Credit

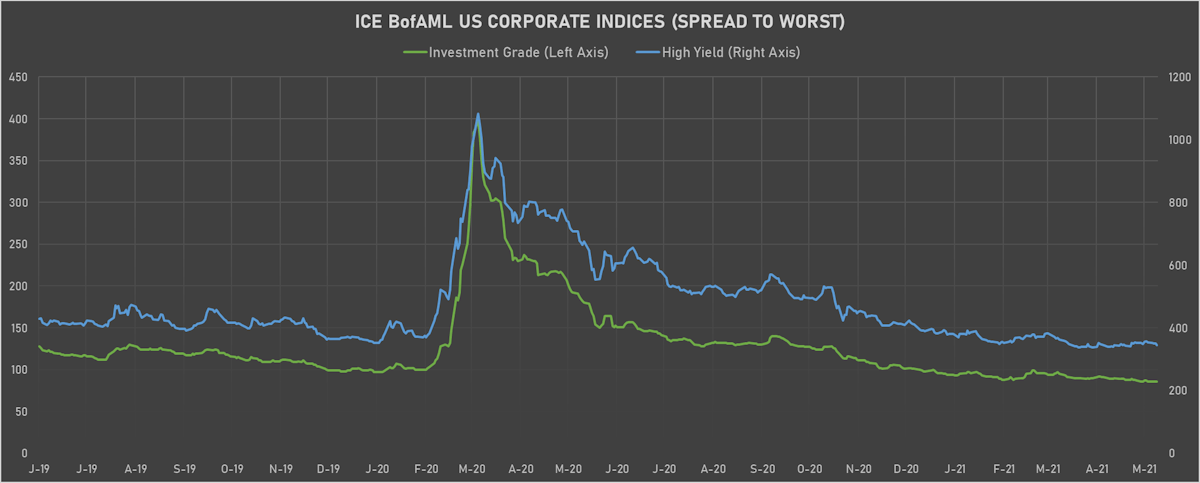

Investment Grade Unchanged, High Yield Spreads Down Today

Positive week for travel companies, as the CDS spreads of Royal Caribbean Cruises, TUI, Carnival drop by double digits on Covid reopening in the US and Europe

Published ET

Carnival 5Y USD CDS Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.09% today, with investment grade down -0.11% and high yield up 0.08% (YTD total return: -2.65%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 345.0 bp (YTD change: -45.0 bp)

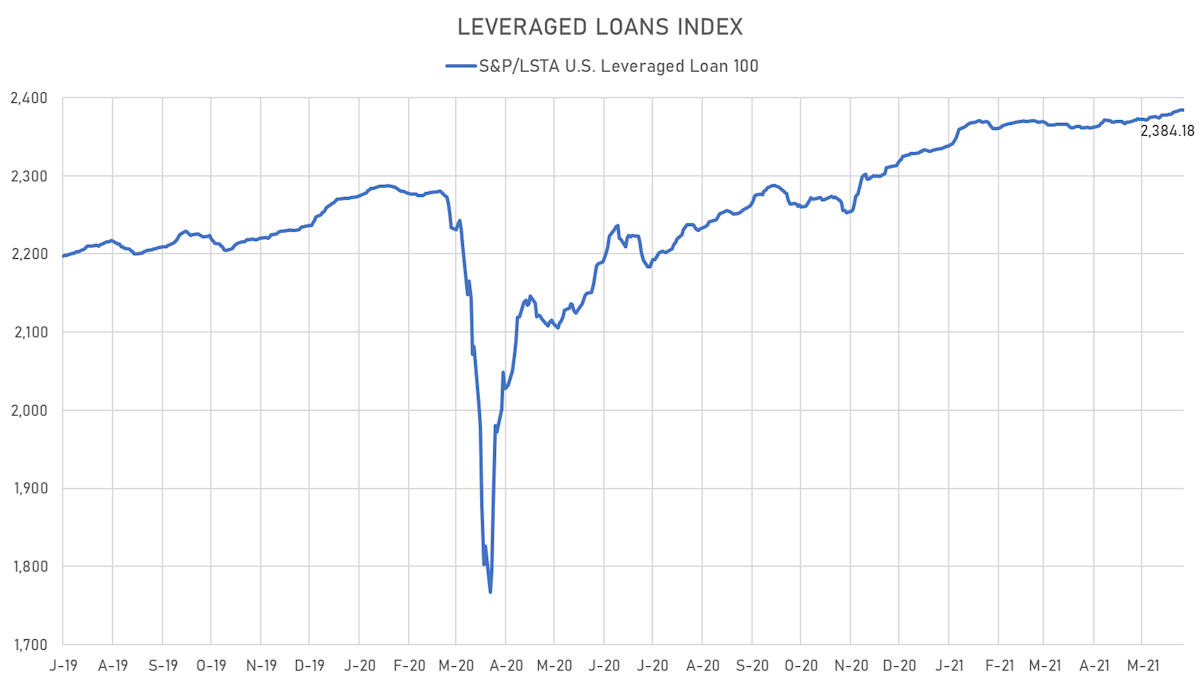

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +2.0%)

- New issues: US$ 22.6bn in dollars and € 11.7bn in euros

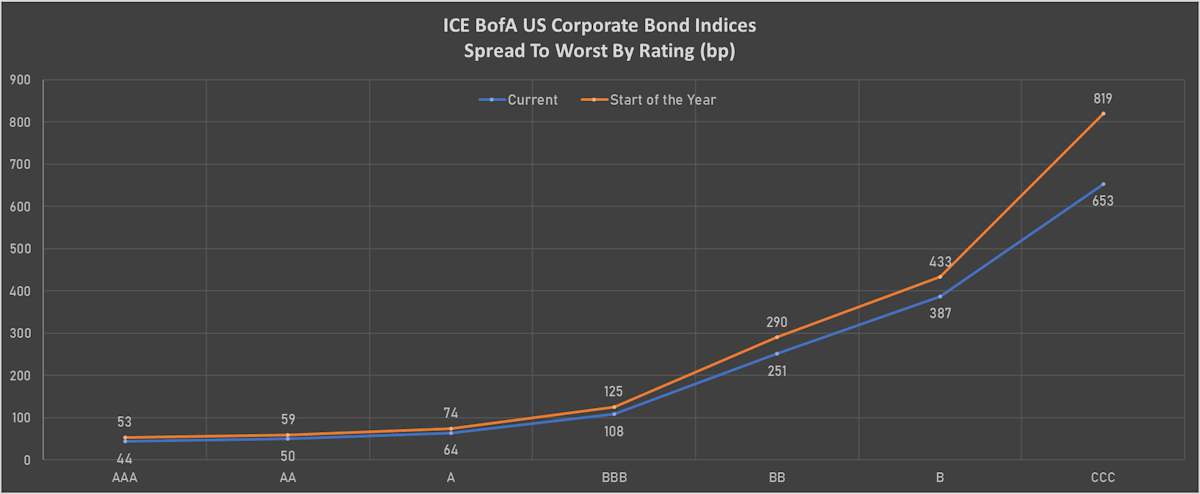

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA unchanged at 54 bp

- A unchanged at 69 bp

- BBB unchanged at 113 bp

- BB down by -4 bp at 240 bp

- B down by -7 bp at 367 bp

- CCC down by -6 bp at 637 bp

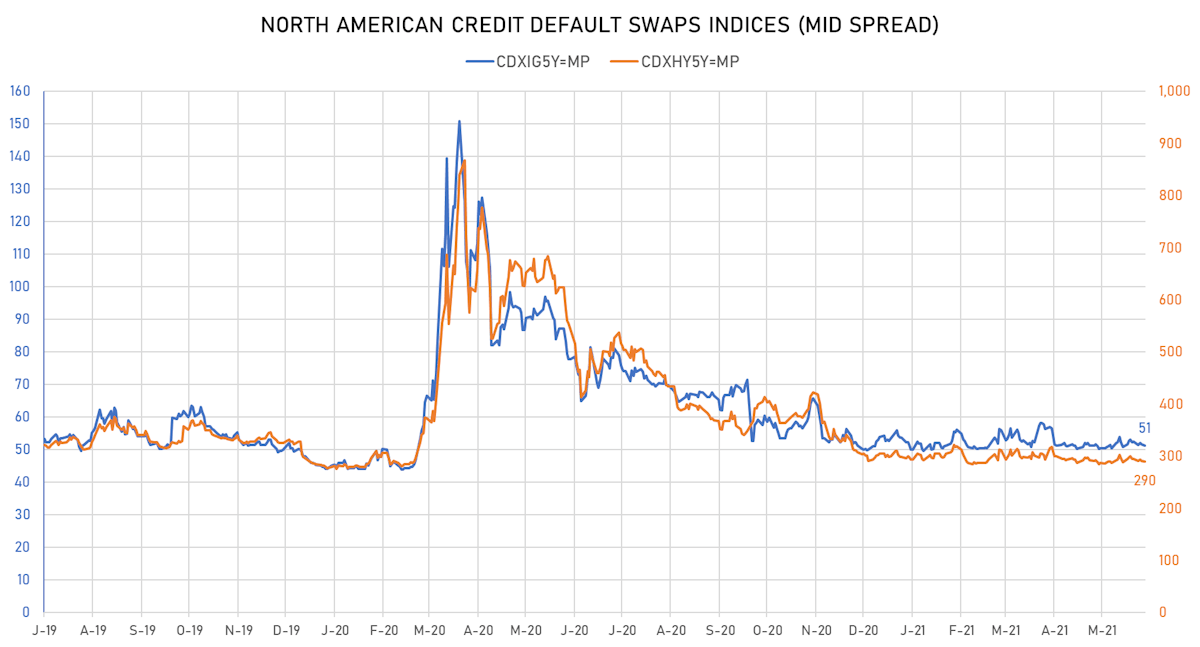

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 51bp (YTD change: +1.1bp)

- Markit CDX.NA.HY 5Y down 1.3 bp, now at 290bp (YTD change: -3.7bp)

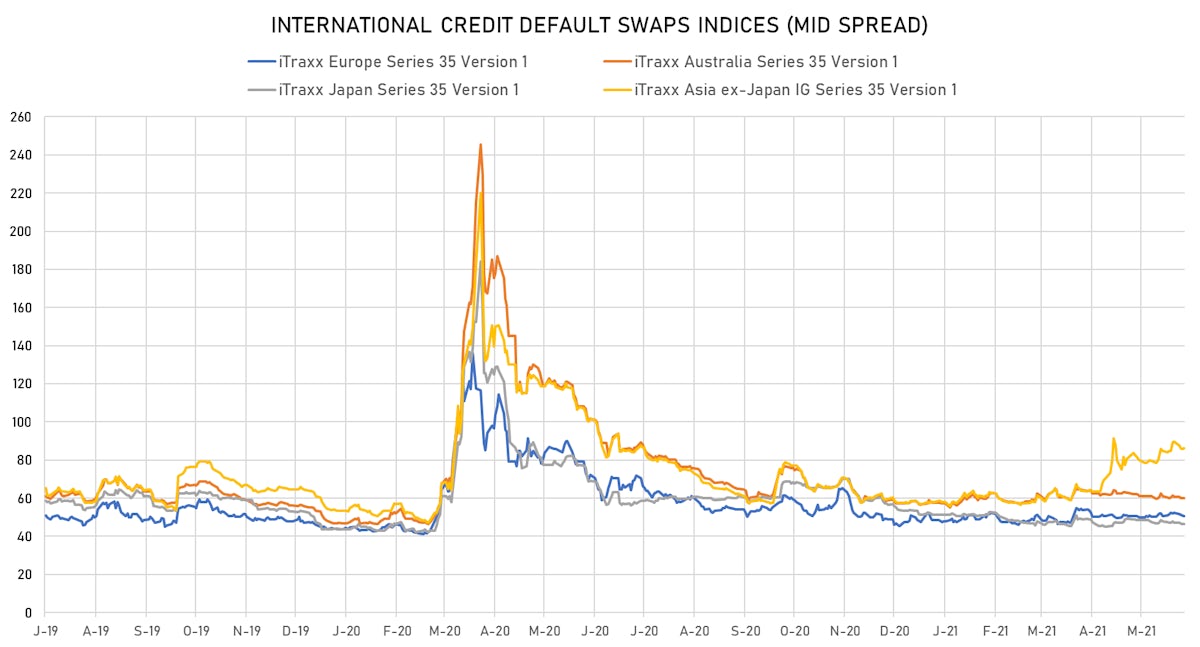

- Markit iTRAXX Europe down 0.5 bp, now at 51bp (YTD change: +2.7bp)

- Markit iTRAXX Japan unchanged at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan up 0.2 bp, now at 86bp (YTD change: +28.0bp)

LARGEST USD CORPORATE CDS MOVERS IN THE LAST 5 DAYS (5Y PAR SPREADS)

- Road King Infrastructure Ltd (Country: HK; rated: WR): up 91.5 bp to 636.6bp (1Y range: 482-786bp)

- Transocean Inc (Country: KY; rated: Caa3): up 82.1 bp to 1,402.6bp (1Y range: 1,315-7,695bp)

- Talen Energy Supply LLC (Country: US; rated: BB): up 71.2 bp to 1,084.9bp (1Y range: 875-1,710bp)

- MBIA Inc (Country: US; rated: Ba3): up 38.7 bp to 524.2bp (1Y range: 378-757bp)

- Nabors Industries Inc (Country: US; rated: B+): up 37.4 bp to 1,049.7bp (1Y range: 808-4,514bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 26.2 bp to 333.4bp (1Y range: 249-404bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 26.5 bp to 333.2bp (1Y range: 238-763bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 61%): down 35.4 bp to 351.2bp (1Y range: 340-1,979bp)

- Ford Motor Co (Country: US; rated: Ba2): down 44.1 bp to 210.1bp (1Y range: 180-646bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): down 47.6 bp to 326.2bp (1Y range: 292-1,408bp)

LARGEST EUR CORPORATE CDS MOVERS IN THE LAST 5 DAYS - 5Y PAR SPREADS

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 12.9 bp to 275.7bp (1Y range: 233-421bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 14.4 bp to 461.4bp (1Y range: 358-1,004bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 14.8 bp to 529.2bp (1Y range: 516-984bp)

- CMA CGM SA (Country: FR; rated: B1): down 15.4 bp to 389.5bp (1Y range: 389-1,510bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 15.5 bp to 277.5bp (1Y range: 206-479bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 15.7 bp to 372.7bp (1Y range: 355-1,223bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 20.4 bp to 374.5bp (1Y range: 317-477bp)

- Novafives SAS (Country: FR; rated: Caa1): down 26.0 bp to 852.9bp (1Y range: 716-1,746bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 27.1 bp to 230.1bp (1Y range: 141-273bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 56.6 bp to 789.6bp (1Y range: 590-1,799bp)

USD BOND ISSUES

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$1,250m All Commercial Paper (XS2348710646) zero coupon maturing on 4 June 2021, non callable

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$170m All Commercial Paper (XS2349450416) zero coupon maturing on 28 July 2021, non callable

- Agence Centrale des Organismes de Securite Sociale (Agency | Montreuil, Ile-De-France, France | Rating: AA): US$110m All Commercial Paper (XS2349345897) zero coupon maturing on 1 July 2021, non callable

- Agricultural Bank of China Ltd (Sydney Branch) (Banking | Sydney, New South Wales, China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348892659), fixed rate (0.16% coupon) maturing on 3 September 2021, priced at 100.00, non callable

- Agricultural Bank of China Ltd (Sydney Branch) (Banking | Sydney, New South Wales, China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348557351), fixed rate (0.16% coupon) maturing on 2 September 2021, priced at 100.00, non callable

- Air Lease Corp (Leasing | Los Angeles, California, United States | Rating: BBB): US$600m Senior Note (US00914AAN28), floating rate (US3MLIB + 35.0 bp) maturing on 15 December 2022, priced at 100.00, non callable

- Arabella Finance Ltd (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$589m Asset Backed Commercial Paper (XS2349391065) zero coupon maturing on 4 June 2021, non callable

- Bank of Montreal (London Branch) (Banking | London, Canada | Rating: NR): US$300m Certificate of Deposit (XS2348770038) zero coupon maturing on 10 June 2021, non callable

- Bip-V Chinook Holdco LLC (Financial - Other | Rating: NR): US$1,400m Note (US12657NAA81), fixed rate (5.50% coupon) maturing on 15 June 2031, priced at 100.00, callable (10nc5)

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$400m All Commercial Paper (XS2349429139) zero coupon maturing on 4 June 2021, non callable

- China Construction Bank Corp (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2348520516), fixed rate (0.23% coupon) maturing on 3 December 2021, priced at 100.00, non callable

- China Construction Bank Corp (Macau Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2349348305), fixed rate (0.23% coupon) maturing on 2 December 2021, priced at 100.00, non callable

- DZ BANK AG Deutsche Zentral Genossenschaftsbank Frankfurt am Main (Banking | Frankfurt, Hessen, Germany | Rating: AA-): US$400m Certificate of Deposit (XS2348774535) zero coupon maturing on 4 June 2021, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$175m Bond (US3133EMF494), fixed rate (1.98% coupon) maturing on 2 June 2031, priced at 100.00, callable (10nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$425m Bond (US3133EMF312), fixed rate (0.13% coupon) maturing on 2 June 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$300m Bond (US3130AMR535), fixed rate (0.62% coupon) maturing on 9 December 2024, priced at 100.00, callable (3nc1m)

- Industrial Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$120m Certificate of Deposit (XS2348282158), fixed rate (0.29% coupon) maturing on 1 March 2022, priced at 100.00, non callable

- La Banque Postale SA (Banking | Paris, Ile-De-France, France | Rating: A): US$225m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126841867) zero coupon maturing on 30 August 2021, non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Baden-Wuerttemberg, Germany | Rating: AA+): US$200m All Commercial Paper (XS2348714044) zero coupon maturing on 30 July 2021, non callable

- Landeskreditbank Baden Wuerttemberg Foerderbank (Agency | Karlsruhe, Baden-Wuerttemberg, Germany | Rating: AA+): US$300m All Commercial Paper (XS2349441852) zero coupon maturing on 1 July 2021, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$150m All Commercial Paper (XS2349500533) zero coupon maturing on 1 September 2021, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$300m All Commercial Paper (XS2349345541) zero coupon maturing on 2 August 2021, non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Hessen, Germany | Rating: AAA): US$300m All Commercial Paper (XS2349282447) zero coupon maturing on 1 July 2021, non callable

- MDGH GMTN (RSC) Ltd (Financial - Other | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: NR): US$500m Senior Note (XS2348658035), fixed rate (2.50% coupon) maturing on 3 June 2031, priced at 99.72 (original spread of 91 bp), callable (10nc10)

- MDGH GMTN BV (Financial - Other | Amsterdam, Noord-Holland, United Arab Emirates | Rating: NR): US$1,000m Senior Note (XS2324826994), fixed rate (3.40% coupon) maturing on 7 June 2051, priced at 100.00 (original spread of 108 bp), callable (30nc30)

- Mitsubishi Ufj Trust and Banking Corp (London Branch) (Banking | London, Japan | Rating: NR): US$186m Certificate of Deposit (XS2348717492), fixed rate (0.15% coupon) maturing on 31 August 2021, priced at 100.00, non callable

- Mizuho Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$250m Certificate of Deposit (XS2349426382) zero coupon maturing on 10 September 2021, non callable

- Mizuho Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$104m Certificate of Deposit (XS2349425814) zero coupon maturing on 1 September 2021, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): US$500m All Commercial Paper (XS2348698338) zero coupon maturing on 8 June 2021, non callable

- NWD Finance (BVI) Ltd (Financial - Other | Hong Kong | Rating: NR): US$1,200m Capital Security (XS2348062899), fixed rate (4.13% coupon) perpetual , priced at 100.00 (original spread of 286 bp), callable (Pnc7)

- Nacional Financiera SNC (London Branch) (Banking | London, Mexico | Rating: NR): US$341m Certificate of Deposit (XS2348767240) zero coupon maturing on 24 June 2021, non callable

- National Australia Bank Ltd (London Branch) (Banking | London, Australia | Rating: NR): US$150m Certificate of Deposit (XS2348323879), fixed rate (0.11% coupon) maturing on 27 August 2021, priced at 100.00, non callable

- Nordea Bank Abp (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): US$150m Unsecured Note (XS2349345202), fixed rate (1.43% coupon) maturing on 4 June 2026, priced at 100.00, non callable

- Oman Arab Bank SAOG (Banking | Jordan | Rating: NR): US$250m Capital Security (XS2346530244), fixed rate (7.63% coupon) perpetual , priced at 100.00 (original spread of 681 bp), callable (Pnc5)

- Pakistan Water and Power Development Authority (Utility - Other | Lahore, Punjab, Pakistan | Rating: B-): US$500m Senior Note (XS2348591707), fixed rate (7.50% coupon) maturing on 4 June 2031, priced at 100.00 (original spread of 589 bp), non callable

- Realogy Group LLC (Home Builders | Madison New Jersey, New Jersey, United States | Rating: B+): US$300m Bond (US75606DAN12), fixed rate (0.25% coupon) maturing on 15 June 2026, priced at 100.00, non callable, convertible

- Select Access Investments Ltd (Financial - Other | New South Wales, Australia | Rating: NR): US$4,650m Unsecured Note (XS2349441001), fixed rate (1.00% coupon) maturing on 14 July 2021, priced at 100.00, non callable

- Shanghai Pudong Development Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$200m Certificate of Deposit (XS2349347083), fixed rate (0.28% coupon) maturing on 3 March 2022, priced at 100.00, non callable

- Shannon Assets DAC (Financial - Other | Ireland | Rating: NR): US$105m Unsecured Note (XS2349107875), fixed rate (7.00% coupon) maturing on 7 June 2023, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$209m Unsecured Note (XS2342623274) zero coupon maturing on 20 March 2051, priced at 47.90, non callable

- Skandinaviska Enskilda Banken AB (Publ) (London Branch) (Banking | London, Sweden | Rating: NR): US$150m Certificate of Deposit (XS2348772323), fixed rate (0.14% coupon) maturing on 29 November 2021, priced at 100.00, non callable

- Stratus Capital II DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$120m Unsecured Note (XS2348772919), floating rate maturing on 30 April 2026, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$200m Certificate of Deposit (XS2348771945) zero coupon maturing on 12 October 2021, non callable

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$113m Certificate of Deposit (XS2349461371), fixed rate (0.17% coupon) maturing on 1 December 2021, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (London Branch) (Banking | London, Japan | Rating: NR): US$200m Certificate of Deposit (XS2348772166) zero coupon maturing on 31 August 2021, non callable

- Times China Holdings Ltd (Service - Other | Guangzhou, Guangdong | Rating: BB-): US$400m Senior Note (XS2348280962), fixed rate (5.55% coupon) maturing on 4 June 2024, priced at 100.00, callable (3nc2)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): US$1,000m Senior Note (XS2348714713), floating rate maturing on 3 June 2032, priced at 100.00 (original spread of 156 bp), callable (11nc10)

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): US$1,000m Senior Note (XS2348710562), floating rate maturing on 3 June 2027, priced at 100.00, callable (6nc5)

- Yango Justice International Ltd (Financial - Other | China (Mainland) | Rating: NR): US$290m Senior Note (XS2347769833), fixed rate (7.88% coupon) maturing on 4 September 2024, priced at 99.52, callable (3nc2)

EUR BOND ISSUES

- Arabella Finance Ltd (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €278m Asset Backed Commercial Paper (XS2348721767) zero coupon maturing on 31 May 2021, non callable

- Atos SE (Information/Data Technology | Bezons, Ile-De-France, France | Rating: BBB+): €200m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864778) zero coupon maturing on 28 September 2021, non callable

- BANK OF CHINA LTD (PARIS BRANCH) (Banking | Paris, Ile-De-France, China (Mainland) | Rating: NR): €150m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864604) zero coupon maturing on 30 August 2021, non callable

- Citycon Oyj (Retail Stores - Other | Espoo, Etela-Suomen, Finland | Rating: BBB-): €350m Capital Security (XS2347397437), fixed rate (3.63% coupon) perpetual , priced at 98.50 (original spread of 450 bp), callable (Pnc5)

- Colgate-Palmolive Co (Consumer Products | New York City, New York, United States | Rating: AA-): €115m All Commercial Paper (XS2348776746) zero coupon maturing on 30 June 2021, non callable

- Deutsche Telekom AG (Telecommunications | Bonn, Nordrhein-Westfalen, Germany | Rating: BBB): €450m All Commercial Paper (XS2349350624) zero coupon maturing on 14 June 2021, non callable

- Electricite de France SA (Agency | Paris, Ile-De-France, France | Rating: BB-): €1,250m Bond (FR0014003S56), floating rate perpetual , priced at 99.21 (original spread of 321 bp), callable (Pnc7)

- HSBC Institutional Trust Services (Singapore) Ltd (Building Products | United Kingdom | Rating: NR): €300m Unsecured Note (XS2349343090), fixed rate (1.00% coupon) maturing on 14 June 2028, priced at 100.00, non callable

- Linde Finance BV (Financial - Other | Amsterdam, Noord-Holland, United Kingdom | Rating: A): €125m All Commercial Paper (XS2349391735) zero coupon maturing on 2 August 2021, non callable

- Managed and Enhanced Tap Magenta Funding ST SA (Securities | Paris, Ile-De-France, France | Rating: NR): €150m Asset Backed Commercial Paper (XS2349347919) zero coupon maturing on 2 August 2021, non callable

- Managed and Enhanced Tap Magenta Funding ST SA (Securities | Paris, Ile-De-France, France | Rating: NR): €137m Asset Backed Commercial Paper (XS2349341391) zero coupon maturing on 1 June 2021, non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €2,000m Jumbo Landesschatzanweisung (DE000NRW0MY1), fixed rate (0.13% coupon) maturing on 4 June 2031, priced at 99.91 (original spread of 30 bp), non callable

- North-Rhine Westphalia, State of (Official and Muni | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,500m Jumbo Landesschatzanweisung (DE000NRW0MZ8), fixed rate (0.60% coupon) maturing on 4 June 2041, priced at 99.83 (original spread of 48 bp), non callable

- Novo Nordisk Finance Netherlands BV (Financial - Other | Denmark | Rating: NR): €650m Senior Note (XS2348030268) zero coupon maturing on 4 June 2024, priced at 100.67 (original spread of 45 bp), callable (3nc3)

- Novo Nordisk Finance Netherlands BV (Financial - Other | Denmark | Rating: NR): €650m Senior Note (XS2348030425), fixed rate (0.13% coupon) maturing on 4 June 2028, priced at 99.41 (original spread of 65 bp), callable (7nc7)

- Oesterreichische Kontrollbank AG (Agency | Wien, Wien, Austria | Rating: AA+): €300m CD/CP 1YR or less: French Negotiable European Commerc Paper (FR0126864570) zero coupon maturing on 28 September 2021, non callable

- Raiffeisenbank as (Banking | Praha, Praha, Austria | Rating: NR): €350m Unsecured Note (XS2348241048), fixed rate (1.00% coupon) maturing on 1 June 2028, priced at 100.00, non callable

- Romulus Funding Corp (Financial - Other | United States | Rating: NR): €500m Asset Backed Commercial Paper (XS2348719860) zero coupon maturing on 30 June 2021, non callable

- Romulus Funding Corp (Financial - Other | United States | Rating: NR): €215m Asset Backed Commercial Paper (XS2348717732) zero coupon maturing on 28 June 2021, non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €200m Unsecured Note (XS2314222857) zero coupon maturing on 31 December 2099, priced at 100.00, non callable

- Synthos SA (Conglomerate/Diversified Mfg | Oswiecim, Woj. Malopolskie, Luxembourg | Rating: BB): €600m Note (XS2348767836), fixed rate (2.50% coupon) maturing on 7 June 2028, priced at 100.00 (original spread of 285 bp), callable (7nc3)

- TenneT Holding BV (Utility - Other | Arnhem, Gelderland, Netherlands | Rating: A-): €450m All Commercial Paper (XS2349276555) zero coupon maturing on 9 June 2021, non callable

- The Norinchukin Bank (London Branch) (Banking | London, Japan | Rating: NR): €250m Certificate of Deposit (XS2349356076) zero coupon maturing on 1 September 2021, non callable

- Wabtec Transportation Netherlands BV (Industrials - Other | Ede, Gelderland, United States | Rating: NR): €500m Senior Note (XS2345035963), fixed rate (1.25% coupon) maturing on 3 December 2027, priced at 99.27 (original spread of 180 bp), callable (7nc6)

NEW ISSUES IN LOANS

- Acciona Energia SA, signed a € 500m Term Loan, to be used for general corporate purposes. It matures on 06/04/26.

- Acciona Energia SA, signed a € 1,000m Term Loan, to be used for general corporate purposes. It matures on 06/04/24.

NEW ISSUES IN SECURITIZED CREDIT

- LFT CRE 2021-Fl1 LLC issued a floating-rate CMBS in 6 tranches, for a total of US$ 834 m. Highest-rated tranche offering a spread over the floating rate of 117bp, and the lowest-rated tranche a spread of 295bp. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- American Finance Trust 2021-1 issued a fixed-rate ABS backed by leases in 4 tranches, for a total of US$ 240 m. Highest-rated tranche offering a yield to maturity of 2.21%, and the lowest-rated tranche a yield to maturity of 3.60%. Bookrunners: Credit Suisse

- Sky Leasing 2021-1 issued a fixed-rate ABS backed by aircraft leases in 2 tranches, for a total of US$ 663 m. Highest-rated tranche offering a yield to maturity of 2.43%, and the lowest-rated tranche a yield to maturity of 3.42%. Bookrunners: Morgan Stanley International Ltd, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, SG Americas Securities LLC, Bank of America Merrill Lynch, MUFG Securities Americas Inc, Natixis Securities Americas LLC