4.0% and the bond now trading up to 126.0 cents on the dollar (1Y price range: 121.3-132.5).

- Issuer: Sappi Papier Holding GmbH (Gratkorn, Austria) | Coupon: 7.50% | Maturity: 15/6/2032 | Rating: B+ | ISIN: XS0149581935 | Option-adjusted spread down by 3.4 bp to 530.5 bp, with the yield to worst at 6.3% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 97.8-109.6).

- Issuer: EQT Corp (Pittsburgh, Pennsylvania (US)) | Coupon: 3.63% | Maturity: 15/5/2031 | Rating: BB | ISIN: USU2689EAB66 | Option-adjusted spread down by 3.7 bp to 179.6 bp, with the yield to worst at 3.3% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 101.3-102.8).

- Issuer: Turkiye Vakiflar Bankasi TAO (Istanbul, Turkey) | Coupon: 5.25% | Maturity: 5/2/2025 | Rating: B | ISIN: XS2112797290 | Option-adjusted spread down by 3.8 bp to 542.3 bp, with the yield to worst at 5.6% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 94.0-101.0).

- Issuer: B2W Digital Lux SARL (Luxembourg, Luxembourg) | Coupon: 4.38% | Maturity: 20/12/2030 | Rating: BB | ISIN: USL0527QAA15 | Option-adjusted spread down by 4.0 bp to 308.7 bp, with the yield to worst at 4.4% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.0-104.4).

- Issuer: Bank of Bahrain and Kuwait BSC (Manama, Bahrain) | Coupon: 5.50% | Maturity: 9/7/2024 | Rating: B | ISIN: XS2017807301 | Option-adjusted spread down by 15.2 bp to 304.7 bp, with the yield to worst at 3.3% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 101.2-106.1).

- Issuer: Borets Finance DAC (DUBLIN, Ireland) | Coupon: 6.00% | Maturity: 17/9/2026 | Rating: BB- | ISIN: XS2230649225 | Option-adjusted spread down by 19.9 bp to 412.4 bp, with the yield to worst at 4.8% and the bond now trading up to 104.5 cents on the dollar (1Y price range: 102.0-105.9).

USD BOND ISSUES

- AAC Technologies Holdings Inc (Information/Data Technology | Shenzhen, Guangdong, China (Mainland) | Rating: BBB): US$350m Senior Note (XS2342248593), fixed rate (3.75% coupon) maturing on 2 June 2031, priced at 99.19 (original spread of 225 bp), callable (10nc10)

- AAC Technologies Holdings Inc (Information/Data Technology | Shenzhen, Guangdong, China (Mainland) | Rating: BBB): US$300m Senior Note (XS2341038656), fixed rate (2.63% coupon) maturing on 2 June 2026, priced at 99.87 (original spread of 185 bp), callable (5nc5)

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$180m All Commercial Paper (XS2348305892) zero coupon maturing on 29 July 2021, non callable

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$225m All Commercial Paper (XS2348232484) zero coupon maturing on 3 June 2021, non callable

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$150m Certificate of Deposit (XS2348232211), fixed rate (0.16% coupon) maturing on 1 September 2021, priced at 100.00, non callable

- Agricultural Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A): US$150m Certificate of Deposit (XS2348232054), fixed rate (0.16% coupon) maturing on 2 September 2021, priced at 100.00, non callable

- Ally Financial Inc (Financial - Other | Detroit, Michigan, United States | Rating: BB+): US$1,000m Preferred Stock (US02005NBN93), fixed rate (4.70% coupon) perpetual , priced at 100.00, callable (Pnc7)

- Arbor Realty Trust Inc (Real Estate Investment Trust | Uniondale, New York, United States | Rating: NR): US$200m Preferred Stock (US0389238769), fixed rate (6.38% coupon) perpetual , priced at 100.00, callable (Pnc5)

- AstraZeneca PLC (Pharmaceuticals | Cambridge, Cambridgeshire, United Kingdom | Rating: BBB+): US$1,400m Senior Note (US046353AY48), fixed rate (0.30% coupon) maturing on 26 May 2023, priced at 99.91 (original spread of 20 bp), with a make whole call

- AstraZeneca PLC (Pharmaceuticals | Cambridge, Cambridgeshire, United Kingdom | Rating: BBB+): US$750m Senior Note (US046353AZ13), fixed rate (3.00% coupon) maturing on 28 May 2051, priced at 98.63 (original spread of 80 bp), callable (30nc30)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: NR): US$1,250m Senior Note (US04636NAA19), fixed rate (1.20% coupon) maturing on 28 May 2026, priced at 99.87 (original spread of 45 bp), callable (5nc5)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: NR): US$750m Senior Note (US04636NAB91), fixed rate (2.25% coupon) maturing on 28 May 2031, priced at 99.88 (original spread of 70 bp), callable (10nc10)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: NR): US$1,600m Senior Note (US04636NAC74), fixed rate (0.70% coupon) maturing on 28 May 2024, priced at 99.99 (original spread of 40 bp), callable (3nc2)

- Astrazeneca Finance LLC (Securities | Wilmington, Delaware, United Kingdom | Rating: NR): US$1,250m Senior Note (US04636NAE31), fixed rate (1.75% coupon) maturing on 28 May 2028, priced at 99.83 (original spread of 55 bp), callable (7nc7)

- Banco Bilbao Vizcaya Argentaria SA (Banking | Bilbao, Vizcaya, Spain | Rating: BBB+): US$200m All Commercial Paper (XS2348289591) zero coupon maturing on 29 November 2021, non callable

- Bank of East Asia Ltd (Banking | Hong Kong | Rating: A-): US$130m Certificate of Deposit (XS2348225355), fixed rate (0.23% coupon) maturing on 1 December 2021, priced at 100.00, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$160m All Commercial Paper (XS2348244141) zero coupon maturing on 28 June 2021, non callable

- Boyd Gaming Corp (Gaming | Las Vegas, Nevada, United States | Rating: B): US$900m Senior Note (US103304BV23), fixed rate (4.75% coupon) maturing on 15 June 2031, priced at 100.00 (original spread of 316 bp), callable (10nc5)

- China Development Bank (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348230785) zero coupon maturing on 1 June 2022, non callable

- Chinalco Capital Holdings Ltd (Financial - Other | Road Town, China (Mainland) | Rating: NR): US$800m Bond (XS2340059794), fixed rate (2.13% coupon) maturing on 3 June 2026, priced at 99.45 (original spread of 145 bp), callable (5nc5)

- DT Midstream Inc (Gas Utility - Local Distrib | Detroit, Michigan, United States | Rating: BB+): US$1,000m Senior Note (US23345MAB37), fixed rate (4.38% coupon) maturing on 15 June 2031, priced at 100.00 (original spread of 286 bp), callable (10nc5)

- DT Midstream Inc (Gas Utility - Local Distrib | Detroit, Michigan, United States | Rating: BB+): US$1,100m Senior Note (US23345MAA53), fixed rate (4.13% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 280 bp), callable (8nc3)

- Deutsche Bank AG (New York Branch) (Banking | New York City, New York, Germany | Rating: NR): US$1,000m Note (US251526CJ68), fixed rate (0.90% coupon) maturing on 28 May 2024, priced at 100.00 (original spread of 60 bp), non callable

- Deutsche Bank AG (New York Branch) (Banking | New York City, New York, Germany | Rating: NR): US$1,500m Note (US251526CK32), floating rate maturing on 28 May 2032, priced at 100.00, callable (11nc10)

- Emera US Finance LP (Financial - Other | Halifax, Nova Scotia, Canada | Rating: NR): US$300m Senior Note (US29103DAN66), fixed rate (0.83% coupon) maturing on 15 June 2024, priced at 100.00 (original spread of 53 bp), with a make whole call

- Emera US Finance LP (Financial - Other | Halifax, Nova Scotia, Canada | Rating: NR): US$450m Senior Note (US29103DAQ97), fixed rate (2.64% coupon) maturing on 15 June 2031, priced at 100.00 (original spread of 108 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$120m Bond (US3133EME240), fixed rate (0.07% coupon) maturing on 2 December 2022, priced at 100.00, callable (2nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$590m Bond (US3133EMD663), fixed rate (0.08% coupon) maturing on 15 September 2022, priced at 100.00 (original spread of 6 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$135m Bond (US3133EMD820), fixed rate (1.46% coupon) maturing on 1 June 2028, priced at 100.00 (original spread of 28 bp), callable (7nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EMD333), floating rate (FFQ + -0.5 bp) maturing on 30 January 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EMD580), fixed rate (0.10% coupon) maturing on 3 January 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$250m Bond (US3133EMD416), floating rate (AB3DM + 2.9 bp) maturing on 3 April 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$200m Bond (US3130AMPZ92), fixed rate (0.53% coupon) maturing on 27 November 2024, priced at 100.00 (original spread of 48 bp), callable (4nc1)

- Hormel Foods Corp (Food Processors | Austin, Minnesota, United States | Rating: A): US$750m Senior Note (US440452AH36), fixed rate (1.70% coupon) maturing on 3 June 2028, priced at 99.76 (original spread of 52 bp), callable (7nc7)

- Hormel Foods Corp (Food Processors | Austin, Minnesota, United States | Rating: A): US$950m Senior Note (US440452AG52), fixed rate (0.65% coupon) maturing on 3 June 2024, priced at 99.98 (original spread of 35 bp), callable (3nc1)

- Hormel Foods Corp (Food Processors | Austin, Minnesota, United States | Rating: A): US$600m Senior Note (US440452AJ91), fixed rate (3.05% coupon) maturing on 3 June 2051, priced at 99.28 (original spread of 114 bp), callable (30nc30)

- Industrial Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$120m Certificate of Deposit (XS2348282158), fixed rate (0.29% coupon) maturing on 1 March 2022, priced at 100.00, non callable

- JAB Holdings BV (Financial - Other | Amsterdam, Noord-Holland, Luxembourg | Rating: NR): US$500m Senior Note (USN4717KBE57), fixed rate (3.75% coupon) maturing on 28 May 2051, priced at 99.45 (original spread of 150 bp), callable (30nc30)

- Jinke Property Group Co Ltd (Service - Other | Chongqing, Chongqing, China (Mainland) | Rating: BB-): US$325m Senior Note (XS2338347003), fixed rate (6.85% coupon) maturing on 28 May 2024, priced at 98.28, non callable

- Jiujiang Municipal Development Group Co Ltd (Financial - Other | Jiujiang, Jiangxi, China (Mainland) | Rating: BBB-): US$300m Senior Note (XS2320304376), fixed rate (3.45% coupon) maturing on 1 June 2024, priced at 100.00, non callable

- John Bean Technologies Corp (Machinery | Chicago, Illinois, United States | Rating: NR): US$350m Bond (US477839AA21), fixed rate (0.25% coupon) maturing on 15 May 2026, priced at 100.00, non callable, convertible

- KB Home (Home Builders | Los Angeles, California, United States | Rating: BB): US$390m Senior Note (US48666KAZ21), fixed rate (4.00% coupon) maturing on 15 June 2031, priced at 100.00 (original spread of 244 bp), callable (10nc10)

- KfW (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$150m All Commercial Paper (XS2348317806) zero coupon maturing on 1 July 2021, non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$500m All Commercial Paper (XS2348274643) zero coupon maturing on 27 April 2022, non callable

- Kommuninvest i Sverige AB (Agency | Orebro, Orebro, Sweden | Rating: AAA): US$150m All Commercial Paper (XS2348302105) zero coupon maturing on 14 April 2022, non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A): US$660m Certificate of Deposit (XS2348302444) zero coupon maturing on 3 June 2021, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$350m All Commercial Paper (XS2348227054) zero coupon maturing on 27 July 2021, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$600m All Commercial Paper (XS2348231759) zero coupon maturing on 27 August 2021, non callable

- Legend Fortune Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: BBB+): US$600m Senior Note (XS2347582418), fixed rate (1.38% coupon) maturing on 2 June 2024, priced at 99.87 (original spread of 110 bp), non callable

- Mizuho Bank Ltd (Hong Kong Branch) (Banking | Japan | Rating: NR): US$150m Certificate of Deposit (XS2347621414), fixed rate (0.16% coupon) maturing on 27 August 2021, priced at 100.00, non callable

- Mizuho Bank Ltd (Hong Kong Branch) (Banking | Japan | Rating: NR): US$150m Certificate of Deposit (XS2347623030), fixed rate (0.16% coupon) maturing on 1 September 2021, priced at 100.00, non callable

- Mizuho Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$125m Certificate of Deposit (XS2348415055) zero coupon maturing on 27 August 2021, non callable

- National Australia Bank Ltd (London Branch) (Banking | London, Australia | Rating: NR): US$150m Certificate of Deposit (XS2348323879), fixed rate (0.11% coupon) maturing on 27 August 2021, priced at 100.00, non callable

- Penske Automotive Group Inc (Retail Stores - Other | Bloomfield Hills, Michigan, United States | Rating: BB-): US$500m Senior Subordinated Note (US70959WAK99), fixed rate (3.75% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 238 bp), callable (8nc3)

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$200m Certificate of Deposit (XS2347772035), fixed rate (0.15% coupon) maturing on 26 August 2021, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$200m Certificate of Deposit (XS2348323796) zero coupon maturing on 1 December 2021, non callable

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: BB): US$750m Junior Subordinated Note (US902613AG32), fixed rate (3.88% coupon) perpetual , priced at 100.00, callable (Pnc5)

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): US$750m Junior Subordinated Note (USH42097CL90), fixed rate (3.88% coupon) perpetual , priced at 100.00, callable (Pnc5)

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$150m Unsecured Note (XS2348324505), fixed rate (1.21% coupon) maturing on 2 June 2026, priced at 100.00, non callable

- Wealthy Vision Holdings Ltd (Financial - Other | Jiangsu, China (Mainland) | Rating: NR): US$300m Senior Note (XS2343552951), fixed rate (3.30% coupon) maturing on 1 June 2024, priced at 100.00, non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): US$1,000m Senior Note (US961214ET65), fixed rate (2.15% coupon) maturing on 3 June 2031, priced at 99.94 (original spread of 60 bp), non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): US$1,450m Senior Note (US961214ER00), fixed rate (1.15% coupon) maturing on 3 June 2026, priced at 99.92 (original spread of 40 bp), non callable

- Westpac Banking Corp (Banking | Sydney, New South Wales, Australia | Rating: A+): US$300m Senior Note (US961214ES82), floating rate (SOFR + 52.0 bp) maturing on 3 June 2026, priced at 100.00, non callable

EUR BOND ISSUES

- Bausparkasse Wuestenrot AG (Banking | Salzburg, Salzburg, Austria | Rating: BBB+): €250m Inhaberschuldverschreibung (AT0000A2RK00), fixed rate (0.50% coupon) maturing on 1 June 2026, priced at 99.63 (original spread of 112 bp), non callable

- BPCE SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,500m Obligation de Financement de l'Habitat (Covered Bond) (FR0014003RH7), fixed rate (0.13% coupon) maturing on 3 December 2030, priced at 99.75 (original spread of 37 bp), non callable

- Caisse des Depots et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR0014003RL9), fixed rate (0.01% coupon) maturing on 1 June 2026, priced at 101.23 (original spread of 31 bp), non callable

- Cellnex Finance Company SA (Financial - Other | Madrid, Madrid, Spain | Rating: BB+): €1,000m Senior Note (XS2348237871), fixed rate (1.50% coupon) maturing on 8 June 2028, priced at 99.59 (original spread of 199 bp), callable (7nc7)

- CVC Cordatus Loan Fund XX DAC (Financial - Other | Dublin, Ireland | Rating: NR): €277m Bond (XS2339004512), floating rate maturing on 22 June 2034, priced at 100.00, non callable

- Danone SA (Food Processors | Paris, Ile-De-France, France | Rating: BBB+): €1,000m Bond (FR0014003Q41) zero coupon maturing on 1 December 2025, priced at 99.85 (original spread of 63 bp), callable (5nc4)

- Deutsche Bahn AG (Railroads | Berlin, Berlin, Germany | Rating: AA-): €420m All Commercial Paper (XS2348236717) zero coupon maturing on 28 June 2021, non callable

- FMS Wertmanagement AoeR (Agency | Muenchen, Bayern, Germany | Rating: AAA): €250m All Commercial Paper (XS2348240156) zero coupon maturing on 3 June 2021, non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR0014003OB7), fixed rate (0.95% coupon) maturing on 28 May 2041, non callable

- Ile-de-France Mobilites (Transportation - Other | Paris, Ile-De-France, France | Rating: AA): €500m Bond (FR0014003OC5), fixed rate (0.40% coupon) maturing on 28 May 2031, non callable

- Ireland (Government) (Sovereign | Ireland | Rating: A): €200m All Commercial Paper (XS2348291738) zero coupon maturing on 29 November 2021, non callable

- KBC Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: A-): €500m Bond (BE0002799808), fixed rate (0.75% coupon) maturing on 31 May 2031, priced at 99,598.00 (original spread of 95 bp), non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): €300m All Commercial Paper (XS2348228292) zero coupon maturing on 27 September 2021, non callable

- Linde Finance BV (Financial - Other | Amsterdam, Noord-Holland, United Kingdom | Rating: A): €130m All Commercial Paper (XS2348228888) zero coupon maturing on 27 August 2021, non callable

- Linde Finance BV (Financial - Other | Amsterdam, Noord-Holland, United Kingdom | Rating: A): €120m All Commercial Paper (XS2348302790) zero coupon maturing on 27 July 2021, priced at 100.09, non callable

- Lma SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: NR): €700m Asset Backed Commercial Paper (XS2348229423) zero coupon maturing on 26 May 2021, non callable

- Lma SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: NR): €150m Asset Backed Commercial Paper (XS2348310207) zero coupon maturing on 26 August 2021, non callable

- Managed and Enhanced Tap Magenta Funding ST SA (Securities | Paris, Ile-De-France, France | Rating: NR): €111m Asset Backed Commercial Paper (XS2348298824) zero coupon maturing on 27 May 2021, non callable

- MERLIN Properties SOCIMI SA (Real Estate Investment Trust | Madrid, Madrid, Spain | Rating: BBB): €500m Senior Note (XS2347367018), fixed rate (1.38% coupon) maturing on 1 June 2030, priced at 99.20 (original spread of 176 bp), callable (9nc9)

- Procter & Gamble Co (Consumer Products | Cincinnati, Ohio, United States | Rating: AA-): €128m All Commercial Paper (XS2348239810) zero coupon maturing on 31 August 2021, non callable

- Romulus Funding Corp (Financial - Other | United States | Rating: NR): €550m Asset Backed Commercial Paper (XS2347924313) zero coupon maturing on 24 June 2021, non callable

- Sparkasse Holstein (Banking | Bad Oldesloe, Schleswig-Holstein, Germany | Rating: A+): €175m Hypothekenpfandbrief (Covered Bond) (DE000A3E5L80), floating rate (EU06MLIB + 22.0 bp) maturing on 1 June 2033, non callable

- Stedin Holding NV (Utility - Other | Rotterdam, Zuid-Holland, Netherlands | Rating: A-): €110m All Commercial Paper (XS2348283636) zero coupon maturing on 28 June 2021, non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €230m All Commercial Paper (XS2348236121) zero coupon maturing on 26 May 2022, non callable

NEW ISSUES IN LOANS

- Gastro Health Holdco LLC, signed a US$ 300m Term Loan B

- Sovos Brands Intermediate Inc (B), signed a US$ 580m Term Loan B, to be used for general corporate purposes. It matures on 06/04/28 and initial pricing is set at LIBOR +475.000bps

- Polimetall AO, signed a US$ 200m Term Loan (maturing 05/24/25), and a US$ 200m Revolving Credit Facility (maturing 05/24/26), both to be used for general corporate purposes.

NEW ISSUES IN STRUCTURED CREDIT

- Carvana Auto Receivables Trust 2021-N2 issued a floating-rate ABS backed by auto receivables in 2 tranches, for a total of US$ 176 m. Highest-rated tranche offering a spread over the floating rate of 18bp, and the lowest-rated tranche a spread of 47bp. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BNP Paribas Securities Corp

- Exeter Automobile Receivables Trust 2021-2 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 573 m. Highest-rated tranche offering a yield to maturity of 0.13%, and the lowest-rated tranche a yield to maturity of 0.30%. Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc