Credit

Corporate Bonds Rise On Stable Spreads, Lower Rates

In the euro primary market, Italy placed a €10bn 10-year issue at a spread to German bunds of 118 basis points (BTP+6bp), and Italian oil company ENEL issued €3.25bn in 3 tranches

Published ET

iBOXX Liquid USD High Yield Credit Index marching in lockstep with the S&P 500 | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.26% today, with investment grade up 0.27% and high yield up 0.17% (YTD total return: -2.14%)

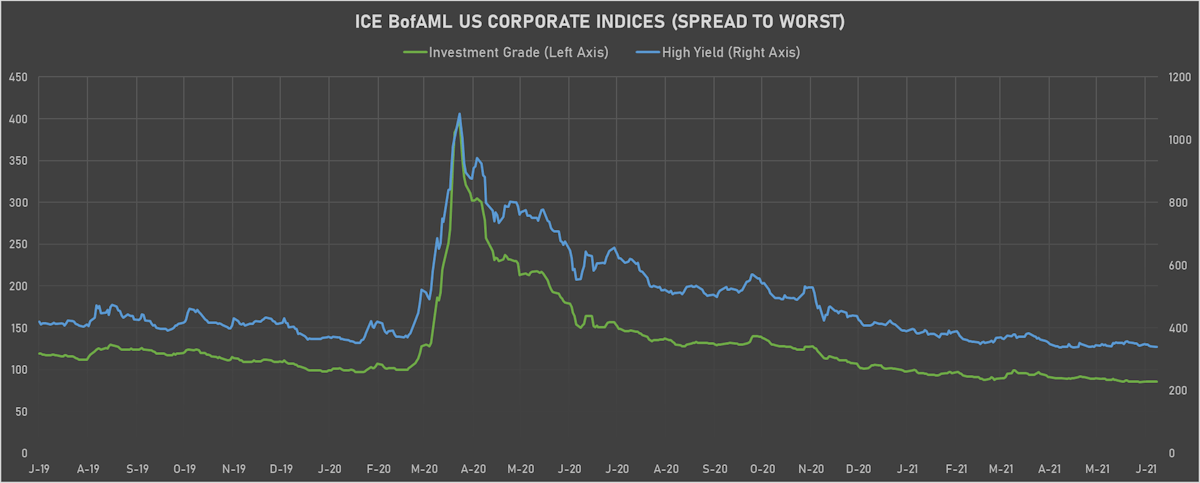

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 339.0 bp (YTD change: -51.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index YTD total return: +2.2%

- New issues: US$ 7.7bn in dollars and € 21.2bn in euros

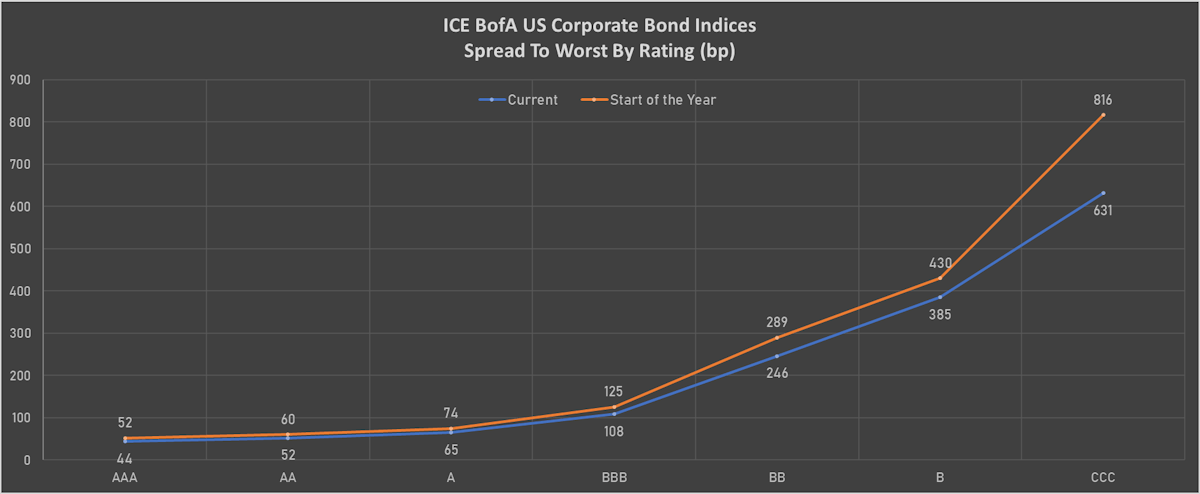

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 55 bp

- A unchanged at 70 bp

- BBB unchanged at 113 bp

- BB unchanged at 236 bp

- B down by -1 bp at 368 bp

- CCC down by -5 bp at 618 bp

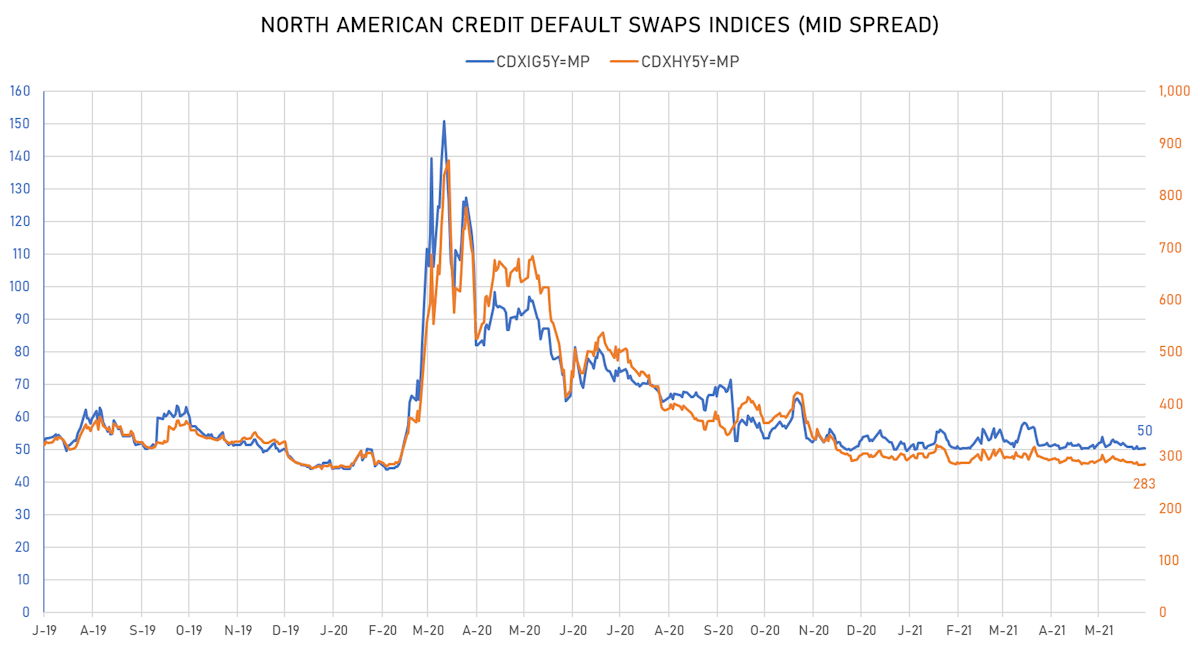

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 50bp (YTD change: +0.4bp)

- Markit CDX.NA.HY 5Y up 0.3 bp, now at 283bp (YTD change: -9.8bp)

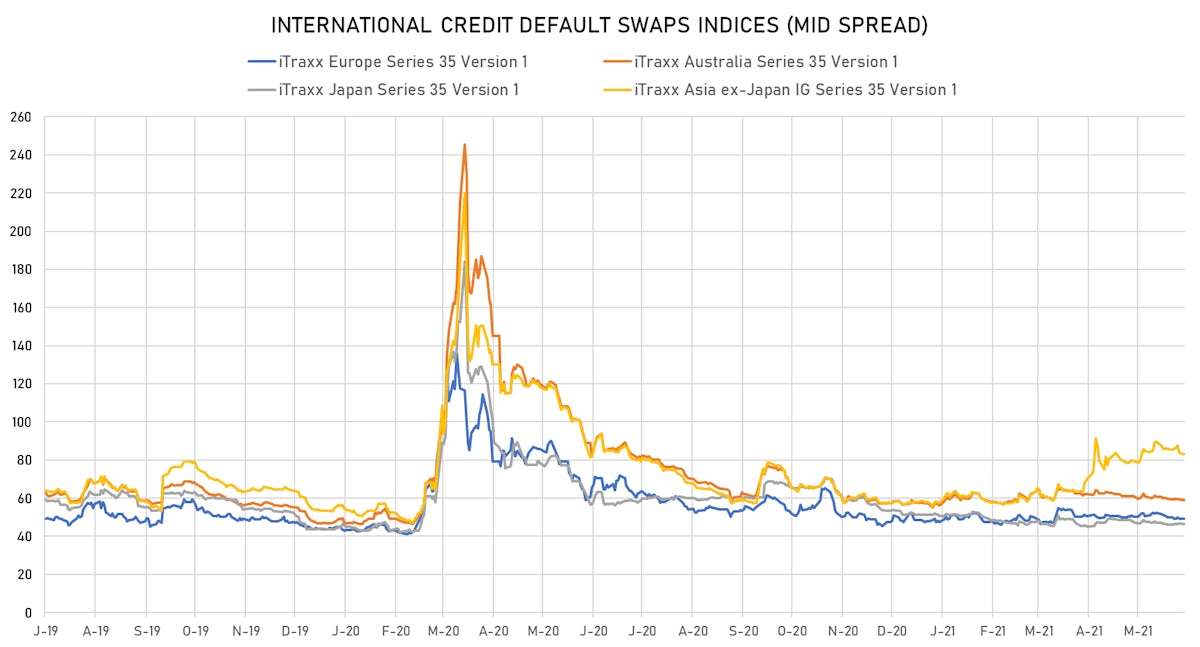

- Markit iTRAXX Europe down 0.4 bp, now at 49bp (YTD change: +0.9bp)

- Markit iTRAXX Japan down 0.1 bp, now at 46bp (YTD change: -4.9bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 83bp (YTD change: +25.0bp)

TOP BONDS MOVERS IN THE PAST WEEK - USD HIGH YIELD

- Issuer: Minsur SA (San Borja, Peru) | Coupon: 6.25% | Maturity: 7/2/2024 | Rating: BB- | ISIN: USP6811TAA36 | Z-spread up by 49.6 bp to 385.2 bp, with the yield to worst at 4.0% and the bond now trading down to 105.2 cents on the dollar (1Y price range: 100.6-111.4).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USU83854AB29 | Z-spread down by 18.4 bp to 355.0 bp, with the yield to worst at 3.6% and the bond now trading up to 100.7 cents on the dollar (1Y price range: 99.0-100.8).

- Issuer: Goodyear Tire & Rubber Co (Akron, Ohio (US)) | Coupon: 5.25% | Maturity: 15/7/2031 | Rating: B | ISIN: USU38255AP71 | Z-spread down by 21.3 bp to 331.9 bp (CDS basis: -49.1bp), with the yield to worst at 4.8% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 101.2-103.4).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 21.6 bp to 539.1 bp (CDS basis: 45.8bp), with the yield to worst at 5.7% and the bond now trading up to 93.0 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.65% | Maturity: 1/10/2027 | Rating: B | ISIN: XS2233227516 | Z-spread down by 21.9 bp to 464.7 bp, with the yield to worst at 5.4% and the bond now trading up to 110.9 cents on the dollar (1Y price range: 100.8-110.9).

- Issuer: Chengdu Airport Xingcheng Investment Group Co Ltd (Chengdu, China (Mainland)) | Coupon: 6.50% | Maturity: 18/7/2022 | Rating: BB+ | ISIN: XS2025664306 | Z-spread down by 25.9 bp to 394.3 bp, with the yield to worst at 3.9% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 102.0-103.0).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.00% | Maturity: 1/5/2025 | Rating: BB- | ISIN: USC67111AG65 | Z-spread down by 26.9 bp to 229.5 bp (CDS basis: -20.3bp), with the yield to worst at 2.7% and the bond now trading up to 107.4 cents on the dollar (1Y price range: 101.4-107.4).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread down by 28.0 bp to 310.1 bp, with the yield to worst at 3.6% and the bond now trading up to 109.3 cents on the dollar (1Y price range: 104.1-109.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 7.00% | Maturity: 15/12/2047 | Rating: CCC | ISIN: USP989MJBN03 | Z-spread down by 30.8 bp to 972.8 bp, with the yield to worst at 11.3% and the bond now trading up to 62.0 cents on the dollar (1Y price range: 48.0-72.0).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.89% | Maturity: 24/4/2025 | Rating: BB | ISIN: USN84413CL06 | Z-spread down by 39.8 bp to 151.7 bp, with the yield to worst at 1.9% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 100.0-110.0).

TOP BONDS MOVERS IN THE PAST WEEK - EURO HIGH YIELD

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 8.8 bp to 334.8 bp (CDS basis: -59.8bp), with the yield to worst at 3.0% and the bond now trading up to 103.2 cents on the dollar (1Y price range: 97.6-103.7).

- Issuer: Nokia Oyj (Espoo, Finland) | Coupon: 3.13% | Maturity: 15/5/2028 | Rating: BB | ISIN: XS2171872570 | Z-spread down by 8.9 bp to 153.8 bp (CDS basis: -27.2bp), with the yield to worst at 1.2% and the bond now trading up to 111.0 cents on the dollar (1Y price range: 108.4-111.6).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2202907510 | Z-spread down by 9.0 bp to 295.2 bp (CDS basis: 46.5bp), with the yield to worst at 2.5% and the bond now trading up to 103.2 cents on the dollar (1Y price range: 101.4-106.3).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by 9.3 bp to 210.4 bp, with the yield to worst at 1.8% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 98.4-101.8).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 9.7 bp to 204.1 bp, with the yield to worst at 1.6% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 97.9-101.2).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread down by 11.1 bp to 391.9 bp (CDS basis: -40.5bp), with the yield to worst at 3.4% and the bond now trading up to 115.3 cents on the dollar (1Y price range: 102.3-115.5).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 11.4 bp to 196.2 bp, with the yield to worst at 1.7% and the bond now trading up to 110.1 cents on the dollar (1Y price range: 108.0-111.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 13.6 bp to 420.5 bp (CDS basis: -42.7bp), with the yield to worst at 3.9% and the bond now trading up to 93.7 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread down by 15.5 bp to 248.5 bp, with the yield to worst at 2.2% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Z-spread down by 16.4 bp to 253.2 bp (CDS basis: -47.3bp), with the yield to worst at 2.1% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.6-101.2).

USD BOND ISSUES

- Berry Global Inc (Industrials - Other | Evansville, United States | Rating: BBB-): US$400m Note (USU0740WAG60), fixed rate (1.65% coupon) maturing on 15 January 2027, priced at 99.90 (original spread of 90 bp), callable (6nc6)

- CVR Partners LP (Chemicals | Sugar Land, United States | Rating: B): US$550m Note (US12663QAC96), fixed rate (6.13% coupon) maturing on 15 June 2028, priced at 100.00, callable (7nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$700m Bond (US3133EMH961), fixed rate (0.13% coupon) maturing on 14 June 2023, priced at 100.00 (original spread of 1 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EMJ454), fixed rate (2.15% coupon) maturing on 14 March 2033, priced at 100.00, callable (12nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$450m Bond (US3133EMH706), floating rate (SOFR + 3.0 bp) maturing on 14 June 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$500m Bond (US3130AMU679), fixed rate (0.40% coupon) maturing on 28 June 2024, priced at 100.00, callable (3nc3m)

- Jersey Central Power & Light Co (Utility - Other | Akron, United States | Rating: BB+): US$500m Senior Note (USU04536AE51), fixed rate (2.75% coupon) maturing on 1 March 2032, priced at 99.73 (original spread of 125 bp), callable (11nc10)

- Keybank NA (Banking | Cleveland, United States | Rating: A-): US$400m Senior Note (US49327M3D40), floating rate (SOFR + 32.0 bp) maturing on 14 June 2024, priced at 100.00, callable (3nc2)

- Keybank NA (Banking | Cleveland, United States | Rating: A-): US$800m Senior Note (US49327M3C66), floating rate maturing on 14 June 2024, priced at 100.00, callable (3nc2)

- Microstrategy Inc (Information/Data Technology | Tysons Corner, United States | Rating: NR): US$500m Note (USU59363AA65), fixed rate (6.13% coupon) maturing on 15 June 2028, priced at 100.00, callable (7nc3)

- SunCoke Energy Inc (Metals/Mining | Lisle, United States | Rating: BB): US$500m Note (US86722AAD54), fixed rate (4.88% coupon) maturing on 30 June 2029, priced at 100.00 (original spread of 352 bp), callable (8nc3)

EUR BOND ISSUES

- Asian Development Bank (Supranational | Mandaluyong, Philippines | Rating: AAA): €1,000m Senior Note (XS2353057123), fixed rate (0.10% coupon) maturing on 17 June 2031, priced at 99.78 (original spread of 33 bp), non callable

- Axacore Inc (Financial - Other | Rating: NR): €500m Senior Note (XS2351301499), fixed rate (0.75% coupon) maturing on 14 June 2028, priced at 99.36 (original spread of 130 bp), non callable

- Banco de Sabadell SA (Banking | Alicante, Spain | Rating: BBB-): €500m Note (XS2353366268), fixed rate (0.88% coupon) maturing on 16 June 2028, priced at 99.56 (original spread of 150 bp), callable (7nc6)

- Caisse Amortissement de la Dette Sociale (Agency | Paris, France | Rating: AA): €4,000m Bond (FR0014004016) zero coupon maturing on 25 November 2026, priced at 101.23 (original spread of 15 bp), non callable

- Eika Boligkreditt AS (Mortgage Banking | Oslo, Norway | Rating: NR): €500m Covered Bond (Other) (XS2353312254), fixed rate (0.13% coupon) maturing on 16 June 2031, priced at 99.64 (original spread of 39 bp), non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,250m Senior Note (XS2353182293), fixed rate (0.50% coupon) maturing on 17 June 2030, priced at 99.73 (original spread of 84 bp), callable (9nc9)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,000m Senior Note (XS2353182020) zero coupon maturing on 17 June 2027, priced at 98.91 (original spread of 73 bp), callable (6nc6)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,000m Senior Note (XS2353182376), fixed rate (0.88% coupon) maturing on 17 June 2036, priced at 98.06 (original spread of 99 bp), callable (15nc15)

- Hamburg Free and Hanseatic, City of (Official and Muni | Hamburg, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A2LQPJ6), fixed rate (0.01% coupon) maturing on 15 June 2028, priced at 101.23 (original spread of 30 bp), non callable

- Italy, Republic of (Government) (Sovereign | Rome, Italy | Rating: BBB-): €10,000m Buono del Tesoro Poliennali (IT0005449969), fixed rate (0.95% coupon) maturing on 1 December 2031, priced at 99.92 (original spread of 6 bp), non callable

- Safran SA (Aerospace | Paris, France | Rating: BBB+): €730m Bond (FR0014003Z32) zero coupon maturing on 1 April 2028, priced at 103.50, non callable, convertible

- Volksbank Wien AG (Banking | Wien, Austria | Rating: NR): €250m Fundierte Schuldverschreibungen (Covered Bond) (AT000B122098), floating rate (EU03MLIB + 0.0 bp) maturing on 18 June 2030, priced at 103.25, non callable

NEW LOANS

- E2open LLC (B), signed a US$ 380m Term Loan B, to be used for acquisition financing. It matures on 02/04/28.

- Tivity Health Inc (B+), signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 01/00/00.

- Signify Health LLC (B), signed a US$ 350m Term Loan B, to be used for general corporate purposes. It matures on 06/17/28 and initial pricing is set at LIBOR +350.000bps

- Solmax International Inc, signed a US$ 535m Term Loan B, to be used for general corporate purposes acquisition financing. It matures on 06/24/28.

- SoftBank Group Corp (BB+), signed a US$ 7,500m Revolving Credit / Term Loan, to be used for general corporate purposes.