Credit

US Corporate Bonds Rise On Tighter Spreads, Lower Rates

A decent day for the USD bond primary market, dominated by financial issuers: the Asian Development Bank raised $5.5bn, Citigroup $3.15bn, and Société Générale $2.5bn

Published ET

Buckeye Partners (USU05638AC24) trading back to par after dropping to the low 70's last year | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.14% today, with investment grade up 0.15% and high yield up 0.11% (YTD total return: -2.60%)

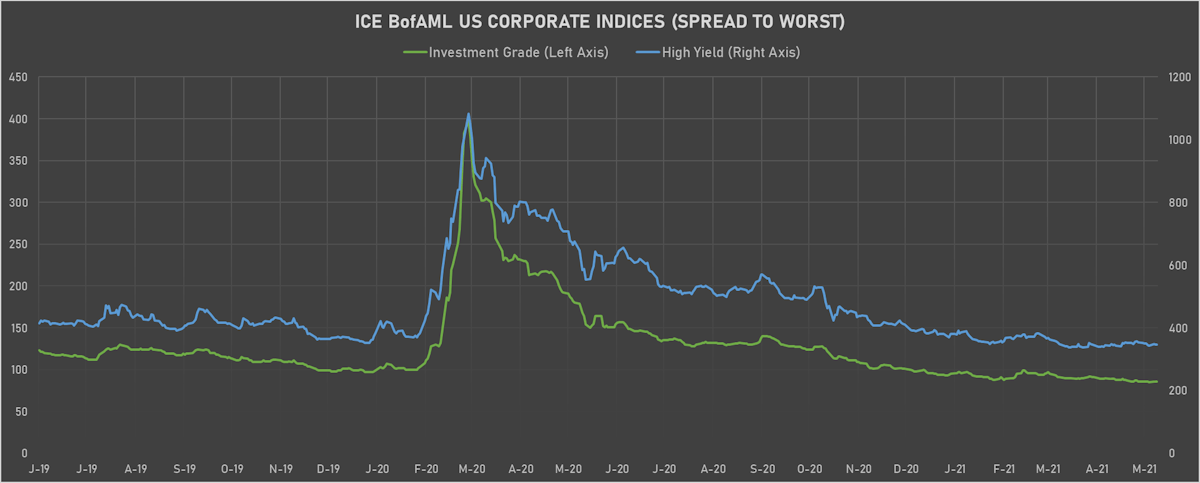

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 346.0 bp (YTD change: -44.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +2.1%)

- New issues: US$ 15.8bn in dollars and € 5.3bn in euros

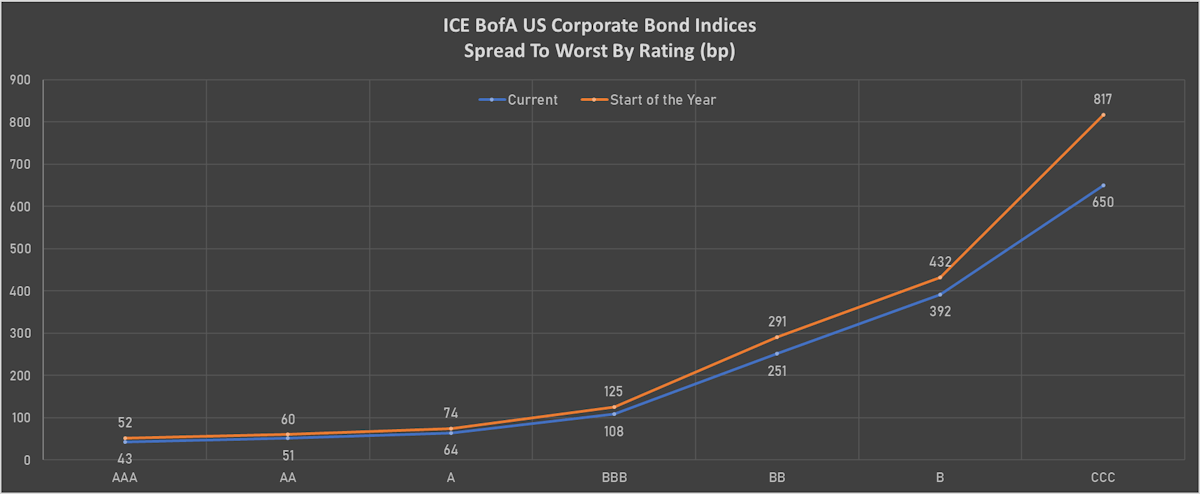

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA down by -1 bp at 54 bp

- A down by -1 bp at 69 bp

- BBB unchanged at 113 bp

- BB down by -1 bp at 239 bp

- B down by -3 bp at 373 bp

- CCC down by -3 bp at 636 bp

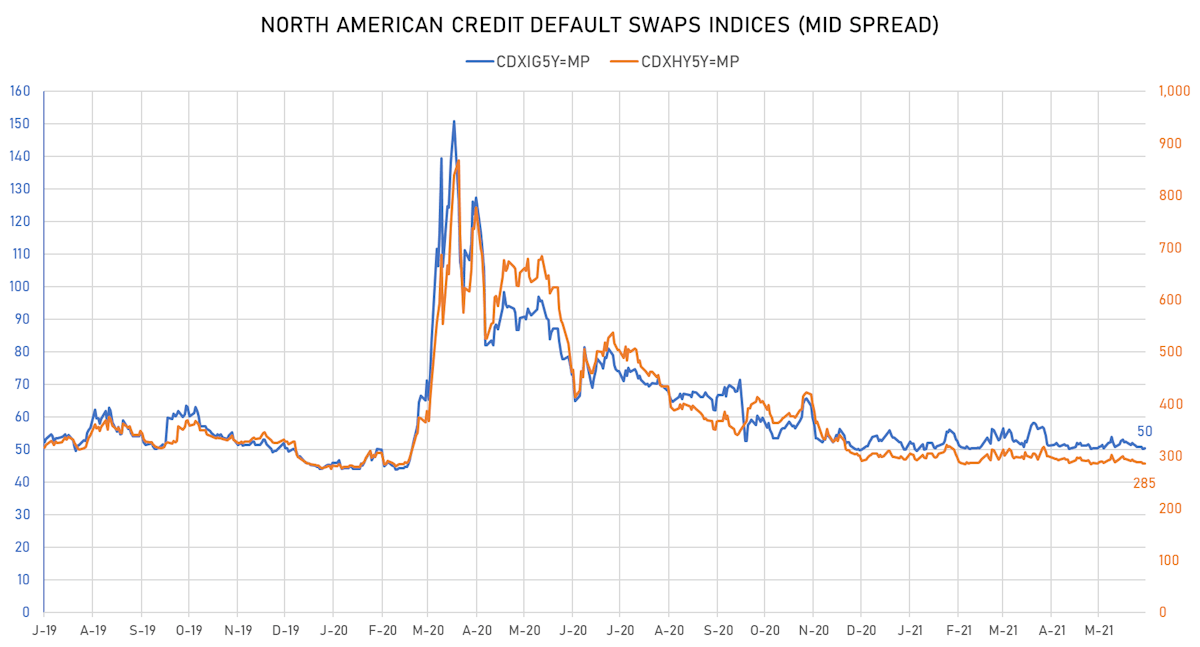

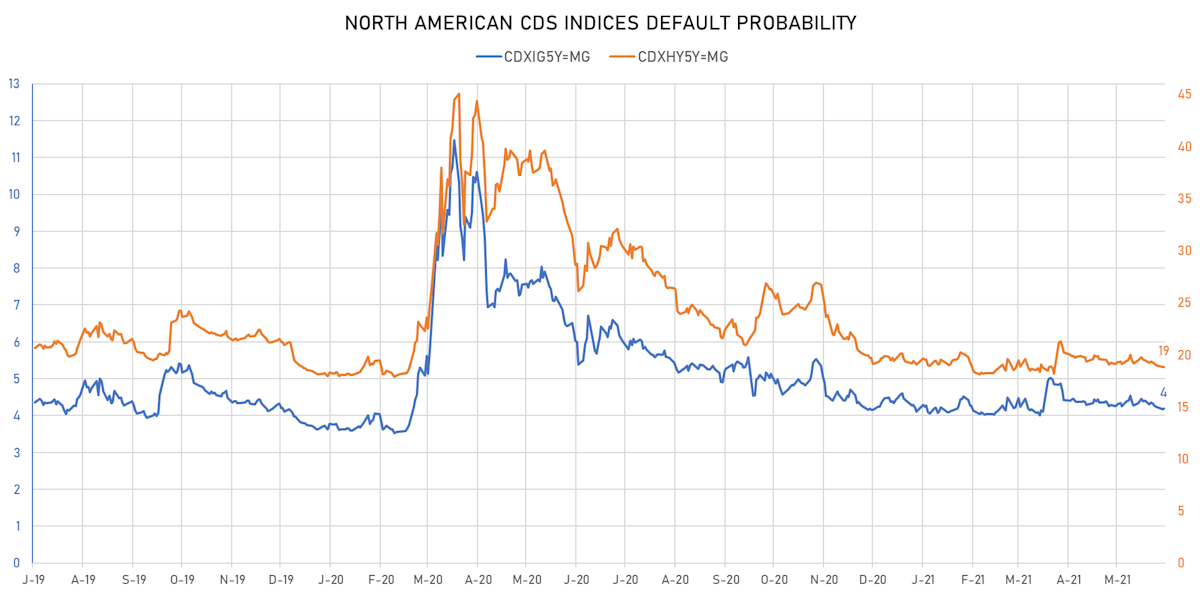

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 50bp (YTD change: +0.3bp)

- Markit CDX.NA.HY 5Y down 0.4 bp, now at 285bp (YTD change: -8.4bp)

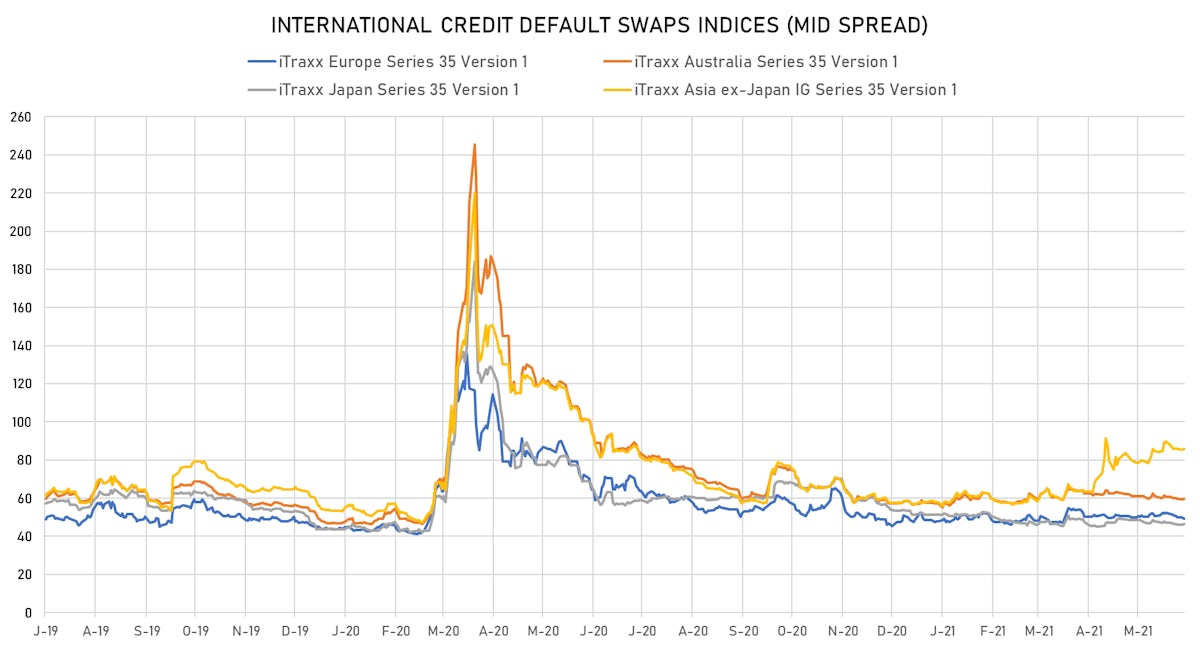

- Markit iTRAXX Europe unchanged at 49bp (YTD change: +1.2bp)

- Markit iTRAXX Japan down 0.2 bp, now at 46bp (YTD change: -5.0bp)

- Markit iTRAXX Asia Ex-Japan up 0.7 bp, now at 87bp (YTD change: +28.5bp)

BIGGEST MOVES IN USD HIGH YIELD

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Option-adjusted spread up by 19.6 bp to 929.3 bp, with the yield to worst at 9.4% and the bond now trading down to 101.0 cents on the dollar (1Y price range: 100.6-107.0).

- Issuer: Metropolitan Edison Co (Akron, Ohio (US)) | Coupon: 3.50% | Maturity: 15/3/2023 | Rating: BB+ | ISIN: USU5919UAD10 | Option-adjusted spread up by 8.7 bp to 92.9 bp (CDS basis: -50.4bp), with the yield to worst at 1.0% and the bond now trading down to 103.6 cents on the dollar (1Y price range: 103.5-104.4).

- Issuer: Buckeye Partners LP (Houston, Texas (US)) | Coupon: 4.50% | Maturity: 1/3/2028 | Rating: B+ | ISIN: USU05638AC24 | Option-adjusted spread down by 8.4 bp to 334.1 bp, with the yield to worst at 4.3% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 99.0-100.6).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.63% | Maturity: 15/6/2035 | Rating: BB- | ISIN: US71656MAE93 | Option-adjusted spread down by 8.5 bp to 530.2 bp (CDS basis: -56.6bp), with the yield to worst at 6.8% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 93.2-100.6).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.63% | Maturity: 1/3/2024 | Rating: BB- | ISIN: USU87286AD91 | Option-adjusted spread down by 9.8 bp to 170.2 bp, with the yield to worst at 1.9% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 106.5-108.8).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Option-adjusted spread down by 11.7 bp to 302.3 bp, with the yield to worst at 3.1% and the bond now trading up to 104.6 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Ultrapar International SA (Luxembourg, Luxembourg) | Coupon: 5.25% | Maturity: 6/6/2029 | Rating: BB+ | ISIN: USL9412AAB37 | Option-adjusted spread down by 18.1 bp to 313.7 bp, with the yield to worst at 4.2% and the bond now trading up to 105.8 cents on the dollar (1Y price range: 103.5-112.1).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Option-adjusted spread down by 41.0 bp to 1,571.0 bp, with the yield to worst at 15.9% and the bond now trading up to 65.3 cents on the dollar (1Y price range: 56.6-71.8).

USD BOND ISSUES

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$4,000m Senior Note (US045167FE86), fixed rate (0.38% coupon) maturing on 11 June 2024, priced at 99.94 (original spread of 10 bp), non callable

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): US$1,500m Senior Note (US045167FF51), fixed rate (1.25% coupon) maturing on 9 June 2028, priced at 99.41 (original spread of 9 bp), non callable

- Athene Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$500m Note (US04685A2Y60), fixed rate (2.67% coupon) maturing on 7 June 2031, priced at 100.00 (original spread of 108 bp), non callable

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$2,750m Senior Note (US172967NA50), floating rate maturing on 9 June 2027, priced at 100.00, callable (6nc5)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$400m Senior Note (US172967MZ11), floating rate (SOFR + 77.0 bp) maturing on 9 June 2027, priced at 100.00, callable (6nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$120m Bond (US3133EMF981), fixed rate (0.65% coupon) maturing on 9 June 2025, priced at 100.00 (original spread of 62 bp), callable (4nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$300m Bond (US3130AMSF02), fixed rate (0.40% coupon) maturing on 28 June 2024, priced at 100.00, callable (3nc3m)

- Indofood Sukses Makmur Tbk PT (Food Processors | Jakarta, Dki Jakarta, Hong Kong | Rating: NR): US$600m Senior Note (XS2343321399), fixed rate (4.75% coupon) maturing on 9 June 2051, priced at 100.00 (original spread of 245 bp), callable (30nc30)

- Indofood Sukses Makmur Tbk PT (Food Processors | Jakarta, Dki Jakarta, Hong Kong | Rating: NR): US$1,150m Senior Note (XS2349180104), fixed rate (3.40% coupon) maturing on 9 June 2031, priced at 100.00 (original spread of 180 bp), callable (10nc10)

- Lumen Technologies Inc (Telecommunications | Monroe, Louisiana, United States | Rating: BB-): US$1,000m Senior Note (USU54985AA15), fixed rate (5.38% coupon) maturing on 15 June 2029, priced at 100.00, callable (8nc3)

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$350m Senior Note (US64952WEE93), floating rate (SOFR + 48.0 bp) maturing on 9 June 2026, priced at 100.00, non callable

- New York Life Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$400m Note (US64952WED11), fixed rate (1.15% coupon) maturing on 9 June 2026, priced at 99.90 (original spread of 37 bp), non callable

- NextEra Energy Capital Holdings Inc (Financial - Other | Juno Beach, Florida, United States | Rating: A-): US$1,500m Bond (US65339KBW99), fixed rate (1.90% coupon) maturing on 15 June 2028, priced at 99.94 (original spread of 65 bp), callable (7nc7)

- Petrobras Global Finance BV (Financial - Other | Rotterdam, Zuid-Holland, Brazil | Rating: BB-): US$1,500m Senior Note (US71647NBJ72), fixed rate (5.50% coupon) maturing on 10 June 2051, priced at 96.45, callable (30nc30)

- Petrorio Luxembourg SARL (Financial - Other | Luxembourg | Rating: NR): US$600m Note (US71677WAA09), fixed rate (6.13% coupon) maturing on 9 June 2026, priced at 100.00, callable (5nc3)

- Shinhan Card Co Ltd (Financial - Other | Seoul, South Korea | Rating: A): US$300m Senior Note (XS2341140932), fixed rate (1.38% coupon) maturing on 23 June 2026, priced at 99.42 (original spread of 70 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): US$1,250m Note (US83368TBC18), fixed rate (1.79% coupon) maturing on 9 June 2027, priced at 100.00 (original spread of 100 bp), callable (6nc5)

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A-): US$1,250m Note (US83368TBD90), fixed rate (2.89% coupon) maturing on 9 June 2032, priced at 100.00 (original spread of 130 bp), callable (11nc10)

- Truist Financial Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,000m Senior Note (US89788MAF95), floating rate (SOFR + 40.0 bp) maturing on 9 June 2025, priced at 100.00, callable (4nc3)

- Truist Financial Corp (Banking | Charlotte, North Carolina, United States | Rating: A-): US$1,000m Senior Note (US89788MAE21), floating rate maturing on 7 June 2029, priced at 100.00 (original spread of 63 bp), callable (8nc7)

EUR BOND ISSUES

- Bank of Montreal (Banking | Montreal, Quebec, Canada | Rating: A+): €1,250m Covered Bond (Other) (XS2351089508), fixed rate (0.05% coupon) maturing on 8 June 2029, priced at 99.95 (original spread of 42 bp), non callable

- Belfius Banque SA (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: A-): €500m Note (BE6328785207), fixed rate (0.38% coupon) maturing on 8 June 2027, priced at 99.75 (original spread of 93 bp), with a regulatory call

- Castilla y Leon, Autonomous Community of (Official and Muni | Valladolid, Valladolid, Spain | Rating: BBB+): €500m Bond (ES0001351586), fixed rate (0.43% coupon) maturing on 30 April 2030, priced at 99.37 (original spread of 17 bp), non callable

- EWE AG (Utility - Other | Oldenburg, Niedersachsen, Germany | Rating: BBB+): €500m Senior Note (DE000A3E5L98), fixed rate (0.25% coupon) maturing on 8 June 2028, priced at 99.66 (original spread of 74 bp), callable (7nc7)

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A1RQD35) zero coupon maturing on 10 June 2026, priced at 101.63 (original spread of 24 bp), non callable

- Ontario, Province of (Official and Muni | Toronto, Ontario, Canada | Rating: A+): €1,000m Senior Note (XS2351088955), fixed rate (0.25% coupon) maturing on 9 June 2031, priced at 99.28 (original spread of 50 bp), non callable

- RWE AG (Utility - Other | Essen, Nordrhein-Westfalen, Germany | Rating: BBB): €500m Senior Note (XS2351092478), fixed rate (0.63% coupon) maturing on 11 June 2031, priced at 99.71 (original spread of 84 bp), callable (10nc10)

- Worley Us Finance Sub Ltd (Financial - Other | Bellaire, Texas, United States | Rating: NR): €500m Senior Note (XS2351032227), fixed rate (0.88% coupon) maturing on 9 June 2026, priced at 99.45, callable (5nc5)

NEW LOANS

- Waterland Private Eq Invest BV, signed a € 500m Bridge Loan, to be used for general corporate purposes. It matures on 06/02/22 and initial pricing is set at