Credit

High Yield Spreads Drop Further, Bond Indices Mostly Unchanged

A good day for the primary market with a number of large new bond issues in USD, including $5bn from Goldman Sachs, $4.5bn from BofA, $3bn from Duke Energy

Published ET

Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.06% and high yield up 0.07% (YTD total return: -2.40%)

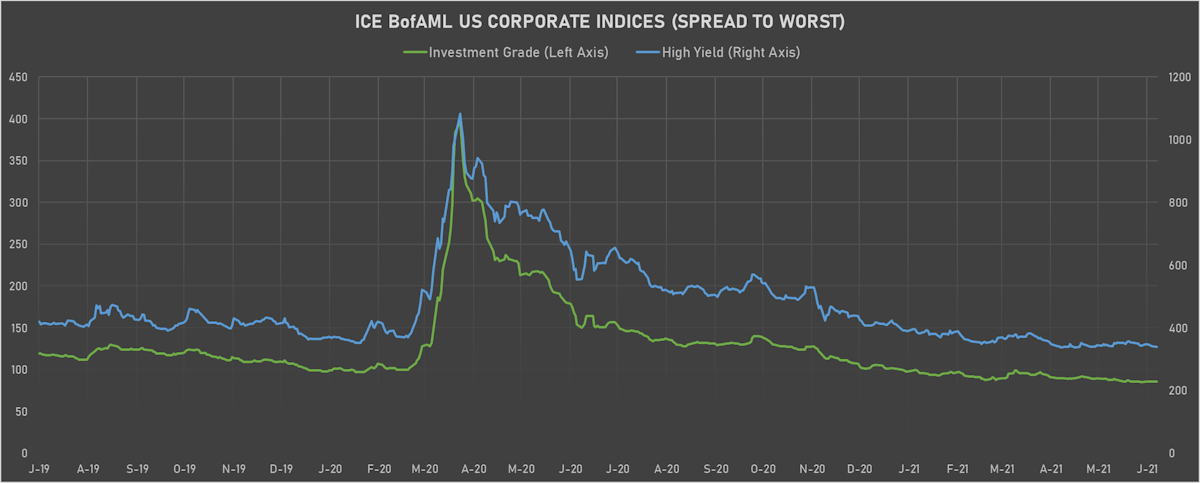

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 340.0 bp (YTD change: -50.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index YTD total return: +2.2%

- New bond issues: US$ 13.0bn in dollars and € 6.1bn in euros

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 55 bp

- A unchanged at 70 bp

- BBB unchanged at 113 bp

- BB down by -2 bp at 236 bp

- B up by 1 bp at 369 bp

- CCC down by -8 bp at 623 bp

CDS INDICES (mid-spreads)

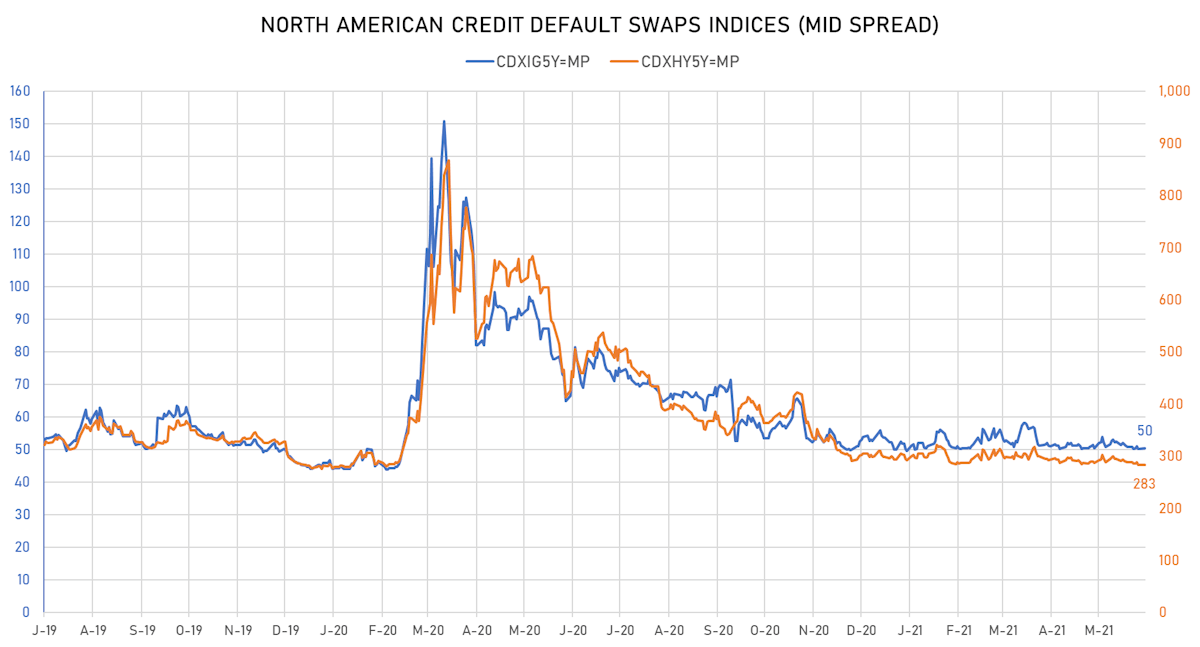

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 50bp (YTD change: +0.3bp)

- Markit CDX.NA.HY 5Y unchanged at 283bp (YTD change: -10.0bp)

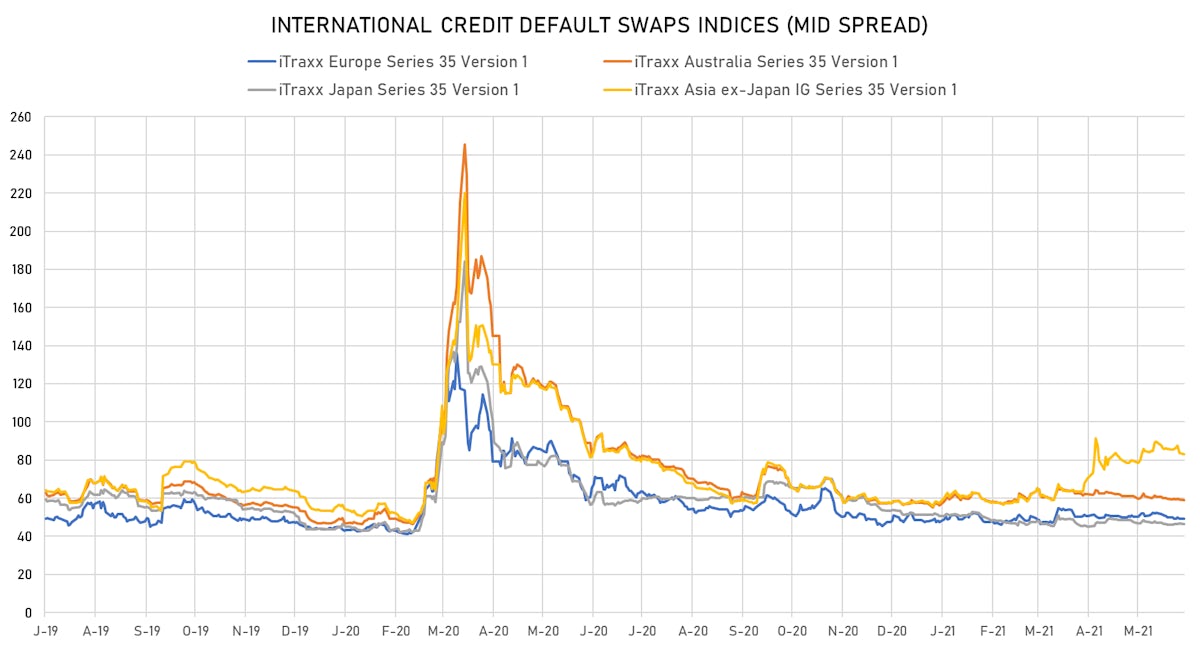

- Markit iTRAXX Europe down 0.1 bp, now at 49bp (YTD change: +1.3bp)

- Markit iTRAXX Japan down 0.3 bp, now at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 83bp (YTD change: +25.0bp)

USD BOND ISSUES

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$1,000m Note (US86959NAH26), fixed rate (1.42% coupon) maturing on 11 June 2027, priced at 100.00 (original spread of 63 bp), callable (6nc5)

- Svenska Handelsbanken AB (Banking | Stockholm, Sweden | Rating: AA-): US$1,250m Note (US86959NAG43), fixed rate (0.55% coupon) maturing on 11 June 2024, priced at 99.92 (original spread of 27 bp), non callable

- Booz Allen Hamilton Inc (Service - Other | Mc Lean, United States | Rating: BB-): US$500m Senior Note (USU1000LAB46), fixed rate (4.00% coupon) maturing on 1 July 2029, priced at 100.00 (original spread of 263 bp), callable (8nc3)

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB): US$1,000m Senior Note (US26441CBL81), fixed rate (2.55% coupon) maturing on 15 June 2031, priced at 99.87 (original spread of 100 bp), callable (10nc10)

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB): US$500m Senior Note (US26441CBK09), floating rate (SOFR + 25.0 bp) maturing on 10 June 2023, priced at 100.00 (original spread of 25 bp), non callable

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB): US$750m Senior Note (US26441CBN48), fixed rate (3.50% coupon) maturing on 15 June 2051, priced at 99.96 (original spread of 125 bp), callable (30nc30)

- Duke Energy Corp (Utility - Other | Charlotte, United States | Rating: BBB): US$750m Senior Note (US26441CBM64), fixed rate (3.30% coupon) maturing on 15 June 2041, priced at 99.75 (original spread of 115 bp), callable (20nc20)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$170m Bond (US3133EMH474), fixed rate (0.60% coupon) maturing on 14 June 2025, priced at 100.00 (original spread of 55 bp), callable (4nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$335m Bond (US3133EMH219), fixed rate (0.90% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 85 bp), callable (5nc1)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, United States | Rating: BBB-): US$1,000m Senior Note (US37045XDL73), fixed rate (2.70% coupon) maturing on 10 June 2031, priced at 99.83 (original spread of 115 bp), callable (10nc10)

- General Motors Financial Company Inc (Financial - Other | Fort Worth, United States | Rating: BBB-): US$1,250m Senior Note (US37045XDK90), fixed rate (1.50% coupon) maturing on 10 June 2026, priced at 99.82 (original spread of 75 bp), callable (5nc5)

- HP Inc (Information/Data Technology | Palo Alto, United States | Rating: BBB): US$1,000m Senior Note (USU44259CA21), fixed rate (2.65% coupon) maturing on 17 June 2031 (original spread of 113 bp), callable (10nc10)

- HP Inc (Information/Data Technology | Palo Alto, United States | Rating: BBB): US$1,000m Senior Note (USU44259BZ80), fixed rate (1.45% coupon) maturing on 17 June 2026, priced at 99.81 (original spread of 70 bp), callable (5nc5)

- Marriott Ownership Resorts Inc (Service - Other | Orlando, United States | Rating: B-): US$500m Senior Note (US57164PAH91), fixed rate (4.50% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 314 bp), callable (8nc3)

- Sirius XM Holdings Inc (Cable/Media | New York City, United States | Rating: NR): US$2,000m Senior Note (USU82764AT53), fixed rate (4.00% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 276 bp), callable (7nc3)

EUR BOND ISSUES

- Agence Francaise de Developpement Epic (Agency | Paris, France | Rating: AA): €1,500m Bond (FR0014003YN1), fixed rate (0.01% coupon) maturing on 25 November 2028, priced at 99.86 (original spread of 107 bp), non callable

- Balder Finland Oyj (Financial - Other | Helsinki, Sweden | Rating: NR): €500m Senior Note (XS2353018141), floating rate (EU03MLIB + 60.0 bp) maturing on 14 June 2023, priced at 100.14, callable (2nc1)

- Carrefour Banque SA (Banking | Evry, France | Rating: BBB): €400m Bond (FR0014003Z81), fixed rate (0.11% coupon) maturing on 14 June 2025, priced at 100.00 (original spread of 75 bp), callable (4nc4)

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Germany | Rating: A-): €400m Oeffenlicher Pfandbrief (Covered Bond) (DE000A3E5K24), floating rate (EU03MLIB + 100.0 bp) maturing on 21 December 2026, priced at 100.00, non callable

- Deutsche Pfandbriefbank AG (Banking | Garching Bei Muenchen, Germany | Rating: A-): €300m Oeffenlicher Pfandbrief (Covered Bond) (DE000A3E5K32), floating rate (EU03MLIB + 100.0 bp) maturing on 20 March 2028, priced at 100.00, non callable

- Eni SpA (Oil and Gas | Rome, Roma, Italy | Rating: BBB+): €1,000m Senior Note (XS2344735811), fixed rate (0.38% coupon) maturing on 14 June 2028, priced at 99.86 (original spread of 85 bp), with a make whole call

- Fluvius System Operator CVBA (Utility - Other | Melle, Belgium | Rating: NR): €500m Bond (BE0002803840), fixed rate (0.25% coupon) maturing on 14 June 2028, priced at 99.34, callable (7nc7)

- Swedish Covered Bond Corp (Financial - Other | Solna, Sweden | Rating: NR): €1,000m Sakerstallda Obligation (Covered Bond) (XS2353010593), fixed rate (0.01% coupon) maturing on 14 March 2030, priced at 99.22 (original spread of 39 bp), non callable

- Traton Finance Luxembourg SA (Financial - Other | Strassen, Germany | Rating: BBB): €500m Senior Note (DE000A3KSGM5) zero coupon maturing on 14 June 2024, priced at 100.10 (original spread of 65 bp), callable (3nc3)

NEW LOANS

- ExGen Renewables IV LLC (BB-), signed a US$ 733m Term Loan B, to be used for general corporate purposes. It matures on 01/00/00.

- Nomad Foods Ltd (BB-), signed a € 553m Term Loan B, to be used for general corporate purposes. It matures on 06/17/28.

- VR-Yhtyma Oy, signed a € 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/07/24.

NEW ISSUES IN SECURITIZED CREDIT

- BX Trust 2021-View issued a floating-rate CMBS in 7 tranches, for a total of US$ 271 m. Highest-rated tranche offering a spread over the floating rate of 128bp, and the lowest-rated tranche a spread of 493bp. Bookrunners: Morgan Stanley International Ltd

- Ellington Financial Mortgage Trust 2021-2 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 325 m. Highest-rated tranche offering a yield to maturity of 0.93%, and the lowest-rated tranche a yield to maturity of 3.86%. Bookrunners: Nomura Securities Co Ltd, Credit Suisse

- Arm Crop 2021-T1t2 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 216 m. Highest-rated tranche offering a yield to maturity of 1.42%, and the lowest-rated tranche a yield to maturity of 2.43%. Bookrunners: Guggenheim Securities LLC

- Bravo Residential Funding Trust 2021-Nqm1 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 313 m. Highest-rated tranche offering a yield to maturity of 0.94%, and the lowest-rated tranche a yield to maturity of 4.18%. Bookrunners: Credit Suisse, Barclays Capital Group, Deutsche Bank Securities Inc

- GCI Funding I LLC issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 253 m. Highest-rated tranche offering a yield to maturity of 2.38%, and the lowest-rated tranche a yield to maturity of 3.04%. Bookrunners: Credit Suisse, Deutsche Bank Securities Inc