Credit

US IG Spreads Unchanged, HY Spreads Lower; CCC Option-Adjusted Spreads Now Down 19bp In The Past Week

A good day for Euro primary issuance: German real estate company Vonovia SE raised €4bn in 5 tranches, Dutch beverages company JDE Peets printed €2bn in 3 tranches

Published ET

NextEra Energy 5Y USD CDS Mid Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.60% today, with investment grade up 0.63% and high yield up 0.37% (YTD total return: -1.81%)

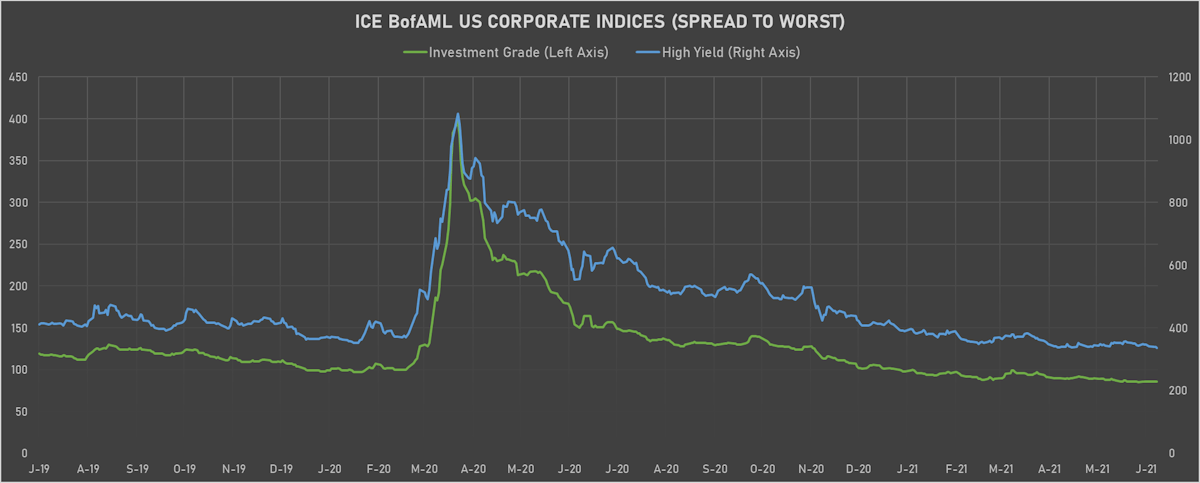

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.1% today (YTD total return: +2.3%)

- New issues: US$ 5.9bn in dollars and € 11.0bn in euros

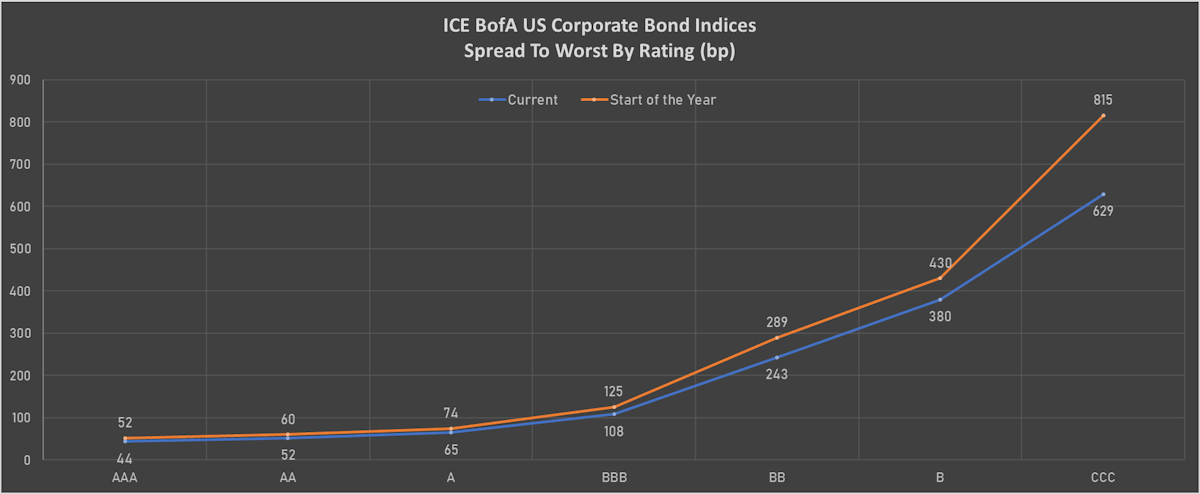

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 55 bp

- A unchanged at 70 bp

- BBB unchanged at 113 bp

- BB down by -3 bp at 233 bp

- B down by -5 bp at 363 bp

- CCC down by -1 bp at 617 bp

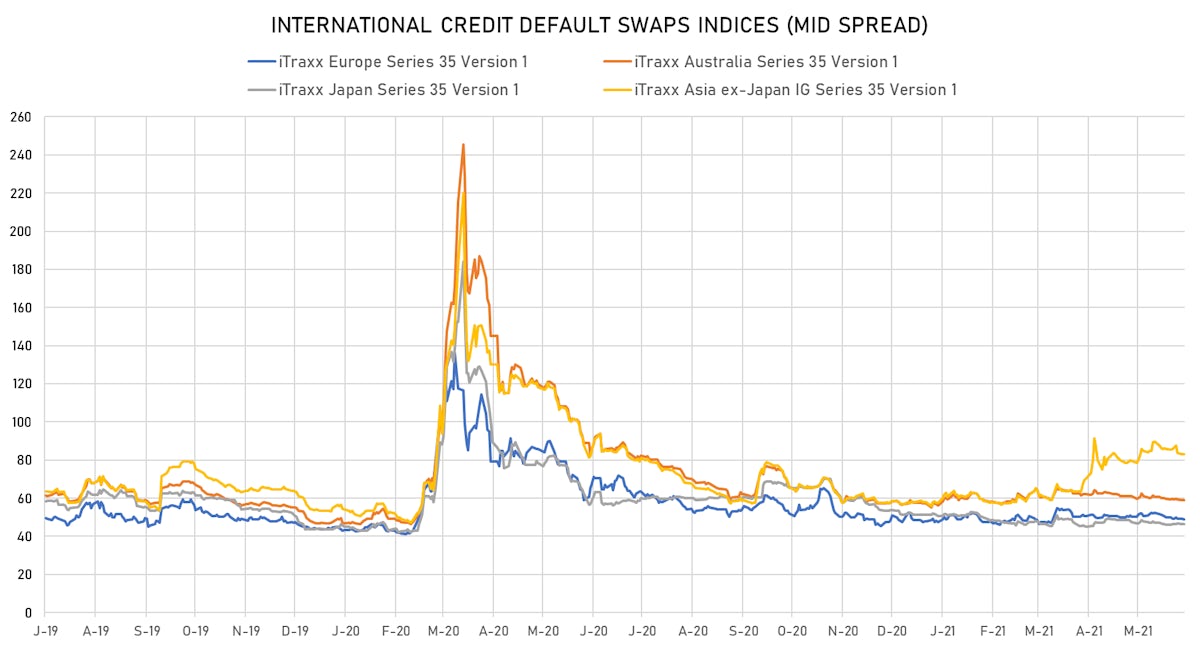

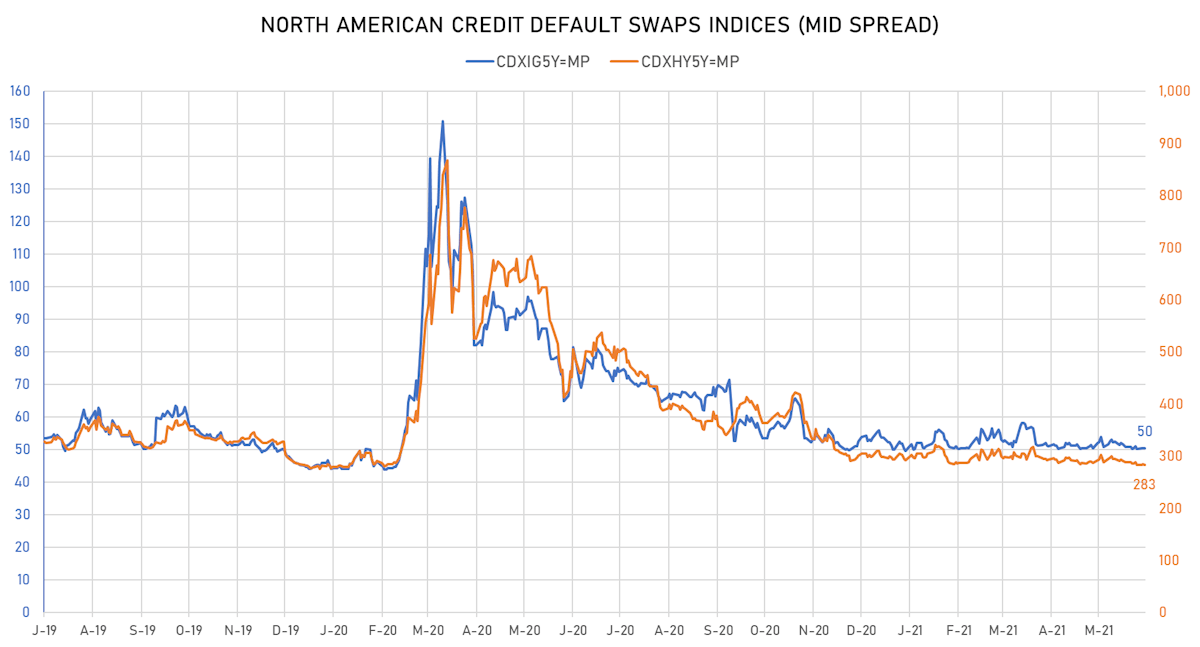

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 50bp (YTD change: +0.3bp)

- Markit CDX.NA.HY 5Y down 0.8 bp, now at 283bp (YTD change: -10.6bp)

- Markit iTRAXX Europe down 0.5 bp, now at 48bp (YTD change: +0.5bp)

- Markit iTRAXX Japan down 0.1 bp, now at 46bp (YTD change: -5.0bp)

- Markit iTRAXX Asia Ex-Japan up 0.9 bp, now at 84bp (YTD change: +25.9bp)

TOP BONDS MOVERS IN THE PAST WEEK - USD HY

- Issuer: BRF GmbH (Wien, Austria) | Coupon: 4.35% | Maturity: 29/9/2026 | Rating: BB- | ISIN: USA08163AA41 | Z-spread up by 27.7 bp to 251.9 bp, with the yield to worst at 3.1% and the bond now trading down to 104.9 cents on the dollar (1Y price range: 102.0-105.8).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 6.50% | Maturity: 18/1/2028 | Rating: BB | ISIN: USL67359AA48 | Z-spread up by 24.1 bp to 384.2 bp, with the yield to worst at 4.6% and the bond now trading down to 108.9 cents on the dollar (1Y price range: 107.5-118.3).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread up by 21.0 bp to 196.3 bp, with the yield to worst at 2.0% and the bond now trading down to 105.3 cents on the dollar (1Y price range: 104.8-106.9).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread down by 23.7 bp to 620.4 bp, with the yield to worst at 6.7% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 98.9-103.9).

- Issuer: Uzpromstroybank AKB (Tashkent, Uzbekistan) | Coupon: 5.75% | Maturity: 2/12/2024 | Rating: BB- | ISIN: XS2083131859 | Z-spread down by 24.3 bp to 333.0 bp, with the yield to worst at 3.6% and the bond now trading up to 106.3 cents on the dollar (1Y price range: 102.4-106.4).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 7.00% | Maturity: 15/12/2047 | Rating: CCC | ISIN: USP989MJBN03 | Z-spread down by 25.3 bp to 961.4 bp, with the yield to worst at 11.2% and the bond now trading up to 62.9 cents on the dollar (1Y price range: 48.0-72.0).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.00% | Maturity: 1/5/2025 | Rating: BB- | ISIN: USC67111AG65 | Z-spread down by 29.6 bp to 227.2 bp (CDS basis: -25.0bp), with the yield to worst at 2.6% and the bond now trading up to 107.5 cents on the dollar (1Y price range: 101.4-107.5).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 31.8 bp to 166.9 bp, with the yield to worst at 1.9% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 108.0-110.8).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.89% | Maturity: 24/4/2025 | Rating: BB | ISIN: USN84413CL06 | Z-spread down by 48.8 bp to 153.2 bp, with the yield to worst at 1.9% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 100.0-110.0).

TOP BONDS MOVERS IN THE PAST WEEK - EUR HY

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread down by 7.8 bp to 219.9 bp, with the yield to worst at 1.8% and the bond now trading up to 104.2 cents on the dollar (1Y price range: 99.7-104.7).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by 7.9 bp to 209.4 bp, with the yield to worst at 1.8% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 98.4-101.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread down by 9.0 bp to 248.2 bp, with the yield to worst at 2.2% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 13.6 bp to 330.4 bp (CDS basis: -53.2bp), with the yield to worst at 2.9% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 97.6-104.0).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 15.3 bp to 412.9 bp (CDS basis: -38.1bp), with the yield to worst at 3.8% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2202907510 | Z-spread down by 17.2 bp to 287.6 bp (CDS basis: 52.5bp), with the yield to worst at 2.4% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 101.4-106.3).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Z-spread down by 19.0 bp to 181.1 bp (CDS basis: -26.8bp), with the yield to worst at 1.3% and the bond now trading up to 103.6 cents on the dollar (1Y price range: 100.4-104.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 20.4 bp to 246.0 bp (CDS basis: -53.0bp), with the yield to worst at 2.1% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 99.5-102.4).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB | ISIN: XS2154325489 | Z-spread down by 34.1 bp to 147.9 bp, with the yield to worst at 1.1% and the bond now trading up to 109.9 cents on the dollar (1Y price range: 102.3-110.0).

USD BOND ISSUES

- Ascent Resources Utica Holdings LLC (Oil and Gas | Oklahoma City, United States | Rating: B): US$400m Senior Note (USU04354AG82), fixed rate (5.88% coupon) maturing on 30 June 2029, priced at 100.00 (original spread of 458 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$325m Bond (US3133EMK270), fixed rate (1.88% coupon) maturing on 16 June 2031, priced at 100.00 (original spread of 183 bp), callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133EMJ942), fixed rate (0.16% coupon) maturing on 15 September 2023, priced at 100.00 (original spread of 15 bp), callable (2nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$160m Bond (US3133EMJ868), fixed rate (1.30% coupon) maturing on 15 December 2027, priced at 100.00 (original spread of 125 bp), callable (7nc3m)

- Globe Life Inc (Life Insurance | Mckinney, United States | Rating: BBB-): US$325m Junior Subordinated Debenture (US37959E3009), fixed rate (4.25% coupon) maturing on 15 June 2061, priced at 100.00, callable (40nc5)

- Ladder Capital Finance Holdings LLLP (Financial - Other | New York City, United States | Rating: BB-): US$650m Senior Note (US505742AP10), fixed rate (4.75% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 398 bp), callable (8nc3)

- Union Electric Co (Utility - Other | St. Louis, United States | Rating: BBB+): US$525m First Mortgage Bond (US906548CT77), fixed rate (2.15% coupon) maturing on 15 March 2032, priced at 99.89 (original spread of 67 bp), callable (11nc10)

- Unum Group (Financial - Other | Chattanooga, United States | Rating: BBB-): US$600m Senior Note (US91529YAR71), fixed rate (4.13% coupon) maturing on 15 June 2051, priced at 99.01 (original spread of 242 bp), callable (30nc30)

EUR BOND ISSUES

- Basic Fit NV (Financial - Other | Hoofddorp, Netherlands | Rating: NR): €275m Bond (XS2354329190), fixed rate (1.13% coupon) maturing on 17 June 2028, priced at 100.00, non callable, convertible

- Bayerische Landesbank (Banking | Muenchen, Germany | Rating: A-): €250m Inhaberschuldverschreibung (DE000BLB9PM5), floating rate (EU03MLIB + 85.0 bp) maturing on 16 December 2024, priced at 102.83, non callable

- Bevco Lux SARL (Securities | Luxembourg, Bermuda | Rating: BBB): €600m Senior Note (XS2348703864), fixed rate (1.00% coupon) maturing on 16 January 2030, priced at 98.99 (original spread of 149 bp), callable (9nc8)

- Coty Inc (Consumer Products | New York City, Luxembourg | Rating: B-): €700m Senior Note (XS2354326683), fixed rate (3.88% coupon) maturing on 15 April 2026, priced at 100.00 (original spread of 450 bp), callable (5nc2)

- Edenred SA (Service - Other | Malakoff, France | Rating: BBB+): €400m Bond (FR0014003YP6) zero coupon maturing on 14 June 2028, priced at 100.88, non callable, convertible

- Energizer Holdings Inc (Electronics | St. Louis, United States | Rating: BB-): €650m Senior Note (XS2353487304), fixed rate (3.50% coupon) maturing on 30 June 2029, priced at 100.00 (original spread of 388 bp), callable (8nc3)

- Euroclear Investments SA (Securities | Luxembourg, Belgium | Rating: AA-): €350m Subordinated Note (BE6328904428), fixed rate (1.38% coupon) maturing on 16 June 2051, priced at 100.00 (original spread of 162 bp), callable (30nc10)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): €750m Senior Note (XS2354444023) zero coupon maturing on 16 January 2026, priced at 99.50 (original spread of 78 bp), callable (5nc5)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): €750m Senior Note (XS2354569407), fixed rate (0.50% coupon) maturing on 16 January 2029, priced at 99.39 (original spread of 104 bp), callable (8nc7)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): €500m Senior Note (XS2354444379), fixed rate (1.13% coupon) maturing on 16 June 2033, priced at 99.78 (original spread of 139 bp), callable (12nc12)

- OP Yrityspankki Oyj (Banking | Helsinki, Finland | Rating: AA-): €500m Note (XS2354246816), fixed rate (0.38% coupon) maturing on 16 June 2028, priced at 99.16 (original spread of 100 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €500m Subordinated Note (XS2353473692), fixed rate (1.38% coupon) maturing on 17 June 2033, priced at 99.47 (original spread of 195 bp), callable (12nc7)

- Transmission Finance DAC (Financial - Other | Ireland | Rating: NR): €300m Note (XS2352405216), fixed rate (0.38% coupon) maturing on 18 June 2028, priced at 99.15 (original spread of 101 bp), callable (7nc7)

- Vonovia SE (Service - Other | Bochum, Germany | Rating: BBB+): €1,000m Senior Note (DE000A3E5MJ2), fixed rate (1.00% coupon) maturing on 16 June 2033, priced at 99.45 (original spread of 129 bp), callable (12nc12)

- Vonovia SE (Service - Other | Bochum, Germany | Rating: BBB+): €1,000m Senior Note (DE000A3E5MG8), fixed rate (0.38% coupon) maturing on 16 June 2027, priced at 99.95 (original spread of 95 bp), callable (6nc6)

- Vonovia SE (Service - Other | Bochum, Germany | Rating: BBB+): €1,000m Senior Note (DE000A3E5MH6), fixed rate (0.63% coupon) maturing on 14 December 2029, priced at 99.61 (original spread of 104 bp), callable (9nc8)

- Vonovia SE (Service - Other | Bochum, Germany | Rating: BBB+): €500m Senior Note (DE000A3E5MF0) zero coupon maturing on 16 September 2024, priced at 100.19 (original spread of 65 bp), callable (3nc3)

- Vonovia SE (Service - Other | Bochum, Germany | Rating: BBB+): €500m Senior Note (DE000A3E5MK0), fixed rate (1.50% coupon) maturing on 14 June 2041, priced at 99.08 (original spread of 150 bp), callable (20nc20)

NEW LOANS

- Heartland Dental Care LLC, signed a US$ 660m Term Loan B, to be used for acquisition financing. It matures on 04/30/25 and initial pricing is set at LIBOR +400.000bps

- Tarkett SA signed a € 950m Term Loan B and a € 350m Revolving Credit Facility, to be used for a leveraged buyout.

- Virgin Media Investment (BB-), signed a € 900m Term Loan, to be used for general corporate purposes. It matures on 06/17/29 and initial pricing is set at EURIBOR +350.000bps

NEW ISSUES IN SECURITIZED CREDIT

- Pearl Street Mortgage Co 2021-2 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 306 m. Highest-rated tranche offering a yield to maturity of 2.39%, and the lowest-rated tranche a yield to maturity of 2.39%. Bookrunners: Wells Fargo Securities LLC

- Goodleap Sustainable Home Solutions Trust 2021-3 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 340 m. Highest-rated tranche offering a yield to maturity of 2.10%, and the lowest-rated tranche a yield to maturity of 3.84%. Bookrunners: Credit Suisse, Goldman Sachs & Co