Credit

Mixed Day For High Yield Spreads, With BBs And Single Bs Up And CCCs Down

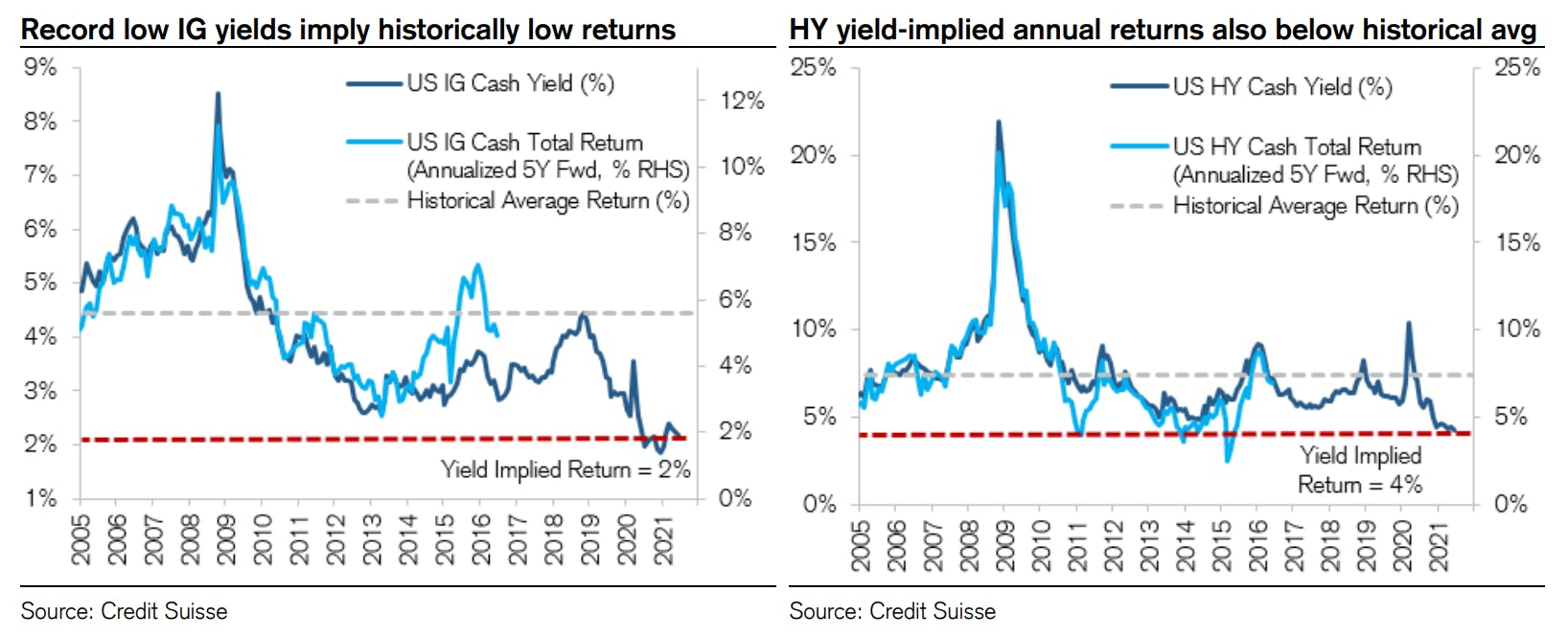

In an interesting analysis, Credit Suisse analysts observe today that record low yields in IG and HY point to well-below-average future returns of about 2% for IG and 4% for HY

Published ET

Prices of the 2025 USD bonds of Guacolda Energia (a Chilean Power company) have recently traded down to 73 cents on the dollar | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.28% today, with investment grade up 0.30% and high yield up 0.13% (YTD total return: -1.54%)

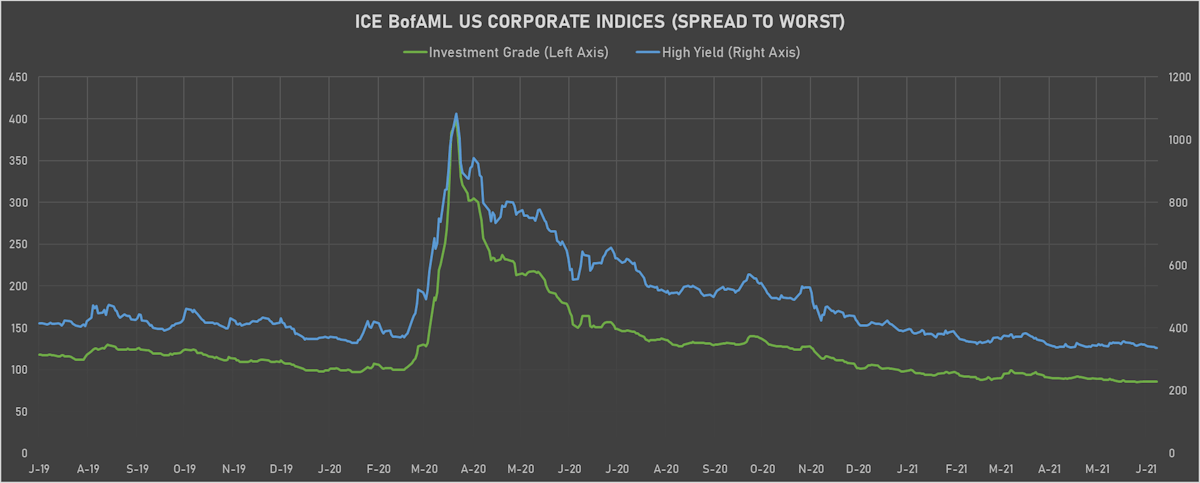

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.0% today (YTD total return: +2.3%)

- New issues: US$ 4.4bn in dollars and € 1.5bn in euros

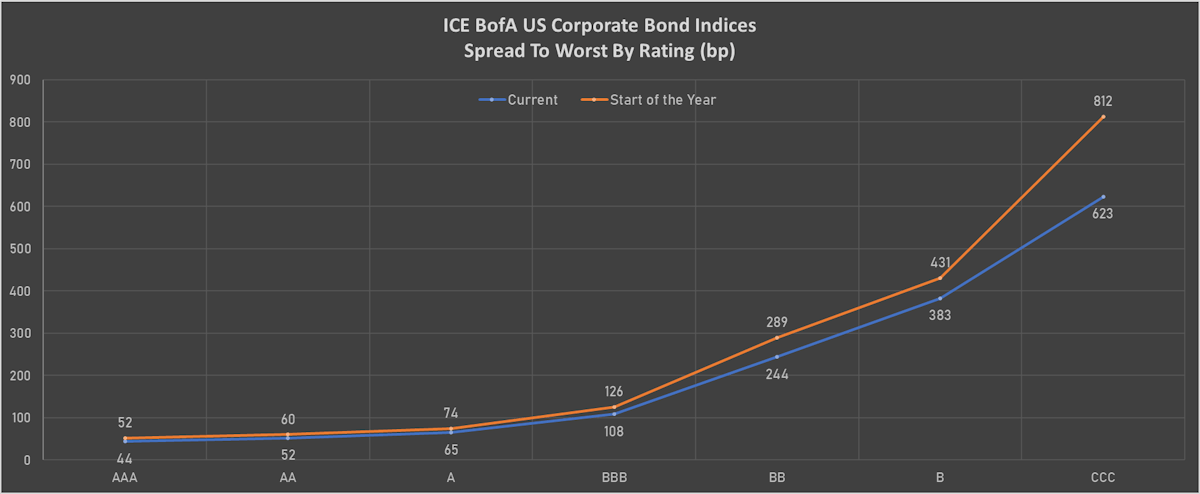

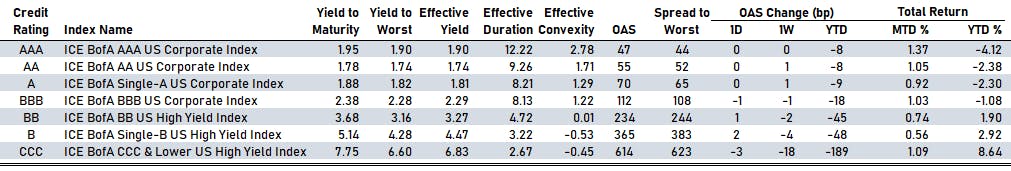

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 55 bp

- A unchanged at 70 bp

- BBB down by -1 bp at 112 bp

- BB up by 1 bp at 234 bp

- B up by 2 bp at 365 bp

- CCC down by -3 bp at 614 bp

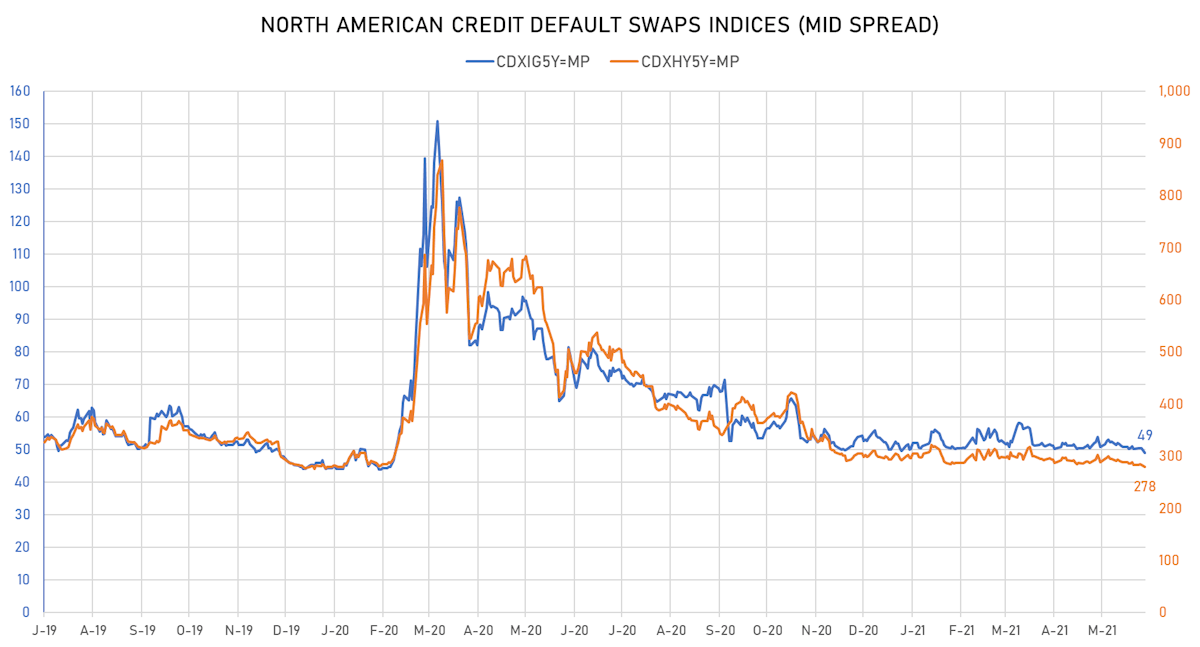

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.3 bp, now at 49bp (YTD change: -1.0bp)

- Markit CDX.NA.HY 5Y down 4.2 bp, now at 278bp (YTD change: -14.8bp)

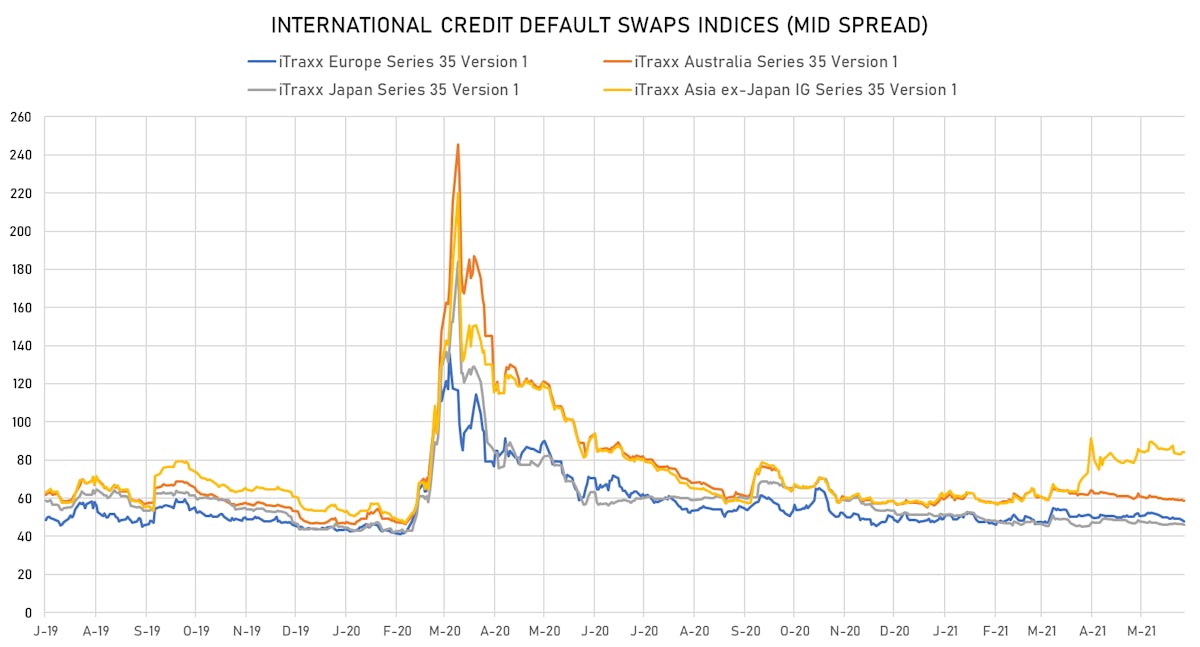

- Markit iTRAXX Europe down 0.7 bp, now at 48bp (YTD change: -0.2bp)

- Markit iTRAXX Japan down 0.3 bp, now at 46bp (YTD change: -5.2bp)

- Markit iTRAXX Asia Ex-Japan unchanged, now at 84bp (YTD change: +25.9bp)

TOP BONDS MOVERS IN THE PAST WEEK - USD HY

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 102.3 bp to 1,328.2 bp, with the yield to worst at 13.4% and the bond now trading down to 72.9 cents on the dollar (1Y price range: 72.8-92.1).

- Issuer: Sappi Papier Holding GmbH (Gratkorn, Austria) | Coupon: 7.50% | Maturity: 15/6/2032 | Rating: B+ | ISIN: XS0149581935 | Z-spread up by 30.4 bp to 541.4 bp, with the yield to worst at 6.3% and the bond now trading down to 106.5 cents on the dollar (1Y price range: 97.8-109.6).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 21.9 bp to 128.2 bp, with the yield to worst at 1.3% and the bond now trading up to 107.6 cents on the dollar (1Y price range: 105.9-108.1).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread down by 22.6 bp to 671.1 bp, with the yield to worst at 6.8% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 67.5-102.5).

- Issuer: Uzpromstroybank AKB (Tashkent, Uzbekistan) | Coupon: 5.75% | Maturity: 2/12/2024 | Rating: BB- | ISIN: XS2083131859 | Z-spread down by 24.5 bp to 348.9 bp, with the yield to worst at 3.8% and the bond now trading up to 105.9 cents on the dollar (1Y price range: 102.4-106.4).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.00% | Maturity: 1/5/2025 | Rating: BB- | ISIN: USC67111AG65 | Z-spread down by 30.4 bp to 226.6 bp (CDS basis: -24.3bp), with the yield to worst at 2.6% and the bond now trading up to 107.6 cents on the dollar (1Y price range: 101.4-107.6).

- Issuer: Turkiye Vakiflar Bankasi TAO (Istanbul, Turkey) | Coupon: 6.50% | Maturity: 8/1/2026 | Rating: B | ISIN: XS2266963003 | Z-spread down by 31.3 bp to 526.8 bp, with the yield to worst at 5.7% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 95.2-105.8).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 33.8 bp to 167.2 bp, with the yield to worst at 1.8% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 108.0-110.8).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 5.18% | Maturity: 24/4/2028 | Rating: BB | ISIN: USN84413CG11 | Z-spread down by 36.4 bp to 199.4 bp, with the yield to worst at 2.8% and the bond now trading up to 112.9 cents on the dollar (1Y price range: 101.5-113.4).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 44.6 bp to 119.8 bp (CDS basis: -60.2bp), with the yield to worst at 1.6% and the bond now trading up to 108.5 cents on the dollar (1Y price range: 106.4-109.8).

TOP BONDS MOVERS IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread down by 10.1 bp to 237.8 bp, with the yield to worst at 1.9% and the bond now trading up to 104.6 cents on the dollar (1Y price range: 103.1-105.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 10.7 bp to 416.3 bp (CDS basis: -41.6bp), with the yield to worst at 3.8% and the bond now trading up to 94.0 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by 11.4 bp to 206.9 bp, with the yield to worst at 1.8% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 98.4-101.8).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread down by 14.1 bp to 299.7 bp (CDS basis: -60.8bp), with the yield to worst at 2.5% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 95.7-101.7).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 14.1 bp to 200.3 bp, with the yield to worst at 1.5% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 97.9-101.5).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread down by 14.4 bp to 384.2 bp (CDS basis: -38.6bp), with the yield to worst at 3.4% and the bond now trading up to 115.8 cents on the dollar (1Y price range: 102.3-115.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread down by 15.9 bp to 242.8 bp, with the yield to worst at 2.1% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread down by 20.0 bp to 178.4 bp (CDS basis: -18.2bp), with the yield to worst at 1.3% and the bond now trading up to 104.2 cents on the dollar (1Y price range: 100.3-104.2).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 20.6 bp to 238.9 bp (CDS basis: -47.8bp), with the yield to worst at 2.0% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 99.5-102.4).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2202907510 | Z-spread down by 21.2 bp to 280.4 bp (CDS basis: 52.7bp), with the yield to worst at 2.4% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 101.4-106.3).

USD BOND ISSUES

- Assurant Inc (Property and Casualty Insurance | New York City, New York, United States | Rating: BBB): US$350m Senior Note (US04621XAN84), fixed rate (2.65% coupon) maturing on 15 January 2032, priced at 99.84 (original spread of 120 bp), callable (11nc10)

- Cheesecake Factory Inc (Restaurants | Calabasas Hills, California, United States | Rating: NR): US$300m Bond (US163072AA98), fixed rate (0.50% coupon) maturing on 15 June 2026, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$275m Bond (US3133EMK767), floating rate (SOFR + 3.5 bp) maturing on 16 June 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$175m Bond (US3133EMK841), fixed rate (1.89% coupon) maturing on 17 March 2031, priced at 100.00, callable (10nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$250m Bond (US3130AMV586), fixed rate (0.34% coupon) maturing on 21 June 2024, priced at 100.00, callable (3nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130AMV412), fixed rate (0.45% coupon) maturing on 23 December 2024, priced at 100.00 (original spread of 30 bp), callable (4nc1)

- RLJ Lodging Trust LP (Financial - Other | Dover, Delaware, United States | Rating: BB-): US$500m Note (US74965LAA98), fixed rate (3.75% coupon) maturing on 1 July 2026, priced at 100.00 (original spread of 303 bp), callable (5nc2)

EUR BOND ISSUES

- Derichebourg SA (Service - Other | Paris, Ile-De-France, France | Rating: BB): €300m Senior Note (XS2351382556), fixed rate (2.25% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 274 bp), callable (7nc3)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): €500m Inhaberschuldverschreibung (DE000DB9U4J6), floating rate maturing on 1 July 2027, priced at 100.00, non callable

- Landesbank Baden Wuerttemberg (Banking | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA-): €250m Inhaberschuldverschreibung (DE000LB2V6R3), floating rate (EU03MLIB + 85.0 bp) maturing on 16 December 2024, priced at 102.83, non callable

- Paysafe Finance PLC (Financial - Other | United Kingdom | Rating: NR): €435m Note (XS2010028269), fixed rate (3.00% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 336 bp), callable (8nc3)

NEW LOANS

- Hilton Grand Vacations Inc (BB), signed a US$ 675m Bridge Loan, to be used for acquisition financing. It matures on 06/30/22 and initial pricing is set at LIBOR +450.000bps

- Pregis LLC, signed a US$ 300m Term Loan B, to be used for general corporate purposes. It matures on 08/01/26 and initial pricing is set at LIBOR +400.000bps

NEW ISSUES IN SECURITIZED CREDIT

- Colt 2021-1 Mortgage Loan Trust issued a fixed-rate RMBS in 5 tranches, for a total of US$ 192 m. Highest-rated tranche offering a yield to maturity of 0.91%, and the lowest-rated tranche a yield to maturity of 3.14%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd

- Pearl Street Mortgage Co 2021-2 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 306 m. Bookrunners: Wells Fargo Securities LLC

- Goodleap Sustainable Home Solutions Trust 2021-3 issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 340 m. Highest-rated tranche offering a yield to maturity of 2.10%, and the lowest-rated tranche a yield to maturity of 3.84%. Bookrunners: Credit Suisse, Goldman Sachs & Co