Credit

Bonds Fall On Higher Rates Despite Tighter Cash Spreads

A decent Monday for primary issuance, with about US$9.2 bn of investment grade and US$ 2.9 bn of high yield bonds priced

Published ET

WeWork 2025 bond prices (USU96217AA99) have more than tripled since March of last year | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.25% and high yield down 0.00% (YTD total return: -1.79%)

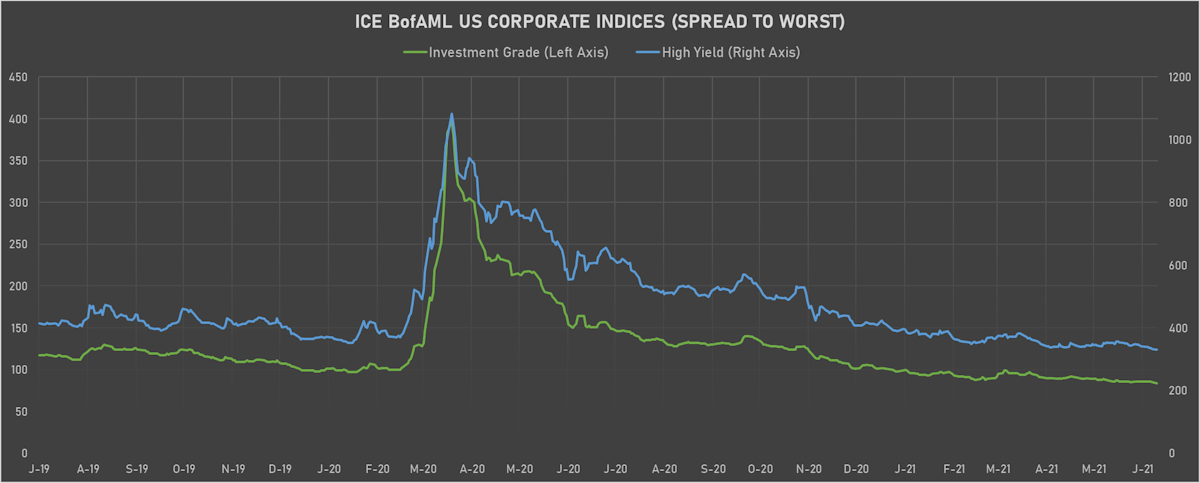

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 84.0 bp (YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 331.0 bp (YTD change: -59.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index YTD total return at +2.3%

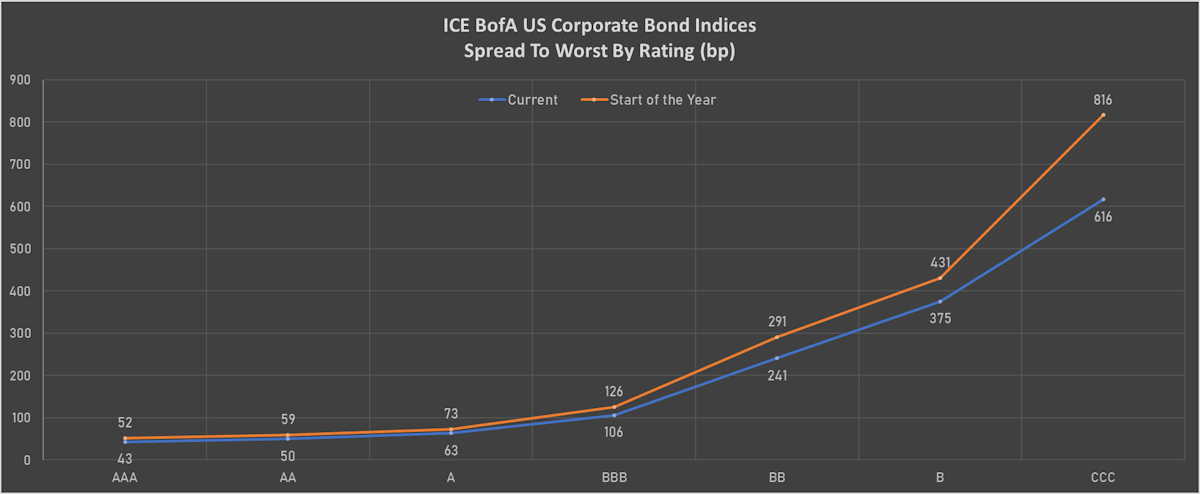

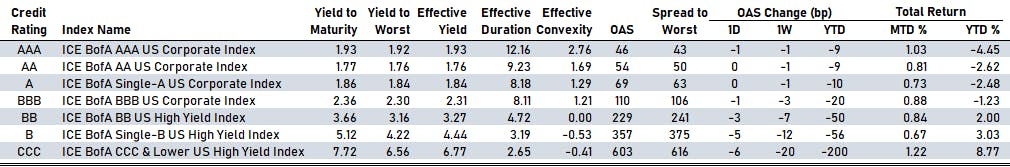

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 46 bp

- AA unchanged at 54 bp

- A unchanged at 69 bp

- BBB down by -1 bp at 110 bp

- BB down by -3 bp at 229 bp

- B down by -5 bp at 357 bp

- CCC down by -6 bp at 603 bp

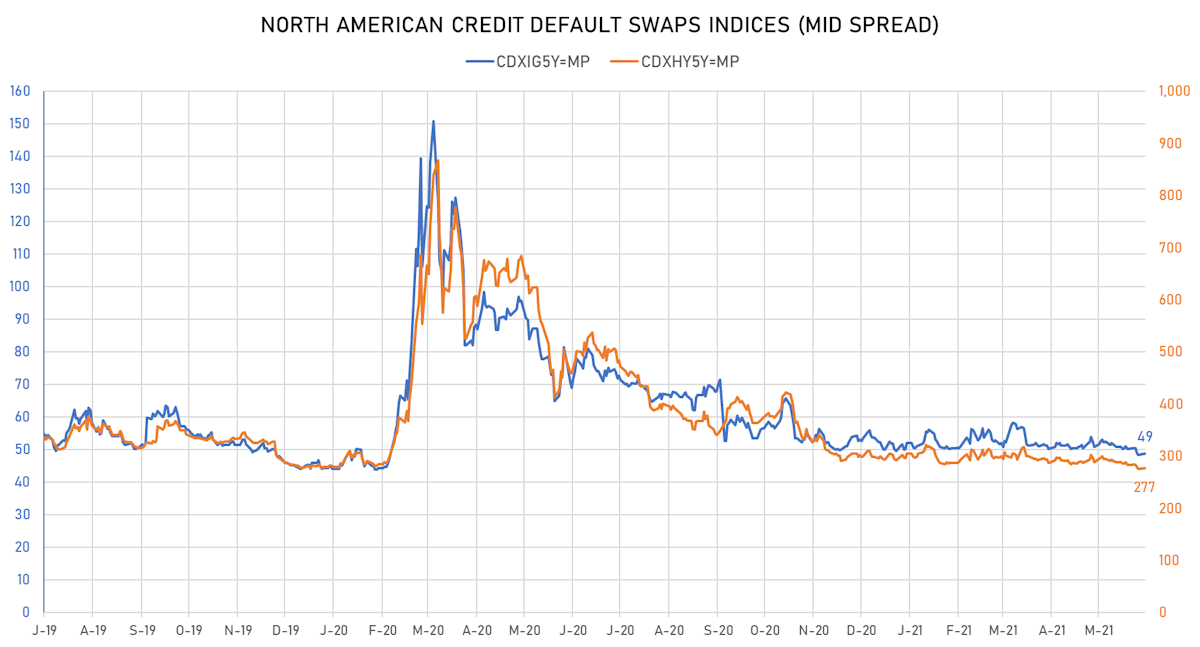

CREDIT DERIVATIVES: CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 49bp (YTD change: -1.4bp)

- Markit CDX.NA.HY 5Y up 1.4 bp, now at 277bp (YTD change: -16.5bp)

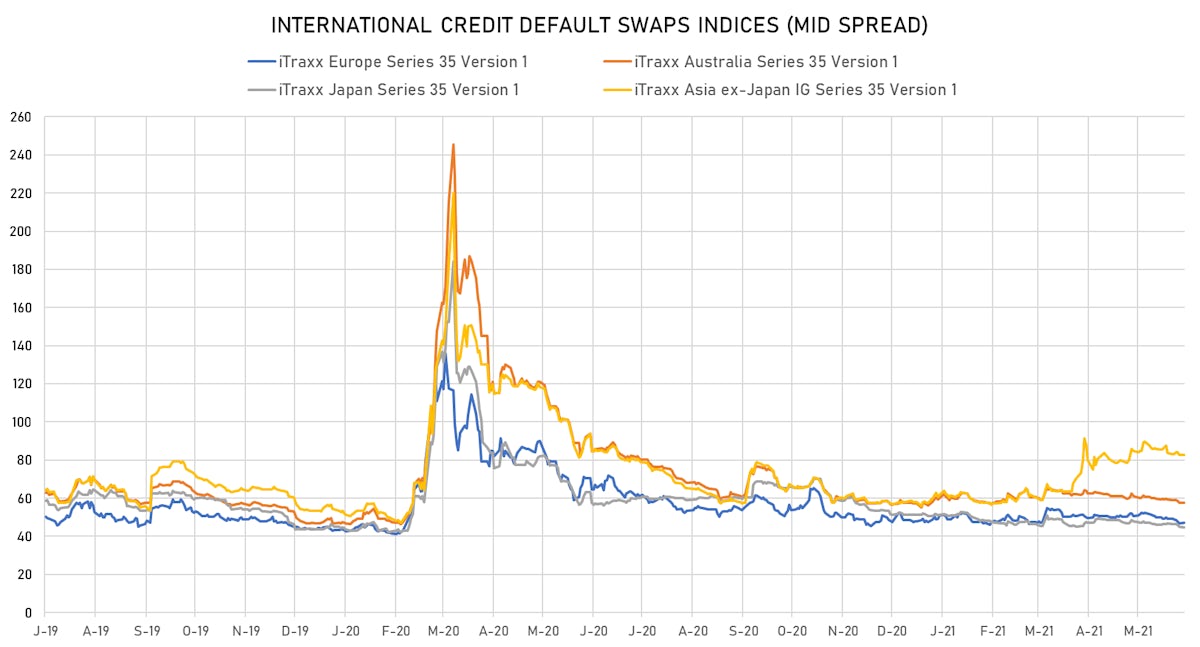

- Markit iTRAXX Europe up 0.3 bp, now at 47bp (YTD change: -0.8bp)

- Markit iTRAXX Japan down 0.3 bp, now at 45bp (YTD change: -6.5bp)

- Markit iTRAXX Asia Ex-Japan unchanged 0.0 bp, now at 83bp (YTD change: +24.8bp)

TOP BONDS MOVERS - USD HY

- Issuer: Turkiye Cumhuriyeti Ziraat Bankasi AS (Ankara, Turkey) | Coupon: 5.38% | Maturity: 2/3/2026 | Rating: B | ISIN: XS2274089288 | Z-spread down by 26.6 bp to 502.1 bp, with the yield to worst at 5.5% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 91.8-102.0).

- Issuer: Minsur SA (San Borja, Peru) | Coupon: 6.25% | Maturity: 7/2/2024 | Rating: BB- | ISIN: USP6811TAA36 | Z-spread down by 31.9 bp to 352.5 bp, with the yield to worst at 3.7% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 100.6-111.4).

- Issuer: Akbank TAS (Istanbul, Turkey) | Coupon: 6.80% | Maturity: 6/2/2026 | Rating: B | ISIN: XS2131335270 | Z-spread down by 32.3 bp to 464.2 bp (CDS basis: 12.9bp), with the yield to worst at 5.1% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 98.1-108.6).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 6.50% | Maturity: 18/1/2028 | Rating: BB | ISIN: USL67359AA48 | Z-spread down by 33.2 bp to 349.4 bp, with the yield to worst at 4.4% and the bond now trading up to 110.8 cents on the dollar (1Y price range: 107.5-118.3).

- Issuer: OCP SA (Casablanca, Morocco) | Coupon: 5.63% | Maturity: 25/4/2024 | Rating: BB+ | ISIN: XS1061043011 | Z-spread down by 33.7 bp to 158.5 bp, with the yield to worst at 1.8% and the bond now trading up to 110.1 cents on the dollar (1Y price range: 108.0-110.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread down by 36.2 bp to 270.0 bp, with the yield to worst at 3.3% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Turkiye Vakiflar Bankasi TAO (Istanbul, Turkey) | Coupon: 6.50% | Maturity: 8/1/2026 | Rating: B | ISIN: XS2266963003 | Z-spread down by 36.9 bp to 507.5 bp, with the yield to worst at 5.5% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 95.2-105.8).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread down by 39.9 bp to 650.4 bp, with the yield to worst at 6.7% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 67.5-103.0).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 40.9 bp to 120.8 bp (CDS basis: -63.1bp), with the yield to worst at 1.7% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 106.4-109.8).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread down by 48.7 bp to 930.0 bp, with the yield to worst at 9.4% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 99.5-107.0).

TOP BONDS MOVERS - EUR HY

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 1.88% | Maturity: 9/1/2026 | Rating: CCC+ | ISIN: XS2270393379 | Z-spread up by 62.5 bp to 275.3 bp, with the yield to worst at 2.3% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 97.7-102.9).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: BB+ | ISIN: XS1713464524 | Z-spread down by 13.1 bp to 219.3 bp, with the yield to worst at 1.7% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 103.0-105.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB+ | ISIN: XS2248826294 | Z-spread down by 13.5 bp to 246.5 bp, with the yield to worst at 2.0% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 100.7-103.2).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Z-spread down by 13.7 bp to 173.5 bp (CDS basis: -15.1bp), with the yield to worst at 1.3% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 100.4-104.2).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 13.8 bp to 324.5 bp (CDS basis: -60.0bp), with the yield to worst at 2.9% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 97.6-104.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread down by 13.9 bp to 377.0 bp (CDS basis: -34.8bp), with the yield to worst at 3.3% and the bond now trading up to 116.1 cents on the dollar (1Y price range: 102.3-116.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 14.0 bp to 192.5 bp, with the yield to worst at 1.5% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 97.9-101.9).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB | ISIN: XS2154325489 | Z-spread down by 17.0 bp to 133.4 bp, with the yield to worst at 0.9% and the bond now trading up to 110.6 cents on the dollar (1Y price range: 102.3-110.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread down by 18.2 bp to 230.9 bp, with the yield to worst at 2.0% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread down by 19.2 bp to 289.8 bp (CDS basis: 89.6bp), with the yield to worst at 2.6% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 98.5-102.6).

USD BOND ISSUES

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): US$200m Senior Note (XS2344478826) zero coupon maturing on 15 June 2061, priced at 100.00 (original spread of 170 bp), callable (40nc5)

- Aig Global Funding (Financial - Other | United States | Rating: NR): US$400m Note (US00138CAS70), fixed rate (0.65% coupon) maturing on 17 June 2024, priced at 99.90 (original spread of 35 bp), non callable

- Comstock Resources Inc (Oil and Gas | Frisco, Texas, United States | Rating: B): US$965m Senior Note (US205768AT12), fixed rate (5.88% coupon) maturing on 15 January 2030, priced at 100.00 (original spread of 452 bp), callable (9nc4)

- Hat Holdings I LLC (Financial - Other | Annapolis, Maryland, United States | Rating: BB+): US$1,000m Senior Note (US418751AE33), fixed rate (3.38% coupon) maturing on 15 June 2026, priced at 100.00 (original spread of 259 bp), callable (5nc5)

- Hilton Grand Vacations Borrower Escrow LLC (Financial - Other | United States | Rating: B-): US$500m Senior Note (US43284MAB46), fixed rate (4.88% coupon) maturing on 1 July 2031, priced at 100.00, callable (10nc5)

- Ingles Markets Inc (Retail Stores - Food/Drug | Asheville, North Carolina, United States | Rating: BB): US$350m Senior Note (US457030AK02), fixed rate (4.00% coupon) maturing on 15 June 2031, priced at 100.00 (original spread of 251 bp), callable (10nc5)

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$550m Senior Note (US24422EVR79), fixed rate (1.05% coupon) maturing on 17 June 2026, priced at 99.84 (original spread of 30 bp), non callable

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$600m Senior Note (US24422EVS52), fixed rate (2.00% coupon) maturing on 17 June 2031, priced at 99.86 (original spread of 52 bp), non callable

- LGI Homes Inc (Home Builders | The Woodlands, Texas, United States | Rating: BB-): US$300m Senior Note (US50187TAF30), fixed rate (4.00% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 270 bp), callable (8nc8)

- NVIDIA Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US67066GAK04), fixed rate (0.31% coupon) maturing on 15 June 2023, priced at 100.00 (original spread of 15 bp), callable (2nc1)

- NVIDIA Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US67066GAL86), fixed rate (0.58% coupon) maturing on 14 June 2024, priced at 100.00 (original spread of 25 bp), callable (3nc2)

- NVIDIA Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US67066GAM69), fixed rate (1.55% coupon) maturing on 15 June 2028, priced at 99.68 (original spread of 40 bp), callable (7nc7)

- NVIDIA Corp (Electronics | Santa Clara, California, United States | Rating: A-): US$1,250m Senior Note (US67066GAN43), fixed rate (2.00% coupon) maturing on 15 June 2031, priced at 99.56 (original spread of 55 bp), callable (10nc10)

EUR BOND ISSUES

- CTP NV (Financial - Other | Utrecht, Utrecht, Netherlands | Rating: BBB-): €500m Senior Note (XS2356030556), fixed rate (1.25% coupon) maturing on 21 June 2029, priced at 99.31 (original spread of 176 bp), callable (8nc8)

- CTP NV (Financial - Other | Utrecht, Utrecht, Netherlands | Rating: BBB-): €500m Senior Note (XS2356029541), fixed rate (0.50% coupon) maturing on 21 June 2025, priced at 99.66 (original spread of 126 bp), callable (4nc4)

- Instituto de Credito Oficial (Agency | Madrid, Madrid, Spain | Rating: A): €500m Senior Note (XS2356033147) zero coupon maturing on 30 April 2027, priced at 100.61 (original spread of 46 bp), non callable

- NATWEST MARKETS PLC (Banking | Edinburgh, Midlothian, United Kingdom | Rating: A-): €1,250m Senior Note (XS2355599197), fixed rate (0.13% coupon) maturing on 18 June 2026, priced at 99.61 (original spread of 83 bp), non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Stockholm, Sweden | Rating: A+): €1,000m Note (XS2356049069), fixed rate (0.38% coupon) maturing on 21 June 2028, priced at 99.80 (original spread of 91 bp), non callable

- Stellantis NV (Automotive Manufacturer | Lijnden, Noord-Holland, Netherlands | Rating: BBB-): €1,250m Senior Note (XS2356041165), fixed rate (1.25% coupon) maturing on 20 June 2033, priced at 98.77 (original spread of 161 bp), callable (12nc12)

- Stellantis NV (Automotive Manufacturer | Lijnden, Noord-Holland, Netherlands | Rating: BBB-): €1,250m Senior Note (XS2356040357), fixed rate (0.75% coupon) maturing on 18 January 2029, priced at 99.90 (original spread of 122 bp), callable (8nc7)

- Teollisuuden Voima Oyj (Utility - Other | Eurajoki, Lansi-Suomen, Finland | Rating: BB): €500m Unsecured Note (XS2355632741), fixed rate (2.00% coupon) maturing on 23 June 2028, priced at 100.00, non callable

NEW LOANS

- Traeger Pellet Grills LLC, signed a US$ 510m Term Loan B (maturing on 06/24/28, priced at LIBOR +400bps) and US$ 125m Revolving Credit Facility, both to be used for general corporate purposes.

- Colisee Intl, signed a € 875m Term Loan B maturing on 10/09/27 and a € 150m Term Loan B maturing on 12/18/27, both for general corporate purposes and both priced at EURIBOR +375bps

NEW ISSUES IN SECURITIZED CREDIT

- Master Credit Card Trust Ii 2021-1 issued a fixed-rate ABS backed by receivables in 3 tranches, for a total of US$ 741 m. Highest-rated tranche offering a yield to maturity of 0.53%, and the lowest-rated tranche a yield to maturity of 1.06%. Bookrunners: Barclays Capital Group, BMO Capital Markets, Bank of America Merrill Lynch

- Wells Fargo Mortgage Backed Securities 2021-Rr1 Trust issued a fixed-rate RMBS in 4 tranches, for a total of US$ 287 m. Highest-rated tranche offering a yield to maturity of 2.44%, and the lowest-rated tranche a yield to maturity of 2.44%. Bookrunners: Wells Fargo Securities LLC