Credit

With Stable Credit Spreads, Bond Indices Edged Down On Higher Rates

Not a terribly active day for USD bond issuance: only half a dozen large deals priced, including 3 tranches from Toronto Dominion to raise $3bn

Published ET

Credit Volatility | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.06% and high yield up 0.06% (YTD total return: -2.74%)

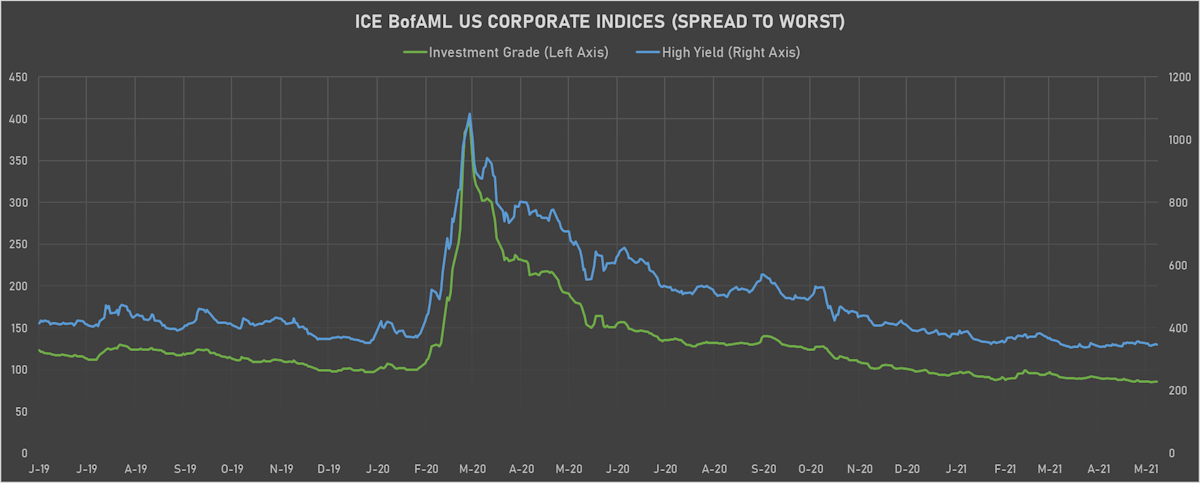

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 347.0 bp (YTD change: -43.0 bp)

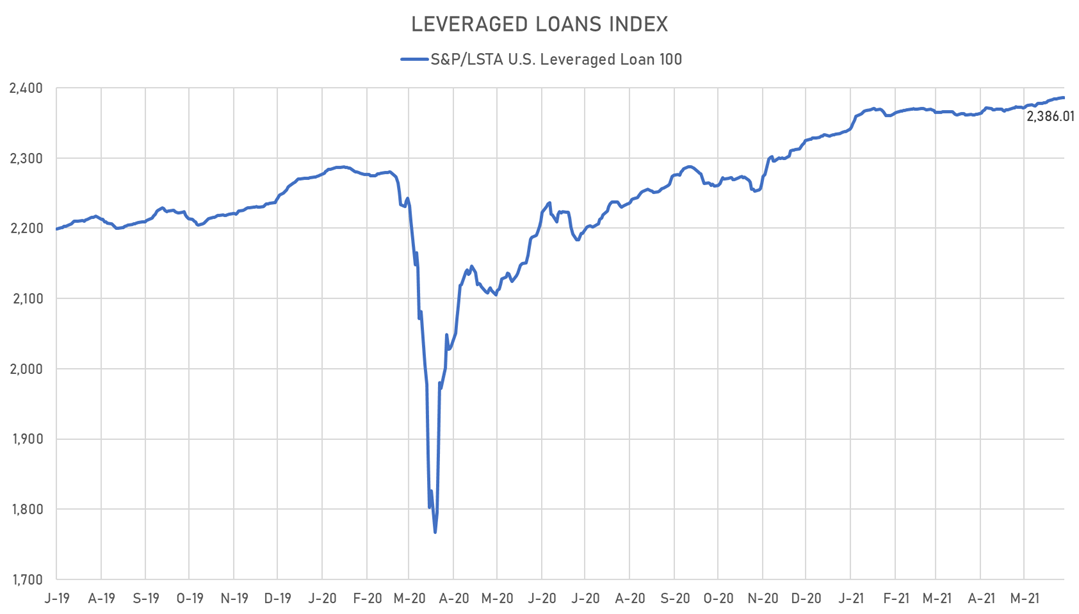

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.1% today (YTD total return: +2.1%)

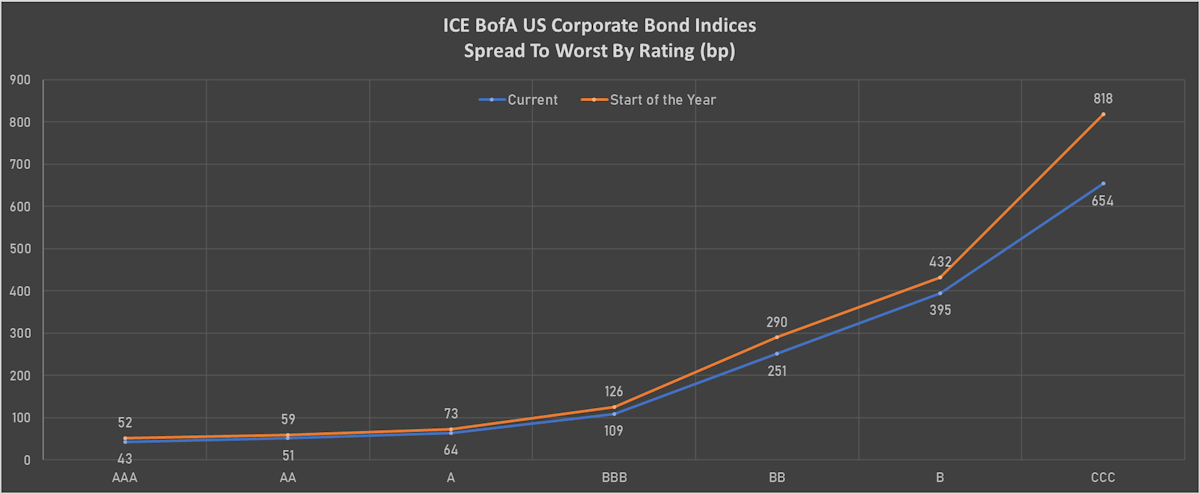

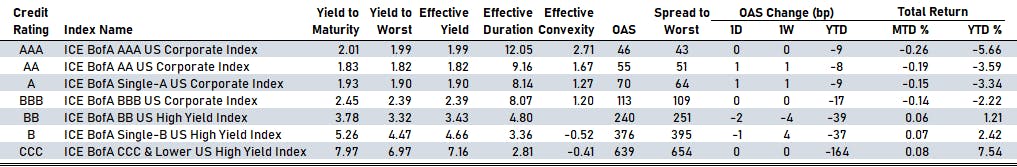

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA up by 1 bp at 55 bp

- A up by 1 bp at 70 bp

- BBB unchanged at 113 bp

- BB down by -2 bp at 240 bp

- B down by -1 bp at 376 bp

- CCC unchanged at 639 bp

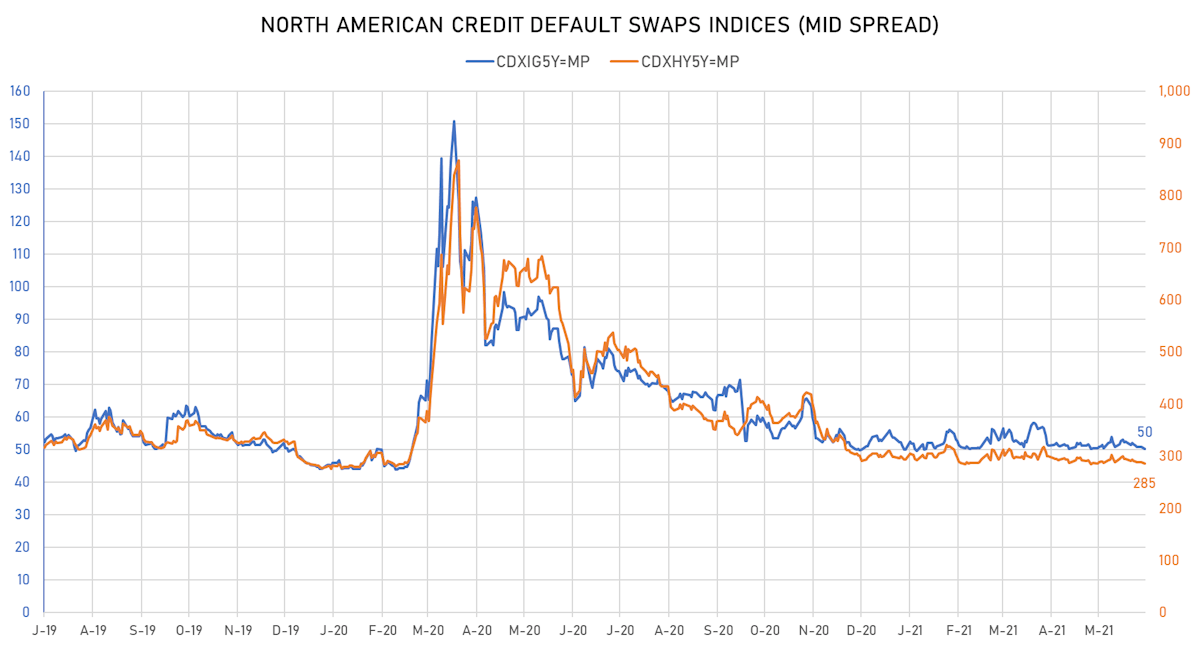

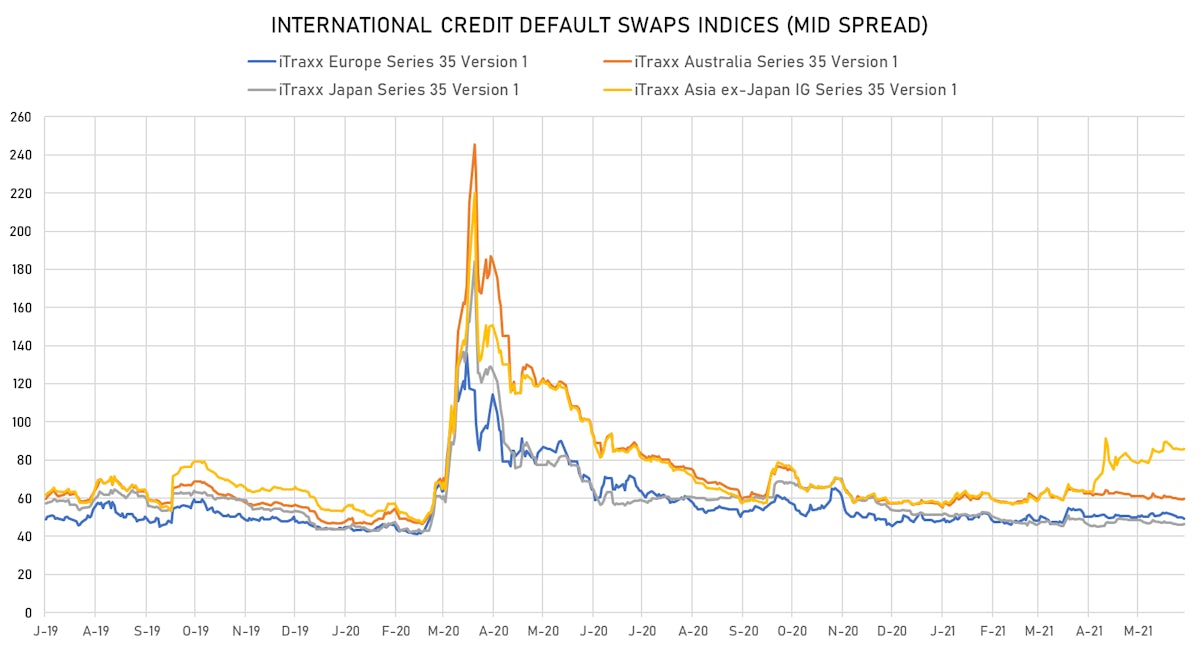

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 50bp (YTD change: +0.1bp)

- Markit CDX.NA.HY 5Y down 2.1 bp, now at 285bp (YTD change: -8.0bp)

- Markit iTRAXX Europe down 0.8 bp, now at 49bp (YTD change: +1.3bp)

- Markit iTRAXX Japan up 0.5 bp, now at 46bp (YTD change: -4.9bp)

- Markit iTRAXX Asia Ex-Japan up 0.4 bp, now at 86bp (YTD change: +27.8bp)

LARGEST MOVES IN USD HIGH YIELD

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Option-adjusted spread up by 19.6 bp to 939.7 bp, with the yield to worst at 9.5% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 100.6-107.0).

- Issuer: Metropolitan Edison Co (Akron, Ohio (US)) | Coupon: 3.50% | Maturity: 15/3/2023 | Rating: BB+ | ISIN: USU5919UAD10 | Option-adjusted spread up by 8.7 bp to 94.4 bp (CDS basis: -51.3bp), with the yield to worst at 1.1% and the bond now trading down to 103.6 cents on the dollar (1Y price range: 103.5-104.4).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Option-adjusted spread up by 7.5 bp to 1,423.9 bp, with the yield to worst at 15.2% and the bond now trading down to 68.5 cents on the dollar (1Y price range: 59.9-73.1).

- Issuer: Buckeye Partners LP (Houston, Texas (US)) | Coupon: 4.50% | Maturity: 1/3/2028 | Rating: B+ | ISIN: USU05638AC24 | Option-adjusted spread down by 8.4 bp to 327.6 bp, with the yield to worst at 4.3% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 99.0-100.6).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.63% | Maturity: 15/6/2035 | Rating: BB- | ISIN: US71656MAE93 | Option-adjusted spread down by 8.5 bp to 542.4 bp (CDS basis: -66.8bp), with the yield to worst at 6.9% and the bond now trading up to 96.8 cents on the dollar (1Y price range: 93.2-100.6).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Option-adjusted spread down by 9.8 bp to 174.8 bp, with the yield to worst at 1.9% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 106.5-108.8).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Option-adjusted spread down by 11.7 bp to 295.6 bp, with the yield to worst at 3.0% and the bond now trading up to 104.7 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Ultrapar International SA (Luxembourg, Luxembourg) | Coupon: 5.25% | Maturity: 6/6/2029 | Rating: BB+ | ISIN: USL9412AAB37 | Option-adjusted spread down by 18.1 bp to 304.4 bp, with the yield to worst at 4.2% and the bond now trading up to 106.3 cents on the dollar (1Y price range: 103.5-112.1).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Option-adjusted spread down by 41.0 bp to 1,523.0 bp, with the yield to worst at 15.5% and the bond now trading up to 66.5 cents on the dollar (1Y price range: 56.6-71.8).

LARGEST MOVES IN EUR HIGH YIELD

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB | ISIN: FR0013299435 | Option-adjusted spread up by 13.5 bp to 181.8 bp (CDS basis: 11.7bp), with the yield to worst at 1.4% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 96.6-98.8).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Option-adjusted spread down by 13.1 bp to 252.0 bp, with the yield to worst at 2.3% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 99.1-99.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Option-adjusted spread down by 13.1 bp to 214.5 bp, with the yield to worst at 1.7% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 97.9-101.2).

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 2.38% | Maturity: 27/11/2025 | Rating: BB+ | ISIN: XS2264074647 | Option-adjusted spread down by 13.2 bp to 152.8 bp (CDS basis: -31.3bp), with the yield to worst at 1.1% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 102.8-105.6).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 2.00% | Maturity: 4/12/2028 | Rating: BB- | ISIN: XS2267889991 | Option-adjusted spread down by 13.9 bp to 144.3 bp (CDS basis: 22.8bp), with the yield to worst at 1.2% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 99.6-104.4).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 2.00% | Maturity: 15/2/2033 | Rating: BB+ | ISIN: XS2300293003 | Option-adjusted spread down by 14.0 bp to 206.9 bp, with the yield to worst at 2.3% and the bond now trading up to 97.2 cents on the dollar (1Y price range: 96.0-99.9).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Option-adjusted spread down by 15.3 bp to 272.0 bp, with the yield to worst at 2.4% and the bond now trading up to 98.7 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Option-adjusted spread down by 15.8 bp to 268.0 bp, with the yield to worst at 2.5% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 94.1-98.1).

USD BOND ISSUES

- China Hongqiao Group Ltd (Metals/Mining | Binzhou, Shandong, Hong Kong | Rating: B+): US$500m Senior Note (XS2348238259), fixed rate (6.25% coupon) maturing on 8 June 2024, priced at 100.00, non callable

- China State Construction Finance (Cayman) I Ltd (Financial - Other | China (Mainland) | Rating: BBB-): US$500m Subordinated Note (XS2344740811), floating rate perpetual , priced at 100.00 (original spread of 258 bp), callable (Pnc5)

- Cinemark USA Inc (Leisure | Plano, Texas, United States | Rating: B): US$765m Senior Note (USU17176AL91), fixed rate (5.25% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 398 bp), callable (7nc3)

- Energy Transfer LP (Gas Utility - Pipelines | Dallas, Texas, United States | Rating: BB): US$900m Preferred Stock (US29273VAN01), fixed rate (6.50% coupon) perpetual , priced at 100.00, callable (Pnc5)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$200m Bond (US3130AMRN45), floating rate (SOFR + 1.0 bp) maturing on 1 June 2022, priced at 100.00, non callable

- GFL Environmental Inc (Service - Other | Vaughan, Ontario, Canada | Rating: B-): US$750m Senior Note (USC39217AM36), fixed rate (4.75% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 334 bp), callable (8nc3)

- Grupo Axo SAPI de CV (Financial - Other | Naucalpan De Juarez, Mexico, D.F., Mexico | Rating: BB): US$325m Senior Note (USP4955MAA91), fixed rate (5.75% coupon) maturing on 8 June 2026, priced at 100.00, callable (5nc2)

- Industrial and Commercial Bank of China Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): US$150m Certificate of Deposit (XS2351084293) zero coupon maturing on 6 June 2022, non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$500m Note (US59217GEN51), fixed rate (0.55% coupon) maturing on 7 June 2024, priced at 99.90 (original spread of 28 bp), non callable

- Pacific Gas and Electric Co (Utility - Other | San Francisco, California, United States | Rating: BBB-): US$800m First Mortgage Bond (US694308JW85), fixed rate (3.00% coupon) maturing on 15 June 2028, priced at 99.51 (original spread of 180 bp), callable (7nc7)

- Public Service Company of New Hampshire (Utility - Other | Manchester, New Hampshire, United States | Rating: A+): US$350m First Mortgage Note (US744538AE99), fixed rate (2.20% coupon) maturing on 15 June 2031, priced at 99.71 (original spread of 62 bp), callable (10nc10)

- Switch Inc (Information/Data Technology | Las Vegas, Nevada, United States | Rating: BB): US$500m Senior Note (USU8681QAB42), fixed rate (4.13% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 273 bp), callable (8nc3)

- Toronto Dominion Bank, $3bn in 3 tranches

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$200m Certificate of Deposit (XS2351142836) zero coupon maturing on 1 April 2022, non callable

- Vodafone Group PLC (Telecommunications | Newbury, Berkshire, United Kingdom | Rating: BBB): US$1,000m Capital Security (US92857WBW91), fixed rate (4.13% coupon) maturing on 4 June 2081, priced at 100.00, callable (60nc10)

- Vodafone Group PLC (Telecommunications | Newbury, Berkshire, United Kingdom | Rating: BBB): US$500m Capital Security (US92857WBV19), fixed rate (3.25% coupon) maturing on 4 June 2081, priced at 100.00 (original spread of 245 bp), callable (60nc5)

- Vodafone Group PLC (Telecommunications | Newbury, Berkshire, United Kingdom | Rating: BBB): US$950m Capital Security (US92857WBX74), fixed rate (5.13% coupon) maturing on 4 June 2081, priced at 100.00, callable (60nc30)

- Zhenro Properties Group Ltd (Service - Other | Shanghai, Shanghai, China (Mainland) | Rating: B): US$340m Senior Note (XS2346158822), fixed rate (7.10% coupon) maturing on 10 September 2024, priced at 99.16, callable (3nc2)

EUR BOND ISSUES

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): €1,250m Covered Bond (Other) (XS2351089508), fixed rate (0.05% coupon) maturing on 8 June 2029, priced at 99.95 (original spread of 42 bp), non callable

- Belfius Banque SA (Banking | Brussels, Belgium | Rating: A-): €500m Note (BE6328785207), fixed rate (0.38% coupon) maturing on 8 June 2027, priced at 99.75 (original spread of 93 bp), with a regulatory call

- Bremen Free Hanseatic, City of (Official and Muni | Bremen, Germany | Rating: AAA): €1,000m Landesschatzanweisung (DE000A3H2YJ1) zero coupon maturing on 15 March 2022, priced at 100.44, non callable

- EWE AG (Utility - Other | Oldenburg, Germany | Rating: BBB+): €500m Senior Note (DE000A3E5L98), fixed rate (0.25% coupon) maturing on 8 June 2028, priced at 99.66 (original spread of 74 bp), callable (7nc7)

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A1RQD35) zero coupon maturing on 10 June 2026, priced at 101.63 (original spread of 24 bp), non callable

- Ontario, Province of (Official and Muni | Toronto, Canada | Rating: A+): €1,000m Senior Note (XS2351088955), fixed rate (0.25% coupon) maturing on 9 June 2031, priced at 99.28 (original spread of 50 bp), non callable

- RWE AG (Utility - Other | Essen, Germany | Rating: BBB): €500m Senior Note (XS2351092478), fixed rate (0.63% coupon) maturing on 11 June 2031, priced at 99.71 (original spread of 84 bp), callable (10nc10)

- Worley Us Finance Sub Ltd (Financial - Other | Bellaire, United States | Rating: NR): €500m Senior Note (XS2351032227), fixed rate (0.88% coupon) maturing on 9 June 2026, priced at 99.45, callable (5nc5)

NEW LOANS

- Core & Main LP (CCC+), signed a US$ 1,500m Term Loan B, to be used for general corporate purposes. It matures on 06/09/27 and initial pricing is set at LIBOR +275.000bps

- Faurecia SA (BB), signed a € 1,500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 05/31/26.

- Kingspan Group PLC, signed a € 700m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/01/26.

NEW ISSUES IN SECURITIZED CREDIT

- BNPP AM Euro CLO 2021 BV issued a floating-rate CLO in 8 tranches, for a total of € 400 m. Highest-rated tranche offering a spread over the floating rate of 30bp, and the lowest-rated tranche a spread of 829bp. Bookrunners: BNP Paribas SA

- Cartesian Residential Mortgages 6 SA issued a floating-rate RMBS in 1 tranche, offering a spread of 65bp, for a total amount of € 439 m. Bookrunners: BNP Paribas SA, Citi, SMBC Nikko Securities Inc

- Hundred Acre Wood Trust 2021-Inv1 issued a floating-rate RMBS in 5 tranches, for a total of US$ 272 m. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch