Credit

Stable Spreads Bring Large Bond Issues In Euros And Dollars Including A $US3bn Offering From Morgan Stanley

In high-yield, Jaguar Land Rover, Rolls Royce and WeWork were some of the names that saw a good spread compression

Published ET

American Airlines Bond (USU0242AAD47) That Has Almost Tripled Since Last Year | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.37% today, with investment grade up 0.38% and high yield up 0.25% (YTD total return: -2.57%)

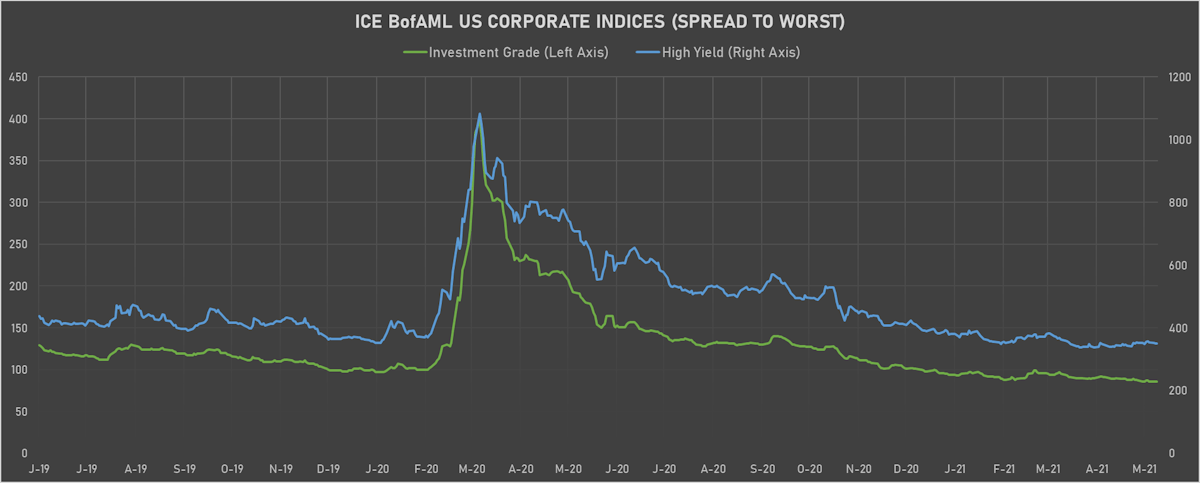

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 350.0 bp (YTD change: -40.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +2.0%)

- New bond issues: US$ 10.8bn in dollars and € 19.1bn in euros

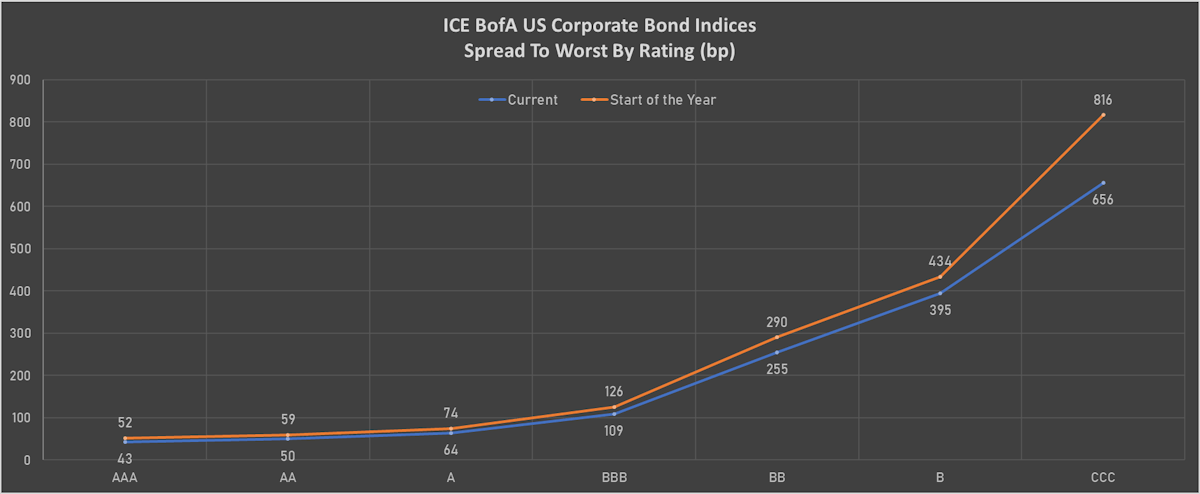

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA unchanged at 54 bp

- A unchanged at 69 bp

- BBB unchanged at 113 bp

- BB unchanged at 244 bp

- B up by 2 bp at 374 bp

- CCC up by 4 bp at 643 bp

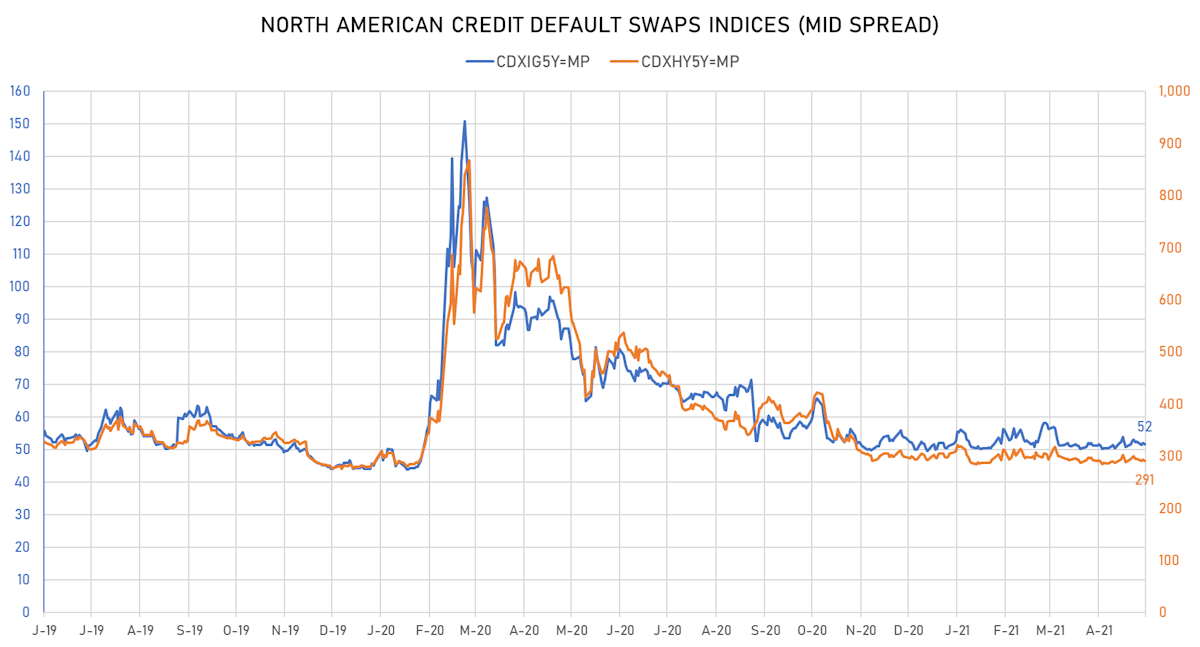

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.3 bp, now at 52bp (YTD change: +1.7bp)

- Markit CDX.NA.HY 5Y down 1.9 bp, now at 291bp (YTD change: -2.3bp)

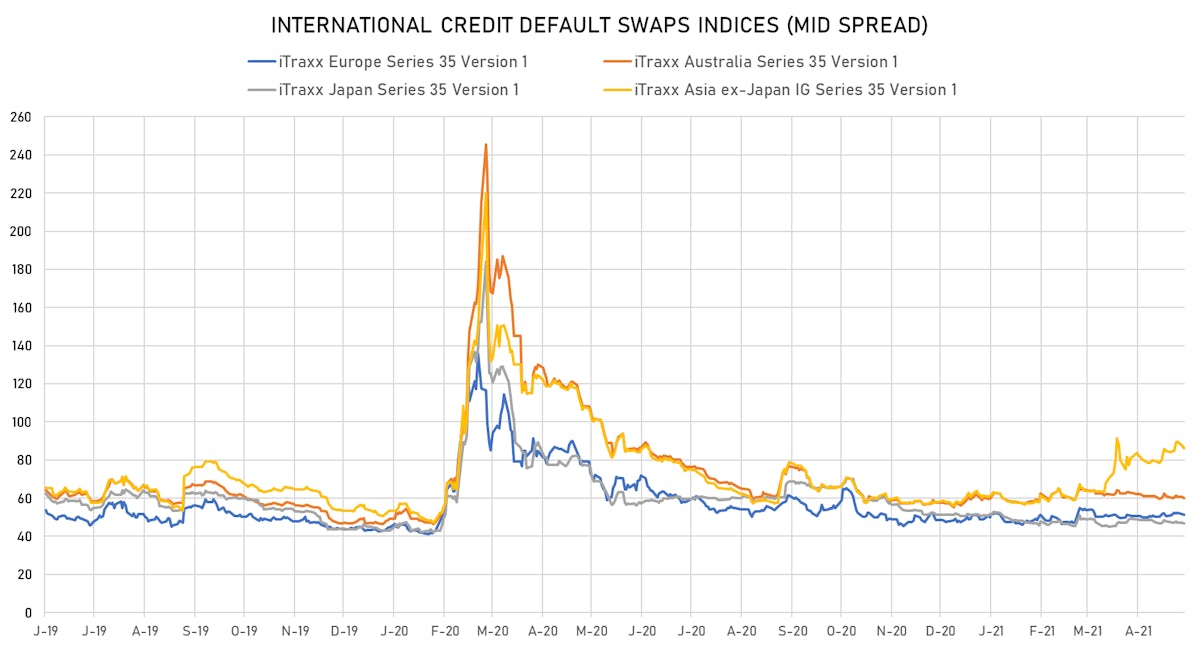

- Markit iTRAXX Europe down 0.1 bp, now at 51bp (YTD change: +3.1bp)

- Markit iTRAXX Japan down 0.1 bp, now at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.3 bp, now at 86bp (YTD change: +27.9bp)

TOP BONDS MOVERS - USD HY

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Option-adjusted spread up by 32.4 bp to 622.4 bp, with the yield to worst at 6.5% and the bond now trading down to 108.3 cents on the dollar (1Y price range: 106.8-109.9).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Option-adjusted spread up by 28.7 bp to 295.3 bp, with the yield to worst at 3.6% and the bond now trading down to 107.5 cents on the dollar (1Y price range: 107.5-114.6).

- Issuer: Hanes Brands Inc (WINSTON SALEM, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Option-adjusted spread down by 13.3 bp to 240.7 bp, with the yield to worst at 3.0% and the bond now trading up to 107.3 cents on the dollar (1Y price range: 106.0-109.9).

- Issuer: Banco BTG Pactual SA (Cayman Islands Branch) (Cayman Islands) | Coupon: 4.50% | Maturity: 10/1/2025 | Rating: BB- | ISIN: US05971BAE92 | Option-adjusted spread down by 14.1 bp to 296.0 bp, with the yield to worst at 3.2% and the bond now trading up to 103.3 cents on the dollar (1Y price range: 102.4-107.7).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Option-adjusted spread down by 15.3 bp to 381.1 bp, with the yield to worst at 4.7% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 96.8-104.0).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Option-adjusted spread down by 15.5 bp to 711.9 bp, with the yield to worst at 7.3% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 67.5-101.0).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB | ISIN: USU6500TAB18 | Option-adjusted spread down by 16.9 bp to 208.1 bp, with the yield to worst at 2.9% and the bond now trading up to 107.5 cents on the dollar (1Y price range: 106.8-112.0).

- Issuer: Chelpipe Finance Designated Activity Co (DUBLIN, Ireland) | Coupon: 4.50% | Maturity: 19/9/2024 | Rating: BB- | ISIN: XS2010044548 | Option-adjusted spread down by 20.1 bp to 296.4 bp, with the yield to worst at 3.1% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 102.5-104.1).

- Issuer: Yapi ve Kredi Bankasi AS (Istanbul, Turkey) | Coupon: 5.85% | Maturity: 21/6/2024 | Rating: B | ISIN: XS1634372954 | Option-adjusted spread down by 24.5 bp to 452.1 bp, with the yield to worst at 4.7% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 97.8-104.0).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Option-adjusted spread down by 33.8 bp to 642.8 bp (CDS basis: 20.0bp), with the yield to worst at 6.7% and the bond now trading up to 89.8 cents on the dollar (1Y price range: 71.0-89.8).

TOP BONDS MOVERS - EUR HY

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Option-adjusted spread up by 7.1 bp to 353.2 bp (CDS basis: 5.8bp), with the yield to worst at 3.1% and the bond now trading down to 81.9 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Option-adjusted spread down by 5.3 bp to 308.1 bp (CDS basis: 5.1bp), with the yield to worst at 2.8% and the bond now trading up to 91.8 cents on the dollar (1Y price range: 90.4-94.1).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 2.38% | Maturity: 12/10/2027 | Rating: BB | ISIN: XS1698218523 | Option-adjusted spread down by 6.0 bp to 196.2 bp (CDS basis: -1.1bp), with the yield to worst at 1.8% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 101.8-105.2).

- Issuer: ArcelorMittal SA (Luxembourg, Luxembourg) | Coupon: 1.75% | Maturity: 19/11/2025 | Rating: BB+ | ISIN: XS2082324018 | Option-adjusted spread down by 6.1 bp to 86.4 bp (CDS basis: 32.8bp), with the yield to worst at 0.5% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 102.8-105.2).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Option-adjusted spread down by 7.0 bp to 341.6 bp, with the yield to worst at 3.2% and the bond now trading up to 89.1 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Option-adjusted spread down by 7.2 bp to 130.0 bp (CDS basis: -14.7bp), with the yield to worst at 0.8% and the bond now trading up to 107.2 cents on the dollar (1Y price range: 106.8-107.8).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Option-adjusted spread down by 9.7 bp to 420.4 bp (CDS basis: -43.9bp), with the yield to worst at 3.7% and the bond now trading up to 114.0 cents on the dollar (1Y price range: 102.3-115.5).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Option-adjusted spread down by 13.3 bp to 350.4 bp, with the yield to worst at 3.1% and the bond now trading up to 92.6 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Option-adjusted spread down by 105.6 bp to 176.2 bp, with the yield to worst at 1.5% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 93.2-100.5).

NEW USD BOND ISSUES

- Abu Dhabi National Oil Co (Oil and Gas | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: AA): US$1,195m Bond (XS2348411062), fixed rate (0.70% coupon) maturing on 4 June 2024, priced at 100.00, non callable, convertible

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$750m All Commercial Paper (XS2348698411) zero coupon maturing on 4 June 2021, non callable

- Agricultural Bank of China Ltd (Sydney Branch) (Banking | Sydney, China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348557351), fixed rate (0.16% coupon) maturing on 2 September 2021, priced at 100.00, non callable

- Bank of Montreal (London Branch) (Banking | London, Canada | Rating: NR): US$1,000m Certificate of Deposit (XS2348323366) zero coupon maturing on 2 June 2021, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$250m All Commercial Paper (XS2348699906) zero coupon maturing on 30 July 2021, non callable

- Bred Banque Populaire SA (Banking | Paris, Ile-De-France, France | Rating: A+): US$200m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864380) zero coupon maturing on 2 June 2021, non callable

- Bred Banque Populaire SA (Banking | Paris, Ile-De-France, France | Rating: A+): US$200m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864232) zero coupon maturing on 27 May 2021, non callable

- China Construction Bank Corp (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348520516), fixed rate (0.23% coupon) maturing on 3 December 2021, priced at 100.00, non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: A+): US$300m All Commercial Paper (XS2348668265) zero coupon maturing on 28 June 2021, priced at 99.99, non callable

- Erste Abwicklungsanstalt (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$600m All Commercial Paper (XS2348607123) zero coupon maturing on 4 June 2021, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$345m Bond (US3133EME406), fixed rate (0.33% coupon) maturing on 3 June 2024, priced at 100.00 (original spread of 5 bp), callable (3nc1)

- Industrial Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$120m Certificate of Deposit (XS2348282158), fixed rate (0.29% coupon) maturing on 1 March 2022, priced at 100.00, non callable

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: A): US$650m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864372) zero coupon maturing on 28 June 2021, non callable

- Morgan Stanley (Financial - Other | New York City, New York, United States | Rating: BBB+): US$3,000m Senior Note (US61747YEA91), floating rate maturing on 30 May 2025, priced at 100.00, callable (4nc3)

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$500m All Commercial Paper (XS2348694188) zero coupon maturing on 7 June 2021, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$500m All Commercial Paper (XS2348418075) zero coupon maturing on 4 June 2021, non callable

- National Australia Bank Ltd (London Branch) (Banking | London, Australia | Rating: NR): US$150m Certificate of Deposit (XS2348323879), fixed rate (0.11% coupon) maturing on 27 August 2021, priced at 100.00, non callable

- Triton Container International Ltd (Transportation - Other | Purchase, Bermuda | Rating: BBB-): US$500m Note (US89680YAB11), fixed rate (1.15% coupon) maturing on 7 June 2024, priced at 99.89 (original spread of 88 bp), callable (3nc3)

- United Overseas Bank Ltd (Banking | Singapore | Rating: AA-): US$150m Unsecured Note (XS2348324505), fixed rate (1.21% coupon) maturing on 2 June 2026, priced at 100.00, non callable

NEW EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): €1,000m Note (XS2348638433), fixed rate (1.00% coupon) maturing on 2 June 2033, priced at 99.36 (original spread of 126 bp), non callable

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): €455m All Commercial Paper (XS2348599353) zero coupon maturing on 3 June 2021, non callable

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): €200m All Commercial Paper (XS2348602082) zero coupon maturing on 28 July 2021, non callable

- Akropolis Group UAB (Financial - Other | Vilnius, Vilniaus, Lithuania | Rating: BB+): €300m Senior Note (XS2346869097), fixed rate (2.88% coupon) maturing on 2 June 2026, priced at 99.43, callable (5nc5)

- Arabella Finance Ltd (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €267m Asset Backed Commercial Paper (XS2348410338) zero coupon maturing on 28 May 2021, non callable

- Archer-Daniels-Midland Co (Food Processors | Chicago, Illinois, United States | Rating: A): €200m All Commercial Paper (XS2348589982) zero coupon maturing on 29 June 2021, non callable

- AstraZeneca PLC (Pharmaceuticals | Cambridge, United Kingdom | Rating: BBB+): €800m Senior Note (XS2347663507), fixed rate (0.38% coupon) maturing on 3 June 2029, priced at 99.58 (original spread of 81 bp), callable (8nc8)

- Autobahnen Und Schnellstrassen finanzierungs AG (Agency | Wien, Wien, Austria | Rating: AA+): €500m Senior Note (XS2348690350), fixed rate (0.13% coupon) maturing on 2 June 2031, priced at 99.89 (original spread of 34 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Madrid, Spain | Rating: A-): €200m All Commercial Paper (XS2348621975) zero coupon maturing on 29 November 2021, non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, France | Rating: A): €1,500m Bond (FR0014003SA0), fixed rate (0.63% coupon) maturing on 3 November 2028, priced at 99.58 (original spread of 111 bp), non callable

- Coral Capital Ltd (Financial - Other | Rating: NR): €245m Asset Backed Commercial Paper (XS2348698254) zero coupon maturing on 30 June 2021, priced at 100.04, non callable

- Credit Agricole SA (Banking | Montrouge, Ile-De-France, France | Rating: A+): €1,600m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864273) zero coupon maturing on 2 June 2021, non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: A+): €200m All Commercial Paper (DE000DK0ZCG2) zero coupon maturing on 28 June 2021, priced at 100.05, non callable

- E.ON AG (Utility - Other | Duesseldorf, Nordrhein-Westfalen, Germany | Rating: A-): €300m All Commercial Paper (XS2348621207) zero coupon maturing on 4 June 2021, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €520m All Commercial Paper (XS2348595526) zero coupon maturing on 15 June 2021, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €520m All Commercial Paper (XS2348596177) zero coupon maturing on 14 June 2021, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €432m All Commercial Paper (XS2348606232) zero coupon maturing on 17 June 2021, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €418m All Commercial Paper (XS2348621892) zero coupon maturing on 18 June 2021, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: NR): €390m All Commercial Paper (XS2348604294) zero coupon maturing on 16 June 2021, non callable

- Erste Group Bank AG (Banking | Wien, Wien, Austria | Rating: A): €400m Certificate of Deposit (XS2347647138) zero coupon maturing on 2 June 2021, priced at 100.01 (original spread of 28 bp), non callable

- FMS Wertmanagement AoeR (Agency | Muenchen, Bayern, Germany | Rating: AAA): €250m All Commercial Paper (XS2348601274) zero coupon maturing on 4 June 2021, non callable

- Hammerson Ireland Finance DAC (Financial - Other | Dublin, United Kingdom | Rating: BBB-): €700m Senior Note (XS2344772426), fixed rate (1.75% coupon) maturing on 3 June 2027, priced at 99.11 (original spread of 244 bp), callable (6nc6)

- Iberdrola International BV (Financial - Other | Amsterdam, Noord-Holland, Spain | Rating: NR): €139m All Commercial Paper (XS2348659355) zero coupon maturing on 27 May 2022, non callable

- Imperial Brands Finance PLC (Financial - Other | Bristol, United Kingdom | Rating: BBB): €250m All Commercial Paper (XS2348684387) zero coupon maturing on 2 June 2021, non callable

- Industrial and Commercial Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): €170m Certificate of Deposit (XS2348668778) zero coupon maturing on 28 June 2021, non callable

- Ireland (Government) (Sovereign | Ireland | Rating: A): €310m All Commercial Paper (XS2348601514) zero coupon maturing on 29 November 2021, non callable

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: A): €200m Junior Subordinated Note (XS2348324687), fixed rate (3.63% coupon) perpetual , priced at 100.00 (original spread of 328 bp), callable (Pnc8)

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Germany | Rating: A): €500m Note (XS2346124410), fixed rate (0.38% coupon) maturing on 4 June 2029, priced at 99.12 (original spread of 87 bp), non callable

- Managed and Enhanced Tap Magenta Funding ST SA (Securities | Paris, Ile-De-France, France | Rating: NR): €128m Asset Backed Commercial Paper (XS2348601787) zero coupon maturing on 28 May 2021, non callable

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB-): €120m All Commercial Paper (XS2348599437) zero coupon maturing on 17 June 2021, non callable

- Opusalpha Funding Ltd (Financial - Other | Dublin, Dublin, Germany | Rating: NR): €265m Asset Backed Commercial Paper (XS2348606075) zero coupon maturing on 18 August 2021, non callable

- Raiffeisenbank as (Banking | Praha, Praha, Austria | Rating: NR): €350m Unsecured Note (XS2348241048), fixed rate (1.00% coupon) maturing on 1 June 2028, priced at 100.00, non callable

- SAP SE (Information/Data Technology | Walldorf, Baden-Wuerttemberg, Germany | Rating: A): €340m All Commercial Paper (XS2348590055) zero coupon maturing on 28 October 2021, non callable

- Sfil SA (Agency | Issy-Les-Moulineaux, Ile-De-France, France | Rating: AA-): €1,000m Bond (FR0014003S98), fixed rate (0.05% coupon) maturing on 4 June 2029, priced at 99.71 (original spread of 18 bp), non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €200m Unsecured Note (XS2314222857) zero coupon maturing on 31 December 2099, priced at 100.00, non callable

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €650m Senior Note (XS2348325650), fixed rate (1.13% coupon) maturing on 9 June 2041, priced at 99.54 (original spread of 106 bp), callable (20nc20)

- TenneT Holding BV (Utility - Other | Arnhem, Netherlands | Rating: A-): €650m Senior Note (XS2348325221), fixed rate (0.13% coupon) maturing on 9 December 2027, priced at 99.86 (original spread of 61 bp), callable (7nc6)

- TenneT Holding BV (Utility - Other | Arnhem, Netherlands | Rating: A-): €500m Senior Note (XS2348325494), fixed rate (0.50% coupon) maturing on 9 June 2031, priced at 99.19 (original spread of 79 bp), callable (10nc10)

- Tritax EuroBox PLC (Real Estate Investment Trust | London, United Kingdom | Rating: NR): €500m Senior Note (XS2347379377), fixed rate (0.95% coupon) maturing on 2 June 2026, priced at 99.13 (original spread of 170 bp), callable (5nc5)

- Weinberg Capital Ltd (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €330m Asset Backed Commercial Paper (XS2348327607) zero coupon maturing on 28 May 2021, non callable

- Wendel SE (Financial - Other | Paris, Ile-De-France, France | Rating: BBB): €300m Bond (FR0014003S72), fixed rate (1.00% coupon) maturing on 1 June 2031, priced at 99.46 (original spread of 126 bp), callable (10nc10)

- Westpac Securities NZ Ltd (London Branch) (Financial - Other | London, Australia | Rating: NR): €850m Covered Bond (Other) (XS2348324414), fixed rate (0.01% coupon) maturing on 8 June 2028, priced at 100.02 (original spread of 47 bp), non callable

NEW LOANS

- FGP Corp, signed a US$ 308m Term Loan, to be used for general corporate purposes. It matures on 05/26/27.

- Turkiye Garanti Bankasi AS, signed a € 294m Term Loan, maturing 05/28/22 and initial pricing is set at EURIBOR +225bps, as well as a US$ 279m Term Loan, maturing on 05/28/22 and initial pricing is set at LIBOR +250bps. Both to be used for finance linked-trade. It

NEW ISSUES IN SECURITIZED CREDIT

- Triumph Rail TRP 2021-2 issued a fixed-rate ABS backed by leases in 2 tranches, for a total of US$ 560 m. Highest-rated tranche offering a yield to maturity of 2.15%, and the lowest-rated tranche a yield to maturity of 3.08%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd, Deutsche Bank Securities Inc, Wells Fargo Securities LLC, Credit Agricole Corporate & Investment Bank