Credit

High Yield Bonds Outperformed Investment Grade On Friday, While CDX Spreads Were Down Across The Board

Very little happening in the primary market, with only a handful of deals priced; most notable was the 2bn euros of covered bonds issued in 2-tranches by Spanish bank Banco de Sabadell

Published ET

Bloomberg Barclays US High Yield Index | Source: FactSet

QUICK SUMMARY

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.20% and high yield down -0.03% (YTD total return: -2.78%)

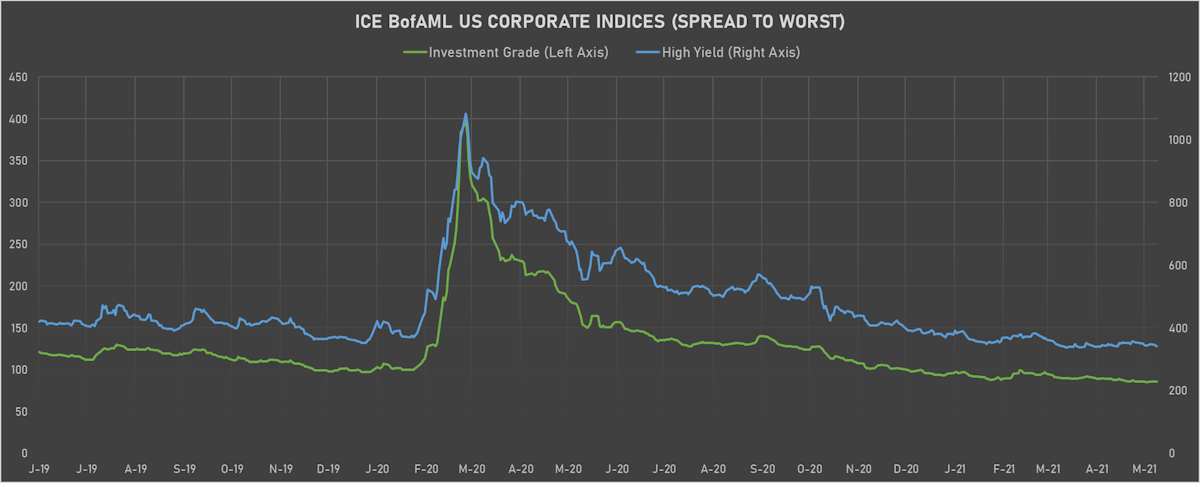

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 341.0 bp (YTD change: -49.0 bp)

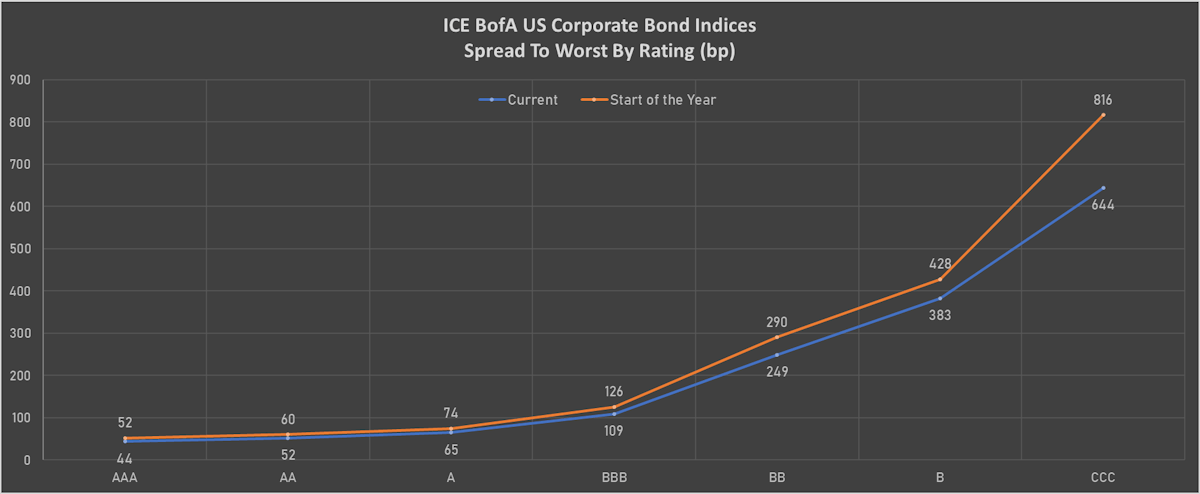

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA up by 1 bp at 55 bp

- A up by 1 bp at 70 bp

- BBB unchanged at 113 bp

- BB up by 2 bp at 238 bp

- B down by -1 bp at 368 bp

- CCC down by -1 bp at 631 bp

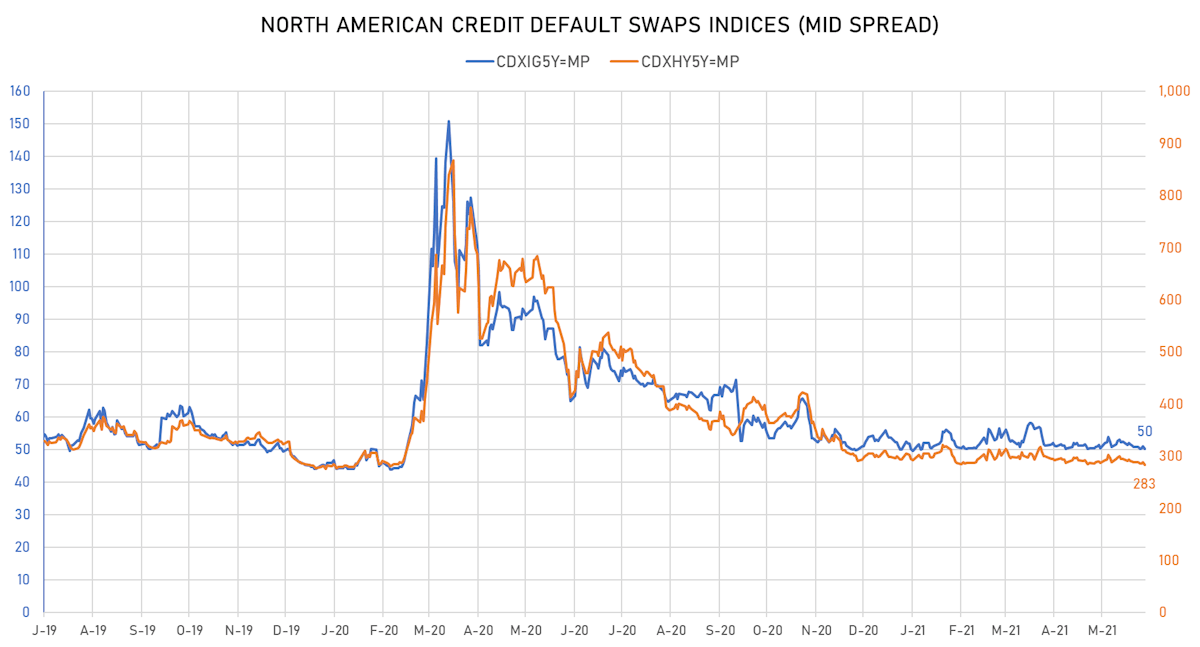

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 50bp (YTD change: +0.1bp)

- Markit CDX.NA.HY 5Y down 4.5 bp, now at 283bp (YTD change: -10.1bp)

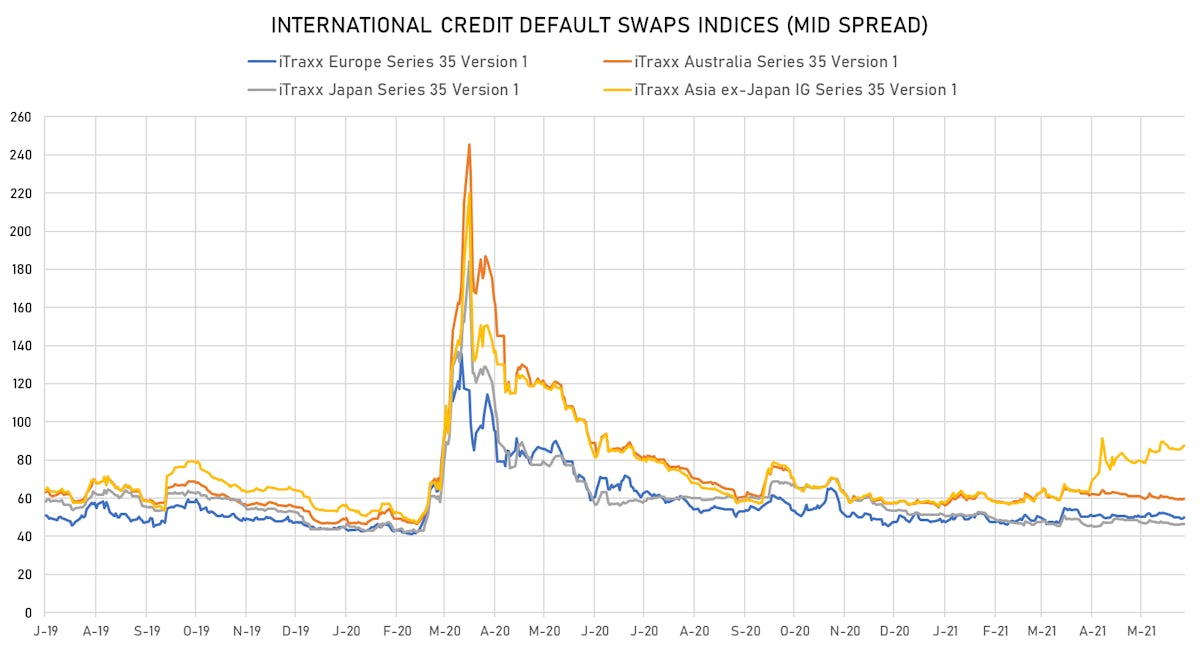

- Markit iTRAXX Europe down 0.5 bp, now at 49bp (YTD change: +1.4bp)

- Markit iTRAXX Japan up 0.4 bp, now at 47bp (YTD change: -4.5bp)

- Markit iTRAXX Asia Ex-Japan down 3.7 bp, now at 84bp (YTD change: +25.7bp)

LARGEST MOVES IN USD HIGH YIELD

- Issuer: Smithfield Foods Inc (Smithfield, Virginia (US)) | Coupon: 4.25% | Maturity: 1/2/2027 | Rating: BB+ | ISIN: USU83223AK06 | Option-adjusted spread up by 12.4 bp to 143.1 bp (CDS basis: 28.1bp), with the yield to worst at 2.3% and the bond now trading down to 109.6 cents on the dollar (1Y price range: 109.2-111.8).

- Issuer: Oil and Gas Holding Company BSC (Closed) (Manama, Bahrain) | Coupon: 7.50% | Maturity: 25/10/2027 | Rating: B+ | ISIN: US67778NAA63 | Option-adjusted spread up by 11.2 bp to 429.4 bp (CDS basis: -173.3bp), with the yield to worst at 5.1% and the bond now trading down to 112.0 cents on the dollar (1Y price range: 110.8-114.5).

- Issuer: Klabin Austria GmbH (Wien, Austria) | Coupon: 3.20% | Maturity: 12/1/2031 | Rating: BB+ | ISIN: USA35155AE99 | Option-adjusted spread up by 9.3 bp to 218.5 bp, with the yield to worst at 3.5% and the bond now trading down to 96.4 cents on the dollar (1Y price range: 94.6-100.4).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Option-adjusted spread up by 7.3 bp to 361.6 bp (CDS basis: -67.8bp), with the yield to worst at 4.4% and the bond now trading down to 105.8 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.80% | Maturity: 15/5/2030 | Rating: BB | ISIN: USU75111AL55 | Option-adjusted spread up by 6.9 bp to 356.4 bp, with the yield to worst at 4.8% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 97.8-105.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Option-adjusted spread down by 8.1 bp to 554.6 bp (CDS basis: 40.9bp), with the yield to worst at 5.9% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 71.0-92.8).

- Issuer: Hanes Brands Inc (WINSTON SALEM, North Carolina (US)) | Coupon: 4.88% | Maturity: 15/5/2026 | Rating: BB- | ISIN: USU24437AE26 | Option-adjusted spread down by 8.2 bp to 233.4 bp, with the yield to worst at 3.0% and the bond now trading up to 107.6 cents on the dollar (1Y price range: 106.0-109.9).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Option-adjusted spread down by 8.8 bp to 195.4 bp, with the yield to worst at 2.0% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 104.8-106.9).

- Issuer: Alpek SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 3.25% | Maturity: 25/2/2031 | Rating: BB+ | ISIN: USP01703AD22 | Option-adjusted spread down by 11.2 bp to 172.7 bp, with the yield to worst at 3.1% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 97.6-100.5).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Option-adjusted spread down by 11.8 bp to 295.4 bp, with the yield to worst at 3.6% and the bond now trading up to 107.5 cents on the dollar (1Y price range: 107.2-114.6).

LARGEST MOVES IN EUR HIGH YIELD

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Option-adjusted spread up by 5.7 bp to 261.3 bp (CDS basis: -55.2bp), with the yield to worst at 2.2% and the bond now trading down to 98.2 cents on the dollar (1Y price range: 97.6-101.2).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Option-adjusted spread down by 5.2 bp to 153.7 bp, with the yield to worst at 1.0% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Option-adjusted spread down by 5.8 bp to 210.6 bp, with the yield to worst at 1.7% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.9-101.2).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 2.88% | Maturity: 26/3/2027 | Rating: BB+ | ISIN: DE000A2YB7B5 | Option-adjusted spread down by 6.1 bp to 178.4 bp, with the yield to worst at 1.4% and the bond now trading up to 107.0 cents on the dollar (1Y price range: 105.7-108.0).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Option-adjusted spread down by 6.6 bp to 194.4 bp (CDS basis: -40.1bp), with the yield to worst at 1.5% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 100.4-103.9).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Option-adjusted spread down by 21.6 bp to 150.4 bp, with the yield to worst at 1.3% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 93.2-100.5).

USD BOND ISSUES

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2218493968), floating rate maturing on 25 June 2031, priced at 100.00, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$180m Senior Note (US89236TJG13), fixed rate (0.50% coupon) maturing on 14 June 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$125m Bond (US3133EMH391), fixed rate (1.72% coupon) maturing on 10 December 2029, priced at 100.00, callable (9nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$130m Bond (US3133EMG484), fixed rate (1.59% coupon) maturing on 14 June 2029, priced at 100.00 (original spread of 154 bp), callable (8nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130AMTE28), floating rate (SOFR + 3.0 bp) maturing on 7 June 2023, priced at 100.00, non callable

EUR BOND ISSUES

- Banco de Sabadell SA (Banking | Alicante, Spain | Rating: BBB): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413860786), floating rate maturing on 8 June 2027, non callable

- Banco de Sabadell SA (Banking | Alicante, Spain | Rating: BBB): €1,000m Cedula Hipotecaria (Covered Bond) (ES0413860778), floating rate maturing on 8 June 2026, non callable

- Deuce Finco PLC (Financial - Other | United Kingdom | Rating: NR): €300m Note (XS2351480640), floating rate (EU03MLIB + 475.0 bp) maturing on 15 June 2027, priced at 100.00, callable (6nc1)

- Transcom Holding AB (Financial - Other | Stockholm, Stockholm, Sweden | Rating: B-): €315m Note (XS2351344622), floating rate (EU03MLIB + 525.0 bp) maturing on 15 December 2026, priced at 99.50, callable (5nc1)

NEW ISSUES IN LOANS

- Culligan Holding Inc (B), signed a US$ 2,000m Term Loan B, a US$ 250m Delayed Draw Term Loan, and a a US$ 225m Revolving Credit Facility

- Dedalus Italia SpA, signed a € 85m Term Loan B, to be used for general corporate purposes. It matures on 05/14/27.

- Prosafe SE, signed a US$ 250m Term Loan, to be used for restructuring. It matures on 12/31/25 and initial pricing is set at LIBOR +250.000bps